Canara Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

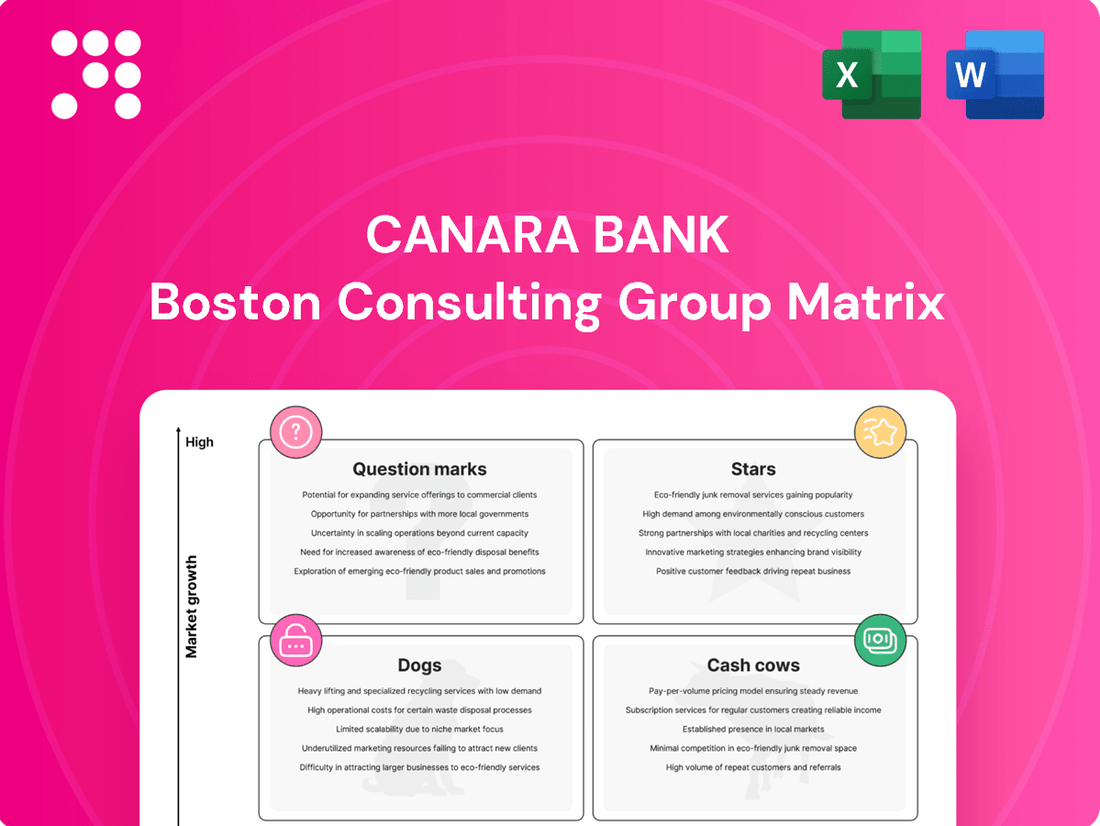

Curious about Canara Bank's strategic product positioning? Our BCG Matrix analysis offers a glimpse into which of their offerings are market leaders, which are generating steady profits, and which might require a closer look.

Don't miss out on the full picture! Purchase the complete Canara Bank BCG Matrix to uncover detailed quadrant placements, understand the growth potential of each product, and gain actionable insights to guide your investment and strategic decisions.

Stars

Canara Bank's digital lending products are a strong contender in its BCG matrix, fueled by the bank's robust digital push. Retail credit saw a significant 33.92% year-over-year growth as of June 2025, with housing loans up 13.92% and vehicle loans by 22.09%.

These digital channels are instrumental in capturing this expanding market, especially as India's digitization accelerates. The ease and accessibility of digital platforms are likely driving a substantial portion of this retail credit expansion, positioning digital lending as a star performer.

Canara Bank's Retail, Agriculture, and MSME (RAM) loan portfolio is a significant growth engine, expanding by an impressive 14.90% year-on-year as of June 2025.

This robust performance underscores the bank's strategic emphasis on these vital sectors, positioning RAM loans as a key driver for future expansion and market share gains.

The bank's commitment to continued growth in RAM lending highlights its confidence in the sector's potential and its ability to capture increasing demand.

Canara Bank's digital payment performance, encompassing UPI and mobile banking, is a standout performer. The bank secured the coveted 'Best Digital Bank Award' for both FY 2022-23 and FY 2023-24, achieving the top rank in digital payment performance. This consistent leadership highlights exceptional adoption rates and a significant market share within India's dynamic digital payments landscape.

This strong showing in digital payments, particularly UPI, positions these services as Canara Bank's Stars in the BCG Matrix. The high adoption and market share indicate a high-growth, high-market-share quadrant, reflecting the bank's success in a rapidly expanding sector. For instance, UPI transactions in India surged by over 90% year-on-year in FY 2023-24, reaching over 130 billion transactions, a testament to the overall market growth Canara Bank is capitalizing on.

Fintech Collaborations and Unified Lending Interface (ULI)

Canara Bank is forging ahead with fintech collaborations, integrating platforms like the Unified Lending Interface (ULI) to streamline credit and underwriting processes. This strategic move is particularly aimed at enhancing services for Micro, Small, and Medium Enterprises (MSMEs) and the agricultural sector, sectors crucial for economic growth.

These efforts are positioned within a rapidly expanding digital financial services market, with projections indicating continued robust growth through 2024 and beyond. By embracing ULI, Canara Bank seeks to tap into new market segments and offer more efficient, data-driven lending solutions.

- Fintech Integration: Canara Bank's focus on fintech partnerships and platforms like ULI aims to modernize its lending operations.

- MSME and Agri Focus: These initiatives are specifically designed to improve credit access and underwriting for MSMEs and agricultural borrowers.

- Market Opportunity: The digital financial services market is experiencing significant expansion, presenting a prime opportunity for Canara Bank to capture new customer bases.

- Enhanced Efficiency: ULI enables smarter credit decisions and faster processing, leading to improved customer experience and operational efficiency.

Gold Loan Products

Canara Bank is strategically expanding its gold loan offerings, anticipating this segment to be a significant driver of future growth and profitability. This focus is particularly relevant given the persistent popularity and expansion of gold-backed credit in the Indian market.

The bank's commitment to innovating and promoting new gold loan products positions them to capture a larger share of this expanding market. This suggests that gold loans could emerge as a star performer within Canara Bank's product portfolio.

In 2023-24, the overall gold loan market in India saw substantial growth, with public sector banks like Canara Bank playing an increasingly important role. For instance, the total value of gold loans disbursed by public sector banks reached significant figures, underscoring the segment's vitality.

- Gold Loan Market Growth: The gold loan sector has demonstrated robust year-on-year growth, driven by demand from rural and semi-urban populations.

- Canara Bank's Focus: The bank's emphasis on developing diverse gold loan products, including those with flexible repayment options and competitive interest rates, aims to attract a wider customer base.

- Potential for High Share: With a strong existing customer base and a proactive approach to product development, Canara Bank is well-positioned to achieve a high market share in the gold loan segment.

- Contribution to Earnings: The anticipated growth in gold loans is expected to contribute positively to Canara Bank's overall net interest income and profitability.

Canara Bank's digital lending, digital payments, and gold loan offerings are identified as Stars in its BCG matrix. These segments exhibit high growth and strong market share, reflecting the bank's successful strategy in rapidly expanding markets. The bank's digital payment performance, in particular, has earned it top accolades, showcasing its leadership in a sector experiencing explosive growth, with UPI transactions alone surging over 90% year-on-year in FY 2023-24.

| Product Segment | BCG Category | Key Growth Drivers | Market Performance Indicator (as of June 2025) |

| Digital Lending | Star | Robust digital push, increasing retail credit demand (33.92% YoY growth) | Housing loans up 13.92%, Vehicle loans up 22.09% |

| Digital Payments (UPI, Mobile Banking) | Star | High adoption rates, award-winning performance, rapid market expansion | Top rank in digital payment performance for FY 2022-23 & FY 2023-24; India's UPI transactions > 130 billion in FY 2023-24 |

| Gold Loans | Star | Persistent market popularity, strategic product innovation, focus on rural/semi-urban demand | Significant growth in the overall gold loan market in India; Public sector banks' increasing share |

What is included in the product

Canara Bank's BCG Matrix details strategic insights for its product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

The Canara Bank BCG Matrix provides a clear, one-page overview, easing the pain of understanding complex business unit performance.

Cash Cows

Canara Bank's extensive branch network, a significant asset, underpins its strong position in traditional CASA deposits. This established presence ensures a stable and substantial customer base for both current and savings accounts. As of March 31, 2024, Canara Bank reported a CASA ratio of 50.04%, demonstrating its reliance on these low-cost funds.

Despite the challenges in achieving rapid deposit growth in a mature market, CASA deposits continue to be a cornerstone of Canara Bank's funding strategy. They provide a consistent and cost-effective source of liquidity, contributing steadily to the bank's overall profitability and financial resilience.

Canara Bank's large corporate lending portfolio represents a significant Cash Cow. This segment is characterized by established relationships and provides stable, recurring interest income, reflecting a high market share in a mature industry. In the fiscal year ending March 31, 2024, Canara Bank reported a net profit of ₹10,042 crore, with its corporate loan book contributing substantially to this performance.

Canara Bank's government business operations represent a significant Cash Cow. As a major public sector bank, it processes substantial volumes of treasury operations and manages numerous government schemes, ensuring a consistent and low-risk revenue stream. This segment benefits from a high market share inherently tied to its public sector status.

In the fiscal year 2023-24, Canara Bank reported a net profit of ₹4,058 crore, a significant portion of which is likely attributable to the stable income generated from these government-related transactions. The bank's extensive branch network across India further solidifies its position in handling these essential public services.

Extensive Branch and ATM Network

Canara Bank's extensive physical footprint, boasting 9,849 branches and 11,144 ATMs/Recyclers as of March 2025, firmly positions its branch network as a Cash Cow. This widespread accessibility ensures a steady stream of business from a diverse and large customer base.

This robust network acts as a reliable engine for consistent revenue generation within the established banking sector. It signifies a mature, high-volume operation that reliably contributes to the bank's overall financial strength.

- Extensive Reach: 9,849 branches and 11,144 ATMs/Recyclers as of March 2025.

- Consistent Revenue: Generates stable income from a broad customer base.

- Mature Market Dominance: Leverages established presence for reliable business.

- Foundational Strength: Serves as a core, dependable revenue generator.

Housing Loans (Established Portfolio)

Canara Bank's established housing loan portfolio functions as a Cash Cow. While the overall housing loan segment saw a 13.92% year-over-year growth as of June 2025, the mature, existing book of these loans signifies a substantial and stable foundation for the bank.

These loans are a predictable source of consistent interest income, contributing reliably to the bank's earnings. Their long-term nature and reduced volatility post-disbursement solidify their role as a dependable cash generator for Canara Bank.

- Stable Income Stream: The established housing loans offer predictable, long-term interest revenue.

- Low Volatility: Once disbursed, these loans exhibit relatively low risk and income fluctuations.

- Significant Asset Base: They represent a considerable and well-established part of Canara Bank's assets.

- Cash Generation: This portfolio reliably generates consistent cash flow for the bank's operations and investments.

Canara Bank's robust retail deposit base, particularly its Current Account and Savings Account (CASA) deposits, functions as a significant Cash Cow. This segment benefits from a broad customer reach and provides a stable, low-cost funding source, crucial for profitability. As of March 31, 2024, Canara Bank's CASA ratio stood at a healthy 50.04%, highlighting the strength of this deposit base.

The bank's substantial corporate loan book is another key Cash Cow. This segment, characterized by established client relationships, generates consistent and predictable interest income, reflecting a strong market position in a mature industry. For the fiscal year ending March 31, 2024, Canara Bank's net profit reached ₹10,042 crore, with corporate lending being a major contributor.

Government business operations also represent a strong Cash Cow for Canara Bank. As a public sector bank, it handles significant volumes of government transactions and schemes, ensuring a steady, low-risk revenue stream. This segment benefits from an inherent market share advantage due to its public sector status, contributing significantly to the bank's financial performance.

| Business Segment | BCG Category | Key Characteristics | Financial Year 2023-24 Data/Notes |

| CASA Deposits | Cash Cow | Low-cost funding, broad customer base, stable revenue | CASA Ratio: 50.04% (as of March 31, 2024) |

| Corporate Lending | Cash Cow | Established relationships, stable interest income, high market share | Net Profit: ₹10,042 crore (FY 2023-24) |

| Government Business | Cash Cow | Consistent, low-risk revenue, inherent market share | Net Profit: ₹4,058 crore (FY 2023-24) attributed in part |

| Branch Network | Cash Cow | Extensive reach, consistent revenue generation, mature market dominance | 9,849 branches, 11,144 ATMs/Recyclers (as of March 2025) |

| Housing Loans (Existing) | Cash Cow | Predictable interest income, low volatility, significant asset base | Housing loan segment grew 13.92% (as of June 2025) |

Full Transparency, Always

Canara Bank BCG Matrix

The Canara Bank BCG Matrix you are previewing is the complete, unadulterated document you will receive immediately after purchase. This comprehensive analysis provides a clear strategic overview of Canara Bank's business units, meticulously categorized as Stars, Cash Cows, Question Marks, and Dogs, based on their market share and growth potential. You can trust that the insights and visualizations presented here are precisely what you will download, ready for immediate integration into your strategic planning and decision-making processes. No watermarks or demo content will obscure the actionable intelligence within this report.

Dogs

Canara Bank's legacy systems and manual processes represent its 'dog' quadrant in the BCG matrix. These outdated operational methods, still lingering in some areas, demand significant time and resources without contributing to a competitive edge or substantial growth. For instance, while the bank has made strides in digitizing, a portion of customer onboarding or loan processing might still involve paper-based steps, hindering efficiency.

The bank is actively addressing this by investing heavily in digital transformation initiatives. By 2024, Canara Bank aimed to complete the integration of its core banking system with newer digital platforms, a move designed to phase out these resource-draining manual operations. This strategic shift is crucial for improving customer experience and operational agility.

Canara Bank's underperforming niche traditional products are those with dwindling demand or low uptake, not central to the bank's strategic direction. Think of legacy services that are costly to maintain but generate minimal returns, impacting overall profitability. For instance, while specific data for these niche products isn't always publicly itemized, a bank like Canara might see a decline in revenue from traditional passbook savings accounts compared to digital alternatives.

Canara Bank has actively managed its international footprint, notably by ceasing operations in Canara Bank (Tanzania) Ltd. This move reflects a strategic pruning of underperforming or non-essential international ventures.

Any other international operations that are not contributing significantly to profitability or offering distinct strategic advantages in their respective low-growth markets can be categorized as 'dogs' within the BCG framework. These ventures might be candidates for divestiture or a substantial scaling back of operations to reallocate resources more effectively.

Very Small, Unprofitable Rural Branches

While Canara Bank is committed to financial inclusion, certain very small or remote rural branches might be classified as 'dogs' in the BCG matrix. These branches often face challenges in generating enough business volume to cover their operational costs, which can be disproportionately high due to their location and scale.

For instance, as of March 2024, Canara Bank reported a total business of ₹22,02,106 crore. However, the profitability of individual low-performing units, including some of these smaller rural branches, could be a point of consideration for strategic review, even as the bank continues its expansion efforts.

- Low Revenue Generation: These branches may struggle to attract a significant customer base or offer a wide range of profitable services, leading to consistently low revenue.

- High Operational Costs: The cost of maintaining a physical presence in remote areas, including staff salaries and infrastructure, can outweigh the income generated.

- Strategic Re-evaluation: While crucial for financial inclusion, the bank might periodically assess the viability and optimal operating model for such branches, potentially exploring consolidation or digital service enhancements.

High-Cost Bulk Deposits

Canara Bank's strategy involves managing its deposit mix to optimize profitability. Reliance on high-cost bulk deposits can put pressure on net interest margins, particularly when the bank faces challenges in attracting deposits. For instance, during periods of intense competition for funds, the cost of these bulk deposits can rise significantly, impacting overall earnings.

The bank's efforts to reduce its dependence on these costly deposits highlight a strategic shift. This indicates a preference for more stable and cost-effective funding sources, such as Current Account Savings Account (CASA) deposits. CASA deposits are generally cheaper and more sticky, contributing positively to the bank's net interest income.

- High-Cost Bulk Deposits: These are large-value deposits, often from corporations or institutions, that come with higher interest rates to attract and retain.

- Net Interest Margin (NIM) Erosion: When the cost of funds (interest paid on deposits) rises faster than the yield on assets (interest earned on loans), NIMs shrink.

- Strategic Shift: Canara Bank is actively working to decrease its reliance on these expensive deposits.

- CASA Deposits: The bank favors Current Account Savings Account deposits, which are typically lower-cost and more stable, thereby improving profitability.

Canara Bank's 'dog' quadrant encompasses legacy systems and manual processes hindering efficiency, alongside underperforming niche traditional products with declining demand. Certain remote rural branches, despite their financial inclusion role, may also fall into this category due to high operational costs and low business volume. Additionally, an over-reliance on high-cost bulk deposits can pressure net interest margins, representing a strategic challenge.

| Category | Description | Example/Impact |

| Legacy Systems & Manual Processes | Outdated operational methods requiring significant resources without competitive advantage. | Paper-based customer onboarding or loan processing steps, impacting efficiency. |

| Underperforming Niche Products | Services with dwindling demand or low uptake, costly to maintain. | Decline in revenue from traditional passbook savings accounts compared to digital alternatives. |

| Low-Volume Rural Branches | Branches in remote areas with challenges in generating sufficient business volume. | High operational costs (staff, infrastructure) outweighing income, impacting profitability. |

| High-Cost Bulk Deposits | Large-value deposits with higher interest rates, potentially eroding net interest margins. | Increased cost of funds when competing for deposits, impacting overall earnings. |

Question Marks

Canara Bank's foray into new digital-only lending platforms and partnerships, like the collaboration with KredX for MSME trade finance, positions it within the rapidly expanding fintech sector. These ventures, while promising high growth potential, represent areas where Canara Bank's current market share might be nascent, necessitating substantial investment to achieve significant scale and establish a strong presence.

Canara Bank is significantly boosting its Artificial Intelligence (AI) and Machine Learning (ML) capabilities, channeling substantial investment into areas like personalized customer engagement for upselling and cross-selling, alongside robust fraud detection systems. This strategic push aims to unlock greater operational efficiency and cultivate novel revenue streams.

While the long-term promise of AI/ML is substantial, these technologies represent a relatively nascent phase for the bank. Consequently, their direct contribution to current market share and immediate revenue generation may still be developing, positioning them as potential stars or question marks in the BCG matrix depending on their evolving impact.

Canara Bank is likely focusing on specialized wealth management offerings for India's burgeoning affluent class, a segment experiencing significant growth. This strategic move aligns with the country's economic expansion, which is creating new wealth demographics.

These new products, though targeting a high-growth market, might represent a nascent stage for Canara Bank, indicating a potentially low current market share. This necessitates dedicated marketing efforts and strategic investments to capture a significant portion of this expanding market.

For instance, as of 2024, India's high-net-worth individual (HNWI) population has seen a consistent upward trend, with reports indicating a substantial increase in wealth accumulation across various sectors, presenting a fertile ground for such specialized offerings.

Digital Rupee Application (CBDC initiatives)

Canara Bank's 'CANARA Digital Rupee' application has been recognized with an award, highlighting its pioneering efforts in India's developing Central Bank Digital Currency (CBDC) ecosystem. This initiative places the bank in a high-growth, nascent market, positioning it as a potential leader in the future of digital currency transactions.

As India actively explores CBDC, Canara Bank's early engagement with its 'CANARA Digital Rupee' application signifies a strategic move into a new frontier. While the market adoption and immediate revenue generation for such digital currency applications are likely still in their early stages, the bank's proactive stance suggests a long-term vision for dominance in this evolving financial landscape.

- Award Recognition: Canara Bank received an award for its 'CANARA Digital Rupee' application.

- Market Potential: India's exploration of CBDC represents a high-growth, nascent market.

- Strategic Positioning: Early involvement positions Canara Bank for potential future market dominance in digital currency.

- Current Status: Market adoption and revenue generation for the application are likely low at present.

Strategic Divestment and Listing of Subsidiaries

Canara Bank's strategic divestment plans for subsidiaries like Canara Robeco Mutual Fund and Canara HSBC Life Insurance Company place them in a 'question mark' category within the BCG Matrix. These are mature businesses with solid track records, but their independent listing introduces uncertainty regarding capital infusion and post-listing valuations. For instance, Canara Robeco Mutual Fund managed assets worth ₹1,09,842 crore as of March 31, 2024, indicating significant potential for capital generation through an IPO.

The success of these listings hinges on market conditions and investor appetite for financial services stocks. Canara HSBC Life Insurance, which reported a solvency ratio of 194.7% as of March 31, 2024, also presents an opportunity for value unlocking. The bank aims to leverage these divestments to strengthen its core operations and capital adequacy.

- Potential Capital Infusion: The IPOs of Canara Robeco Mutual Fund and Canara HSBC Life Insurance are anticipated to inject significant capital into Canara Bank.

- Market Valuation Uncertainty: The exact market valuation post-listing for these subsidiaries remains a key question mark, dependent on investor sentiment and financial performance.

- Strategic Focus Shift: Divesting stakes allows Canara Bank to concentrate resources on its core banking activities while still retaining an interest in the growth of its subsidiaries.

- Established Business Performance: Both entities are well-established, with Canara Robeco Mutual Fund managing substantial assets and Canara HSBC Life Insurance demonstrating strong solvency, providing a solid foundation for listing.

Canara Bank's initiatives in areas like digital-only lending platforms and its 'CANARA Digital Rupee' application represent investments in high-growth, yet currently nascent, markets. These ventures, while holding significant future potential, are likely to have a low current market share and may not yet be generating substantial revenue, fitting the 'question mark' profile. The bank's strategic focus on these emerging areas indicates a long-term vision to capture future market share, requiring continued investment and development to transition them into stronger market positions.

| Initiative | Market Growth Potential | Current Market Share | Revenue Generation | BCG Category |

| Digital-only Lending Platforms (e.g., KredX partnership) | High | Nascent/Low | Developing | Question Mark |

| AI/ML Capabilities | High | Developing | Emerging | Question Mark |

| Specialized Wealth Management Offerings | High | Low | Growing | Question Mark |

| 'CANARA Digital Rupee' Application | High | Nascent/Low | Low | Question Mark |

BCG Matrix Data Sources

Our Canara Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.