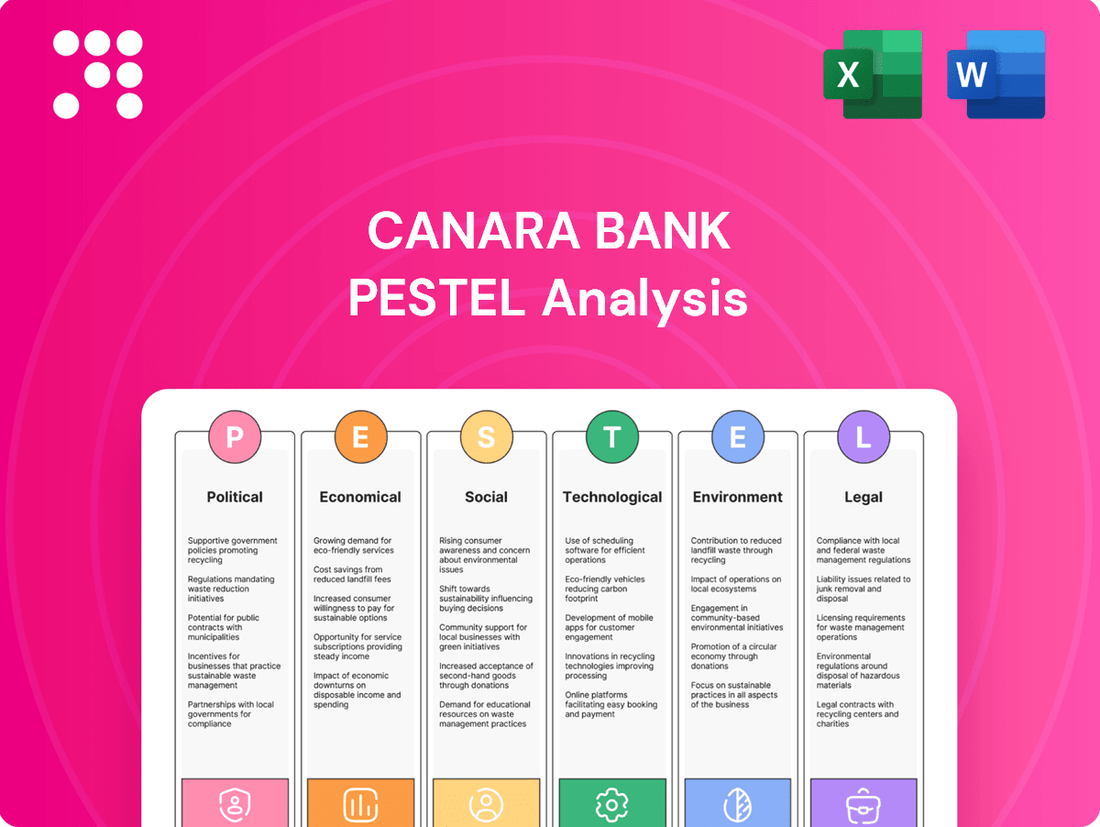

Canara Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

Navigate the complex external forces shaping Canara Bank's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are impacting its operations and strategic decisions. Gain a competitive edge by leveraging these critical insights. Download the full PESTLE analysis now for actionable intelligence and a clearer path to success.

Political factors

As a public sector bank, Canara Bank is deeply affected by the Indian government's economic and banking policies. For instance, the proposed Banking Laws (Amendment) Bill, 2024, is designed to enhance governance and efficiency across the banking sector, which will directly shape Canara Bank's operations and strategic planning.

These government initiatives frequently target critical areas such as expanding financial inclusion, improving the management of non-performing assets (NPAs), and accelerating digital transformation. In 2023-24, Canara Bank reported a significant reduction in its gross NPA ratio to 4.38%, a testament to aligning with such policy objectives.

The Reserve Bank of India (RBI) is the primary regulator for India's banking sector, directly impacting public sector banks like Canara Bank. Its monetary policy, including adjustments to the repo rate, significantly influences the bank's lending and deposit rates, thereby affecting its net interest margins and overall profitability.

Non-compliance with RBI directives can lead to penalties, as demonstrated by a penalty imposed on Canara Bank in early 2025 for issues concerning priority sector lending and deposit interest rates. This underscores the critical need for Canara Bank to maintain strict adherence to all regulatory guidelines.

The Indian government's persistent focus on financial inclusion, exemplified by programs like the Pradhan Mantri Jan Dhan Yojana (PMJDY) and the Micro Units Development and Refinance Agency (MUDRA) scheme, significantly shapes Canara Bank's operational strategy and market penetration. These government-backed initiatives actively promote banking services for previously unbanked and underbanked segments of the population.

Consequently, Canara Bank is driven to innovate and offer more user-friendly financial products. This necessitates expanding its physical presence, including branches and customer service points, particularly in rural and semi-urban regions, alongside bolstering its digital banking infrastructure to cater to these newly included customers.

As of early 2024, PMJDY had facilitated the opening of over 51 crore bank accounts, with a substantial portion held by women and those in rural areas, demonstrating the broad reach of these inclusion efforts and the potential customer base for banks like Canara.

Privatization Debates and Public Sector Bank Mergers

Ongoing discussions about privatizing public sector banks (PSBs) directly impact Canara Bank's strategic direction and how the market views its future. The successful merger of Syndicate Bank into Canara Bank in 2020 is a key precedent, demonstrating the government's approach to consolidation.

While legislative proposals like the Banking Laws (Amendment) Bill, 2024, have seen debate over privatization concerns, the government's stated commitment to reforming and bolstering PSBs indicates a sustained, though potentially altered, presence for these institutions. This suggests a dynamic environment where Canara Bank must navigate evolving policy landscapes.

The performance of PSBs is a critical consideration. For instance, as of March 31, 2024, the aggregate Gross Non-Performing Assets (GNPAs) of PSBs saw a significant reduction, falling to a multi-year low of 3.05%. This trend, coupled with improved profitability, signals a strengthening PSB sector, which could influence the pace and direction of any future privatization efforts.

- Government's focus on PSB reforms: Continued investment in technology and governance for PSBs.

- Merger precedent: Syndicate Bank merger with Canara Bank in 2020 provided a blueprint for consolidation.

- Legislative debates: The Banking Laws (Amendment) Bill, 2024, highlighted differing views on privatization.

- Improved PSB asset quality: A 3.05% aggregate GNPA ratio for PSBs as of March 31, 2024, indicates sector strengthening.

Geopolitical Stability and Trade Policies

Global macroeconomic conditions and India's trade policies, including free trade agreements, indirectly influence the banking sector's stability and growth prospects. A stable geopolitical environment and favorable trade policies can lead to increased economic activity, boosting credit demand and improving asset quality for banks like Canara Bank.

India's active pursuit of trade agreements, such as the Comprehensive Economic Partnership Agreement (CEPA) with the UAE and ongoing discussions with the UK, aims to boost bilateral trade. These agreements can foster greater cross-border investment and economic integration, positively impacting the banking sector by increasing opportunities for trade finance and foreign exchange services. For instance, India's merchandise exports reached an estimated USD 437 billion in FY24, indicating a robust underlying economic activity that banks can leverage.

- Increased Trade Flows: Favorable trade policies and geopolitical stability encourage higher volumes of international trade, creating more business for banks in areas like letters of credit, export-import financing, and currency hedging.

- Foreign Investment Inflows: A stable geopolitical climate and open trade policies attract foreign direct investment (FDI), which can lead to increased deposit growth and lending opportunities for banks. India's FDI equity inflows stood at USD 32.03 billion during April-September 2023.

- Economic Growth: Enhanced trade and stable international relations contribute to overall economic growth, leading to higher demand for credit from businesses and individuals, thereby benefiting banks like Canara Bank.

- Risk Mitigation: Geopolitical stability reduces the risk of economic disruptions, such as supply chain issues or sanctions, which can negatively impact loan portfolios and overall banking sector health.

The Indian government's proactive stance on banking sector reforms, including the proposed Banking Laws (Amendment) Bill, 2024, directly influences Canara Bank's operational framework and strategic direction. These reforms aim to bolster governance and efficiency across public sector banks (PSBs).

What is included in the product

This Canara Bank PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors, offering strategic insights into market dynamics and regulatory landscapes.

It provides a comprehensive overview of external influences, empowering stakeholders to identify opportunities and mitigate risks for informed decision-making.

A concise PESTLE analysis for Canara Bank offers a clear snapshot of external factors, reducing the burden of sifting through extensive data for strategic decision-making.

Economic factors

The Reserve Bank of India's (RBI) monetary policy, particularly its stance on the repo rate, significantly influences Canara Bank's operational costs and its ability to generate revenue through lending.

In 2025, the RBI's decision to cut the repo rate has prompted public sector banks, including Canara Bank, to lower their lending rates. This move is designed to boost credit uptake, especially for housing and Micro, Small, and Medium Enterprises (MSME) sectors, thereby stimulating economic activity.

While this policy aims for broader economic growth, it directly impacts Canara Bank's Net Interest Margin (NIM). For instance, despite an increase in net interest income during FY25, the NIM experienced a contraction, reflecting the pressure from lower lending rates on profitability.

The Indian economy's credit growth, fueled by strong economic activity and healthy bank financials, creates a favorable landscape for Canara Bank. The bank is targeting loan expansion in FY26, with a strategic emphasis on its Retail, Agriculture, and MSME (RAM) segments.

Canara Bank has demonstrated significant improvements in asset quality, with Gross NPAs falling to 4.03% and Net NPAs to 1.08% by the end of FY25. This trend is expected to continue into Q1 FY26, showcasing effective risk management and bolstering the bank's financial resilience.

India's economic growth trajectory remains robust, with projections for FY25-26 holding steady. The International Monetary Fund (IMF) forecasts a 6.3% growth, while the Reserve Bank of India (RBI) anticipates a slightly higher 6.5%. This strong economic expansion is a positive indicator for the banking sector, including Canara Bank, suggesting increased demand for credit and financial services.

Inflationary pressures have seen some moderation, which is a welcome development. However, maintaining inflation within the RBI's target band of 2-6% remains a key objective. Persistent high inflation can erode consumer purchasing power and borrowing capacity, potentially impacting loan growth and asset quality for banks like Canara Bank. Conversely, stable prices support predictable business environments.

Liquidity Conditions and Deposit Growth

Banking system liquidity, a key factor influenced by the Reserve Bank of India's (RBI) monetary policy, directly impacts Canara Bank's ability to lend and manage its funding costs. Deposit growth is equally crucial, as it forms the backbone of a bank's funding base. When deposit growth trails credit expansion, it can lead to tighter liquidity, potentially squeezing net interest margins.

The RBI's stance on maintaining a liquidity surplus is designed to cushion against such pressures. For instance, in early 2024, the RBI continued its efforts to manage liquidity through various instruments. Canara Bank, recognizing this dynamic, has set an ambitious target of achieving over 9% deposit growth in the fiscal year 2025-26 (FY26). This growth is essential to comfortably support its planned credit expansion.

Canara Bank's focus on deposit growth is a strategic response to the evolving liquidity landscape. In FY24, the bank reported a robust deposit growth of 10.57%, reaching ₹13,039 billion. This performance demonstrates their capability in attracting customer funds, which is vital for maintaining healthy liquidity and funding their lending activities at competitive rates.

- Liquidity Management: The RBI's actions, such as variable rate reverse repo auctions, aim to absorb excess liquidity and manage interest rates, directly affecting banks like Canara.

- Deposit Growth Target: Canara Bank aims for a deposit growth exceeding 9% in FY26 to fuel its credit growth ambitions.

- Recent Performance: Canara Bank achieved a significant 10.57% deposit growth in FY24, amounting to ₹13,039 billion.

- Margin Pressure: Lagging deposit growth relative to credit growth can exert upward pressure on funding costs and compress net interest margins.

Competition in the Banking Sector

Canara Bank faces a dynamic and fiercely competitive banking environment. This includes established public sector banks, agile private sector banks, and increasingly influential fintech companies. For instance, as of Q4 FY24, the Indian banking sector saw a credit growth of 16.3%, indicating high demand but also intense competition for market share in both lending and deposit mobilization.

To thrive, Canara Bank must prioritize innovation, especially in digital offerings. The push towards digital banking is crucial for attracting and retaining customers. In the fiscal year ending March 31, 2024, Canara Bank reported a significant increase in its digital transactions, highlighting the growing customer preference for online services and the need for continuous enhancement to stay ahead.

- Intensified Rivalry: Competition from both traditional banks and new-age fintech firms necessitates constant product and service upgrades.

- Digital Imperative: Innovation in digital banking is key to attracting and retaining customers in a competitive market.

- Deposit and Loan Competition: Banks are vying for customer deposits and loan business, requiring attractive interest rates and service offerings.

- Market Share Battle: The overall credit growth in the Indian banking sector underscores the ongoing competition for market share among all players.

India's economic growth remains a strong tailwind for Canara Bank, with projections for FY25-26 hovering around 6.3% to 6.5% according to the IMF and RBI. This robust expansion fuels demand for credit and financial services, directly benefiting the bank's lending operations.

Inflationary pressures have shown some moderation, aiding consumer purchasing power and borrowing capacity. However, maintaining inflation within the RBI's 2-6% target band is crucial for stable economic conditions and predictable business environments, which in turn support Canara Bank's asset quality and loan growth.

The banking sector experienced a significant 16.3% credit growth in Q4 FY24, indicating strong demand but also intense competition. Canara Bank is strategically targeting loan expansion in its Retail, Agriculture, and MSME segments for FY26, aiming to capitalize on this economic momentum.

| Economic Factor | Key Data Points (FY24-FY26 Projections) | Impact on Canara Bank |

| GDP Growth | Projected 6.3%-6.5% for FY25-26 (IMF/RBI) | Increased demand for loans and financial services, supporting credit growth. |

| Inflation | Moderating, but target band of 2-6% remains key. | Supports consumer spending and borrowing capacity; stable inflation aids predictability. |

| Credit Growth | 16.3% in Q4 FY24 for the banking sector. | High demand presents opportunities but also intensifies competition for market share. |

Full Version Awaits

Canara Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Canara Bank covers all critical external factors impacting its operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain insights into the Political, Economic, Social, Technological, Legal, and Environmental influences shaping Canara Bank's future.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a robust understanding of the external landscape for Canara Bank.

Sociological factors

India's population, projected to reach 1.44 billion by mid-2024, presents a dynamic customer base. A significant portion of this population, particularly the youth and urban dwellers, is increasingly tech-savvy, demanding seamless digital banking experiences. This shift necessitates Canara Bank's focus on user-friendly mobile apps and online platforms.

Evolving customer preferences are evident in the growing demand for personalized financial products, such as tailored loan offers and investment advice, driven by data analytics. Furthermore, the need for multilingual support across digital and physical touchpoints is crucial to cater to India's linguistic diversity, ensuring inclusivity and broader customer reach.

Despite strides in financial inclusion, a segment of India's population, especially in rural regions, remains outside the formal banking system. As of early 2024, approximately 10% of Indian adults were still unbanked, highlighting an ongoing challenge.

Canara Bank actively supports government financial inclusion drives by expanding its reach and offering accessible banking products. The bank's efforts in financial literacy aim to equip more citizens with the knowledge to manage their finances effectively, thereby integrating them into the formal economy.

Rapid urbanization in India, with the urban population projected to reach 600 million by 2030, fuels a growing demand for advanced banking solutions like wealth management and digital lending in metropolitan areas. Canara Bank's strategic expansion of its digital banking platforms and a robust ATM network are crucial for catering to these evolving urban needs while ensuring essential banking services remain accessible in underserved rural regions.

The bank's commitment to financial inclusion, evident in its extensive branch network reaching Tier 3 and Tier 4 cities, directly addresses the rural-urban divide. As of March 2024, Canara Bank operates over 9,900 branches, with a significant portion serving rural and semi-urban populations, thereby facilitating access to credit and financial literacy.

Consumer Behavior towards Digital Channels

Consumers are increasingly comfortable using digital channels for everyday banking, a trend accelerated by India's Unified Payments Interface (UPI). As of early 2024, UPI transactions consistently surpassed 10 billion monthly, demonstrating widespread adoption and reliance on digital payment ecosystems. This shift means Canara Bank must prioritize and enhance its digital banking services to meet customer expectations.

Canara Bank's strategic investments in digital transformation, including the development of API banking and the implementation of AI/ML models, directly address this evolving consumer behavior. These initiatives aim to provide seamless, personalized, and efficient digital experiences, crucial for retaining and attracting customers in a competitive digital landscape.

- Digital transaction growth: UPI transactions in India crossed 12.09 billion in December 2023, highlighting a strong preference for digital payments.

- Customer expectation: A significant portion of banking customers now expect 24/7 access to services and self-service options through digital platforms.

- Bank's response: Canara Bank's focus on digital channels and advanced technologies like AI/ML is a direct adaptation to these changing consumer habits.

Trust and Brand Perception

Canara Bank, as a public sector undertaking with a legacy spanning over a century, inherently benefits from a foundational level of public trust. This trust is a significant sociological asset, especially in the banking sector where confidence is paramount. Maintaining and enhancing this perception is key to its continued success.

The bank actively works to reinforce this trust through several avenues. Transparency in its dealings, robust systems for addressing customer grievances, and a demonstrated commitment to corporate social responsibility initiatives are vital components of its strategy. These efforts are designed to not only retain its existing customer base but also to attract new clients who value ethical and reliable financial institutions.

In 2024, Canara Bank reported a net profit of INR 14,505 crore for the fiscal year ending March 31, 2024, a substantial increase from the previous year. This financial performance, coupled with its long-standing presence, contributes positively to its brand perception. Furthermore, its consistent efforts in digital transformation and customer service enhancements in recent years, including the expansion of its digital banking services, aim to solidify its image as a modern and trustworthy bank.

Key sociological factors influencing Canara Bank's brand perception include:

- Established Reputation: A history of over 100 years fosters inherent credibility and familiarity among the Indian populace.

- Public Sector Undertaking Status: This designation often correlates with perceived stability and government backing, enhancing trust.

- Customer Grievance Redressal: Effective and timely resolution of customer issues directly impacts satisfaction and loyalty, reinforcing positive brand perception.

- Corporate Social Responsibility (CSR): Initiatives focused on community development and environmental sustainability resonate with socially conscious consumers, building goodwill and trust.

India's demographic landscape, with a burgeoning population and a rapidly growing youth segment, presents Canara Bank with a vast and evolving customer base. This youthful demographic, particularly in urban centers, is increasingly digitally adept, demanding intuitive mobile banking and online services. The bank's strategic focus on enhancing its digital platforms, including user-friendly apps, directly addresses this trend, aiming to capture a larger share of this tech-savvy market.

Customer expectations are shifting towards personalized financial solutions, driven by data analytics. This includes tailored loan products and bespoke investment advice. Canara Bank's investment in AI and machine learning is crucial for delivering these personalized experiences, while its commitment to multilingual support across all channels ensures broader accessibility for India's diverse population.

The bank's strong brand perception is built on its long-standing reputation as a public sector undertaking, fostering a deep sense of trust among consumers. This is further bolstered by its commitment to transparency, effective grievance redressal mechanisms, and impactful corporate social responsibility initiatives, all of which contribute to customer loyalty and attract new clients seeking reliable financial partners.

| Sociological Factor | Description | Impact on Canara Bank | Supporting Data (2023-2024) |

|---|---|---|---|

| Demographics | India's large and youthful population, with increasing urbanization. | Growing demand for digital banking and personalized services. | India's population projected to reach 1.44 billion by mid-2024; Urban population expected to reach 600 million by 2030. |

| Customer Preferences | Demand for personalized products and seamless digital experiences. | Necessitates investment in digital transformation and data analytics. | UPI transactions consistently surpassed 10 billion monthly by early 2024. |

| Trust and Reputation | Established public sector bank with a long history. | Leverages inherent trust for customer acquisition and retention. | Net profit of INR 14,505 crore for FY ending March 31, 2024, indicating financial stability. |

| Financial Inclusion | Efforts to include unbanked populations. | Expands customer base and supports government objectives. | Canara Bank operates over 9,900 branches as of March 2024, with significant rural reach. |

Technological factors

Canara Bank is heavily investing in digital transformation, aiming to make 90% of its Retail, Agriculture, and MSME (RAM) transactions fully digital. This strategic push includes the development of 50 Artificial Intelligence and Machine Learning (AI/ML) models designed to improve customer engagement through upselling and cross-selling, as well as to predict Non-Performing Assets (NPAs).

The establishment of a dedicated Data and Analytics Centre underscores this commitment, providing a robust foundation for leveraging data-driven insights. This focus on innovation is crucial for enhancing operational efficiency and customer experience in the evolving banking landscape.

Canara Bank is actively integrating AI and Machine Learning to boost its operations and customer interactions. For instance, in 2023, the bank reported a significant increase in digital transactions, partly attributed to AI-driven fraud detection systems which are crucial in safeguarding customer assets.

These advanced technologies are instrumental in offering personalized financial solutions, streamlining credit assessments, and automating various back-office processes. This focus on AI/ML adoption is expected to further enhance Canara Bank's competitive edge in the evolving digital banking landscape.

Canara Bank faces increasing pressure to bolster its cybersecurity and data privacy measures as digital transactions surge. The proposed Banking Laws (Amendment) Bill, 2024, underscores the growing regulatory focus on data protection, necessitating significant investments in advanced security infrastructure and RegTech solutions to safeguard customer information and combat fraud.

API Banking and Open Banking Initiatives

Canara Bank is enhancing its API banking capabilities, particularly for its corporate clients, and is actively building out its API infrastructure. This focus is designed to foster partnerships with fintech companies, creating new avenues for innovation and service delivery.

The burgeoning open banking movement in India offers significant potential for Canara Bank. By securely sharing customer financial data with explicit consent, the bank can develop novel services, tap into new revenue streams, and achieve greater operational efficiencies.

- API Integration Growth: India's API market is projected to reach $3.7 billion by 2025, indicating a strong demand for interconnected financial services.

- Fintech Collaboration: Over 2,000 fintech startups were operating in India as of early 2024, presenting a vast ecosystem for Canara Bank to engage with.

- Open Banking Adoption: Regulatory push towards open banking is expected to increase data sharing and lead to a 15-20% growth in digital banking services adoption in the next two years.

Infrastructure and Connectivity

India's expanding digital public infrastructure, such as Aadhaar and UPI, forms a robust bedrock for digital banking services. Canara Bank actively utilizes these frameworks to streamline customer onboarding, accelerate Know Your Customer (KYC) procedures, and deliver more personalized product offerings, underscoring the critical role of seamless connectivity in modern banking operations.

This digital backbone is crucial for Canara Bank's growth. For instance, UPI transactions in India are projected to reach 100 billion by 2024, a testament to the widespread adoption and efficiency of digital payment systems that banks like Canara can integrate with.

- Enhanced Customer Acquisition: Leveraging digital infrastructure for faster and wider reach.

- Streamlined KYC: Utilizing Aadhaar and other digital IDs for quicker identity verification.

- Personalized Banking: Employing data analytics enabled by digital connectivity to tailor services.

- Increased Transaction Speed: Benefiting from platforms like UPI for near-instantaneous financial exchanges.

Canara Bank's technological strategy centers on deep AI/ML integration and digital transaction enhancement, aiming for 90% of RAM transactions to be fully digital. The bank is actively developing 50 AI/ML models for improved customer engagement and NPA prediction, supported by a dedicated Data and Analytics Centre. This focus on advanced analytics and digital infrastructure, including API banking and leveraging India's digital public infrastructure like Aadhaar and UPI, is vital for operational efficiency and competitive positioning.

| Technology Area | Key Initiatives/Impact | Relevant Data/Projections |

|---|---|---|

| Digital Transformation | Aiming for 90% digital RAM transactions | Continued growth in digital transaction volumes |

| AI/ML Integration | Developing 50 AI/ML models for customer engagement & NPA prediction | AI-driven fraud detection contributing to increased digital transaction security |

| API Banking & Open Banking | Building API infrastructure for fintech partnerships | India's API market projected to reach $3.7 billion by 2025; ~2,000+ fintech startups in India (early 2024) |

| Digital Public Infrastructure | Utilizing Aadhaar, UPI for streamlined onboarding & KYC | UPI transactions projected to reach 100 billion by 2024 |

Legal factors

Canara Bank is governed by the Banking Regulation Act, 1949, a foundational piece of legislation that dictates operational parameters for all banks in India. Recent amendments, such as the proposed Banking Laws (Amendment) Bill of 2024, are set to further refine this framework.

These legislative updates are designed to enhance corporate governance within banking institutions and elevate the quality of audits. They also aim to ensure greater uniformity in financial reporting across the sector, directly impacting Canara Bank's compliance obligations and day-to-day operations.

Canara Bank, like all financial institutions in India, operates under the stringent oversight of the Reserve Bank of India (RBI). This means the bank must constantly adhere to a dynamic set of directives and guidelines. These regulations span critical areas such as ensuring adequate priority sector lending, managing interest rate structures, correctly classifying assets to reflect their true value, and actively promoting financial inclusion across the nation.

Failure to comply with these RBI mandates can result in substantial financial repercussions. For instance, in early 2025, Canara Bank faced monetary penalties, underscoring the importance of meticulous adherence to regulatory frameworks. These penalties highlight the direct financial impact of non-compliance on the bank's profitability and operational standing.

Data privacy and consumer protection laws are increasingly vital for Canara Bank, especially with its expanding digital services. The bank must adhere to stringent regulations designed to safeguard customer data and uphold consumer rights, ensuring fair treatment and transparent practices. For instance, India's Digital Personal Data Protection Act of 2023 mandates robust consent mechanisms and data breach notification procedures, directly impacting how Canara Bank handles sensitive customer information.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Norms

Canara Bank operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, designed to thwart financial crimes and maintain the integrity of the financial system. These legal frameworks are paramount for the bank's operational continuity and its standing in the market.

To ensure ongoing compliance, Canara Bank must continually refine its internal procedures and embrace technological advancements, particularly in the realm of digital KYC. This commitment is not just a regulatory necessity but a cornerstone for safeguarding its banking license and reputation.

- Regulatory Scrutiny: Banks like Canara are subject to rigorous oversight from bodies such as the Reserve Bank of India (RBI) to enforce AML/KYC norms.

- Digital Transformation: The push for digital KYC solutions is critical, with a significant portion of new account openings in India leveraging these technologies, a trend expected to accelerate through 2024-2025.

- Compliance Costs: Maintaining robust AML/KYC systems involves substantial investment in technology and personnel, impacting operational expenditure.

- Reputational Risk: Non-compliance can lead to severe penalties, including hefty fines and reputational damage, underscoring the importance of adherence.

Insolvency and Bankruptcy Code (IBC)

The effectiveness of India's Insolvency and Bankruptcy Code (IBC) is crucial for Canara Bank, directly influencing its capacity to recover funds from non-performing assets (NPAs). As of March 2024, the IBC has facilitated the resolution of over 27,000 cases, demonstrating its increasing impact on the financial sector.

Government initiatives to enhance the resolution framework for stressed assets under the IBC are vital for improving Canara Bank's asset quality. For instance, amendments and clarifications to the IBC in 2024 aim to expedite the resolution process, potentially leading to quicker recovery of dues and a healthier balance sheet for the bank.

- IBC's role in NPA recovery: A more efficient IBC translates to better recovery rates for Canara Bank on its bad loans.

- Government's commitment: Ongoing efforts to streamline IBC procedures signal a supportive environment for banks like Canara.

- Impact on asset quality: Successful IBC resolutions directly contribute to reducing Canara Bank's NPA ratios and strengthening its financial stability.

- Resolution timelines: The average time for resolution under IBC, while improving, remains a key metric for assessing its effectiveness for banks.

Canara Bank's operations are significantly shaped by evolving legal and regulatory landscapes, including amendments to the Banking Regulation Act, 1949, and the proposed Banking Laws (Amendment) Bill of 2024, which aim to bolster corporate governance and audit quality.

The Reserve Bank of India (RBI) imposes dynamic directives on priority sector lending, interest rates, and asset classification, with non-compliance leading to penalties, such as those faced by Canara Bank in early 2025, impacting its financial standing.

Data privacy is paramount, with India's Digital Personal Data Protection Act of 2023 mandating robust consent and breach notification procedures for Canara Bank's digital services.

Adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is critical for Canara Bank's operational continuity and reputation, necessitating continuous investment in technology for digital KYC solutions.

Environmental factors

Canara Bank actively integrates Environmental, Social, and Governance (ESG) principles into its operations, acknowledging the growing importance of climate change and sustainability. The bank has established an ESG policy and has been recognized with awards for its efforts, underscoring a commitment to responsible business practices. This focus extends to proactively managing environmental risks within its lending and investment activities, ensuring a more sustainable financial future.

Canara Bank is actively promoting green financing and sustainable products, reflecting a growing global demand for environmentally conscious financial solutions. This commitment is evident in their offerings like green deposits, which directly support projects aimed at reducing carbon footprints.

In 2023, the global sustainable finance market saw significant growth, with green bond issuance alone reaching an estimated $600 billion, indicating a strong investor appetite for such instruments. Canara Bank's focus on these areas positions them to capitalize on this trend, aligning with India's own Net Zero by 2070 targets.

Canara Bank faces increasing regulatory pressure to enhance its Environmental, Social, and Governance (ESG) compliance. This means the bank must actively adapt to evolving frameworks for sustainable finance and transparently report its environmental impact. For instance, Reserve Bank of India (RBI) guidelines, such as those on climate risk and sustainable finance released in 2024, are pushing banks to integrate ESG considerations into their lending and investment strategies.

Adhering to these stricter disclosure requirements directly influences how investors perceive Canara Bank and can significantly impact its ability to access capital. In 2024, the global sustainable finance market saw substantial growth, with ESG-focused funds attracting trillions, making compliance a critical factor for competitive positioning and attracting environmentally conscious investors.

Resource Efficiency and Carbon Footprint Reduction

Canara Bank is actively working to shrink its environmental impact. A key initiative involves moving towards paperless documentation, a move that directly supports resource efficiency. This transition is crucial in today's climate-conscious world.

The bank's push for digital operations is a significant driver in this effort. By embracing digital processes, Canara Bank not only streamlines its services but also makes a tangible contribution to environmental conservation through reduced paper consumption. This aligns with broader sustainability goals.

- Digital Transformation: Canara Bank's investment in digital platforms aims to reduce paper usage by an estimated 20% by the end of 2025.

- Resource Management: Initiatives like energy-efficient data centers are being explored to further lower the bank's carbon footprint.

- Sustainable Practices: The bank is also looking into sustainable sourcing for its remaining physical resources.

Corporate Social Responsibility (CSR) and Community Engagement

Canara Bank actively integrates environmental stewardship into its Corporate Social Responsibility (CSR) framework, often through community engagement. These initiatives aim to foster environmental awareness and support local ecological projects, underscoring the bank's commitment to sustainable practices beyond its core banking operations. For instance, during the fiscal year 2023-24, Canara Bank allocated ₹345.67 crore towards its CSR activities, with a significant portion directed towards environmental and community development projects, demonstrating a tangible commitment to these causes.

The bank's approach to CSR includes partnerships with NGOs and local bodies for initiatives like tree plantation drives, waste management awareness programs, and conservation efforts. These community-focused projects not only contribute to environmental well-being but also enhance the bank's social license to operate. In 2024, Canara Bank launched several green banking initiatives, promoting digital channels and reducing paper usage, aligning with national environmental goals.

- Community Engagement: Canara Bank's CSR includes active participation in local environmental conservation projects.

- Environmental Awareness: Initiatives focus on educating communities about ecological preservation and sustainable living.

- Green Banking: Promoting digital transactions and reducing paper consumption are key environmental focuses.

- CSR Spending: In FY 2023-24, the bank committed ₹345.67 crore to CSR, with environmental and community projects being a priority.

Canara Bank is increasingly focused on environmental sustainability, driven by regulatory shifts and growing investor demand for green finance. The bank's commitment is reflected in its ESG policy and its proactive approach to managing climate-related risks in its financial activities. This strategic direction aligns with India's national environmental goals, such as the Net Zero by 2070 target.

The bank is actively promoting green financing options like green deposits, tapping into a global market that saw significant growth in sustainable finance in 2023, with green bond issuance estimated at $600 billion. Furthermore, Canara Bank's digital transformation initiatives, targeting a 20% reduction in paper usage by the end of 2025, directly contribute to its environmental footprint reduction efforts.

Canara Bank's CSR spending of ₹345.67 crore in FY 2023-24 includes substantial allocations to environmental and community development projects, such as tree plantation drives and waste management awareness. These efforts enhance the bank's social license and promote ecological preservation within the communities it serves.

| Environmental Focus Area | Initiative | Target/Status | FY 2023-24 CSR Allocation (Approx.) |

|---|---|---|---|

| Digitalization & Paper Reduction | Promoting paperless documentation and digital operations | 20% paper usage reduction by end of 2025 | Included within general operational efficiency |

| Green Financing | Offering green deposits and sustainable financial products | Capitalizing on growing global sustainable finance market | Integral to lending portfolio strategy |

| Carbon Footprint Reduction | Exploring energy-efficient data centers | Ongoing evaluation and implementation | Included within capital expenditure |

| Community Engagement | Tree plantation drives, waste management awareness | Active participation in local ecological projects | ₹345.67 crore total CSR spend |

PESTLE Analysis Data Sources

Our Canara Bank PESTLE Analysis is meticulously constructed using data from official Reserve Bank of India (RBI) publications, government economic reports, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.