BT Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BT Group Bundle

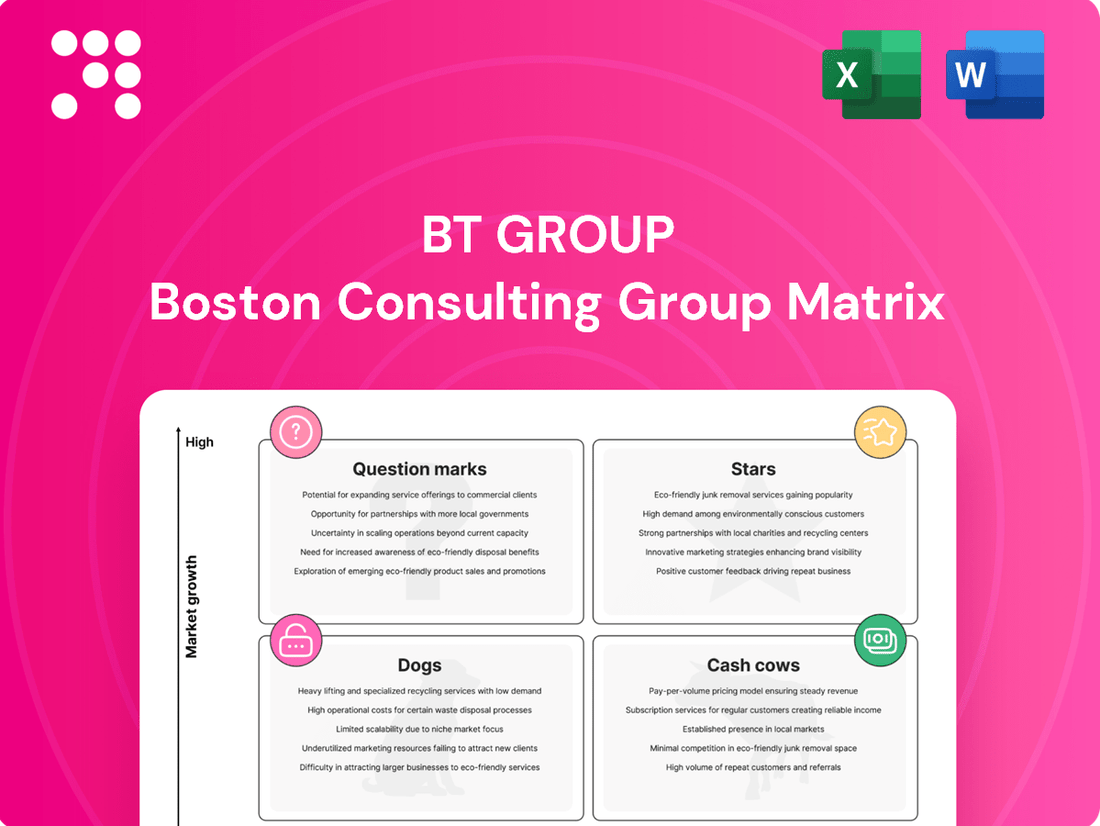

The BT Group BCG Matrix offers a powerful lens to understand its diverse portfolio, revealing which ventures are thriving (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or hold future potential but require investment (Question Marks). This initial glimpse highlights the strategic positioning of BT's key business units.

To truly harness this information and make informed decisions, dive into the full BCG Matrix report. It provides a granular breakdown of each product's placement, along with actionable strategies and data-driven insights to optimize resource allocation and drive future growth for BT.

Stars

Openreach, a division of BT Group, is aggressively expanding its Fibre to the Premises (FTTP) network across the UK, a segment experiencing significant market growth.

BT Group has achieved record build rates, passing over 1 million premises in recent quarters, and is on track to reach 25 million premises by the end of 2026, showcasing substantial investment and execution.

This extensive infrastructure rollout positions Openreach as a dominant player in the rapidly evolving broadband market, representing a strong growth prospect for BT Group.

Openreach's FTTP (Fibre to the Premises) connections are a clear Star in BT Group's BCG Matrix. Customer demand is robust, with net additions showing substantial year-on-year increases.

As of Q1 FY26, Openreach had connected 7.1 million premises, boasting a leading market take-up rate of 37%. This strong uptake in a rapidly expanding market segment highlights its high market share and future growth potential.

EE, a prominent brand under the BT Group, stands as a leader in 5G network expansion. By July 2024, EE's 5G network had achieved coverage for over 85% of the UK population, a significant milestone in its aggressive deployment strategy.

This extensive reach positions EE favorably to capitalize on the rapidly growing 5G market, capturing a substantial customer base. The company’s ongoing investment in network infrastructure and technological innovation solidifies its role as a primary growth engine for BT Group.

EE 5G Customer Base Growth

EE's 5G customer base has seen impressive expansion, reaching 13.5 million by the first quarter of fiscal year 2026. This substantial growth underscores the strong consumer appetite for advanced mobile technology.

This significant subscriber increase demonstrates EE's dominant market share within the rapidly evolving 5G mobile sector. The demand for next-generation connectivity is a key driver behind this upward trend.

- EE 5G Subscribers: 13.5 million by Q1 FY26

- Market Position: High market share in the 5G sector

- Growth Driver: Strong consumer adoption of next-generation mobile connectivity

Wholesale Fibre Services (Openreach)

Openreach's wholesale fibre services are a significant player in the UK market, experiencing robust growth. This expansion is largely fueled by the increasing adoption of Fibre to the Premises (FTTP) connections. The improved speed mix offered by these services is also contributing to a higher average revenue per user (ARPU).

As the UK's main wholesale provider of fixed access network infrastructure, Openreach is well-positioned to capitalize on the nationwide shift towards fibre technology. This dominance solidifies its standing in the market.

- Openreach's FTTP deployments reached 14.7 million premises by the end of March 2024.

- The company aims to reach 25 million premises by the end of 2026.

- Wholesale revenue from Openreach increased by 8% year-on-year in the fiscal year ending March 2024, reaching £5.7 billion.

- This growth reflects the increasing demand for higher-speed broadband services.

Openreach's FTTP network is a prime example of a Star within BT Group's portfolio. The company is aggressively expanding its fibre infrastructure, having passed 14.7 million premises by March 2024 and targeting 25 million by the end of 2026. This substantial investment is met with strong market demand, as evidenced by a significant year-on-year wholesale revenue increase of 8% to £5.7 billion for the fiscal year ending March 2024.

| BT Group Business Unit | BCG Category | Key Metrics (as of latest available data) | Growth Outlook |

|---|---|---|---|

| Openreach (FTTP) | Star | 14.7 million premises passed (March 2024); £5.7 billion wholesale revenue (FY24); 8% YoY revenue growth | High, driven by nationwide fibre adoption and increased ARPU |

| EE (5G) | Star | 85%+ UK population 5G coverage (July 2024); 13.5 million 5G subscribers (Q1 FY26) | High, fueled by consumer demand for advanced mobile connectivity |

What is included in the product

The BT Group BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, recommending which units to grow, maintain, or divest for optimal portfolio performance.

The BT Group BCG Matrix offers a clear, one-page overview, instantly identifying each business unit's strategic position to relieve the pain of complex portfolio analysis.

Cash Cows

BT Group's overall broadband customer base, including brands like BT, EE, and Plusnet, stands as a significant cash cow. As of March 2025, the company boasted over 8.8 million broadband subscribers in the UK, the largest in the market.

This extensive customer base in a mature sector generates reliable and substantial cash flow. Despite potentially modest revenue growth per customer, the sheer volume ensures a stable financial bedrock for BT Group.

BT's existing fixed-line broadband services, especially those not yet upgraded to full fibre, are a solid revenue generator. This established customer base, benefiting from BT's strong brand, provides a predictable income stream. For the fiscal year ending March 31, 2024, BT reported a total of 6.9 million broadband connections, with a significant portion still on older copper-based technology.

BT's legacy mobile subscriptions, those not on 5G, represent a significant cash cow. These customers, on older, established plans, consistently contribute to revenue. Despite a mature and competitive mobile market, with modest price increases and a trend towards SIM-only deals, the sheer volume of these subscribers provides a reliable and predictable income stream for BT.

This segment benefits from reduced marketing expenditure, as it doesn't require the same level of investment as emerging technologies like 5G. In 2023, BT reported that its consumer division, which includes mobile, generated £7.9 billion in revenue, showcasing the ongoing importance of its established subscriber base.

Wholesale Copper Broadband (Openreach)

Wholesale Copper Broadband, operated by Openreach within BT Group, represents a classic Cash Cow in the BCG Matrix. Despite the significant push towards fibre, a substantial portion of broadband connections still utilize the existing copper network, ensuring a consistent revenue stream. This segment is characterized by its maturity and declining market share, yet it remains highly profitable due to the minimal ongoing investment needed for maintenance and promotion.

The cash generated from copper broadband is crucial for funding BT’s strategic investments, particularly the extensive fibre rollout. In 2024, Openreach continued to leverage its copper assets, with a significant number of UK households still connected via this technology, even as fibre deployment accelerated. This sustained revenue allows BT to reinvest in future growth areas without needing external financing for its core operations.

- Stable Revenue Generation: Copper broadband lines continue to provide a predictable and substantial revenue for Openreach, supporting overall BT Group profitability.

- Low Investment Requirement: As a mature technology, copper infrastructure requires minimal new capital expenditure, allowing for high cash flow conversion.

- Funding Future Growth: Profits from this Cash Cow are instrumental in financing the capital-intensive transition to full-fibre broadband across the UK.

- Bridging Technology Gap: The copper network serves as a vital link, maintaining service for customers during the ongoing fibre upgrade process.

Core Enterprise Network Services

BT's Core Enterprise Network Services function as a classic Cash Cow within the BCG Matrix. These services are fundamental to the operations of businesses and public sector entities, forming an integral part of their infrastructure. The critical nature of reliable connectivity ensures a steady demand and supports stable, recurring revenue streams, often bolstered by long-term contracts.

This segment, while not characterized by rapid expansion, is a significant generator of consistent cash flow for BT Group. For instance, in the fiscal year ending March 2024, BT reported substantial revenue from its Global division, which encompasses enterprise network services, underscoring the segment's reliable financial contribution.

- Stable Revenue: Long-term contracts for essential network services provide predictable income.

- Critical Infrastructure: Businesses rely heavily on these services, ensuring continued demand.

- Cash Generation: The segment consistently generates cash flow, supporting other business areas.

- Mature Market: While growth is modest, the established nature of the market ensures stability.

BT's legacy mobile services, particularly those on older plans and not yet upgraded to 5G, represent a significant cash cow. These subscribers, while perhaps not driving high growth, contribute a predictable and substantial revenue stream. In 2023, BT's consumer division, which includes mobile, generated £7.9 billion in revenue, highlighting the enduring value of its established customer base.

This segment benefits from lower marketing costs compared to newer technologies, as it serves a mature and loyal customer base. The sheer volume of these legacy mobile connections ensures a stable financial contribution, allowing BT to allocate resources to more dynamic growth areas.

BT's wholesale copper broadband services, managed by Openreach, continue to be a strong cash cow. Despite the ongoing fibre rollout, a significant number of UK homes still rely on copper connections, generating consistent revenue with minimal new investment. This segment's profitability is crucial for funding BT's strategic fibre expansion.

For the fiscal year ending March 31, 2024, Openreach reported a substantial number of connections still utilizing copper technology, even as fibre deployment progressed. This sustained income from copper infrastructure provides the financial flexibility needed for BT's ambitious network upgrades.

| Segment | BCG Category | Key Characteristics | Financial Contribution (FY24 Est.) |

|---|---|---|---|

| Legacy Mobile Services | Cash Cow | Mature market, high subscriber volume, low investment needs | Significant recurring revenue |

| Wholesale Copper Broadband | Cash Cow | Established infrastructure, stable demand, minimal capex | Consistent revenue stream supporting fibre investment |

Delivered as Shown

BT Group BCG Matrix

The preview of the BT Group BCG Matrix you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report for immediate application in your business planning.

Dogs

The Public Switched Telephone Network (PSTN) and its associated copper voice services represent a classic example of a Question Mark in BT Group's BCG Matrix. This analogue technology, while foundational, is rapidly becoming obsolete, facing increasing fragility and a mandated retirement by January 2027.

BT is actively migrating customers away from these legacy copper lines. The market for these services is shrinking, evidenced by declining revenues and increasing maintenance costs that far outweigh the diminishing returns, making them a strategic challenge for the company.

Legacy wholesale line rental products, primarily reliant on the aging copper network, are firmly positioned in the Dogs quadrant of the BCG Matrix for BT Group. This is largely due to the ongoing Public Switched Telephone Network (PSTN) switch-off, which is rendering these services obsolete and causing substantial line losses for Openreach.

These products exhibit characteristics of low market share and low growth, a classic indicator of a Dog. As BT Group redirects investment towards modernizing its infrastructure and phasing out these legacy offerings, they are increasingly becoming a cash trap. Resources are being consumed by decommissioning efforts rather than being allocated to areas with growth potential.

BT's global and portfolio channels outside the UK are currently facing significant headwinds, leading to a downturn in revenue. These international segments are characterized by low market share and limited growth prospects.

In response, BT is strategically shrinking its international presence, actively divesting from these underperforming operations. For instance, in the fiscal year ending March 2024, BT Group reported a decline in its Global segment revenue, underscoring the challenges in these markets.

This divestment strategy allows BT to reallocate resources and concentrate its efforts on capitalizing on more promising domestic growth opportunities within the UK market.

Outdated Business Managed Contracts

The 'Outdated Business Managed Contracts' segment within BT Group's BCG Matrix is characterized by a decline stemming from legacy managed contracts and a reduction in sales within low-margin segments. This reflects BT's strategic shift away from older, less profitable services towards more modern, high-value digital offerings for businesses.

This division faces challenges as the market evolves and demand for older technologies wanes. BT's focus is on migrating customers to newer, more efficient solutions, which naturally impacts the revenue generated by these legacy contracts.

- Legacy Contract Decline: The company is actively phasing out older, less profitable managed contracts.

- Low-Margin Sales Reduction: BT is strategically reducing its engagement in low-margin business areas.

- Portfolio Simplification: This aligns with BT's broader strategy to streamline its offerings and concentrate on future-oriented digital services.

- Focus on Next-Gen Solutions: The emphasis is on enterprise solutions that leverage current and emerging technologies.

Low-Margin Handset Sales in Consumer Division

BT Group's Consumer division has seen weaker handset sales, impacting overall revenue. This points to a product area with low profit margins and minimal strategic value for BT's future expansion.

The company's focus might be better served by channeling resources into its core connectivity services, rather than competing in the hardware market.

- Handset sales: Contributed to a revenue decline in BT's Consumer division.

- Profit margins: Identified as low within this product category.

- Strategic importance: Limited for future growth compared to core services.

- Resource allocation: Suggestion to prioritize connectivity services over hardware.

Legacy wholesale line rental products, heavily reliant on the aging copper network, are firmly categorized as Dogs within BT Group's BCG Matrix. These services are experiencing a significant decline due to the ongoing Public Switched Telephone Network (PSTN) switch-off, leading to substantial losses for Openreach.

These offerings exhibit low market share and minimal growth, a defining characteristic of Dogs. BT is actively divesting from underperforming international segments, such as its Global division, which saw revenue decline in the fiscal year ending March 2024. This strategic move allows for resource reallocation towards more promising domestic opportunities.

The Consumer division's weaker handset sales also represent a Dog, characterized by low profit margins and limited strategic value. BT's focus is shifting towards its core connectivity services, rather than competing in the hardware market.

BT's legacy business managed contracts are also in the Dog quadrant, facing declining sales due to the market's evolution away from older technologies. The company is actively simplifying its portfolio by phasing out these less profitable contracts and concentrating on future-oriented digital offerings.

| BCG Category | BT Group Segments | Key Characteristics | Financial Impact (FY24 Est.) | Strategic Action |

|---|---|---|---|---|

| Dogs | Legacy Wholesale Line Rental | Obsolete due to PSTN switch-off, declining revenue, high maintenance costs | Significant losses for Openreach | Phasing out, decommissioning |

| Dogs | International Operations (e.g., Global segment) | Low market share, limited growth prospects, revenue downturn | Revenue decline reported in FY24 | Divestment, shrinking presence |

| Dogs | Consumer Handset Sales | Weak sales, low profit margins, minimal strategic value | Contributed to revenue decline in Consumer division | Reduced focus, reallocation of resources |

| Dogs | Outdated Business Managed Contracts | Declining sales, low-margin segments, legacy technology | Reduction in revenue from older contracts | Phasing out, migration to new solutions |

Question Marks

BT's 5G Standalone (SA) services represent a high-growth potential area within the BCG matrix, driven by its advanced capabilities like ultra-low latency and massive device connectivity. However, the current rollout is limited to select UK locations, indicating an early stage of market penetration and requiring substantial investment to achieve wider adoption.

While BT's overall 5G network coverage is a competitive advantage, the full realization of 5G SA's benefits is still developing. As of early 2024, the widespread availability of true 5G SA across the UK is limited, meaning its market share and revenue generation are nascent, placing it firmly in the question mark category due to its high growth potential but uncertain market position.

BT's advanced cybersecurity solutions, encompassing areas like hardware memory safety through its involvement in the CHERI Alliance, represent a strategic play in a rapidly expanding market. This segment is fueled by the constant escalation of cyber threats, making it a high-growth opportunity.

While BT is making significant investments, its current market share in these specialized, cutting-edge cybersecurity offerings, beyond traditional network security, is likely still in its early stages. Achieving substantial penetration will require continued focus and execution.

BT is strategically expanding its enterprise offerings into cloud computing and Internet of Things (IoT), recognizing these as crucial drivers of digital transformation. These sectors are experiencing robust growth, with the global IoT market projected to reach $1.1 trillion by 2024, and the cloud computing market continuing its upward trajectory.

Despite the significant market potential, BT faces intense competition from established cloud giants. Its current market share in these specialized areas is relatively small, necessitating considerable investment to build brand recognition, develop advanced capabilities, and achieve substantial profitability.

Network-as-a-Service (NaaS) Platform (Global Fabric)

BT's Global Fabric, a Network-as-a-Service (NaaS) platform, positions itself as a key player in the high-growth segment of agile, cloud-driven networking for large organizations. This innovative offering provides flexible, on-demand connectivity, aiming to meet the evolving needs of businesses reliant on dynamic network solutions.

While Global Fabric targets a promising market, its status as a relatively new product means its market adoption and share are still developing. BT is likely investing strategically to foster widespread acceptance and build momentum in this competitive space.

- Market Opportunity: The NaaS market is projected to grow significantly, with some analysts estimating it could reach over $100 billion globally by 2027, driven by increasing cloud adoption and digital transformation initiatives.

- BT's Position: Global Fabric aims to capture a share of this expanding market by offering a flexible, scalable, and programmable network infrastructure.

- Strategic Importance: For BT, Global Fabric represents a move towards more service-oriented, recurring revenue models, aligning with industry trends and customer demands for adaptable connectivity solutions.

- Challenges: Early-stage adoption for new platforms like Global Fabric often involves overcoming customer inertia, demonstrating clear ROI, and building robust channel partnerships to achieve significant market penetration.

Generative AI (GenAI) Integration and Applications

BT's Digital Unit launched its GenAI Gateway in September 2024, a strategic move to harness large language models. This platform aims to boost internal efficiencies and explore new service possibilities within a high-growth technology sector.

The GenAI Gateway is positioned as an investment in a rapidly evolving field. While its direct revenue generation and market share are still developing, BT's 2024 investment signifies a commitment to future innovation in AI-driven solutions.

- GenAI Gateway Launch: September 2024.

- Objective: Internal efficiencies and new service development.

- Market Position: Exploring a high-growth, rapidly evolving technological area.

- Revenue Impact: Commercial market share and direct revenue from these specific AI applications are yet to be fully realized.

BT's 5G Standalone (SA) services, while promising ultra-low latency and massive connectivity, are currently in limited UK rollout as of early 2024. This early market penetration, despite high growth potential, places it in the question mark category due to its uncertain market position and significant investment needs for wider adoption.

BT's advanced cybersecurity solutions, including hardware memory safety initiatives, target a rapidly expanding market driven by escalating cyber threats. However, its market share in these specialized, cutting-edge offerings is still developing, requiring continued focus and investment to achieve substantial penetration.

BT's expansion into cloud computing and IoT faces intense competition from established players, with its current market share in these high-growth sectors remaining relatively small. Significant investment is needed to build brand recognition and develop advanced capabilities to achieve profitability.

BT's Global Fabric, a Network-as-a-Service (NaaS) platform, targets the growing demand for agile networking. While the NaaS market is projected to exceed $100 billion globally by 2027, Global Fabric's market adoption is still developing, necessitating strategic investment to foster acceptance.

BT's September 2024 GenAI Gateway launch aims to leverage large language models for internal efficiencies and new services. This investment is in a high-growth technology sector, but its direct revenue generation and market share are still in the developmental stages.

| Business Unit | BCG Category | Market Growth | Market Share | Key Considerations |

| 5G Standalone (SA) | Question Mark | High | Low/Developing | Limited rollout, high investment needed. |

| Advanced Cybersecurity | Question Mark | High | Low/Developing | Specialized offerings, requires continued focus. |

| Cloud & IoT Enterprise | Question Mark | High | Low | Intense competition, significant investment required. |

| Global Fabric (NaaS) | Question Mark | High (Projected >$100bn by 2027) | Developing | New platform, requires strategic investment for adoption. |

| GenAI Gateway | Question Mark | Very High | Developing | New launch, revenue impact still to be realized. |

BCG Matrix Data Sources

Our BT Group BCG Matrix leverages comprehensive data from BT's annual reports, public financial filings, and industry-specific market research to accurately assess business unit performance and market share.