Bonduelle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bonduelle Bundle

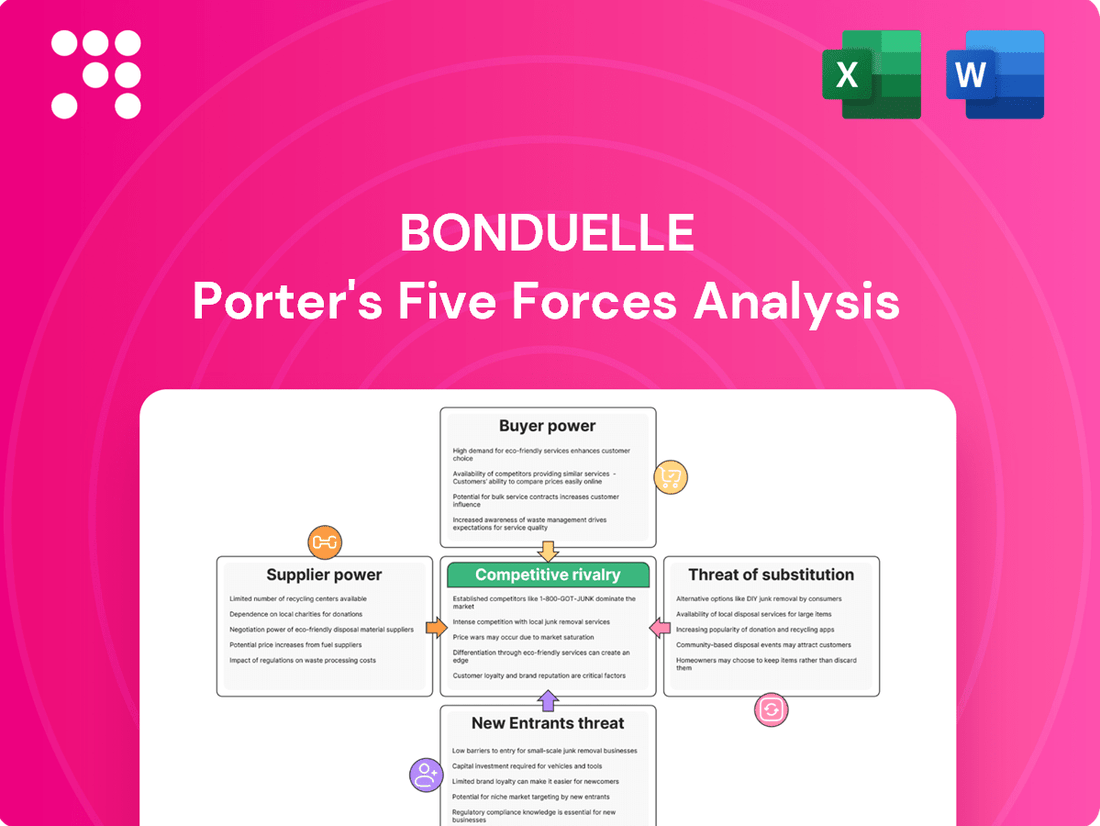

Bonduelle navigates a competitive landscape shaped by moderate buyer power and the persistent threat of substitutes, particularly in the fresh produce sector. Understanding the intensity of rivalry and the influence of suppliers is crucial for strategic positioning.

The complete report reveals the real forces shaping Bonduelle’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for essential raw materials, such as fresh vegetables, directly influences Bonduelle's operational costs. A limited number of dominant suppliers for particular crops or geographical areas can amplify their leverage, potentially driving up the price of inputs for Bonduelle.

Bonduelle's strategy of engaging with over 2,080 partner farmers worldwide serves to broaden its supplier network. This diversification is key in mitigating the risk of over-dependence on a small group of major suppliers, thereby strengthening Bonduelle's position against concentrated supplier power.

Bonduelle's bargaining power with its suppliers is influenced by switching costs. If it's expensive or difficult for Bonduelle to change its suppliers, those suppliers gain more power. For instance, if a supplier provides specialized seeds or requires unique processing equipment that Bonduelle has invested in, switching to a new supplier would incur significant costs in terms of new equipment and retraining.

Bonduelle's commitment to sustainable agriculture and fostering long-term relationships with its farming partners likely aims to reduce these switching costs. By building strong, reliable partnerships, Bonduelle can create a more stable supply chain and potentially negotiate better terms, as suppliers value the consistent business. This approach helps to mitigate the risk of suppliers wielding excessive power due to high switching barriers.

The ease with which Bonduelle can find alternative sources for its raw materials significantly impacts supplier bargaining power. If the vegetables Bonduelle uses, like peas or corn, can be sourced from multiple growers or even different geographical regions, suppliers have less leverage. For instance, in 2024, the global vegetable market saw a steady supply of many common produce items, which generally keeps individual supplier power in check.

However, this dynamic shifts when Bonduelle requires highly specialized or unique vegetable varieties for its premium product lines. In such cases, where few growers can meet stringent quality or specific varietal demands, the bargaining power of those limited suppliers increases. This is particularly true for niche organic or heritage varieties that may have a more concentrated supply base.

Supplier's Ability to Forward Integrate

The ability of suppliers to forward integrate, meaning they could start processing and selling their own branded vegetable products, significantly boosts their bargaining power against Bonduelle. This threat is more pronounced with large agricultural cooperatives or raw material processors than with individual farmers. For instance, a major cooperative controlling a substantial portion of a key vegetable supply could threaten to bypass Bonduelle and sell directly to consumers or retailers under their own brand, potentially capturing more of the value chain.

Bonduelle's robust processing capabilities and established distribution channels serve as a crucial counter-measure to this supplier threat. By efficiently transforming raw produce into finished goods and having strong relationships with retailers, Bonduelle can absorb more of the value internally, making it less attractive for suppliers to attempt forward integration. In 2024, Bonduelle's global presence, with operations across numerous countries and a diverse product portfolio, further solidifies its position against potential supplier leverage.

- Supplier Forward Integration Threat: Suppliers can increase their bargaining power by threatening to process and sell their own branded vegetable products, directly competing with Bonduelle.

- Cooperative vs. Individual Farmer Power: This threat is more credible for large agricultural cooperatives or processors than for individual farmers.

- Bonduelle's Counter-Strategy: Bonduelle's extensive processing infrastructure and distribution network are key defenses against supplier forward integration.

- 2024 Market Context: Bonduelle's global scale and diverse product offerings in 2024 enhance its ability to manage supplier relationships and mitigate integration risks.

Importance of Bonduelle to the Supplier

Bonduelle's role as a significant customer can diminish a supplier's bargaining power. If a supplier relies heavily on Bonduelle for a large percentage of its sales, that supplier becomes more dependent and less likely to exert strong price demands or dictate terms.

Bonduelle's vast global operations and its established network of partner farmers mean that the impact of Bonduelle's purchasing power varies considerably among its suppliers. For smaller, specialized suppliers, Bonduelle might represent a more critical portion of their business, thus reducing their leverage.

- Customer Dependence: The degree to which suppliers depend on Bonduelle for revenue directly impacts their bargaining power. A supplier with a diversified customer base is less susceptible to Bonduelle's demands.

- Supplier Concentration: If Bonduelle sources from a few large suppliers, those suppliers might have more power. Conversely, a fragmented supplier base generally gives Bonduelle more leverage.

- Switching Costs for Bonduelle: The ease or difficulty Bonduelle faces in finding alternative suppliers also shapes supplier power. High switching costs for Bonduelle empower existing suppliers.

Bonduelle's bargaining power with suppliers is influenced by the concentration of suppliers for essential raw materials. A limited number of dominant suppliers for specific crops can increase their leverage, potentially driving up input costs. For example, in 2024, the market for certain niche vegetables or those with specific growing requirements might have fewer suppliers, giving them more power.

Bonduelle mitigates this by diversifying its supplier base, engaging with over 2,080 partner farmers globally. This broad network reduces dependence on any single supplier, strengthening Bonduelle's negotiating position. High switching costs, such as investments in specialized equipment or seeds, can also empower suppliers, making it difficult and expensive for Bonduelle to change providers.

Conversely, Bonduelle's significant purchasing volume can diminish supplier power, especially for smaller or less diversified suppliers who rely heavily on Bonduelle for their sales. The threat of supplier forward integration, where suppliers might start processing and selling their own branded products, is a key concern, particularly with large agricultural cooperatives. However, Bonduelle's extensive processing capabilities and established distribution channels in 2024 serve as a strong defense against this, allowing it to capture more value internally.

| Factor | Impact on Bonduelle | Mitigation Strategies | 2024 Relevance |

|---|---|---|---|

| Supplier Concentration | Can increase input costs if few suppliers dominate | Diversified supplier network (2,080+ farmers) | Niche vegetable markets may still see concentration |

| Switching Costs | High costs empower existing suppliers | Building long-term relationships, potentially reducing perceived switching barriers | Investment in specialized seeds/equipment for premium lines |

| Supplier Forward Integration Threat | Suppliers could compete directly with Bonduelle | Robust processing and distribution capabilities | Global operations enhance ability to manage this risk |

| Bonduelle's Purchasing Power | Reduces supplier leverage if Bonduelle is a major customer | Leveraging scale across diverse markets | Significant global presence amplifies purchasing influence |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Bonduelle's position in the global food industry.

Quickly identify and address competitive threats with a visual breakdown of Bonduelle's industry landscape, enabling proactive strategy adjustments.

Customers Bargaining Power

Bonduelle's diverse customer base, spanning retail consumers and foodservice clients globally, presents a varied buyer landscape. For major retail chains and large foodservice organizations, their substantial purchasing volumes grant them considerable bargaining power. These buyers can leverage their scale to negotiate lower prices and more advantageous contract terms.

The company's performance in the first half of fiscal year 2024-2025 highlights this dynamic, with a noted decline in its private label segment. This downturn often correlates with increased buyer power exerted by retailers, who are keen to secure the most competitive pricing for their own-brand products.

The bargaining power of Bonduelle's customers is significantly influenced by the ease with which they can switch to rival processed vegetable brands or even fresh produce alternatives. Low switching costs, often seen when product differentiation is minimal or price differences are negligible, empower customers to demand better terms.

Bonduelle actively works to mitigate this by emphasizing product quality, health benefits, and sustainability initiatives. For instance, in 2024, Bonduelle reported a strong focus on its plant-based offerings and organic product lines, aiming to build brand loyalty and increase customer stickiness. These efforts are designed to create a perception of unique value, thereby increasing the perceived switching costs for consumers who prioritize these attributes.

Customers' access to information about product pricing, quality, and competitor offerings significantly enhances their bargaining power. With increased transparency in the food market, both individual consumers and large institutional buyers can readily compare Bonduelle's products and pricing against those of its rivals. This readily available data empowers them to negotiate more favorable terms or seek alternative suppliers, directly impacting Bonduelle's pricing strategies and market share.

Threat of Backward Integration by Customers

The threat of backward integration by customers significantly amplifies their bargaining power over Bonduelle. If major retail chains or foodservice providers possess the capacity or a believable threat to manufacture their own processed vegetables, they can exert greater pressure on Bonduelle regarding pricing and terms.

While individual consumers typically lack this capability, large supermarket chains frequently leverage their scale to develop private label brands. These private labels directly compete with Bonduelle's offerings, giving retailers leverage to negotiate more favorable terms or even reduce their reliance on Bonduelle's products. For instance, in 2024, private label sales in the U.S. grocery market continued to grow, capturing an estimated 19% of total sales, demonstrating the significant market power these retailers wield.

- Increased Private Label Penetration: Retailers developing their own brands can directly challenge Bonduelle's market share and pricing.

- Negotiating Leverage: The credible threat of backward integration allows large customers to demand lower prices or better contract conditions.

- Market Dynamics: In 2024, the continued rise of private label brands in major markets like the U.S. and Europe underscores this growing customer power.

- Reduced Dependency: Customers can decrease their dependence on Bonduelle by producing certain processed vegetables in-house.

Price Sensitivity of Customers

Customer price sensitivity is a significant driver of Bonduelle's bargaining power, particularly within the highly competitive processed food sector. In 2024, persistent inflation and a heightened cost of living have amplified this sensitivity, leading consumers to increasingly favor budget-friendly brands over premium offerings.

This shift compels Bonduelle to carefully consider its pricing strategies and potentially introduce more competitively priced product lines to retain market share.

- Impact of Inflation: Rising food prices in 2024 have directly increased consumer price sensitivity.

- Brand Switching: A notable trend observed is consumers switching from premium to value brands, affecting Bonduelle's premium segment.

- Pricing Pressure: Increased price sensitivity translates to direct pressure on Bonduelle's profit margins.

- Competitive Response: Bonduelle may need to implement promotional activities or adjust its product mix to counter this trend.

Bonduelle's customers, especially large retailers and foodservice providers, wield significant bargaining power due to their substantial order volumes. This power is amplified by the availability of numerous alternatives and the ease with which they can switch suppliers, especially concerning private label products. For instance, in 2024, private label penetration in the U.S. grocery market reached approximately 19%, showcasing retailers' ability to leverage their scale and potentially reduce reliance on brands like Bonduelle.

This customer power directly translates into pressure on Bonduelle's pricing and contract terms. The increasing price sensitivity of consumers, exacerbated by inflation in 2024, further empowers buyers to demand more competitive pricing. Bonduelle's strategy to counter this involves emphasizing product quality, health benefits, and sustainability, as seen in their focus on plant-based and organic offerings in 2024, aiming to build loyalty and differentiate its products.

| Customer Segment | Bargaining Power Drivers | Impact on Bonduelle | 2024 Market Trend Example |

|---|---|---|---|

| Large Retailers (e.g., Supermarkets) | High volume purchases, private label development, switching ease | Price pressure, demand for favorable terms | U.S. private label sales ~19% of market |

| Foodservice Clients (e.g., Restaurants) | Bulk ordering, potential for backward integration | Negotiating leverage on pricing and supply chain | Continued consolidation in foodservice sector |

| Individual Consumers | Price sensitivity, access to information, brand switching | Preference for value brands, demand for promotions | Increased consumer focus on affordability due to inflation |

Full Version Awaits

Bonduelle Porter's Five Forces Analysis

This preview displays the complete Bonduelle Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the vegetable processing industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive instantly after purchase, ensuring no surprises or missing information.

Rivalry Among Competitors

The processed vegetable sector is a crowded arena, featuring a wide array of competitors from global giants to niche local players. This maturity means established brands and new entrants alike are vying for market share.

Bonduelle faces formidable competition from major entities such as The Bel Group, known for its cheese and plant-based alternatives, and Ardo Coordination Center N.V., a significant European processor of frozen vegetables. Additionally, companies like Valfrutta and Bellisio Foods, with their own distinct product lines and market focuses, contribute to the diverse competitive pressures.

The overall growth rate of the processed vegetable market significantly shapes how fiercely companies compete. When a market expands at a slower pace, it typically intensifies competition as businesses battle more aggressively for their slice of the market share. This dynamic directly impacts strategic decisions and resource allocation.

Looking at the numbers, the global processed and frozen vegetables market is expected to see a compound annual growth rate (CAGR) of 3.42% between 2022 and 2033. This indicates a period of moderate growth, suggesting that while opportunities exist, the landscape will likely remain competitive as firms strive to capture this expanding demand.

Bonduelle’s ability to differentiate its products significantly influences competitive rivalry within the vegetable sector. By focusing on sustainable agriculture and healthy food options, the company carves out a distinct market position. This strategy is supported by a broad product portfolio encompassing canned, frozen, fresh-cut, and ready-to-eat salads, catering to diverse consumer needs.

Innovation further strengthens Bonduelle's differentiation. For instance, the introduction of plant-based lunch bowls addresses growing consumer demand for convenient, healthy, and meat-free meal solutions. This proactive approach to product development helps Bonduelle stand out against competitors who may offer more standardized vegetable products.

Exit Barriers

High exit barriers in the processed food sector, including specialized manufacturing assets and long-term agricultural supply agreements, can trap less profitable companies in the market. This situation naturally amplifies competitive pressure among existing players. For instance, the capital-intensive nature of food processing, requiring dedicated factories and machinery, makes it difficult and costly for firms to divest or repurpose these assets if they become unprofitable.

Bonduelle's substantial investments in its extensive production infrastructure and its commitments to sustainable farming practices create significant exit barriers for the company. These investments are not easily recouped, meaning Bonduelle is likely to continue operating even in challenging market conditions rather than abandoning its established facilities and supply chains. This commitment to long-term operational viability, while beneficial for stability, also means increased pressure to maintain competitiveness within the industry.

- Specialized Assets: Food processing plants are highly specific and cannot be easily converted to other uses, representing a sunk cost.

- Long-Term Contracts: Agreements with farmers for raw materials often span multiple years, obligating continued operation.

- Brand Reputation: Divesting or ceasing operations can damage brand equity built over decades.

- Regulatory Compliance: Meeting food safety and environmental regulations requires ongoing investment, making closure costly.

Fixed Costs and Capacity

Bonduelle, like many in the food processing sector, faces a competitive landscape shaped by significant fixed costs and the potential for excess capacity. Industries with high upfront investments in manufacturing facilities and equipment often see companies aggressively competing on price to maximize sales volume and cover these substantial fixed expenses. This dynamic can lead to a constant pressure to reduce costs and maintain market share.

The food processing industry, including operations like those of Bonduelle, requires considerable capital for its production plants, machinery, and distribution networks. For example, setting up a modern vegetable processing facility can easily run into tens or even hundreds of millions of dollars. When these facilities are not operating at full capacity, the pressure to fill them intensifies, often leading to price wars as companies attempt to spread their fixed overheads over a larger output.

- High Fixed Costs: The capital-intensive nature of food processing, involving significant investment in plants and equipment, creates a barrier to entry and a constant need to utilize these assets efficiently.

- Excess Capacity Risk: Fluctuations in demand or overinvestment can lead to excess production capacity, compelling companies to lower prices to achieve higher sales volumes and cover fixed costs.

- Price Competition: The drive to utilize capacity and recover fixed costs often translates into intense price competition among players in the food processing market.

- Impact on Margins: This competitive pressure can squeeze profit margins, making operational efficiency and effective cost management crucial for survival and profitability.

Bonduelle operates in a highly competitive processed vegetable market, facing rivals like The Bel Group and Ardo. The market's moderate growth rate, projected at 3.42% CAGR from 2022 to 2033, intensifies competition as companies vie for market share. Bonduelle differentiates itself through sustainable practices and a diverse product range, including innovative plant-based options.

High exit barriers, such as specialized assets and long-term contracts, keep less profitable firms in the market, amplifying rivalry. Bonduelle's significant investments in infrastructure also contribute to these barriers. The industry's high fixed costs and risk of excess capacity often lead to price competition, impacting profit margins.

| Competitor | Key Product Areas | Market Presence |

| The Bel Group | Cheese, Plant-based alternatives | Global |

| Ardo Coordination Center N.V. | Frozen vegetables | European focus |

| Valfrutta | Processed fruits and vegetables | European focus |

| Bellisio Foods | Frozen foods, including vegetables | North American focus |

SSubstitutes Threaten

The threat of substitutes for Bonduelle's processed vegetable products is significant, primarily stemming from the availability of fresh vegetables. Consumers can opt to buy fresh produce and prepare meals themselves, bypassing the convenience and processing of Bonduelle's offerings. This direct alternative allows for greater control over ingredients and preparation methods.

Beyond fresh produce, other substitutes include a range of convenient meal solutions. Ready-to-eat meals, meal kits, and even restaurant dining present alternatives to processed vegetables as part of a broader food consumption choice. For instance, the global ready-to-eat meal market was valued at approximately $176.8 billion in 2023 and is projected to grow, indicating a strong consumer pull towards convenience.

Furthermore, the general category of home-cooked meals, prepared from scratch using various ingredients, also acts as a substitute. This appeals to consumers seeking healthier or more customized eating experiences. The rise in home cooking, particularly post-2020, demonstrates a persistent demand for non-processed food preparation, impacting the market share for companies like Bonduelle.

The attractiveness of substitute products for Bonduelle hinges significantly on their price-performance ratio. While fresh, unpackaged vegetables might be perceived as offering superior nutritional value or a more natural product, they often fall short in terms of convenience and shelf life compared to Bonduelle's ready-to-eat or easily prepared options.

For instance, consumers may opt for whole heads of lettuce or loose carrots due to a lower per-unit price, but the added time and effort for washing, chopping, and storage represent a tangible cost. In contrast, Bonduelle’s bagged salads or pre-cut vegetables command a premium, justified by the immediate usability and extended freshness they provide, appealing to time-pressed consumers.

Consumer demand for healthier, more sustainable, and fresh food options is a significant driver, increasing the likelihood that buyers will switch from processed alternatives. This trend directly impacts Bonduelle's product portfolio, pushing for innovation and adaptation.

Bonduelle is actively responding to this by emphasizing sustainable agricultural practices and developing healthier, convenient food choices within its processed product lines. For instance, in 2024, the company continued its focus on expanding its organic offerings and reducing packaging waste, aligning with these evolving consumer preferences.

Switching Costs to Substitutes

The threat of substitutes for Bonduelle's processed vegetables is influenced by switching costs. For many consumers, the convenience of ready-to-eat or minimally processed options represents a significant benefit, meaning the 'cost' of switching to entirely fresh preparation involves a greater investment of time and effort in washing, chopping, and cooking.

This convenience factor creates a barrier. For instance, a consumer accustomed to a quick can of corn might find the prospect of preparing fresh corn from the cob less appealing due to the additional labor involved. This preference for ease of use is a key element in maintaining customer loyalty to processed vegetable products.

Furthermore, the availability and price of fresh produce can impact this dynamic. While fresh vegetables offer perceived health benefits, their shelf life and potential for spoilage also represent a cost to consumers, both in terms of potential waste and the need for frequent shopping trips. This contrast in convenience and potential waste contributes to the switching costs associated with moving away from processed options.

- Convenience Premium: Consumers often pay a premium for the time-saving aspect of processed vegetables, making the 'cost' of switching to fresh preparation a tangible deterrent.

- Time Investment: The effort required to prepare fresh vegetables from scratch is a significant switching cost for busy individuals and families.

- Perceived Value: The perceived value of convenience can outweigh the potential cost savings or perceived health benefits of fresh alternatives for a substantial portion of the market.

Marketing and Innovation by Substitute Producers

The threat of substitutes is amplified by the marketing and innovation efforts of producers offering fresh produce or alternative meal solutions. These competitors actively shape consumer preferences through compelling campaigns, directly impacting demand for Bonduelle's products. For instance, in 2024, the plant-based food market continued its robust growth, with key players investing heavily in marketing to highlight health and sustainability benefits, potentially drawing consumers away from traditional canned or frozen vegetable options.

Bonduelle actively combats this threat by prioritizing its own innovation in product development and marketing, particularly focusing on its plant-based and ready-to-eat meal categories. By introducing new, convenient, and health-oriented options, Bonduelle aims to retain and attract customers. The company's strategic investments in R&D for plant-based alternatives are crucial, as demonstrated by its continued expansion of its ready-to-cook and plant-based product lines throughout early 2025, responding to evolving consumer tastes and the aggressive marketing by substitute producers.

- Intensified Marketing by Competitors: Companies offering fresh, minimally processed, or entirely different meal solutions are increasingly using digital marketing and influencer collaborations to capture consumer attention.

- Innovation in Convenience and Health: Substitute producers are launching innovative products that emphasize convenience, nutritional value, and specific dietary needs, creating a direct challenge to Bonduelle's market share.

- Bonduelle's Counter-Strategy: Bonduelle is responding by accelerating its innovation pipeline, focusing on plant-based foods and convenient meal kits, backed by targeted marketing campaigns to highlight these advantages.

- Market Data Support: Reports from 2024 indicated a significant rise in consumer spending on plant-based alternatives, underscoring the competitive pressure from substitutes and the need for Bonduelle's enhanced innovation and marketing focus.

The threat of substitutes for Bonduelle's processed vegetable products is substantial, primarily driven by the widespread availability of fresh produce and other convenient meal solutions. Consumers can easily opt for fresh vegetables, offering greater control over ingredients and preparation, or choose from a growing market of ready-to-eat meals and meal kits, which directly compete with Bonduelle's convenience offerings.

The perceived value of convenience and the time investment required for preparing fresh vegetables act as significant switching costs, deterring some consumers from moving away from processed options. However, evolving consumer preferences towards healthier, sustainable, and fresh food are increasing the appeal of substitutes, forcing companies like Bonduelle to innovate and adapt their product lines to meet these demands.

Competitors in the substitute market are actively leveraging marketing and innovation to capture consumer attention, particularly in the rapidly growing plant-based food sector. This competitive landscape necessitates that Bonduelle continues to invest in its own product development, focusing on plant-based alternatives and convenient meal solutions to maintain its market position.

| Substitute Category | Key Differentiators | Consumer Appeal Drivers | Market Trend (2024/2025) |

| Fresh Produce | Healthier perception, ingredient control, natural appeal | Lower cost per unit (sometimes), perceived freshness, sustainability | Continued strong demand, focus on local sourcing |

| Ready-to-Eat Meals/Meal Kits | Ultimate convenience, variety, time-saving | Busy lifestyles, desire for diverse culinary experiences | Market valued at ~$177 billion in 2023, with continued growth |

| Plant-Based Alternatives | Health, ethical, and environmental benefits | Growing awareness of health impacts and sustainability | Robust market growth, significant R&D investment by major players |

Entrants Threaten

The processed vegetable sector demands substantial upfront capital. Newcomers must fund the construction or acquisition of advanced processing facilities, sophisticated machinery for washing, cutting, freezing, or canning, and establish robust, cold-chain compliant distribution networks. These extensive investments create a significant financial hurdle.

Bonduelle's established global presence, with numerous production sites and a vast logistics network, highlights the scale of capital required to compete effectively. For instance, in 2024, the company continued to invest in modernizing its facilities and expanding its reach, reinforcing the high capital barriers that deter potential new entrants aiming for similar operational scale and efficiency.

Established players like Bonduelle leverage significant economies of scale in production, procurement, and logistics. This allows them to achieve lower per-unit costs, making it difficult for newcomers to compete on price. For instance, Bonduelle's extensive global sourcing network in 2024 likely provides substantial purchasing power for raw materials, a key advantage over smaller, less established firms.

New entrants would face considerable challenges in matching these cost efficiencies from the outset. Building a similarly robust supply chain and distribution network requires substantial upfront investment, creating a high barrier to entry. Without achieving comparable production volumes, new companies will likely operate at a cost disadvantage, impacting their profitability and market penetration strategies.

Bonduelle benefits from significant brand loyalty, cultivated over decades through a commitment to quality and sustainable agriculture. This deep-rooted customer trust makes it challenging for new players to gain a foothold.

To effectively challenge established brands like Bonduelle, Cassegrain, Globus, and Ready Pac Bistro, new entrants must invest heavily in marketing and develop truly unique product offerings that resonate with consumers seeking both quality and ethical sourcing.

Access to Distribution Channels

New companies entering the food industry, particularly in the processed vegetable sector where Bonduelle operates, face significant hurdles in securing shelf space in major supermarkets and access to the foodservice sector. These established channels are often dominated by existing players who have built strong relationships and loyalty with distributors and retailers. For instance, in 2024, major grocery chains continued to consolidate their supplier lists, making it harder for smaller, newer brands to gain widespread distribution.

Bonduelle’s extensive global presence and long-standing partnerships provide a substantial advantage. The company already has established routes to market, reaching consumers through a wide array of distribution channels, from large hypermarkets to smaller convenience stores and the critical foodservice industry. This existing infrastructure significantly raises the barrier to entry for newcomers who would need to invest heavily to replicate such reach.

- Distribution Channel Access: New entrants struggle to secure shelf space in major supermarkets and access to the foodservice sector, which are vital for reaching consumers.

- Bonduelle's Advantage: Bonduelle benefits from its established global distribution network, built over years of operation.

- Market Consolidation: In 2024, retail channels saw continued consolidation, intensifying the challenge for new brands seeking placement.

Government Policy and Regulations

Government policy and regulations present a substantial threat to new entrants in the processed food sector. Stringent food safety standards, detailed labeling requirements, and complex agricultural policies can create significant hurdles, demanding substantial investment and expertise to navigate. For instance, regulations concerning pesticide residue limits and organic certifications require rigorous compliance, acting as a deterrent for smaller, less resourced newcomers.

Bonduelle's proactive approach to these regulations, evidenced by its commitment to high operational standards and its B Corp certification, positions it favorably. This certification, which signifies a company's commitment to social and environmental performance, public transparency, and legal accountability, demonstrates an ability to meet and exceed regulatory expectations. In 2023, Bonduelle continued to emphasize its sustainability efforts, aligning with evolving global regulatory trends that favor environmentally conscious and transparent business practices.

- Regulatory Burden: New entrants face significant costs and complexities in complying with food safety, labeling, and agricultural policies.

- Industry Standards: Adherence to high industry standards, such as those required for organic or specific health claims, is a barrier.

- Bonduelle's Compliance: Bonduelle's established compliance framework and B Corp status reduce its vulnerability to regulatory shifts compared to potential new entrants.

- Market Access: Meeting these diverse regulatory requirements is often a prerequisite for market access in key regions, impacting a new entrant's ability to scale.

The processed vegetable sector presents a formidable barrier to entry due to the substantial capital required for advanced processing facilities, sophisticated machinery, and robust cold-chain logistics. Bonduelle's significant investments in facility modernization in 2024 underscore these high capital demands.

Economies of scale in production and procurement, driven by Bonduelle's extensive global sourcing network, create significant cost advantages that new entrants struggle to match. Without comparable production volumes, newcomers face inherent cost disadvantages.

Brand loyalty and established distribution channels, where Bonduelle has cultivated deep customer trust and strong retailer relationships, pose significant challenges for new entrants seeking market access and shelf space, especially as market consolidation continued in 2024.

Navigating complex government regulations, including stringent food safety and labeling requirements, demands considerable expertise and investment, further deterring new entrants. Bonduelle's compliance framework and B Corp certification, reinforced by its sustainability efforts in 2023, position it favorably against these regulatory hurdles.

| Barrier | Description | Impact on New Entrants | Bonduelle's Position |

|---|---|---|---|

| Capital Requirements | High investment in processing, machinery, and logistics. | Significant financial hurdle. | Established infrastructure and ongoing modernization. |

| Economies of Scale | Lower per-unit costs due to large-scale production and procurement. | Difficulty competing on price. | Strong purchasing power and efficient operations. |

| Brand Loyalty & Distribution | Established customer trust and retailer relationships. | Challenges in gaining market access and shelf space. | Extensive global network and long-standing partnerships. |

| Regulatory Compliance | Costs and complexities of adhering to food safety and labeling laws. | Requires substantial expertise and investment. | Robust compliance framework and certifications (e.g., B Corp). |

Porter's Five Forces Analysis Data Sources

Our Bonduelle Porter's Five Forces analysis leverages data from Bonduelle's annual reports, investor presentations, and publicly available financial statements. We also incorporate industry-specific reports from market research firms, competitor analyses, and relevant trade publications.