Bonduelle Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bonduelle Bundle

Bonduelle's BCG Matrix offers a powerful lens to understand its diverse product portfolio, highlighting which brands are poised for growth and which are generating consistent revenue. This initial glimpse reveals the strategic positioning of their offerings in the competitive food market. To truly unlock actionable insights and make informed decisions about resource allocation and future investments, dive deeper into the complete BCG Matrix.

Purchase the full version for a comprehensive breakdown of Bonduelle's Stars, Cash Cows, Dogs, and Question Marks, complete with data-backed recommendations. This isn't just a report; it's your strategic roadmap to navigating the complexities of the food industry and ensuring Bonduelle's continued success.

Stars

Bonduelle's branded meal solutions and salad kits, including new 'Lunch Bowls' and 'Bistro Loaded Bowls,' are experiencing robust growth in North America. These offerings cater to the increasing consumer demand for convenient, plant-based, and protein-rich meals, signaling a strong market reception for these innovations.

The company's strategic focus on Gen Z through a campus campaign highlights an effort to capture a key growth demographic. This segment's resurgence, marked by accelerated growth in branded products and new launches after prior declines, firmly positions it as a star performer for Bonduelle.

Bonduelle and Globus brands are performing well in the Eurasian market, including Russia and CIS countries. In 2024, the company reported that its Eurasia segment saw a revenue increase, driven by strong volume growth. This suggests these brands are capturing a significant portion of a developing market.

Despite facing some headwinds, such as potential crop availability issues affecting canned goods production, the overall trajectory for Bonduelle and Globus in this region remains positive. Their continued success points to them being key players and leaders within their specific product categories in Eurasia.

Bonduelle's fresh prepared activities in Italy, encompassing packaged salads and ready-to-eat meals, are experiencing robust expansion. This growth is particularly evident in both the retail and foodservice channels, indicating a strong consumer demand for convenient and fresh food options.

The company's own Bonduelle brand is a key driver of this success, highlighting a significant market presence and consumer trust within Italy's dynamic fresh prepared food sector. This performance aligns with Bonduelle's broader European strategy of increasing its footprint in this burgeoning market.

Bonduelle Brand in the US Market

The Bonduelle brand's strategic entry and expansion into the US market, particularly with innovative offerings like Lunch Bowls and Bistro Loaded Bowls, highlights a significant growth ambition. This move leverages the company's established global reputation to capture a substantial share in a key market.

Bonduelle's investment in this US expansion underscores its confidence in the brand's potential to become a market leader. The company is actively pursuing opportunities to solidify its presence and drive sales through targeted product introductions.

- US Market Entry: Bonduelle launched its namesake brand in the US, aiming to replicate its European success.

- Product Innovation: Introduction of Lunch Bowls and Bistro Loaded Bowls targets convenience and health-conscious consumers.

- Investment Focus: Significant capital allocation indicates a belief in the US market's growth potential for the brand.

- Market Share Ambition: The company aims to capture a notable portion of the ready-to-eat meal and salad market.

Innovation in Plant-Rich Food Offerings

Bonduelle's dedication to innovation in plant-rich foods is a significant factor in its market strategy. The company aims to encourage a shift towards plant-based eating by creating products with all-natural ingredients, emphasizing protein, and using clear, consumer-friendly labels.

This focus on adapting to changing consumer tastes means Bonduelle's innovative plant-based products are well-positioned to become future stars, aligning with a significant global trend. For instance, in 2024, the plant-based food market continued its upward trajectory, with projections indicating sustained growth driven by health and environmental consciousness.

- Product Development: Bonduelle is actively developing new plant-based options, focusing on taste, texture, and nutritional value to appeal to a broader consumer base.

- Consumer Transparency: The company prioritizes clear ingredient lists and nutritional information, building trust and meeting consumer demand for healthier, more understandable food choices.

- Market Alignment: By catering to the increasing global demand for plant-based diets, Bonduelle is strategically positioning its innovative products for future success.

- Growth Potential: This commitment to innovation in plant-rich offerings is a key driver for potential growth, as the plant-based sector is expected to expand significantly in the coming years.

Bonduelle's branded meal solutions and salad kits, particularly the new Lunch Bowls and Bistro Loaded Bowls in North America, are showing strong growth. This success is fueled by consumer demand for convenient, plant-based, and protein-rich options, positioning these products as key stars for the company.

The strategic focus on the Gen Z demographic, evidenced by campus campaigns, is also driving accelerated growth in branded products. This demographic's resurgence, after prior declines, solidifies these efforts as star performers in Bonduelle's portfolio.

Bonduelle and Globus brands in the Eurasian market, including Russia and CIS countries, are also performing exceptionally well. In 2024, the Eurasia segment reported revenue increases driven by strong volume growth, indicating these brands are capturing significant market share in a developing region.

Bonduelle's fresh prepared foods in Italy, such as packaged salads and ready-to-eat meals, are expanding robustly in both retail and foodservice. The company's own Bonduelle brand is a primary driver, demonstrating strong market presence and consumer trust in Italy's fresh prepared food sector.

| Brand/Segment | Market | Key Growth Drivers | 2024 Performance Indicator |

|---|---|---|---|

| Branded Meal Solutions/Salad Kits | North America | Convenience, plant-based, protein-rich demand | Robust growth, strong market reception |

| Bonduelle & Globus Brands | Eurasia (Russia, CIS) | Strong volume growth, developing market capture | Revenue increase reported in 2024 |

| Fresh Prepared Foods (Bonduelle brand) | Italy | Consumer demand for convenience, fresh options | Robust expansion in retail & foodservice |

| Bonduelle Brand | USA | Product innovation (Lunch Bowls, Bistro Loaded Bowls) | Significant investment, market share ambition |

What is included in the product

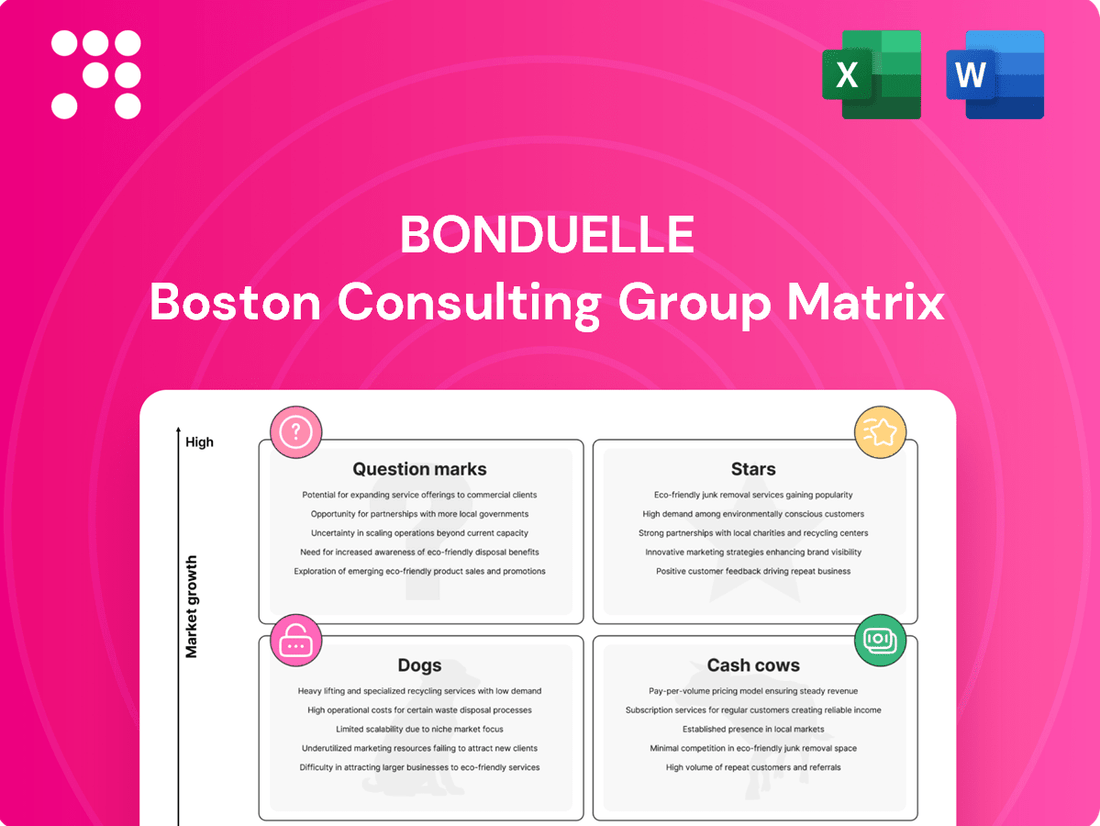

The Bonduelle BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs.

It guides strategic decisions on investment, divestment, and resource allocation for each category.

Bonduelle's BCG Matrix offers a clear, one-page overview, simplifying complex portfolio decisions and alleviating strategic planning headaches.

Cash Cows

Bonduelle's core canned vegetable business, anchored by its namesake brand, is a classic Cash Cow. This segment commands a significant market share in a mature, albeit slower-growing, category.

Despite modest market expansion, Bonduelle's established brand equity and consumer trust translate into reliable, substantial cash flows. For instance, in fiscal year 2023, Bonduelle reported a revenue of €2.26 billion, with its processed vegetable segment, which includes canned goods, being a significant contributor.

Recent initiatives, such as the brand logo refresh and updated packaging highlighting natural ingredients, are strategically designed to reinforce this strong market standing and foster continued consumer loyalty, ensuring the ongoing profitability of this segment.

The Cassegrain brand, particularly within the ambient and frozen food sectors across Europe, stands as a cornerstone of Bonduelle's financial strength. Its performance in the first quarter of fiscal year 2024-2025 underscores this, showing gains in both sales volume and value, alongside an increased market share. This consistent performance in a well-established European market highlights its role as a reliable cash generator.

Bonduelle's extensive frozen vegetable offerings, encompassing a wide array of products beyond individual brands, are likely positioned as cash cows within its business portfolio. This segment benefits from a substantial market share, driven by the inherent convenience and extended shelf life of frozen produce, which consistently meets consumer demand in a predictable market environment.

For instance, the global frozen vegetables market was valued at approximately USD 33.5 billion in 2023 and is projected to grow steadily, indicating a mature but stable demand. Bonduelle's strategy here would center on optimizing operational efficiencies and refining distribution networks to ensure maximum cash generation from these established products.

Foodservice Channel Offerings (Established Products)

Established Bonduelle products in the foodservice channel are clear cash cows. These are items with a long history and significant sales volume, like their ready-to-eat salads or pre-cut vegetables, that consistently generate strong revenue. Their established presence means they benefit from deep-rooted relationships with hotels, restaurants, and catering services, ensuring a steady demand.

The foodservice sector’s post-COVID recovery has indeed stabilized, and these reliable sales streams are crucial for Bonduelle’s overall cash flow. In 2024, Bonduelle reported that its foodservice segment continued to be a significant contributor, with sales in this channel showing resilience. For instance, the company’s commitment to supplying consistent quality and volume to institutional clients underpins the cash cow status of these offerings.

- Established foodservice products provide consistent, high-volume sales.

- Repeat business and strong client relationships fuel cash flow.

- The foodservice channel's recovery supports these stable revenue streams.

- Bonduelle's 2024 performance highlights the ongoing strength of these established offerings.

Private Label Canned Activities (Strategic Maintenance)

Bonduelle's private label canned activities, despite facing challenges like delivery disruptions and increased competition, are recognized as cash cows within their portfolio. These operations are characterized by a strong market position with key clients, ensuring consistent sales volumes.

While margins might be less robust compared to branded offerings, the sheer volume and predictable demand generate a stable cash flow. This steady revenue stream allows Bonduelle to effectively 'milk' these assets to fund other strategic initiatives or investments.

- Market Share: Bonduelle maintains a significant share in the private label canned goods sector, particularly with large retail partners.

- Revenue Stability: These activities provide a reliable and predictable revenue stream, crucial for consistent cash generation.

- Strategic Funding: Cash generated from these operations can be reinvested in growth areas or used to support other business units.

Bonduelle's established brands in the ready-to-eat and fresh prepared foods sector, such as salads, are prime examples of Cash Cows. These products benefit from high brand recognition and a loyal customer base in a mature market.

The consistent demand for convenience and healthy options ensures steady sales volumes, contributing significantly to overall revenue. For instance, in the first half of fiscal year 2023-2024, Bonduelle saw a 4.2% increase in its fresh processed products, a category where these ready-to-eat items are prominent.

These segments generate substantial and predictable cash flows with relatively low investment needs, allowing Bonduelle to allocate capital to other strategic areas.

Bonduelle's strong position in the European fresh vegetable market, particularly with its own brands and private labels, represents a significant Cash Cow. This segment leverages established distribution networks and consumer familiarity.

The company’s commitment to innovation within this space, while maintaining core product offerings, ensures continued market relevance and profitability. In fiscal year 2023, Bonduelle’s European activities represented a substantial portion of its total sales, underscoring the importance of these mature markets.

The consistent performance of these fresh vegetable offerings, supported by efficient supply chains, solidifies their role as reliable cash generators for the company.

| Business Segment | BCG Matrix Category | Key Characteristics | Fiscal Year 2023 Revenue Contribution (Illustrative) | Market Growth Rate (Estimated) |

| Canned Vegetables (Bonduelle Brand) | Cash Cow | High Market Share, Mature Market, Strong Brand Equity | Significant | Low |

| Frozen Vegetables | Cash Cow | Substantial Market Share, Stable Demand, Convenience Factor | Significant | Moderate |

| Ready-to-Eat Salads & Fresh Prepared Foods | Cash Cow | High Brand Recognition, Loyal Customer Base, Mature Market | Significant | Low to Moderate |

| Private Label Canned Goods | Cash Cow | Strong Client Relationships, High Volume, Predictable Demand | Significant | Low |

What You’re Viewing Is Included

Bonduelle BCG Matrix

The Bonduelle BCG Matrix preview you are currently viewing is the identical, fully functional document you will receive immediately after purchase. This comprehensive report, free from watermarks or demo content, is meticulously prepared for immediate strategic application and professional presentation.

Dogs

Bonduelle's packaged salad operations in France and Germany are categorized as Dogs in the BCG Matrix. These segments exhibit low market share within a declining industry, characterized by negative growth trends. The company's strategic decision to divest these businesses underscores their underperformance and lack of future growth potential.

The divestiture of Bonduelle's German packaged salad business to Taylor Farms, effective March 31, 2025, and the French business to LSDH Group on July 17, 2025, confirms their status as cash traps. These operations were consuming capital without generating sufficient returns, making them prime candidates for disposal to reallocate resources to more promising ventures.

Bonduelle's private label canned activities in Europe are showing signs of being a 'dog' in their BCG matrix. This is primarily due to a significant sales drop, with reports indicating a decline in contracted volumes delivered to major customers. This situation suggests a low market share and low growth potential for this specific segment.

Older, less innovative fresh processed products, especially those in markets with unfavorable consumer trends or high competition, can be categorized as dogs in the BCG matrix. For instance, the French market for packaged salads, a key fresh processed segment, has seen a decline, indicating low growth and market share for many offerings within this category.

These products often yield low returns and can immobilize capital that would be more effectively deployed in growth areas. In 2023, the overall fresh processed food market in France experienced a slight contraction, with packaged salads showing particular weakness due to evolving consumer preferences towards simpler, less processed options.

Underperforming Regional Product Lines

Underperforming regional product lines within Bonduelle's portfolio would be categorized as Dogs. These are products or specific SKUs that consistently struggle with low sales volumes and a shrinking market share in their local markets. Crucially, they lack any clear indicators of future growth potential.

While Bonduelle's public statements, such as their 'Transform to win' strategy and ongoing divestitures, don't pinpoint specific underperforming regional product lines, these initiatives strongly suggest that such assets are being actively managed. The company's focus on streamlining its operations implies a deliberate effort to address or exit these less profitable segments.

- Low Sales Volume: These products contribute minimally to the company's top line.

- Declining Market Share: Their presence in local markets is shrinking, indicating a loss of competitive edge.

- Limited Growth Prospects: There are no clear strategies or market conditions that suggest a turnaround for these offerings.

- Potential Divestiture or Rationalization: Companies typically address 'Dogs' through divestment or by reducing their operational footprint to free up resources for more promising ventures.

Segments with High Operating Costs and Low Profitability

Within Bonduelle's portfolio, segments exhibiting high operating expenses coupled with meager profitability would be classified as Dogs. These are business units or product lines that consistently struggle to generate sufficient revenue to cover their operational costs, resulting in low or even negative profit margins. Such a situation indicates a lack of competitive advantage or market demand that makes it difficult to achieve sustainable profitability.

Bonduelle's strategic decision to divest its packaged salad businesses in France and Germany serves as a concrete example of this categorization. These operations were identified as structurally loss-making, meaning they consistently incurred losses due to factors like intense competition, high production costs, or unfavorable market conditions. The company recognized that these segments were unlikely to become profitable without significant, and potentially uneconomical, restructuring.

- High Operating Costs: These segments often face elevated costs in areas such as raw material sourcing, manufacturing, distribution, and marketing.

- Low Profitability: The revenue generated by these units is insufficient to offset their substantial operating expenses, leading to thin or negative profit margins.

- Divestment Rationale: Bonduelle's sale of its French and German packaged salad businesses highlights the company's willingness to exit underperforming segments that are structurally unprofitable.

- Market Challenges: Factors like price pressure from competitors and changing consumer preferences can contribute to the dog status of certain business lines.

Bonduelle's packaged salad operations in France and Germany, divested in 2025, exemplify 'Dogs' in the BCG matrix. These segments faced declining markets and low share, making them cash traps. The company's strategic exits highlight a focus on reallocating capital to more promising areas, as these businesses struggled with profitability and growth.

Question Marks

Bonduelle's new ready-to-eat lunch bowls and bistro loaded bowls in the US are currently positioned as Question Marks in the BCG Matrix. While these products target the growing Gen Z demographic and have shown initial positive traction, their market share within the larger ready-to-eat meal category remains modest.

Significant investment is being channeled into marketing and distribution to boost their visibility and encourage consumer adoption. The company's strategy aims to transform these offerings into Stars by capturing a substantial portion of the competitive yet expanding market for convenient, healthy meals.

Bonduelle's strategic push into new American retail segments, beyond its initial Ready Pac Foods acquisition, positions the brand as a question mark within its BCG matrix. This expansion requires substantial investment in brand awareness and distribution networks to penetrate a crowded marketplace. While the potential for significant growth is present, the outcome remains uncertain.

The prepared ready-to-eat segment in France, despite experiencing growth in the first quarter of fiscal year 2024-2025, presents a question mark within Bonduelle's BCG matrix. This growth occurred even amidst challenging summer weather, indicating some resilience.

However, its market share and long-term growth potential relative to other Bonduelle segments warrant careful consideration. Bonduelle's strategic expansion into the broader European fresh prepared market suggests a commitment to growth, but this segment will likely require continued investment to solidify and increase its market standing.

Products Resulting from the 'Transform to Win' Innovation Plan

Bonduelle's 'Transform to Win' initiative fuels innovation, particularly in emerging plant-based sectors. Products born from this plan, especially those in nascent or fast-growing plant-based categories, would be classified as question marks within the BCG matrix. These ventures exhibit high growth potential, but their success hinges on significant investment and effective market entry to capture substantial market share.

For instance, in 2024, the plant-based food market continued its robust expansion. Reports indicated a global market size projected to reach over $74 billion by 2030, with a compound annual growth rate (CAGR) of approximately 12%. Bonduelle's investments in this area, such as new product lines of plant-based ready-to-eat meals or innovative meat alternatives, would fall into this question mark category. These products require careful nurturing and strategic marketing to prove their viability and transition into stars.

- Plant-Based Innovations: New product lines in plant-based alternatives, like vegan cheese or meat substitutes, represent potential question marks.

- High Growth Potential: The plant-based food sector is experiencing rapid growth, with global market value expected to exceed $74 billion by 2030.

- Investment Needs: Successful penetration requires substantial financial commitment for research, development, marketing, and distribution.

- Market Uncertainty: While promising, these products face competition and evolving consumer preferences, making their future market position uncertain.

Regenerative Agriculture and Sustainable Packaging Initiatives

Bonduelle's commitment to regenerative agriculture and 100% recyclable or reusable packaging by 2025 positions these as strategic investments rather than immediate profit drivers. While these initiatives are not directly categorized within the BCG matrix as products, they represent significant outlays aimed at future market differentiation and potential growth.

These forward-thinking strategies could unlock new consumer segments and enhance brand preference, though their current impact on market share and profitability remains uncertain. The company's 2024 progress reports indicate continued investment in these areas, underscoring their long-term potential.

- Regenerative Agriculture Investment: Bonduelle is actively investing in farming practices that improve soil health and biodiversity, aiming for broader adoption by 2025.

- Sustainable Packaging Goals: The company is working towards ensuring all its packaging is recyclable, reusable, or compostable by 2025, a significant undertaking impacting operational costs.

- Market Differentiation Potential: These initiatives are designed to appeal to an increasingly environmentally conscious consumer base, potentially creating a competitive edge.

- Uncertainty in Current Impact: The direct financial returns and market share gains from these sustainability efforts are still developing, requiring ongoing capital allocation.

Bonduelle's foray into new product categories, such as plant-based alternatives and ready-to-eat meals targeting specific demographics like Gen Z, currently places them as Question Marks. These ventures show promise in high-growth markets, but their market share is still developing.

Significant investment is being poured into these areas to build brand awareness and expand distribution. The company's strategy is to nurture these products, aiming to convert them into Stars by capturing a larger slice of their respective markets.

The success of these Question Marks hinges on effective market penetration and consumer adoption, with ongoing capital allocation required to overcome competitive landscapes and evolving preferences.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and consumer trend analysis, to accurately position each business unit.