BT Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BT Group Bundle

BT Group boasts significant strengths in its extensive network infrastructure and loyal customer base, but faces threats from intense competition and evolving technological landscapes. Understanding these dynamics is crucial for navigating the future of telecommunications.

Want the full story behind BT Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BT Group boasts the UK's most extensive fixed and mobile network infrastructure, a key strength. This includes the widespread Openreach fibre network and EE's dominant 5G coverage, giving it a significant competitive edge.

As of March 2025, Openreach's full fibre network had passed over 18 million premises, with ambitious plans to reach 25 million by the end of 2026. This vast reach allows BT to offer a comprehensive suite of services to a massive customer base across the nation.

Furthermore, EE's 5G network demonstrates impressive penetration, covering more than 87% of the UK population. This robust mobile presence complements its fixed-line capabilities, solidifying BT's position as a leading telecommunications provider.

BT Group boasts a commanding presence in the UK telecommunications sector, anchored by its iconic brands: BT, EE, Plusnet, and Openreach. This diverse portfolio solidifies its trusted position and deep customer relationships, fostering significant loyalty.

The company's strong brand equity translates directly into market leadership. For instance, EE's consistent recognition as the UK's best mobile network for 11 consecutive years underscores BT's enduring strength and customer trust.

BT Group boasts a remarkably diversified service portfolio, spanning essential consumer offerings like fixed-line telephony, mobile services, broadband internet, and television packages. This breadth extends into robust enterprise solutions, encompassing critical areas such as advanced network services, cloud computing, and vital cybersecurity. Such extensive diversification across both consumer and business markets, coupled with its wholesale network infrastructure, significantly diminishes reliance on any single revenue stream.

Commitment to Fibre Rollout and 5G Expansion

BT Group is heavily invested in expanding its fibre broadband and 5G networks, positioning itself as a leader in high-speed connectivity. This aggressive rollout strategy is crucial for meeting the growing consumer and business demand for faster and more reliable internet services.

The company has ambitious plans, targeting the completion of its full fibre to the premises (FTTP) rollout to 25 million homes by 2026. Furthermore, BT has boosted its FY26 build target by 20%, aiming to connect 5 million additional premises, underscoring its dedication to future-proofing its infrastructure.

- Accelerated Fibre Rollout: BT is prioritizing its FTTP deployment, a key driver for future revenue and customer satisfaction.

- 5G Network Expansion: Significant investment in 5G is essential to capitalize on emerging mobile data trends and maintain competitive edge.

- Ambitious Targets: The goal of passing 25 million homes with FTTP by 2026 and increasing the FY26 build target by 20% demonstrates a strong commitment to growth.

Cost Transformation and Efficiency Programs

BT Group has a strong track record in cost transformation and simplification, consistently delivering substantial annualised cost savings. These initiatives directly bolster EBITDA and normalised free cash flow, reinforcing the company's financial stability and operational effectiveness.

The company's commitment to efficiency is highlighted by its achievement of over £900 million in annualised cost savings for FY25. This aggressive cost management strategy is projected to continue, with a target to reduce its workforce by up to 40,000 roles and achieve a total of £3 billion in cost savings by 2030, which is expected to significantly boost profitability.

- Significant Cost Savings: Achieved over £900 million in annualised cost savings in FY25.

- Workforce Reduction Target: Plans to reduce workforce by up to 40,000 roles.

- Long-Term Savings Goal: Aiming for £3 billion in cost savings by 2030.

- Financial Impact: These programs directly improve EBITDA and normalised free cash flow.

BT Group's extensive network infrastructure, encompassing Openreach's fibre and EE's 5G, provides a substantial competitive advantage. As of March 2025, Openreach's fibre network reached over 18 million premises, with a goal of 25 million by the end of 2026.

EE's 5G network covers more than 87% of the UK population, complementing its fixed-line services. This dual strength solidifies BT's market leadership.

The company's strong brand portfolio, including BT, EE, Plusnet, and Openreach, fosters deep customer loyalty, further cemented by EE's consistent recognition as the UK's best mobile network for 11 consecutive years.

BT's diversified service offerings, from consumer broadband and mobile to enterprise cloud and cybersecurity solutions, reduce reliance on any single revenue stream.

BT Group's strategic focus on accelerating fibre rollout and expanding its 5G network positions it for future growth. The company aims to pass 25 million homes with full fibre by 2026 and has increased its FY26 build target by 20%.

Significant cost transformation efforts have yielded over £900 million in annualised cost savings for FY25. BT plans further workforce reductions of up to 40,000 roles to achieve £3 billion in total cost savings by 2030, boosting profitability.

| Metric | Value (as of FY25/early 2025) | Significance |

|---|---|---|

| Openreach Fibre Premises Passed | 18+ million | Extensive reach, competitive advantage |

| EE 5G Population Coverage | 87%+ | Dominant mobile presence |

| EE Brand Recognition | Best UK mobile network (11 consecutive years) | Strong brand equity, customer trust |

| FY25 Annualised Cost Savings | £900+ million | Improved EBITDA and cash flow |

| Projected Workforce Reduction | Up to 40,000 roles | Efficiency drive, cost optimization |

| Projected Total Cost Savings by 2030 | £3 billion | Long-term profitability enhancement |

What is included in the product

Delivers a strategic overview of BT Group’s internal and external business factors, highlighting its strong brand and network infrastructure while acknowledging competitive pressures and regulatory challenges.

Offers a clear, actionable framework to identify and address BT Group's critical challenges and leverage opportunities.

Weaknesses

BT Group is grappling with the shrinking revenue from its older services, like traditional voice calls and its businesses outside the UK. This decline is a significant hurdle, as it's counteracting the progress made in newer, more promising areas of the business.

For the full year ending March 2025, BT reported a 2% drop in overall revenue. This downturn was largely attributed to tough market conditions within its Global division and its non-UK operations, alongside softer sales of mobile phones.

BT Group's significant net debt, standing at £19.8 billion as of March 31, 2025, coupled with a £4.1 billion gross IAS 19 pension deficit, presents a considerable financial challenge. These substantial liabilities can constrain the company's ability to invest in future growth initiatives and limit its financial flexibility. While BT is actively managing these obligations, they remain a notable burden on its balance sheet.

BT Group faces a fiercely competitive landscape in the UK telecom sector. The market is characterized by aggressive expansion from alternative network providers, known as altnets, and a notable trend of consolidation among mobile carriers. This heightened rivalry directly translates into significant pricing pressures, which can erode BT's market share, especially within its crucial broadband segment.

The impact of this competition is evident in BT's operational data. For instance, Openreach, BT's network division, experienced a decline of 243,000 broadband lines in the fourth quarter of fiscal year 2025. This reduction was primarily attributed to customer churn towards rival providers and a general softening in the overall broadband market, underscoring the intensity of competitive forces.

Regulatory Scrutiny and Compliance

BT Group's history as a former state-owned monopoly means it continues to face significant regulatory oversight from Ofcom. This scrutiny, while offering a degree of market stability, can also limit BT's operational freedom and impact its investment profitability. For instance, Ofcom's investigations have previously led to substantial fines for the company, and current reviews like the Telecoms Access Review are actively shaping the industry's future regulatory framework.

- Ongoing Ofcom Scrutiny: BT operates under continuous regulatory examination due to its historical market dominance.

- Restrictions and Fines: Regulatory compliance can impose limitations and result in financial penalties, affecting flexibility.

- Telecoms Access Review Impact: The ongoing review by Ofcom is a key factor in the evolving regulatory environment for BT.

Vulnerability to Cyber Threats

BT Group, as a critical infrastructure provider, faces significant risks from sophisticated cyber threats. The company's extensive network and vast customer data make it a prime target for malicious actors. Despite substantial investments in cybersecurity measures, the ever-evolving landscape of cyber-attacks presents a persistent challenge.

The potential impact of a successful breach is severe, encompassing operational disruptions, financial losses, and irreparable damage to customer trust and brand reputation. For instance, a December 2024 incident saw a ransomware group claim the theft of sensitive data from a BT Conferencing platform, underscoring the ongoing vulnerability.

- Targeted Attacks: Major telecom providers like BT are consistently targeted by advanced persistent threats (APTs) and organized cybercrime groups.

- Data Breach Impact: A breach could expose millions of customer records, leading to significant regulatory fines and compensation claims, potentially running into hundreds of millions of pounds.

- Operational Disruption: Cyber-attacks can cripple network services, impacting millions of individuals and businesses reliant on BT's infrastructure, leading to substantial revenue loss and reputational damage.

BT Group's substantial net debt, reported at £19.8 billion as of March 31, 2025, alongside a £4.1 billion pension deficit, significantly limits its financial flexibility and capacity for new investments. This financial burden can hinder its ability to compete effectively and pursue strategic growth opportunities.

Preview Before You Purchase

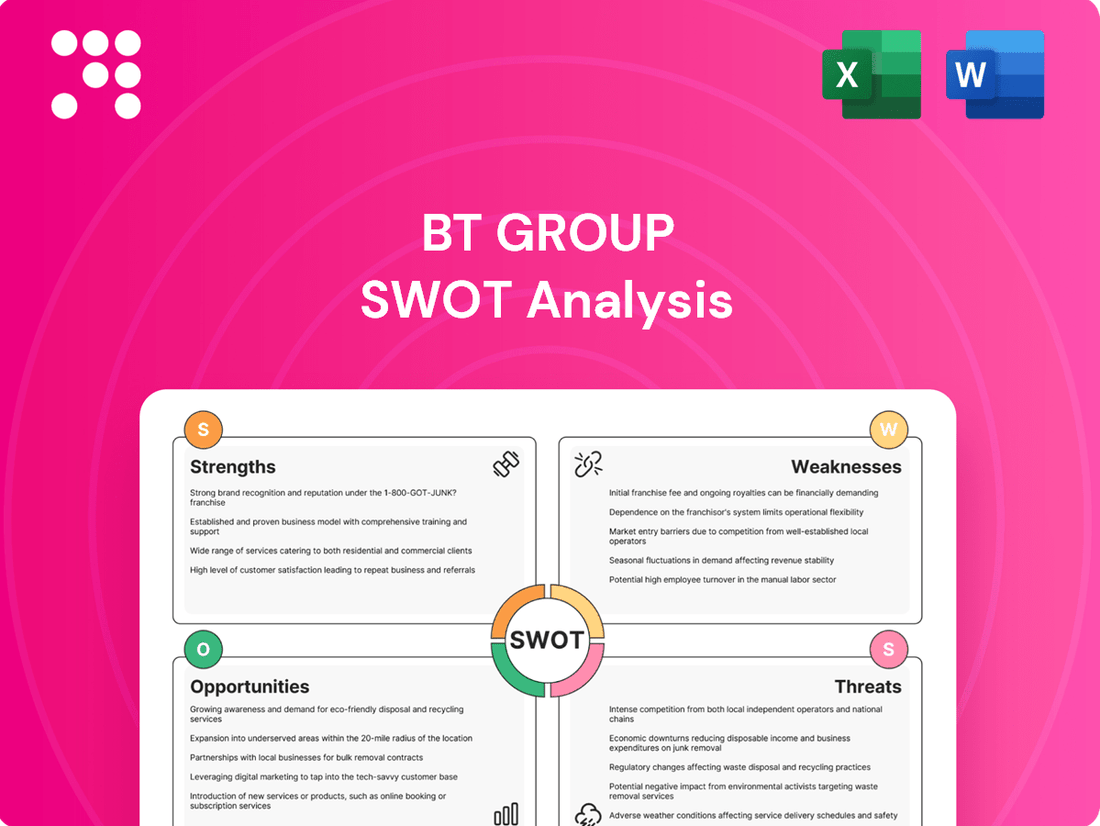

BT Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of BT Group's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for BT Group.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the BT Group SWOT analysis, ready for your strategic planning needs.

Opportunities

The continued expansion of full fibre broadband and 5G networks represents a prime opportunity for BT Group. This infrastructure build-out allows BT to secure a larger slice of the market and introduce more advanced services, directly boosting revenue.

BT's commitment to reaching 25 million homes with full fibre by the end of 2026, coupled with its 5G network already reaching over 87% of the UK population, highlights the substantial growth potential in providing faster and more reliable connectivity.

BT Group is well-positioned to capitalize on the increasing demand for sophisticated enterprise and public sector solutions. This includes vital services like robust network infrastructure, secure cloud computing, and advanced cybersecurity measures, which are becoming essential for modern businesses and government bodies.

The company's existing expertise and extensive infrastructure provide a strong foundation for expanding its presence in these lucrative markets. This strategic direction, focusing on domestic enterprise expansion and broadening managed service offerings, represents a pragmatic and promising avenue for growth.

For instance, in the fiscal year ending March 31, 2024, BT's Enterprise division reported revenue of £5.7 billion, demonstrating a solid base to build upon. Their commitment to delivering integrated solutions can significantly enhance their market share in these high-value segments.

BT Group can significantly boost customer satisfaction and streamline operations by integrating artificial intelligence (AI) and other cutting-edge technologies. For instance, AI-powered chatbots can handle a large volume of customer inquiries 24/7, freeing up human agents for more complex issues. This adoption is crucial for staying competitive in the rapidly evolving telecommunications landscape.

BT is actively pursuing collaborations to harness the power of AI and machine learning. These partnerships are designed to refine customer interactions and optimize backend processes, leading to a more efficient and responsive service. The company's commitment to innovation in this area is a key opportunity for growth and differentiation.

By embracing AI, BT can also unlock new avenues for service development. Imagine personalized network management or predictive maintenance for infrastructure, all powered by intelligent systems. This technological advancement presents a clear pathway to creating innovative offerings that meet the future demands of consumers and businesses alike.

Digital Transformation and IoT Market Growth

The rapid digital transformation sweeping across various sectors presents a significant opportunity for BT Group. As businesses increasingly rely on digital processes and the Internet of Things (IoT), the demand for robust connectivity solutions escalates. BT is well-positioned to leverage this trend by offering essential network infrastructure and tailored IoT services to support this evolving digital landscape.

The expansion of the IoT market is particularly noteworthy. Projections indicate the global IoT market will surpass £530 billion in 2023, highlighting a vast and growing revenue stream. This substantial market size offers BT a considerable opportunity to expand its service offerings and capture market share in this burgeoning sector.

- Expanding Connectivity Services: BT can capitalize on the digital transformation by offering advanced fiber broadband and 5G network solutions, crucial for supporting data-intensive IoT applications.

- IoT Solutions for Businesses: Developing and marketing specialized IoT platforms and managed services for sectors like manufacturing, logistics, and smart cities can unlock new revenue streams.

- Partnerships and Ecosystem Development: Collaborating with IoT device manufacturers and software providers can create a comprehensive ecosystem, strengthening BT's market position.

- Data Analytics and Security: Offering data analytics and robust security services for IoT deployments can add significant value for enterprise clients.

Strategic Partnerships and Acquisitions

BT Group can significantly bolster its offerings and market presence through strategic alliances and acquisitions. Collaborating with cutting-edge technology firms or acquiring complementary businesses would allow BT to enhance its service portfolio and reach new customer segments. The UK telecom landscape is experiencing a trend towards consolidation, creating potential avenues for strategic moves that could reshape BT's competitive standing.

For instance, in late 2023, BT announced a partnership with Microsoft to enhance its cloud capabilities and accelerate digital transformation for its enterprise customers. This aligns with the strategy of strengthening its service portfolio by leveraging external expertise. Furthermore, the ongoing consolidation in the UK market, such as Virgin Media O2's continued integration, highlights the evolving competitive environment and the potential for BT to explore similar strategic opportunities to expand its footprint or acquire new technologies.

- Strategic Partnerships: Collaborating with technology leaders like Microsoft to enhance cloud services and digital transformation capabilities, as seen in late 2023.

- Acquisition Opportunities: The UK telecom market's consolidation trend, exemplified by Virgin Media O2's integration, presents potential acquisition targets for BT to expand market reach or technology access.

- Portfolio Enhancement: Strategic moves can directly strengthen BT's existing service offerings, making them more competitive and attractive to a wider customer base.

- Market Expansion: Partnerships and acquisitions are key pathways to accessing new geographical markets or customer demographics previously underserved by BT.

BT Group is uniquely positioned to benefit from the ongoing digital transformation across industries. As businesses increasingly adopt IoT and cloud-based solutions, the demand for robust, high-speed connectivity is soaring. BT's extensive fiber and 5G networks are critical infrastructure for these evolving digital needs.

The company's focus on expanding its enterprise and public sector offerings, particularly in areas like cybersecurity and cloud computing, taps into essential services for modern organizations. This strategic emphasis allows BT to leverage its existing infrastructure and expertise to capture a larger share of these lucrative markets.

Furthermore, BT's proactive integration of AI and machine learning presents a significant opportunity to enhance customer experience and operational efficiency. By adopting these technologies, BT can develop innovative services and maintain a competitive edge in the rapidly advancing telecommunications sector.

Strategic partnerships and potential acquisitions also offer a clear path for growth. Collaborating with technology leaders or acquiring complementary businesses can expand BT's service portfolio and market reach, especially within the consolidating UK telecom landscape.

Threats

The aggressive expansion of fibre networks by numerous alternative providers, known as altnets, presents a substantial challenge. These companies are rapidly deploying their own infrastructure, directly competing with BT's Openreach division. This increased competition can lead to a fragmentation of the market and put downward pressure on pricing, impacting BT's revenue streams and market share.

Furthermore, the ongoing consolidation within the mobile sector, such as the proposed merger between Vodafone and Three in the UK, creates larger, more formidable competitors. Such mergers can lead to greater economies of scale and enhanced market power, potentially intensifying competition across the telecommunications landscape and posing a threat to BT's existing customer base and future growth prospects.

Adverse regulatory changes pose a significant threat to BT Group. Ofcom's ongoing Telecoms Access Review, for instance, could directly influence BT's wholesale pricing structures and its obligations regarding network access, potentially impacting its revenue streams and the returns on its substantial infrastructure investments. While current regulatory sentiment appears stable, the possibility of future shifts in policy introduces a layer of uncertainty for BT's operational and financial planning.

BT Group faces significant headwinds from a challenging economic climate, characterized by high inflation and persistent cost-of-living pressures. These factors directly impact consumer discretionary spending, potentially leading to reduced demand for telecommunications services as households prioritize essential expenditures.

Increased operational costs, driven by inflation, put pressure on BT's margins. While the company has implemented price adjustments, such as the April 2024 price hikes averaging 7.3% for many customers, these measures risk alienating price-sensitive consumers and could exacerbate customer churn in a competitive market.

Technological Disruption and Rapid Innovation

BT Group faces the ongoing threat of technological disruption. The telecommunications industry is characterized by rapid innovation, meaning that current infrastructure and services could quickly become outdated. This necessitates substantial and consistent investment simply to keep pace and remain competitive in the market. For instance, the ongoing rollout of 5G and the development of future network technologies require significant capital expenditure, impacting profitability if not managed effectively.

Furthermore, the escalating sophistication of cyber threats poses a continuous challenge. Staying ahead of these evolving security risks demands constant innovation in security measures and protocols. BT reported a significant number of cyber incidents in its 2023-2024 fiscal year, highlighting the scale of this threat and the resources required to combat it.

- Rapid technological evolution in areas like AI-driven network management and quantum computing could make existing BT infrastructure less relevant.

- Increased cybersecurity risks require ongoing investment in advanced threat detection and prevention systems, a cost that directly impacts operational budgets.

- The need for continuous R&D to develop and deploy next-generation services, such as enhanced IoT capabilities and advanced cloud solutions, is critical for future revenue streams.

Supply Chain Disruptions and Geopolitical Risks

BT Group faces significant threats from ongoing global supply chain disruptions and escalating geopolitical risks. These external pressures can directly affect the availability and cost of essential network equipment, potentially slowing down crucial infrastructure upgrades and impacting overall operational efficiency. For instance, the semiconductor shortage that persisted into 2023 continued to influence the availability of advanced networking components, a challenge BT has had to navigate.

Wider macroeconomic instability, including inflation and fluctuating interest rates, further compounds these threats. Such conditions can increase BT's operational costs and potentially dampen consumer and business demand for telecommunications services. The ongoing conflict in Eastern Europe, for example, has had ripple effects on energy prices and global trade, contributing to this broader economic uncertainty that BT must factor into its strategic planning.

- Supply chain vulnerabilities: BT relies on a global network of suppliers for network infrastructure, making it susceptible to disruptions caused by natural disasters, trade disputes, or manufacturing issues.

- Geopolitical tensions: Conflicts and political instability in key regions can disrupt trade routes, impact raw material availability, and lead to increased cybersecurity threats.

- Macroeconomic headwinds: Inflationary pressures and potential recessions can reduce consumer spending on telecommunications services and increase the cost of capital for infrastructure investment.

- Regulatory uncertainty: Evolving regulations in different markets can impose additional compliance costs and affect BT's ability to operate and expand its services.

BT Group faces intense competition from new fibre network providers, known as altnets, which are rapidly building their own infrastructure. This aggressive expansion directly challenges BT's Openreach division, potentially fragmenting the market and driving down prices, which could impact BT's revenue and market share. The consolidation of mobile operators, such as the proposed Vodafone-Three merger, also creates larger rivals with greater market power, intensifying competition and threatening BT's customer base.

Regulatory changes represent a significant threat, with Ofcom's reviews potentially altering BT's wholesale pricing and network access obligations, impacting its revenue and investment returns. Economic instability, including high inflation and cost-of-living pressures, reduces consumer spending on telecom services, while rising operational costs, like the 7.3% price hikes in April 2024, risk alienating customers and increasing churn.

Technological disruption necessitates continuous investment to avoid infrastructure obsolescence, with 5G and future network developments requiring substantial capital expenditure. Cyber threats are escalating in sophistication, demanding ongoing investment in advanced security measures, as evidenced by BT's numerous reported cyber incidents in fiscal year 2023-2024.

Supply chain disruptions and geopolitical risks can affect the availability and cost of network equipment, potentially delaying infrastructure upgrades. Macroeconomic instability, including inflation and fluctuating interest rates, increases operational costs and can dampen demand for telecom services. For example, semiconductor shortages persisted into 2023, impacting the availability of networking components.

| Threat Category | Specific Threat | Impact on BT | Example/Data Point |

|---|---|---|---|

| Competition | Altnets Fibre Expansion | Market fragmentation, price pressure | Rapid deployment of new fibre networks across the UK. |

| Competition | Mobile Operator Consolidation | Increased market power of rivals | Proposed merger of Vodafone and Three in the UK. |

| Regulatory | Ofcom Reviews (e.g., Telecoms Access) | Impact on wholesale pricing, network access obligations | Potential changes to BT's revenue streams and investment returns. |

| Economic | Inflation & Cost-of-Living | Reduced consumer spending, increased operational costs | April 2024 price hikes averaged 7.3% for many customers. |

| Technological | Rapid Innovation | Risk of infrastructure obsolescence, need for continuous investment | Ongoing 5G rollout and development of future network technologies. |

| Cybersecurity | Sophisticated Cyber Threats | Increased security costs, potential data breaches | Numerous cyber incidents reported in FY 2023-2024. |

| Supply Chain/Geopolitical | Disruptions & Instability | Impact on equipment availability, cost increases | Semiconductor shortages persisted into 2023, affecting component availability. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from BT Group's official financial reports, comprehensive market research, and insights from industry analysts to ensure a well-informed and accurate assessment.