Cleanaway Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cleanaway Bundle

Cleanaway's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the constant threat of new companies entering the waste management sector. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Cleanaway’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for critical inputs like specialized waste collection vehicles and advanced processing technology can significantly influence Cleanaway's operational costs and flexibility. When a limited number of suppliers control essential resources, their leverage escalates, potentially driving up prices or dictating less advantageous contract terms for Cleanaway.

Switching costs play a significant role in how much power suppliers hold over Cleanaway. If it's expensive and time-consuming for Cleanaway to switch to a different supplier, the current suppliers gain more leverage. These costs can include things like retooling machinery to accommodate new materials, training employees on new processes, or even the administrative burden of renegotiating contracts and setting up new supply chains.

Suppliers in the waste management sector, particularly those providing specialized equipment or processing technologies, could pose a threat to Cleanaway if they have the capability and incentive to integrate forward. This means they might start offering waste management services directly, bypassing Cleanaway and becoming a competitor.

For instance, a technology provider for advanced recycling might decide to operate its own collection and processing facilities, directly competing with Cleanaway's core business. Such a move would diminish Cleanaway's need for that supplier's services and could intensify market competition, potentially impacting pricing and market share.

Uniqueness of Inputs

The uniqueness of inputs significantly influences supplier bargaining power for Cleanaway. For instance, specialized hazardous waste disposal solutions, often requiring specific licensing and advanced technology, are not readily available from numerous providers. This specialization means suppliers offering these critical services can negotiate more favorable terms, as Cleanaway’s operational continuity depends on them.

If a supplier holds patents for unique waste treatment technologies or possesses proprietary methods for handling complex waste streams, their position is strengthened. Cleanaway would find it difficult and costly to switch to an alternative, potentially leading to higher input costs. This dependence on specialized, non-substitutable inputs directly translates to increased bargaining leverage for these suppliers.

- Specialized Waste Treatment Technologies: Suppliers with patented or proprietary waste treatment processes can command higher prices due to their unique capabilities.

- Hazardous Waste Disposal Expertise: Companies possessing the necessary licenses and infrastructure for safe hazardous waste disposal have a distinct advantage.

- Limited Substitutability: The difficulty in finding alternative suppliers for critical, specialized inputs empowers existing suppliers.

- Impact on Pricing: Unique and essential inputs allow suppliers to dictate higher prices, directly affecting Cleanaway's cost structure.

Importance of Supplier's Input to Cleanaway's Cost Structure

The bargaining power of suppliers for Cleanaway is significantly influenced by the proportion of their input in Cleanaway's overall cost structure. When a supplier's product or service constitutes a substantial part of Cleanaway's operating expenses, that supplier gains considerable leverage.

For instance, if the cost of waste collection vehicles or specialized disposal equipment represents a large percentage of Cleanaway's capital expenditure and ongoing operational costs, the manufacturers or providers of these essential assets can exert greater influence. This leverage allows them to potentially dictate terms, pricing, and service agreements.

- Fuel Costs: Fuel is a major expense for a waste management company like Cleanaway, directly impacting the cost of vehicle operation and logistics. Fluctuations in global oil prices can therefore increase supplier power for fuel providers.

- Vehicle and Equipment Procurement: The cost of purchasing and maintaining specialized waste collection trucks, processing machinery, and landfill equipment represents a significant portion of Cleanaway's capital and operational budget. Suppliers in this sector can hold substantial power due to the specialized nature and high cost of their products.

- Disposal Site Access: In certain regions, access to licensed landfill sites or specialized treatment facilities can be limited. Suppliers who control these essential disposal points can wield considerable bargaining power over waste management companies.

The bargaining power of suppliers for Cleanaway is a key factor in its cost structure and operational efficiency. Suppliers of specialized waste treatment technologies and hazardous waste disposal expertise hold significant leverage due to the unique nature of their offerings and the high switching costs involved. For instance, in 2024, the increasing demand for advanced recycling solutions, coupled with stringent environmental regulations, means that providers of these niche technologies can command premium pricing. Furthermore, the substantial capital investment required for specialized waste collection vehicles and processing equipment limits the number of viable suppliers, thereby concentrating power in their hands.

| Supplier Category | Key Factor Influencing Power | Impact on Cleanaway |

|---|---|---|

| Specialized Waste Treatment Technologies | Proprietary processes, patents, limited providers | Higher input costs, dependence on specific suppliers |

| Hazardous Waste Disposal Expertise | Licensing, infrastructure, specialized knowledge | Limited supplier options, potential for price increases |

| Waste Collection Vehicles & Processing Equipment | High capital cost, specialized manufacturing | Significant procurement costs, supplier negotiation leverage |

| Fuel Providers | Global oil price volatility | Direct impact on operational expenses and logistics costs |

What is included in the product

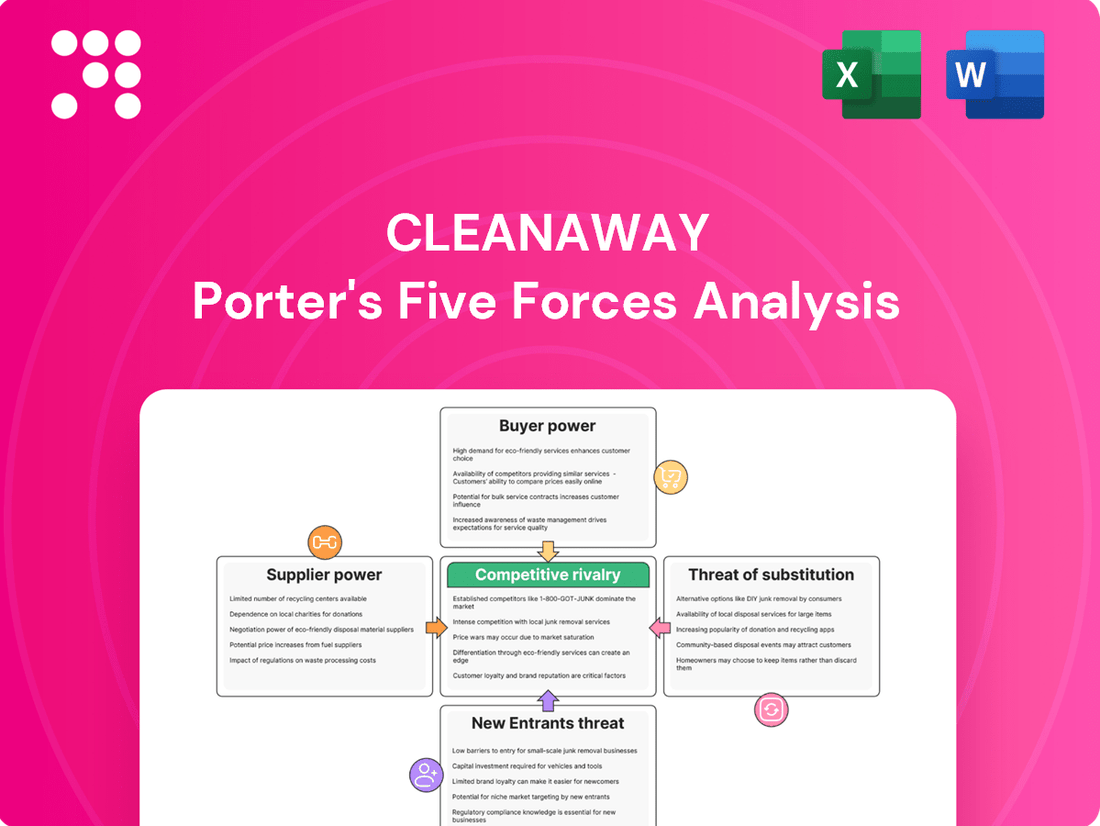

Analyzes the competitive intensity within the waste management industry for Cleanaway, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals.

Gain immediate clarity on competitive pressures with a visual spider chart that maps Cleanaway's position across all five forces.

Customers Bargaining Power

Customer concentration is a key factor in assessing bargaining power. If a few large clients account for a substantial portion of a company's revenue, they gain leverage to negotiate better terms.

Cleanaway serves a broad customer base, encompassing municipal, commercial, and industrial sectors. This diversification generally mitigates the risk of any single customer having excessive bargaining power.

While Cleanaway serves over 170,000 customers annually, the impact of customer concentration depends on the revenue distribution among these clients. A significant revenue share from a small number of major customers would increase their bargaining power.

Customer switching costs significantly influence their bargaining power in the waste management sector. If it's easy and inexpensive for clients to change providers, they can demand better terms or readily switch to a competitor, thereby increasing their leverage over Cleanaway.

In 2024, Cleanaway demonstrated its ability to retain customers and win new business, evidenced by securing a substantial six-year contract with Defence. Such long-term agreements suggest that customers may face higher switching costs, whether due to contractual obligations, the effort involved in transitioning services, or the perceived value of Cleanaway's offerings.

The threat of backward integration by customers, where they manage their waste internally, poses a potential challenge to Cleanaway. However, this is typically less of a concern for intricate waste streams or large-scale operations that demand substantial infrastructure and specialized knowledge, areas where Cleanaway excels.

Price Sensitivity of Customers

The degree to which customers are sensitive to price changes directly impacts their bargaining power. For instance, municipal contracts, frequently secured through competitive tenders, often exhibit high price sensitivity. Conversely, specialized hazardous waste disposal services may demonstrate lower price sensitivity due to stringent regulatory compliance needs and the unique expertise required.

The Australian waste management sector is experiencing growth, with projections indicating continued expansion. This sustained demand can create opportunities for companies like Cleanaway to implement price adjustments, although the extent of this flexibility is heavily influenced by customer price sensitivity.

- Price Sensitivity in Municipal Contracts: Municipalities often prioritize cost-effectiveness, leading to intense bidding wars where the lowest price frequently wins.

- Specialized Services vs. Price: For hazardous waste, safety and compliance are paramount, often outweighing minor price differences for customers.

- Market Growth and Pricing: The Australian waste management market's projected growth suggests a generally robust demand, potentially allowing for some pricing power, especially in niche or essential service areas.

Availability of Substitute Services

The bargaining power of Cleanaway's customers is significantly affected by the availability of substitute services in the waste management sector. When customers have numerous alternative providers to choose from, their ability to negotiate better terms, such as lower prices or improved service levels, increases. This is particularly true in markets where smaller, more localized waste management companies or specialized niche providers can offer competitive solutions.

Cleanaway operates within a competitive landscape that includes other major national waste management companies. For instance, J.J. Richards & Sons Pty Ltd and Veolia are prominent competitors, offering a range of waste management services that can serve as direct substitutes for Cleanaway's offerings. The presence of these established players, alongside a potentially growing number of smaller regional or specialized firms, creates an environment where customers have a tangible choice, thereby amplifying their bargaining power.

- Availability of Substitutes: Customers can switch to alternative waste management providers if Cleanaway's pricing or service quality is not satisfactory.

- Competitive Landscape: Major competitors like J.J. Richards & Sons Pty Ltd and Veolia provide viable alternatives, intensifying customer leverage.

- Market Fragmentation: The presence of smaller, specialized waste management firms further diversifies customer options, increasing their bargaining power.

The bargaining power of Cleanaway's customers is influenced by several factors, including customer concentration, switching costs, price sensitivity, and the availability of substitutes. While Cleanaway serves a broad customer base, the impact of concentration depends on revenue distribution. High switching costs, such as those in long-term contracts like the one with Defence, can limit customer leverage.

Price sensitivity is notable in municipal contracts, where cost is a primary driver, contrasting with specialized services where safety and compliance often take precedence. The competitive landscape, featuring players like J.J. Richards & Sons and Veolia, offers customers alternatives, thereby increasing their bargaining power.

| Factor | Impact on Customer Bargaining Power | Cleanaway's Position (as of 2024/early 2025) |

|---|---|---|

| Customer Concentration | High concentration increases power. | Diversified base, but revenue distribution is key. |

| Switching Costs | Low costs increase power. | Long-term contracts (e.g., Defence) suggest higher costs. |

| Price Sensitivity | High sensitivity increases power. | Varies by segment; high in municipal, lower in specialized waste. |

| Availability of Substitutes | More substitutes increase power. | Competition from major players and smaller firms exists. |

Preview the Actual Deliverable

Cleanaway Porter's Five Forces Analysis

This preview showcases the comprehensive Cleanaway Porter's Five Forces Analysis, detailing threats from new entrants, the bargaining power of buyers and suppliers, the intensity of competitive rivalry, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ready for your strategic planning needs.

Rivalry Among Competitors

The Australian waste management sector features significant players like Cleanaway, J.J. Richards & Sons, and Veolia Recycling & Recovery. These substantial, well-established companies create a highly competitive environment.

The overall growth rate of the Australian waste management market significantly shapes the intensity of competition. A more robust market expansion generally allows companies like Cleanaway to grow by capturing new opportunities. However, a slower growth environment often forces businesses to compete more fiercely for existing market share.

Projections indicate the Australian waste management sector is expected to experience a compound annual growth rate (CAGR) between 5.18% and 6.20% from 2025 through 2034. This steady growth suggests that while competition exists, the expanding pie may temper the most aggressive market share battles.

The degree to which waste management services can be differentiated significantly influences competitive rivalry. While basic waste collection might be seen as a commodity, specialized offerings such as hazardous waste treatment, advanced resource recovery, and innovative recycling technologies provide avenues for companies to stand out. Cleanaway, for instance, highlights its broad spectrum of services and commitment to sustainable solutions as key differentiators.

Exit Barriers

High exit barriers significantly influence competitive rivalry within the waste management sector. Companies like Cleanaway have made substantial investments in specialized infrastructure, including landfills, transfer stations, and advanced treatment plants. These high fixed costs, coupled with long-term contracts with local governments and industrial clients, make it economically challenging and often impractical for firms to exit the market, even when experiencing low profitability. This can lead to an oversupply of services and intensified competition as existing players remain committed to their operations.

Cleanaway's extensive network of facilities across Australia represents a considerable capital investment. For instance, as of June 30, 2023, Cleanaway reported property, plant, and equipment valued at approximately AUD 2.03 billion. This substantial asset base, essential for providing waste collection, processing, and disposal services, creates a significant financial hurdle for any company considering withdrawal from the industry. The specialized nature of these assets further limits their resale value, reinforcing the exit barriers.

- High Infrastructure Investment: Cleanaway's significant investment in landfills, recycling facilities, and collection fleets creates substantial sunk costs.

- Long-Term Contracts: Binding agreements with municipalities and industrial clients often span many years, obligating companies to continue operations.

- Specialized Assets: Waste management equipment and facilities are highly specialized, making them difficult to repurpose or sell, thereby increasing exit difficulty.

- Regulatory Compliance: Meeting stringent environmental regulations requires ongoing investment and operational commitment, further discouraging exits.

Strategic Stakes

The Australian waste management market holds significant strategic importance, particularly for domestic leaders like Cleanaway. As Australia's largest waste management company, Cleanaway has a substantial stake in defending its market share and leadership position. This inherent drive to maintain dominance naturally intensifies the competitive rivalry within the sector.

This strategic imperative means that any perceived threat to Cleanaway's leadership, whether from existing competitors or new entrants, is met with a robust response. The company's substantial investments in infrastructure, technology, and customer relationships underscore the high stakes involved. For instance, in the fiscal year 2023, Cleanaway reported revenue of AUD 3.1 billion, demonstrating the scale of its operations and the value of its market position.

- Market Leadership: Cleanaway's position as Australia's largest waste management provider creates a strong incentive to actively compete and deter rivals.

- Strategic Investments: Significant capital expenditure, such as ongoing investments in resource recovery facilities, highlights the company's commitment to its strategic goals and market presence.

- Industry Scale: The overall size and growth potential of the Australian waste management market, projected to reach approximately AUD 25 billion by 2028, further elevates the strategic importance for all players.

- Competitive Response: Cleanaway's established market share and operational capabilities enable it to respond aggressively to competitive pressures, thereby heightening rivalry.

The competitive rivalry in Australia's waste management sector is substantial, driven by a few large, established players like Cleanaway, J.J. Richards & Sons, and Veolia. These companies possess significant infrastructure and long-term contracts, making market entry difficult but also locking existing players into ongoing competition. The market's projected steady growth, with an estimated CAGR between 5.18% and 6.20% from 2025-2034, suggests that while competition is present, the expanding market size may temper overly aggressive battles for market share.

| Competitor | Market Position | Key Differentiators/Strategies |

|---|---|---|

| Cleanaway | Australia's largest waste management company | Broad service spectrum, focus on sustainable solutions, extensive infrastructure network |

| J.J. Richards & Sons | Significant national presence | Integrated waste management solutions, strong regional focus |

| Veolia Recycling & Recovery | Global leader with Australian operations | Advanced resource recovery technologies, circular economy focus |

SSubstitutes Threaten

The threat of substitutes for Cleanaway's services arises from alternative waste management approaches. While direct, comprehensive substitutes are scarce for major industrial clients, smaller businesses might explore on-site composting for organic waste or directly selling recyclable materials to processors, bypassing traditional waste haulers.

Emerging waste-to-energy technologies present a growing substitute to traditional landfilling. These advanced methods convert waste into usable energy, potentially reducing the volume sent to landfills and offering an alternative revenue stream for waste generators.

The attractiveness of substitutes for Cleanaway's waste management services hinges significantly on their relative price and performance. If alternative solutions, such as advanced recycling technologies or localized waste-to-energy plants, offer comparable or superior service at a lower cost, the threat of substitution intensifies. For instance, a 10% reduction in the operational cost of a new recycling method could make it a more appealing option for businesses seeking to manage their waste streams more economically.

The viability and adoption rate of these substitutes are also heavily influenced by government incentives and evolving regulations. For example, subsidies for companies investing in circular economy initiatives or stricter mandates on landfill diversion can dramatically shift the landscape, making substitutes more competitive. In 2024, many regions saw increased government funding for green technology, potentially lowering the barrier to entry for innovative waste management alternatives.

Customer willingness to switch to alternative waste management methods is a significant threat. For instance, if businesses find composting or on-site recycling more cost-effective and environmentally friendly than traditional waste collection services, they might reduce their reliance on companies like Cleanaway. The increasing focus on sustainability, with many companies aiming for zero-waste targets, directly fuels this propensity to substitute.

Regulatory Changes Promoting Alternatives

Government policies and regulations are increasingly pushing for alternative waste management solutions, directly impacting companies like Cleanaway. For instance, Australia has set ambitious targets for resource recovery, aiming to divert a significant portion of waste away from landfills. These regulatory shifts can make alternative methods, such as advanced recycling technologies or waste-to-energy facilities, more attractive and economically viable.

These evolving regulations act as a potent force by making substitutes more competitive. As landfill bans or restrictions on certain waste streams are implemented, businesses and municipalities are compelled to explore and adopt these alternatives. This creates a direct competitive pressure on traditional landfill services.

The Australian government's commitment to a circular economy is a key driver. For example, the National Waste Policy Action Plan aims to halve the amount of new landfill created by 2030. This policy landscape directly encourages the development and adoption of substitute waste management strategies, thereby increasing the threat to established players.

- Increased Recycling Targets: Many Australian states are implementing or strengthening mandatory recycling targets for households and businesses.

- Landfill Bans: Specific waste materials, like certain plastics or organic waste, are facing or are projected to face landfill bans in various jurisdictions.

- Resource Recovery Incentives: Government grants and tax incentives are becoming available for facilities that can demonstrate high rates of resource recovery and recycling.

- Waste-to-Energy Development: Policy support for waste-to-energy technologies is growing, presenting an alternative to landfilling for residual waste.

Technological Advancements

Technological advancements pose a significant threat of substitution for Cleanaway. New innovations are emerging that offer alternative ways to manage waste, potentially bypassing traditional integrated services. For instance, technologies enabling more efficient on-site processing or advanced material recovery could reduce reliance on centralized facilities.

Consider the rise of decentralized waste-to-energy solutions. These systems can process waste closer to its source, offering a more localized and potentially cost-effective alternative to Cleanaway's established infrastructure. This directly challenges the need for their comprehensive collection and processing services.

Furthermore, advancements in areas like AI-driven sorting systems and chemical recycling are creating new pathways for waste management. These technologies can extract higher value from waste streams or convert them into new materials, presenting a compelling substitute for conventional recycling and disposal methods. For example, the global chemical recycling market is projected to grow substantially, with some estimates suggesting it could reach tens of billions of dollars by the late 2020s, indicating a significant shift in how waste is handled.

- On-site Waste Processing: Technologies that allow for waste treatment at the point of generation reduce the need for transportation and centralized facilities.

- Advanced Material Recovery: Innovations in sorting and extraction can recover more valuable materials from waste streams, creating new revenue streams and potentially replacing raw material sourcing.

- Decentralized Waste-to-Energy: Smaller-scale, localized plants can convert waste into energy, offering an alternative to large, centralized power generation.

- AI and Chemical Recycling: Sophisticated sorting systems and advanced chemical processes offer new methods for waste conversion and material reuse, challenging traditional recycling models.

The threat of substitutes for Cleanaway's services is growing, driven by technological advancements and evolving sustainability goals. While direct, comprehensive substitutes are limited for large industrial clients, smaller businesses can explore on-site composting or directly sell recyclables, bypassing traditional haulers. Emerging waste-to-energy technologies also present a viable alternative to landfilling, converting waste into usable energy and potentially reducing the volume sent to landfills.

The economic viability of these substitutes is crucial; if alternative solutions offer comparable or better service at a lower cost, the threat intensifies. For example, a 10% reduction in operational costs for a new recycling method could make it more appealing. Government incentives and regulations, such as subsidies for circular economy initiatives, are also making substitutes more competitive. In 2024, increased government funding for green technology in many regions lowered the barrier to entry for innovative waste management alternatives.

Customer willingness to adopt alternative methods, influenced by cost-effectiveness and environmental benefits, directly impacts Cleanaway. Increasing focus on sustainability and zero-waste targets fuels this propensity to substitute. For instance, Australia's National Waste Policy Action Plan aims to halve new landfill creation by 2030, encouraging alternative strategies like advanced recycling and waste-to-energy facilities.

| Substitute Type | Key Driver | Impact on Cleanaway | 2024 Trend/Data Point |

| On-site Composting/Processing | Cost savings, reduced transport | Reduced volume for collection | Growing interest from small businesses seeking localized solutions |

| Direct Sale of Recyclables | Higher commodity prices, direct revenue | Bypasses traditional waste management | Increased participation in direct material markets |

| Waste-to-Energy (WtE) | Energy generation, landfill diversion | Alternative for residual waste | Policy support for WtE development in Australia and globally |

| Advanced Recycling Technologies | Higher material recovery rates, circular economy | Potential for higher value extraction | Global chemical recycling market projected for significant growth |

Entrants Threaten

The waste management sector, especially for integrated services like Cleanaway's, demands massive upfront investment. This includes acquiring and maintaining fleets of collection trucks, building and operating transfer stations, and establishing advanced recycling and landfill facilities. For instance, Cleanaway operates an extensive network comprising 135 licensed facilities and a fleet exceeding 6,350 vehicles, illustrating the scale of capital needed.

These substantial capital requirements create a formidable barrier for potential new competitors looking to enter the market. The sheer cost of establishing the necessary infrastructure and operational capacity makes it challenging for smaller or less-funded entities to compete effectively with established players like Cleanaway.

Economies of scale present a significant barrier for potential new entrants in the waste management sector. Established players like Cleanaway, Australia's largest waste management company, leverage these scale advantages across their extensive collection routes, high-volume processing facilities, and optimized operational networks. This allows them to achieve lower per-unit costs.

For a new competitor to emerge, they would need substantial upfront investment to build a comparable infrastructure and achieve similar operational efficiencies. Without this scale, new entrants would find it extremely challenging to match Cleanaway's pricing power, making it difficult to gain market share and compete effectively.

Securing contracts with municipalities and large commercial and industrial clients is a significant hurdle for new entrants. These channels are vital for waste management services, and access often depends on established relationships, a proven track record of reliability, and a demonstrated capacity to handle large volumes. Cleanaway, for instance, serves over 170,000 customers, highlighting the scale and entrenched nature of existing players within these key distribution networks.

Government Policy and Regulation

Government policy and regulation significantly deter new entrants in the waste management sector. The industry operates under stringent environmental standards, demanding licensing, and often relies on lengthy government contracts, creating substantial hurdles for newcomers. For instance, in 2024, Australia continued to emphasize its commitment to waste reduction, with initiatives aimed at bolstering recycling infrastructure, which requires significant capital investment and regulatory navigation.

Navigating this intricate web of regulations and securing the necessary permits presents a considerable barrier. New companies must invest heavily in compliance and understanding the nuances of environmental protection laws. The Australian government’s ambitious waste reduction targets, coupled with incentives for developing recycling capabilities, further shape the competitive landscape, favoring established players with existing infrastructure and regulatory expertise.

- Stringent Licensing: Obtaining operational licenses involves rigorous checks and compliance with environmental and safety standards.

- Environmental Standards: Adherence to strict regulations regarding waste disposal, treatment, and pollution control is mandatory.

- Government Contracts: Long-term, often exclusive, contracts with local or federal governments create a high barrier to entry for new, unproven entities.

- Policy Incentives: Government support for recycling and waste-to-energy projects can favor existing players with the capacity to leverage these programs.

Brand Identity and Customer Loyalty

For certain customer groups, a company's brand name and how dependable it is really matter. Cleanaway has been around for a while and is a top player in Australia. This means they have a strong brand identity and loyal customers, which makes it tough for new companies to win over business.

In 2023, Cleanaway reported revenue of AUD 1.4 billion. This significant market presence is built on years of trust and service delivery. New entrants would need substantial investment to build comparable brand recognition and overcome existing customer allegiances.

- Brand Recognition: Cleanaway is a household name in Australia's waste management sector.

- Customer Loyalty: Long-term contracts and established relationships create a sticky customer base.

- Switching Costs: For many clients, the effort and potential disruption of switching providers can be a deterrent.

The threat of new entrants in Australia's waste management sector remains moderate, largely due to the substantial capital investment required for infrastructure and fleet acquisition. Cleanaway's extensive network, comprising 135 licensed facilities and over 6,350 vehicles as of 2024, exemplifies the scale of resources needed to compete. This high barrier to entry, coupled with established economies of scale enjoyed by incumbent firms, makes it challenging for newcomers to achieve cost competitiveness and secure market share.

Furthermore, securing long-term contracts with municipal and large commercial clients is a significant hurdle, as these relationships are often built on trust and a proven track record, which new entrants lack. Government regulations and stringent licensing requirements also add complexity and cost, favoring established players with existing compliance expertise. For instance, ongoing government initiatives in 2024 to boost recycling infrastructure necessitate significant capital and regulatory navigation, further solidifying the position of established entities like Cleanaway, which reported AUD 1.4 billion in revenue in 2023.

| Barrier to Entry | Description | Impact on New Entrants | Example (Cleanaway) |

|---|---|---|---|

| Capital Requirements | High upfront investment for facilities, fleet, and technology. | Deters smaller, less-funded competitors. | Operates 135 licensed facilities and a fleet of over 6,350 vehicles. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Makes it difficult for new entrants to match pricing. | Leverages scale across extensive collection routes and processing facilities. |

| Contractual Relationships | Access to municipal and commercial contracts requires established trust and reliability. | New entrants struggle to gain access to key customer segments. | Serves over 170,000 customers. |

| Government Regulation & Licensing | Strict environmental standards, licensing, and permits are mandatory. | Increases compliance costs and complexity for newcomers. | Navigates complex environmental protection laws; 2024 saw continued emphasis on waste reduction initiatives. |

| Brand Recognition & Loyalty | Established reputation and customer loyalty create switching costs. | New entrants face challenges in winning over existing customer bases. | Strong brand identity built on years of service delivery; 2023 revenue of AUD 1.4 billion. |

Porter's Five Forces Analysis Data Sources

Our Cleanaway Porter's Five Forces analysis is built on a foundation of robust data, drawing from Cleanaway's annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from regulatory filings and economic indicators to provide a comprehensive view of the competitive landscape.