Bill.com Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

Bill.com operates in a dynamic market, facing moderate threats from new entrants and substitutes, while buyer power is influenced by switching costs and the availability of alternatives. Understanding these forces is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Bill.com’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bill.com's reliance on software and cloud infrastructure means many suppliers are large, diversified tech companies. The commoditized nature of basic cloud services and standard software components provides Bill.com with numerous alternatives, thereby limiting the bargaining power of individual suppliers. For instance, major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform compete heavily, offering Bill.com flexibility in sourcing. This competition typically keeps prices in check for these essential services.

Key technology partners, especially those providing critical integrations with major accounting systems like QuickBooks, Xero, or NetSuite, hold some bargaining power over Bill.com. This reliance ensures a seamless customer experience, and if switching to alternative providers is costly or complex, these partners gain influence. For instance, in 2023, the accounting software market saw continued consolidation, with major players like Intuit (QuickBooks) and Xero solidifying their market positions, potentially increasing their leverage with integration partners.

The availability of skilled software engineers, cybersecurity experts, and fintech specialists directly influences Bill.com's supplier power. A scarcity in these critical talent pools means these individuals become powerful suppliers, capable of commanding higher compensation and better benefits.

In 2024, the tech talent market remained competitive, with demand for specialized skills often outstripping supply. For instance, reports indicated that the average salary for a senior software engineer in major tech hubs could exceed $150,000 annually, a figure that directly impacts recruitment costs for companies like Bill.com. This tight labor market amplifies the bargaining power of these employees, potentially leading to increased operational expenses and slower innovation cycles if not managed effectively.

Payment processing networks have moderate power

Payment processing networks, such as ACH and major credit card networks, hold a moderate level of bargaining power over Bill.com. These networks are fundamental to Bill.com's business model, which relies heavily on transaction volumes for revenue generation.

The significant investment in infrastructure and the strict regulatory requirements associated with these payment systems create high switching costs. Consequently, Bill.com cannot easily or cost-effectively bypass these established networks.

- Critical Infrastructure: Bill.com depends on payment networks for its core operations and revenue streams.

- High Switching Costs: The complexity and regulatory hurdles of payment processing make it difficult for Bill.com to switch providers.

- Transaction Fees: The bargaining power of these networks is evident in the transaction fees charged, which directly impact Bill.com's profitability. For instance, credit card processing fees can range from 1.5% to 3.5% or more, depending on the card type and transaction volume.

Data and AI technology providers gaining importance

The increasing reliance on advanced AI and data analytics by companies like Bill.com is shifting the balance of power towards specialized technology providers. As Bill.com integrates AI for enhanced financial insights, fraud prevention, and operational automation, the vendors supplying these critical AI models and data analytics tools are becoming more influential.

These providers' proprietary algorithms and unique datasets are essential for Bill.com's ability to differentiate itself in the market. This dependence grants these suppliers greater negotiation leverage, as their technology becomes a key enabler of Bill.com's competitive edge.

- Data and AI providers are becoming indispensable for Bill.com's innovation pipeline.

- The unique nature of AI algorithms and datasets strengthens supplier bargaining power.

- Bill.com's competitive differentiation increasingly relies on these specialized technology inputs.

- This trend suggests a potential increase in costs or stricter terms from these key technology suppliers.

The bargaining power of suppliers for Bill.com is generally moderate, influenced by the nature of the goods and services procured. While basic cloud services and software components are largely commoditized with many alternatives, specialized technology and critical infrastructure providers hold more sway. This dynamic is shaped by factors like switching costs, the uniqueness of offerings, and the concentration within specific supplier markets.

Key suppliers such as major cloud providers (AWS, Azure, GCP) face intense competition, limiting their individual power over Bill.com. However, providers of essential accounting software integrations and specialized AI/data analytics tools can exert more influence due to the critical nature of their services for Bill.com's operations and innovation. Payment processing networks also represent a significant supplier group with moderate bargaining power due to high switching costs and regulatory complexities.

| Supplier Type | Bargaining Power Level | Key Factors Influencing Power |

|---|---|---|

| Cloud Infrastructure (AWS, Azure, GCP) | Low to Moderate | High competition among providers, commoditized services |

| Accounting Software Integrations (Intuit, Xero) | Moderate to High | Customer reliance on seamless integrations, potential switching costs for Bill.com |

| AI & Data Analytics Providers | Moderate to High | Proprietary algorithms, unique datasets, critical for differentiation |

| Payment Processing Networks (ACH, Credit Cards) | Moderate | Essential for core operations, high switching costs, regulatory hurdles |

What is included in the product

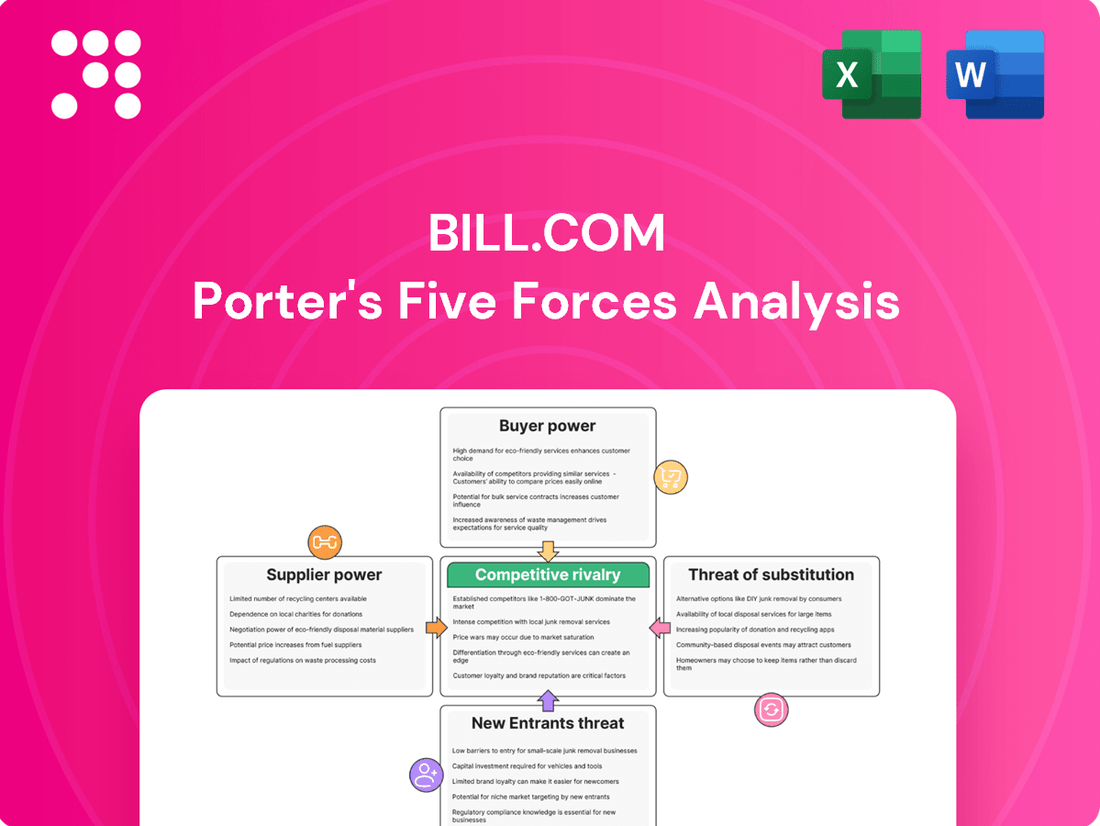

This Bill.com Porter's Five Forces analysis dissects the competitive landscape, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the B2B payment and financial operations software market.

Bill.com's Porter's Five Forces Analysis simplifies complex competitive landscapes, allowing businesses to quickly identify and address threats and opportunities, thereby alleviating strategic uncertainty.

Customers Bargaining Power

While individual small and midsize businesses (SMBs) typically possess limited bargaining power against a platform like Bill.com due to their smaller transaction volumes, their collective strength cannot be overlooked. This aggregated demand significantly shapes Bill.com's strategic decisions regarding pricing and feature enhancements, as the company relies on this broad customer base for its growth.

In 2024, the continued growth of the SMB sector, with millions of new businesses forming annually, underscores the importance of this collective influence. Bill.com's success hinges on its ability to cater to the diverse needs of these businesses, making responsiveness to their aggregated demands a key competitive advantage.

Switching costs significantly curb the bargaining power of Bill.com's customers. Once a small or medium-sized business (SMB) integrates Bill.com into their accounting systems and optimizes their financial processes, moving to a competitor becomes a complex undertaking. This involves the potential for data migration issues, the need for employee retraining, and the disruption of re-engineering established workflows.

These inherent switching costs diminish a customer's immediate leverage to negotiate for lower prices or demand extensive, costly customizations. For instance, the time and resources required to transfer historical financial data and retrain staff on a new platform can be substantial, making a switch less appealing. This sticky nature of the platform's integration strengthens Bill.com's position by reducing price sensitivity among its user base.

While small and medium-sized businesses (SMBs) often exhibit a degree of price sensitivity, Bill.com's value proposition extends beyond mere cost. The platform's ability to automate and streamline financial processes, leading to significant efficiency gains and time savings, often justifies its subscription and transaction fees for these businesses.

However, the competitive landscape presents a challenge. The availability of free or low-cost alternatives, particularly those offering only basic functionalities, can indeed exert pricing pressure on Bill.com, especially when targeting customer segments that prioritize cost savings over advanced features.

Availability of alternatives provides leverage

The availability of numerous alternatives significantly bolsters customer bargaining power. Customers can opt for manual invoice processing, utilize features within existing accounting software, or switch to competing AP/AR automation platforms. This ease of substitution means Bill.com must remain competitive on pricing and features to retain its user base.

For instance, in 2024, the AP automation market saw continued growth, with many players offering tiered pricing structures and feature sets that can be tailored to different business needs. This competitive landscape directly empowers customers, as they can easily compare offerings and switch if they perceive better value elsewhere.

- Customer Choice: Businesses can choose between manual processes, integrated accounting software modules, or specialized AP/AR automation tools.

- Price Sensitivity: The presence of alternatives makes customers more sensitive to pricing, encouraging Bill.com to offer competitive rates.

- Feature Comparison: Customers can readily compare the feature sets of various platforms, influencing their decision-making and potentially driving demand for specific functionalities.

Network effects enhance customer stickiness

Network effects significantly bolster customer stickiness for Bill.com. The platform's proprietary network connects businesses and their suppliers, streamlining payments and collections within the ecosystem. This interconnectedness creates a stronger value proposition for existing users, making it less likely for them to switch to a competitor, thereby reducing their bargaining power.

The increasing value derived from a larger user base makes Bill.com's platform more attractive, reinforcing customer loyalty. For instance, as more businesses join and integrate their payment processes, the efficiency gains for all participants grow. This dynamic makes switching costs higher for individual customers.

- Network Effects Value: Bill.com's network effect increases the utility of the platform as more businesses join, making it harder for individual customers to leave.

- Reduced Switching Incentive: The integrated nature of payments and collections within the Bill.com ecosystem discourages customers from seeking alternative solutions.

- Customer Stickiness: This enhanced stickiness translates to a diminished ability for customers to exert significant bargaining power over Bill.com.

While individual SMBs have limited power against Bill.com, their collective demand is significant. This aggregated need influences Bill.com's pricing and feature development, as the company relies on its vast customer base for growth. In 2024, the robust expansion of the SMB sector, with millions of new businesses emerging, highlights the impact of this collective influence.

Switching costs also reduce customer bargaining power. Once businesses integrate Bill.com into their accounting and workflows, migrating to a competitor involves data transfer complexities, retraining, and process re-engineering. These substantial hurdles make customers less likely to negotiate aggressively on price or demand costly customizations.

The bargaining power of Bill.com's customers is moderate, influenced by the availability of alternatives and the value proposition of the platform. While switching costs and network effects create stickiness, price sensitivity and competitive offerings provide some leverage.

| Factor | Impact on Customer Bargaining Power | 2024 Context/Data |

|---|---|---|

| Customer Concentration | Low for individual SMBs, High collectively | Millions of SMBs in the US, Bill.com serves a significant portion. |

| Switching Costs | High | Integration with accounting software (e.g., QuickBooks, Xero) and established workflows. |

| Price Sensitivity | Moderate | Customers weigh cost savings against efficiency gains; competitive pricing pressures exist. |

| Availability of Alternatives | Moderate | Numerous AP/AR automation tools and accounting software features offer substitutes. |

| Network Effects | Lowers bargaining power | Growing ecosystem of businesses and suppliers increases platform value and stickiness. |

Preview the Actual Deliverable

Bill.com Porter's Five Forces Analysis

This preview showcases the complete Bill.com Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. This detailed report covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

The financial automation landscape is a crowded space, with specialized fintechs aggressively vying for dominance. Companies like Tipalti, Stampli, and Melio are key players, offering robust solutions for accounts payable, accounts receivable, and overall spend management. This intense competition, particularly within the small and medium-sized business (SMB) and mid-market segments, directly impacts Bill.com's ability to capture and retain customers.

Established accounting software giants like Intuit (QuickBooks) and Xero, with their substantial existing customer bases, are increasingly integrating or partnering for Accounts Payable (AP) and Accounts Receivable (AR) functionalities. For instance, QuickBooks Online reported over 3.4 million subscribers as of Q3 2023, showcasing their significant market penetration.

While Bill.com strategically integrates with these platforms, these partnerships also present a competitive dynamic. These software providers might enhance their own native AP/AR features or develop direct alternatives, potentially capturing a larger share of the workflow automation market from within their established ecosystems.

Banks are increasingly bolstering their business banking services, integrating payment and financial management tools to better serve their clients. This strategic move directly challenges Bill.com's core offerings by providing businesses with more comprehensive, in-house solutions.

For instance, in 2024, major banks continued to invest heavily in digital transformation, aiming to capture a larger share of the business payments market. Some institutions are even forging partnerships with fintech companies, including those in Bill.com's space, to enhance their capabilities, creating a complex competitive landscape where direct offerings and strategic alliances both pose a challenge.

Focus on innovation and AI integration drives rivalry

The competitive landscape for Bill.com is characterized by intense rivalry, particularly driven by a relentless focus on innovation and the integration of artificial intelligence. Competitors are actively developing and deploying AI-powered features to enhance automation, bolster fraud detection capabilities, and deliver deeper financial insights to their users. This ongoing technological arms race compels Bill.com to consistently invest in research and development to not only keep pace but also to establish clear differentiation for its platform, thereby intensifying the competitive pressure.

This innovation push is clearly reflected in the market. For instance, in 2024, many fintech companies, including Bill.com's rivals, significantly ramped up their AI R&D spending. While specific figures for all competitors are not publicly disclosed, industry reports indicate a substantial increase in venture capital funding directed towards AI-driven financial solutions. This trend highlights the critical need for Bill.com to maintain its technological leadership.

- AI-driven automation: Competitors are enhancing invoice processing, payment approvals, and reconciliation through AI, aiming for greater efficiency.

- Advanced fraud detection: Machine learning algorithms are being deployed to identify and prevent fraudulent transactions more effectively.

- Predictive financial insights: AI is being used to offer users better cash flow forecasting and spending analysis.

- Platform integration: Competitors are also focusing on seamless integration with other business software, creating a more comprehensive ecosystem.

Pricing pressure and feature parity contribute to rivalry

The competitive environment for Bill.com is intense, with pricing pressure a significant factor. Rivals often match or undercut Bill.com's pricing for comparable services, forcing the company to continually evaluate its cost structure and value proposition to remain competitive.

Feature parity is another major challenge. As Bill.com introduces innovative functionalities, competitors are quick to develop similar offerings. This rapid replication makes it difficult for Bill.com to sustain a unique product advantage, demanding continuous investment in research and development to stay ahead.

- Pricing Pressure: Competitors like Melio and QuickBooks Online offer competing solutions, often with aggressive pricing strategies that can impact Bill.com's market share and revenue growth.

- Feature Replication: The rapid adoption and imitation of features, such as automated invoice processing and payment integrations, mean Bill.com must constantly innovate to maintain its competitive edge.

- Market Saturation: The fintech space for small business financial management is becoming increasingly crowded, intensifying rivalry and the need for clear differentiation.

Bill.com faces fierce competition from specialized fintechs like Tipalti and Stampli, as well as accounting software giants such as Intuit's QuickBooks, which boasts over 3.4 million subscribers as of Q3 2023. Banks are also enhancing their digital offerings, creating a crowded market where innovation and pricing are key differentiators.

The rivalry is intensified by competitors' rapid AI integration for automation and fraud detection, forcing Bill.com to continuously invest in R&D. This technological arms race is evident in 2024's significant increase in venture capital funding for AI-driven financial solutions.

Pricing pressure is a constant challenge, with rivals often undercutting Bill.com's services. Furthermore, the quick replication of features necessitates ongoing innovation to maintain a competitive edge in an increasingly saturated market.

| Competitor | Key Offerings | Target Market | Competitive Tactics |

|---|---|---|---|

| Tipalti | AP automation, global payments | Mid-market, enterprise | Feature depth, global reach |

| Stampli | AI-powered AP automation | Mid-market | Advanced AI, user experience |

| Melio | B2B payments, AP/AR | SMBs | Aggressive pricing, ease of use |

| Intuit QuickBooks | Accounting software with AP/AR integration | SMBs | Large customer base, ecosystem integration |

SSubstitutes Threaten

Manual processes and traditional methods represent a significant threat of substitutes for Bill.com. For smaller businesses or those hesitant about digital adoption, manual invoicing, paper checks, and traditional bank transfers are viable alternatives. These methods, while less efficient, bypass subscription fees and the learning curve associated with new software, making them particularly appealing to very small businesses or those with limited budgets.

Generic accounting software like QuickBooks and Xero provides basic invoicing and bill payment functionalities. For businesses that don't need advanced automation, these integrated features can act as a substitute for specialized platforms. For instance, in 2024, a significant portion of small businesses still rely on these all-in-one solutions for their core financial needs, indicating a viable alternative for less complex operations.

Larger small and medium-sized businesses (SMBs) or mid-market companies with very specific operational requirements may choose to develop their own financial management systems or invest in heavily customized enterprise resource planning (ERP) solutions. These bespoke systems, though demanding in terms of initial investment and ongoing upkeep, represent a direct alternative to platforms like Bill.com. They offer unparalleled control over every facet of financial operations.

Direct bank payment services and portals

Direct bank payment services and portals present a significant threat of substitutes for platforms like Bill.com. Many banks now offer robust online payment functionalities, including wire transfers and basic accounts payable portals, directly to their business clients. These services can be particularly appealing to businesses that already have strong existing banking relationships and don't require the advanced workflow automation or integration capabilities offered by specialized payment platforms.

For companies whose primary need is simply to execute payments efficiently, these bank-provided solutions can be a cost-effective and convenient alternative. For instance, a significant portion of businesses still rely on traditional methods or their bank's native online banking for payments. As of 2024, while digital payment adoption is high, many small to medium-sized businesses (SMBs) maintain a preference for integrated banking solutions due to familiarity and perceived simplicity.

- Banks offer integrated online payment services, including wire transfers and basic AP portals.

- Existing banking relationships make these services a convenient substitute for businesses prioritizing payment execution over advanced automation.

- The threat is amplified for businesses that do not require complex workflow management.

- Many SMBs in 2024 continue to leverage their bank's direct offerings for payment processing.

Standalone payment gateways and virtual card providers

Standalone payment gateways and virtual card providers pose a significant threat to Bill.com. Businesses can opt for these specialized services to manage receivables or spend, effectively circumventing Bill.com's integrated platform. For instance, companies might use Stripe or Square for invoicing and payment processing, while employing virtual card solutions like Conferma Pay or Conferma Travel for expense management.

These alternative solutions, while often addressing niche needs, can be pieced together to replicate much of Bill.com's functionality. This fragmentation allows businesses to cherry-pick best-in-class tools for specific tasks, potentially reducing their reliance on a single, comprehensive platform. The availability of such specialized, often more cost-effective, alternatives increases the bargaining power of buyers.

The market for payment processing and spend management is highly competitive, with numerous providers vying for market share. In 2024, the global digital payment market was valued at over $10 trillion, highlighting the scale of competition and the availability of alternatives. This environment makes it easier for customers to switch or adopt a combination of standalone services.

- Fragmented Solutions: Businesses can leverage specialized payment gateways (e.g., Stripe, PayPal) for accounts receivable and virtual card providers (e.g., Conferma Pay, Extend) for accounts payable, creating a composite solution.

- Cost-Effectiveness: Standalone services may offer more competitive pricing for specific functions compared to an all-in-one platform, especially for businesses with unique needs.

- Feature Specialization: Niche providers often offer deeper functionality or better user experiences for particular tasks, attracting businesses that prioritize these specialized features.

- Market Accessibility: The ease of integration and adoption of many standalone payment and virtual card solutions lowers the switching costs for businesses looking to bypass or supplement existing platforms.

The threat of substitutes for Bill.com is significant, stemming from both traditional methods and increasingly sophisticated digital alternatives. Businesses can opt for manual processes, generic accounting software with basic payment features, or even develop custom internal systems. Furthermore, direct bank payment services and specialized standalone payment gateways offer integrated or niche functionalities that can fulfill specific business needs without requiring a comprehensive platform like Bill.com.

In 2024, many small to medium-sized businesses (SMBs) continue to leverage their existing banking relationships for payment processing, finding these integrated solutions familiar and convenient. For instance, a substantial portion of SMBs still utilize direct bank transfers or their bank's online portals for bill payments, often prioritizing simplicity over advanced automation. This reliance on established banking infrastructure presents a direct substitute, particularly for companies that do not require complex workflow management or extensive integrations.

The market also sees a rise in specialized payment gateways and virtual card providers. Businesses can assemble a suite of these tools to manage accounts receivable and payable, effectively bypassing a single platform. For example, using Stripe for invoicing and a virtual card solution for expenses allows businesses to cherry-pick best-in-class services, potentially at a lower cost for specific functions. This fragmentation makes it easier for customers to adopt alternative, tailored solutions.

| Substitute Category | Description | 2024 Relevance |

|---|---|---|

| Manual Processes | Paper checks, manual invoicing, traditional bank transfers. | Still viable for very small businesses or those with budget constraints, bypassing software fees. |

| Generic Accounting Software | Basic invoicing and payment features within platforms like QuickBooks, Xero. | Sufficient for businesses with less complex needs, offering an all-in-one solution. |

| Direct Bank Payment Services | Online payment portals, wire transfers offered by banks. | Appealing due to existing relationships and perceived simplicity for payment execution. |

| Standalone Payment Gateways/Virtual Cards | Specialized services like Stripe, PayPal, Conferma Pay, Extend. | Allow businesses to create composite solutions for specific financial tasks, often cost-effectively. |

Entrants Threaten

Developing a robust financial operations platform demands substantial capital. Bill.com, for instance, requires significant investment in cutting-edge technology, secure infrastructure, and rigorous compliance measures. This financial hurdle acts as a strong deterrent for many aspiring competitors.

The sheer cost of building and maintaining a comprehensive platform, encompassing features like accounts payable, accounts receivable, and payment processing, is immense. For example, in 2024, the average cost for a small business to implement a new financial software solution can range from $5,000 to $50,000 annually, highlighting the scale of investment needed to compete effectively.

The fintech sector, especially areas dealing with payments and financial data, is heavily regulated. Think about rules like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, not to mention data privacy laws. These aren't simple checkboxes; they demand significant resources and specialized knowledge to navigate correctly.

For any new company wanting to enter the Bill.com market, these regulatory hurdles represent a major barrier. The cost and effort involved in achieving and maintaining compliance can be substantial, deterring potential competitors. For instance, the global regulatory technology market was projected to reach over $100 billion by 2027, highlighting the scale of investment required.

Bill.com's significant advantage lies in its deeply entrenched network of over 400,000 small and medium-sized businesses and its extensive integrations with leading accounting platforms like QuickBooks and Xero. Establishing comparable reach and seamless integration capabilities would demand substantial time and capital investment for any new entrant.

Brand recognition and trust in financial services

Brand recognition and trust are paramount in financial services, especially for small and medium-sized businesses (SMBs) entrusting sensitive data. Bill.com has cultivated a strong reputation over years of reliable service, making it a go-to solution for many.

New entrants must overcome substantial hurdles to establish comparable credibility. This involves significant investment in marketing and demonstrating a proven track record, which can be a lengthy and costly process.

- Incumbent Trust: Bill.com's established presence means many SMBs already rely on its platform for critical financial operations.

- Customer Loyalty: High switching costs and the perceived risk associated with changing financial management tools foster customer loyalty.

- Reputational Barrier: New competitors need to build a reputation for security and reliability, a process that takes time and consistent performance.

- Market Penetration: Bill.com's existing market share presents a barrier, as new entrants must capture a significant portion of the market to gain traction.

Technological complexity and AI development costs

The increasing reliance on AI and advanced automation within financial operations presents a significant hurdle for potential new entrants. Developing competitive AI-powered solutions demands substantial investment in cutting-edge technology and specialized data science expertise. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating the scale of investment required.

These high upfront costs and the need for niche talent create a formidable barrier to entry. New companies must not only build robust platforms but also continuously innovate to keep pace with established players like Bill.com, which are already leveraging these technologies. This technological arms race means that newcomers face a steep climb to achieve parity, let alone a competitive advantage.

- High R&D Investment: New entrants must commit significant capital to research and development for AI and automation features.

- Talent Acquisition Costs: Recruiting and retaining skilled AI engineers and data scientists is expensive and competitive.

- Infrastructure Demands: Building and maintaining the necessary IT infrastructure to support advanced AI capabilities requires substantial financial outlay.

- Data Security and Compliance: Ensuring robust data security and compliance with financial regulations adds further complexity and cost for new entrants.

The threat of new entrants for Bill.com is moderate. Significant capital investment is required for technology, infrastructure, and compliance, acting as a deterrent. For example, in 2024, implementing new financial software for small businesses can cost between $5,000 and $50,000 annually.

Regulatory hurdles, such as AML and KYC compliance, demand substantial resources and expertise, further increasing the barrier to entry. The global regulatory technology market was projected to exceed $100 billion by 2027.

Bill.com's established network of over 400,000 SMBs and its integrations with platforms like QuickBooks and Xero create a strong competitive advantage. Replicating this reach and integration would require considerable time and capital.

Brand recognition and customer trust are crucial in financial services. Bill.com has built a strong reputation for reliability, making it difficult for new entrants to establish comparable credibility, which requires significant marketing investment and a proven track record.

Porter's Five Forces Analysis Data Sources

Our Bill.com Porter's Five Forces analysis is built upon a foundation of robust data, including financial reports from Bill.com and its competitors, industry-specific market research from firms like Gartner and Forrester, and publicly available regulatory filings.