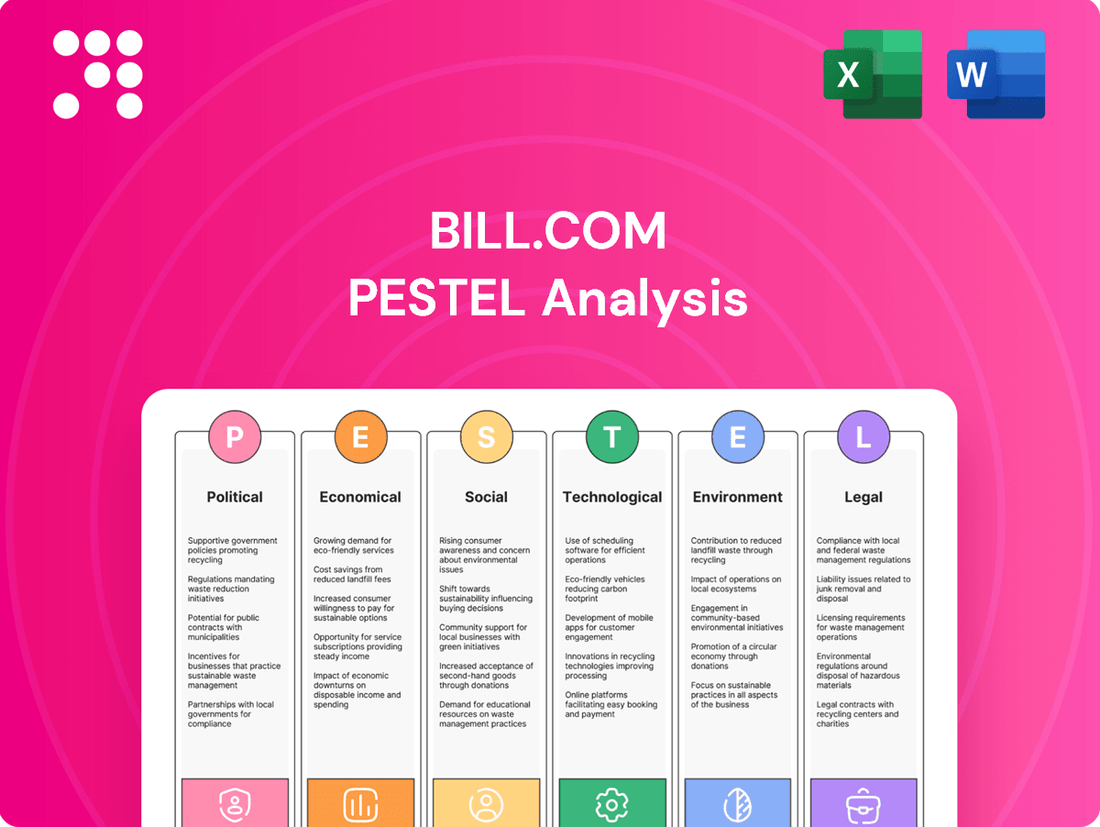

Bill.com PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bill.com Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Bill.com's trajectory. Our expertly crafted PESTLE analysis provides a clear roadmap to understanding these external forces. Gain a competitive advantage and make informed strategic decisions. Download the full version now for actionable intelligence.

Political factors

Government initiatives aimed at boosting small and midsize business (SMB) digitalization directly benefit Bill.com by increasing adoption of financial automation tools. For instance, in 2024, the U.S. Small Business Administration (SBA) continued to offer resources and potential funding streams that encourage technology adoption, including cloud-based accounting and payment solutions. These programs, often involving grants or tax credits for technology investments, lower the barrier to entry for SMBs looking to modernize their financial operations.

Specific policies like the proposed Digital Equity Act of 2025, if enacted, could further accelerate this trend by providing grants to underserved SMBs for digital infrastructure and software. Such government support translates into a larger addressable market for Bill.com, as more businesses are incentivized and enabled to invest in solutions like automated invoicing and payment processing, crucial for their operational efficiency and competitiveness.

The regulatory environment for fintech is a critical political factor for Bill.com. Governments worldwide are actively shaping rules around digital payments, data privacy, and consumer protection in financial services. For instance, the European Union's PSD2 directive has opened up banking data, fostering innovation but also increasing compliance burdens for fintechs like Bill.com.

In the United States, the Consumer Financial Protection Bureau (CFPB) and state-level regulators continuously monitor fintech operations, influencing how Bill.com handles customer data and offers its services. A more favorable regulatory stance, characterized by clear guidelines and support for innovation, can significantly boost Bill.com's growth, whereas overly restrictive policies could impede its expansion and product development efforts.

Bill.com's global operations and user transactions are significantly influenced by international trade policies. For instance, the USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA, has reshaped trade dynamics in North America, potentially impacting cross-border payment flows for businesses using Bill.com. Changes in tariffs or trade barriers, like those seen in ongoing US-China trade relations, can affect the cost of goods and services, indirectly influencing the volume of B2B payments processed through platforms like Bill.com.

Cross-border payment regulations, such as evolving Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements in various jurisdictions, add layers of complexity and compliance costs for Bill.com. Geopolitical stability is also a critical factor; for example, regional conflicts or sanctions can disrupt payment networks and create significant hurdles for facilitating international transactions, potentially limiting Bill.com's reach or increasing operational risks for its global clientele.

Data Privacy and Security Regulations

Data privacy and security regulations are becoming increasingly stringent, directly impacting how Bill.com handles sensitive financial information. Laws like the California Consumer Privacy Act (CCPA) and similar global regulations necessitate robust compliance measures, adding to operational costs.

Adherence to these evolving rules is paramount for maintaining customer trust and avoiding significant financial penalties. For instance, non-compliance with GDPR can result in fines of up to 4% of annual global turnover or €20 million, whichever is higher, a risk Bill.com must actively mitigate.

- Increased Compliance Costs: Bill.com must invest in advanced data protection technologies and legal expertise to meet varying international data privacy standards.

- Reputational Risk: Data breaches or non-compliance can severely damage Bill.com's reputation, impacting customer acquisition and retention in the highly sensitive fintech sector.

- Operational Adjustments: The company needs to continuously adapt its data management practices to align with new cybersecurity frameworks and privacy legislation.

Political Stability and Economic Certainty

Political stability in major markets directly impacts the confidence of Bill.com's small and medium-sized business (SMB) customer base. When governments provide clear economic policies and avoid sudden shifts, SMBs are more likely to invest in operational improvements. For instance, in 2024, the US saw continued focus on economic growth initiatives, which generally supports SMB spending on financial management tools.

Government responses to economic fluctuations are crucial. Proactive measures that foster a predictable business environment, such as clear tax regulations and support for small businesses, create an atmosphere of certainty. This certainty encourages SMBs to adopt platforms like Bill.com that streamline payment processing and improve cash flow management, essential for navigating economic cycles.

Conversely, political instability or unpredictable government interventions can lead to economic uncertainty, causing SMBs to delay or reduce investments in new technologies.

- Market Stability: Political stability in key markets like the US and Canada, where Bill.com has a significant customer base, directly correlates with SMB investment in financial automation.

- Government Support: Government programs aimed at supporting SMBs, such as tax credits or grants, can indirectly boost adoption of efficiency tools by improving SMB financial health.

- Regulatory Environment: Predictable regulatory frameworks around financial transactions and data privacy contribute to a stable operating environment for both Bill.com and its clients.

Government initiatives supporting small and medium-sized businesses (SMBs) with digitalization directly benefit Bill.com. For example, in 2024, the U.S. Small Business Administration (SBA) continued to provide resources that encourage technology adoption, including cloud-based financial solutions. Proposed legislation like the Digital Equity Act of 2025 aims to further accelerate this by offering grants for digital infrastructure, expanding Bill.com's potential customer base.

What is included in the product

This Bill.com PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides actionable insights for stakeholders to navigate the external landscape and capitalize on emerging opportunities.

Bill.com's PESTLE analysis provides a clear, summarized version of external factors, making it easy to reference during meetings and presentations, thereby alleviating the pain point of information overload.

Economic factors

Robust economic growth directly fuels Bill.com's market opportunity by expanding its potential customer base of small and medium-sized businesses (SMBs). When the economy is thriving, SMBs experience increased transaction volumes and revenue, making them more receptive to investing in solutions that streamline financial operations. For instance, in 2024, the U.S. economy was projected to grow by approximately 2.3%, indicating a healthy environment for businesses to expand and adopt new technologies.

Higher SMB spending power, a consequence of positive economic cycles, translates into greater willingness to adopt financial automation tools like those offered by Bill.com. As businesses grow, manual financial processes become bottlenecks, driving demand for efficiency and accuracy. This trend is supported by reports indicating that SMB spending on software and technology solutions saw a notable increase in late 2023 and early 2024, as businesses prioritized digital transformation to enhance productivity.

Inflation directly impacts Bill.com's operational costs, from employee salaries to technology infrastructure. For its customers, rising prices can strain their own budgets, making efficient invoice processing and payment management, key features of Bill.com, even more critical.

Interest rate shifts significantly influence how businesses manage their cash. As of mid-2024, central banks have maintained higher interest rates to combat inflation, encouraging businesses to optimize cash flow. This environment could boost demand for Bill.com's services, as companies seek better visibility and control over their finances, though higher rates could also increase Bill.com's own borrowing costs if it needs external financing.

The availability and cost of skilled talent, especially in crucial areas like software development and cybersecurity, directly impact Bill.com's capacity to hire and keep its workforce. In 2024, the tech sector continued to experience a competitive landscape for specialized roles, with average salaries for senior software engineers in the US ranging from $140,000 to $180,000 annually, according to industry reports.

A constrained labor market can elevate Bill.com's operational expenditures due to increased recruitment and compensation costs. Simultaneously, this environment encourages small and medium-sized businesses (SMBs), Bill.com's core customer base, to adopt automation solutions like those offered by Bill.com to mitigate their own escalating labor expenses.

Digital Transformation Investment Trends

Businesses are significantly increasing their investment in digital transformation, with a strong emphasis on cloud adoption and automation. This trend is driven by the pursuit of operational efficiency and competitive edge. For instance, global spending on digital transformation was projected to reach $2.3 trillion in 2023 and was expected to grow by 17.5% in 2024, reaching over $2.7 trillion. This robust growth signals a highly receptive market for solutions like Bill.com, which facilitate the modernization of financial back-office processes.

The continued adoption of cloud-based solutions is a cornerstone of this digital shift. Companies are migrating critical financial operations to the cloud to enhance scalability, accessibility, and security. Automation technologies, particularly in areas like accounts payable and receivable, are also seeing substantial investment as businesses aim to reduce manual effort and minimize errors. This focus on streamlining financial workflows directly aligns with Bill.com's core value proposition, making the economic climate favorable for its growth.

- Global digital transformation spending is on a steep upward trajectory, exceeding $2.7 trillion in 2024.

- Cloud adoption remains a primary driver, with businesses prioritizing cloud-native financial management tools.

- Investment in automation technologies for financial processes is accelerating, aiming for greater efficiency and accuracy.

Competitive Landscape and Pricing Pressure

The fintech and financial automation space is intensely competitive, directly impacting Bill.com's pricing power. As more players enter the market, offering similar services, Bill.com faces pressure to keep its pricing competitive to maintain and grow its market share. This dynamic can lead to a reduction in revenue per user if rivals adopt more aggressive pricing tactics.

For instance, the broader financial automation market is projected to grow significantly, with some reports estimating it could reach over $100 billion by 2027, indicating a fertile ground for new entrants. This growth attracts both established tech companies and nimble startups, all vying for a piece of the market. Bill.com's ability to differentiate its offerings beyond price will be crucial.

- Intensifying Competition: The fintech sector, particularly in business payments and financial workflow automation, sees a constant influx of new competitors and feature enhancements from existing ones.

- Pricing Sensitivity: Businesses, especially small and medium-sized ones, are often price-sensitive. Aggressive pricing by competitors can force Bill.com to adjust its own pricing, potentially impacting margins.

- Market Share Dynamics: Competitors offering lower-cost alternatives or more comprehensive feature sets can chip away at Bill.com's market share if its value proposition isn't clearly superior.

- Impact on Revenue: A sustained pricing war or a significant shift in competitor pricing could lead to downward pressure on Bill.com's average revenue per user (ARPU), affecting overall financial performance.

Economic growth directly benefits Bill.com by increasing the number of small and medium-sized businesses (SMBs) that can afford and need its services. As of mid-2024, the U.S. economy showed resilience, with projected growth continuing to support business expansion. This environment encourages SMBs to invest in financial automation to manage increased transaction volumes and improve efficiency, a core offering of Bill.com. Higher SMB spending power, fueled by economic upturns, directly translates into greater adoption of financial technology solutions.

Preview Before You Purchase

Bill.com PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Bill.com PESTLE analysis offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to provide actionable insights for strategic decision-making.

Sociological factors

The widespread adoption of remote and hybrid work models significantly boosts the demand for cloud-based financial management solutions like Bill.com. Businesses operating with distributed teams increasingly rely on automated and accessible platforms for tasks such as invoicing, payments, and expense tracking. This trend is evident as many companies continue to embrace flexible work arrangements post-pandemic; for instance, a 2024 survey indicated that 60% of US companies offer hybrid work options, directly increasing the need for seamless digital financial operations.

The increasing digital literacy among small and midsize business (SMB) owners and their employees is a significant tailwind for Bill.com. In 2024, surveys indicated that over 85% of SMBs utilize cloud-based accounting software, a trend that accelerates the adoption of integrated financial workflow solutions like Bill.com.

Furthermore, the willingness of businesses to embrace new technologies directly correlates with Bill.com's market penetration. Reports from late 2024 show a 15% year-over-year increase in SMBs actively seeking and implementing automation tools for tasks such as accounts payable and receivable, directly boosting Bill.com's user engagement and growth potential.

Younger generations, particularly Millennials and Gen Z, are increasingly inheriting or launching businesses. These demographics, having grown up with digital technology, show a strong preference for automated and online financial management tools. For instance, a 2024 report indicated that 65% of small business owners under 40 prefer cloud-based accounting software, directly benefiting platforms like Bill.com.

This generational shift means a growing segment of business owners is naturally inclined towards adopting solutions that streamline invoicing, payments, and reconciliation. As these digitally native entrepreneurs take the helm, the demand for integrated financial operations platforms that offer efficiency and accessibility is set to rise, aligning perfectly with Bill.com's core offerings.

Trust in Cloud-Based Financial Services

Societal trust in cloud-based financial services is a critical factor for Bill.com. As of early 2025, consumer confidence in storing sensitive financial data online continues to grow, though concerns about data breaches persist. A significant portion of businesses, particularly small and medium-sized enterprises, are increasingly adopting cloud solutions for their financial operations, driven by convenience and perceived cost savings.

Bill.com's platform leverages this trend, but its growth hinges on effectively addressing lingering skepticism regarding data security and platform reliability. The company must continually demonstrate robust cybersecurity measures and a stable user experience to build and maintain credibility. For instance, while 85% of US businesses surveyed in late 2024 reported using at least one cloud-based financial tool, only 60% felt completely confident in the security of their sensitive data stored in the cloud.

- Growing Adoption: Businesses are increasingly comfortable with cloud solutions for financial management, with adoption rates rising steadily.

- Security Concerns Remain: Despite progress, a notable percentage of users still express concerns about the security of their financial data in the cloud.

- Trust as a Differentiator: Bill.com's ability to foster trust through transparent security practices and reliable service is paramount to its market position.

- Digital Transformation Push: The broader societal shift towards digital transformation fuels the demand for cloud-based financial services like Bill.com.

Demand for Work-Life Balance and Efficiency

Societal expectations are increasingly prioritizing a healthy work-life balance, driving demand for solutions that automate tedious tasks. For instance, a 2024 survey indicated that 70% of small business owners felt overwhelmed by administrative work, highlighting a clear need for efficiency tools. Bill.com directly addresses this by offering automated invoice processing and payment solutions.

This trend translates into a strong market for financial technology that frees up valuable time. By reducing manual data entry and streamlining workflows, Bill.com empowers business owners and their teams to focus on core business activities rather than administrative overhead. This focus on efficiency is a key driver for adoption in the current business landscape.

The desire for greater operational efficiency is not just a preference but a necessity for many businesses navigating a competitive environment. In 2025, projections suggest that businesses leveraging automation in their back-office functions could see up to a 25% reduction in operational costs. Bill.com's platform is positioned to meet this demand head-on.

Key aspects of this demand include:

- Reduced Administrative Burden: Automation of tasks like invoice management and payment reconciliation.

- Improved Work-Life Balance: Enabling business owners and employees to reclaim time previously spent on manual processes.

- Enhanced Operational Efficiency: Streamlining financial workflows for faster processing and fewer errors.

- Focus on Core Business: Allowing resources to be directed towards growth and strategic initiatives.

The increasing acceptance of remote and hybrid work models directly fuels the demand for Bill.com's cloud-based financial management solutions. As businesses operate with distributed teams, the need for accessible platforms for invoicing and payments grows; a 2024 survey showed 60% of US companies offering hybrid work, increasing the need for seamless digital financial operations.

The growing digital literacy among business owners and their employees is a significant advantage for Bill.com. In 2024, over 85% of small and midsize businesses used cloud-based accounting software, accelerating the adoption of integrated financial workflow solutions.

Younger generations, increasingly leading businesses, exhibit a strong preference for automated financial tools. A 2024 report indicated 65% of small business owners under 40 favor cloud-based accounting software, directly benefiting platforms like Bill.com.

Societal trust in cloud financial services is crucial for Bill.com's growth, though data security concerns persist. While 85% of US businesses used cloud financial tools in late 2024, only 60% felt fully confident in cloud data security.

| Sociological Factor | Impact on Bill.com | Supporting Data (2024-2025) |

|---|---|---|

| Remote/Hybrid Work | Increased demand for cloud-based financial tools | 60% of US companies offer hybrid work (2024) |

| Digital Literacy | Accelerated adoption of financial workflow solutions | 85% of SMBs use cloud accounting software (2024) |

| Generational Shift | Preference for automated, online financial management | 65% of small business owners <40 prefer cloud accounting (2024) |

| Trust in Cloud Services | Growth dependent on addressing security concerns | 60% confident in cloud data security (late 2024) |

Technological factors

Ongoing advancements in cloud computing and Software-as-a-Service (SaaS) are critical enablers for Bill.com's business model. These innovations provide the scalable and reliable infrastructure necessary to deliver its financial automation solutions. The increasing maturity of cloud technology directly supports Bill.com's ability to offer accessible and continuously updated services to its users.

Bill.com's platform is seeing significant enhancements through AI and ML integration. These technologies are streamlining operations by automating data entry, which reduces manual errors and speeds up processing times. For instance, AI-powered invoice processing can cut data entry time by up to 70% compared to manual methods, as reported by industry studies.

Furthermore, AI and ML are crucial for robust fraud detection, analyzing transaction patterns to identify anomalies and protect businesses. Predictive analytics are also being leveraged to offer users better cash flow forecasting, enabling more informed financial planning. Intelligent workflow automation, driven by AI, further optimizes processes like payment approvals and reconciliation, leading to greater operational efficiency and accuracy for Bill.com's diverse user base.

Cybersecurity threats are constantly evolving, with sophisticated attacks becoming more frequent. This necessitates continuous investment in advanced data protection technologies like enhanced encryption algorithms and real-time intrusion detection systems. Bill.com's commitment to adopting these cutting-edge solutions is paramount for safeguarding customer financial information and maintaining trust in an increasingly digital landscape.

Integration Capabilities and API Development

Bill.com's technological strength hinges on its integration capabilities, particularly its robust API development. This allows for seamless connections with a wide array of accounting software, enterprise resource planning (ERP) systems, and other business applications, creating a unified financial workflow for users. The ability to easily connect and share data across these platforms is a significant competitive advantage in the B2B payments space.

The breadth and depth of these integrations are crucial differentiators for Bill.com. For instance, as of early 2024, the platform boasts integrations with over 100 popular accounting and business management tools, including major players like QuickBooks, Xero, and NetSuite. This extensive network ensures that businesses can maintain their existing software infrastructure while leveraging Bill.com's payment automation features.

- API-driven integrations streamline data flow between Bill.com and other business software.

- Over 100 integrations with leading accounting and ERP systems were available as of early 2024.

- Unified financial ecosystem is enabled by seamless connectivity, reducing manual data entry and errors.

Mobile Technology and Ubiquitous Access

The proliferation of mobile technology and the expectation of ubiquitous access are critical for Bill.com. Businesses increasingly rely on mobile devices for managing finances, making a robust mobile-first strategy essential. Bill.com's ability to offer seamless on-the-go access for tasks like invoice approvals and payment processing directly impacts its user adoption and competitive edge.

By 2024, a significant portion of small and medium-sized businesses (SMBs) will be primarily accessing business management tools via mobile devices. This trend underscores the need for Bill.com to continue investing in its mobile application's functionality and user experience to remain relevant and capture market share. A strong mobile presence allows users to manage their finances efficiently from anywhere, anytime.

- Mobile Usage Growth: Projections indicate that mobile commerce transactions will continue to surge, with a substantial percentage of SMB owners preferring mobile solutions for financial management.

- Feature Demand: Users expect mobile apps to offer comprehensive features, mirroring desktop functionality, including payment approvals, expense tracking, and client communication.

- Competitive Landscape: Competitors offering superior mobile experiences are likely to gain an advantage, making Bill.com's mobile platform a key differentiator.

Bill.com's technological advantage is amplified by its AI and machine learning capabilities, which are central to its 2024 and 2025 strategy. These advancements are crucial for automating complex financial tasks, such as intelligent invoice processing, which can reduce data entry time by up to 70% compared to manual methods. Furthermore, AI enhances fraud detection and provides predictive cash flow forecasting, directly improving user efficiency and financial planning.

Legal factors

Bill.com operates within a stringent regulatory environment, requiring adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) mandates. These regulations are crucial for preventing financial crime and ensuring customer verification, impacting platform design and operational procedures. For instance, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) continuously updates its guidance, which Bill.com must integrate to maintain compliance.

Bill.com operates within a complex web of data privacy laws, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), alongside numerous other state-specific regulations emerging across the US. Compliance is paramount, as failure to protect user data can result in significant fines; for instance, GDPR violations can lead to penalties of up to 4% of global annual revenue or €20 million, whichever is higher.

These regulations dictate how Bill.com must handle sensitive financial and personal information, from initial collection and secure storage to processing and eventual deletion. Maintaining robust data governance frameworks and transparent privacy policies is crucial for building and retaining user trust, a key differentiator in the financial technology sector where data security is a primary concern for businesses and individuals alike.

Contract law is fundamental to Bill.com's operations, governing its relationships with customers, partners, and vendors. Terms of service agreements, for instance, outline user rights and responsibilities, while Service Level Agreements (SLAs) define performance expectations and remedies for service disruptions. In 2023, Bill.com reported a significant increase in user adoption, underscoring the importance of robust and legally sound contracts to manage this growth and ensure client satisfaction.

Indemnification clauses within these agreements are critical for risk management, protecting Bill.com from liabilities arising from third-party claims. As of Q1 2024, the company continues to refine its contractual frameworks to adapt to evolving regulatory landscapes and maintain compliance, ensuring its agreements are both protective and enforceable.

Consumer Protection and Fair Practices Legislation

Consumer protection laws are crucial for Bill.com, ensuring fair practices in financial services. Regulations like the Consumer Financial Protection Act (CFPA) in the United States aim to prevent deceptive or abusive acts. Bill.com's commitment to transparency in pricing and service terms is vital for maintaining customer trust and avoiding penalties.

Compliance with these legal frameworks is paramount. For instance, the Electronic Signatures in Global and National Commerce Act (E-SIGN Act) governs digital agreements, a core function for Bill.com. Failure to adhere to such laws can lead to significant fines and reputational damage, impacting customer acquisition and retention.

Key areas requiring strict adherence include:

- Truth in Lending Act (TILA) compliance for any credit-related offerings.

- Data privacy regulations such as GDPR and CCPA, impacting how customer information is handled.

- Fair Debt Collection Practices Act (FDCPA) if payment collection processes are involved.

- Advertising standards that prohibit misleading claims about services or fees.

Intellectual Property Rights and Patents

Bill.com's competitive edge hinges on the legal protection of its innovative software and business processes. This involves securing patents for novel technologies, copyrights for its code, and trademarks for its brand. In 2024, the landscape of intellectual property law continues to evolve, with increased scrutiny on software patents and digital rights management.

Protecting its intellectual property is paramount for Bill.com to maintain its market position and prevent competitors from replicating its solutions. Infringement could lead to significant financial losses and damage to its brand reputation. The company actively monitors for potential violations and pursues legal action when necessary to safeguard its assets.

- Patent Protection: Bill.com likely holds patents on its core automation technologies for accounts payable and receivable processes.

- Copyright Safeguards: The company's software code, user interfaces, and documentation are protected by copyright.

- Trademark Enforcement: Bill.com's brand name and logo are registered trademarks, preventing unauthorized use.

- Legal Vigilance: Ongoing legal efforts are focused on deterring and addressing any intellectual property infringement.

Bill.com navigates a complex legal terrain, with data privacy laws like GDPR and CCPA demanding robust protection of user information. Compliance with these regulations, which can impose penalties up to 4% of global annual revenue for GDPR violations, is critical for maintaining customer trust and avoiding significant financial repercussions.

Contract law underpins Bill.com's customer and vendor relationships, with terms of service and SLAs defining operational parameters. The company's growth, evidenced by increased user adoption in 2023, highlights the necessity of legally sound agreements for managing client expectations and ensuring service delivery.

Consumer protection laws, such as those enforced by the U.S. Consumer Financial Protection Bureau, mandate fair practices and transparency in financial services. Adherence to acts like the E-SIGN Act for digital agreements is vital for operational integrity and preventing penalties.

Intellectual property law is essential for Bill.com's competitive advantage, protecting its automation technologies through patents and its code via copyright. The company's active legal vigilance in 2024 aims to deter infringement and safeguard its market position.

| Legal Area | Key Regulations/Acts | Impact on Bill.com | Example Data/Fact |

|---|---|---|---|

| Data Privacy | GDPR, CCPA | Mandates secure handling and protection of customer data; risk of substantial fines for non-compliance. | GDPR fines can reach up to 4% of global annual revenue. |

| Contract Law | Terms of Service, SLAs | Governs customer and vendor relationships; essential for managing growth and service expectations. | Increased user adoption in 2023 necessitates robust contractual frameworks. |

| Consumer Protection | CFPA, E-SIGN Act | Ensures fair practices, transparency in pricing, and legality of digital agreements. | E-SIGN Act governs digital agreements, a core Bill.com function. |

| Intellectual Property | Patent Law, Copyright Law | Protects core automation technologies and software code, crucial for market differentiation. | Ongoing evolution of software patent scrutiny in 2024. |

Environmental factors

The global push for paperless operations is a significant tailwind for Bill.com. As companies increasingly prioritize environmental sustainability, the demand for digital invoicing and payment solutions like Bill.com's grows. This trend directly supports Bill.com's core business by offering a tangible way for businesses to reduce their paper consumption and carbon footprint.

Data from 2023 indicates a strong consumer preference for environmentally friendly practices, with a significant percentage of businesses reporting that sustainability initiatives influence their purchasing decisions. Bill.com's platform facilitates this by enabling businesses to eliminate paper invoices, receipts, and checks, thereby contributing to a greener operational model and aligning with corporate social responsibility goals.

Bill.com's dedication to environmental sustainability and broader Corporate Social Responsibility (CSR) can significantly boost its brand perception, particularly among businesses prioritizing eco-friendly operations. By showcasing green practices, Bill.com can differentiate itself in the competitive fintech landscape.

For instance, in 2023, companies with strong ESG (Environmental, Social, and Governance) performance saw an average of 20% higher valuation multiples compared to those with weaker ESG profiles, according to a report by Morgan Stanley. This highlights the tangible financial benefits of robust CSR initiatives.

Bill.com's commitment to reducing its carbon footprint, perhaps through energy-efficient data centers or supporting renewable energy, directly appeals to a growing segment of the market that scrutinizes the environmental impact of their service providers.

The energy consumption of cloud data centers, which host Bill.com's platform, presents an environmental consideration. While Bill.com champions paperless workflows, its operational footprint is indirectly tied to the energy efficiency of its cloud providers' infrastructure.

Globally, data centers are significant energy consumers. For instance, in 2023, estimates suggested data centers accounted for roughly 1% of global electricity consumption, a figure projected to rise with increased digital activity.

This indirect energy usage means Bill.com, like many SaaS companies, must consider the carbon emissions associated with powering these facilities, even as it facilitates digital transactions for its clients.

Regulatory Pressure for Green Business Practices

Government bodies worldwide are increasingly enacting regulations that push businesses toward greener operations. For instance, in 2024, the European Union continued to expand its corporate sustainability reporting directives, requiring more companies to disclose their environmental impact, including carbon emissions. This trend could indirectly affect Bill.com by influencing its customers' demand for vendors with strong environmental, social, and governance (ESG) credentials, potentially driving Bill.com to offer features that facilitate such reporting or vendor vetting.

These regulatory shifts often come with incentives designed to accelerate the adoption of sustainable practices. Many governments are offering tax credits or grants for investments in renewable energy and energy efficiency. While not directly targeting software providers like Bill.com, these incentives encourage businesses across various sectors to digitize and streamline their operations to better manage and report on their environmental performance, creating a potential indirect market opportunity.

- Increased Disclosure Requirements: Expect more mandates for carbon footprint reporting, similar to the EU's CSRD, impacting businesses of all sizes.

- Green Incentives: Governments are providing financial carrots, like tax breaks for adopting renewable energy, which may indirectly boost demand for efficiency-focused software.

- Customer Preference Shift: Businesses are increasingly scrutinizing their supply chains for environmental responsibility, influencing vendor selection.

- Potential for New Features: Bill.com could see demand for tools that help clients track and report their own environmental impact or vet green vendors.

Supply Chain Sustainability and Vendor Selection

Bill.com's approach to supply chain sustainability involves vetting its own vendors for environmental responsibility. As corporate environmental, social, and governance (ESG) expectations grow, this due diligence becomes crucial for maintaining brand reputation and mitigating risks. For instance, a significant portion of businesses now consider supplier ESG performance when making purchasing decisions, with some studies showing over 70% of companies prioritizing sustainability in their vendor selection process.

This focus on environmentally conscious partners can translate into tangible benefits for Bill.com. By choosing vendors with strong sustainability practices, such as those committed to reducing carbon emissions or waste, Bill.com can indirectly lower its own environmental footprint. This aligns with broader market trends; for example, by the end of 2024, it's projected that over 80% of large corporations will have formal sustainability targets integrated into their procurement strategies.

The selection of sustainable vendors also impacts operational efficiency and resilience. Companies that prioritize green supply chains often demonstrate better risk management and innovation. In 2025, the demand for transparent and sustainable supply chains is expected to further intensify, with businesses increasingly looking for partners who can demonstrate measurable progress in areas like renewable energy adoption and circular economy principles within their operations.

- Vendor Environmental Audits: Bill.com likely incorporates environmental criteria into its supplier onboarding and ongoing review processes.

- ESG Reporting: Emphasis on vendors providing clear ESG data and performance metrics.

- Risk Mitigation: Partnering with sustainable vendors helps Bill.com avoid reputational damage and supply chain disruptions linked to environmental non-compliance.

- Market Alignment: Meeting the increasing demand from clients and investors for environmentally responsible business practices.

The global shift towards sustainability directly benefits Bill.com by promoting paperless operations. In 2024, a significant majority of businesses reported integrating environmental factors into their purchasing decisions, creating a favorable market for digital solutions like Bill.com's. This trend is further amplified by increasing regulatory pressure, such as the EU's expanding corporate sustainability reporting directives in 2024, which encourage businesses to digitize and manage their environmental impact more effectively.

Bill.com's platform facilitates this by enabling clients to reduce paper waste, aligning with growing corporate social responsibility goals. For instance, data from 2023 showed that companies with strong ESG performance experienced higher valuation multiples, underscoring the financial advantages of eco-friendly practices. As of 2025, the demand for transparent and sustainable supply chains is intensifying, pushing companies like Bill.com to vet their own vendors for environmental responsibility, thereby enhancing their brand reputation and mitigating risks.

| Environmental Factor | Impact on Bill.com | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Paperless Operations Push | Increased demand for digital invoicing and payment solutions. | Growing consumer preference for eco-friendly practices; businesses actively seeking to reduce paper consumption. |

| Regulatory Mandates (e.g., ESG Reporting) | Drives customer need for digital tools to manage and report environmental impact. | EU's CSRD expansion in 2024 requires more companies to disclose environmental data. |

| Supply Chain Sustainability | Encourages Bill.com to select environmentally responsible vendors, enhancing its own ESG profile. | Over 70% of companies consider supplier ESG performance in procurement; demand for transparent supply chains intensifying by 2025. |

| Energy Consumption of Data Centers | Indirect environmental footprint associated with cloud infrastructure. | Data centers accounted for ~1% of global electricity consumption in 2023, a figure projected to rise. |

PESTLE Analysis Data Sources

Our Bill.com PESTLE analysis is built on a comprehensive review of data from government regulatory bodies, financial institutions, and leading technology research firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable information.