CNH Industrial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CNH Industrial Bundle

CNH Industrial faces significant competitive pressures from established players and the threat of new entrants in the agricultural and construction equipment sectors. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this complex landscape.

The complete report reveals the real forces shaping CNH Industrial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CNH Industrial, a major player in agricultural and construction equipment, faces significant bargaining power from its concentrated and specialized suppliers. Companies providing essential components like advanced engines, hydraulic systems, and sophisticated electronics often hold considerable sway. This is because there are typically few suppliers capable of meeting the stringent quality and performance demands for heavy machinery, and these components are absolutely critical to CNH Industrial's product lines.

For instance, the market for high-performance diesel engines, a core component for both agricultural tractors and construction vehicles, is dominated by a handful of global manufacturers. These suppliers, due to their specialized expertise and production scale, can dictate terms and pricing. Similarly, suppliers of advanced electronic control units (ECUs) and precision hydraulic systems are crucial, and their concentrated nature means they can exert considerable influence over CNH Industrial's procurement costs and supply chain reliability.

CNH Industrial faces significant supplier bargaining power due to high switching costs for specialized components. The process of changing suppliers for critical, highly engineered parts can necessitate extensive redesigns, costly retooling of manufacturing lines, and rigorous re-certification procedures, potentially delaying production and impacting product quality.

These substantial barriers make it challenging for CNH Industrial to readily source compatible alternatives, thereby strengthening the leverage of its current specialized parts suppliers. For instance, in 2024, the agricultural machinery sector, a key area for CNH, continued to see consolidation among component manufacturers, further concentrating supply chains and amplifying supplier influence.

The quality and performance of CNH Industrial's agricultural and construction equipment are directly tied to the components and materials sourced from its suppliers. If a supplier offers a critical, differentiated input, such as an advanced powertrain component or a proprietary software module, their leverage in negotiations naturally grows, impacting CNH Industrial's cost structure and product innovation.

Potential for Forward Integration by Suppliers

While direct forward integration by suppliers into manufacturing is rare for CNH Industrial due to the immense capital required, the *threat* of such a move, or simply the ability to redirect specialized component sales, grants them significant leverage. This means suppliers of critical, proprietary parts can wield considerable bargaining power.

This power is amplified if a supplier's components are highly specialized and difficult for CNH Industrial to source elsewhere. For instance, if a supplier of advanced engine technology or unique hydraulic systems were to face limited alternative buyers, they could potentially dictate terms or even explore partnerships that mimic forward integration.

CNH Industrial's reliance on these specialized suppliers means they must carefully manage these relationships. The potential for a supplier to shift focus to competitors or to limit supply, even without full integration, can disrupt production and impact CNH Industrial's market position.

- Supplier Leverage: Suppliers of specialized components for agricultural and construction equipment can exert significant bargaining power.

- Barriers to Integration: The high capital intensity of manufacturing equipment acts as a substantial barrier to suppliers attempting direct forward integration.

- Strategic Importance: CNH Industrial's reliance on unique, hard-to-replicate parts from certain suppliers underscores their potential influence.

- Market Dynamics: The threat of suppliers withholding supply or redirecting sales to competitors remains a key factor in managing supplier relationships.

Global Supply Chain Dynamics and Geopolitical Factors

Global supply chain disruptions, exacerbated by events like the COVID-19 pandemic and ongoing geopolitical tensions, have significantly amplified supplier bargaining power. These disruptions can lead to material shortages and increased lead times, forcing companies like CNH Industrial to accept less favorable terms.

Shifting trade policies and tariffs also play a crucial role. For instance, in 2024, many nations continued to implement protectionist measures, impacting the cost and availability of components sourced internationally. This environment grants suppliers leverage as they can capitalize on increased import costs or restricted market access for competitors.

CNH Industrial's extensive reliance on a global network of suppliers for everything from specialized engine parts to electronic components makes it particularly vulnerable. When suppliers face their own challenges, such as raw material price hikes or production bottlenecks, their ability to dictate terms to CNH Industrial increases substantially. This susceptibility can directly translate into higher input costs for CNH Industrial.

- Increased Lead Times: In 2024, average lead times for certain critical components in the industrial machinery sector extended by up to 30% compared to pre-pandemic levels.

- Raw Material Volatility: Prices for key commodities like steel and aluminum saw fluctuations of 15-20% throughout 2024, directly impacting supplier costs.

- Geopolitical Risk Premiums: Suppliers facing operations in politically unstable regions often pass on higher insurance and logistics costs, adding to CNH Industrial's procurement expenses.

- Limited Supplier Alternatives: For highly specialized components, the number of qualified suppliers can be very small, giving those suppliers considerable pricing power.

CNH Industrial's suppliers of specialized components, such as advanced engines and hydraulic systems, possess significant bargaining power. This is due to the concentrated nature of these markets and the critical role these parts play in CNH's final products, making switching suppliers costly and complex.

The high switching costs, involving redesigns and retooling, coupled with the limited availability of alternative suppliers for highly engineered parts, further amplify supplier leverage. In 2024, supply chain disruptions and geopolitical factors continued to strengthen the position of these key suppliers.

For example, in 2024, lead times for certain industrial components increased by as much as 30%, and raw material prices like steel saw 15-20% fluctuations, directly impacting supplier costs and their ability to dictate terms to CNH Industrial.

The strategic importance of unique, hard-to-replicate parts from a few key suppliers means CNH Industrial must carefully manage these relationships to mitigate risks to production and cost structures.

| Factor | Impact on CNH Industrial | 2024 Data/Observation |

| Supplier Concentration | High leverage for key component providers | Domination of engine and ECU markets by few global manufacturers |

| Switching Costs | Significant barriers to changing suppliers | Extensive redesign, retooling, and re-certification required |

| Supply Chain Disruptions | Amplified supplier power due to shortages/delays | Extended lead times (up to 30% increase for some components) |

| Raw Material Volatility | Increased supplier costs passed on | Steel and aluminum prices fluctuated 15-20% |

What is included in the product

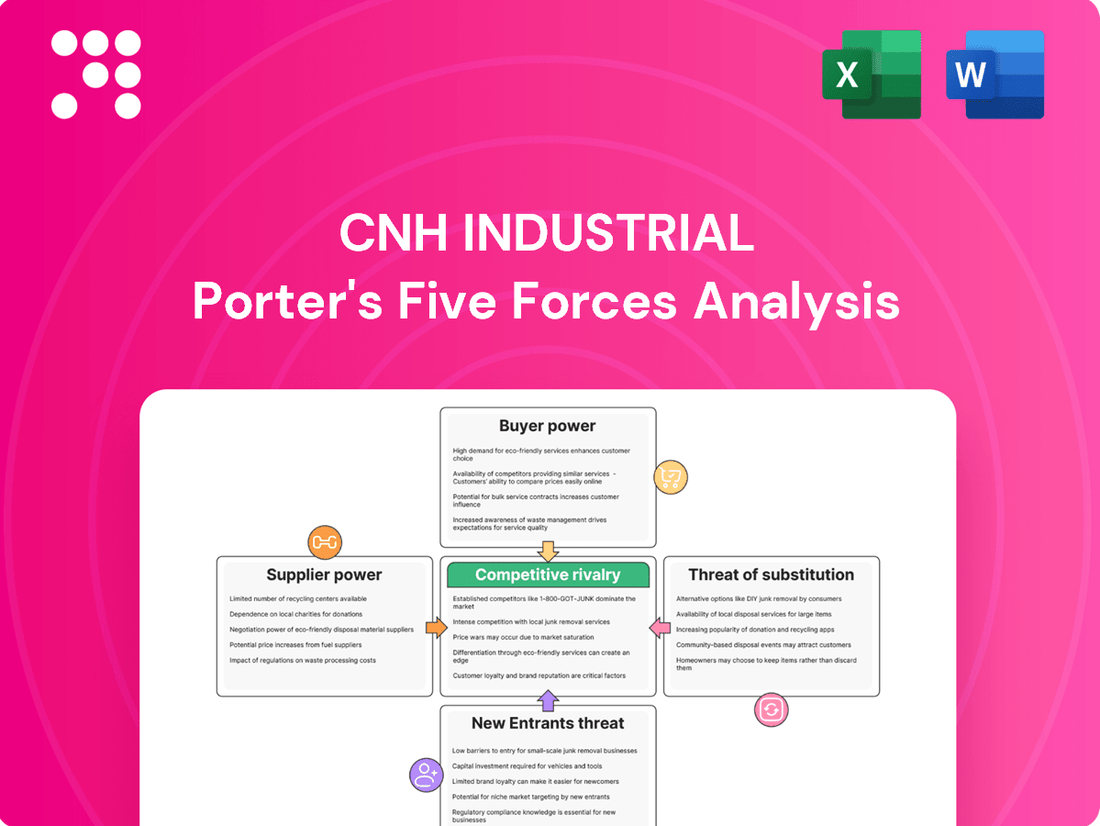

This analysis delves into the competitive forces impacting CNH Industrial, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the agricultural and construction equipment sectors.

Understand the competitive landscape of CNH Industrial by visualizing the intensity of each of Porter's Five Forces, providing instant strategic clarity.

Customers Bargaining Power

CNH Industrial caters to a wide array of customers, from individual farmers and large agricultural corporations to construction firms and government bodies. Each segment possesses unique purchasing power and specific requirements for equipment and services.

This broad customer base, while diverse, also presents a degree of fragmentation. For instance, in 2023, CNH Industrial reported that its agricultural segment revenue was approximately $14.5 billion, serving millions of individual farmers alongside large enterprises, highlighting this varied customer dynamic.

While large-scale buyers like major construction companies or government agencies can exert considerable bargaining power due to the volume of their purchases, the sheer number of smaller customers dilutes this collective influence across the entire customer base.

CNH Industrial's customers, particularly in agriculture and construction, face substantial upfront costs for machinery. For instance, a new combine harvester can easily cost hundreds of thousands of dollars. This significant capital outlay means buyers are highly sensitive to the total cost of ownership, including maintenance, repairs, and financing.

This financial commitment empowers customers to negotiate aggressively on price, demand extended warranty periods, and seek out reliable, widespread after-sales service networks. Their leverage increases when they can compare offerings across manufacturers, pushing CNH Industrial to provide competitive financing and service packages to secure sales.

CNH Industrial's offering of financing services directly impacts customer bargaining power. By providing financial solutions to dealers and end-users, CNH can influence purchase decisions and foster loyalty. This in-house financing can lower the perceived cost for buyers, making CNH products more attractive.

However, the presence of competitive financing options from external lenders still grants customers leverage. For instance, in 2024, the agricultural equipment financing sector saw increased competition, with various banks and specialized lenders offering attractive rates, which could empower CNH's customers to negotiate better terms or seek alternatives if CNH's financing isn't competitive.

Influence of Dealer Networks and Aftermarket Support

CNH Industrial's customers, particularly those in agriculture and construction, depend significantly on its extensive dealer networks for crucial sales, ongoing service, and readily available parts. This reliance means the strength and reach of CNH Industrial's dealer network directly influence customer loyalty and, consequently, their bargaining power.

A robust and well-supported dealer network can significantly lower a customer's perceived cost of switching to a competitor, thereby mitigating their bargaining leverage. Conversely, a less developed or fragmented network might inadvertently empower buyers by making it easier for them to seek alternatives or negotiate better terms.

- Dealer Network Strength: CNH Industrial's global network of over 4,000 dealers across its brands (Case IH, New Holland Agriculture, CASE Construction Equipment, etc.) is a key asset in managing customer relationships and mitigating direct bargaining power.

- Aftermarket Service Importance: The availability and quality of aftermarket support, including parts and maintenance, are critical for equipment uptime, making customers less likely to switch if they have a reliable service partner.

- Customer Dependence: For specialized machinery, customers often lack viable alternatives for parts and expert service, further reducing their ability to exert significant bargaining power.

Technological Advancements and Data-Driven Farming/Construction

Customers in the agriculture and construction sectors are increasingly leveraging technology, which bolsters their bargaining power. They are actively seeking advanced features like precision agriculture, automation, and telematics to boost operational efficiency and output. This demand for cutting-edge solutions means customers can negotiate more effectively for integrated and high-performing systems.

CNH Industrial's strategic focus on developing AI-powered solutions and robust digital platforms directly addresses these evolving customer needs. For instance, their investments in autonomous farming equipment and connected machinery aim to deliver the advanced capabilities customers expect. This proactive approach, however, also sets a higher bar for customer expectations regarding seamless integration and overall system efficiency.

- Customer Demand for Technology: A significant portion of CNH Industrial's customer base is actively seeking precision agriculture and automation technologies.

- CNH Industrial's Response: The company is investing heavily in AI, telematics, and digital platforms to meet these advanced technological demands.

- Increased Customer Expectations: As CNH Industrial rolls out more sophisticated solutions, customer expectations for integrated and highly efficient systems rise, enhancing their bargaining power.

The bargaining power of CNH Industrial's customers is moderate, influenced by high switching costs and the critical nature of their equipment. While individual buyers may have limited leverage, large fleet owners or government contracts can command significant attention. For example, in 2023, CNH's agricultural equipment sales reached approximately $14.5 billion, indicating a substantial market where large purchasers can exert influence.

Customers' sensitivity to price is amplified by the considerable investment required for machinery, with new combine harvesters often costing hundreds of thousands of dollars. This financial commitment encourages buyers to seek competitive pricing, extended warranties, and robust after-sales support, as demonstrated by the increasing competition in agricultural equipment financing in 2024.

CNH Industrial's extensive dealer network, comprising over 4,000 locations globally, acts as a buffer against direct customer bargaining power by ensuring service and parts availability. However, customers' growing demand for advanced technologies like precision agriculture and AI-driven solutions means they can negotiate for more integrated and efficient systems, increasing their leverage.

| Customer Segment | Leverage Factors | CNH Industrial's Mitigation Strategies |

| Large Agricultural Corporations | High purchase volume, price sensitivity | Volume discounts, tailored financing, integrated solutions |

| Individual Farmers | High equipment cost, reliance on dealer network | Financing options, service contracts, technology integration |

| Construction Companies | Fleet size, uptime requirements | Extended warranties, rapid parts availability, specialized service |

Preview the Actual Deliverable

CNH Industrial Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of CNH Industrial, detailing the competitive landscape and strategic implications for the company. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights without any surprises. It delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the agricultural and construction machinery sectors, providing a complete picture for strategic decision-making.

Rivalry Among Competitors

CNH Industrial operates in highly competitive markets where major global players like John Deere, Caterpillar, and AGCO exert significant influence. These companies engage in vigorous competition across various fronts, including the development of new technologies, aggressive pricing strategies, extensive distribution networks, and robust after-sales service.

The agricultural equipment sector, for instance, saw John Deere report revenues of approximately $61.4 billion in fiscal year 2023, highlighting its substantial market presence and competitive capacity. Similarly, Caterpillar, a key competitor in construction equipment, achieved net sales and revenues of $67.1 billion in 2023, underscoring the scale and financial muscle of these dominant firms.

This intense rivalry necessitates continuous investment in research and development, efficient supply chain management, and strong customer relationships to maintain market share and profitability. The drive for innovation is particularly evident, with companies frequently introducing advanced machinery featuring precision agriculture capabilities and enhanced automation.

CNH Industrial, like many in the heavy equipment manufacturing sector, faces intense rivalry driven by high fixed costs. These costs, associated with massive factories and specialized machinery, necessitate high production volumes to achieve economies of scale. For instance, in 2024, the capital expenditures for companies in this industry remain significant, requiring continuous output to lower per-unit costs.

This pressure to spread fixed costs often leads to aggressive pricing tactics and a fierce competition for market share. When demand softens, as it can in cyclical industries, companies may engage in price wars to maintain production levels, further intensifying rivalry among established players like CNH Industrial and its competitors.

Competitive rivalry in the agricultural and construction equipment sectors is intensely fueled by ongoing technological advancements. Companies are constantly innovating in areas like precision agriculture, which uses GPS and sensors to optimize planting and harvesting, and autonomous capabilities, leading to self-driving tractors and machinery. Electrification is also a growing trend, offering more sustainable and efficient equipment options, alongside the development of advanced digital solutions for fleet management and data analysis.

CNH Industrial, for instance, is actively pursuing a strategy centered on integrating 'Iron + Tech' into its product lines. This approach emphasizes not just the physical machinery but also the embedded technological advancements. A prime example is their investment in AI-powered sprayers, designed to precisely target weeds, thereby reducing herbicide usage and improving crop yields. This focus on specialized, tech-driven features helps CNH Industrial differentiate its products in a crowded market and capture a competitive edge.

Global Market Reach and Regional Dynamics

CNH Industrial's global footprint means it navigates a complex web of competitors, with intensity varying by region. Mature markets like North America and Europe often feature established players with significant market share, leading to fierce price competition and innovation battles. For instance, in 2023, the agricultural machinery market in Europe saw CNH Industrial vying with giants like John Deere and AGCO, each holding substantial portions of key segments.

Emerging markets, conversely, present a dual challenge and opportunity. While these regions, such as parts of Asia and South America, offer substantial growth potential, they also introduce a different competitive dynamic. Local manufacturers, often with lower cost structures and a deep understanding of regional needs, can pose a significant threat. CNH Industrial's strategy must therefore adapt to these localized competitive pressures, which may involve different product offerings or pricing strategies compared to its approach in developed economies.

- Regional Competition: CNH Industrial faces intense rivalry from global players like John Deere and AGCO in mature markets, while also contending with local manufacturers in emerging economies.

- Market Maturity Impact: Competition is fiercer in developed markets due to established players and slower growth, necessitating greater focus on innovation and efficiency.

- Emerging Market Dynamics: Growth opportunities in regions like Asia and South America are accompanied by challenges from cost-competitive local competitors who understand specific regional demands.

- Strategic Adaptation: CNH Industrial must tailor its competitive strategies, including product development and pricing, to suit the unique landscape of each regional market it operates within.

Cyclical Nature of the Industries

CNH Industrial operates in sectors like agriculture and construction, which are inherently cyclical. This means demand for their equipment fluctuates significantly with broader economic trends, commodity prices, and government investment in infrastructure. For instance, in 2024, global construction spending is projected to see varied growth depending on region, with some areas experiencing slowdowns impacting equipment demand.

This cyclicality directly fuels competitive rivalry. When the market shrinks during economic downturns, companies like CNH Industrial find themselves competing more fiercely for a reduced customer base. This often translates into price competition and can put considerable pressure on profit margins as companies try to maintain market share.

The intensity of this rivalry is further amplified by the presence of other major global players. For example, in the agricultural sector, CNH Industrial competes with companies like John Deere and AGCO, all vying for sales when demand is high and fighting for every deal when it is not.

- Cyclical Demand: Agricultural and construction equipment markets are sensitive to economic cycles, commodity prices, and government spending.

- Intensified Rivalry: During economic downturns, competition increases as companies fight for fewer customers.

- Price Pressure: The fight for market share in down cycles can lead to price wars, impacting profitability.

- Key Competitors: CNH Industrial faces strong competition from global players in both agriculture and construction equipment markets.

Competitive rivalry within CNH Industrial's operating sectors is exceptionally high, driven by the presence of well-established global giants and the inherent nature of the industries. Companies like John Deere and Caterpillar are significant players, engaging in aggressive competition through technological innovation, pricing, distribution, and after-sales service. This dynamic necessitates continuous investment in R&D and efficient operations to maintain market position.

| Competitor | Primary Sector | 2023 Revenue (Approx.) |

| John Deere | Agriculture | $61.4 billion |

| Caterpillar | Construction | $67.1 billion |

| AGCO | Agriculture | $14.5 billion |

SSubstitutes Threaten

The threat of substitutes for heavy equipment remains remarkably low for CNH Industrial. For major agricultural operations and large-scale construction endeavors, there simply aren't direct replacements that can efficiently perform the tasks of tractors, combines, excavators, or bulldozers. This lack of viable alternatives significantly strengthens CNH Industrial's market position.

Technological advancements within CNH Industrial's existing equipment present a subtle but significant threat. For instance, upgrades in precision agriculture technology can extend the useful life of tractors and harvesters, making customers less inclined to purchase entirely new models. This means a customer might invest in a new GPS guidance system for their 2020 combine rather than buying a 2024 model, impacting CNH's new equipment sales volume.

The expanding rental market for agricultural and construction equipment presents a significant threat of substitution for CNH Industrial. For smaller businesses or those undertaking short-term projects, renting machinery offers a viable alternative to purchasing new equipment, bypassing substantial upfront capital investment.

This trend is particularly noticeable in the compact construction equipment segment. For instance, in 2023, the global equipment rental market was valued at over $100 billion, with a significant portion driven by construction and agricultural machinery, indicating a strong preference for flexible access over ownership for many users.

Used Equipment Market

The robust used equipment market presents a significant threat to CNH Industrial. A well-functioning secondary market offers a compelling lower-cost alternative for customers, especially when new equipment prices are high or during economic slowdowns. This directly impacts demand for new machinery.

The availability and competitive pricing of used agricultural and construction equipment can significantly pressure CNH Industrial's new equipment sales. For instance, in 2024, the market saw a continued demand for pre-owned tractors and excavators, with some models retaining a substantial percentage of their original value, making them attractive to budget-conscious buyers.

- Lower Price Point: Used equipment offers a considerable cost saving compared to new machinery, attracting a broad segment of buyers.

- Economic Sensitivity: During economic downturns, the used market often thrives as customers seek more affordable solutions.

- Inventory Management Impact: A strong used market can influence CNH Industrial's inventory management strategies for new equipment.

- Value Retention: The residual value of CNH Industrial's equipment in the used market directly affects the total cost of ownership for customers, influencing their purchasing decisions.

Shift to Different Farming/Construction Methods

While not a direct equipment substitute, evolving farming and construction methods present a long-term threat to CNH Industrial. For instance, the rise of vertical farming and urban agriculture could reduce the need for large-scale, traditional agricultural machinery. Similarly, increased adoption of modular construction in certain building sectors might lessen demand for some heavy construction equipment.

This shift impacts CNH Industrial by potentially shrinking the market for its core products. For example, if vertical farms become widespread, the demand for tractors and harvesters in those specific operations would diminish. The construction industry's move towards pre-fabricated components could also mean fewer on-site heavy lifting or earthmoving requirements for some projects.

- Vertical Farming Growth: The global vertical farming market was valued at approximately $5.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating a significant potential shift away from traditional field agriculture.

- Modular Construction Expansion: The modular construction market is also experiencing robust growth, with projections suggesting it could account for a substantial portion of new construction projects in the coming years, potentially impacting demand for certain types of heavy machinery.

- CNH Industrial's Diversification: CNH Industrial, through its brands like Case IH and New Holland, is actively exploring solutions for precision agriculture and alternative power sources to adapt to these changing industry dynamics.

The threat of substitutes for CNH Industrial's heavy equipment is generally low for core functions, but alternative purchasing models and evolving industry practices pose challenges. The rental market, valued at over $100 billion globally in 2023 for equipment, offers a flexible alternative to ownership, especially for smaller operations. Furthermore, the robust used equipment market, with strong demand for pre-owned tractors and excavators in 2024, provides a significant cost-saving substitute for new machinery.

Emerging trends like vertical farming, a market projected to grow from $5.5 billion in 2023 to over $30 billion by 2030, and modular construction could also indirectly substitute demand for traditional large-scale agricultural and construction machinery. CNH Industrial is adapting by focusing on precision agriculture and alternative power solutions.

| Threat Type | Impact on CNH Industrial | 2023/2024 Data Point |

| Rental Market | Reduces demand for new equipment purchases | Global equipment rental market valued over $100 billion (2023) |

| Used Equipment Market | Offers lower-cost alternative, impacting new sales | Continued strong demand for pre-owned tractors/excavators (2024) |

| Vertical Farming | Potential reduction in demand for traditional ag equipment | Market projected to grow from $5.5 billion (2023) to >$30 billion (2030) |

| Modular Construction | May lessen need for certain heavy construction machinery | Growing market share in construction projects |

Entrants Threaten

The significant capital needed to build manufacturing plants, research and development centers, and worldwide distribution systems presents a substantial hurdle for newcomers in the agricultural and construction machinery sectors. For instance, establishing a new tractor manufacturing facility can easily cost hundreds of millions of dollars, a figure that deters many potential entrants.

Established players like CNH Industrial leverage significant economies of scale in production, procurement, and research and development. This cost advantage makes it challenging for new entrants to match their pricing and profitability. For instance, CNH Industrial's extensive global manufacturing footprint allows for bulk purchasing of raw materials and components, driving down per-unit costs.

The experience curve also plays a crucial role; CNH Industrial has accumulated decades of expertise in designing efficient manufacturing processes, optimizing product quality, and understanding customer needs. This deep market knowledge and operational efficiency are difficult and costly for newcomers to replicate quickly, creating a substantial barrier to entry.

CNH Industrial's established brands, such as Case IH and New Holland, command significant customer loyalty built over decades. This deep-rooted trust makes it incredibly difficult and costly for new companies to gain a foothold, as replicating such brand equity requires immense time and financial resources.

Extensive Dealer and Service Networks

CNH Industrial's significant advantage lies in its extensive global dealer and service networks, a critical barrier for new entrants in the heavy equipment sector. Building a comparable infrastructure requires massive investment and time, encompassing sales, distribution, parts availability, and skilled technician support across diverse geographical markets.

For instance, as of late 2023, CNH Industrial operates through a vast network of dealers and service points, ensuring widespread product availability and customer support. This established presence makes it incredibly difficult for newcomers to compete effectively on a global scale, as replicating such a comprehensive support system is a monumental undertaking. The sheer scale and established relationships within these networks represent a substantial competitive moat.

- Global Reach: CNH Industrial's network spans over 170 countries, providing a significant advantage in market penetration and customer service.

- Service Excellence: The emphasis on skilled technicians and readily available parts ensures high customer satisfaction and equipment uptime, a difficult standard for new players to match.

- Distribution Prowess: Established logistics and distribution channels streamline product delivery and inventory management, offering efficiency that new entrants would struggle to replicate quickly.

- Brand Loyalty: The long-standing presence and reliable service foster brand loyalty, making it challenging for new brands to attract and retain customers.

Intellectual Property and Technological Complexity

The threat of new entrants for CNH Industrial, particularly concerning intellectual property and technological complexity, is moderate. The agricultural and construction equipment sectors are deeply entrenched with established players who possess significant R&D capabilities and extensive patent portfolios. For instance, CNH Industrial heavily invests in areas like precision agriculture, which involves sophisticated GPS, IoT, and data analytics, requiring substantial upfront investment and specialized expertise. In 2023, CNH Industrial reported R&D expenses of €1.2 billion, highlighting the continuous innovation needed to stay competitive.

Newcomers would face considerable barriers to entry due to the high cost and time required to develop proprietary technologies and secure necessary patents. The pace of innovation in alternative power solutions, such as electric and hydrogen powertrains for heavy machinery, further elevates these barriers. Companies like John Deere and AGCO also invest billions annually in R&D, creating a high bar for any potential new competitor to overcome in terms of technological advancement and intellectual property protection.

- High R&D Investment: CNH Industrial's commitment to innovation, exemplified by its €1.2 billion R&D spend in 2023, necessitates significant capital for new entrants to match.

- Patent Protection: Existing patents on core technologies in precision agriculture and automation create legal and competitive hurdles for new market participants.

- Technological Sophistication: The increasing complexity of machinery, integrating advanced software, AI, and alternative powertrains, demands specialized knowledge and infrastructure that are costly to replicate.

- Industry Leaders' Scale: Competitors like John Deere and AGCO also invest heavily in R&D, creating a formidable competitive landscape for any new entrant.

The threat of new entrants in the agricultural and construction equipment sectors remains relatively low for CNH Industrial due to substantial barriers. The immense capital required for manufacturing, research, and global distribution, often in the hundreds of millions of dollars for a single plant, deters many potential competitors. Furthermore, CNH Industrial's established economies of scale in procurement and production, coupled with decades of accumulated expertise and strong brand loyalty, create significant cost and knowledge advantages that are difficult and expensive for newcomers to overcome.

| Barrier Type | Description | Impact on New Entrants | CNH Industrial's Position |

| Capital Requirements | High cost of manufacturing plants, R&D, and distribution networks. | Significant deterrent; requires hundreds of millions to establish. | Well-established global infrastructure. |

| Economies of Scale | Cost advantages from large-scale production and procurement. | Makes it hard for new entrants to match pricing and profitability. | Leverages extensive global manufacturing and supply chains. |

| Brand Loyalty & Reputation | Customer trust built over decades. | Difficult and costly for new companies to gain market share. | Strong brand equity with Case IH and New Holland. |

| Distribution & Service Networks | Extensive dealer and service infrastructure. | Requires massive investment and time to replicate. | Vast global network ensuring product availability and support. |

Porter's Five Forces Analysis Data Sources

Our CNH Industrial Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, investor presentations, and publicly available financial statements. We also leverage industry-specific market research reports and trade publications to capture current competitive dynamics.