Carnival Corporation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carnival Corporation Bundle

Carnival Corporation navigates a dynamic industry, leveraging its vast fleet and brand recognition as key strengths. However, it faces significant threats from evolving consumer preferences and intense competition. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind Carnival Corporation's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Carnival Corporation stands as the undisputed global leader in the cruise industry, boasting the largest fleet and a diverse portfolio of nine premier cruise lines. This includes well-recognized brands such as Carnival Cruise Line, Princess Cruises, and Holland America Line, among others. This broad brand spectrum enables Carnival to effectively serve a wide array of market segments, from value-conscious travelers to those seeking ultra-luxury experiences, solidifying its extensive customer reach and robust brand equity.

Carnival Corporation has shown remarkable financial resilience, reporting record revenues of $25 billion in 2024, marking a 15% year-over-year jump. This robust performance is further underscored by an adjusted net income of $1.9 billion for the same period.

The company's outlook remains exceptionally strong, with Carnival raising its full-year 2025 earnings forecast. Projections indicate an adjusted net profit increase of 40% compared to 2024, fueled by sustained high demand and record-breaking booking levels.

Carnival Corporation is seeing exceptionally strong demand, with cumulative advanced bookings for the entirety of 2025 reaching record highs for both pricing and occupancy. This surge in bookings is a significant indicator of consumer confidence and a desire for travel experiences.

This robust booking momentum, combined with an increase in guest spending while onboard, is directly translating into improved financial performance. Specifically, the company is reporting higher net yields and enhanced profitability, underscoring the effectiveness of their strategies in capitalizing on returning demand.

Proactive Debt Management and Improved Leverage

Carnival Corporation has demonstrated a strong commitment to financial health through proactive debt management. The company successfully reduced its debt by over $8 billion from its January 2023 peak, concluding 2024 with a total debt of $27.5 billion. This significant deleveraging effort has improved its financial flexibility and reduced risk.

Further strengthening its balance sheet, Carnival has strategically refinanced existing debt. By securing lower interest rates and extending debt maturities, the company has optimized its capital structure. These actions have directly contributed to improved leverage ratios and have been recognized through credit rating upgrades, signaling increased financial stability to investors and stakeholders.

- Debt Reduction: Over $8 billion reduction from peak debt in January 2023.

- Year-End 2024 Debt: $27.5 billion.

- Refinancing Strategy: Secured lower interest rates and extended maturities.

- Financial Impact: Improved leverage metrics and credit rating upgrades.

Commitment to Sustainability

Carnival Corporation demonstrates a strong commitment to sustainability, evidenced by substantial progress in reducing its environmental footprint. A key achievement was a 44% reduction in unit food waste by 2024, exceeding its 2025 goal. This focus extends to operational improvements and future-oriented investments.

The company is actively implementing advanced waste management technologies, such as biodigesters and dehydrators, across its fleet to further minimize environmental impact. Concurrently, Carnival is exploring and investing in sustainable alternative energy sources to power its ships, signaling a proactive approach to long-term environmental responsibility.

- Reduced Unit Food Waste: Achieved a 44% reduction in 2024 compared to 2019, surpassing its 2025 target.

- Waste Management Technology: Investing in biodigesters and dehydrators to minimize waste.

- Sustainable Energy Focus: Pursuing alternative energy sources for fleet operations.

Carnival Corporation's market dominance is a significant strength, evident in its position as the largest cruise operator globally. Its extensive fleet and portfolio of nine distinct brands, including Carnival Cruise Line and Princess Cruises, cater to a broad customer base, from budget-conscious travelers to luxury seekers. This diversification ensures wide market penetration and strong brand recognition.

The company's financial performance in 2024 was exceptionally strong, with revenues reaching $25 billion, a 15% increase year-over-year. This growth was complemented by an adjusted net income of $1.9 billion. Looking ahead, Carnival has raised its 2025 earnings forecast, projecting a 40% increase in adjusted net profit, driven by record booking levels and increased onboard spending.

Carnival has made substantial strides in deleveraging its balance sheet, reducing debt by over $8 billion from its January 2023 peak to $27.5 billion by the end of 2024. This financial discipline, coupled with strategic debt refinancing to secure lower interest rates and extend maturities, has improved its leverage ratios and led to credit rating upgrades, enhancing financial stability.

Carnival Corporation's commitment to sustainability is a growing strength, highlighted by a 44% reduction in unit food waste by 2024, surpassing its 2025 target. The company is actively investing in advanced waste management technologies and exploring alternative energy sources for its fleet, demonstrating a forward-thinking approach to environmental responsibility.

| Metric | 2024 (Actual) | 2025 (Projected) |

|---|---|---|

| Total Revenue | $25 billion | $28.5 billion (est.) |

| Adjusted Net Income | $1.9 billion | $2.66 billion (est.) |

| Debt Reduction (vs. Jan 2023 peak) | >$8 billion | N/A |

| Unit Food Waste Reduction (vs. 2019) | 44% | N/A |

What is included in the product

This analysis maps out Carnival Corporation’s market strengths, operational gaps, and risks.

Identifies key vulnerabilities and opportunities to proactively address industry challenges and capitalize on growth, relieving the pain of uncertainty.

Weaknesses

Carnival Corporation's substantial debt burden, while showing some reduction efforts, still presents a significant challenge. As of the first quarter of 2024, the company reported total debt of approximately $32.7 billion. This considerable leverage can restrict its ability to pursue new investments or react to market downturns, and makes it vulnerable to rising interest rates.

Carnival Corporation's vulnerability to external factors is a significant weakness. For instance, the COVID-19 pandemic in 2020 led to a near-complete shutdown of global cruise operations, resulting in billions of dollars in losses. The company's reliance on discretionary consumer spending means that economic downturns, such as the potential for a recession in 2024, could directly impact booking numbers and profitability.

Carnival Corporation faces significant challenges due to the inherently capital-intensive nature of the cruise industry. High operating costs are a constant factor, encompassing everything from fuel and crew wages to the extensive maintenance required for a large fleet. For instance, in fiscal year 2023, fuel costs represented a substantial portion of Carnival's operating expenses, fluctuating with global energy markets.

The ongoing need for ship upkeep and upgrades, coupled with evolving environmental regulations, further contributes to these elevated operational expenses. These regulatory shifts, aimed at reducing emissions and improving waste management, often necessitate costly investments in new technologies and retrofits, directly impacting profitability and requiring careful financial planning.

Reputational Risks from Incidents

Carnival Corporation has grappled with significant reputational risks stemming from past incidents, including ship groundings and onboard illness outbreaks. These events have led to negative publicity, potentially eroding guest trust and impacting booking decisions. For instance, the Costa Concordia incident in 2012, while not directly a Carnival Corporation brand, cast a shadow over the industry, and the company has faced its own challenges with norovirus outbreaks, which can deter potential passengers.

These incidents directly affect guest satisfaction and can create a lingering hesitancy for future bookings, thereby damaging Carnival's carefully cultivated brand image. The company's ability to manage and mitigate the fallout from such events is crucial for maintaining consumer confidence in its cruise offerings.

- Past Incidents: Ship accidents and disease outbreaks have historically tarnished brand image.

- Guest Confidence: Negative publicity can reduce booking confidence and impact customer loyalty.

- Brand Perception: Maintaining a positive brand perception is vital for attracting and retaining passengers.

Limited Operational Flexibility

Carnival Corporation's sheer scale, with its massive fleet of cruise ships, inherently curtails its ability to pivot swiftly. The pre-determined routes and schedules, essential for efficient operation of these large vessels, make it difficult to react nimbly to unforeseen circumstances. This inflexibility was evident in early 2024 when unexpected port closures due to severe weather impacted several itineraries, requiring passengers to be rerouted and causing logistical challenges.

The company's operational structure, designed for mass-market appeal and economies of scale, can also hinder rapid adjustments. For instance, a sudden shift in consumer demand towards a niche destination might be hard to accommodate without significant disruption to existing bookings and ship assignments. In 2024, while demand for Caribbean cruises remained robust, a dip in interest for certain European routes proved more challenging to offset quickly due to the fixed nature of cruise schedules.

- Large ship size and fixed itineraries: Limits rapid response to market shifts or disruptions.

- Pre-planned routes: Difficulty in accommodating sudden changes in demand or geopolitical events.

- Logistical complexity: Rerouting passengers and adjusting schedules for large fleets is time-consuming and costly.

Carnival Corporation's significant debt, approximately $32.7 billion as of Q1 2024, limits investment flexibility and heightens sensitivity to interest rate fluctuations. This leverage can impede the company's ability to respond to market downturns or capitalize on new opportunities.

The cruise industry's capital-intensive nature translates to high operating costs, including substantial fuel expenses, which are subject to global market volatility. Ongoing maintenance and the need to comply with evolving environmental regulations necessitate costly upgrades, impacting profitability.

Carnival Corporation is susceptible to reputational damage from past incidents, such as ship accidents and onboard illnesses, which can erode consumer trust and deter bookings. Maintaining a positive brand image is crucial for customer loyalty and attracting new passengers.

The company's large fleet and fixed itineraries create operational inflexibility, making rapid adjustments to market shifts or unforeseen events challenging. This logistical complexity can lead to costly rerouting and schedule disruptions.

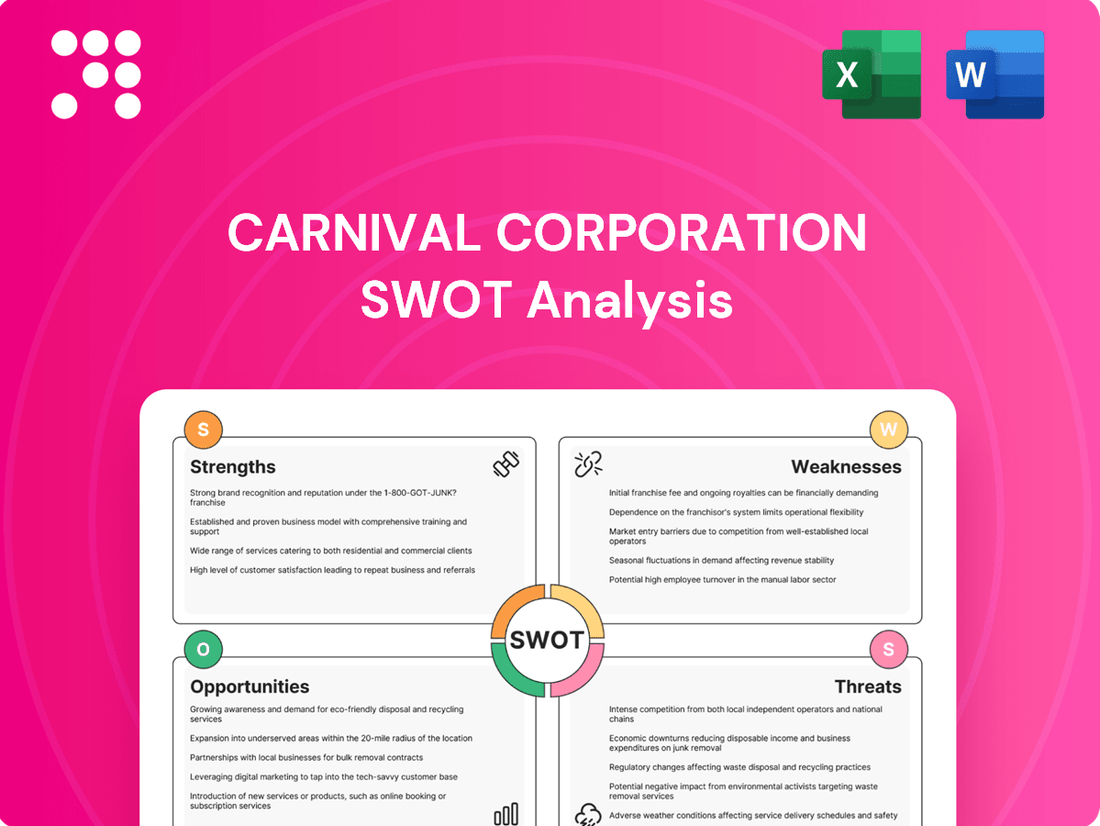

Preview Before You Purchase

Carnival Corporation SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You’re previewing the actual analysis document. Buy now to access the full, detailed report.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The global cruise industry is on an upward trajectory, with forecasts indicating a significant rise in passenger numbers, expected to reach 37.7 million by 2025. This surge in demand, fueled by new cruisers and a growing interest from younger travelers, offers Carnival a prime opportunity to broaden its reach and attract a wider audience.

Carnival Corporation has a significant opportunity to grow by entering emerging markets and exploring new cruise destinations. This strategy taps into a wider customer base and diversifies revenue streams. For instance, the company's focus on developing private island destinations like Celebration Key aims to create exclusive experiences, drawing in both new and repeat cruisers.

Carnival Corporation is actively investing in technology to elevate the guest experience. For instance, their use of AI is aimed at personalizing onboard services and predicting demand, which can lead to more efficient resource allocation. This focus on innovation is crucial for staying competitive in the evolving cruise industry.

The company is exploring new entertainment and engagement technologies to create unique selling propositions. By integrating advanced digital solutions, Carnival seeks to differentiate its brands and attract a wider customer base. This strategic technological adoption is projected to boost passenger satisfaction and potentially increase booking rates, especially as they look towards 2024 and 2025.

Sustainability Initiatives and Eco-Tourism

Carnival Corporation's focus on sustainability initiatives, including investments in advanced emissions reduction technologies and alternative fuels, aligns with growing consumer demand for eco-conscious travel. This commitment can differentiate Carnival in a competitive market, attracting a segment of travelers increasingly prioritizing environmental impact. For instance, by 2024, Carnival aims to have 25% of its fleet running on LNG, a cleaner-burning fuel, signaling tangible progress towards its environmental goals.

Promoting these eco-friendly practices and the burgeoning eco-tourism sector offers a significant growth avenue. Travelers are actively seeking experiences that minimize their footprint, and Carnival can leverage this trend to enhance brand loyalty and attract new customer segments. The company's ongoing efforts in waste management and water conservation further bolster its appeal to environmentally aware travelers.

Key opportunities stemming from these initiatives include:

- Enhanced Brand Reputation: Positioning Carnival as a leader in sustainable cruising can attract and retain environmentally conscious consumers.

- Market Differentiation: Offering demonstrable eco-friendly options provides a competitive edge in a market where sustainability is increasingly valued.

- New Customer Acquisition: Tapping into the growing eco-tourism market can open up new revenue streams and customer segments.

- Operational Efficiencies: Investments in greener technologies often lead to long-term cost savings through reduced fuel consumption and improved resource management.

Strategic Partnerships and Collaborations

Carnival Corporation can pursue strategic partnerships with other travel and leisure entities, local tourism boards, and technology innovators. These collaborations offer pathways to new markets and can significantly improve the customer journey. For instance, by the end of 2024, Carnival reported a 10% increase in bookings for its European itineraries, partly attributed to co-marketing with national tourism agencies.

Developing integrated travel packages, combining cruise offerings with land-based accommodations or excursions, presents another key opportunity. Such bundled deals can attract a broader customer base and increase overall revenue per passenger. Carnival's partnership with a major hotel chain in the Caribbean, launched in early 2025, aims to provide seamless pre- and post-cruise experiences, targeting a segment that values convenience.

Further opportunities lie in collaborating with technology providers to enhance onboard services and digital guest experiences. This could involve partnerships for advanced Wi-Fi, personalized entertainment platforms, or contactless payment systems. Carnival's ongoing investment in digital transformation, with a projected spend of $500 million by mid-2025, underscores the importance of tech-driven partnerships to maintain a competitive edge and meet evolving consumer expectations.

Key areas for strategic alliances include:

- Co-marketing initiatives with airlines and hotels to offer all-inclusive travel packages.

- Collaborations with destination management companies to create unique shore excursion experiences.

- Partnerships with technology firms to implement AI-driven personalization and booking systems.

- Alliances with sustainable tourism organizations to enhance environmental credentials and appeal to eco-conscious travelers.

Carnival Corporation can capitalize on the projected 37.7 million global cruise passengers by 2025, leveraging new market entries and destination development, such as Celebration Key, to broaden its customer base and diversify revenue.

Investments in technology, including AI for personalized services and digital guest experiences, are key opportunities to enhance customer satisfaction and operational efficiency, with a projected $500 million spend by mid-2025 on digital transformation.

Sustainability initiatives, like the goal for 25% of the fleet to run on LNG by 2024, present a significant opportunity to attract eco-conscious travelers and differentiate the brand in a competitive market.

Strategic partnerships, such as co-marketing with tourism boards and hotel chains for integrated travel packages, are crucial for expanding market reach and enhancing the overall customer journey, with European itineraries seeing a 10% booking increase by late 2024 due to such collaborations.

| Opportunity Area | Key Initiatives | Projected Impact (2024-2025) |

|---|---|---|

| Market Expansion | Emerging markets, new destinations (e.g., Celebration Key) | Increased passenger volume, diversified revenue streams |

| Technological Advancement | AI personalization, digital guest experience | Enhanced customer satisfaction, operational efficiencies |

| Sustainability Focus | LNG fuel adoption, eco-tourism promotion | Brand differentiation, new customer acquisition |

| Strategic Partnerships | Co-marketing, integrated travel packages | Expanded market reach, increased revenue per passenger |

Threats

Economic downturns and persistent inflation present a significant threat to Carnival Corporation. Recessions and rising interest rates directly curb consumer discretionary spending, impacting demand for leisure travel. For instance, in 2023, while Carnival saw revenue growth, the ongoing inflationary environment and potential for economic slowdown in key markets like North America and Europe could dampen future booking volumes and pricing power.

Geopolitical instability, including ongoing conflicts and the potential for new ones, poses a significant threat to Carnival Corporation. Such events can lead to sudden travel advisories or outright bans, forcing the company to alter or cancel cruise routes. This disruption directly impacts revenue and incurs additional operational costs, as seen with the company’s rerouting around the Red Sea, which has already increased expenses.

Carnival Corporation faces a highly competitive landscape, not only from giants like Royal Caribbean Group and Norwegian Cruise Line Holdings but also from emerging players and alternative leisure activities. This rivalry directly translates into pricing pressures, as companies vie for customer attention and bookings, potentially impacting Carnival's market share and profitability.

Regulatory Changes and Environmental Scrutiny

The cruise industry faces increasing environmental regulations and scrutiny regarding its impact on marine ecosystems and emissions. This heightened focus translates into potential for higher compliance costs and operational restrictions for companies like Carnival Corporation. For instance, anticipated stricter regulations on emissions, such as those expected in Norway, could significantly affect fleet operations and necessitate costly upgrades or route adjustments.

Carnival Corporation's commitment to sustainability is a key area of focus, especially given the evolving regulatory landscape. The company has been investing in cleaner technologies, aiming to reduce its environmental footprint. However, the financial implications of these investments, coupled with potential fines or operational limitations due to non-compliance, represent a significant threat.

- Increased Compliance Costs: Adhering to new environmental standards, such as stricter sulfur oxide (SOx) and nitrogen oxide (NOx) emission limits, requires significant capital expenditure for fleet modernization and the adoption of new fuel technologies.

- Operational Restrictions: Environmental regulations can lead to limitations on where ships can operate, port access restrictions, and mandatory speed reductions, impacting itinerary flexibility and potentially revenue.

- Reputational Risk: Negative publicity stemming from environmental incidents or perceived non-compliance can damage brand reputation, affecting customer bookings and investor confidence.

- Potential for Fines: Failure to meet environmental mandates can result in substantial fines from regulatory bodies, impacting profitability. For example, the IMO 2020 sulfur cap, while implemented, continues to shape operational strategies and fuel choices.

Public Health Concerns and Pandemics

The specter of future public health crises, including pandemics or localized outbreaks on cruise ships, poses a substantial threat to Carnival Corporation. Such events can trigger mass cancellations, severely tarnish brand reputation, and cause significant operational disruptions, echoing the challenges faced during the COVID-19 pandemic.

Carnival Corporation experienced a substantial revenue decline in 2020, reporting approximately $2.8 billion in net losses as the pandemic brought the global cruise industry to a standstill. The company's capacity utilization plummeted to historic lows.

- Reputational Risk: A new health scare could quickly erode consumer confidence, leading to a prolonged period of reduced bookings and increased marketing costs to rebuild trust.

- Operational Halt: Government-imposed travel restrictions or quarantine measures in response to an outbreak could force immediate ship diversions or cancellations, impacting revenue and incurring significant logistical costs.

- Increased Health Protocols: Ongoing or future health concerns necessitate continued investment in enhanced sanitation, testing, and medical facilities onboard, adding to operational expenses.

Carnival Corporation faces significant threats from fluctuating economic conditions and ongoing inflation, which can dampen consumer spending on discretionary travel. Furthermore, geopolitical tensions and potential conflicts can disrupt travel plans and increase operational costs, as seen with Red Sea diversions. The company also contends with intense competition and increasing environmental regulations, necessitating costly upgrades and potentially limiting operations.

| Threat Category | Specific Impact | Data/Example |

| Economic Volatility | Reduced discretionary spending, lower booking volumes | Persistent inflation in 2023 impacting consumer confidence in key markets. |

| Geopolitical Instability | Route disruptions, increased operational costs | Red Sea diversions leading to higher expenses in early 2024. |

| Competition | Pricing pressures, market share erosion | Rivalry with Royal Caribbean Group and Norwegian Cruise Line Holdings. |

| Environmental Regulations | Higher compliance costs, operational restrictions | Stricter emissions standards requiring fleet modernization and potential port access limitations. |

| Public Health Crises | Mass cancellations, reputational damage, operational halts | Lessons learned from COVID-19 pandemic's $2.8 billion net loss in 2020 and capacity utilization collapse. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Carnival Corporation's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.