Carnival Corporation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carnival Corporation Bundle

Carnival Corporation navigates a complex landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic position.

The complete report reveals the real forces shaping Carnival Corporation’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global cruise ship manufacturing market is highly concentrated, with a few major shipyards like Meyer Werft, Fincantieri, and Chantiers de l'Atlantique dominating over 70% of the market share in 2024. This limited supply gives these shipbuilders significant bargaining power, potentially leading to higher costs for Carnival Corporation when ordering new vessels.

Fuel represents a significant operational expense for Carnival Corporation, and despite a generally competitive global fuel market, the immense quantities Carnival procures grant its suppliers considerable leverage. In 2023, fuel costs for the cruise industry, including Carnival, remained a primary concern, with prices fluctuating based on geopolitical events and global demand. For instance, Brent crude oil prices, a key benchmark, saw considerable volatility throughout 2023, impacting Carnival's bottom line.

The substantial portion of Carnival's operating budget dedicated to fuel, often in the hundreds of millions of dollars annually, means that even minor price increases can have a material impact on profitability. This dependency underscores the bargaining power of fuel suppliers, as Carnival must secure large volumes of a critical commodity to maintain its extensive fleet operations. The company's ability to hedge against fuel price volatility is a key strategy, but the underlying power of suppliers remains a constant factor.

Carnival Corporation relies heavily on specialized port operators for critical services such as docking, passenger management, and enabling access to unique cruise destinations. In areas where fewer port options exist or the destinations themselves are highly sought after, these operators can wield significant influence. This power often translates into higher port fees and more stringent logistical requirements, directly impacting Carnival's operational costs and flexibility.

The bargaining power of these specialized operators is amplified by factors like limited competition and the unique nature of certain cruise locations. For instance, ports with specific infrastructure or environmental regulations can become bottlenecks. Furthermore, the trend of some ports imposing restrictions or outright bans on certain vessel types or operations, as seen in some European destinations, directly forces Carnival to alter its itineraries and incur additional expenses, demonstrating a clear leverage by these port entities.

Labor and Crew Availability

The cruise industry, including Carnival Corporation, depends heavily on a global talent pool for its extensive operations. This includes everything from the officers and crew aboard ships to the vast network of onshore support staff. The availability of skilled labor is a critical factor in maintaining smooth and efficient service delivery across Carnival's fleet.

While Carnival sources labor from many different countries, ensuring a broad base, the demand for experienced and qualified personnel can sometimes shift the bargaining power towards labor suppliers. This is particularly true for specialized roles requiring extensive training and certifications. When demand for these specific skills outstrips supply, suppliers can leverage this to negotiate higher wages and better working conditions, directly impacting Carnival's operational costs.

For instance, as of early 2024, the global maritime sector has experienced increased competition for experienced officers and engineers. This tight labor market means that recruitment and retention efforts become more crucial, potentially giving labor providers more leverage in wage discussions. Carnival, like other major cruise lines, must navigate these dynamics to ensure it has the necessary crew to operate its ships safely and effectively.

- Global Workforce Dependence: Carnival Corporation's operations are supported by a diverse international workforce, essential for ship and shore-based functions.

- Skilled Labor Demand: The need for experienced and certified crew members can grant labor suppliers negotiation power, influencing wage rates.

- Market Dynamics: In 2024, a competitive global maritime labor market for skilled positions means suppliers may have increased leverage in wage negotiations.

Onboard Services and Entertainment Providers

Carnival Corporation relies on a diverse range of third-party providers for onboard services and entertainment, from culinary experts to performers. While the sheer number of potential suppliers can dilute individual power, specialized or highly reputable providers, such as Michelin-starred chefs or renowned entertainment troupes, can command better terms. These select suppliers can influence contract costs and service standards, directly impacting Carnival's operational expenses and the guest experience.

The bargaining power of these onboard service and entertainment providers is moderated by Carnival's scale and its ability to negotiate bulk contracts. However, unique or high-quality offerings are critical to maintaining a competitive edge in the cruise industry. For instance, securing exclusive entertainment acts or unique culinary experiences can differentiate Carnival's product, giving those specific suppliers leverage.

- Supplier Specialization: Niche providers of specialized onboard services or entertainment can exert greater influence due to limited alternatives.

- Quality and Reputation: Highly regarded suppliers with established reputations for quality can negotiate more favorable terms.

- Contractual Agreements: The terms and duration of contracts significantly shape the bargaining power of both Carnival and its suppliers.

- Guest Experience Impact: Services directly affecting guest satisfaction and perceived value can give suppliers more leverage.

Carnival Corporation faces significant bargaining power from its key suppliers, particularly in ship manufacturing and fuel procurement. The concentrated nature of the global cruise ship building market, with major players like Fincantieri and Meyer Werft controlling over 70% of market share in 2024, allows these shipyards to command higher prices for new vessels. Similarly, fuel suppliers wield considerable leverage due to Carnival's vast consumption, with fluctuating global oil prices in 2023 impacting operational costs. This dependency on large volumes of a critical commodity underscores the suppliers' influence.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Carnival Corporation | 2024 Data/Trend Example |

| Shipbuilders | Market concentration, high capital investment, specialized technology | Higher newbuild costs, longer lead times | Major shipyards hold over 70% market share. |

| Fuel Suppliers | Global commodity pricing, geopolitical factors, Carnival's volume | Volatile operating costs, impact on profitability | Brent crude oil prices showed significant volatility in 2023. |

| Specialized Port Operators | Limited competition in key destinations, unique infrastructure requirements | Increased port fees, logistical constraints, itinerary changes | Some European ports have imposed restrictions on vessel types. |

| Skilled Labor Providers | Demand for specialized maritime skills, global talent pool competition | Higher wage demands, increased recruitment/retention costs | Increased competition for experienced officers and engineers in early 2024. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Carnival Corporation's cruise industry operations.

Gain immediate clarity on competitive pressures and potential threats within the cruise industry, enabling proactive strategy adjustments.

Customers Bargaining Power

Customers in the cruise industry exhibit significant price sensitivity, actively comparing offerings from various cruise lines and even alternative vacation types. This comparison shopping, amplified by readily available online tools, grants them substantial power to negotiate better prices and secure attractive deals.

The cruise industry presents a vast landscape of options for consumers, from luxury liners to budget-friendly voyages, and a multitude of destinations and onboard experiences. This sheer volume of choices, including the ever-present alternative of land-based holidays, significantly bolsters customer bargaining power. For instance, in 2024, the cruise industry continued to see robust demand, with major players like Carnival Corporation offering diverse product lines to capture different market segments. Travelers could readily compare pricing, amenities, and itineraries across numerous cruise lines, making it easier to find the best value.

Travel agencies and large group organizers wield significant bargaining power over Carnival Corporation. By consolidating demand, they can negotiate better rates and concessions, influencing Carnival's pricing and revenue streams. For instance, in 2023, the cruise industry saw a strong rebound, with many agencies reporting robust bookings, indicating their continued importance in driving volume for major players like Carnival.

Demand for Value and Personalized Experiences

Customers today are keenly focused on getting the most bang for their buck, especially when it comes to discretionary spending like vacations. Cruises, including those offered by Carnival Corporation, often present a compelling value proposition when compared to traditional land-based holidays. For instance, a 2024 industry report indicated that all-inclusive cruise packages can be up to 20% more cost-effective than comparable resort stays when factoring in accommodation, dining, and entertainment.

Beyond just price, there's a significant shift towards personalized experiences. Travelers are no longer content with a one-size-fits-all approach; they want their vacations tailored to their specific tastes. This includes everything from choosing preferred dining times and specialty restaurants to selecting specific shore excursions and even customizing cabin amenities. This demand for personalization directly empowers customers, giving them a stronger voice in shaping Carnival's product and service offerings.

- Value Proposition: Cruises often offer a more comprehensive value package than land-based vacations, bundling accommodation, food, and entertainment.

- Personalization Demand: Customers increasingly seek customized experiences, influencing Carnival's service delivery and product development.

- Customer Influence: The desire for tailored itineraries and onboard activities gives passengers leverage in negotiating and influencing offerings.

Strong Customer Satisfaction and Repeat Business

Despite some price sensitivity, a significant portion of past cruisers, around 70% in recent surveys, indicate a strong likelihood of taking another cruise. This high repeat business, with many loyal customers embarking on multiple voyages annually, points to considerable customer satisfaction and loyalty. However, this also means customers have firm expectations for consistent quality and value, giving them leverage if Carnival fails to meet these standards.

Customers wield considerable power due to the cruise industry's transparency and the availability of numerous alternatives. This allows them to easily compare prices and offerings, driving down prices and demanding better value. For instance, in 2024, online travel agencies and review sites provided unprecedented access to competitor pricing and customer feedback, enabling savvy travelers to secure significant discounts.

| Factor | Impact on Carnival | Evidence (2024 Data) |

|---|---|---|

| Price Sensitivity | High | Customers actively compare cruise prices against land-based vacations, often finding cruises to be up to 20% more cost-effective for all-inclusive packages. |

| Availability of Substitutes | High | A vast array of cruise options and alternative vacation types means customers have many choices, increasing their bargaining leverage. |

| Information Availability | High | Online platforms provide extensive information on pricing, itineraries, and reviews, empowering customers to make informed decisions and negotiate effectively. |

| Switching Costs | Low | For many customers, switching between cruise lines or vacation types involves minimal effort or cost, further enhancing their power. |

What You See Is What You Get

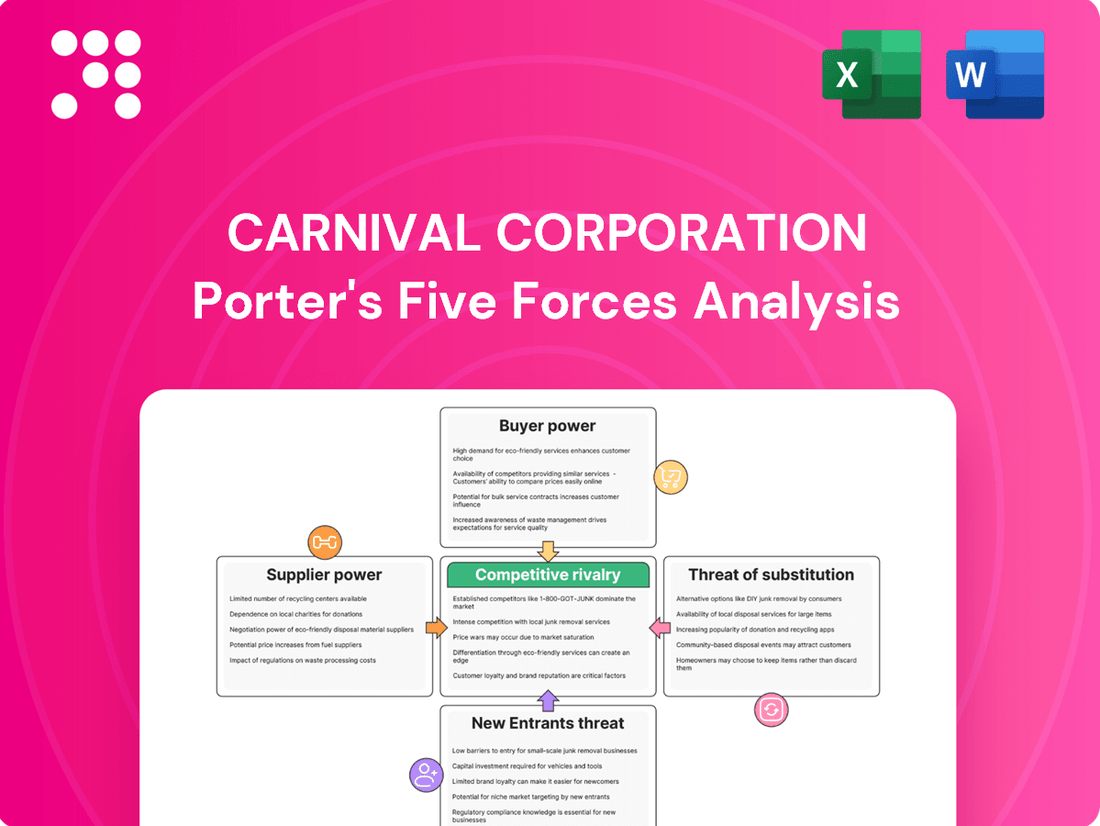

Carnival Corporation Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Carnival Corporation, detailing the competitive landscape and strategic implications for the cruise industry. The document you see here is precisely what you will receive immediately after purchase, offering a comprehensive and professionally formatted examination of the forces shaping Carnival's business environment.

Rivalry Among Competitors

The global cruise industry exhibits a high degree of concentration, with Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings collectively dominating the market. This oligopolistic structure means competition is fierce among these few giants, shaping pricing and service offerings.

Carnival Corporation, a key player, commands a substantial market share, underscoring the intense rivalry. For instance, in 2023, Carnival Corporation reported total revenues of $21.6 billion, demonstrating its significant scale and influence within this concentrated market.

Carnival Corporation faces intense rivalry due to the cruise industry's massive fixed costs for shipbuilding and fleet upkeep. These substantial investments, often in the hundreds of millions or even billions of dollars per vessel, demand high occupancy rates to offset expenses and achieve profitability.

This pressure for passenger volume fuels aggressive competition among cruise lines, driving strategic decisions around capacity management. For instance, in 2024, Carnival Corporation continued to navigate this by balancing new ship deliveries, like the Carnival Jubilee, with the retirement or redeployment of older vessels to optimize its fleet's efficiency and market positioning.

Carnival Corporation's competitive rivalry is significantly shaped by its extensive brand differentiation and a remarkably diverse portfolio. Operating nine distinct cruise lines, the company effectively segments the market, appealing to everyone from value-conscious travelers to those seeking ultra-luxury experiences. This multi-brand strategy directly intensifies competition by offering a wide spectrum of choices, fostering customer loyalty within specific niches.

This broad portfolio allows Carnival to capture a larger share of the global cruise market, making it a formidable competitor against other major players like Royal Caribbean Group and Norwegian Cruise Line Holdings. For instance, in 2024, Carnival continued to leverage its diverse fleet, which comprises over 100 ships, to cater to varied demand patterns and price points across different regions, further solidifying its competitive standing.

Investment in New Ships and Destinations

Major cruise lines are locked in a fierce competition, constantly investing in larger, more amenity-rich ships and developing exclusive private island destinations. This arms race aims to lure travelers with novel experiences and superior onboard offerings, directly intensifying rivalry. For instance, in 2024, Carnival Cruise Line alone is scheduled to take delivery of new vessels like the Carnival Firenze, adding significant capacity and new features to its fleet.

This continuous investment in fleet modernization and destination development creates a high barrier to entry and fuels the rivalry among existing players. Companies must continually innovate to differentiate themselves, leading to increased marketing spend and a focus on guest satisfaction metrics. The pursuit of unique selling propositions, such as advanced entertainment or exclusive port access, means companies are always looking to outdo each other.

- Fleet Expansion: Major cruise lines are committed to significant new ship orders, with the industry expecting numerous vessel deliveries throughout 2024 and beyond, increasing overall capacity.

- Destination Development: Investment in private islands and exclusive port experiences is a key strategy to attract and retain customers, offering unique vacation packages.

- Technological Integration: New ships often feature cutting-edge technology and enhanced amenities, forcing competitors to match or exceed these advancements to remain competitive.

- Customer Experience Focus: The drive to offer unparalleled guest experiences through ship design, entertainment, and dining is a primary battleground in the competitive landscape.

Dynamic Pricing and Marketing Strategies

Carnival Corporation and its competitors actively employ dynamic pricing models, adjusting fares based on demand, seasonality, and competitor actions. Extensive marketing campaigns are crucial for capturing consumer attention in this highly competitive sector.

The cruise industry experienced a significant surge in demand, with Carnival reporting record-breaking bookings for 2024 and projections for continued strength into 2025. This robust demand underscores the effectiveness of current pricing and marketing strategies but also intensifies the pressure to maintain market share.

- Record Bookings: Carnival reported its highest-ever booking day on March 20, 2024, and its highest-ever booking week in March 2024, indicating successful demand generation.

- Pricing Power: The ability to achieve record bookings suggests that pricing strategies are resonating with consumers, even amidst a competitive landscape.

- Marketing Investment: Significant marketing spend is a constant in the industry, with companies like Carnival investing heavily to differentiate their offerings and attract new cruisers.

- Competitive Intensity: The ongoing need to secure market share means pricing and marketing efforts must be consistently innovative and responsive to consumer trends and competitor moves.

The competitive rivalry within the cruise industry is exceptionally intense, driven by a concentrated market structure dominated by a few major players, including Carnival Corporation. This oligopoly forces companies to constantly innovate and compete aggressively on price, service, and onboard experience to capture market share.

Carnival Corporation's multi-brand strategy, encompassing nine distinct cruise lines, allows it to target a wide array of customer segments, thereby intensifying competition by offering diverse choices. This broad appeal, supported by a fleet of over 100 ships in 2024, enables Carnival to effectively compete against rivals like Royal Caribbean and Norwegian Cruise Line Holdings.

The continuous investment in new, larger, and amenity-rich ships, coupled with the development of exclusive private island destinations, represents a significant aspect of this rivalry. For example, Carnival Cruise Line's introduction of vessels like the Carnival Firenze in 2024 highlights this commitment to enhancing fleet capabilities and guest offerings.

Record-breaking booking periods, such as Carnival's highest-ever booking day and week in March 2024, demonstrate the effectiveness of current pricing and marketing strategies. However, this strong demand also fuels further competitive pressure, as companies strive to maintain and grow their market positions through dynamic pricing and substantial marketing investments.

| Competitor | Estimated Market Share (2024) | Key Competitive Actions (2024) |

|---|---|---|

| Carnival Corporation | ~25-30% | Fleet expansion (e.g., Carnival Jubilee, Carnival Firenze), multi-brand strategy, dynamic pricing, record booking initiatives. |

| Royal Caribbean Group | ~20-25% | New ship deliveries (e.g., Icon of the Seas), focus on premium experiences, investment in private destinations. |

| Norwegian Cruise Line Holdings | ~10-15% | Fleet modernization, expansion of itineraries, emphasis on customer loyalty programs. |

SSubstitutes Threaten

The primary substitutes for a cruise vacation are land-based alternatives like resort stays, all-inclusive packages, city breaks, and guided tours. These offer diverse experiences and can be more flexible in duration and location, presenting a moderate threat to the cruise industry. For instance, the global tourism market is projected to reach $15.8 trillion by 2024, with a significant portion allocated to land-based travel.

While not direct substitutes for the entire cruise experience, air travel, trains, and road transportation present viable alternatives for travelers focused solely on reaching specific destinations. For these individuals, these modes can offer a more direct and time-efficient way to travel compared to a cruise, especially for shorter trips or when the primary goal is exploration rather than the onboard experience itself.

In 2024, the global airline industry is projected to carry over 4.7 billion passengers, highlighting the significant reach of air travel as a transportation option. Similarly, extensive rail networks and well-developed road infrastructure globally provide accessible alternatives for reaching many popular tourist destinations, potentially diverting some travelers who might otherwise consider a cruise.

Consumers are increasingly prioritizing value, particularly when economic conditions feel uncertain. This means that vacation options perceived as cheaper than cruising, such as all-inclusive resorts or even staycations, can become more attractive. For instance, a 2024 travel survey indicated that 65% of respondents considered cost the primary factor when choosing a vacation.

Changing Consumer Preferences and Demographics

The cruise industry, including Carnival Corporation, faces a growing threat from substitutes as consumer preferences and demographics shift. Younger travelers and solo adventurers are showing increased interest in cruising, but if the industry fails to adapt its offerings to these evolving tastes, alternative travel options could become more appealing. For instance, the rise of experiential travel and more personalized vacation packages in sectors like adventure tourism or boutique hotels presents a strong alternative for these demographics.

Carnival Corporation must actively address these changing demands. In 2024, the cruise sector is seeing a greater emphasis on sustainability and unique onboard experiences, areas where land-based travel might offer more immediate or diverse solutions. Failure to innovate in these aspects could push consumers towards substitutes.

- Shifting Demographics: Younger generations (Millennials and Gen Z) are increasingly seeking authentic experiences and value, potentially favoring flexible, independent travel over traditional cruise packages.

- Rise of Alternative Travel: The growth of the sharing economy, eco-tourism, and personalized travel planning platforms provides accessible and often more affordable alternatives to cruises.

- Pace of Innovation: If the cruise industry's adaptation to new trends, such as wellness, digital integration, and sustainable practices, lags behind other travel sectors, the threat of substitution intensifies.

Perception of Value and Unique Offerings

The cruise industry, including Carnival Corporation, distinguishes itself by providing an all-encompassing vacation. This includes not just travel but also accommodation, diverse dining options, extensive entertainment, and visits to multiple destinations, all bundled into one price. This integrated experience is key to its value proposition.

Maintaining this perception of high value and uniqueness is critical for Carnival Corporation to counter the threat of substitutes. For instance, in 2024, the cruise sector continued to invest heavily in onboard amenities and destination experiences to reinforce its distinct offering against alternatives.

- Comprehensive Vacation Packages: Cruises offer a singular price for travel, lodging, food, and entertainment, a stark contrast to piecing together independent travel components.

- Destination Variety: The ability to visit multiple countries or regions within a single trip remains a significant draw, a convenience often difficult to replicate with other vacation types.

- Onboard Experience: Carnival Corporation, for example, focuses on diverse entertainment, from Broadway-style shows to themed parties, enhancing the perceived value beyond simple transportation.

The threat of substitutes for Carnival Corporation remains moderate to high. While cruises offer a unique, all-inclusive experience, land-based vacations, adventure travel, and even staycations are increasingly appealing due to flexibility and perceived value. In 2024, the global tourism market's growth, projected to reach $15.8 trillion, indicates strong demand for various travel types, many of which directly compete with cruising.

For instance, all-inclusive resorts and city breaks provide concentrated experiences that can be more cost-effective or cater to specific interests. A 2024 travel survey found that 65% of consumers prioritize cost when selecting a vacation, making these alternatives attractive. Furthermore, the rise of experiential travel and personalized packages appeals to younger demographics seeking unique adventures that might be more readily found outside the traditional cruise model.

| Substitute Type | Key Appeal | 2024 Market Indicator |

|---|---|---|

| Land-based Resorts/All-inclusives | Cost-effectiveness, focused experience | Global tourism market projected at $15.8 trillion |

| City Breaks/Guided Tours | Cultural immersion, flexibility | Significant portion of tourism spend |

| Experiential/Adventure Travel | Authenticity, personalization | Growing segment, especially among younger travelers |

| Independent Travel (Air/Rail/Road) | Flexibility, direct access | Over 4.7 billion passengers projected for global airlines in 2024 |

Entrants Threaten

The threat of new entrants for Carnival Corporation is significantly mitigated by the astronomical capital investment required to enter the cruise industry. Building even a single modern cruise ship can cost upwards of $1 billion, a figure that presents a formidable barrier for any potential competitor.

For instance, Carnival Corporation itself has invested billions in its fleet, with new builds like the Excel-class ships costing well over $1 billion each. This immense financial hurdle means that only well-capitalized entities or those with significant strategic partnerships can realistically consider entering the market, thereby limiting the number of new potential rivals.

Carnival Corporation's vast operational scale creates substantial economies of scale, particularly in purchasing power for supplies and fuel, and in marketing reach. For example, in 2023, Carnival reported over $21.6 billion in revenue, a testament to its massive global footprint. This scale advantage allows them to negotiate better terms with suppliers and spread fixed costs like advertising across a larger customer base, presenting a significant cost barrier for any new cruise line attempting to enter the market.

New entrants would struggle to match Carnival's per-unit cost efficiency. Without a similarly large fleet and established infrastructure, they would likely pay higher prices for everything from ship construction and maintenance to onboard supplies and travel agent commissions. This cost disadvantage makes it difficult for newcomers to offer competitive pricing and achieve profitability, effectively deterring many potential entrants.

The threat of new entrants into the cruise industry is significantly tempered by the limited availability of shipyard construction slots and the highly specialized technical expertise needed to build modern cruise ships. As of early 2024, the global shipbuilding capacity for large passenger vessels remains concentrated among a few key players, such as Meyer Werft and Fincantieri. Securing a building slot for a new, technologically advanced cruise ship can involve waiting periods of several years and substantial upfront investment, acting as a considerable deterrent for potential new competitors.

Brand Recognition and Customer Loyalty

Carnival Corporation and its competitors have cultivated significant brand recognition and deep customer loyalty over many years. This makes it challenging for new players to attract customers who already trust and prefer established brands.

New entrants face the daunting task of investing substantial resources in marketing and brand development to even begin competing with the established preferences and trust consumers place in brands like Carnival. For instance, in 2024, the cruise industry continued to see strong demand, with major players reporting robust booking trends, underscoring the entrenched customer base.

- Brand Equity: Decades of operation have allowed Carnival to build substantial brand equity, a significant barrier for newcomers.

- Customer Loyalty Programs: Established loyalty programs incentivize repeat business, making it harder for new entrants to capture market share.

- Marketing Investment: Overcoming established brand awareness requires massive marketing expenditures, a hurdle for less capitalized entrants.

- Consumer Trust: Existing brands benefit from a proven track record, fostering a level of consumer trust that new entrants must earn.

Extensive Distribution Networks and Destination Access

New entrants face a formidable barrier in replicating Carnival Corporation's vast global distribution networks and exclusive destination access. Carnival has cultivated deep relationships with travel agencies worldwide and secured prime spots on popular cruise itineraries, a feat requiring substantial time and capital investment to emulate.

For instance, in 2023, Carnival Corporation operated a fleet of 90 ships, calling at over 700 ports globally, demonstrating the sheer scale of their operational reach. Establishing comparable partnerships and port agreements would be a monumental undertaking for any new competitor entering the market.

- Global Reach: Carnival's established network spans over 150 countries, facilitating bookings and operations across diverse markets.

- Destination Control: Access to sought-after ports, often secured through long-term agreements, limits new entrants' ability to offer compelling itineraries.

- Brand Loyalty: Decades of operation have fostered significant brand recognition and customer loyalty, making it harder for newcomers to attract passengers.

The threat of new entrants for Carnival Corporation is low due to the immense capital required for fleet acquisition, with new ships costing over $1 billion each. Furthermore, securing shipyard slots and specialized expertise presents significant delays and costs for potential competitors.

Carnival's established economies of scale, evidenced by its $21.6 billion revenue in 2023, allow for superior purchasing power and marketing reach, creating a substantial cost disadvantage for newcomers. New entrants also struggle to match Carnival's extensive global distribution networks and exclusive destination access, built over decades and involving significant investment in partnerships and port agreements.

The industry's high barriers to entry, including substantial capital, operational scale, brand loyalty, and distribution networks, effectively shield Carnival Corporation from significant new competitive threats.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building a modern cruise ship exceeds $1 billion. | Extremely high barrier, limiting entrants to well-capitalized entities. |

| Economies of Scale | Carnival's 2023 revenue of $21.6 billion enables cost advantages. | New entrants face higher per-unit costs for supplies and marketing. |

| Distribution & Access | Global networks and exclusive port agreements are time-consuming to replicate. | New entrants struggle to offer comparable itineraries and reach. |

| Brand Loyalty | Decades of operation foster strong customer trust and repeat business. | Newcomers must invest heavily in marketing to build brand awareness. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Carnival Corporation is built upon a foundation of publicly available data, including annual reports, SEC filings, and investor presentations. We also leverage industry-specific market research reports and news from reputable trade publications to capture competitive dynamics.