Cleanaway Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cleanaway Bundle

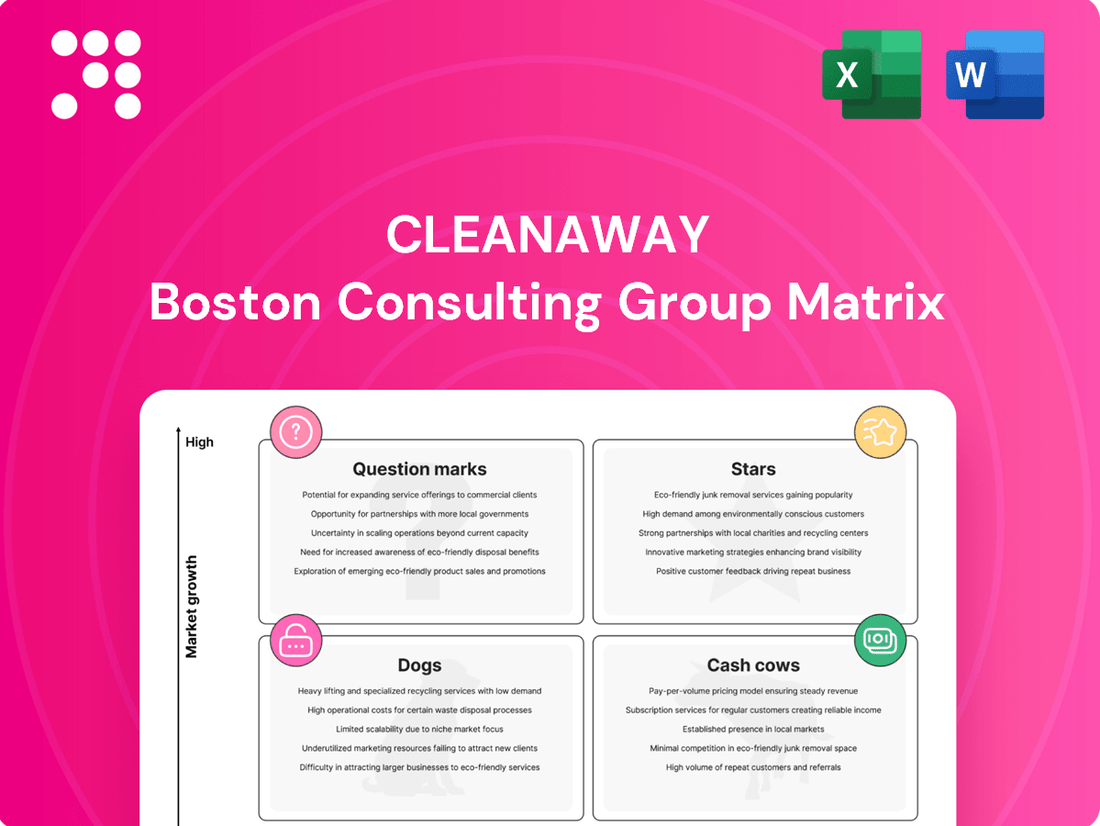

Unlock the strategic potential of Cleanaway's product portfolio with a glimpse into its BCG Matrix. Understand where its offerings sit as Stars, Cash Cows, Dogs, or Question Marks, and identify key areas for growth and optimization.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Cleanaway.

Stars

Cleanaway's Solid Waste Services in NSW/ACT are a star performer, demonstrating robust net revenue growth in the first half of FY24, fueled by new contracts and effective pricing strategies. This segment benefits from Cleanaway's dominant market position and comprehensive infrastructure, including collection, resource recovery, and disposal facilities.

The company's commitment to operational efficiency in these key regions has translated into impressive EBIT growth and expanding profit margins. This strong financial showing underscores their high market share within a sector experiencing consistent demand for these essential services.

Liquid Technical Services (LTS) is a significant growth engine for Cleanaway, showing impressive revenue and EBIT expansion in FY24. This segment focuses on the specialized handling of challenging waste, such as hazardous materials and industrial byproducts.

LTS's strength lies in its technical proficiency and innovative approaches within this specialized waste management sector. The acquisition of Australian Eco Oils in FY24 further solidifies its leadership in a high-margin, expanding market.

Cleanaway's expansion into Container Deposit Schemes (CDS) across Australia is a significant growth area. The company successfully launched operations in Victoria in late 2023 and has continued to expand its footprint in Queensland, demonstrating a strategic push into this burgeoning sector.

These CDS operations are a key driver for Cleanaway's resource recovery business. They contribute substantially to increased recycling volumes and revenue growth, positioning the company as a major player in a segment experiencing rapid expansion due to supportive environmental policies and growing consumer demand for circular economy solutions.

Resource Recovery and Circular Economy Initiatives

Cleanaway is actively investing in resource recovery and circular economy initiatives, aiming to capture value from waste streams. Their strategic focus includes advanced plastic recycling partnerships and the production of renewable diesel from used cooking oil. These efforts tap into a growing demand for sustainable solutions and reduce reliance on traditional landfilling.

These initiatives are crucial for Cleanaway's future growth, positioning them as a leader in the environmental services sector. For instance, their collaboration with Viva Energy on soft plastics recycling demonstrates a commitment to creating closed-loop systems. This strategic direction addresses both environmental concerns and market opportunities.

- Strategic Investments: Cleanaway is channeling resources into advanced recycling technologies and waste-to-energy solutions.

- Circular Economy Focus: Partnerships like the one with Viva Energy for soft plastics recycling exemplify their dedication to circularity.

- Market Demand: These initiatives align with increasing consumer and regulatory pressure for sustainable waste management.

- Growth Potential: The resource recovery sector represents a significant high-growth area for Cleanaway's business portfolio.

Acquisition and Integration of Strategic Assets

Cleanaway's strategic asset acquisition and integration efforts are central to its growth strategy. The acquisition of Contract Resources in March 2025, for instance, was a significant move to bolster its presence in higher-margin technical services, a segment showing robust growth potential.

Furthermore, the integration of Citywide's waste collection and recycling assets is designed to consolidate Cleanaway's market leadership. These acquisitions collectively aim to enhance market share and diversify service capabilities, directly impacting future earnings.

- Acquisition of Contract Resources (March 2025): Expanded into higher-margin technical services.

- Integration of Citywide Assets: Strengthened waste collection and recycling operations.

- Strategic Goal: Enhance market position and diversify service offerings in Australia.

- Expected Outcome: Accelerated growth and increased future earnings potential.

Cleanaway's Solid Waste Services in NSW/ACT and its Liquid Technical Services (LTS) segment are clear stars in its portfolio. These areas show strong revenue and profit growth, driven by market leadership, technical expertise, and strategic acquisitions like Australian Eco Oils in FY24. The expansion into Container Deposit Schemes (CDS) across Australia, notably in Victoria and Queensland, also represents a significant star, capitalizing on growing demand for recycling and supportive policies.

These segments are characterized by high growth and high market share, aligning perfectly with the 'Star' quadrant of the BCG matrix. Cleanaway's investments in resource recovery and circular economy initiatives, including partnerships for advanced plastic recycling and renewable diesel production, further solidify their star status by tapping into future growth trends.

The recent acquisition of Contract Resources in March 2025 and the integration of Citywide's assets are strategic moves to reinforce these star performers, aiming to boost market share and diversify into higher-margin technical services. These actions are expected to accelerate growth and enhance future earnings potential.

| Segment | Market Share | Growth Rate | FY24 Performance Highlight |

|---|---|---|---|

| Solid Waste Services (NSW/ACT) | Dominant | High | Robust net revenue and EBIT growth |

| Liquid Technical Services (LTS) | Leading | High | Impressive revenue and EBIT expansion, acquisition of Australian Eco Oils |

| Container Deposit Schemes (CDS) | Growing | High | Successful launches in Victoria and Queensland, increased recycling volumes |

What is included in the product

The Cleanaway BCG Matrix analyzes its business units by market growth and share, guiding investment decisions.

The Cleanaway BCG Matrix provides clarity on business unit performance, relieving the pain of uncertain investment decisions.

Cash Cows

Cleanaway's solid waste collection services, encompassing municipal, commercial, and industrial waste, are its bedrock Cash Cow. This segment consistently generates the largest portion of the company's revenue, underpinned by the non-negotiable need for waste management and the security of long-term contracts.

The company's extensive national infrastructure, including its fleet and operational branches, solidifies its dominant market position in this mature but reliable sector. For the fiscal year 2023, Cleanaway reported a significant portion of its revenue stemming from its Solid Waste services, demonstrating its role as a consistent cash generator for the business.

Cleanaway's engineered landfills are a prime example of a Cash Cow within its operations. These facilities are essential for managing non-recyclable waste, a consistent need in Australia. The significant regulatory hurdles and high capital costs associated with developing new landfill sites create a natural moat, protecting the profitability of existing operations.

In 2023, Cleanaway reported that its Solid Waste services, which include landfill operations, generated a significant portion of its earnings. For instance, the company's FY23 results highlighted the resilience of its waste management segment, benefiting from established landfill capacity and ongoing demand for waste disposal services.

Cleanaway's established transfer stations and post-collection infrastructure, including processing and sorting facilities, act as the company's Cash Cows in the BCG matrix. These vital assets ensure efficient waste management by consolidating and sorting materials, generating consistent cash flow in a mature market. For instance, in the fiscal year 2023, Cleanaway reported revenue of AUD 3.1 billion, with its Waste Management segment, heavily reliant on these infrastructure assets, being a significant contributor.

Hazardous Waste Management Services

Cleanaway's hazardous waste management services, a key part of its liquid and technical services, are considered a Cash Cow. This is largely because the sector is heavily regulated, requiring specialized knowledge and equipment, which creates significant barriers to entry for competitors.

These services, though potentially lower in volume than general solid waste, typically offer higher profit margins. The consistent demand from industrial and commercial sectors, coupled with the specialized nature of the work, ensures a steady and reliable stream of cash flow for Cleanaway.

- High Barriers to Entry: Stringent regulations and specialized expertise limit competition.

- Strong Profitability: Higher margins compared to less specialized waste management.

- Consistent Demand: Reliable need from industrial and commercial clients.

- Cash Flow Generation: Predictable revenue streams contribute significantly to overall cash flow.

Queensland Solid Waste Services (Post-Restoration)

Following a successful restoration program, Cleanaway's Queensland Solid Waste Services have transitioned into a Cash Cow within their BCG matrix. This segment has seen profitability restored and is now contributing positively to EBIT growth, reflecting a stable market share in a revitalized regional market.

The turnaround demonstrates efficient operational management in a mature service area, generating consistent earnings. For the fiscal year 2024, this segment is expected to contribute significantly to Cleanaway's overall financial performance, building on the positive momentum from the restoration.

- Restored Profitability: The Queensland Solid Waste Services segment has moved from a turnaround phase to a consistent profit generator.

- EBIT Growth Contribution: This segment is now a positive contributor to Cleanaway's Earnings Before Interest and Taxes (EBIT) growth.

- Stable Market Share: The services maintain a solid position in the revitalized Queensland market.

- Operational Efficiency: The segment exemplifies effective management in a mature service area.

Cleanaway's solid waste collection and engineered landfills are definitive Cash Cows, consistently generating substantial revenue and profit. These segments benefit from high barriers to entry due to stringent regulations and significant capital investment, ensuring stable market positions. For fiscal year 2023, Cleanaway's Waste Management segment, which includes these core operations, was a significant contributor to its total revenue of AUD 3.1 billion.

| Segment | BCG Category | FY23 Revenue Contribution (Indicative) | Key Strengths |

| Solid Waste Collection | Cash Cow | Largest Portion of FY23 Revenue | Essential service, long-term contracts, extensive infrastructure |

| Engineered Landfills | Cash Cow | Significant Contributor to FY23 Earnings | High regulatory hurdles, capital intensity, consistent demand |

| Hazardous Waste Management | Cash Cow | Higher Profit Margins | Specialized expertise, regulatory barriers, consistent industrial demand |

Preview = Final Product

Cleanaway BCG Matrix

The Cleanaway BCG Matrix preview you see is the exact, fully editable document you will receive upon purchase, offering immediate strategic insights without any watermarks or demo content. This comprehensive analysis, meticulously prepared by industry experts, is designed to equip you with the actionable data needed to effectively categorize Cleanaway's business units and guide your investment decisions. You can confidently download this report knowing it's ready for immediate integration into your strategic planning, presentations, or internal discussions, providing a clear roadmap for optimizing Cleanaway's portfolio.

Dogs

Certain older or geographically isolated regional collection contracts can be categorized as Dogs within Cleanaway's BCG Matrix. These might be found in low-growth regions facing stiff local competition, struggling to achieve optimal route density. For instance, if a contract in a rural area with a declining population only captures a small portion of the local waste management market, it would fit this profile.

These underperforming contracts often yield a low market share and minimal profit, effectively tying up valuable resources without generating substantial returns. Imagine a contract that, despite years of operation, consistently reports operating margins below 2%, a significant drag on overall profitability. This lack of significant return makes them a prime candidate for divestment or at least a drastic reduction in capital allocation.

Cleanaway's strategy for these Dog segments would likely involve minimizing further investment and exploring options for divestment if they persist in underperforming. For example, if a regional contract in a market with limited growth potential, perhaps a 1-2% annual increase, continues to show negative EBITDA, the company would actively seek a buyer or consider ceasing operations to reallocate capital to more promising areas.

Legacy non-core asset holdings, particularly those with low market share and limited strategic alignment, would be categorized as Dogs within Cleanaway's BCG Matrix. These could include older waste management facilities or niche recycling operations that no longer fit the company's forward-looking Blueprint 2030 strategy.

For instance, if Cleanaway held a small, underperforming landfill in a region with declining waste volumes, this would exemplify a Dog. Such assets often consume resources without contributing significantly to overall growth or profitability, potentially requiring divestment or restructuring to free up capital for more promising ventures.

Certain commodity recycling streams with volatile low prices, such as mixed paper or certain types of plastics, could be considered Dogs within Cleanaway's BCG Matrix. These materials often have fluctuating market values, and in 2024, prices for some recovered paper grades saw significant declines, impacting the profitability of collection and processing operations.

Despite Cleanaway's commitment to resource recovery, the economic viability of these streams is challenged when processing costs exceed or closely match the meager revenue generated from their sale. For instance, the cost of sorting and baling mixed paper can outweigh the low per-tonne price it commands on the global market, creating a net loss for this segment of their recycling business.

Inefficient or Outdated Small-Scale Facilities

Small-scale facilities or depots that are outdated, have high operating costs, or are in areas with dwindling demand might be categorized here. These assets often hold a low market share in their immediate vicinity and contribute minimally to overall profitability, acting as a drain on resources rather than a strategic advantage.

For instance, a waste management company like Cleanaway might have several small transfer stations that are no longer cost-effective to operate due to aging infrastructure and increasing maintenance expenses. In 2024, such facilities could represent a significant portion of operational overhead without generating proportional revenue, especially if the surrounding population or industrial activity has declined.

- Low Market Share: These facilities typically serve a limited geographic area and may face competition from larger, more efficient competitors.

- High Operating Costs: Outdated equipment and inefficient processes lead to higher energy consumption and labor costs per unit of waste processed.

- Dwindling Demand: Changes in local industry or population can reduce the volume of waste, making these small-scale operations economically unviable.

- Resource Drain: Continued investment in maintaining these facilities diverts capital from more promising growth areas.

Industrial & Waste Services (I&WS) with Reduced Activity

Cleanaway's Industrial & Waste Services (I&WS) segment faced headwinds in the first half of FY25, reporting a downturn in revenue and earnings before interest and taxes (EBIT). This decline was attributed to a combination of factors, including a general slowdown in industrial activity, the closure of certain sites, and a strategic deferral of non-essential maintenance by clients seeking to manage costs.

Despite ongoing initiatives aimed at revitalizing the segment's financial performance, the recent operational challenges and subdued market conditions place I&WS in a position that could be classified as a Dog within the BCG Matrix. This classification suggests that the segment requires substantial strategic intervention and investment to overcome its current difficulties and improve its competitive standing.

- Revenue and EBIT Decline: The I&WS segment saw a reduction in its financial contributions during the first half of FY25.

- Causal Factors: Reduced industry activity, site closures, and deferred maintenance were key drivers of this downturn.

- Turnaround Efforts: Cleanaway is actively pursuing strategies to restore profitability and market share for the I&WS segment.

- BCG Matrix Classification: The segment's current performance suggests it may be categorized as a Dog, indicating a need for significant strategic focus.

Certain older or geographically isolated regional collection contracts can be categorized as Dogs within Cleanaway's BCG Matrix. These might be found in low-growth regions facing stiff local competition, struggling to achieve optimal route density. For instance, if a contract in a rural area with a declining population only captures a small portion of the local waste management market, it would fit this profile.

These underperforming contracts often yield a low market share and minimal profit, effectively tying up valuable resources without generating substantial returns. Imagine a contract that, despite years of operation, consistently reports operating margins below 2%, a significant drag on overall profitability. This lack of significant return makes them a prime candidate for divestment or at least a drastic reduction in capital allocation.

Cleanaway's strategy for these Dog segments would likely involve minimizing further investment and exploring options for divestment if they persist in underperforming. For example, if a regional contract in a market with limited growth potential, perhaps a 1-2% annual increase, continues to show negative EBITDA, the company would actively seek a buyer or consider ceasing operations to reallocate capital to more promising areas.

Legacy non-core asset holdings, particularly those with low market share and limited strategic alignment, would be categorized as Dogs within Cleanaway's BCG Matrix. These could include older waste management facilities or niche recycling operations that no longer fit the company's forward-looking Blueprint 2030 strategy.

For instance, if Cleanaway held a small, underperforming landfill in a region with declining waste volumes, this would exemplify a Dog. Such assets often consume resources without contributing significantly to overall growth or profitability, potentially requiring divestment or restructuring to free up capital for more promising ventures.

Certain commodity recycling streams with volatile low prices, such as mixed paper or certain types of plastics, could be considered Dogs within Cleanaway's BCG Matrix. These materials often have fluctuating market values, and in 2024, prices for some recovered paper grades saw significant declines, impacting the profitability of collection and processing operations.

Despite Cleanaway's commitment to resource recovery, the economic viability of these streams is challenged when processing costs exceed or closely match the meager revenue generated from their sale. For instance, the cost of sorting and baling mixed paper can outweigh the low per-tonne price it commands on the global market, creating a net loss for this segment of their recycling business.

Small-scale facilities or depots that are outdated, have high operating costs, or are in areas with dwindling demand might be categorized here. These assets often hold a low market share in their immediate vicinity and contribute minimally to overall profitability, acting as a drain on resources rather than a strategic advantage.

For instance, a waste management company like Cleanaway might have several small transfer stations that are no longer cost-effective to operate due to aging infrastructure and increasing maintenance expenses. In 2024, such facilities could represent a significant portion of operational overhead without generating proportional revenue, especially if the surrounding population or industrial activity has declined.

Cleanaway's Industrial & Waste Services (I&WS) segment faced headwinds in the first half of FY25, reporting a downturn in revenue and earnings before interest and taxes (EBIT). This decline was attributed to a combination of factors, including a general slowdown in industrial activity, the closure of certain sites, and a strategic deferral of non-essential maintenance by clients seeking to manage costs.

Despite ongoing initiatives aimed at revitalizing the segment's financial performance, the recent operational challenges and subdued market conditions place I&WS in a position that could be classified as a Dog within the BCG Matrix. This classification suggests that the segment requires substantial strategic intervention and investment to overcome its current difficulties and improve its competitive standing.

| Segment/Asset Type | Market Share | Market Growth | Profitability | BCG Classification |

|---|---|---|---|---|

| Older Regional Collection Contracts | Low | Low | Low/Negative | Dog |

| Legacy Non-Core Landfills | Low | Low | Low | Dog |

| Commodity Recycling Streams (e.g., Mixed Paper) | Low (price dependent) | Low/Volatile | Low/Negative | Dog |

| Small, Outdated Transfer Stations | Low | Low | Low | Dog |

| Industrial & Waste Services (I&WS) Segment (H1 FY25) | Declining | Subdued | Negative EBIT | Potential Dog |

Question Marks

Cleanaway is actively investing in advanced recycling technologies, notably chemical recycling for soft plastics. This strategic move targets high-growth markets fueled by circular economy initiatives.

While these emerging technologies hold significant potential, their current market share remains low due to early-stage development and pre-feasibility assessments. For example, the global chemical recycling market was valued at approximately USD 4.5 billion in 2023 and is projected to grow substantially, but these advanced methods are still nascent.

Scaling these operations to achieve a dominant market position will necessitate substantial capital investment. Companies in this space are looking at significant upfront costs for research, development, and infrastructure to bring these processes to commercial viability.

Cleanaway's new waste-to-energy (WTE) projects are positioned as Question Marks in the BCG matrix. They operate in a high-growth market driven by the urgent need for landfill alternatives and renewable energy sources, with global WTE capacity projected to reach over 500 million tonnes per annum by 2027.

However, Cleanaway's market share in this nascent segment is currently small. These ventures demand significant capital expenditure, estimated in the hundreds of millions for modern facilities, and require careful navigation of complex environmental regulations and permitting processes, making their path to becoming profitable Stars uncertain.

Expanding into new Australian regions or specialized niche waste management markets positions Cleanaway as a potential "Question Mark" in the BCG matrix. These moves are characterized by high growth potential but also significant investment needs and market uncertainty. For example, entering the complex medical waste sector in Western Australia, where Cleanaway's current footprint is smaller, would require substantial capital for specialized facilities and regulatory compliance.

Digital Transformation and Smart Waste Solutions

Cleanaway is investing significantly in digital transformation to enhance its waste management operations. This includes implementing AI-driven recycling plants and smart bins, which are crucial for improving efficiency and data collection in the evolving waste sector.

These technological advancements are key to capturing market share in the high-growth area of smart waste solutions. For instance, by mid-2024, the global smart waste management market was projected to reach approximately $2.5 billion, indicating substantial growth potential.

- AI-driven recycling plants

- Smart bins with real-time monitoring

- Data analytics for operational optimization

- Investment in scaling innovative technologies

New Resource Recovery Facilities for Specific Waste Streams

Developing new, dedicated resource recovery facilities for specific, currently less-recycled waste streams beyond Cleanaway's established operations signifies a strategic move into niche markets. These initiatives are designed to address growing environmental demands and tap into potential future markets for materials like certain plastics or construction and demolition waste. For instance, in 2024, the Australian government announced new targets to increase recycling rates for plastics, creating a clearer market signal for such specialized facilities.

These ventures, however, demand substantial upfront capital investment and dedicated market development efforts. Cleanaway must secure sufficient volumes of these specific waste streams and establish stable end markets to ensure profitability. This approach, while carrying higher risk, has the potential to significantly increase market share in these specialized segments as the circular economy matures.

- Targeted Waste Streams: Focus on materials with lower current recycling rates, such as mixed plastics or specific industrial by-products.

- Market Development: Requires proactive engagement with potential buyers and manufacturers to create demand for recovered resources.

- Capital Investment: Significant upfront funding is needed for specialized processing equipment and facility construction.

- Profitability Challenges: Achieving profitability depends on securing consistent waste volumes and stable market prices for recovered materials.

Question Marks represent Cleanaway's ventures into high-growth, uncertain markets where their current market share is low. These include investments in advanced recycling technologies like chemical recycling and new waste-to-energy projects. These areas offer significant future potential but require substantial capital and face developmental hurdles.

The success of these Question Marks hinges on Cleanaway's ability to scale operations, navigate complex regulations, and secure market demand. For instance, their push into specialized waste streams requires dedicated market development and significant upfront funding, with profitability dependent on consistent waste volumes and stable prices for recovered materials.

By mid-2024, the global smart waste management market was projected to reach approximately $2.5 billion, highlighting the growth potential Cleanaway is targeting with its digital transformation efforts, including AI-driven plants and smart bins.

The company's strategic moves into these nascent segments are crucial for future growth, but they carry inherent risks due to the need for significant capital investment and market uncertainty.

BCG Matrix Data Sources

Our Cleanaway BCG Matrix is built on a foundation of comprehensive data, integrating financial disclosures, market share analysis, and industry growth forecasts to provide strategic clarity.