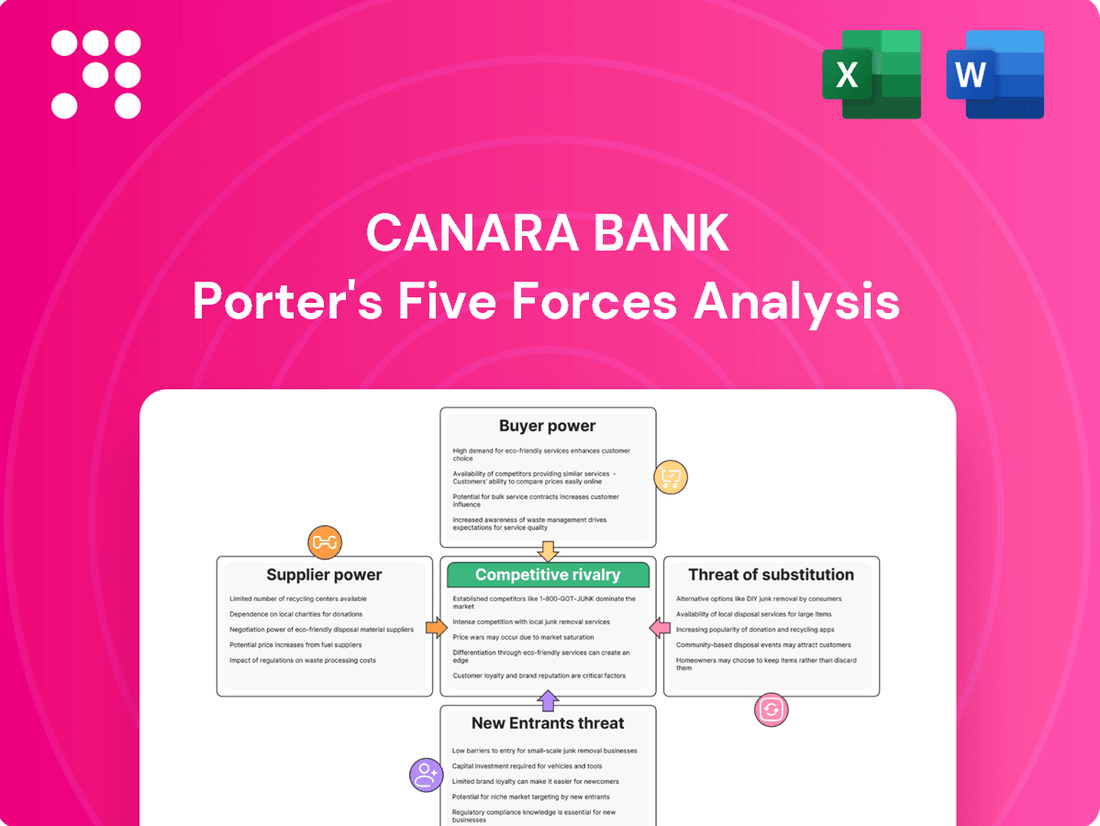

Canara Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

Canara Bank navigates a dynamic banking landscape shaped by intense rivalry and the ever-present threat of new entrants, while buyer power and supplier leverage present distinct challenges. Understanding these forces is crucial for strategic positioning.

The complete report reveals the real forces shaping Canara Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Canara Bank's reliance on technology means IT service providers hold considerable sway. Specialized firms offering advanced AI, cloud computing, and robust cybersecurity are crucial for the bank's operations and risk management. The complexity and critical nature of these services, coupled with the escalating threat of cyberattacks, empower these suppliers.

The demand for sophisticated IT solutions is high across the banking sector. For instance, global IT spending by financial services is projected to reach $600 billion in 2024, highlighting the importance of these services. Suppliers who can offer unique, cutting-edge solutions, particularly in areas like data analytics for fraud detection or AI-driven customer service, can command higher prices and favorable terms from banks like Canara.

The banking industry, including Canara Bank, relies heavily on specialized skills. Areas like advanced data analytics, cybersecurity, and digital banking require professionals with deep expertise. A scarcity of these skilled individuals can significantly boost their leverage, potentially driving up salary expectations and making it more expensive for Canara Bank to attract and retain top talent.

The increasing emphasis on regulatory compliance and the growth of digital lending channels are further escalating the demand for specialized roles such as compliance officers and digital lending specialists. This heightened demand for specific expertise strengthens the bargaining power of employees possessing these in-demand skills within the banking sector.

Canara Bank, like other financial institutions, taps into various wholesale funding sources beyond customer deposits. These include the interbank market, central bank lending facilities, and crucially, capital markets. The ease of access and the cost of these funds directly impact the bank's operational efficiency and expansion capabilities.

In 2023, India's inclusion of government bonds in major global indices like JPMorgan’s Government Bond Index-Emerging Markets was a significant development. While this move aims to boost foreign investment and potentially lower borrowing costs over time by increasing demand, it could also lead to increased volatility and potentially higher yields demanded by international investors seeking returns comparable to other emerging markets, thus impacting Canara Bank's wholesale funding costs.

Infrastructure and Real Estate Providers

Canara Bank's extensive physical footprint, encompassing numerous branches and ATMs, necessitates substantial investment in real estate and related infrastructure. This reliance gives suppliers of property, construction, and maintenance services a degree of bargaining power, particularly for premium locations or specialized banking facilities. For instance, acquiring prime urban real estate for new branches can be a significant cost factor.

While physical branches remain important, the increasing shift towards digital banking channels for Canara Bank could potentially dilute the bargaining power of traditional infrastructure suppliers over the long term. However, the demand for high-quality, secure, and accessible physical touchpoints continues to support the leverage of these suppliers.

- Real Estate Costs: The cost of leasing or purchasing property for branches and ATMs is a key expenditure, with rates varying significantly by location.

- Construction and Maintenance: Specialized construction for secure banking environments and ongoing maintenance services are essential, granting these providers negotiation leverage.

- Digital Shift Impact: The growing emphasis on digital platforms may reduce the future dependence on extensive physical networks, potentially influencing supplier power dynamics.

Regulatory Bodies and Government

Regulatory bodies and the government act as powerful, albeit unconventional, suppliers to banks like Canara Bank. Their influence is felt through licensing, policy directives, and stringent compliance mandates. For instance, the Reserve Bank of India (RBI) continuously updates guidelines, impacting everything from capital adequacy ratios to customer data protection. In 2024, the RBI's focus on digital lending norms and the evolution of UPI transaction frameworks directly dictates operational strategies for all banks, including Canara.

These governmental and regulatory interventions significantly shape the competitive landscape and risk management practices. Canara Bank, like its peers, must adapt its business models and technological investments to align with these evolving requirements. The imposition of new capital requirements or changes in lending regulations can directly affect profitability and strategic planning.

- RBI's Digital Lending Guidelines: Mandates for transparency and consumer protection in digital loan offerings.

- UPI Transaction Evolution: Ongoing policy updates impacting fees, security, and interoperability.

- Capital Adequacy Norms: Regulatory adjustments to ensure financial stability, affecting lending capacity.

Canara Bank's reliance on IT service providers for critical functions like cybersecurity and cloud computing grants these suppliers significant bargaining power. The increasing complexity of digital banking and the constant threat of cyberattacks amplify the need for specialized, high-quality IT solutions, allowing these vendors to command premium pricing and terms.

The high demand for advanced IT solutions across the financial sector, with global IT spending projected to reach $600 billion in 2024, underscores the leverage of IT suppliers. Banks like Canara are compelled to adopt cutting-edge technologies, making suppliers with unique offerings in areas such as AI-driven analytics or robust cybersecurity particularly influential.

Canara Bank's need for specialized talent in areas like data analytics and cybersecurity also creates bargaining power for employees possessing these in-demand skills. The scarcity of such expertise can drive up compensation expectations, impacting the bank's recruitment and retention costs.

| Supplier Category | Key Dependence | Bargaining Power Factor | Example Impact on Canara Bank |

| IT Service Providers | Cybersecurity, Cloud, AI | Specialized skills, high demand | Higher costs for advanced solutions, favorable contract terms |

| Skilled Workforce | Data Analytics, Cybersecurity | Scarcity of talent | Increased salary and retention costs |

What is included in the product

Tailored exclusively for Canara Bank, analyzing its position within its competitive landscape by examining the intensity of rivalry, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Canara Bank.

Customers Bargaining Power

Customers in India's banking landscape wield significant power, thanks to a vast selection of institutions. They can choose from public sector banks, private players, foreign banks, and even specialized small finance banks, all competing for their business.

The rapid digital shift has amplified this power. With the ease of online account opening and digital banking services, switching between banks has become remarkably simple. This means customers can easily move their funds for even minor advantages, like a slightly better interest rate or lower fees, as demonstrated by the increasing adoption of digital banking platforms, with over 70% of banking transactions in India occurring digitally as of early 2024.

Customers in the banking sector, including those of Canara Bank, exhibit significant price sensitivity. This is largely due to the abundance of alternative banking providers and products available in the market. Consequently, customers closely scrutinize interest rates offered on deposits and loans, as well as the various fees associated with banking services.

This heightened customer sensitivity directly pressures Canara Bank to maintain competitive pricing for its products and services. Failing to do so can lead to customer attrition, impacting the bank's ability to attract and retain its client base. The need to offer attractive rates and fees can compress the bank's net interest margins, a key profitability metric.

Financial reports indicate that customer acquisition costs have seen an upward trend over the past three years. For instance, in the fiscal year 2023-24, the cost to acquire a new banking customer for many public sector banks, including those comparable to Canara Bank, has reportedly increased by an average of 8-10% compared to the previous year, reflecting the intensified competition for customer loyalty.

Customers are increasingly empowered by digital tools, with platforms like Unified Payments Interface (UPI) becoming commonplace. In 2023, UPI transactions in India surged by over 50% year-on-year, reaching staggering volumes that underscore customer comfort and preference for digital interactions.

This digital shift means customers now anticipate instant service, tailored offerings, and smooth, intuitive digital journeys. They are less tolerant of delays or friction in their banking experiences.

To counter this rising customer bargaining power, Canara Bank needs to prioritize significant investments in its digital infrastructure and customer-focused innovations. Failing to meet these elevated expectations risks losing customers to more agile competitors.

Diverse Customer Segments with Varying Needs

Canara Bank caters to a wide array of customers, from individuals and small to medium-sized enterprises (SMEs) to large corporations and the agricultural sector. Each of these segments possesses unique requirements and varying degrees of bargaining power.

Large corporate clients, for example, can leverage their substantial transaction volumes to negotiate more favorable terms and pricing. In contrast, individual retail customers typically prioritize convenience, accessibility, and competitive interest rates on their banking products.

- Retail Customers: Seek competitive deposit and loan rates, convenient digital banking platforms, and accessible branch networks.

- SMEs: Require tailored credit solutions, cash management services, and often have moderate bargaining power based on their business size and relationship with the bank.

- Large Corporations: Possess significant bargaining power due to high transaction volumes, complex financial needs, and the potential to switch providers if terms are not met.

- Agricultural Sector: Needs may include specialized loans and support services, with bargaining power influenced by government policies and sector-specific economic conditions.

Financial Inclusion Initiatives and Rural Reach

Government-backed financial inclusion programs have significantly expanded banking access in rural and previously underserved regions. This broadens the customer base but also brings in individuals with varying financial literacy and service expectations, potentially increasing the cost to serve these segments.

For instance, as of December 2023, India's Pradhan Mantri Jan Dhan Yojana (PMJDY) had over 51 crore accounts opened, with a substantial portion in rural areas. This initiative, while fostering inclusion, means banks like Canara Bank must adapt their service models to cater to a wider spectrum of customer needs and digital adoption rates.

- Expanded Customer Base: Financial inclusion efforts have brought millions of new customers into the formal banking system, particularly in rural India.

- Diverse Banking Habits: New customer segments often exhibit different transaction patterns and service preferences compared to traditional urban customers.

- Cost-to-Serve Considerations: Tailoring services, providing financial literacy, and managing a more dispersed customer network can impact operational costs.

- Digital Adoption Gaps: While digital channels are promoted, a segment of the newly included population may still rely on branch services, influencing service delivery strategies.

Customers in India's banking sector possess considerable bargaining power, driven by a highly competitive market with numerous providers and the ease of digital switching. This power is further amplified by customers' increasing price sensitivity and demand for seamless digital experiences, pushing banks like Canara to offer competitive rates and efficient services to retain their business.

The bank must continually invest in digital infrastructure and customer-centric innovations to meet evolving expectations. Failing to do so risks losing customers to more agile competitors who can better cater to demands for instant service and tailored offerings. For instance, by early 2024, over 70% of banking transactions in India were already digital, highlighting this critical shift.

Canara Bank serves a diverse customer base, from individuals to large corporations, each segment exhibiting varying levels of bargaining power. Large corporations, with their high transaction volumes, can negotiate more favorable terms, while retail customers prioritize convenience and competitive interest rates. This segmentation necessitates tailored strategies to address the unique needs and bargaining leverage of each group.

| Customer Segment | Bargaining Power Drivers | Key Expectations |

|---|---|---|

| Retail Customers | Abundance of alternatives, ease of digital switching | Competitive interest rates, convenient digital platforms, accessible branches |

| SMEs | Business size, relationship value | Tailored credit solutions, efficient cash management |

| Large Corporations | High transaction volumes, complex needs, potential to switch | Favorable pricing, customized financial services, dedicated relationship management |

| Agricultural Sector | Government policies, sector economics | Specialized loans, accessible support services |

What You See Is What You Get

Canara Bank Porter's Five Forces Analysis

This preview showcases the complete Canara Bank Porter's Five Forces Analysis, offering a detailed examination of industry competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes. You're looking at the actual document; once your purchase is complete, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

Canara Bank operates within a fiercely competitive Indian banking landscape. The sector is populated by numerous public sector banks, including its own operations, alongside a significant number of large private sector banks and a growing presence of foreign banks. This crowded market intensifies rivalry as each institution strives to capture market share across diverse customer segments, from retail to corporate banking.

As of September 2023, India boasted over 12 public sector banks, 21 private sector banks, and 43 foreign banks, illustrating the sheer density of competition. This high number of players means banks like Canara Bank must constantly innovate and offer competitive pricing and services to attract and retain customers. The ongoing digital transformation further fuels this competition, with banks investing heavily in technology to offer seamless online and mobile banking experiences.

Competitive rivalry in the banking sector is intensifying, heavily influenced by digital capabilities and customer-centric innovation. Banks are pouring resources into advanced technologies like artificial intelligence and sophisticated digital platforms to elevate customer experiences, tailor services, and optimize internal processes. This digital arms race means that success hinges on a bank's ability to offer seamless, personalized, and technologically advanced solutions.

Canara Bank is a prime example of this trend, with its digital transaction volume showing robust growth. For instance, in the fiscal year ending March 2024, Canara Bank reported a substantial increase in digital transactions, underscoring its commitment to digital transformation and its ability to compete effectively in this evolving landscape. This focus on digital innovation directly impacts its competitive standing.

Canara Bank, like its peers, faces intense competition for customer deposits, particularly the low-cost Current Account and Savings Account (CASA) deposits. This fierce rivalry, coupled with downward pressure on lending rates, directly impacts net interest margins (NIMs), squeezing profitability.

The bank's own performance reflects this trend. Canara Bank's net interest margin saw a slight dip, moving from 3.05% in FY23 to 2.96% in FY24. This marginal decline underscores the pervasive competitive pressures that all banks are navigating in the current financial landscape.

Focus on Asset Quality and NPA Management

Competitive rivalry in the banking sector heavily hinges on asset quality and the effective management of non-performing assets (NPAs). Banks that demonstrate superior asset quality and maintain lower NPA ratios are generally viewed as more resilient and operationally sound, thereby gaining a significant competitive advantage.

Canara Bank has made notable strides in improving its asset quality. As of the quarter ending March 31, 2024, the bank reported a gross NPA ratio of 4.15% and a net NPA ratio of 1.31%. This represents a positive trend compared to previous periods, enhancing its competitive standing.

- Gross NPA Ratio: 4.15% (as of March 31, 2024)

- Net NPA Ratio: 1.31% (as of March 31, 2024)

- Competitive Edge: Lower NPAs signal better risk management and financial health, attracting more customers and investors.

Regulatory Environment and Consolidation

The regulatory environment, particularly initiatives like the Prompt Corrective Action (PCA) framework, has been a significant driver of change in the Indian banking sector. This framework, implemented by the Reserve Bank of India (RBI), aims to ensure financial discipline among banks by imposing restrictions based on their asset quality, profitability, and capital adequacy. For instance, in recent years, several public sector banks have been brought under PCA, leading to a period of enhanced scrutiny and operational adjustments.

This regulatory push for greater financial health has also indirectly fueled consolidation within the public sector banking space. Mergers and acquisitions, often encouraged by the government, have resulted in the creation of larger, more robust banking entities. For example, the amalgamation of Vijaya Bank and Dena Bank into Bank of Baroda in 2019, and the more recent merger of Oriental Bank of Commerce and United Bank of India into Punjab National Bank, are prime examples of this trend. These consolidations create formidable competitors with expanded market share and resources, thereby intensifying the competitive rivalry for banks like Canara Bank.

The impact of these consolidations is felt across various banking segments, from retail lending to corporate finance. Larger banks often possess greater capacity for risk-taking, wider distribution networks, and enhanced technological capabilities, allowing them to offer more competitive pricing and a broader range of products. This dynamic forces remaining players to constantly innovate and optimize their operations to maintain market position.

- Regulatory Framework Impact: Initiatives like the PCA framework have driven greater financial discipline among Indian banks, influencing operational strategies and risk management practices.

- Consolidation Trends: The Indian government has actively promoted consolidation in the public sector banking space, leading to the creation of larger banking entities through mergers.

- Competitive Intensification: These consolidations result in stronger, more resource-rich competitors, increasing rivalry for banks like Canara Bank in areas such as market share and product offerings.

- Examples of Consolidation: Significant mergers include Vijaya Bank and Dena Bank into Bank of Baroda, and Oriental Bank of Commerce and United Bank of India into Punjab National Bank, reshaping the competitive landscape.

The Indian banking sector is characterized by intense competitive rivalry, with Canara Bank facing strong competition from public sector banks, private sector banks, and foreign banks. This dense market necessitates continuous innovation and competitive pricing strategies to attract and retain customers across various segments. The ongoing digital transformation further intensifies this rivalry, pushing banks to invest heavily in technology for enhanced customer experiences.

Canara Bank's focus on digital transactions, with robust growth reported in FY24, highlights its strategic response to this competitive pressure. However, the competition for low-cost CASA deposits and downward pressure on lending rates continue to impact net interest margins, as evidenced by Canara Bank's NIM dipping slightly from 3.05% in FY23 to 2.96% in FY24.

Improvements in asset quality, with Canara Bank reporting a gross NPA ratio of 4.15% and a net NPA ratio of 1.31% as of March 31, 2024, enhance its competitive standing against peers. Furthermore, regulatory initiatives and consolidation, such as the merger of Oriental Bank of Commerce and United Bank of India into Punjab National Bank, have created larger, more formidable competitors, increasing the overall rivalry in the market.

| Metric | Canara Bank (FY24) | Industry Trend |

|---|---|---|

| Net Interest Margin (NIM) | 2.96% | Slightly declining due to competition |

| Gross NPA Ratio | 4.15% (as of Mar 31, 2024) | Improving trend across the sector |

| Net NPA Ratio | 1.31% (as of Mar 31, 2024) | Improving trend across the sector |

| Digital Transactions | Robust Growth | Increasing importance for competitive edge |

SSubstitutes Threaten

Fintech companies and digital payment platforms like UPI, PhonePe, and Google Pay present a considerable threat to Canara Bank. These platforms offer faster, more convenient, and often more cost-effective alternatives for services traditionally dominated by banks, including payments, lending, and wealth management.

The rapid adoption of UPI is a clear indicator of this shift; in 2023, UPI processed over 117 billion transactions, a significant jump from 89.5 billion in 2022, signaling a growing preference for digital channels and potentially reducing customer reliance on traditional banking infrastructure for everyday financial activities.

Non-Banking Financial Companies (NBFCs) present a significant threat of substitutes for Canara Bank. NBFCs provide a diverse array of financial services, including loans, wealth management, and insurance, often with more adaptable terms and specialized offerings than traditional banks. Their increasing penetration, particularly in retail and MSME financing, directly competes with bank credit offerings.

The competitive landscape is further shaped by regulatory changes, with the Reserve Bank of India (RBI) implementing new rules for NBFCs that influence their operational capabilities and market positioning. For instance, as of September 2023, the NBFC sector’s total assets stood at approximately ₹63.8 lakh crore, showcasing their substantial market share and capacity to serve as viable alternatives to banking services.

Online direct lending and peer-to-peer (P2P) platforms are emerging as substitutes by directly connecting borrowers with lenders, bypassing traditional banks like Canara Bank. While this sector is still growing, its ability to cater to niche financing needs and underserved markets poses a potential challenge to conventional bank loans.

The global P2P lending market was valued at approximately $55 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a significant growth trajectory. This expansion means more borrowers might opt for these platforms, especially for smaller loans or specific consumer financing, diverting business from established banks.

Investment Vehicles (Mutual Funds, Equities, Bonds)

Customers increasingly view mutual funds, equities, and bonds as viable alternatives to traditional bank deposits for savings and investment. The growing financial literacy and the potential for higher returns in these markets can siphon funds away from bank offerings, directly impacting Canara Bank's ability to maintain a stable, low-cost funding base. For instance, as of early 2024, the Indian mutual fund industry saw its Assets Under Management (AUM) surpass INR 50 lakh crore, demonstrating a significant shift in investor preference.

The attractiveness of these substitute investment vehicles is directly tied to their performance and accessibility. When market conditions favor equities or bonds, offering potentially higher yields than bank fixed deposits, customers are more likely to allocate their capital elsewhere. This dynamic presents a significant threat, as it can reduce the volume of retail deposits that form a cornerstone of Canara Bank's funding structure.

- Growing Mutual Fund AUM: The Indian mutual fund industry's AUM crossed INR 50 lakh crore in early 2024, indicating a strong preference for these investment avenues.

- Equity Market Performance: Strong equity market returns in recent years have made stocks a more appealing alternative to bank deposits for many investors.

- Bond Yields: Fluctuations in bond yields, particularly when they exceed deposit rates, can draw significant investor interest away from traditional banking products.

- Financial Literacy Impact: Increased awareness and understanding of investment options empower customers to diversify beyond bank deposits, intensifying the threat of substitutes.

Emerging Financial Technologies (Blockchain, DeFi)

Emerging financial technologies like blockchain and decentralized finance (DeFi) pose a potential threat by offering alternative avenues for transactions, credit, and asset management, bypassing traditional banks. For instance, the total value locked (TVL) in DeFi protocols reached over $100 billion in early 2024, demonstrating significant user adoption and capital flow outside conventional systems.

These technologies enable peer-to-peer lending and borrowing, potentially reducing the need for banks like Canara Bank to act as intermediaries. The growth in stablecoins, a key component of DeFi, saw a market capitalization exceeding $150 billion by mid-2024, indicating a substantial shift in how value is stored and transferred.

While widespread adoption is still developing, the long-term impact of these disintermediation forces is a significant concern. The increasing regulatory clarity and institutional interest in blockchain-based solutions suggest these substitutes will become more competitive in the coming years.

The threat of substitutes is amplified by the lower cost structures often associated with blockchain-based financial services. For example, transaction fees on some blockchain networks can be a fraction of those charged by traditional payment processors, making them attractive alternatives for cost-conscious users.

Fintech innovations, including digital payment platforms like UPI, offer faster and more convenient alternatives to traditional banking services, directly impacting Canara Bank. The sheer volume of UPI transactions, exceeding 117 billion in 2023, underscores a significant shift in customer behavior towards digital channels for everyday financial needs.

NBFCs and P2P lending platforms also present strong substitutes, providing specialized financial products and easier access to credit, particularly for MSMEs and niche markets. The substantial asset base of NBFCs, around ₹63.8 lakh crore as of September 2023, highlights their capacity to compete directly with bank offerings.

Furthermore, the growing popularity of mutual funds, equities, and bonds as investment vehicles, evidenced by the Indian mutual fund industry's AUM surpassing INR 50 lakh crore in early 2024, diverts savings away from traditional bank deposits. This trend, fueled by increased financial literacy and the pursuit of higher returns, challenges the stability of Canara Bank's funding base.

| Substitute Type | Key Characteristics | Market Data/Trend | Impact on Canara Bank |

| Fintech & Digital Payments (UPI, PhonePe) | Speed, Convenience, Lower Cost | UPI transactions: 117B+ in 2023 | Reduced reliance on traditional banking for payments |

| NBFCs | Specialized Products, Flexible Terms | Total Assets: ~₹63.8 Lakh Crore (Sep 2023) | Competition for loans and retail financing |

| P2P Lending | Direct Lending, Niche Markets | Global Market: ~$55B (2023), projected $200B+ by 2030 | Potential diversion of smaller loan business |

| Investment Avenues (Mutual Funds, Equities) | Higher Potential Returns, Diversification | Indian MF AUM: >₹50 Lakh Crore (Early 2024) | Siphoning of retail deposits, impacting funding base |

Entrants Threaten

The Indian banking sector, overseen by the Reserve Bank of India (RBI), presents significant hurdles for potential new entrants. These include rigorous licensing procedures, strict capital adequacy ratios, and extensive compliance mandates. For instance, in 2024, the RBI continued to emphasize robust capital requirements, with various categories of banks needing to maintain specific capital-to-risk weighted assets ratios, making it financially prohibitive for many to establish themselves as full-fledged banks.

These substantial capital demands, coupled with the intricate regulatory framework, act as a formidable deterrent. New entities must invest heavily in technology, infrastructure, and skilled personnel to meet these standards, a commitment that few can readily undertake. This effectively limits the threat of new entrants, offering a degree of protection to established players like Canara Bank.

Established brand loyalty and trust represent a significant barrier for new entrants looking to compete with established players like Canara Bank. Canara Bank, with its long history, has cultivated deep customer relationships and a reputation for reliability, making it difficult for newcomers to gain immediate traction. For instance, in the fiscal year 2023-24, Canara Bank reported a substantial customer base, reflecting the trust it has earned over decades of service, a trust that new entrants would struggle to build overnight.

Canara Bank boasts an impressive physical footprint with over 6,300 branches and 9,000 ATMs spread across India as of March 2024. This extensive network, particularly strong in rural and semi-urban regions, offers unparalleled customer accessibility and convenience. Establishing a comparable distribution system would demand colossal capital expenditure and years of development, creating a substantial hurdle for any new player aiming to enter the Indian banking sector.

Digital-First Challengers and Fintech Expansion

The threat of new entrants for Canara Bank is primarily driven by digital-first challenger banks and innovative fintech companies. While establishing a full-fledged traditional bank remains challenging due to regulatory hurdles and capital requirements, these new players can effectively enter specific segments of the financial services market. They often bypass the need for extensive physical infrastructure by leveraging technology.

These digital challengers and fintechs are expanding their service portfolios, moving beyond their initial niche offerings. This expansion allows them to compete more directly with established banks like Canara Bank across a wider range of products, from payments and lending to wealth management.

- Digital Banks' Growth: By mid-2024, the global neobanking market was projected to reach over $200 billion, indicating significant customer adoption and investment in digital-first financial solutions.

- Fintech Investment: In 2023, fintech funding globally remained robust, with significant capital flowing into companies developing innovative payment, lending, and digital banking platforms, signaling continued competitive pressure.

- Service Diversification: Many fintechs are now offering integrated banking services, such as current accounts and savings options, directly challenging traditional banks' core deposit base.

Acquisition and Customer Acquisition Costs

Acquiring customers in India's banking sector, even for digital-first players, presents a significant hurdle due to high costs. The competitive landscape means new entrants must invest heavily in marketing and incentives to attract and retain customers.

Customer acquisition costs (CAC) in the banking industry have been on an upward trend. For instance, reports from 2023 and early 2024 indicate that acquiring a new retail banking customer can range from several hundred to over a thousand rupees, depending on the channel and services offered. This escalating cost makes it difficult for new banks to achieve profitability swiftly and gain a substantial market share against established players like Canara Bank.

- Rising CAC: The average cost to acquire a new banking customer in India has seen a steady increase, impacting the viability of new entrants.

- Digital Entry Challenges: Even digital banks face substantial marketing and promotional expenses to build brand awareness and acquire users in a crowded market.

- Economies of Scale: High CAC hinders new players from reaching the critical mass needed to benefit from economies of scale, a key advantage for incumbents.

The threat of new entrants in the Indian banking sector, while moderated by high capital requirements and stringent regulations, is increasingly influenced by nimble fintech companies and digital-only banks. These new players can bypass the extensive physical infrastructure of incumbents like Canara Bank, leveraging technology to offer specialized services and attract specific customer segments.

Despite regulatory barriers, digital challengers are expanding their offerings, moving into areas like payments, lending, and even deposit accounts, directly competing with established banks. For instance, by mid-2024, the global neobanking market was projected to exceed $200 billion, highlighting significant customer acceptance of digital-first financial solutions.

The cost of acquiring customers remains a substantial hurdle, even for digital entrants. Reports from 2023-2024 suggest customer acquisition costs in Indian banking can range from hundreds to over a thousand rupees, making it difficult for newcomers to achieve profitability against established players with existing customer bases and economies of scale.

| Factor | Impact on New Entrants | Implication for Canara Bank |

| Regulatory Hurdles & Capital Requirements | High barrier to entry; requires significant financial resources and compliance expertise. | Provides a strong protective moat, limiting direct competition from traditional banks. |

| Digital-First Challengers & Fintechs | Lower infrastructure costs; ability to target niche markets and offer innovative services. | Potential for disintermediation in specific service areas; necessitates continuous digital innovation. |

| Customer Acquisition Costs (CAC) | Escalating costs due to market competition; hinders rapid customer base growth and profitability. | Advantage for Canara Bank due to established brand loyalty and lower relative CAC for existing customers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Canara Bank is built upon a foundation of verified data, including Canara Bank's annual reports, investor presentations, and public filings. We supplement this with industry-specific reports from reputable sources and macroeconomic data to capture the broader competitive landscape.