Cleanaway SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cleanaway Bundle

Cleanaway's operational efficiency and strong brand recognition are key strengths, but evolving regulatory landscapes and infrastructure costs present significant challenges. Want to fully understand how these factors shape their market dominance and future trajectory?

Unlock the complete picture with our in-depth Cleanaway SWOT analysis. This comprehensive report provides actionable insights, strategic context, and financial implications, perfect for investors and industry analysts seeking a competitive edge.

Strengths

Cleanaway stands as Australia's undisputed leader in waste management, boasting an expansive and integrated national network. This infrastructure encompasses over 330 operational locations and a substantial fleet of more than 6,350 specialized vehicles, enabling the company to provide end-to-end waste solutions. Their extensive reach across collection, processing, treatment, and landfill operations gives them a powerful competitive edge.

Cleanaway's comprehensive service offering is a significant strength, covering the entire waste management lifecycle from collection and recycling to treatment and disposal. This broad spectrum includes specialized services such as health and biohazardous waste management and waste oil refining, which diversifies revenue streams and expands market penetration across various industries.

Cleanaway has shown impressive financial strength, with its net revenue and underlying earnings before interest and taxes (EBIT) experiencing substantial growth. For the fiscal year 2024, the company announced a statutory net profit of $158.2 million, and importantly, its underlying net profit after tax (NPAT) saw a healthy increase of 14.8%, reaching $170.6 million. This performance highlights effective operational management and market positioning.

Looking ahead, Cleanaway is well-positioned to meet its ambitious mid-term financial goals. The company is on track to surpass its underlying EBIT target of $450 million by fiscal year 2026. This forward-looking projection underscores a consistent growth trajectory and a positive financial outlook, driven by strategic initiatives and market demand for its services.

Commitment to Sustainability and Circular Economy

Cleanaway's unwavering commitment to sustainability and the circular economy is a significant strength. They are actively positioning themselves as a leader in Australia's shift towards resource recovery, with their 2024 Sustainability Framework outlining clear goals in environmental protection and emissions reduction.

Their dedication is tangible through initiatives like the Eastern Creek organics facility, which diverts valuable organic waste from landfill. This facility processes significant volumes of food and garden waste, transforming it into beneficial compost, thereby closing the loop in resource management.

- Resource Recovery Focus: Cleanaway's strategy prioritizes extracting maximum value from waste streams.

- Circular Economy Alignment: Their operations directly support Australia's transition to a circular economy model.

- Environmental Stewardship: The 2024 Sustainability Framework emphasizes reducing emissions and protecting natural resources.

- Tangible Initiatives: The Eastern Creek organics facility exemplifies their practical approach to resource recovery.

Operational Excellence and Strategic Initiatives

Cleanaway's 'Blueprint 2030' strategy is a key strength, focusing on operational excellence and strategic growth. This plan aims to optimize its extensive branch network and boost labor efficiency, which are crucial for cost management in the waste management sector. For instance, the company has been investing in strategic infrastructure to support these improvements.

The company has demonstrated success in transforming specific business segments, such as Queensland Solids and Health Services. These successful transformations have directly led to better profitability and enhanced operational performance. Such targeted improvements highlight Cleanaway's capability to execute complex strategic initiatives effectively.

- Blueprint 2030: A comprehensive strategy driving operational efficiency and growth.

- Network Optimization: Focus on improving branch networks for better resource allocation.

- Labor Efficiency: Initiatives to enhance productivity and reduce labor costs.

- Strategic Infrastructure Investment: Capital allocation towards assets that support long-term growth and efficiency.

Cleanaway's market leadership is underpinned by its extensive national infrastructure, comprising over 330 sites and a fleet exceeding 6,350 vehicles, enabling comprehensive waste management services. Their integrated approach across collection, processing, treatment, and landfill offers a significant competitive advantage.

The company's diverse service portfolio, from general waste to specialized health and biohazardous waste management, along with waste oil refining, creates multiple revenue streams and broad market appeal. This breadth of services positions Cleanaway as a one-stop solution for various industries.

Financially, Cleanaway has demonstrated robust performance. For FY24, the company reported a statutory net profit of $158.2 million, with underlying NPAT growing by 14.8% to $170.6 million, indicating strong operational management and market traction.

Cleanaway's commitment to sustainability and the circular economy is a core strength, actively driving resource recovery initiatives. Their 2024 Sustainability Framework highlights goals for environmental protection and emissions reduction, exemplified by facilities like Eastern Creek organics, which processes significant volumes of waste into compost.

| Strength | Description | Supporting Data/Initiative |

|---|---|---|

| Market Leadership & Infrastructure | Australia's leading integrated waste management provider with a vast national network. | Over 330 operational locations, 6,350+ specialized vehicles. |

| Comprehensive Service Offering | End-to-end waste solutions including specialized services. | Health and biohazardous waste management, waste oil refining. |

| Financial Performance | Strong revenue growth and profitability. | FY24 Statutory Net Profit: $158.2 million; FY24 Underlying NPAT growth: 14.8% to $170.6 million. |

| Sustainability & Circular Economy | Commitment to resource recovery and environmental stewardship. | 2024 Sustainability Framework, Eastern Creek organics facility. |

What is included in the product

Delivers a strategic overview of Cleanaway’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Identifies key internal strengths and weaknesses to address operational inefficiencies and leverage competitive advantages.

Weaknesses

The waste management sector demands substantial upfront investment in critical infrastructure such as landfills, transfer stations, and advanced processing facilities. This inherent capital intensity means companies like Cleanaway must continuously allocate significant funds to maintain and upgrade these essential assets.

Cleanaway's ongoing need for capital expenditure, coupled with the cost of financing these investments, can present a considerable financial strain. This can directly affect the company's ability to generate strong returns on the capital it deploys, potentially impacting overall profitability and investor returns.

Despite its leading position, Cleanaway faces intense competition from major players such as J.J. Richards & Sons and Veolia, creating significant pricing pressures. This rivalry particularly impacts the waste collection segment, where maintaining and growing market share requires constant strategic adaptation.

While Cleanaway is actively pursuing resource recovery, its continued reliance on landfill operations presents a notable weakness. These operations remain a significant revenue stream but also represent the largest contributor to the company's greenhouse gas emissions, a critical environmental concern.

This dependence on landfilling exposes Cleanaway to increasing regulatory risks and potential carbon levies. As environmental regulations become more stringent and the demand for sustainable waste management solutions grows, the profitability of traditional landfilling could be negatively impacted, especially with the global push towards a circular economy.

Potential for Accidents and Environmental Incidents

Operating within the waste management sector inherently exposes Cleanaway to the risk of accidents and environmental incidents. These can range from vehicle collisions to fires at processing facilities, posing a constant threat to operations and safety. For instance, the significant fire at their St Marys facility in February 2025 highlighted these vulnerabilities.

Such incidents can result in substantial financial repercussions, including cleanup costs, regulatory fines, and potential litigation. Beyond the immediate financial impact, these events can severely disrupt business operations and lead to considerable damage to Cleanaway's reputation and public trust. Even with stringent safety measures, the nature of waste handling means these risks cannot be entirely eliminated.

- Risk of Accidents: Waste management operations, by their nature, involve handling hazardous materials and operating heavy machinery, increasing the likelihood of accidents.

- Environmental Incidents: Potential for spills, leaks, or fires can lead to environmental contamination and require costly remediation efforts.

- Reputational Damage: Incidents like the St Marys fire in February 2025 can significantly impact public perception and stakeholder confidence.

- Financial Costs: Beyond direct operational losses, companies face significant expenses related to incident response, regulatory penalties, and insurance claims.

Integration Challenges of Acquisitions

Cleanaway has a history of strategic acquisitions, including significant deals like the purchase of Citywide's waste collection and recycling assets and Contract Resources. These moves aim to broaden their market reach and service offerings. However, the process of merging these acquired entities, their distinct operational systems, and differing corporate cultures can be complex and time-consuming.

Successfully integrating these new businesses is crucial for realizing projected synergies and achieving the expected financial returns. For instance, the integration of Citywide's operations, completed in 2022, involved significant effort to harmonize systems and processes. Failure to manage these integration challenges effectively can lead to unforeseen costs and delays, potentially impacting profitability and the overall success of the acquisition strategy.

- Operational Integration Complexity: Merging diverse IT systems, fleet management, and waste processing facilities from acquired companies like Citywide can be technically demanding and costly.

- Cultural Assimilation: Aligning different organizational cultures and employee mindsets is often a significant hurdle, potentially impacting productivity and employee retention post-acquisition.

- Synergy Realization Risk: There's an inherent risk that anticipated cost savings or revenue enhancements from acquisitions might not fully materialize due to integration difficulties or market changes.

Cleanaway's reliance on landfill operations, while a current revenue driver, poses a significant weakness due to increasing environmental scrutiny and the global shift towards a circular economy. This dependence exposes the company to evolving regulatory risks and potential carbon pricing mechanisms, which could erode the profitability of traditional landfilling in the coming years.

The company's extensive capital expenditure requirements for maintaining and upgrading its infrastructure, such as landfills and processing facilities, place a continuous financial burden. This high capital intensity, coupled with the costs associated with financing these essential assets, can strain financial resources and potentially limit returns on invested capital.

Despite efforts in resource recovery, Cleanaway's ongoing operational incidents, exemplified by the February 2025 fire at its St Marys facility, highlight inherent risks. These events not only incur substantial remediation and regulatory costs but also pose a significant threat to the company's reputation and operational continuity.

Integrating acquired businesses, such as the Citywide assets, presents complex operational and cultural challenges. Difficulties in harmonizing IT systems, fleet management, and corporate cultures can lead to unforeseen costs and delays, potentially hindering the realization of projected synergies and impacting overall acquisition success.

Preview Before You Purchase

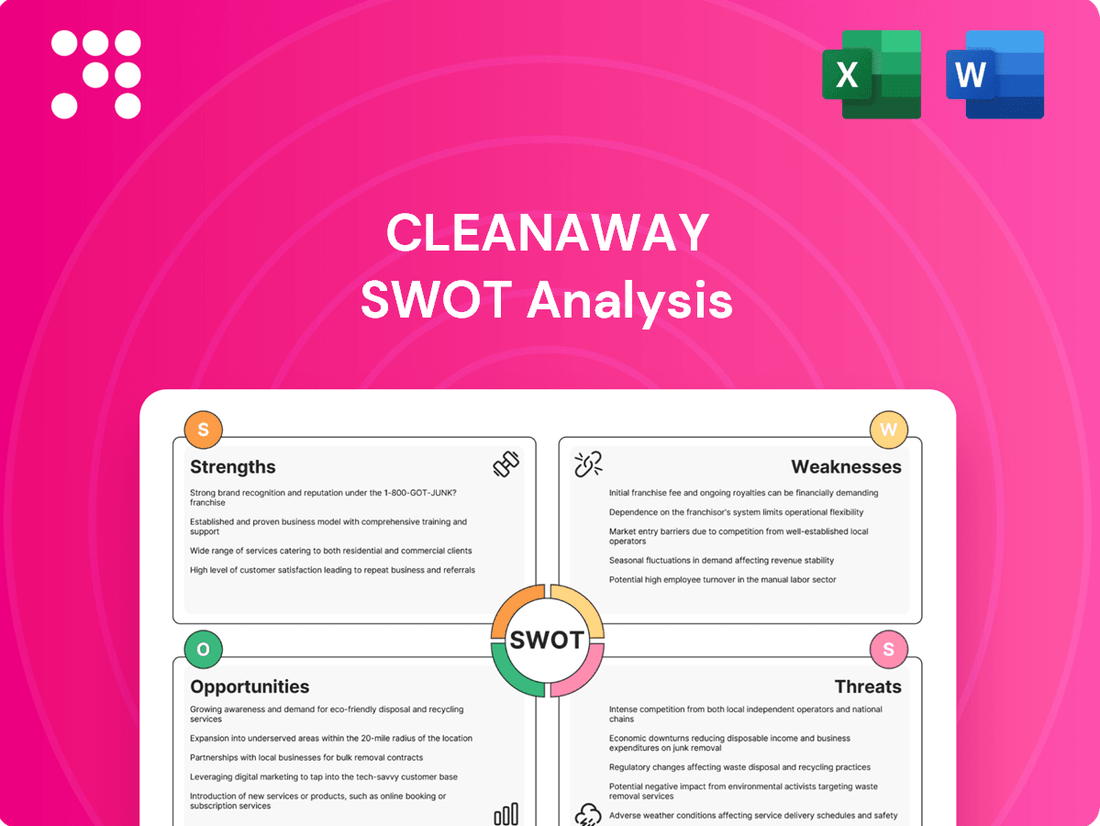

Cleanaway SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It outlines Cleanaway's Strengths, Weaknesses, Opportunities, and Threats comprehensively.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview for Cleanaway.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Cleanaway SWOT analysis, ready for your strategic planning.

Opportunities

Increasing environmental awareness and supportive government policies are fueling a significant rise in demand for resource recovery and circular economy solutions. This trend is a major opportunity for Cleanaway, aligning with a global push towards sustainability.

Cleanaway is well-positioned to capitalize on the growing demand for high-circularity, low-carbon waste management options. The company can expand its resource recovery capabilities, focusing on advanced recycling and processing of diverse waste streams, including organics and electronic waste, to meet evolving market needs.

The global shift towards a low-carbon economy presents a significant opportunity for Cleanaway. The company can leverage this by expanding its energy-from-waste facilities and enhancing landfill gas capture projects. These investments align with growing demand for renewable energy sources.

These green initiatives offer a dual benefit: reducing greenhouse gas emissions and creating new revenue streams from generated renewable energy. For instance, in 2023, Cleanaway's operations contributed to the diversion of over 2.5 million tonnes of waste from landfill, a strong foundation for further energy recovery development.

Cleanaway can leverage technological advancements to boost efficiency and recovery. For instance, investing in AI-powered sorting systems can significantly improve the accuracy and speed of separating recyclable materials, potentially increasing the recovery rate of valuable resources from mixed waste streams. This aligns with their strategy to explore innovative waste solutions.

The company can also adopt digital platforms to streamline customer interactions and internal operations. By implementing advanced data analytics for route optimization and resource allocation, Cleanaway can reduce operational costs and enhance service delivery. This focus on digital solutions is crucial for managing complex waste streams and improving overall business performance.

Government Policies and Regulatory Support

Supportive government policies are a significant tailwind for Cleanaway. Statewide mandates for things like food and garden organics (FOGO) recycling and container deposit schemes create a more favorable regulatory landscape, directly benefiting Cleanaway's operations. These initiatives are designed to boost recycling volumes and resource recovery, which translates into new revenue streams and strengthens Cleanaway's standing in the market. For instance, as of early 2024, several Australian states are expanding or implementing container deposit schemes, projected to significantly increase the volume of recyclable materials collected.

These government actions directly translate into tangible opportunities:

- Increased Collection Volumes: Mandates for FOGO and container deposits funnel more recyclable materials into the system, directly benefiting Cleanaway's collection and processing services.

- New Revenue Streams: The expansion of resource recovery programs, often supported by government incentives, opens up new avenues for Cleanaway to generate income beyond traditional waste disposal.

- Market Leadership: By aligning with and capitalizing on these policy shifts, Cleanaway can solidify its position as a leader in the circular economy and sustainable waste management.

- Investment in Infrastructure: Government support can also include funding or incentives for upgrading recycling and processing infrastructure, allowing Cleanaway to enhance its capabilities and efficiency.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships offer significant growth avenues for Cleanaway. By acquiring businesses that complement its existing services or expand its geographic footprint, Cleanaway can solidify its market leadership. For instance, in the 2024 financial year, Cleanaway continued to explore opportunities to enhance its waste management and recycling capabilities through targeted M&A activity, aiming to integrate new technologies and service models.

Forming strategic alliances is also crucial for innovation and scaling new solutions. Cleanaway's collaboration with Viva Energy on advanced plastics recycling demonstrates a commitment to developing circular economy solutions. This partnership, which commenced in late 2023, aims to process a significant volume of post-consumer plastics, aligning with increasing demand for sustainable waste management practices and potentially creating new revenue streams by 2025.

- Geographic Expansion: Acquisitions can unlock new regional markets, increasing Cleanaway's customer base and revenue potential.

- Service Enhancement: Partnerships can lead to the development of advanced recycling and reuse technologies, broadening Cleanaway's service portfolio.

- Market Consolidation: Strategic M&A can reduce competition and strengthen Cleanaway's competitive advantage in key segments of the waste management industry.

The increasing global focus on sustainability and the circular economy presents a significant opportunity for Cleanaway to expand its resource recovery services. By investing in advanced recycling technologies and processing capabilities for diverse waste streams, the company can meet the growing demand for environmentally friendly waste solutions.

Cleanaway is poised to benefit from the transition to a low-carbon economy through its energy-from-waste facilities and landfill gas capture projects. These initiatives not only address environmental concerns but also create new revenue streams from renewable energy generation, aligning with market trends. In FY23, Cleanaway diverted over 2.5 million tonnes of waste from landfill, providing a strong base for further energy recovery development.

Technological advancements, such as AI-powered sorting systems, offer substantial opportunities to improve operational efficiency and increase resource recovery rates. Furthermore, digital platforms can streamline customer interactions and optimize logistics, reducing costs and enhancing service delivery, which is crucial for managing complex waste streams effectively.

Supportive government policies, including mandates for food and garden organics (FOGO) recycling and container deposit schemes, create a favorable operating environment. These policies directly increase collection volumes and open new revenue streams, bolstering Cleanaway's market leadership in sustainable waste management. As of early 2024, several Australian states are expanding their container deposit schemes, expected to boost recycling volumes.

Strategic acquisitions and partnerships provide avenues for growth and innovation. Cleanaway's continued exploration of M&A opportunities, as seen in FY24, aims to integrate new technologies and service models. Collaborations, like the one with Viva Energy for advanced plastics recycling initiated in late 2023, are key to developing circular economy solutions and potentially generating new revenue by 2025.

| Opportunity Area | Description | Key Data/Impact |

|---|---|---|

| Resource Recovery Growth | Expanding services for high-circularity, low-carbon waste management. | Increased demand driven by environmental awareness and policy. |

| Energy-from-Waste & Gas Capture | Leveraging waste for renewable energy production. | FY23: Diverted >2.5 million tonnes from landfill; potential for new revenue streams. |

| Technological Advancement | Implementing AI sorting and digital platforms for efficiency. | Improved recovery rates and operational cost reduction. |

| Policy Alignment | Capitalizing on FOGO and container deposit schemes. | Increased collection volumes; new revenue streams; market leadership. Early 2024: State CDS expansions expected to boost recycling. |

| M&A and Partnerships | Acquiring complementary businesses and forming strategic alliances. | FY24: Continued M&A exploration. Late 2023: Viva Energy plastics recycling partnership targets new revenue by 2025. |

Threats

The waste management landscape is becoming more crowded, with established companies and nimble specialists vying for market share. This intensified competition, particularly from those focusing on single waste streams like e-waste or plastics, puts pressure on pricing and can lead to customer shifts. For instance, in 2024, the global waste management market is projected to reach over $1.7 trillion, indicating significant growth but also a prime target for new entrants.

Disruptive technologies, such as advanced sorting robotics and chemical recycling, further complicate the competitive environment. Companies like Cleanaway must continually innovate and invest to stay ahead, as these new methods can offer more efficient or specialized solutions. Failure to adapt could result in losing ground to competitors who embrace these technological advancements, impacting revenue streams and market position.

Economic downturns pose a significant threat to Cleanaway. Fluctuations in economic growth, industrial activity, and consumer spending directly influence the volume and composition of waste generated. For instance, a slowdown in manufacturing or retail could reduce commercial and industrial waste streams, which are often more profitable than municipal waste.

As of early 2024, global economic growth forecasts have been revised downwards by organizations like the IMF, signaling potential headwinds. This economic sensitivity means that a substantial contraction in GDP could lead to lower waste volumes, impacting Cleanaway's revenue and overall profitability, particularly in its commercial waste segments.

The waste management sector faces increasing regulatory scrutiny, with evolving environmental standards and landfill levies directly impacting operational expenses for companies like Cleanaway. For instance, stricter emissions targets introduced in 2024 across various jurisdictions are compelling waste-to-energy facilities to invest in advanced filtration systems, potentially adding millions to compliance budgets.

New waste disposal requirements, such as expanded prohibitions on certain materials entering landfills, necessitate significant operational adjustments and capital investments in sorting and processing technologies. These changes can lead to higher operating costs, which may need to be passed on to customers, affecting pricing strategies and market competitiveness.

Commodity Price Volatility for Recycled Materials

Cleanaway's resource recovery segment faces a significant threat from the fluctuating prices of recycled commodities. When the market value of materials like recycled plastic or paper drops sharply, it directly erodes the revenue generated from these operations, impacting overall profitability.

For instance, the global recycled plastics market experienced considerable price swings in 2024. While demand for sustainable materials remains strong, the supply chain disruptions and shifts in manufacturing output can lead to unpredictable pricing, making consistent revenue generation challenging for Cleanaway.

- Market Sensitivity: Cleanaway's earnings from recycling are directly tied to global commodity markets, which are inherently volatile.

- Profitability Impact: A downturn in prices for recovered materials like mixed paper or certain plastic grades can significantly reduce margins on recycling services.

- Forecasting Difficulty: The unpredictable nature of commodity pricing makes it harder for Cleanaway to accurately forecast revenue and plan for future investments in its resource recovery infrastructure.

Public Perception and Environmental Activism

Negative public perception stemming from environmental incidents, such as spills or improper waste disposal, can significantly damage Cleanaway's brand. This scrutiny, amplified by environmental activism, directly impacts its social license to operate, potentially delaying crucial infrastructure projects. For instance, in 2023, Cleanaway faced community opposition regarding proposed landfill expansions, highlighting the sensitivity of public opinion to waste management operations.

Increased environmental activism can translate into more stringent regulatory oversight and community-driven challenges to Cleanaway's operations. This can lead to higher compliance costs and operational disruptions. For example, protests against landfill operations in Western Australia during 2024 underscored the direct impact of activist pressure on project timelines and public acceptance.

- Brand Reputation: Negative incidents can erode public trust, impacting customer loyalty and investor confidence.

- Social License to Operate: Community opposition can hinder new project approvals and expansions.

- Regulatory Scrutiny: Increased activism often leads to heightened regulatory attention and more rigorous compliance demands.

Intensified competition from specialized waste handlers and the emergence of disruptive recycling technologies pose a threat to Cleanaway's market share and necessitate continuous innovation. Economic downturns, as indicated by revised global growth forecasts for 2024, can reduce waste volumes, particularly impacting revenue from commercial and industrial sectors. Evolving environmental regulations and landfill levies are increasing operational expenses, requiring significant capital investment for compliance and potentially impacting pricing strategies.

The fluctuating prices of recycled commodities, such as plastics and paper, directly affect the profitability of Cleanaway's resource recovery segment, making revenue forecasting challenging. Negative public perception and increased environmental activism can damage brand reputation, hinder project approvals, and lead to greater regulatory scrutiny, impacting the company's social license to operate.

| Threat Category | Description | Impact on Cleanaway | Example Data/Context (2024/2025) |

|---|---|---|---|

| Competition | Increased market entrants and specialized waste services. | Pressure on pricing, potential loss of customers. | Global waste management market projected to exceed $1.7 trillion in 2024, attracting new players. |

| Economic Factors | Global economic slowdown and reduced industrial activity. | Lower waste volumes, decreased revenue from commercial sectors. | IMF forecasts revised downwards for global GDP growth in early 2024. |

| Regulatory & Compliance | Stricter environmental standards and landfill levies. | Higher operating costs, need for capital investment in compliance. | New emissions targets in 2024 requiring advanced filtration for waste-to-energy. |

| Commodity Price Volatility | Fluctuations in the market value of recycled materials. | Reduced profitability in resource recovery, forecasting challenges. | Significant price swings observed in the global recycled plastics market during 2024. |

| Public Perception & Activism | Negative environmental incidents and increased activism. | Brand damage, operational disruptions, hindered project approvals. | Community opposition to landfill expansions in 2023 and protests in Western Australia in 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Cleanaway's official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded and accurate strategic overview.