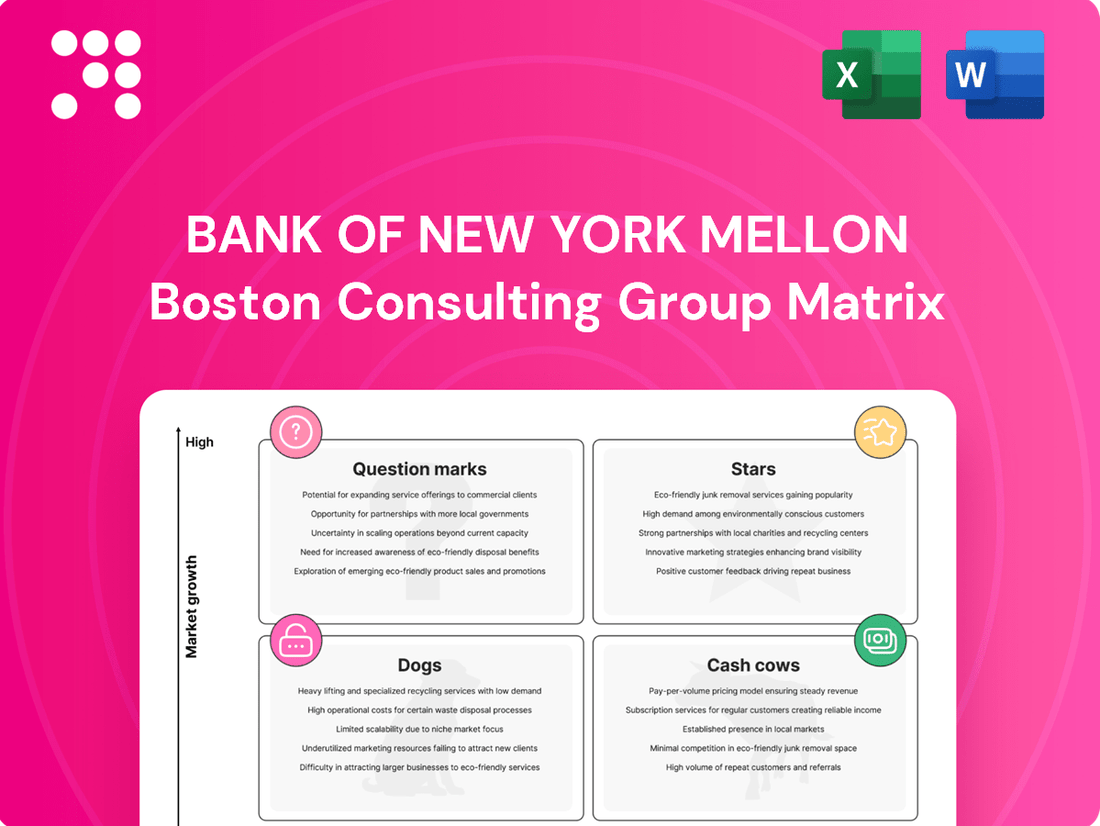

Bank of New York Mellon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of New York Mellon Bundle

Curious about The Bank of New York Mellon's strategic product portfolio? Our BCG Matrix analysis offers a glimpse into how its offerings might be performing as Stars, Cash Cows, Dogs, or Question Marks. Understand the current landscape and identify potential growth areas.

Don't miss out on the full picture! Purchase the complete BCG Matrix report to unlock detailed quadrant placements, expert analysis, and actionable strategies for optimizing BNY Mellon's product mix and driving future success.

Stars

BNY Mellon is actively participating in the digital asset custody space, a market anticipated to grow significantly. Projections suggest this sector could reach $709.05 billion by 2025, expanding at an 18.1% compound annual growth rate. This positions BNY Mellon within a high-potential area.

Their collaboration with Goldman Sachs to introduce tokenized money market funds highlights BNY Mellon's role in integrating traditional finance with blockchain innovations. This initiative underscores their commitment to leading in the evolving digital asset landscape.

Bank of New York Mellon (BNY Mellon) is significantly investing in AI and data analytics, a move that positions its AI-Driven Data and Analytics Solutions within the Stars quadrant of the BCG Matrix. By Q1 2025, over 40 AI solutions are expected to be deployed, with 80% of employees trained on their Eliza platform.

Strategic partnerships with tech giants like Microsoft Azure, ThoughtSpot, and Snowflake are crucial for BNY Mellon's data management and insight generation capabilities. These collaborations are designed to fuel growth in high-demand fintech sectors by offering clients enhanced, actionable data analytics.

BNY Mellon's pivot to a platform-oriented business model is a significant strategic move, with over half the firm embracing it within a year. This transformation, evidenced in their Q1 2025 performance, aims to streamline operations and elevate client experiences.

The adoption of this platform approach is directly contributing to cost reductions and fostering greater business agility. It's a key driver for unlocking cross-selling potential across BNY Mellon's extensive client network, as noted in their recent financial disclosures.

Strategic Fintech Acquisitions

BNY Mellon's strategic fintech acquisitions are key to its growth. The acquisition of Archer in late 2024 for $1.2 billion is a prime example. This move significantly enhances BNY Mellon's digital asset custody platform, a critical and rapidly evolving sector.

These targeted mergers and acquisitions are instrumental in solidifying BNY Mellon's presence in high-growth markets. They directly support the company's overarching strategy to build a robust, platform-centric business model.

- Digital Asset Custody Enhancement: The $1.2 billion acquisition of Archer in late 2024 bolstered BNY Mellon's capabilities in digital asset custody.

- Strategic Focus on Technology: This acquisition underscores BNY Mellon's commitment to investing in technology-forward sectors.

- Platform-Oriented Vision: Such disciplined M&A activity aligns with the company's long-term vision of becoming a leading platform provider.

Cross-Selling and Integrated Client Solutions

BNY Mellon's strategic shift towards cross-selling and integrated client solutions has yielded significant results, culminating in their strongest sales quarter ever. This approach focuses on deepening relationships by encouraging clients to engage with multiple business lines.

The success of this strategy is evident in the 40% increase in clients utilizing three or more lines of business over the past two years. This indicates a strong client adoption of BNY Mellon's comprehensive service offerings.

This emphasis on integrated solutions across segments like Securities Services and Market and Wealth Services is a primary engine for organic growth. It effectively leverages their vast global client network to foster expansion.

- Record Sales Quarter: BNY Mellon achieved its strongest sales quarter on record due to its new commercial coverage strategy.

- Client Engagement Growth: Clients using three or more lines of business increased by 40% over two years.

- Segment Integration: The strategy integrates services across Securities Services and Market and Wealth Services.

- Organic Expansion Driver: Deepening client relationships and offering comprehensive solutions fuels organic growth.

BNY Mellon's AI-Driven Data and Analytics Solutions are positioned as Stars in the BCG Matrix, reflecting their high growth and market share. By Q1 2025, over 40 AI solutions are slated for deployment, with 80% of employees trained on the Eliza platform, demonstrating significant investment and internal adoption. Strategic partnerships with tech leaders like Microsoft Azure further bolster these capabilities, driving innovation in a rapidly expanding fintech sector.

| BCG Quadrant | BNY Mellon Business Area | Key Growth Drivers | Market Share | Strategic Focus |

|---|---|---|---|---|

| Stars | AI-Driven Data & Analytics | AI solution deployment, employee training, tech partnerships | High (projected) | Innovation, client solutions |

What is included in the product

This BCG Matrix overview identifies BNY Mellon's business units as Stars, Cash Cows, Question Marks, or Dogs, guiding investment and divestment strategies.

The Bank of New York Mellon BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Traditional Asset Servicing, encompassing custody and administration, stands as a robust Cash Cow for BNY Mellon. As of March 31, 2025, the bank managed a staggering $53.1 trillion in assets under custody and/or administration, marking a significant 9% increase from the previous year.

This segment benefits from a dominant market share within a mature industry, consistently delivering substantial fee-based revenue. Its stability and reliability provide a predictable and significant cash flow, underpinning BNY Mellon's overall financial strength.

BNY Mellon's Corporate Trust Services are a classic example of a Cash Cow within the BCG Matrix. The bank has a long-standing reputation and manages a substantial portion of debt and equity issuances, which translates into predictable, fee-based income.

This segment operates in a mature market, meaning growth is modest, but its established position and high barriers to entry for competitors allow for strong profitability. For instance, in 2023, BNY Mellon reported total revenue of $17.1 billion, with its Pershing and Securities Services segments, which include corporate trust, contributing significantly to this stable revenue base.

BNY Mellon's Treasury Services, encompassing cash management and payments, are a bedrock for its institutional clients. These operations are vital, handling substantial transaction volumes and leveraging deep, long-standing client ties.

In 2024, Treasury Services continued to be a significant revenue driver for BNY Mellon, contributing to both net interest income and fee-based earnings. The business operates within a mature, stable market, reflecting its established position and consistent demand from a broad client base.

Core Investment Management Services

BNY Mellon's core investment management services, representing established, large-cap funds, function as Cash Cows within its BCG Matrix. Despite a flat $2.01 trillion in Assets Under Management (AUM) for Q1 2025, these mature offerings consistently generate substantial management fees. This steady revenue stream is a hallmark of a Cash Cow, providing stability even as new inflows and outflows balance out in other segments.

- Consistent Fee Generation: Mature, diversified funds provide a reliable income source.

- Stable AUM Base: While growth may be modest, the sheer size of these assets ensures significant fee collection.

- Low Investment Needs: These established products require minimal marketing or development expenditure.

- Contribution to Overall Profitability: Cash Cows fund growth initiatives in other business areas.

Clearing and Collateral Management

BNY Mellon's clearing and collateral management services are considered cash cows. These businesses are fundamental to the smooth operation of capital markets, and BNY Mellon enjoys a robust market share in this space. They offer essential support to financial institutions, leading to consistent transaction volumes and reliable fee income, even in a mature market with established competitors and steady demand.

The resilience of these services is a key factor in their cash cow status. In 2024, BNY Mellon reported significant revenue from its Pershing segment, which includes many of these back-office and clearing functions. For instance, their asset servicing business, closely related to these operations, generated billions in revenue, demonstrating the steady cash flow these mature businesses provide.

- Strong Market Position: BNY Mellon is a leader in clearing and collateral management, a vital component of financial market infrastructure.

- Stable Revenue Generation: These services provide predictable fee income and consistent transaction volumes, characteristic of cash cows.

- Integral to Operations: They are critical for financial institutions, ensuring operational stability and regulatory compliance.

- Mature Market Dynamics: The established nature of this market means predictable demand and less disruptive competition, supporting consistent profitability.

BNY Mellon's established investment management offerings, particularly those managing large-cap, mature funds, are prime examples of Cash Cows. Despite a stable Assets Under Management (AUM) of $2.01 trillion in Q1 2025, these segments consistently generate substantial management fees. This reliable revenue stream, a hallmark of Cash Cows, underpins the company's financial stability.

Traditional Asset Servicing, including custody and administration, remains a significant Cash Cow, managing $53.1 trillion in assets as of March 31, 2025, a 9% year-over-year increase. This segment benefits from a dominant market share in a mature industry, consistently delivering robust fee-based revenue and predictable cash flow.

BNY Mellon's Treasury Services, crucial for institutional clients' cash management and payments, also operate as a Cash Cow. These operations, vital for handling substantial transaction volumes and leveraging long-standing client relationships, continued to be a significant revenue driver in 2024, contributing to both net interest income and fee-based earnings in a stable market.

| Business Segment | BCG Matrix Category | Key Characteristics | Relevant Data (as of early 2025) |

|---|---|---|---|

| Traditional Asset Servicing | Cash Cow | Mature industry, dominant market share, stable fee revenue | $53.1 trillion in AUA/AUC (March 31, 2025) |

| Investment Management (Large-Cap Funds) | Cash Cow | Consistent management fees, stable AUM, low investment needs | $2.01 trillion in AUM (Q1 2025) |

| Treasury Services | Cash Cow | Vital for institutional clients, stable market, consistent revenue | Significant contributor to 2024 revenue |

Full Transparency, Always

Bank of New York Mellon BCG Matrix

The Bank of New York Mellon BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means the strategic insights and analysis presented are exactly what you'll have access to for your business planning. Rest assured, no watermarks or demo content will be present in the final download, ensuring a professional and actionable document.

Dogs

BNY Mellon's Investment and Wealth Management segment is currently facing significant challenges. In the first quarter of 2025, revenues within this segment saw an 8% decrease, while pre-tax income experienced a substantial 41% drop.

Assets Under Management (AUM) remained stagnant, further compounded by net outflows, signaling a difficult market position. This performance suggests the segment operates in a low-growth environment with limited market share, struggling against intense competition, particularly from agile digital wealth management platforms.

Legacy technology infrastructure, such as on-premise data centers and older software systems, can be considered a Dog in the Bank of New York Mellon's BCG Matrix. These systems often require substantial ongoing maintenance and upgrade expenses, diverting resources from more innovative projects. For instance, in 2024, many financial institutions reported that maintaining their legacy IT systems consumed a significant portion of their technology budgets, sometimes exceeding 70% of the total IT spend, according to industry analyses.

Certain specialized or legacy financial products, not central to BNY Mellon's current strategic direction, can be found here. These offerings often face diminishing customer interest or intense rivalry from nimble fintech alternatives, resulting in reduced profitability and market presence.

For instance, some older trust or custody services might be experiencing this, especially as digital asset management gains traction. In 2024, the global fintech market is projected to reach over $300 billion, highlighting the competitive pressure on traditional players.

Highly Competitive, Low-Margin Advisory Services

Highly competitive, low-margin advisory services within Bank of New York Mellon's portfolio could be categorized as question marks or even dogs in a BCG matrix analysis, particularly if BNY Mellon lacks a unique selling proposition. These services often face intense price competition, leading to thin profit margins. For instance, general financial consulting or basic investment advice where BNY Mellon doesn't offer a specialized edge would fit this description.

These types of offerings might struggle to attract substantial new clients and can consume valuable resources without yielding significant returns. In 2024, the advisory sector saw continued fee compression, with many firms reporting average advisory fees in the range of 0.5% to 1.0% of assets under management for broad services. This environment makes it challenging for undifferentiated services to generate robust profits.

- Low Profitability: Intense price competition in general advisory services limits profit margins, often falling below industry averages for specialized offerings.

- Stagnant Growth: Without a clear competitive advantage or unique value proposition, these services may experience slow or negative growth in new business acquisition.

- Resource Drain: Continued investment in marketing, technology, and personnel for these services can divert resources from more promising areas of the business.

Segments with Persistent Client Outflows

Certain client segments and geographic regions within Bank of New York Mellon (BNY Mellon) have consistently experienced net client outflows. These areas represent a challenge to market share retention and future revenue growth.

For instance, BNY Mellon's asset servicing business, particularly in regions facing intense competition and regulatory pressures, has seen persistent outflows. In the first quarter of 2024, the company reported a net outflow of $13 billion in its Investment Services segment, largely driven by continued client deleveraging and asset consolidation.

These segments, often characterized by lower margins or a lack of differentiated offerings, require a thorough strategic review. Potential actions could include divestiture of non-core assets or a significant restructuring to improve competitiveness.

- Persistent Outflows in Specific Segments: BNY Mellon's asset servicing and certain wealth management sub-segments have shown consistent net client outflows.

- Geographic Challenges: Regions with high competition and evolving regulatory landscapes have contributed to these outflows.

- Q1 2024 Data: BNY Mellon experienced $13 billion in net outflows in its Investment Services segment during the first quarter of 2024.

- Strategic Implications: These areas signal a loss of market share and necessitate evaluation for divestiture or restructuring.

BNY Mellon's "Dogs" in the BCG matrix likely encompass legacy technology infrastructure and certain undifferentiated, low-margin advisory services. These segments typically exhibit low growth potential and weak market share, demanding significant resources for maintenance and upgrades without generating substantial returns. For example, industry analyses in 2024 indicated that maintaining legacy IT systems could consume over 70% of a financial institution's technology budget.

Additionally, specific client segments and geographic regions experiencing persistent net outflows, such as parts of the asset servicing business, also fall into this category. These areas face intense competition and may lack unique value propositions, leading to declining profitability and market presence. In Q1 2024, BNY Mellon reported $13 billion in net outflows in its Investment Services segment, underscoring these challenges.

| Category | Characteristics | Examples | 2024 Data/Context |

| Legacy Technology | Low growth, low market share, high maintenance costs | On-premise data centers, older software systems | IT budgets heavily allocated to legacy system maintenance (often >70%) |

| Undifferentiated Advisory Services | Low growth, low market share, low profitability | General financial consulting, basic investment advice | Fee compression in advisory sector, average fees 0.5%-1.0% AUM |

| Challenged Client Segments/Regions | Low growth, declining market share, persistent outflows | Specific asset servicing sub-segments, competitive geographic markets | $13 billion net outflows in Investment Services (Q1 2024) |

Question Marks

BNY Mellon's exploration into blockchain applications beyond custody, such as asset tokenization and smart contracts, positions it in a high-growth, albeit currently low-market-share, segment. These ventures require substantial investment but promise significant future returns.

The tokenization of real-world assets, a key emerging application, is projected to reach $5.5 trillion by 2030 according to a recent BCG report, highlighting the immense potential BNY Mellon could tap into. Smart contracts, automating complex financial agreements, also offer efficiency gains and new revenue streams.

BNY Mellon is actively developing and integrating advanced AI/ML-driven advisory and predictive tools, moving beyond internal operations to offer hyper-personalized investment advice to specific client segments. This strategic push aims to capture a growing market for sophisticated financial analytics, though BNY Mellon is still in the process of establishing a dominant market position in this rapidly evolving space.

The firm's investment in these technologies is significant, recognizing the potential for AI to revolutionize client engagement and wealth management. By leveraging machine learning, BNY Mellon seeks to provide clients with more precise, data-driven insights and tailored strategies, a crucial differentiator in today's competitive financial landscape.

BNY Mellon's aggressive push into emerging markets with low current penetration presents a classic Question Mark scenario. These regions, such as parts of Southeast Asia and Africa, offer substantial long-term growth potential, with some economies projected to grow at over 5% annually in the coming years. However, establishing a strong foothold demands significant capital investment for infrastructure, navigating complex regulatory landscapes, and cultivating local expertise.

Specialized Niche Fintech Solutions Development

Bank of New York Mellon (BNY Mellon) might strategically place its specialized niche fintech solutions development in the Question Marks quadrant of the BCG matrix. These ventures, often born from internal incubation or small acquisitions, focus on highly specific, rapidly evolving client needs like advanced RegTech or unique payment rails. This positioning acknowledges their high-risk, high-reward nature, demanding substantial investment to validate and scale their market potential.

- High Investment Need: These initiatives require significant capital to develop and prove their efficacy, mirroring the investment demands of Question Marks. For instance, developing a proprietary AI-driven compliance monitoring system could cost tens of millions in R&D and talent acquisition.

- Uncertain Market Share: While addressing niche demands, their future market share is not guaranteed, making them prime candidates for the Question Marks category. A new blockchain-based cross-border payment solution might capture a small but growing segment, but its ultimate dominance is unknown.

- Potential for Growth: The rapid evolution of client needs in areas like cybersecurity and personalized wealth management offers substantial growth potential if these specialized solutions gain traction. BNY Mellon’s 2024 focus on enhancing digital client onboarding, for example, highlights this pursuit of specialized, high-growth areas.

- Strategic Importance: Even if not immediately profitable, these niche solutions can be strategically vital for BNY Mellon, offering competitive differentiation and insights into emerging market trends.

Cybersecurity Solutions as a Service

BNY Mellon's Cybersecurity Solutions as a Service (CSaaS) can be viewed as a potential question mark in its BCG Matrix. This offering leverages the bank's internal security expertise and infrastructure to provide advanced cybersecurity solutions to clients, tapping into a rapidly expanding market. The global cybersecurity market was projected to reach $345 billion in 2024, with significant growth expected in managed security services.

While the demand for such services is robust, BNY Mellon's market share in this specific, standalone CSaaS segment is likely still developing. This means it requires substantial strategic investment and focused execution to gain traction and compete with established players.

- Market Growth: The demand for cybersecurity services is escalating, driven by increasing cyber threats and regulatory compliance needs.

- Nascent Market Share: BNY Mellon's presence in the standalone CSaaS market is likely in its early stages, indicating potential for growth but also requiring significant effort.

- Investment Requirement: To effectively compete, BNY Mellon will need to allocate resources for service development, talent acquisition, and marketing.

- Competitive Landscape: The CSaaS market is crowded with specialized providers, necessitating a clear differentiation strategy for BNY Mellon.

BNY Mellon's ventures into nascent digital asset custody and blockchain solutions, while holding immense future promise, currently represent Question Marks. These areas demand significant upfront investment to build infrastructure and gain regulatory clarity, but their long-term market share is not yet established. For example, BNY Mellon's exploration of tokenized real-world assets, a market projected to reach $5.5 trillion by 2030, requires substantial capital to develop the necessary platforms and secure partnerships.

The firm's expansion into emerging geographical markets also fits the Question Mark profile. While these regions offer high growth potential, with some economies expected to expand by over 5% annually, they necessitate considerable investment in local infrastructure, talent, and navigating complex regulatory environments to secure a meaningful market share.

BNY Mellon's development of specialized fintech solutions, such as AI-driven RegTech or novel payment rails, are positioned as Question Marks. These initiatives, often requiring tens of millions in R&D, target niche but rapidly evolving client needs. Their success hinges on gaining traction in a competitive landscape, making their future market share uncertain despite their strategic importance.

BNY Mellon's Cybersecurity Solutions as a Service (CSaaS) is a prime example of a Question Mark. The global cybersecurity market was valued at $345 billion in 2024, presenting a significant opportunity. However, BNY Mellon's market share in this specific, standalone service offering is still developing, requiring substantial investment for service enhancement, talent acquisition, and marketing to compete effectively.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.