BT Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BT Group Bundle

BT Group navigates a complex telecommunications landscape, facing intense rivalry and significant threats from new entrants and substitutes. Understanding the power of buyers and the influence of suppliers is crucial for any strategic assessment of the company.

The complete report reveals the real forces shaping BT Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The telecommunications sector, including BT Group, often depends on a select few manufacturers for essential network equipment. For instance, companies providing advanced 5G radio units or specialized fiber optic cable solutions represent a concentrated supply base. This limited number of key players means BT Group has fewer alternatives when sourcing critical components, potentially increasing the suppliers' leverage.

Suppliers offering highly specialized technology, like advanced network management software or unique cybersecurity solutions, wield significant bargaining power over BT Group. This power stems from their proprietary intellectual property, often protected by strong patent portfolios. For instance, in 2024, the increasing reliance on AI-driven network optimization tools, often developed by a limited number of specialized firms, means BT Group may face higher procurement costs or limited options if these suppliers are the sole providers of such critical components.

The availability of a skilled workforce, especially in crucial areas like fiber optic installation and network engineering, directly influences the bargaining power of labor suppliers. A scarcity of these specialized talents can empower labor providers to negotiate for higher wages and better working conditions, thereby increasing BT Group's operational expenses.

Regulatory and Compliance Requirements

Suppliers whose services and equipment must meet strict regulatory and compliance standards, like those concerning network security or data privacy, can leverage this to ask for higher prices. For BT Group, this means suppliers with the necessary certifications and specialized knowledge, such as those adhering to the UK's Network and Information Systems Regulations 2018 (NIS Regulations), often have a stronger bargaining position.

Meeting these compliance demands frequently necessitates specialized expertise and certified products, which naturally narrows the field of potential suppliers. This reduced competition among qualified providers allows them to negotiate more favorable terms.

- Reduced Supplier Pool: Suppliers meeting stringent UK data privacy laws (e.g., GDPR as implemented post-Brexit) limit options for BT Group.

- Increased Costs for Compliance: Suppliers investing in certified security protocols or specialized network equipment pass these costs on, impacting BT's procurement expenses.

- Critical Infrastructure Reliance: For components vital to national telecommunications infrastructure, suppliers with proven compliance and reliability can command premium pricing.

Switching Costs for BT Group

Switching from one major infrastructure supplier to another presents significant hurdles for BT Group. The process involves substantial investment in re-tooling existing systems, comprehensive retraining of technical staff, and the inherent risk of service disruptions during the transition period. These factors contribute to high switching costs.

These elevated switching costs directly translate into increased bargaining power for BT's current suppliers. Because it is so costly and disruptive to change providers, BT is often locked into existing relationships, giving suppliers more leverage in negotiations regarding pricing and terms.

For instance, in 2024, the telecommunications industry continued to see substantial investments in network upgrades, such as 5G and fiber optic infrastructure. Companies like BT rely on specialized equipment from a limited number of vendors for these deployments. A shift in supplier for such critical components could easily run into hundreds of millions of pounds, considering the scale of BT's operations across the UK.

- High Re-tooling Expenses: Replacing specialized network hardware often requires significant capital outlay.

- Extensive Staff Retraining: New systems necessitate training programs for engineers and technicians.

- Potential Service Interruption: Migrating infrastructure carries the risk of downtime, impacting customer satisfaction and revenue.

- Supplier Lock-in: The complexity and cost of switching create dependencies on existing providers.

The bargaining power of suppliers for BT Group is considerable due to the concentrated nature of the market for essential telecommunications equipment and services. This concentration means BT often has limited alternatives for critical components, such as advanced 5G infrastructure or specialized software. For example, in 2024, the demand for cutting-edge network technology from a few key manufacturers grants these suppliers significant leverage in pricing and contract terms.

Furthermore, suppliers offering proprietary technology, protected by patents, can command higher prices and dictate terms. The high costs and technical complexities associated with switching suppliers for critical infrastructure, like fiber optic networks, further solidify the suppliers' position. BT's reliance on specialized components for its ongoing network modernization, including 5G rollouts, means that switching vendors could incur substantial costs, potentially in the hundreds of millions of pounds, reinforcing supplier lock-in.

| Factor | Impact on BT Group | Example (2024) |

| Supplier Concentration | Limited alternatives increase supplier leverage. | Few manufacturers for advanced 5G radio units. |

| Proprietary Technology | Suppliers with unique IP can demand premium pricing. | AI-driven network optimization software providers. |

| High Switching Costs | BT faces significant expenses and risks when changing suppliers. | Hundreds of millions in potential costs for infrastructure upgrades. |

| Critical Infrastructure Reliance | Suppliers of vital components have strong negotiation power. | Providers of core fiber optic network equipment. |

What is included in the product

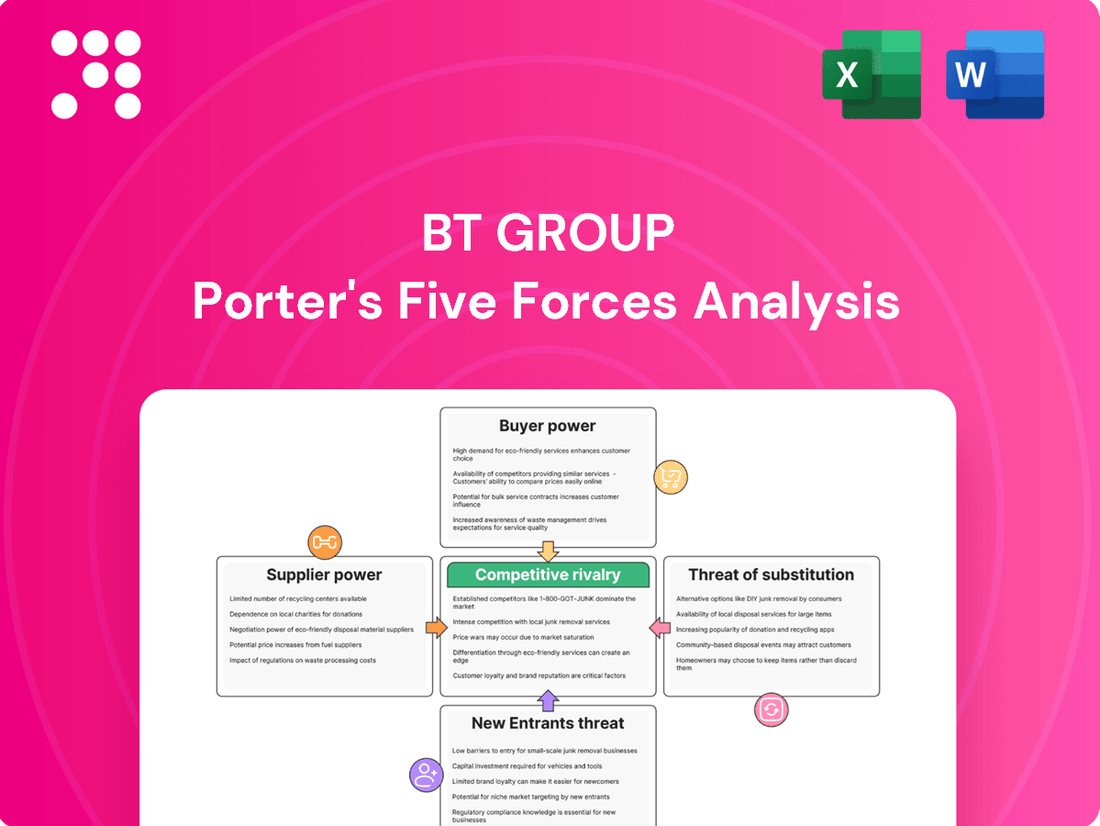

This analysis examines the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes within BT Group's operating environment.

Instantly identify and quantify the impact of each of Porter's Five Forces on BT Group, allowing for targeted strategic adjustments to alleviate competitive pressures.

Customers Bargaining Power

BT Group operates in highly competitive retail markets for fixed-line, mobile, and broadband services. Competitors such as Virgin Media O2, Vodafone, and numerous emerging altnets vie for customer attention. This crowded landscape significantly boosts customer bargaining power.

With so many providers offering similar services, customers can easily switch to a competitor if they are dissatisfied with BT's pricing or service quality. For instance, in 2024, the UK broadband market saw average monthly prices for a 100Mbps connection hover around £30-£40, creating a price-sensitive environment where switching is a common tactic for consumers to secure better deals.

This intense competition forces BT to continually innovate and offer attractive packages to retain its customer base. The ability for customers to readily compare and switch providers directly translates into increased leverage, compelling BT to maintain competitive pricing and invest in service improvements to avoid churn.

The bargaining power of customers for BT Group, specifically concerning its Openreach division, is substantial. Openreach, as the sole provider of wholesale network infrastructure to over 700 communication providers, including major competitors like Sky and Vodafone, holds a critical position.

These communication providers, acting as wholesale customers, wield significant leverage. This power is amplified by the essential nature of network access for their own service delivery and the existence of regulatory interventions. For instance, the Equinox plan, a pricing agreement implemented by Ofcom, directly influences the wholesale charges Openreach can levy, thereby capping customer price sensitivity.

In 2024, the competitive landscape continues to exert pressure. Many of these communication providers are large, established entities with significant market share, giving them the ability to negotiate favorable terms or even explore alternative infrastructure solutions in the long term. Their reliance on Openreach for essential services, coupled with regulatory oversight on pricing, creates a dynamic where customer demands heavily influence Openreach's operational and pricing strategies.

The ease with which customers can switch providers, particularly with regulatory pushes like ‘One Touch Switching’ in the UK, significantly amplifies their bargaining power against BT Group. This regulatory environment aims to simplify the process, making it less of a hurdle for consumers to move to a competitor.

High churn rates directly impact BT's financial health, as losing existing customers means a loss of recurring revenue and increased costs associated with acquiring new ones. For instance, in 2023, the UK broadband market saw churn rates fluctuate, with some reports indicating figures around 10-12% annually, a significant concern for established players like BT.

To combat this, BT is compelled to offer more attractive pricing, bundles, and improved service quality to retain its subscriber base. This competitive pressure means that customer retention is paramount, directly influencing BT's pricing strategies and investment in customer experience initiatives to mitigate the impact of easy switching.

Price Sensitivity of Consumers and Businesses

BT Group customers, both individuals and companies, are quite aware of pricing, especially when other providers offer comparable services. This price sensitivity is a major factor in how BT Group sets its prices. For instance, in the UK broadband market, a significant portion of consumers actively switch providers for better deals, often driven by price. Data from Ofcom in late 2023 indicated that around 25% of consumers had switched broadband provider in the past year, with price being a primary motivator.

This means BT needs to carefully consider any price adjustments. A slight increase could easily push customers towards competitors, impacting BT's market share and revenue. For example, if BT were to increase its average monthly broadband price by just £2, it could result in a substantial loss of subscribers if competitors maintain their current pricing. This dynamic forces BT to constantly evaluate its cost structure and service offerings to remain competitive without alienating its customer base.

- Price Sensitivity Impact: Customers are likely to switch providers for even minor price differences, affecting BT's subscriber numbers.

- Competitive Landscape: The UK telecommunications market is highly competitive, with numerous providers vying for customers, intensifying price pressure.

- Customer Acquisition vs. Retention: BT must balance attracting new customers with keeping existing ones, often through competitive pricing strategies.

- Market Data: Ofcom reported in late 2023 that approximately 25% of consumers switched broadband providers within a year, with price being a key driver.

Bundling and Value-Added Services Demand

Customers are increasingly demanding bundled services, combining broadband, mobile, and TV. This trend strengthens their bargaining power as they seek comprehensive packages. For instance, in 2024, many consumers expect integrated entertainment and communication solutions, pushing providers like BT Group to offer attractive bundles to retain their business.

The desire for value-added services, such as free streaming subscriptions or discounts on smart home technology, further empowers customers. This demand forces BT Group to differentiate its offerings beyond basic connectivity, adding complexity to service design and pricing strategies.

- Bundled Service Demand: Customers want integrated broadband, mobile, and TV packages.

- Value-Added Services: Perks like streaming subscriptions and smart home discounts are highly sought after.

- Customer Leverage: The demand for flexibility and comprehensive offerings increases customer bargaining power.

- BT Group's Response: The company must innovate beyond basic connectivity to meet these evolving customer expectations.

The bargaining power of customers for BT Group is significant, largely driven by the highly competitive UK telecommunications market. With numerous providers offering similar services, customers can easily switch, making them highly price-sensitive. In 2024, the market continues to see consumers actively seeking better deals, with price being a primary motivator for switching providers. This dynamic forces BT to maintain competitive pricing and invest in service improvements to retain its customer base.

Furthermore, the Openreach division, which supplies wholesale network infrastructure, faces substantial bargaining power from its communication provider customers. These providers, including major competitors, leverage their reliance on Openreach and regulatory oversight on pricing to negotiate favorable terms. For instance, Ofcom’s pricing agreements directly influence wholesale charges, limiting Openreach’s pricing flexibility.

Customer demand for bundled services, combining broadband, mobile, and TV, also amplifies their bargaining power. Consumers expect integrated solutions and value-added services, compelling BT to innovate beyond basic connectivity. This pressure means BT must continually adapt its offerings and pricing strategies to meet evolving customer expectations and mitigate the impact of high churn rates, which can significantly affect recurring revenue.

| Factor | Impact on BT Group | Supporting Data (2023-2024) |

|---|---|---|

| Price Sensitivity | Customers readily switch for lower prices, impacting subscriber numbers. | Approx. 25% of UK consumers switched broadband providers in the past year (late 2023), with price as a key driver. |

| Competitive Landscape | Intense competition from rivals like Virgin Media O2 and Vodafone increases customer leverage. | UK broadband market average monthly prices for 100Mbps connections hovered around £30-£40 in 2024. |

| Bundled Services Demand | Customers seek integrated packages, forcing BT to offer comprehensive solutions. | Growing consumer expectation for integrated entertainment and communication solutions in 2024. |

| Churn Rates | High churn directly affects BT’s revenue and increases customer acquisition costs. | UK broadband market churn rates fluctuated around 10-12% annually in 2023. |

What You See Is What You Get

BT Group Porter's Five Forces Analysis

This preview showcases the complete BT Group Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the telecommunications industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises. It delves into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, providing valuable strategic insights.

Rivalry Among Competitors

BT Group operates in highly competitive broadband and mobile markets. Rivals such as Virgin Media O2, Vodafone, and Sky actively engage in price wars and promotional campaigns to capture market share. For instance, in 2024, the UK broadband market continued to see intense competition with providers offering speeds up to 1 Gbps at increasingly competitive price points, impacting average revenue per user across the industry.

The UK broadband market is characterized by intense competitive rivalry, particularly driven by the rapid expansion of full-fiber networks by alternative network providers, or altnets. Companies such as CityFibre and Community Fibre are aggressively deploying their own infrastructure, creating significant network duplication alongside incumbent Openreach, BT Group's wholesale network division. This 'fiber land grab' escalates competition as multiple players race to capture market share in the lucrative next-generation broadband sector.

This heightened rivalry directly impacts BT Group's market position. For instance, by the end of 2023, CityFibre had already connected over 3 million premises, with ambitious plans to reach 8 million by 2025, directly challenging Openreach's dominance. This aggressive rollout by competitors necessitates substantial ongoing investment from Openreach to maintain its competitive edge, thereby increasing operational costs and potentially pressuring profit margins within BT Group.

Ofcom, the UK's communications regulator, significantly influences the competitive landscape for BT Group. Its policies are designed to encourage more players in the market, impacting how BT operates and strategizes.

For instance, Ofcom's Equinox plan dictates wholesale pricing, directly affecting BT's revenue streams and competitive positioning against rivals who utilize its infrastructure. This regulatory intervention aims to create a more level playing field.

Furthermore, policies promoting Physical Infrastructure Access (PIA) allow competitors to use BT's existing network. In 2023, Ofcom continued to push for greater access, with initiatives aimed at accelerating fibre deployment, which directly challenges BT's market dominance.

Convergence of Services and Bundling Strategies

The telecommunications landscape is increasingly defined by the convergence of fixed and mobile services, leading to intense rivalry as companies bundle offerings to capture market share. This strategy aims to provide customers with a single, comprehensive solution for their communication needs, thereby increasing customer loyalty and reducing churn.

BT Group, for instance, has been actively integrating its broadband, mobile, and TV services to present a more compelling and unified customer experience. This push for bundled packages intensifies competition as operators vie to offer the most attractive and cost-effective combinations.

- Convergence Trend: In 2024, the market continues to see a strong push towards bundled fixed and mobile services, with major players like BT Group enhancing their integrated offerings.

- Customer Retention: Bundling is a key strategy to reduce customer churn, a critical metric in the highly competitive telecom sector.

- Competitive Pressure: This convergence directly fuels competitive rivalry, forcing companies to innovate and differentiate their bundled packages to attract and retain subscribers.

- Market Dynamics: Operators are investing heavily in network infrastructure and service integration to support these bundled strategies, impacting overall industry profitability and investment.

Impact of Mergers and Acquisitions

Mergers and acquisitions are a significant force impacting BT Group's competitive rivalry. For instance, the UK's Competition and Markets Authority (CMA) approved the merger between Three and Vodafone in early 2024. This consolidation is expected to create a more formidable competitor, potentially altering spectrum holdings and network investment strategies across the UK mobile market.

This merger could lead to intensified competition for BT Group by creating a larger entity with potentially greater resources for infrastructure development and customer acquisition. The combined strength of Three and Vodafone might necessitate strategic adjustments from BT in areas like pricing, service offerings, and network upgrades to maintain its market position.

The implications of such large-scale consolidation are far-reaching:

- Increased Market Concentration: The Three-Vodafone merger reduces the number of major mobile operators in the UK from four to three, concentrating market power.

- Altered Investment Landscape: The merged entity's investment decisions in 5G and fiber infrastructure could set new benchmarks, pressuring BT to accelerate its own deployment plans.

- Potential for Price Wars: A stronger competitor may engage in more aggressive pricing strategies to gain market share, impacting BT's revenue streams.

- Spectrum Holdings Reshuffle: Changes in spectrum ownership resulting from the merger could affect BT's ability to offer competitive mobile services in the future.

Competitive rivalry within BT Group's operating environment is fierce, fueled by aggressive pricing and service innovation from major players like Virgin Media O2, Vodafone, and Sky. The ongoing expansion of full-fibre networks by alternative providers, such as CityFibre, further intensifies this rivalry by creating network duplication and challenging BT's established infrastructure dominance. This dynamic necessitates continuous investment and strategic adaptation from BT to maintain its market share and profitability.

| Competitor | Key Competitive Action (2024) | Impact on BT Group |

|---|---|---|

| Virgin Media O2 | Aggressive pricing on broadband and mobile bundles. | Pressure on ARPU, potential customer churn. |

| Vodafone | Merger with Three, creating a larger, more resource-rich competitor. | Increased market concentration, potential for altered investment strategies. |

| Sky | Continued focus on bundled TV, broadband, and mobile offerings. | Intensified competition in the convergent services market. |

| Alt-nets (e.g., CityFibre) | Rapid deployment of full-fibre networks, connecting millions of premises. | Direct challenge to Openreach's wholesale market, requiring investment to maintain competitiveness. |

SSubstitutes Threaten

Fixed Wireless Access (FWA), utilizing 4G and 5G, is a significant substitute for BT Group's traditional broadband. This is especially true in regions where fiber optic deployment is lagging. As 5G technology matures, FWA is becoming a more compelling option for households seeking high-speed internet.

The threat is amplified by the increasing capabilities of FWA. For instance, in 2024, many FWA providers are offering speeds comparable to entry-level fiber plans, making the switch more attractive. This directly challenges BT's market share in the home broadband sector.

Satellite broadband services, exemplified by SpaceX's Starlink, are increasingly presenting a viable alternative to traditional terrestrial broadband. This is particularly true for customers located in rural or underserved regions where high-quality wired or wireless internet access is scarce or altogether unavailable.

While currently occupying a smaller segment of the overall market, the expanding reach and improving capabilities of satellite internet, which saw significant user growth throughout 2023 and into early 2024, signal a growing potential threat to established providers like BT Group. For instance, Starlink reported reaching over 2 million users globally by the end of 2023, a substantial increase from earlier periods.

The rise of mobile-only lifestyles presents a significant threat of substitutes for BT Group. As more consumers, especially younger ones, rely exclusively on smartphones for internet and communication, unlimited or generous mobile data plans directly compete with traditional fixed-line broadband services. This shift can erode demand for BT's core offerings.

In 2024, the trend of mobile-first internet access continues to solidify. For instance, Ofcom reported that by the end of 2023, 39% of UK adults primarily used their mobile phone for internet access, a figure expected to grow. This increasing reliance on mobile data, often bundled with attractive plans by competitors, directly substitutes for the need for a home broadband connection, impacting BT's market share in fixed-line services.

Over-the-Top (OTT) Communication Services

Over-the-top (OTT) communication services like WhatsApp, Zoom, and Microsoft Teams present a significant threat of substitution to BT Group's traditional voice and video offerings. These internet-based platforms allow users to communicate freely, often at a lower cost or even for free, bypassing traditional carrier networks. This directly erodes BT's reliance on core voice revenue streams.

The widespread adoption of these OTT services directly impacts BT's revenue. For instance, the global mobile voice traffic has seen a substantial shift towards data-based communication. While specific figures for BT's voice revenue decline due to OTT are not publicly detailed, industry trends show a consistent decrease in traditional voice call minutes in favor of messaging and video calls over IP networks.

- Shift in Communication Habits: Consumers and businesses increasingly prefer instant messaging and video conferencing over traditional voice calls, directly impacting BT's legacy voice services.

- Cost-Effectiveness of OTT: Services like WhatsApp offer free voice and video calls, making them a highly attractive substitute for paid traditional telephony.

- Revenue Erosion: The substitution effect directly pressures BT's revenue from fixed-line and mobile voice services, forcing a strategic pivot towards data and digital offerings.

Private Networks and Localized Connectivity Solutions

The increasing adoption of private 5G networks and localized connectivity solutions presents a significant threat of substitution for BT Group's enterprise network services. Businesses are increasingly exploring dedicated, on-premises network infrastructure to meet specific operational demands, thereby lessening their dependence on traditional telecommunications providers like BT.

This trend is driven by the desire for greater control over network performance, security, and cost. For instance, industrial sectors requiring ultra-low latency and high bandwidth for applications like autonomous operations or real-time data analytics may find private networks a more suitable alternative than relying on shared public infrastructure.

According to industry reports from 2024, the global private wireless network market is experiencing robust growth, with projections indicating substantial expansion in the coming years. This indicates a clear shift where companies are willing to invest in their own connectivity solutions.

- Growing Market for Private 5G: The private 5G market is projected to reach tens of billions of dollars globally by the end of the decade, with significant investments already underway in 2024.

- Industry-Specific Needs: Sectors like manufacturing, logistics, and healthcare are leading the charge in adopting private networks due to stringent requirements for reliability and data privacy.

- Reduced Reliance on Telcos: As more enterprises build or outsource their private networks, the demand for traditional leased lines and managed network services from large carriers like BT could diminish.

- Technological Advancements: Innovations in edge computing and network slicing further enhance the appeal of private networks, offering tailored performance characteristics that public networks may struggle to match consistently.

The threat of substitutes for BT Group is multifaceted, encompassing alternative internet access technologies and evolving communication methods. Fixed Wireless Access (FWA) and satellite broadband are increasingly viable substitutes, particularly for users in underserved areas. Furthermore, the pervasive use of mobile-only lifestyles and Over-the-Top (OTT) communication services directly challenges BT's traditional broadband and voice offerings.

In 2024, these substitutes are gaining significant traction. FWA providers are matching entry-level fiber speeds, while satellite services like Starlink have surpassed 2 million users globally by the end of 2023. Mobile-first internet access is also prevalent, with 39% of UK adults primarily using their phones for internet by late 2023, according to Ofcom. This widespread adoption of alternatives directly erodes BT's market share and revenue streams.

| Substitute Technology | Key Characteristic | Impact on BT | 2023/2024 Data Point |

|---|---|---|---|

| Fixed Wireless Access (FWA) | High-speed wireless internet | Direct competitor to fixed broadband | Matching entry-level fiber speeds |

| Satellite Broadband (e.g., Starlink) | Internet access for underserved areas | Alternative for rural/remote users | Over 2 million global users (end of 2023) |

| Mobile-Only Lifestyle | Reliance on smartphones for internet | Reduces demand for fixed broadband | 39% of UK adults primarily mobile internet users (late 2023) |

| Over-the-Top (OTT) Services (e.g., WhatsApp, Zoom) | Internet-based communication | Threatens traditional voice/video revenue | Significant shift from traditional voice traffic to data-based communication |

Entrants Threaten

The telecommunications sector, particularly in the UK, demands substantial upfront capital for network infrastructure. This includes the costly deployment of fiber optic cables and the ongoing expansion of 5G networks. For instance, BT Group's ongoing investment in its fiber network is a significant undertaking, with the company aiming to connect millions of homes by the mid-2020s, requiring billions in capital expenditure.

The UK telecom market's intricate regulatory framework, overseen by Ofcom, presents a substantial hurdle for potential new entrants. Navigating complex licensing procedures, securing spectrum allocation, and adhering to stringent consumer protection and wholesale access regulations demand significant investment and expertise, effectively deterring many new players.

Established brand loyalty is a significant barrier for new entrants in the telecommunications sector. BT Group, for instance, has cultivated decades of customer trust and recognition, making it difficult for newcomers to attract a substantial market share. In 2024, customer retention rates for major providers like BT often exceed 90%, a testament to this loyalty.

Furthermore, while technological advancements are simplifying the switching process, perceived hassle and the fear of service disruption remain potent deterrents. Many consumers still associate BT with reliable service, and the effort involved in changing providers, even if reduced, can outweigh the perceived benefits of a new, unproven offering, especially for essential services like broadband and mobile plans.

Access to Existing Infrastructure (Openreach)

While Openreach, a part of BT Group, offers wholesale access to its extensive network, new entrants still encounter significant challenges and costs. Integrating with or replicating this existing infrastructure, especially in areas where Openreach's coverage is limited, presents a substantial barrier. For instance, the Equinox plan, designed to streamline access, still represents a complex framework that requires considerable investment and effort to navigate.

The threat of new entrants is somewhat mitigated by the high costs associated with accessing and integrating with Openreach's established infrastructure. New companies must not only factor in the wholesale charges but also the potential expenses of building out their own networks to complement or compete with Openreach’s reach. This capital expenditure can be prohibitive for smaller or less-funded entities aiming to enter the market.

- Infrastructure Integration Costs: New entrants face substantial costs when integrating with Openreach's existing network, including access fees and potential upgrade requirements.

- Network Duplication Expenses: Building out competing infrastructure in areas not adequately served by Openreach requires significant capital investment, acting as a deterrent.

- Regulatory Hurdles: Navigating the regulatory landscape surrounding access to essential telecommunications infrastructure, even with frameworks like Equinox, adds complexity and cost.

Technological Expertise and Talent Acquisition

The threat of new entrants for BT Group, particularly concerning technological expertise and talent acquisition, is significant. Building and maintaining cutting-edge telecommunications infrastructure demands deep knowledge in network design, cybersecurity, and rapidly evolving fields like artificial intelligence. New players must commit substantial resources to recruit and train top talent to even approach parity with established giants.

For instance, the global cybersecurity market was projected to reach $345.5 billion in 2024, highlighting the intense competition for skilled professionals. Similarly, the demand for AI specialists continues to soar, with salaries for experienced AI engineers often exceeding $200,000 annually in 2024. BT Group's ability to attract and retain this specialized talent is a critical factor in mitigating the threat from agile, technologically adept new entrants.

- High Capital Investment: New entrants need substantial upfront investment to acquire the necessary technological infrastructure and intellectual property.

- Talent Scarcity: Competition for skilled engineers in areas like 5G, fiber optics, and cybersecurity is fierce, driving up labor costs.

- Regulatory Hurdles: Navigating complex telecommunications regulations and obtaining licenses can be a significant barrier for newcomers.

- Brand Loyalty and Scale: Established players like BT benefit from existing customer bases and economies of scale, making it difficult for new entrants to gain market share quickly.

The threat of new entrants in the UK telecommunications market, while present, is significantly tempered by substantial barriers. High capital expenditure for network build-out, stringent regulatory requirements, and the established brand loyalty of incumbents like BT Group create a formidable entry landscape. Furthermore, the need for specialized technical expertise and the ongoing competition for talent in areas like cybersecurity and AI add further complexity for potential newcomers.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|---|

| Capital Investment | Building new network infrastructure (e.g., 5G, fiber) requires billions. | High barrier, limiting entrants to well-funded entities. | BT Group's fiber rollout involves multi-billion pound investments. |

| Regulatory Environment | Complex licensing, spectrum allocation, and compliance with Ofcom. | Requires significant legal and administrative resources. | Spectrum auctions alone can cost hundreds of millions. |

| Brand Loyalty & Switching Costs | Customers are often hesitant to switch from trusted providers. | Difficult to gain market share quickly. | Customer retention rates for major UK operators often exceed 90%. |

| Technical Expertise | Need for skilled personnel in network engineering, cybersecurity, AI. | Intense competition for talent drives up labor costs. | AI specialist salaries can exceed $200,000 annually. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BT Group is built upon a robust foundation of data, including BT's official annual reports, Ofcom regulatory filings, and industry-specific market research from firms like Statista and GlobalData. This blend of internal and external data ensures a comprehensive understanding of the competitive landscape.