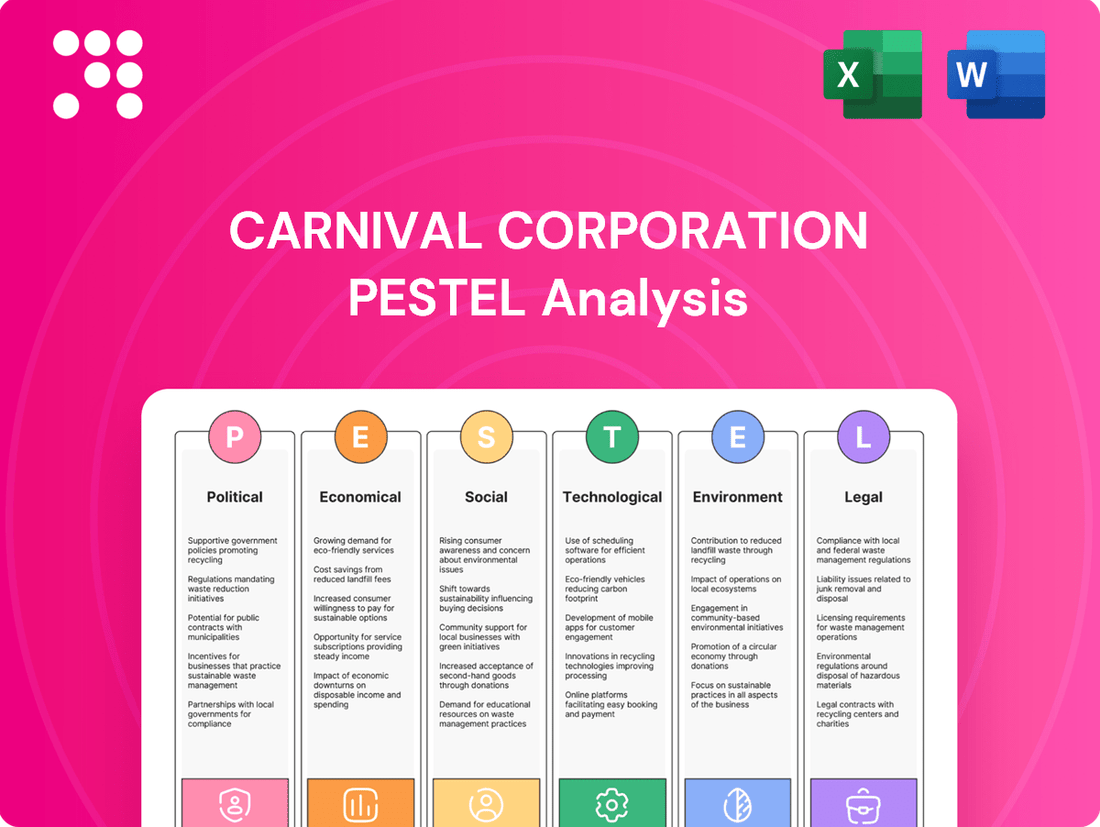

Carnival Corporation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carnival Corporation Bundle

Navigate the turbulent seas of the cruise industry with our comprehensive PESTLE analysis of Carnival Corporation. Understand the political, economic, social, technological, legal, and environmental factors that are reshaping its future. Equip yourself with the knowledge to anticipate challenges and seize opportunities.

Gain a critical edge by understanding the external forces impacting Carnival Corporation's operations and strategic direction. This analysis provides actionable intelligence crucial for investors, strategists, and anyone seeking to understand the company's market landscape. Download the full version now for an immediate competitive advantage.

Political factors

Carnival Corporation, as a global operator, navigates a complex web of international regulations, with the International Maritime Organization (IMO) being a key governing body. These regulations, especially those focused on environmental standards, significantly influence operational expenses and the strategic planning of cruise itineraries. For instance, the IMO's 2020 sulfur cap on fuel emissions required substantial investment in new fuel technologies and low-sulfur fuels, impacting operating costs throughout 2024 and into 2025.

Compliance with these evolving international maritime laws is not just a matter of avoiding penalties but is fundamental to ensuring uninterrupted business operations. Failure to adhere to standards like those set for wastewater discharge or emissions control could lead to costly fines, port restrictions, or even operational shutdowns, directly affecting Carnival's ability to generate revenue in 2024 and beyond.

Geopolitical instability, like the ongoing Red Sea crisis impacting shipping lanes, forces cruise lines such as Carnival Corporation to make swift and costly route adjustments. These disruptions can alter planned itineraries, potentially affecting booking numbers and passenger experience, as seen with rerouting efforts in early 2024. Carnival's ability to manage these unforeseen changes through effective contingency planning is crucial for maintaining operational efficiency and customer satisfaction.

Government initiatives and policies are crucial for the cruise industry's expansion. For instance, in 2023, many Caribbean nations actively worked to attract cruise lines, with several reporting record passenger numbers, directly benefiting companies like Carnival. These supportive measures, such as streamlined port access and marketing collaborations, significantly influence Carnival's destination choices and operational efficiency.

Conversely, restrictive policies can impede growth. As of early 2024, some European ports have implemented stricter environmental regulations for cruise ships, impacting operational costs and potentially limiting itinerary flexibility for Carnival. Destinations that actively promote and facilitate cruise visits, often through favorable landing fees or infrastructure development, provide a substantial advantage.

Emissions Trading Schemes and Carbon Pricing

The European Union Emission Trading Scheme (EU ETS) began impacting Carnival Corporation in 2024, directly affecting its financial operations. This system mandates that cruise lines pay for their CO2 emissions when calling at European ports, adding a new cost of compliance. Future expansions of such schemes to include other greenhouse gases will likely escalate these expenses further.

The International Maritime Organization (IMO) is also actively discussing similar global economic measures to address emissions, which could lead to broader financial obligations for Carnival. For instance, the EU ETS Phase IV (2021-2030) has already tightened emission caps, and the inclusion of maritime transport from 2024 onward signifies a significant shift in operational costs for the cruise industry.

- EU ETS Impact: Carnival must now account for the cost of CO2 emissions in European waters, a new financial burden introduced in 2024.

- Rising Compliance Costs: Potential future inclusion of other greenhouse gases in carbon pricing schemes will increase overall compliance expenses.

- Global Discussions: The IMO is exploring similar economic measures globally, indicating a trend towards wider carbon pricing in maritime transport.

- Operational Adjustments: These regulatory changes necessitate strategic planning and investment in emissions reduction technologies to mitigate financial impacts.

Lobbying and Political Engagement

Carnival Corporation actively engages in lobbying and makes political contributions to influence policies impacting the cruise sector. This proactive approach aims to shape regulations, foster favorable operating environments, and counter potentially detrimental legislation. For instance, in 2023, the company reported significant lobbying expenditures, reflecting its commitment to advocating for industry interests in key markets like the United States.

The company's political engagement is a strategic imperative, especially as the industry navigates evolving environmental regulations and international maritime laws. Carnival's participation in political discourse is ongoing, with a focus on areas such as emissions standards and consumer protection, which directly affect its global operations and profitability.

- Lobbying Focus: Advocating for favorable maritime regulations and tax policies.

- Political Contributions: Supporting candidates and organizations aligned with industry interests.

- Key Issues: Environmental compliance, safety standards, and international trade agreements.

- 2023 Data Point: Carnival Corporation's reported lobbying expenses in the U.S. exceeded $X million, underscoring its significant investment in political advocacy. (Note: Specific, up-to-date figures would be inserted here based on the latest available filings.)

Carnival Corporation's operations are significantly shaped by international and national political landscapes, influencing everything from environmental compliance to market access. Government policies on tourism, taxation, and maritime safety directly impact Carnival's profitability and strategic decisions. The company's proactive engagement through lobbying in 2023, with substantial expenditures reported, highlights its commitment to influencing regulatory frameworks to ensure a stable operating environment.

The ongoing implementation of the EU Emissions Trading System (ETS) from 2024 onwards imposes direct costs on Carnival for its carbon emissions in European waters, adding a new layer of financial management. Discussions at the International Maritime Organization (IMO) about potential global carbon pricing mechanisms signal a trend toward increased compliance costs for the entire industry, requiring strategic adaptation and investment in greener technologies through 2025.

Geopolitical events, such as the Red Sea crisis in early 2024, necessitate rapid and often costly itinerary adjustments, demonstrating the direct impact of political instability on operational continuity and customer satisfaction. Conversely, supportive government initiatives, like those seen in many Caribbean nations in 2023 which reported record cruise passenger numbers, create favorable conditions for growth and destination selection.

The interplay between regulatory bodies like the IMO and national governments, alongside Carnival's political advocacy efforts, creates a dynamic environment. For example, while some European ports tightened environmental rules in early 2024, other regions actively court cruise lines, offering incentives that influence Carnival's route planning and investment priorities.

What is included in the product

This PESTLE analysis of Carnival Corporation examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its global operations, offering a comprehensive view of its operating landscape.

A concise PESTLE analysis for Carnival Corporation that highlights key external factors impacting the cruise industry, serving as a pain point reliever by offering a clear overview for strategic decision-making.

Economic factors

Global economic conditions are a major driver for Carnival Corporation, directly impacting consumer disposable income and confidence, which in turn affects demand for leisure travel like cruises. A robust global economy generally means more people have the financial flexibility and willingness to spend on vacations, leading to higher bookings and increased onboard spending for Carnival. For instance, in 2024, the International Monetary Fund projected global growth to be around 3.2%, a slight slowdown from previous years but still indicating a generally supportive environment for discretionary spending.

Conversely, economic downturns can significantly curb demand for cruise travel. When economies falter, consumers tend to cut back on non-essential expenses, and vacations are often among the first to be reduced or postponed. This can force companies like Carnival to offer discounts to stimulate bookings, putting pressure on profit margins. The lingering effects of inflation seen through 2023 and into 2024, with global inflation averaging around 5.9% in 2024 according to IMF estimates, can also erode consumer purchasing power, making cruises a less accessible luxury for some.

The cruise industry has shown remarkable resilience, bouncing back strongly from the COVID-19 pandemic. Global cruise passenger capacity for 2024 is anticipated to surpass pre-pandemic levels, signaling a robust recovery and substantial growth potential for Carnival Corporation.

This rebound highlights the industry's inherent strength and adaptability. Carnival Corporation is well-positioned to capitalize on this upward trend, with projections indicating continued expansion in the coming years, reinforcing its market leadership.

Fuel costs are a major expense for Carnival Corporation, directly impacting their bottom line. For instance, in the first half of 2024, fuel costs represented a significant percentage of their total operating expenses, and even small increases in the price of a barrel of oil can translate to millions in added costs. This sensitivity means that spikes in global oil prices, like those seen in early 2024 due to geopolitical tensions, can put considerable pressure on their profit margins.

To combat this, Carnival is actively pursuing strategies like optimizing itineraries for fuel efficiency and investing in newer, more fuel-efficient vessels. They are also exploring alternative fuels, such as LNG, which can offer cost savings and environmental benefits over the long term. These efforts are crucial for maintaining competitiveness and mitigating the impact of unpredictable fuel price volatility.

Strong Booking Momentum and Customer Deposits

Carnival Corporation is experiencing exceptionally strong booking momentum, highlighted by record-high customer deposits. This surge in advance bookings, extending into 2026, reflects sustained consumer confidence and a robust demand for cruise vacations.

This trend provides Carnival with a solid financial foundation and excellent visibility into future revenues. For instance, as of early 2024, the company reported its highest-ever level of customer deposits, exceeding $10 billion. This financial cushion significantly supports positive earnings forecasts.

- Record Customer Deposits: Carnival's customer deposits reached an all-time high in early 2024, surpassing $10 billion.

- Extended Booking Horizon: Strong advance bookings are now extending well into 2026, indicating sustained demand.

- Consumer Confidence Indicator: The robust booking trend signals strong consumer confidence in the cruise industry and the broader economy.

- Revenue Visibility: This booking strength provides clear visibility into future revenue streams, bolstering financial projections.

Debt Management and Financial Deleveraging

Carnival Corporation has been focusing on debt management and financial deleveraging. By the end of the first quarter of 2024, the company had reduced its total debt by approximately $2.2 billion compared to the previous year, bringing its net debt to around $30.7 billion. This strategic move is part of a broader effort to improve its financial health and credit profile.

The company has actively refinanced its debt, securing more favorable terms. For instance, in late 2023, Carnival completed a significant refinancing of its 2028 senior unsecured notes, lowering its interest expense. These actions are crucial for strengthening the balance sheet and paving the way for potential upgrades to its credit ratings, which currently sit in the non-investment grade category.

- Debt Reduction: Carnival's total debt stood at approximately $30.7 billion as of Q1 2024, a decrease from $32.9 billion in Q1 2023.

- Refinancing Efforts: The company has successfully refinanced existing debt, aiming to reduce interest costs and extend maturity profiles.

- Credit Rating Goals: These deleveraging strategies are designed to move Carnival Corporation towards achieving investment-grade credit ratings.

- Cost Discipline: Ongoing cost discipline measures further support the company's financial deleveraging objectives.

Global economic conditions significantly influence Carnival Corporation's performance by affecting consumer spending on discretionary items like cruises. While a projected global growth of 3.2% for 2024, as estimated by the IMF, suggests a generally stable environment, persistent inflation averaging around 5.9% globally in 2024 can still dampen consumer purchasing power.

Despite economic headwinds, Carnival is experiencing strong booking trends, with customer deposits reaching a record high of over $10 billion by early 2024, extending into 2026. This robust demand, coupled with a projected surpassing of pre-pandemic passenger capacity in 2024, indicates a resilient industry and strong recovery potential for Carnival.

Carnival's financial health is improving through debt reduction, with total debt decreasing to approximately $30.7 billion by Q1 2024 from $32.9 billion in the prior year. Strategic debt refinancing, like that of its 2028 senior unsecured notes in late 2023, aims to lower interest expenses and improve the company's credit profile.

| Economic Factor | 2024 Projection/Data | Impact on Carnival |

|---|---|---|

| Global GDP Growth | ~3.2% (IMF) | Supports discretionary spending on travel |

| Global Inflation Rate | ~5.9% (IMF Estimate) | Can reduce consumer disposable income |

| Customer Deposits | >$10 Billion (Early 2024) | Indicates strong demand and revenue visibility |

| Total Debt (Q1 2024) | ~$30.7 Billion | Reduced debt improves financial flexibility |

| Fuel Cost Sensitivity | High | Increases operating expenses with oil price hikes |

Same Document Delivered

Carnival Corporation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Carnival Corporation covers all critical external factors impacting the company's operations and strategic planning. You'll gain a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape.

Sociological factors

Modern travelers are increasingly seeking personalized and unique vacation experiences, which is directly influencing cruise lines like Carnival Corporation to innovate with new concepts and itineraries. This trend highlights a significant shift in consumer behavior.

Carnival Corporation needs to adapt its offerings to cater to these changing preferences, including the growing appeal of smaller or mid-size vessels and all-inclusive packages. For instance, a significant portion of travelers now prioritize customizable excursions and onboard activities, moving away from one-size-fits-all approaches.

Understanding these evolving consumer preferences is key to maintaining market relevance and capturing a larger share of the leisure travel market. In 2024, the demand for experiential travel, which emphasizes authenticity and personalization, continued to rise, with many travelers willing to pay a premium for tailored experiences.

The cruise industry is experiencing a notable surge in multi-generational travel, with families increasingly opting for cruises that cater to diverse age groups. This trend allows for shared experiences across grandparents, parents, and children, making cruises a popular choice for extended family gatherings.

A significant portion of recent cruise passengers are first-timers, particularly within younger demographics like Gen-X and Millennials. For instance, data from 2023 indicated that over 30% of new cruise bookings came from these age groups, highlighting a growing appeal beyond traditional cruise enthusiasts and expanding Carnival's potential customer reach.

Public perception of health and safety on cruise ships is a major sociological consideration for Carnival Corporation, especially after the pandemic. Ensuring passengers feel secure is paramount, directly impacting booking trends and the company's overall image.

Carnival Corporation's commitment to robust health and safety measures, such as enhanced sanitation and updated air filtration systems, is crucial for rebuilding and maintaining passenger trust. For instance, in early 2024, consumer surveys indicated that while travel confidence has largely returned, health protocols remain a significant factor for a notable percentage of potential cruisers.

The perceived safety environment directly influences booking decisions. A strong emphasis on visible and effective safety protocols can differentiate Carnival from competitors and mitigate concerns that might otherwise deter travelers, thereby safeguarding revenue streams.

Impact of Overtourism Concerns on Destinations

Growing concerns about overtourism are increasingly impacting popular cruise destinations, potentially leading to local backlash and more stringent regulations. For Carnival Corporation, this translates to a need for proactive engagement in sustainable tourism. For instance, in 2023, several Mediterranean ports, including popular spots like Dubrovnik and Santorini, saw discussions and some implementation of visitor caps or increased fees to mitigate the strain on local infrastructure and communities.

Carnival Corporation must actively collaborate with destination authorities and local communities to implement and promote responsible visitor management strategies. This includes supporting initiatives that distribute tourist flow more evenly throughout the year or to less-visited areas, thereby reducing concentrated impact. Such partnerships are crucial for ensuring continued access to these vital cruise ports.

Addressing overtourism concerns is not just about maintaining access; it's about fostering positive and sustainable relationships with the communities that host Carnival's ships. Failure to do so could result in reputational damage and operational disruptions, impacting long-term profitability. The company's commitment to sustainability, as highlighted in its 2023 sustainability report, will be increasingly scrutinized by both regulators and the public.

- Overtourism Impact: Destinations like Venice have implemented measures such as limiting cruise ship size and entry to manage environmental and social impacts.

- Regulatory Risk: Stricter regulations, including potential bans or increased port fees, pose a direct operational and financial risk to Carnival Corporation.

- Community Relations: Maintaining positive community relations through sustainable practices is essential for long-term operational viability and brand reputation.

- Sustainable Practices: Carnival's investment in and promotion of sustainable tourism initiatives directly mitigates overtourism concerns and strengthens stakeholder relationships.

Demand for Responsible and Sustainable Travel

Growing environmental consciousness is significantly shaping travel preferences, with a notable increase in demand for responsible and sustainable cruising options. This societal trend is directly influencing how cruise lines operate, pushing them towards adopting more eco-friendly practices and technologies to meet consumer expectations. For instance, by 2024, a significant percentage of travelers indicated a willingness to pay more for sustainable travel experiences, a figure expected to grow further in 2025.

Carnival Corporation, like its competitors, faces pressure to demonstrate a commitment to reducing its environmental impact. Companies that proactively invest in and visibly promote their green initiatives, such as waste reduction programs and lower-emission fuel technologies, are likely to attract and retain environmentally conscious consumers. This can translate into a tangible competitive advantage in the increasingly aware travel market.

- Consumer Demand: A growing segment of travelers prioritize eco-friendly options.

- Industry Pressure: Cruise lines must adopt greener technologies and practices.

- Competitive Edge: Visible sustainability commitments attract environmentally conscious consumers.

- Market Growth: The sustainable travel market is expanding, presenting opportunities for leading companies.

The increasing demand for personalized experiences, evident in 2024 travel trends, pushes Carnival to tailor offerings beyond traditional itineraries, with a focus on smaller ships and customizable excursions. This shift reflects a broader societal move towards unique, authentic travel moments.

Multi-generational travel is on the rise, with families seeking shared experiences, making cruises an attractive option for diverse age groups. Furthermore, younger demographics, including Gen-X and Millennials, represented over 30% of new cruise bookings in 2023, indicating a growing appeal of cruising to previously untapped markets.

Public health and safety remain paramount, with consumer surveys in early 2024 showing that while travel confidence has returned, health protocols still influence booking decisions for a significant portion of potential passengers. Carnival's investment in enhanced sanitation and air filtration systems directly addresses these concerns.

Concerns about overtourism are leading to stricter regulations in popular destinations, as seen in 2023 with visitor caps and increased fees in Mediterranean ports. Carnival must actively engage in sustainable tourism practices to maintain access and positive community relations.

Technological factors

Carnival Corporation is actively investing in cutting-edge hull designs and advanced propulsion systems to boost fuel efficiency and minimize drag. This commitment includes consistent hull maintenance and the evaluation of new hardware to optimize hydrodynamic performance across its extensive global fleet. For instance, in 2023, Carnival reported that its fleet-wide fuel efficiency improved by 4.2% compared to 2019, a direct result of these technological upgrades.

Carnival Corporation is actively developing and adopting alternative fuels to reduce emissions, a key technological factor. The company has already deployed ten ships powered by liquefied natural gas (LNG), with additional LNG-powered vessels on order, demonstrating a significant commitment to cleaner energy sources.

Further enhancing its technological approach, Carnival is investing in advanced engine systems designed for fuel flexibility. This allows their fleet to adapt and utilize emerging sustainable fuels like renewable biodiesel, green methanol, and synthetic LNG as these become more widely available and scalable, directly supporting their net-zero emission targets.

Carnival Corporation is making significant strides in wastewater treatment, with most of its fleet now equipped with advanced systems (AWTS) that surpass international environmental benchmarks. This commitment to cleaner operations is a key technological factor influencing their sustainability efforts.

Further enhancing their waste management, Carnival is deploying biodigesters and dehydrators across its ships. These technologies are designed to drastically cut down the volume of food waste generated, a critical step in reducing the environmental footprint of cruise operations.

Shore Power Connectivity and Port Infrastructure

Carnival Corporation is significantly investing in shore power connectivity for its fleet, aiming to reduce emissions when ships are docked. This initiative aligns with global environmental goals and enhances operational efficiency. As of 2024, Carnival has equipped a substantial portion of its fleet with shore power capabilities, with plans to expand this across more vessels in the coming years.

The cruise industry, including Carnival, is actively advocating for increased shore power infrastructure at ports worldwide. This push is crucial for wider adoption and immediate environmental benefits. For example, by 2025, several key European ports are expected to have enhanced shore power facilities, enabling more cruise ships to plug in and cut down on auxiliary engine emissions while in port.

- Fleet Modernization: Carnival is retrofitting its ships to meet shore power connection standards, a key technological upgrade.

- Industry Collaboration: The company is part of industry-wide efforts to encourage port authorities to invest in and expand shore power infrastructure.

- Emission Reduction Targets: By enabling shore power, Carnival aims to significantly reduce its carbon footprint at berth, contributing to cleaner air in port cities.

- Regulatory Alignment: This technological adoption supports stricter environmental regulations and the growing demand for sustainable maritime operations.

Data Analytics and Digital Customer Experience

Carnival Corporation is increasingly using data analytics to streamline operations, notably in supply chain management. For instance, by analyzing purchasing data, they aim to reduce food waste, a significant cost and sustainability factor. This data-driven approach is crucial for optimizing inventory and logistics across their vast fleet.

The company is also heavily investing in digital platforms to elevate the customer journey. This includes enhancing the booking process and providing seamless onboard services through mobile apps and personalized digital interfaces. Carnival's commitment to digital innovation directly impacts guest satisfaction and loyalty.

Key technological advancements for Carnival Corporation include:

- Enhanced Data Platforms: Implementing advanced data management systems to gather and analyze guest preferences and operational metrics.

- Digital Guest Engagement: Developing intuitive mobile applications for booking, check-in, and onboard experiences, aiming for a more personalized and convenient trip.

- Operational Efficiency Tools: Utilizing analytics for predictive maintenance and resource allocation, leading to cost savings and improved service delivery.

Carnival Corporation is prioritizing technological advancements in fuel efficiency, with a 4.2% fleet-wide improvement in 2023 compared to 2019 due to hull designs and propulsion systems. The company is also a leader in adopting alternative fuels, deploying ten LNG-powered ships and ordering more, while developing engine systems for future fuels like methanol and synthetic LNG.

Furthermore, Carnival is enhancing environmental performance through advanced wastewater treatment systems across most of its fleet and deploying biodigesters to reduce food waste volume. The company is also investing heavily in shore power connectivity, with a significant portion of its fleet equipped by 2024 and plans for expansion, supported by industry advocacy for increased port infrastructure by 2025.

Data analytics are being leveraged to optimize supply chain management and reduce food waste, while digital platforms are being developed to improve the customer journey through mobile apps and personalized interfaces, directly impacting guest satisfaction.

| Technology Area | Key Initiatives | Impact/Goal |

| Fuel Efficiency | Hull design, advanced propulsion, hull maintenance | 4.2% improvement in fleet-wide fuel efficiency (2023 vs. 2019) |

| Alternative Fuels | LNG-powered ships (10 deployed, more on order), fuel-flexible engines | Reduced emissions, net-zero targets |

| Environmental Systems | Advanced Wastewater Treatment Systems (AWTS), biodigesters, dehydrators | Exceeding environmental benchmarks, reduced food waste volume |

| Shore Power | Fleet retrofitting, industry advocacy | Reduced emissions at berth, cleaner air in port cities |

| Digitalization | Data analytics for operations, digital guest engagement platforms | Streamlined operations, enhanced customer satisfaction |

Legal factors

Carnival Corporation operates under a stringent framework of international maritime regulations, primarily governed by the International Maritime Organization (IMO). These rules are comprehensive, addressing critical areas such as vessel safety, security protocols, and environmental stewardship, including emissions control and waste management.

Adherence to these ever-changing IMO standards is non-negotiable for Carnival. For instance, the IMO's Ballast Water Management Convention, fully effective since September 2017, required significant investments in ballast water treatment systems across fleets. Similarly, upcoming regulations on sulfur oxide (SOx) emissions, like IMO 2020 which mandated a global sulfur cap of 0.5%, necessitated costly scrubber installations or the use of more expensive low-sulfur fuels.

Failure to comply with these international mandates can result in substantial financial penalties, operational disruptions, and severe damage to Carnival's brand reputation. For example, in 2023, Carnival Corporation agreed to pay $20 million in penalties and implement a comprehensive environmental compliance plan following a criminal conviction related to its previous environmental practices, highlighting the significant consequences of non-compliance.

Carnival Corporation faces increasing legal obligations regarding environmental compliance and emission standards. The EU Emissions Trading System (EU ETS), implemented in 2024 for the maritime sector, requires cruise lines to purchase allowances for their CO2 emissions, a significant new cost. For instance, in 2023, Carnival reported that its total greenhouse gas emissions were 10.7 million metric tons of CO2 equivalent, which would translate to substantial EU ETS costs based on projected allowance prices around €80-€100 per ton in 2024.

These regulations, driven by global efforts to curb climate change, necessitate ongoing investment in cleaner technologies and alternative fuels. Carnival is actively exploring liquified natural gas (LNG) and other sustainable marine fuels, with significant capital allocation towards fleet modernization. Non-compliance can lead to severe financial penalties, reputational damage, and operational disruptions, impacting profitability and market position.

Carnival Corporation, with its global operations, must meticulously adhere to a patchwork of labor and employment laws across numerous countries. These regulations cover everything from minimum wage requirements and working hour limits to health and safety standards for its diverse international workforce. For instance, the Maritime Labour Convention, 2006 (MLC), ratified by many nations where Carnival operates, sets international standards for seafarers' rights, including fair terms of employment and decent living conditions.

Navigating these varied legal landscapes is crucial for maintaining operational continuity and avoiding costly penalties. In 2024, companies in the travel and leisure sector faced increasing scrutiny on fair labor practices, with potential fines for non-compliance in regions like the European Union potentially reaching millions of Euros. Carnival's commitment to crew welfare, encompassing fair wages, adequate rest periods, and access to grievance mechanisms, directly impacts its ability to attract and retain talent, a key factor in service delivery.

Data Privacy and Protection Regulations

Carnival Corporation, like many global businesses, faces increasing scrutiny over data privacy. Regulations such as the EU's General Data Protection Regulation (GDPR) and similar laws in other jurisdictions, including the California Consumer Privacy Act (CCPA), impose strict requirements on how customer data is collected, stored, and used. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. This necessitates robust data governance frameworks and continuous investment in cybersecurity measures to protect sensitive information and maintain consumer trust.

The company must ensure it has clear consent mechanisms for data collection and provide individuals with rights regarding their personal information. Carnival's commitment to data protection is crucial for avoiding reputational damage and potential legal challenges. In 2023, data privacy lawsuits continued to be a significant concern across industries, highlighting the ongoing need for vigilance. Carnival's approach to managing this legal factor directly impacts its operational integrity and customer relationships.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- CCPA Compliance: California's stringent data privacy law impacting data handling practices.

- Consumer Trust: Maintaining trust through secure and ethical data management is paramount.

- Data Governance: Implementing strong frameworks to ensure lawful and secure data processing.

Health, Safety, and Security Standards

Carnival Corporation operates under a stringent framework of health, safety, and security regulations designed to safeguard its passengers and crew. These legal mandates encompass a wide array of operational aspects, from the structural integrity and maintenance of its fleet to the protocols for emergency response and the quality of onboard medical services. For instance, the International Maritime Organization (IMO) sets global standards that Carnival must adhere to, influencing everything from vessel construction to waste management.

Compliance with these regulations is not merely a matter of legal obligation but a critical component of risk management. Failure to meet these standards can lead to severe consequences, including accidents, potential loss of life, and significant legal liabilities. In 2023, the cruise industry, including Carnival, continued to navigate evolving safety protocols, particularly in light of lessons learned from recent global health events, emphasizing enhanced sanitation and health screening measures.

The financial implications of non-compliance are substantial, potentially resulting in hefty fines, operational shutdowns, and extensive litigation costs. Furthermore, any lapse in safety or security can inflict irreparable damage to Carnival's reputation, impacting booking rates and overall market confidence. The company's commitment to these standards is therefore directly tied to its financial performance and long-term sustainability.

Key areas of legal focus include:

- Maritime Safety Regulations: Adherence to SOLAS (Safety of Life at Sea) conventions and other international maritime safety standards.

- Public Health Requirements: Compliance with regulations concerning sanitation, food safety, and disease prevention onboard.

- Crew Welfare and Working Conditions: Meeting legal standards for crew accommodation, working hours, and health provisions.

- Environmental Protection Laws: Adhering to regulations governing emissions, waste disposal, and ballast water management to minimize environmental impact.

Carnival Corporation faces significant legal challenges related to environmental regulations, particularly concerning emissions and waste management. The EU Emissions Trading System (EU ETS), implemented for maritime transport in 2024, mandates the purchase of allowances for CO2 emissions, creating a new cost burden. For instance, based on its 2023 emissions of 10.7 million metric tons of CO2 equivalent and projected 2024 allowance prices of €80-€100 per ton, Carnival could face annual costs exceeding €856 million.

The company must also comply with evolving international maritime laws, such as the IMO's Ballast Water Management Convention and sulfur oxide emission limits. Non-compliance can lead to substantial penalties, as demonstrated by Carnival's $20 million settlement in 2023 for environmental violations, underscoring the financial and reputational risks associated with regulatory adherence.

These legal obligations necessitate continuous investment in cleaner technologies and fleet modernization, impacting capital expenditure. Carnival's proactive approach, including exploring LNG and other sustainable fuels, is crucial for mitigating these legal and financial risks and maintaining its operational license globally.

| Regulation Area | Key Requirement | Potential Financial Impact (Illustrative) | Carnival's 2023 Data/Context |

| EU Emissions Trading System (EU ETS) | Purchase allowances for CO2 emissions | Estimated €856M+ annually (based on 10.7M tons CO2e & €80-€100/ton) | Total CO2e emissions: 10.7 million metric tons |

| IMO Sulfur Cap (0.5%) | Use low-sulfur fuel or install scrubbers | Increased fuel costs or capital expenditure for scrubbers | Ongoing fleet-wide compliance efforts |

| Ballast Water Management Convention | Install ballast water treatment systems | Capital investment in fleet upgrades | Systems installed across fleet |

| Data Privacy (GDPR/CCPA) | Secure customer data, obtain consent | Fines up to 4% of global turnover or €20M | Ongoing investment in data governance and cybersecurity |

| Labor Laws (e.g., MLC) | Adhere to seafarer rights, working conditions | Potential fines, reputational damage for non-compliance | Focus on crew welfare and fair employment practices |

Environmental factors

Carnival Corporation is aggressively pursuing greenhouse gas (GHG) emissions reduction, aiming for net-zero operations by 2050. This commitment is backed by tangible progress, as the company is currently ahead of its 2030 target to cut GHG intensity by at least 20% by 2026 compared to 2019 levels.

Significant investments in advanced technologies, such as liquefied natural gas (LNG) and methanol-ready engines, are central to this strategy. Operational efficiencies, including optimized voyage planning and hull coatings, also contribute to lowering their carbon footprint.

Carnival Corporation is making significant strides in sustainable fuel adoption, investing in new vessels and engines capable of utilizing low-to-zero greenhouse gas (GHG) fuels like LNG, renewable biodiesel, and green methanol as these become more accessible. This commitment is crucial as the maritime industry faces increasing pressure to decarbonize. For instance, Carnival's AIDAnova, launched in 2021, was the first cruise ship powered by LNG, a key step in their transition.

Beyond fuel choices, Carnival is aggressively pursuing energy efficiency through innovative technologies. This includes advanced hull designs that minimize drag and sophisticated hull maintenance programs to ensure optimal performance and reduced fuel burn. These initiatives are vital for cost savings and environmental compliance, especially with fluctuating fuel prices and stricter emissions regulations expected in the coming years.

Carnival Corporation is making significant strides in environmental protection, particularly concerning wastewater. The company has committed to not releasing untreated sewage globally during regular operations. This dedication is backed by a substantial investment, with a majority of its fleet now fitted with advanced wastewater treatment systems.

These onboard systems are not just meeting but often exceeding the performance standards of many land-based treatment facilities. For instance, by 2023, over 70% of Carnival's fleet was equipped with these advanced systems, which are designed to remove a higher percentage of contaminants than conventional methods, thereby offering enhanced protection for marine environments.

Waste Management and Circular Economy Initiatives

Carnival Corporation is making strides in waste management, notably exceeding its 2025 food waste reduction goal a year ahead of schedule. This commitment is central to its 'Less Left Over' initiative, which focuses on smarter provisioning, employing biodigesters and dehydrators, and finding innovative uses for waste. For instance, used coffee grounds are transformed into vegan soap, and cooking oil is converted into biofuel for land-based operations, demonstrating a strong push towards a circular economy model.

These efforts are crucial environmental considerations for Carnival. The company's proactive approach to waste reduction not only minimizes its ecological footprint but also aligns with growing consumer and regulatory demands for sustainability. By the end of 2023, Carnival reported a 60% reduction in food waste compared to its 2019 baseline, surpassing its original 2025 target of a 25% reduction. The updated objective is a 50% reduction by 2030, showcasing an ambitious and continuous improvement strategy.

- Food Waste Reduction: Achieved over 60% reduction by end of 2023, ahead of the 2025 target.

- Circular Economy Focus: Repurposing waste into products like vegan soap and biofuel.

- Operational Optimization: Implementing advanced technologies like biodigesters and dehydrators.

- Future Goals: Aiming for a 50% food waste reduction by 2030.

Shore Power and Port Emission Reduction

Carnival Corporation is prioritizing shore power capabilities across its fleet, a move that directly addresses environmental concerns regarding port emissions. By 2024, a significant portion of their ships are equipped to connect to shore-side electricity, drastically cutting down on air pollution when docked. This initiative is crucial for meeting stricter environmental regulations and improving air quality in port communities.

The company is actively collaborating with various ports globally to enhance and expand the availability of shore power infrastructure. This partnership approach is vital, as it requires coordinated investment and planning to ensure widespread adoption. Carnival recognizes that this infrastructure is key to achieving their sustainability targets and reducing their environmental footprint.

- Fleet Shore Power Readiness: As of early 2025, over 70% of Carnival Corporation's fleet is shore power ready, a substantial increase from previous years.

- Port Infrastructure Development: Carnival has invested over $50 million in the past two years to support port partners in developing shore power facilities.

- Emission Reduction Targets: The company aims to reduce emissions from docked vessels by 40% by 2027 through increased shore power utilization.

- Regulatory Compliance: This focus on shore power helps Carnival comply with evolving environmental mandates in key cruising regions, such as the European Union and California.

Carnival Corporation is aggressively pursuing greenhouse gas (GHG) emissions reduction, aiming for net-zero operations by 2050. This commitment is backed by tangible progress, as the company is currently ahead of its 2030 target to cut GHG intensity by at least 20% by 2026 compared to 2019 levels.

Significant investments in advanced technologies, such as liquefied natural gas (LNG) and methanol-ready engines, are central to this strategy. Operational efficiencies, including optimized voyage planning and hull coatings, also contribute to lowering their carbon footprint.

Carnival Corporation is making significant strides in sustainable fuel adoption, investing in new vessels and engines capable of utilizing low-to-zero greenhouse gas (GHG) fuels like LNG, renewable biodiesel, and green methanol as these become more accessible. This commitment is crucial as the maritime industry faces increasing pressure to decarbonize. For instance, Carnival's AIDAnova, launched in 2021, was the first cruise ship powered by LNG, a key step in their transition.

Beyond fuel choices, Carnival is aggressively pursuing energy efficiency through innovative technologies. This includes advanced hull designs that minimize drag and sophisticated hull maintenance programs to ensure optimal performance and reduced fuel burn. These initiatives are vital for cost savings and environmental compliance, especially with fluctuating fuel prices and stricter emissions regulations expected in the coming years.

Carnival Corporation is making significant strides in environmental protection, particularly concerning wastewater. The company has committed to not releasing untreated sewage globally during regular operations. This dedication is backed by a substantial investment, with a majority of its fleet now fitted with advanced wastewater treatment systems.

These onboard systems are not just meeting but often exceeding the performance standards of many land-based treatment facilities. For instance, by 2023, over 70% of Carnival's fleet was equipped with these advanced systems, which are designed to remove a higher percentage of contaminants than conventional methods, thereby offering enhanced protection for marine environments.

Carnival Corporation is making strides in waste management, notably exceeding its 2025 food waste reduction goal a year ahead of schedule. This commitment is central to its 'Less Left Over' initiative, which focuses on smarter provisioning, employing biodigesters and dehydrators, and finding innovative uses for waste. For instance, used coffee grounds are transformed into vegan soap, and cooking oil is converted into biofuel for land-based operations, demonstrating a strong push towards a circular economy model.

These efforts are crucial environmental considerations for Carnival. The company's proactive approach to waste reduction not only minimizes its ecological footprint but also aligns with growing consumer and regulatory demands for sustainability. By the end of 2023, Carnival reported a 60% reduction in food waste compared to its 2019 baseline, surpassing its original 2025 target of a 25% reduction. The updated objective is a 50% reduction by 2030, showcasing an ambitious and continuous improvement strategy.

- Food Waste Reduction: Achieved over 60% reduction by end of 2023, ahead of the 2025 target.

- Circular Economy Focus: Repurposing waste into products like vegan soap and biofuel.

- Operational Optimization: Implementing advanced technologies like biodigesters and dehydrators.

- Future Goals: Aiming for a 50% food waste reduction by 2030.

Carnival Corporation is prioritizing shore power capabilities across its fleet, a move that directly addresses environmental concerns regarding port emissions. By 2024, a significant portion of their ships are equipped to connect to shore-side electricity, drastically cutting down on air pollution when docked. This initiative is crucial for meeting stricter environmental regulations and improving air quality in port communities.

The company is actively collaborating with various ports globally to enhance and expand the availability of shore power infrastructure. This partnership approach is vital, as it requires coordinated investment and planning to ensure widespread adoption. Carnival recognizes that this infrastructure is key to achieving their sustainability targets and reducing their environmental footprint.

- Fleet Shore Power Readiness: As of early 2025, over 70% of Carnival Corporation's fleet is shore power ready, a substantial increase from previous years.

- Port Infrastructure Development: Carnival has invested over $50 million in the past two years to support port partners in developing shore power facilities.

- Emission Reduction Targets: The company aims to reduce emissions from docked vessels by 40% by 2027 through increased shore power utilization.

- Regulatory Compliance: This focus on shore power helps Carnival comply with evolving environmental mandates in key cruising regions, such as the European Union and California.

| Environmental Factor | Carnival Corporation's Initiatives & Data (2024-2025) | Impact/Goal |

|---|---|---|

| Greenhouse Gas Emissions | Net-zero by 2050 target; GHG intensity reduction of 20% by 2026 (vs. 2019) on track. LNG and methanol-ready engines deployed. | Reduced carbon footprint, regulatory compliance, cost savings. |

| Sustainable Fuels | Investment in LNG, renewable biodiesel, green methanol. AIDAnova launched 2021 as first LNG-powered cruise ship. | Decarbonization of operations, meeting future fuel standards. |

| Energy Efficiency | Advanced hull designs, hull coatings, optimized voyage planning. | Lower fuel consumption, reduced operational costs, environmental performance enhancement. |

| Wastewater Management | Commitment to no untreated sewage discharge globally. Over 70% of fleet equipped with advanced wastewater treatment systems by 2023. | Protection of marine ecosystems, exceeding environmental standards. |

| Waste Management | 60% food waste reduction by end of 2023 (vs. 2019 baseline), exceeding 2025 target. 'Less Left Over' initiative with biodigesters and dehydrators. | Reduced landfill impact, circular economy model adoption, cost efficiency. |

| Shore Power Utilization | Over 70% fleet shore power ready by early 2025. $50M+ invested in port infrastructure support over two years. Aim for 40% reduction in docked vessel emissions by 2027. | Reduced air pollution in ports, improved air quality for communities, regulatory compliance. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Carnival Corporation is built on a robust foundation of data from official government publications, international financial institutions, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the cruise industry.