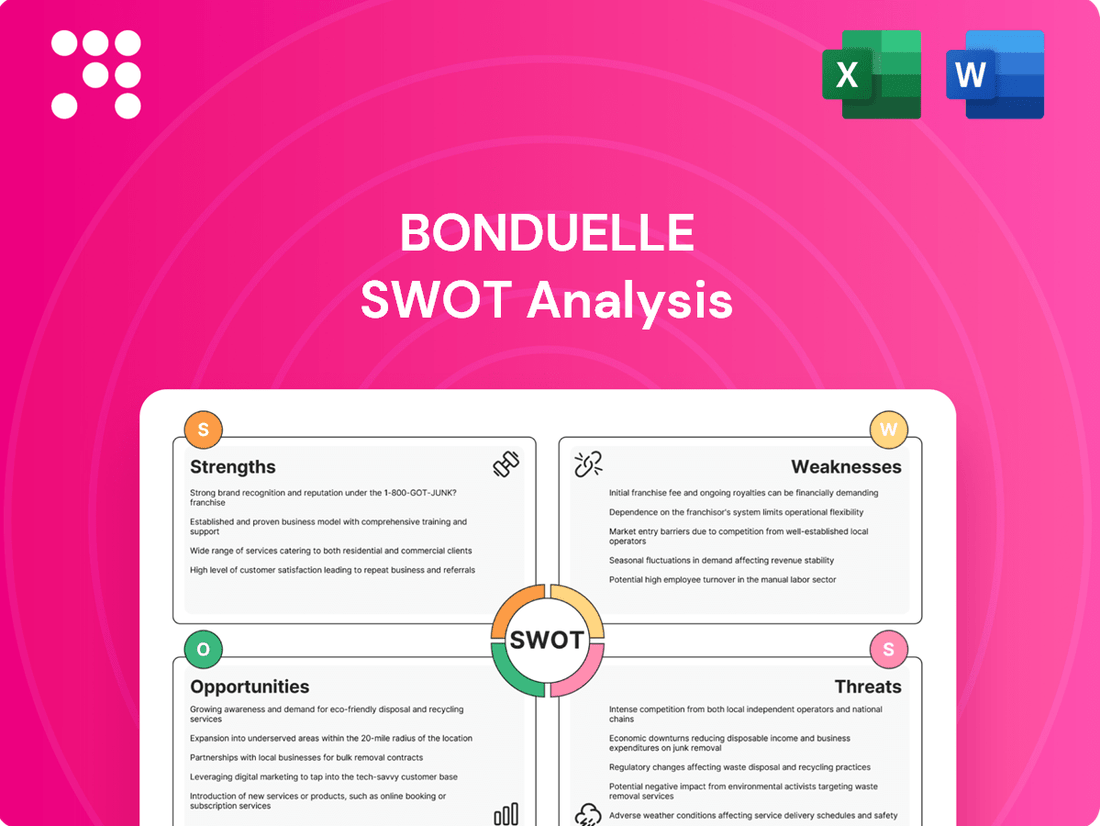

Bonduelle SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bonduelle Bundle

Bonduelle's market presence is shaped by its strong brand recognition in the vegetable sector, yet it faces challenges in adapting to evolving consumer preferences and intense competition. Understanding these dynamics is crucial for any stakeholder navigating the food industry.

Want the full story behind Bonduelle's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bonduelle stands as a dominant force in the global processed vegetables sector, a leadership position solidified across canned, frozen, and fresh-cut segments. This expansive reach translates into significant advantages, including the ability to capitalize on economies of scale and maintain high brand recognition on an international stage. The company's diverse distribution network effectively serves both consumer retail and the foodservice industry in numerous countries.

Bonduelle boasts a remarkably diverse product portfolio, encompassing everything from conventional processed vegetables to convenient ready-to-eat salads and complete meal solutions. This extensive range effectively addresses a wide spectrum of consumer tastes and requirements, mitigating the risk associated with over-dependence on any single product line.

The company’s commitment to innovation is evident in its recent launches, such as plant-based lunch bowls. This strategic move taps into the burgeoning market for natural and healthy food options, further strengthening its competitive position.

Bonduelle enjoys significant strength from its portfolio of widely recognized brands like Bonduelle, Cassegrain, Globus, and Ready Pac Foods. These established names cultivate deep consumer trust and loyalty, a key factor in the positive performance of its branded segments, even when overall sales experience a dip.

The company's commitment to nurturing these brands is a cornerstone of its strategic direction, as emphasized in its 'Transform to win' plan. This focus ensures continued investment in brand equity, reinforcing their market position and consumer appeal in the competitive food industry.

Commitment to Sustainability and B Corp Ambition

Bonduelle's dedication to sustainable agriculture and healthy eating is a significant strength, underscored by its ambitious goal to achieve 100% B Corp certification by the close of 2025. This commitment appeals to a growing segment of environmentally and socially conscious consumers, bolstering brand image and market positioning.

The company's B! Pact strategy outlines concrete objectives for minimizing ecological footprints and championing plant-based diets, aligning with evolving consumer preferences and regulatory trends.

- Sustainability Focus: Bonduelle aims for 100% B Corp certification by end of 2025.

- Consumer Appeal: Strong environmental and social responsibility resonates with conscious consumers.

- Brand Differentiation: Sustainability efforts enhance brand reputation and market standing.

- B! Pact Strategy: Includes targets for reduced environmental impact and promotion of plant-based foods.

Extensive Global Reach and Supply Chain

Bonduelle's extensive global reach, operating in nearly 100 countries, is a significant strength. This vast international footprint, coupled with a well-developed supply chain network, allows for diversified revenue streams and mitigates risks associated with reliance on any single market. For instance, in its 2023-2024 fiscal year, Bonduelle reported a strong performance across its various international segments, demonstrating the resilience provided by its global diversification.

The company is strategically investing in enhancing its supply chain efficiency, leveraging digitalization and artificial intelligence. This focus on modernization is crucial for maintaining competitiveness and ensuring product availability across its wide operational area. By integrating advanced technologies, Bonduelle aims to optimize logistics, reduce waste, and improve overall operational agility in a dynamic global market.

Key aspects of this strength include:

- Global Presence: Operations in approximately 100 countries provide market diversification.

- Supply Chain Network: A robust network supports efficient distribution and sourcing worldwide.

- Revenue Diversification: Reduced dependence on any single geographical market enhances financial stability.

- Digitalization Initiatives: Ongoing efforts to improve supply chain efficiency through AI and digital tools.

Bonduelle's extensive brand portfolio, featuring names like Bonduelle, Cassegrain, and Ready Pac Foods, fosters significant consumer trust and loyalty. This brand equity contributes to positive performance in branded segments, even during broader market fluctuations, as highlighted in their strategic focus on brand investment within the 'Transform to win' plan.

The company's commitment to sustainability, aiming for 100% B Corp certification by the end of 2025, strongly appeals to the growing market of environmentally conscious consumers. This focus on ecological and social responsibility, detailed in their B! Pact strategy, enhances brand image and market differentiation.

Bonduelle's global operational footprint, spanning nearly 100 countries, provides crucial market diversification and revenue stability. This broad reach, supported by ongoing supply chain modernization through digitalization and AI, ensures resilience against regional economic downturns.

| Strength Aspect | Description | Supporting Data/Example |

|---|---|---|

| Brand Portfolio | Strong consumer recognition and loyalty across multiple established brands. | Brands like Bonduelle and Ready Pac Foods drive consistent sales. |

| Sustainability Leadership | Commitment to ethical and environmental practices appeals to conscious consumers. | Targeting 100% B Corp certification by end of 2025. |

| Global Diversification | Operations in ~100 countries reduce reliance on single markets. | Fiscal year 2023-2024 performance showed resilience across international segments. |

| Innovation in Products | Development of new offerings like plant-based meals taps into market trends. | Successful launches in the healthy and natural food segment. |

What is included in the product

Delivers a strategic overview of Bonduelle’s internal and external business factors, highlighting its brand recognition and market leadership alongside challenges in supply chain and evolving consumer preferences.

Bonduelle's SWOT analysis offers a clear roadmap to address competitive pressures and capitalize on growing plant-based trends.

Weaknesses

Bonduelle's private label segment has faced a notable challenge, with sales dropping 6.9% in the first half of fiscal year 2024-2025. This decline is particularly concerning when viewed against the backdrop of growth in the company's branded product lines, suggesting a potential strategic misstep or pricing disadvantage in the private label arena.

Further exacerbating this weakness, contracted volume delivery delays from key European clients directly hampered sales in the canned private label category. This points to issues in supply chain reliability or customer relationship management within this specific segment.

Bonduelle has faced significant financial headwinds, reporting a consolidated net loss of -€5 million in the first half of fiscal year 2024-2025. This follows a more substantial net loss of -€119.8 million for the entirety of fiscal year 2023-2024.

A key contributor to the prior year's loss was a considerable impairment charge impacting its North American fresh produce operations. These recurring negative net income figures raise concerns about the company's underlying profitability and its ability to generate consistent earnings.

Bonduelle's reliance on agricultural outputs exposes it to significant volatility. For instance, a poor harvest in Russia is projected to negatively impact the company's performance in the latter half of fiscal year 2024-2025, underscoring the direct link between agricultural yields and financial results.

This dependence means that unpredictable weather patterns and agricultural diseases can disrupt supply chains and inflate raw material costs, directly affecting profitability. The company's ability to manage these inherent agricultural risks is a key determinant of its financial stability.

Struggles in Specific Fresh Segments

Bonduelle has encountered difficulties in particular fresh product categories. This is evidenced by the company's decision to sell its packaged salad operations in France and Germany. This move, intended to boost financial performance, highlights a long-term downturn in salad consumption within France, a trend observed over the last ten years.

Further illustrating these challenges, Bonduelle's fresh food operations in North America experienced a significant impairment charge. This indicates a substantial write-down in the value of these assets due to underperformance or changing market conditions.

- Divestment of Packaged Salads: Bonduelle is exiting packaged salad businesses in France and Germany.

- Market Decline: French salad consumption has seen a structural decline over the past decade.

- North American Impairment: A substantial impairment charge was recorded for North American fresh activities.

Impact of Macroeconomic Headwinds

Bonduelle faces significant challenges from global macroeconomic headwinds. Economic uncertainties, geopolitical tensions, and declining consumer purchasing power directly impact food spending, potentially leading to reduced sales volumes and profitability. For instance, the Europe Zone, a key market, has seen a notable deceleration in its business activity, directly affecting Bonduelle's performance in that region.

These external pressures translate into tangible financial risks for the company. A widespread erosion of consumer purchasing power can force shoppers to trade down to cheaper alternatives or reduce overall consumption of packaged food products. This dynamic was evident in the first half of fiscal year 2024, where Bonduelle reported a 1.4% decrease in its Europe Zone revenue, highlighting the immediate impact of these adverse economic conditions.

The company's reliance on consumer spending makes it particularly vulnerable to these macroeconomic shifts.

- Economic Uncertainty: Global economic slowdowns and volatility create an unpredictable operating environment.

- Consumer Tensions: Rising inflation and cost-of-living pressures reduce discretionary spending on food items.

- Geopolitical Instability: Conflicts and trade disputes can disrupt supply chains and increase operational costs.

- Regional Slowdown: Specific markets, like the Europe Zone, are experiencing direct impacts on business activity.

Bonduelle's private label segment is struggling, with a 6.9% sales drop in the first half of fiscal year 2024-2025, indicating potential issues with pricing or strategy compared to its branded offerings. Delays in contracted volume deliveries for canned private label products in Europe further highlight operational challenges and customer relationship management gaps.

The company's financial performance remains a significant weakness, marked by a consolidated net loss of -€5 million in H1 FY2024-2025, following a substantial -€119.8 million loss in FY2023-2024. This persistent unprofitability is partly due to a significant impairment charge in its North American fresh produce operations.

Bonduelle's direct exposure to agricultural volatility is a key vulnerability. A projected negative impact from a poor Russian harvest in H2 FY2024-2025 demonstrates how agricultural yields directly affect financial results, with weather and disease posing ongoing risks to supply chains and costs.

The company is also divesting its packaged salad operations in France and Germany due to a decade-long structural decline in French salad consumption, underscoring difficulties in specific fresh product categories. This is compounded by a substantial impairment charge for North American fresh activities, signaling underperformance in that segment.

Macroeconomic headwinds, including economic uncertainty, geopolitical tensions, and reduced consumer purchasing power, pose a significant threat. The Europe Zone, a crucial market, has experienced a deceleration in business activity, contributing to a 1.4% revenue decrease in H1 FY2024, directly impacting Bonduelle's performance.

Full Version Awaits

Bonduelle SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis for Bonduelle, giving you a clear understanding of its strengths, weaknesses, opportunities, and threats. Purchase unlocks the complete, in-depth report for your strategic planning needs.

Opportunities

The global shift towards plant-rich diets and healthier eating habits is a major opportunity for Bonduelle. This growing consumer preference for plant-based options directly fuels demand for the company's core products.

The frozen vegetable market is a key area of growth, with projections indicating substantial expansion by 2035. This surge is largely attributed to increasing urbanization, which often leads to a greater need for convenient, ready-to-eat food solutions like those offered by Bonduelle.

Bonduelle's strategic mission to encourage a transition to plant-based eating perfectly positions the company to capitalize on this expanding market. This alignment ensures that the company is well-placed to meet evolving consumer needs and preferences in the coming years.

The demand for convenient, ready-to-eat meals is on the rise, especially with younger demographics like Gen Z showing a strong preference for these options. Bonduelle's introduction of plant-based Lunch Bowls in North America highlights their ability to tap into this growing market. This strategic move positions them well to capitalize on evolving consumer habits.

Bonduelle's investment in plant-based innovation, such as their Lunch Bowls, directly addresses a key market trend. The global plant-based food market, valued at approximately USD 20 billion in 2023, is projected to grow significantly, offering substantial revenue potential. Expanding these convenient, healthy meal solutions can further solidify Bonduelle's market position and drive future sales growth.

Bonduelle's deep-rooted commitment to sustainability, exemplified by its pursuit of B Corp certification and significant investments in regenerative agriculture, presents a prime opportunity to boost its brand image. This focus resonates strongly with today's consumers, who actively seek out and support businesses demonstrating genuine environmental and social responsibility.

In 2024, a significant majority of consumers, around 70%, indicated they are willing to pay more for products from sustainable brands, highlighting a clear market demand. By effectively communicating its eco-friendly practices and ethical sourcing, Bonduelle can carve out a distinct competitive advantage, attracting a growing segment of environmentally conscious shoppers and potentially increasing its market share in the plant-based food sector.

Strategic Portfolio Optimization

Bonduelle’s strategic divestment of underperforming assets, such as its packaged salad operations in France and Germany, represents a significant opportunity. This move, a core component of the 'Transform to win' strategy, liberates capital and management focus. By shedding these less profitable segments, the company can reallocate resources towards higher-growth and more margin-accretive areas within its portfolio.

This optimization directly supports an enhanced focus on core competencies and more attractive market segments. For instance, the company has been investing in plant-based alternatives and ready-to-eat meals, areas showing stronger consumer demand. This strategic pruning is designed to bolster overall operating profitability and strengthen Bonduelle's competitive position in its key markets, aiming for improved financial performance in the 2024-2025 period.

- Divestment of Packaged Salads: Exited French and German packaged salad businesses as part of portfolio streamlining.

- Resource Reallocation: Redirecting capital and management attention to more promising, growth-oriented segments.

- Profitability Enhancement: Aiming to improve overall operating profitability through strategic focus.

- 'Transform to Win' Alignment: This action directly supports the company's broader strategic plan for enhanced competitiveness.

Digital Transformation and AI in Supply Chain

Bonduelle is poised to leverage digital transformation and AI to revolutionize its supply chain. This strategic focus is critical for enhancing integration and operational efficiency. By embracing these technologies, the company can expect to see more intelligent and rapid decision-making processes, a reduction in operational expenditures, and a bolstered ability to adapt swiftly to shifting market needs.

The integration of AI and digital tools offers a pathway to significant competitive differentiation. For instance, advanced analytics can optimize inventory management, predict demand fluctuations with greater accuracy, and streamline logistics. Companies that effectively implement these solutions often report substantial improvements in delivery times and a decrease in waste. In 2024, the global market for AI in supply chain management was projected to reach over $10 billion, highlighting the significant growth and adoption of these technologies across industries.

- Enhanced Visibility: AI-powered platforms can provide real-time tracking of goods from farm to fork, improving transparency.

- Predictive Maintenance: Utilizing AI to anticipate equipment failures in processing plants and logistics can minimize downtime.

- Demand Forecasting: Advanced algorithms can analyze historical data, weather patterns, and market trends to predict consumer demand more accurately, reducing overstocking and stockouts.

- Route Optimization: AI can optimize delivery routes, cutting fuel costs and delivery times, which is particularly relevant for a company with a global distribution network like Bonduelle.

Bonduelle's strategic focus on plant-based foods aligns perfectly with the growing global demand for healthier and more sustainable options. This trend is projected to continue its upward trajectory, creating a significant market opportunity for the company's core offerings.

The company's commitment to innovation, particularly in convenient, ready-to-eat plant-based meals like their Lunch Bowls, directly addresses the preferences of younger consumers. This segment shows a strong inclination towards quick, healthy, and plant-forward food choices.

Bonduelle's proactive approach to sustainability, including its pursuit of B Corp certification and investment in regenerative agriculture, is a key differentiator. With approximately 70% of consumers in 2024 willing to pay more for products from sustainable brands, this commitment can significantly enhance brand loyalty and market appeal.

The divestment of less profitable packaged salad operations in France and Germany allows Bonduelle to reallocate resources toward higher-growth areas, such as plant-based alternatives. This strategic streamlining is expected to improve overall profitability and strengthen its competitive stance in key markets through 2025.

Threats

The processed vegetable and ready-to-eat food sectors are crowded spaces, featuring a multitude of both local and global competitors. This fierce rivalry can exert considerable pressure on Bonduelle's pricing strategies, profit margins, and overall market standing. For instance, in 2024, the global frozen vegetable market alone was valued at approximately $45 billion and is projected to grow, indicating significant competitive activity.

To navigate this challenging landscape and preserve its leadership, Bonduelle must consistently focus on product innovation and differentiation. Staying ahead requires not just offering quality products but also developing unique offerings that capture consumer attention and loyalty amidst a sea of similar options.

Bonduelle's reliance on agricultural products means it's susceptible to fluctuating raw material costs and supply chain issues. Events like climate change, crop diseases, or geopolitical instability can significantly impact the availability and price of key ingredients. For instance, a poor harvest in a major growing region, such as the impact of drought on corn yields in parts of Europe in recent years, can directly affect Bonduelle's production costs and the availability of its finished goods.

Consumers are increasingly wary of processed foods, citing concerns about high sodium, fat content, and artificial additives. This sentiment, amplified by a growing awareness of health and wellness, poses a significant challenge for companies like Bonduelle that offer traditionally processed vegetable products.

The rise of plant-based diets, while potentially an opportunity, also highlights a parallel shift towards fresh, minimally processed options. This preference for natural ingredients could directly impact the demand for Bonduelle's more processed offerings, potentially hindering long-term volume expansion in these segments.

Economic Downturns and Erosion of Purchasing Power

Global economic instability and rising inflation are significant threats, directly impacting consumer spending on food. As inflation erodes purchasing power, consumers are likely to shift towards more budget-friendly options, potentially favoring private labels over branded products like those offered by Bonduelle. This trend could lead to a noticeable decrease in sales volume and overall revenue for the company.

For instance, in 2024, many economies are grappling with persistent inflation, with some regions experiencing annual inflation rates exceeding 5% (as reported by various international financial institutions). This economic pressure forces consumers to make difficult choices, often cutting back on discretionary spending and seeking value for money in their grocery purchases.

- Reduced Consumer Spending: Inflationary pressures in 2024 have demonstrably lowered real household incomes in many developed and developing economies.

- Shift to Private Labels: Retail data from late 2023 and early 2024 indicates a growing market share for private label brands across various food categories.

- Volume Decline: A direct consequence of reduced purchasing power and brand switching is a potential contraction in the overall volume of branded food products sold.

- Margin Pressure: To remain competitive, Bonduelle might face pressure to lower prices or absorb higher input costs, impacting profit margins.

Regulatory and Environmental Scrutiny

Bonduelle faces increasing regulatory and environmental scrutiny, a significant threat to its operations. Evolving standards for food safety, sustainable sourcing, and environmental impact necessitate constant adaptation and investment. For instance, the European Union's Farm to Fork Strategy, a key driver of regulatory change, aims for a more sustainable food system, impacting agricultural practices and supply chains across the continent.

Failure to comply with these stringent regulations can lead to severe consequences. These include substantial fines, damage to Bonduelle's brand reputation, and a rise in operational expenses as the company works to meet new requirements. The company's commitment to ambitious sustainability goals, such as reducing its carbon footprint by 50% by 2030, also presents a challenge in terms of consistent execution and transparent reporting to stakeholders.

- Increased regulatory oversight in food safety and environmental practices.

- Potential for fines and reputational damage due to non-compliance with evolving standards.

- Higher operational costs associated with meeting sustainability and sourcing mandates.

- Challenges in consistently executing and reporting on ambitious sustainability targets.

Intense competition within the processed and ready-to-eat food markets puts pressure on Bonduelle's pricing and market share, especially as the global frozen vegetable market is valued at around $45 billion in 2024. Consumer concerns regarding processed foods, coupled with a growing preference for fresh, minimally processed items, could decrease demand for Bonduelle's core products.

Economic instability and rising inflation, with inflation rates exceeding 5% in some regions in 2024, reduce consumer spending power, potentially driving shoppers towards cheaper private label alternatives. Furthermore, stricter regulations and environmental standards, like the EU's Farm to Fork Strategy, necessitate costly adaptations and pose risks of fines and reputational damage if not met.

SWOT Analysis Data Sources

This Bonduelle SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a well-informed strategic perspective.