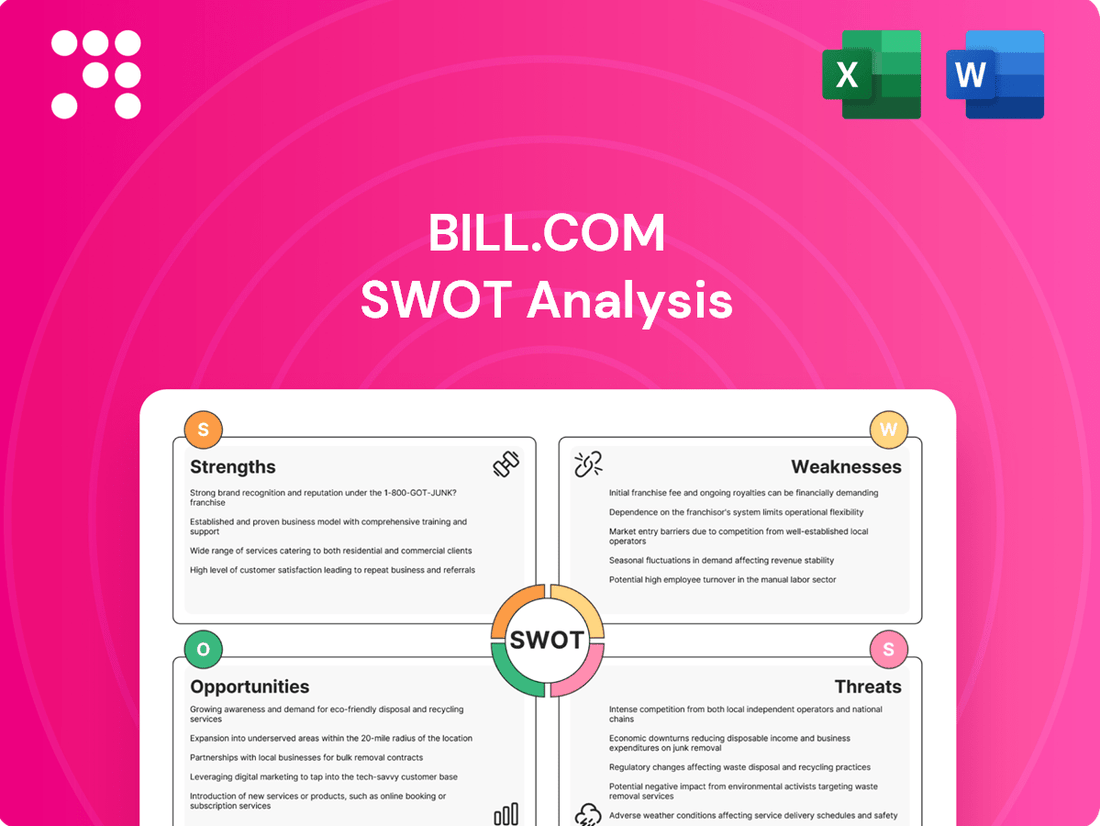

Bill.com SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

Bill.com's strengths lie in its robust platform and strong market position, while its opportunities include expanding into new verticals and international markets. However, potential weaknesses like reliance on integrations and threats from emerging competitors require careful consideration.

Want the full story behind Bill.com's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bill.com's strength lies in its comprehensive, cloud-based platform that seamlessly integrates accounts payable and accounts receivable, along with expense management. This unified approach tackles the complexities of financial workflows for small and midsize businesses, offering a single point of control for cash flow management.

This integrated ecosystem significantly boosts efficiency and provides greater oversight of financial operations. For instance, in the fiscal year ending June 30, 2023, Bill.com reported a 26% increase in total revenue, reaching $1.05 billion, underscoring the market's demand for such streamlined financial solutions.

Bill.com commands a robust presence in the U.S. small and medium-sized business (SMB) accounting sector. Its platforms are highly regarded by its intended users, demonstrating strong product-market fit.

The company's dedication to modernizing the financial operations of small businesses has fostered a substantial and growing network. As of early 2024, Bill.com serves close to 500,000 SMBs, a testament to its widespread adoption and value proposition.

This concentrated approach allows Bill.com to effectively address the unique requirements of this crucial business demographic, solidifying its standing as a market leader.

Bill.com's robust integration capabilities are a significant strength, allowing seamless connection with major accounting software such as QuickBooks, Sage, Intacct, and NetSuite. This ensures financial data remains synchronized, reducing manual entry and potential errors for businesses.

This strong integration fuels a powerful network effect, amplified by Bill.com's proprietary network of millions of members. As more businesses join and utilize the platform, its value proposition grows, making it more attractive for others to adopt for faster payments.

Recurring Revenue Model and High Gross Margins

Bill.com's recurring revenue model, fueled by subscriptions and transaction fees, provides a stable and predictable income stream. This predictability is a significant strength, offering a solid foundation for financial planning and growth. For instance, in the fiscal year ending June 30, 2023, Bill.com reported total revenue of $1.02 billion, with a substantial portion coming from its recurring service fees.

The company consistently demonstrates high gross profit margins, frequently surpassing 80%. This high profitability underscores Bill.com's operational efficiency and the inherent value proposition of its automated financial workflow solutions. These strong margins translate directly into robust financial health and a greater capacity for reinvestment.

- Recurring Revenue: Subscription and transaction fees form the backbone of Bill.com's income, ensuring consistent cash flow.

- High Gross Margins: Consistently above 80%, these margins highlight operational efficiency and pricing power.

- Financial Stability: The combination of recurring revenue and high profitability fosters a stable financial footing.

- Predictable Income: This model allows for more accurate forecasting and strategic capital allocation.

Continuous Innovation and AI Adoption

Bill.com's dedication to continuous innovation, particularly through AI and automation, is a significant strength. By integrating advanced AI, they are enhancing their platform with features like sophisticated procurement tools and more efficient reconciliation processes. This focus on intelligent, predictive solutions directly benefits small and medium-sized businesses (SMBs) by reducing manual work and improving financial decision-making.

This commitment to AI adoption is evident in their ongoing product development. For instance, in fiscal year 2024, Bill.com continued to roll out AI-powered features aimed at simplifying workflows and providing deeper financial insights for their users. This forward-thinking approach ensures their offerings remain competitive and address the evolving needs of the market.

The company's investment in AI is designed to empower SMBs to:

- Reduce manual data entry and processing time.

- Enhance fraud detection and prevention capabilities.

- Gain more strategic insights from their financial data.

- Improve overall financial operational efficiency.

Bill.com's integrated, cloud-based platform is a core strength, simplifying AP, AR, and expense management for SMBs. This unified approach provides crucial oversight and efficiency in cash flow management.

The company has a strong market position within the U.S. SMB accounting sector, reflecting excellent product-market fit. As of early 2024, Bill.com serves nearly 500,000 SMBs, showcasing its widespread adoption and value.

Bill.com's robust integration capabilities with major accounting software, coupled with its extensive member network, create a powerful network effect. This seamless connectivity and growing user base enhance the platform's value proposition, particularly for facilitating faster payments.

The company benefits from a stable, recurring revenue model driven by subscriptions and transaction fees, contributing to its financial predictability. In fiscal year 2023, Bill.com's total revenue reached $1.02 billion, with a significant portion derived from these recurring services.

Bill.com demonstrates high gross profit margins, consistently exceeding 80%, which points to strong operational efficiency and pricing power. This high profitability supports robust financial health and reinvestment capacity.

| Metric | FY 2023 (Ending June 30, 2023) | Early 2024 |

|---|---|---|

| Total Revenue | $1.02 Billion | N/A (Ongoing) |

| Customer Base | N/A (Pre-500k) | ~500,000 SMBs |

| Gross Profit Margin | >80% | >80% (Indicative) |

What is included in the product

Delivers a strategic overview of Bill.com’s internal and external business factors, highlighting its strengths in automation and market reach while addressing challenges in integration and competition.

Simplifies complex financial workflows, acting as a pain point reliever for manual accounts payable and receivable processes.

Weaknesses

Bill.com's significant reliance on the small and midsize business (SMB) market, while a core strength, also presents a key weakness. This segment is particularly sensitive to economic fluctuations, and recent data suggests a cautious spending environment among SMBs. For instance, a Q4 2024 survey by Principal Financial Group indicated that only 30% of small businesses planned to increase their spending in the next six months, a trend that could temper Bill.com's customer acquisition and revenue growth.

While Bill.com excels in many areas, some users have expressed dissatisfaction with customer service, noting slow response times and difficulties in resolving issues. This can be particularly problematic for businesses that require immediate assistance with financial workflows.

Integration challenges, especially with complex Enterprise Resource Planning (ERP) systems, have also been a recurring theme in customer feedback. These hurdles can lead to sync errors, potentially corrupting historical client data and disrupting essential business operations.

While Bill.com is a strong player in the domestic market, its international payment capabilities remain a notable weakness. Businesses frequently operating with overseas suppliers might find the platform less efficient than specialized global payment solutions. This can lead to extended payment timelines and potentially less favorable currency exchange rates and fees, impacting overall cost-effectiveness for international transactions.

The company's international revenue stream, a key indicator of its global reach, was less than 5% of its total revenue in 2024. This statistic underscores the platform's current limitations in serving a broad international client base or facilitating seamless cross-border payments compared to more established global financial technology providers.

Intense Competition in FinTech Sector

The financial technology landscape for small and medium-sized businesses (SMBs) is experiencing a surge in competition. This means Bill.com faces a crowded market with many companies offering similar services. This intense rivalry could force Bill.com to lower prices, potentially affecting its revenue and profitability.

To stay ahead, Bill.com must continually invest in its products and services to stand out from competitors. For instance, as of early 2024, the FinTech sector saw significant venture capital investment, with reports indicating billions poured into startups aiming to disrupt existing markets. This influx of capital fuels innovation and increases the pressure on established players like Bill.com to maintain a competitive edge through superior features and user experience.

- Intensifying competition from both established FinTech firms and emerging startups.

- Potential for pricing pressure impacting Bill.com's revenue streams.

- Need for sustained investment in product development to maintain differentiation.

- Risk of market share erosion if competitors offer more attractive pricing or features.

Ongoing Net Losses Despite Revenue Growth

Despite consistent revenue growth, Bill.com has continued to report net losses. For instance, in fiscal year 2023, the company reported a net loss of $121.7 million, even as revenue increased by 26% to $884.7 million.

This persistent unprofitability stems from significant operating expenses, especially in research and development and sales and marketing, which have often grown faster than the company's top line. These investments are aimed at future expansion, but they pressure the company's bottom line.

While strategic investments are crucial for long-term growth, the ongoing net losses raise concerns about Bill.com's trajectory towards sustainable profitability.

- Fiscal Year 2023 Net Loss: $121.7 million.

- Fiscal Year 2023 Revenue Growth: 26%.

- Key Expense Drivers: Research and development, sales and marketing.

- Profitability Concern: Continued net losses despite revenue expansion.

Bill.com's reliance on the SMB market makes it vulnerable to economic downturns, as evidenced by a Q4 2024 survey showing only 30% of small businesses planned increased spending. Customer feedback highlights issues with slow customer service response times, which can disrupt critical financial workflows. Furthermore, integration challenges with complex ERP systems have led to sync errors and potential data corruption, impacting business operations.

The company's international payment capabilities are a significant weakness, with international revenue representing less than 5% of total revenue in 2024, limiting its appeal to businesses with global transactions.

Preview Before You Purchase

Bill.com SWOT Analysis

This is the actual Bill.com SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report. Unlock the full, detailed analysis by completing your purchase.

Opportunities

Bill.com has a prime opportunity to grow by entering new countries, as its current international presence is minimal. This geographic expansion could tap into previously unreached customer bases.

The company is also making strides in serving the mid-market segment, which involves catering to larger businesses with more intricate financial needs. This strategic move aims to broaden its appeal to a wider range of company sizes.

By focusing on both international markets and the mid-market, Bill.com is positioning itself to capture significant new revenue opportunities and attract a more diverse set of clients.

Bill.com can capitalize on the rapidly growing FinTech AI market, which is expected to reach $100 billion by 2028, by embedding advanced analytics. This integration can unlock deeper financial insights for its users, bolster fraud prevention mechanisms, and introduce more intelligent automation features. Such enhancements will empower businesses to streamline operations and achieve greater efficiency.

Bill.com can significantly enhance its market standing by forging strategic alliances with key players in the financial and software sectors. These partnerships, like its expanded collaboration with Bank of America, are crucial for integrating services and accessing new customer bases.

By embedding its capabilities within financial institutions and accounting software, Bill.com can create a more interconnected ecosystem. This strategy, evidenced by its ongoing integration efforts, aims to boost platform adoption and customer loyalty by offering seamless solutions.

Deepening Integration with Financial Services

Bill.com has a significant opportunity to expand its reach by integrating more deeply with banking services and other fintech solutions, like corporate cards and lending. This move would transform Bill.com into a more complete financial operations hub for businesses.

By bolstering features such as the BILL Divvy Corporate Card and simplifying how payments are reconciled, Bill.com can offer a wider range of services. This not only encourages existing customers to stay longer but also draws in new users. For instance, in Q1 2024, Bill.com reported a 27% year-over-year increase in total revenue to $317.2 million, demonstrating strong growth that can be further fueled by these expanded offerings.

- Holistic Financial Platform: Deeper integration with banks and fintechs creates a one-stop shop for financial management.

- Enhanced Customer Value: Offering corporate cards and lending solutions increases customer stickiness and lifetime value.

- Market Expansion: A broader service suite can attract a wider customer base, including businesses seeking integrated financial tools.

- Revenue Growth: Expanding service offerings directly contributes to revenue diversification and growth, building on existing momentum like the 27% revenue increase seen in Q1 2024.

Capitalizing on the Shift Towards Digital Transformation

The accelerating global move towards digital and paperless operations, especially within small and medium-sized businesses (SMBs), is a significant and ongoing opportunity for Bill.com. This trend is fueled by businesses actively searching for cloud-based platforms to simplify their invoicing, payment, and expense management processes, all while aiming for improved cost-efficiency and operational fluidity.

Bill.com is strategically positioned to benefit from this digital transformation wave. The company can highlight its core strengths in automating previously manual tasks and enhancing a business's visibility into its cash flow. For instance, a substantial portion of SMBs still grapple with manual processes; a 2024 survey indicated that over 40% of small businesses reported spending more than 10 hours per week on manual financial tasks. Bill.com's platform directly addresses this pain point.

- Sustained Growth Driver: The persistent global shift to digital and paperless operations, particularly impacting SMBs, offers Bill.com a continuous avenue for expansion.

- Demand for Cloud Solutions: Businesses are actively adopting cloud-based systems to streamline financial workflows, driven by the promise of cost savings and increased efficiency.

- Automation Advantage: Bill.com's ability to automate manual processes in invoicing, payments, and expense management directly aligns with market demand.

- Cash Flow Visibility: The platform's capacity to provide clearer insights into cash flow is a critical value proposition for businesses navigating complex financial landscapes.

Bill.com can expand its offerings by integrating more deeply with banking services and other fintech solutions, such as corporate cards and lending. This strategic move would transform Bill.com into a more comprehensive financial operations hub for businesses, enhancing customer value and market reach.

The company is well-positioned to capitalize on the global trend towards digital and paperless operations, especially among small and medium-sized businesses (SMBs). By highlighting its strengths in automating manual tasks and improving cash flow visibility, Bill.com can address the significant pain points faced by many SMBs, as over 40% of small businesses in a 2024 survey reported spending more than 10 hours weekly on manual financial tasks.

Further strategic alliances with financial and software sector leaders are key opportunities. These partnerships, building on existing collaborations, can facilitate service integration and unlock access to new customer segments, solidifying Bill.com's ecosystem presence.

Bill.com's potential to grow by entering new international markets, where its presence is currently minimal, offers a significant avenue for expansion. This geographic diversification aims to tap into previously unreached customer bases and broaden its global footprint.

| Opportunity Area | Description | Potential Impact | Supporting Data |

|---|---|---|---|

| Geographic Expansion | Entering new international markets. | Tap into new customer bases, increase global revenue. | Minimal current international presence. |

| Mid-Market Penetration | Serving larger businesses with complex needs. | Broaden appeal, capture larger deal sizes. | Strategic focus on this segment. |

| FinTech AI Integration | Embedding advanced analytics and AI. | Enhanced insights, fraud prevention, intelligent automation. | FinTech AI market projected to reach $100 billion by 2028. |

| Strategic Alliances | Partnerships with financial and software firms. | Service integration, access to new customers. | Expanded collaboration with Bank of America. |

| Deeper Fintech Integration | Integrating with banking, corporate cards, lending. | Become a complete financial operations hub. | BILL Divvy Corporate Card offering. |

| Digital Transformation Adoption | Capitalizing on the shift to digital/paperless operations. | Address SMB pain points, drive platform adoption. | Over 40% of SMBs spend >10 hours/week on manual finance tasks (2024 survey). |

Threats

The financial technology sector is a crowded space, with both seasoned companies and new entrants vying for market share in AP and AR automation. This fierce competition, exemplified by rivals such as Tipalti, Stampli, and Melio, is creating significant pricing pressure.

This pressure could compel Bill.com to lower its service fees to remain competitive, potentially impacting its ability to maintain current monetization rates and hindering revenue growth. For instance, in Q1 2024, Bill.com reported a 22% year-over-year increase in revenue, reaching $271.6 million, but sustained competitive pressure could moderate this growth trajectory.

Bill.com faces significant headwinds from macroeconomic shifts. For instance, the Federal Reserve's interest rate hikes throughout 2023 and into early 2024 have made borrowing more expensive for small and medium-sized businesses (SMBs), potentially dampening their willingness to spend on financial software and services.

Inflationary pressures also squeeze SMB budgets, forcing them to prioritize essential operational costs over discretionary software investments. This can directly impact Bill.com's total payment volume (TPV) and the rate at which it acquires new customers, thereby slowing revenue expansion.

The volatility inherent in the SMB sector means that during economic slowdowns, these businesses are often the first to cut back on expenditures. This spending reticence can have a pronounced effect on Bill.com's financial performance, as its growth is closely tied to the health and spending capacity of its core clientele.

As a cloud-based platform managing substantial customer funds and sensitive financial information, Bill.com is inherently exposed to cybersecurity risks. A significant data breach could result in considerable financial losses, severe reputational harm, and a critical erosion of customer trust, directly impacting its operations and market position.

The company acknowledged minor security incidents in 2023, highlighting the ongoing nature of these threats. The increasing sophistication of cyberattacks means that even with robust security measures, the potential for breaches remains a persistent concern for Bill.com and its user base.

Regulatory Changes and Compliance Burdens

Bill.com faces ongoing threats from evolving financial regulations, especially concerning data privacy, payment processing, and any potential lending activities. For instance, in the US, the Consumer Financial Protection Bureau (CFPB) continues to scrutinize payment platforms and data handling practices, with increased focus expected in 2024-2025.

These shifting regulatory landscapes can force significant investments in compliance infrastructure, potentially raising operational expenses and restricting the scope of services Bill.com can offer. Failure to adapt can lead to penalties and reputational damage.

Navigating these complex and frequently changing rules is a constant challenge for the company. For example, the ongoing discussions around open banking and data sharing in various markets could impact how Bill.com integrates with other financial services.

Key areas of regulatory concern include:

- Data Security and Privacy: Adherence to regulations like GDPR and CCPA, with potential for stricter enforcement in 2024-2025.

- Payment Processing Compliance: Meeting evolving standards from bodies like Nacha for ACH transactions and PCI DSS for card payments.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Continuous updates to regulations requiring robust identity verification and transaction monitoring.

- Potential Future Lending Regulations: If Bill.com expands into credit or financing services, it will face direct oversight from lending regulators.

Emergence of Disruptive Technologies or Business Models

The financial technology landscape is evolving at an unprecedented speed. Emerging technologies like blockchain payment platforms and sophisticated AI-driven financial management tools pose a significant threat. For instance, the global blockchain in fintech market was valued at approximately $1.6 billion in 2023 and is projected to reach over $10 billion by 2028, indicating substantial growth in disruptive potential.

If new competitors introduce solutions that are markedly more innovative or offer substantial cost savings, Bill.com could struggle to retain its competitive standing and market share. This rapid technological advancement necessitates continuous adaptation and investment in research and development to stay ahead of potential disruptions.

- Technological Disruption: The rise of blockchain and advanced AI could offer more efficient or cheaper payment and financial management alternatives.

- Market Share Erosion: Innovative new entrants could attract customers away from Bill.com if their offerings are superior.

- Competitive Pressure: Bill.com must invest in R&D to counter the threat of more advanced, cost-effective solutions entering the market.

Bill.com faces intense competition from established players and emerging fintechs, leading to pricing pressure that could impact revenue growth. Macroeconomic factors like rising interest rates and inflation are also squeezing SMB budgets, potentially reducing spending on financial services. Cybersecurity risks are a constant threat, as a data breach could severely damage trust and finances.

SWOT Analysis Data Sources

This Bill.com SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded perspective.