Bank of New York Mellon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of New York Mellon Bundle

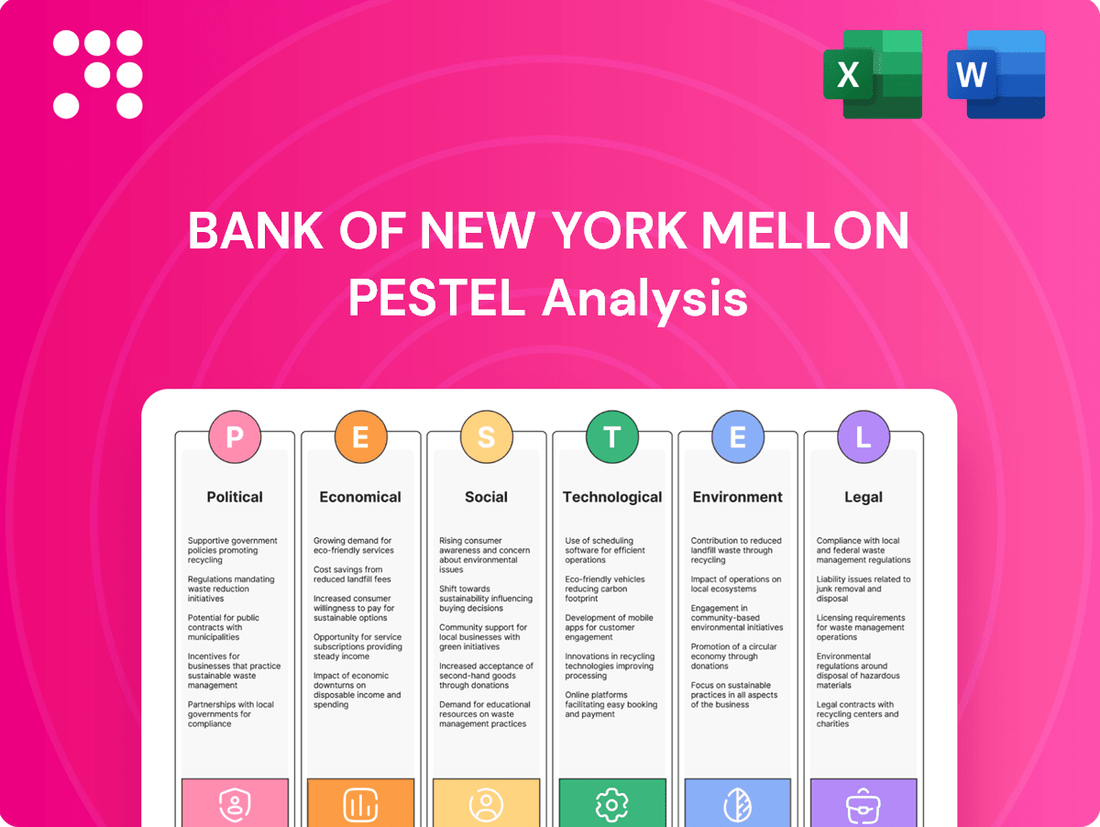

Navigate the complex external environment impacting Bank of New York Mellon with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping its strategic landscape. Gain a critical advantage by leveraging these expert-driven insights to inform your own market approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

BNY Mellon, a major global financial player, faces continuous regulatory oversight from agencies such as the CFTC and SEC. This environment demands rigorous compliance measures to navigate the complexities of financial markets.

In 2024, BNY Mellon received a $5 million penalty for swap reporting errors, underscoring the critical importance of accurate data management and adherence to reporting standards. Such enforcement actions highlight the significant financial and reputational risks associated with compliance failures.

The ongoing political pressure from regulatory bodies reinforces the necessity for BNY Mellon to maintain robust internal controls and invest in advanced compliance technologies. This ensures not only avoidance of penalties but also the preservation of market trust and operational integrity.

Government policy shifts, especially concerning trade and tariffs, can profoundly affect global economic expansion and, by extension, BNY Mellon's business. The 2025 Global Economic Outlook from Mellon Investments Corporation highlights potential adjustments in trade policy by the new US administration and the influence of upcoming elections on international trade patterns.

These evolving policies directly impact client investment strategies and the volume of cross-border transactions, which are core to BNY Mellon's services. For instance, a shift towards protectionist trade measures could increase the cost of international capital flows, potentially affecting BNY Mellon's fee income from global custody and transaction services.

Geopolitical instability, including ongoing conflicts in Ukraine and the Middle East, continues to inject volatility into global financial markets. This directly impacts BNY Mellon's core business, particularly its investment and wealth management divisions, by influencing client behavior and asset flows.

Clients often exhibit increased caution during periods of heightened geopolitical risk, favoring liquidity and lower-risk assets over more speculative investments. This shift in sentiment can lead to reduced asset inflows and potentially impact fee-based revenues, as observed in market commentary around BNY Mellon's Q1 2025 performance. The pervasive uncertainty can significantly shape investment decisions and overall market sentiment, creating a challenging operating environment.

Financial Stability Regulations

As a systemically important financial institution (SIFI), Bank of New York Mellon (BNY Mellon) operates under a rigorous regulatory framework designed to ensure financial stability. These regulations, including regular stress tests conducted by bodies like the Federal Reserve, directly influence the company's capital management and risk-taking. For instance, BNY Mellon maintained its Stress Capital Buffer (SCB) at the regulatory floor for the 2025-2026 period, signaling a robust capital position that meets these demanding requirements.

These stringent rules, while indicative of BNY Mellon's resilience, do impose constraints on capital allocation and necessitate sophisticated risk management strategies. The ongoing evolution of financial stability regulations, particularly in the wake of global economic shifts, means BNY Mellon must continually adapt its operational and capital planning to remain compliant and competitive. This regulatory environment is a critical political factor shaping the bank's strategic decisions and financial performance.

BNY Mellon’s adherence to these financial stability regulations is a testament to its proactive approach. For example, in the Federal Reserve's 2024 stress tests, BNY Mellon's Common Equity Tier 1 (CET1) ratio remained well above minimum requirements, even under severe economic downturn scenarios. This consistent performance underscores the effectiveness of its capital and risk management frameworks in navigating the complex political landscape of financial oversight.

International Cooperation and Sanctions

The effectiveness of international cooperation and the implementation of global sanctions regimes directly impact BNY Mellon's ability to conduct cross-border business and manage global assets. For instance, the evolving landscape of sanctions, particularly concerning Russia, has required significant adjustments in how financial institutions operate globally. BNY Mellon, like other major banks, must navigate these complex geopolitical shifts to ensure compliance and maintain its worldwide operational footprint.

Compliance with diverse international regulations is crucial to avoid legal penalties and maintain its global operational footprint. In 2024, regulatory bodies worldwide continue to emphasize stringent anti-money laundering (AML) and know-your-customer (KYC) requirements, with fines for non-compliance reaching billions of dollars annually across the financial sector. BNY Mellon’s adherence to these varied frameworks is paramount.

Any changes in these frameworks require adaptive strategies for the company's worldwide services. For example, the European Union's ongoing efforts to harmonize financial regulations, alongside individual country-specific data privacy laws like GDPR, necessitate flexible operational models. BNY Mellon’s strategic planning must account for these dynamic international legal and regulatory environments to ensure uninterrupted service delivery.

- Global Sanctions Impact: Geopolitical tensions and sanctions regimes, such as those impacting trade with certain nations, directly affect BNY Mellon's cross-border transaction capabilities and asset management operations.

- Regulatory Compliance Costs: Financial institutions globally incurred an estimated $36 billion in compliance costs in 2023, highlighting the significant investment required to navigate diverse international regulations.

- Data Localization Requirements: An increasing number of countries are implementing data localization laws, forcing financial firms like BNY Mellon to adapt their IT infrastructure and data management strategies to comply with regional mandates.

- International Cooperation in Financial Crime: Enhanced cooperation between international regulatory bodies in combating financial crime and illicit flows of capital influences BNY Mellon's risk management and due diligence processes.

Political stability and government policies significantly shape BNY Mellon's operational landscape. Shifts in trade agreements and fiscal policies can directly influence international capital flows and investment strategies, impacting the bank's fee-based revenues. For instance, the 2025 Global Economic Outlook from Mellon Investments Corporation anticipates potential adjustments in US trade policy influenced by upcoming elections, which could affect cross-border transactions.

The bank's status as a systemically important financial institution (SIFI) subjects it to stringent regulatory oversight, including stress tests and capital requirements. BNY Mellon's adherence to these mandates, such as maintaining its Stress Capital Buffer at the regulatory floor for 2025-2026, demonstrates its commitment to financial stability and compliance, although these regulations do constrain capital allocation.

International sanctions regimes and evolving global financial crime regulations necessitate continuous adaptation. BNY Mellon must navigate these complex geopolitical shifts and varying compliance requirements, such as anti-money laundering (AML) and know-your-customer (KYC) standards, to maintain its global operations and avoid penalties, with sector-wide compliance costs estimated at $36 billion in 2023.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing the Bank of New York Mellon, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions. It provides actionable insights for strategic decision-making by identifying key trends and potential impacts.

A PESTLE analysis for BNY Mellon acts as a pain point reliver by providing a structured framework to anticipate and navigate external challenges, enabling proactive strategy development and mitigating potential risks.

Economic factors

Fluctuations in interest rates directly impact Bank of New York Mellon's (BNY Mellon) net interest income (NII), a vital component of its revenue. The company's performance in the first half of 2025 demonstrated this, with robust NII growth. This was achieved through skillful navigation of a rising rate environment and the successful reinvestment of maturing investment assets at more favorable yields.

BNY Mellon's Q1 2025 results showed a notable increase in NII, a trend that continued into Q2 2025. This growth was attributed to strategic asset-liability management and benefiting from higher market rates on its substantial investment portfolio. For instance, the average yield on investment securities saw an uptick, directly contributing to the improved NII figures.

Looking ahead, sustained NII growth for BNY Mellon hinges on the stability of the interest rate environment. While recent quarters have been favorable, any significant downturn or rapid shifts in rates could present challenges to maintaining this positive momentum in NII generation.

The overall health of the global economy is a crucial driver for Bank of New York Mellon's (BNY Mellon) asset servicing and investment management operations. Stronger global growth typically translates to increased client activity, higher asset values, and greater demand for financial services.

BNY Mellon reported revenue growth in the first quarter of 2025, partly attributed to improved market demand. However, the '2025 Global Economic Outlook' from Mellon Investments Corporation points to potential challenges. For instance, Europe's economic recovery may face headwinds, and China is dealing with domestic economic issues. These factors could dampen client confidence and impact asset flows into BNY Mellon's managed funds.

Inflationary pressures significantly shape central bank decisions and bond yields. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, though it has shown signs of moderating.

This persistent inflation can prompt central banks, like the Federal Reserve, to maintain tighter monetary policies, potentially delaying interest rate cuts. Such actions directly influence bond yields, making borrowing more expensive for institutions like Bank of New York Mellon and its corporate clients.

The Federal Reserve's own projections, as of their March 2024 Summary of Economic Projections, indicated a median expectation of 3.1% for core PCE inflation in 2024, suggesting a gradual return towards their 2% target but with lingering upside risks.

Currency Fluctuations

Currency fluctuations significantly impact BNY Mellon as a global financial institution, affecting the value of its international holdings and earnings. For instance, a stronger US dollar can reduce the dollar-denominated value of assets held in other currencies, influencing BNY Mellon's reported financial performance.

Market commentary from institutions like BNY Mellon often highlights the impact of major currency pair movements. For example, shifts in the USD/JPY exchange rate can directly influence foreign exchange trading revenues and the profitability of cross-border financial activities.

- Impact on International Assets: A stronger USD relative to other currencies can decrease the reported value of BNY Mellon's foreign assets.

- Foreign Exchange Revenue: Fluctuations in exchange rates directly affect the income generated from BNY Mellon's foreign exchange services.

- Cross-Border Transaction Profitability: Changes in currency values can alter the profit margins on international banking and investment transactions.

- 2024/2025 Data Consideration: Analysts will closely monitor the USD's performance against major currencies like the Euro and Yen throughout 2024 and into 2025 to assess its impact on BNY Mellon's earnings.

Capital Market Volatility

Elevated financial market volatility, driven by factors like geopolitical tensions and shifts in monetary policy, significantly influences investor sentiment and the valuation of assets. For Bank of New York Mellon (BNY Mellon), this turbulence can translate into a more cautious client base, directly impacting assets under management (AUM) and the performance fees earned across its investment and wealth management divisions.

The ongoing uncertainties in the global economic landscape, including inflation concerns and interest rate adjustments, contributed to notable market swings throughout 2024. For instance, major indices experienced significant intraday and week-to-week fluctuations, creating a challenging environment for asset managers aiming to maintain stable AUM growth. This heightened volatility can lead to a decrease in trading volumes and advisory service demand, affecting fee-based revenue streams.

- Market Volatility Impact: Increased price swings in global equity and fixed-income markets in 2024 affected the valuation of BNY Mellon's AUM.

- Client Behavior: Heightened uncertainty often leads to client risk aversion, potentially slowing new asset inflows and increasing outflows.

- Revenue Streams: Performance fees, a key component of BNY Mellon's revenue, are directly tied to asset appreciation, making them vulnerable to market downturns.

Economic growth directly influences BNY Mellon's fee-based revenues, as a robust economy typically correlates with higher asset values and increased client transaction volumes. For example, BNY Mellon's Q1 2025 results showed revenue growth, partly due to improved market demand. However, global economic headwinds, such as Europe's slower recovery and China's domestic issues, pose potential risks to sustained asset inflows and overall client activity through 2025.

Inflationary pressures and subsequent central bank policies significantly impact BNY Mellon's investment portfolio yields and borrowing costs. The Federal Reserve's March 2024 projections anticipated core PCE inflation at 3.1% for 2024, indicating a cautious approach to monetary easing. This environment means higher interest rates could persist, affecting BNY Mellon's net interest income and the cost of capital for its clients.

Interest rate fluctuations are a primary driver of BNY Mellon's net interest income (NII). The company experienced strong NII growth in the first half of 2025, benefiting from rising rates that boosted yields on its investment portfolio. Maintaining this trajectory into late 2025 and beyond will depend on the stability of the rate environment and BNY Mellon's continued success in asset-liability management.

Preview Before You Purchase

Bank of New York Mellon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Bank of New York Mellon covers all critical external factors impacting its operations. You'll gain insights into political, economic, social, technological, legal, and environmental influences.

Sociological factors

Clients and investors are increasingly pushing for ESG factors to be woven into investment choices and how performance is reported. This shift reflects a growing awareness of the long-term financial implications of environmental, social, and governance issues.

BNY Mellon is actively addressing this demand by providing investment options and guidance that prioritize responsible investing. For instance, in 2023, BNY Mellon Investment Management saw significant inflows into its ESG-focused strategies, demonstrating client appetite for sustainable approaches.

The firm recognizes that a thorough understanding of ESG risks and opportunities is no longer a niche concern but a crucial element for effective portfolio management, impacting everything from risk mitigation to identifying new growth avenues.

BNY Mellon actively promotes workforce diversity and inclusion, aiming for specific representation targets for women and underrepresented ethnic/racial groups in leadership roles and on its Board of Directors. For instance, as of early 2024, the company reported that approximately 36% of its global workforce identified as women, with a stated goal to increase female representation in senior leadership.

This strategic focus not only cultivates a more inclusive internal culture but also significantly aids in attracting a broader pool of top talent. Such initiatives are increasingly vital for corporate reputation and align with evolving societal expectations for equitable business practices, directly impacting BNY Mellon's ability to innovate and connect with a diverse customer base.

Long-term demographic trends, such as the aging population in developed nations and the significant intergenerational wealth transfer, directly impact the demand for wealth management and estate planning services. As baby boomers continue to age, the volume of assets being passed down is expected to surge, creating new opportunities for financial institutions.

BNY Mellon, with its established focus on high-net-worth individuals and its role as a custodian for trillions in assets, is well-positioned to benefit from these demographic shifts. The firm needs to offer increasingly specialized solutions to meet the evolving needs of clients navigating complex inheritance scenarios and seeking sophisticated wealth preservation strategies.

The global wealth management market is projected to reach $100 trillion by 2025, with a substantial portion driven by the wealth transfer from older generations to younger ones. For instance, estimates suggest that over $68 trillion in wealth is expected to transfer in the United States alone over the next two decades.

Client Trust and Reputation

Client trust and reputation are foundational for The Bank of New York Mellon (BNY Mellon). Maintaining public confidence is critical, especially after facing regulatory scrutiny. For instance, BNY Mellon agreed to pay $1.5 million in August 2024 to settle a Commodity Futures Trading Commission (CFTC) complaint regarding alleged failures in its derivatives business. Such penalties highlight the need for stringent ethical practices and robust internal controls to safeguard client relationships and prevent reputational erosion, which directly affects client acquisition and retention.

A strong reputation is a significant asset in the financial services industry. Adverse regulatory actions can lead to a tangible loss of business. For example, a significant reputational hit could deter new clients and cause existing ones to seek services elsewhere. BNY Mellon's commitment to rectifying past issues and demonstrating strong corporate governance is therefore essential for sustained growth and market position.

The impact of trust extends to BNY Mellon's ability to attract and retain talent as well. Employees are more likely to remain with an institution that has a positive public image and a strong ethical framework. Conversely, reputational damage can lead to increased employee turnover, impacting operational efficiency and client service delivery.

Employee Well-being and Talent Management

BNY Mellon actively cultivates a high-performance culture that prioritizes employee well-being and work-life integration, offering flexible work arrangements to its vast global team. This commitment is crucial for attracting and retaining premier talent within the highly competitive financial sector, necessitating ongoing investment in professional growth and a supportive, collaborative atmosphere.

The company's focus on talent management is underscored by its initiatives to enhance employee engagement and development. For instance, BNY Mellon reported an employee engagement score of 74% in its 2023 internal survey, highlighting areas of strength and opportunities for improvement in fostering a positive workplace. Furthermore, the firm offers a comprehensive suite of benefits and resources aimed at supporting physical, mental, and financial well-being, including access to mental health services and financial planning tools.

- Employee Engagement: BNY Mellon's 2023 internal survey indicated a 74% employee engagement rate, reflecting a strong foundation for talent retention.

- Talent Development Investment: The company consistently invests in training and development programs, with employees averaging over 40 hours of learning annually.

- Workforce Diversity: BNY Mellon is committed to diversity and inclusion, with women holding 32% of senior leadership positions globally as of year-end 2023.

- Flexibility Initiatives: The firm offers hybrid work models and flexible scheduling options, acknowledging the evolving needs of its workforce.

Societal expectations regarding corporate responsibility and ethical conduct significantly influence BNY Mellon's operations and reputation. Clients and investors are increasingly demanding that financial institutions demonstrate strong Environmental, Social, and Governance (ESG) performance, impacting investment choices and how success is measured.

BNY Mellon is actively responding to this by offering ESG-focused investment options and guidance, as evidenced by significant inflows into these strategies in 2023. This demonstrates a clear market trend toward sustainable investing, which BNY Mellon is integrating into its core business to meet client demand and manage evolving risks.

The firm also prioritizes workforce diversity and inclusion, setting targets for representation of women and underrepresented groups in leadership. As of early 2024, approximately 36% of BNY Mellon's global workforce were women, with specific goals for senior leadership. This focus not only fosters a more inclusive culture but also enhances talent acquisition and retention, vital for innovation and connecting with a diverse client base.

Demographic shifts, particularly the aging population and intergenerational wealth transfer, are creating substantial opportunities in wealth management and estate planning. With an estimated $68 trillion in wealth expected to transfer in the U.S. over the next two decades, BNY Mellon's established position in serving high-net-worth individuals positions it to capitalize on these trends by offering specialized solutions.

| Sociological Factor | BNY Mellon's Response/Impact | Key Data/Initiative |

|---|---|---|

| Demand for ESG Integration | Clients and investors push for ESG in investment choices and reporting. | Significant inflows into ESG strategies in 2023. |

| Workforce Diversity & Inclusion | Focus on representation targets for women and underrepresented groups. | 36% of global workforce identified as women (early 2024); goal to increase female representation in senior leadership. |

| Demographic Shifts (Wealth Transfer) | Opportunities in wealth management and estate planning due to aging populations. | Over $68 trillion in wealth transfer expected in the U.S. over the next two decades. |

| Client Trust & Reputation | Maintaining public confidence is critical, especially after regulatory scrutiny. | Agreed to pay $1.5 million in August 2024 to settle CFTC complaint. |

| Employee Well-being & Engagement | Cultivating a high-performance culture with focus on employee well-being. | 74% employee engagement score in 2023 internal survey; employees averaged over 40 hours of learning annually. |

Technological factors

BNY Mellon's digital transformation is a cornerstone of its strategy, with its innovative 'Platforms Model' now operational across more than 50% of its business segments. This strategic shift is designed to significantly cut costs and boost operational agility, allowing the company to respond more swiftly to market changes.

The focus on digitalization extends to enhancing client experiences and optimizing internal workflows. By leveraging advanced technologies, BNY Mellon aims to deliver superior client services and achieve greater operational efficiencies, a critical factor in remaining competitive in the evolving financial landscape.

BNY Mellon is aggressively integrating Artificial Intelligence and Machine Learning, currently deploying over 40 AI solutions across its operations. This strategic investment spans critical areas such as risk management, client service, and operational efficiency.

The company is experiencing tangible benefits from these AI initiatives, with efficiencies materializing ahead of projections, as noted in their Q1 2025 earnings report. These advancements are directly contributing to cost reduction efforts and a significant enhancement of the customer experience.

BNY Mellon is actively embracing blockchain technology, notably through its collaboration with Goldman Sachs to introduce tokenized money market funds. This initiative allows for round-the-clock settlement and immediate tracking of ownership for institutional clients, fundamentally improving liquidity and collateral management in the digital asset space.

Cybersecurity and Data Security

BNY Mellon, as a custodian of trillions in assets, faces substantial cybersecurity and data security risks. The escalating threat landscape necessitates ongoing, significant investment in enterprise-grade security measures to protect sensitive client information. Achieving and maintaining certifications like SOC 2 Type 2, along with meticulous user logging, are paramount for safeguarding data and preserving client confidence.

The financial services industry, including BNY Mellon, is a prime target for cyberattacks, with the average cost of a data breach in the financial sector reaching $5.90 million in 2023, according to IBM's Cost of a Data Breach Report. This underscores the critical need for BNY Mellon to continuously enhance its defenses. The firm's commitment to robust security protocols is not just a compliance issue but a fundamental requirement for maintaining its reputation and operational integrity in the face of evolving cyber threats.

- Cybersecurity Investment: BNY Mellon's commitment to robust security is essential given the sheer volume of assets it manages.

- Data Protection: Protecting client data is a core responsibility, demanding advanced security infrastructure and protocols.

- Trust and Reputation: Maintaining client trust is directly linked to the firm's ability to prevent and respond to cyber incidents.

- Regulatory Compliance: Adherence to stringent data security regulations is a baseline requirement for financial institutions.

Automation and Operational Efficiency

BNY Mellon's investment in automation, including robotic process automation (RPA) and artificial intelligence, is directly impacting its operational efficiency. These technologies are key to streamlining complex back-office processes within its asset servicing and treasury services divisions, aiming to reduce manual errors and accelerate transaction processing times. For instance, in 2024, the company continued to expand its use of AI-powered solutions to automate client onboarding and reconciliation tasks, which are historically labor-intensive.

The drive for operational efficiency through automation is critical for BNY Mellon to remain competitive. By automating repetitive tasks, the firm can reallocate human capital to more strategic, value-added activities. This not only improves service delivery speed for clients but also contributes to cost optimization, a significant factor in the financial services industry. BNY Mellon reported in early 2025 that its ongoing automation initiatives were projected to yield substantial cost savings, though specific figures were not yet fully quantified.

- RPA Deployment: BNY Mellon is actively deploying RPA across various functions to automate data entry, report generation, and reconciliation processes.

- AI Integration: The firm is exploring and implementing AI for predictive analytics, fraud detection, and personalized client services.

- Efficiency Gains: Automation is expected to lead to a reduction in processing times for key operations, potentially by double-digit percentages in specific areas by the end of 2025.

- Cost Reduction: While exact figures are still emerging, the strategic implementation of automation is a core component of BNY Mellon's long-term cost management strategy.

BNY Mellon's technological advancement centers on its digital transformation, with its Platforms Model now active in over half its business segments, aiming for cost reduction and enhanced agility. The firm is aggressively integrating AI and Machine Learning, deploying over 40 solutions to improve risk management, client service, and operational efficiency, with early 2025 reports indicating these initiatives are yielding benefits ahead of schedule.

The company is also embracing blockchain, notably through a collaboration to introduce tokenized money market funds, facilitating 24/7 settlement and real-time ownership tracking for institutional clients. This focus on cutting-edge technology is crucial for BNY Mellon to maintain its competitive edge and deliver superior client experiences in the rapidly evolving financial landscape.

| Technology Area | BNY Mellon Initiative | Impact/Goal | Data Point (2024/2025) |

|---|---|---|---|

| Digital Transformation | Platforms Model | Cost reduction, operational agility | Operational in >50% of business segments |

| Artificial Intelligence | AI/ML Solutions Deployment | Enhanced risk management, client service, efficiency | Over 40 AI solutions deployed; efficiencies noted ahead of projections (Q1 2025) |

| Blockchain | Tokenized Money Market Funds | 24/7 settlement, improved liquidity | Collaboration with Goldman Sachs |

| Automation (RPA/AI) | Process Automation | Streamlined back-office, reduced errors, faster processing | Expansion of AI for client onboarding and reconciliation (2024); projected double-digit percentage efficiency gains in specific areas by end of 2025 |

Legal factors

BNY Mellon navigates a dense regulatory landscape, with key frameworks like Basel III dictating capital adequacy and Dodd-Frank addressing systemic risk and consumer protection. These regulations are crucial for maintaining financial stability and trust in the banking sector.

The Federal Reserve's rigorous stress tests are a prime example of this oversight. In the 2023 Comprehensive Capital Analysis and Review (CCAR), BNY Mellon demonstrated robust capital levels, consistently passing the tests, which underscores its resilience even under hypothetical severe economic downturns.

BNY Mellon's adherence to Anti-Money Laundering (AML) and sanctions laws is paramount. Non-compliance can lead to substantial fines, reputational damage, and even operational restrictions. For instance, in 2023, financial institutions globally faced billions in AML-related penalties, underscoring the high stakes.

Operating across numerous jurisdictions, BNY Mellon must implement robust, globally consistent AML and sanctions screening systems. This includes sophisticated transaction monitoring and customer due diligence to identify and report suspicious activities, a complex task given the volume and speed of global financial flows.

Operating globally, BNY Mellon navigates a complex web of data privacy regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws, which continue to evolve, mandate strict controls over how client data is collected, processed, and stored, impacting BNY Mellon's operations across different jurisdictions.

Protecting client data and ensuring the secure handling of personal information is a critical operational imperative. BNY Mellon's commitment to data privacy necessitates the implementation of robust data governance frameworks and advanced cybersecurity measures to prevent breaches and maintain client trust in an increasingly digital financial landscape.

Swap Data Reporting Requirements

The Bank of New York Mellon (BNY Mellon) operates under stringent legal frameworks governing financial markets, particularly concerning swap data reporting. These regulations are critical for market transparency and stability.

Recent enforcement actions underscore the importance of compliance. For instance, in 2024, BNY Mellon received a $5 million penalty from the Commodity Futures Trading Commission (CFTC). This fine was levied due to deficiencies in accurately reporting swap transactions and inadequate supervision of its swap dealer activities. Such penalties highlight the significant legal responsibility financial institutions have to ensure precise and timely data submission in derivative markets.

- Regulatory Scrutiny: Financial institutions like BNY Mellon face intense scrutiny regarding swap data reporting.

- Enforcement Actions: Failures in reporting can lead to substantial fines, as evidenced by the 2024 CFTC penalty.

- Operational Impact: Non-compliance necessitates significant investment in systems and processes to meet legal obligations.

- Market Integrity: Accurate reporting is fundamental to maintaining the integrity and stability of global financial markets.

Litigation and Legal Disputes

BNY Mellon, like other major financial institutions, navigates a landscape of ongoing litigation and legal disputes. These can stem from various sources, including historical business practices and adherence to regulatory compliance. Such legal challenges represent a significant operational risk and can impact financial performance and reputation.

The Securities and Exchange Commission (SEC) has actively pursued enforcement actions against financial firms. For instance, BNY Mellon was fined $1.5 million in September 2023 for making inaccurate ESG disclosures related to mutual funds. This penalty highlights the heightened scrutiny and legal ramifications of product claims and public statements concerning environmental, social, and governance factors.

- Regulatory Fines: BNY Mellon has faced penalties for compliance failures, such as the $1.5 million SEC fine in September 2023 for ESG misstatements.

- Litigation Landscape: As a large financial entity, the company is routinely involved in various legal proceedings, impacting operational costs and strategic planning.

- Disclosure Risks: Inaccurate or misleading statements, particularly regarding investment products and ESG commitments, carry substantial legal and reputational consequences.

BNY Mellon's legal environment is characterized by stringent regulations, including Basel III for capital adequacy and Dodd-Frank for systemic risk. Recent penalties, such as a $5 million CFTC fine in 2024 for swap data reporting deficiencies, underscore the critical need for precise compliance and robust oversight. The company also faces litigation risks, as evidenced by a $1.5 million SEC fine in September 2023 for inaccurate ESG disclosures, highlighting the significant consequences of misstatements.

| Legal Factor | Impact on BNY Mellon | Example Data/Event |

|---|---|---|

| Regulatory Compliance | Requires substantial investment in systems and processes to adhere to evolving financial regulations. | $5 million CFTC fine in 2024 for swap data reporting deficiencies. |

| Litigation and Disputes | Can lead to significant financial penalties, reputational damage, and operational disruptions. | $1.5 million SEC fine in September 2023 for inaccurate ESG disclosures. |

| Data Privacy Laws | Mandates strict controls over client data, impacting global operations and necessitating advanced cybersecurity measures. | Compliance with GDPR and CCPA requires robust data governance frameworks. |

Environmental factors

BNY Mellon is actively incorporating climate-related financial disclosures, aligning with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. This proactive approach recognizes the tangible financial risks stemming from climate change, encompassing both the direct impacts of extreme weather events and the indirect consequences of shifting towards a low-carbon economy.

The institution is rigorously assessing physical risks, such as the potential damage to assets from increased frequency and intensity of storms or floods, and transition risks, like the impact of new environmental regulations or evolving consumer preferences for sustainable products. For instance, as of its 2024 reporting, BNY Mellon has detailed its exposure to climate-related risks across various sectors, highlighting the need for robust risk management frameworks to navigate these evolving challenges.

The financial sector, including BNY Mellon, is increasingly prioritizing sustainable finance, evident in the growing market for green bonds. For instance, the global green bond market reached an estimated $1.5 trillion in issuance by early 2024, a significant jump from previous years.

BNY Mellon's position as a major custodian and asset servicer allows it to facilitate the flow of capital into these environmentally focused investments. The firm actively supports the issuance of green bonds and offers a range of ESG-integrated investment products, responding to a clear demand from clients seeking to align their portfolios with sustainability goals.

This trend is further underscored by a 2024 survey indicating that over 70% of institutional investors consider ESG factors in their investment decisions, creating a substantial opportunity for institutions like BNY Mellon to lead in providing these solutions.

BNY Mellon's commitment to annual ESG reporting, detailing its environmental, social, and governance impacts, is a cornerstone of its operational strategy. This transparency is vital for stakeholders who rely on comprehensive data to assess the company's sustainability performance and its adherence to global standards like the Global Reporting Initiative (GRI).

In 2023, BNY Mellon reported a 23% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, demonstrating tangible progress in its environmental stewardship. This focus on measurable outcomes underscores the integration of ESG considerations into the core of its business operations.

Operational Environmental Footprint

BNY Mellon actively manages its operational environmental footprint across its global facilities, focusing on reducing energy consumption, waste generation, and carbon emissions. This commitment is integral to its broader sustainability objectives and corporate environmental responsibility initiatives.

Key initiatives and data points for BNY Mellon's operational environmental footprint include:

- Energy Efficiency: BNY Mellon has set targets to reduce absolute Scope 1 and Scope 2 greenhouse gas (GHG) emissions. For instance, in 2023, the company reported a 29% reduction in absolute Scope 1 and 2 GHG emissions compared to its 2019 baseline, primarily driven by energy efficiency measures and renewable energy procurement.

- Waste Reduction: The company aims to minimize waste sent to landfills. In 2023, BNY Mellon achieved a waste diversion rate of 85% across its operations, diverting significant amounts of waste through recycling and composting programs.

- Sustainable Procurement: BNY Mellon incorporates environmental considerations into its procurement processes, favoring vendors with strong sustainability practices and products with lower environmental impacts.

- Water Management: Efforts are also made to conserve water in its operations, particularly in water-stressed regions where its facilities are located.

Regulatory and Stakeholder Pressure for Green Initiatives

BNY Mellon is experiencing heightened scrutiny from regulators, investors, and clients who are demanding concrete proof of its commitment to environmental sustainability. This push is compelling the bank to bolster its green initiatives, focusing on creating solutions that facilitate a transition to a low-carbon economy and aligning its service offerings with broader sustainable development objectives.

Financial institutions like BNY Mellon are increasingly expected to integrate Environmental, Social, and Governance (ESG) factors into their core business strategies. For instance, as of early 2024, global sustainable investment assets were projected to exceed $50 trillion, indicating a significant market demand for environmentally conscious financial products and services. This trend directly influences BNY Mellon's strategic direction, pushing for greater transparency and action on climate-related risks and opportunities.

- Regulatory Mandates: Growing number of regulations globally requiring financial institutions to disclose climate-related financial risks and implement sustainable practices.

- Investor Activism: A significant portion of institutional investors, managing trillions in assets, are actively engaging with companies to improve their ESG performance, including environmental impact.

- Client Demand: Corporate and individual clients are increasingly choosing financial partners whose values and operations align with sustainability principles, impacting client retention and acquisition.

Environmental factors significantly shape BNY Mellon's strategy, driven by increasing global pressure for climate action and sustainable finance. The company is actively managing its operational footprint, evidenced by a 29% reduction in Scope 1 and 2 GHG emissions by 2023 compared to 2019, and a 85% waste diversion rate in the same year. This focus is crucial as over 70% of institutional investors consider ESG factors, creating a strong market demand for environmentally conscious financial solutions.

| Environmental Metric | 2023 Data | Baseline Year | Target/Goal |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 29% | 2019 | Absolute reduction |

| Waste Diversion Rate | 85% | N/A | Minimize landfill waste |

| Green Bond Market Growth (Est.) | $1.5 trillion (early 2024) | N/A | Facilitate capital flow |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bank of New York Mellon draws upon data from financial regulatory bodies, global economic indicators, and technology trend reports. We also incorporate insights from industry-specific publications and geopolitical analyses to provide a comprehensive view.