BE Semiconductor Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BE Semiconductor Industries Bundle

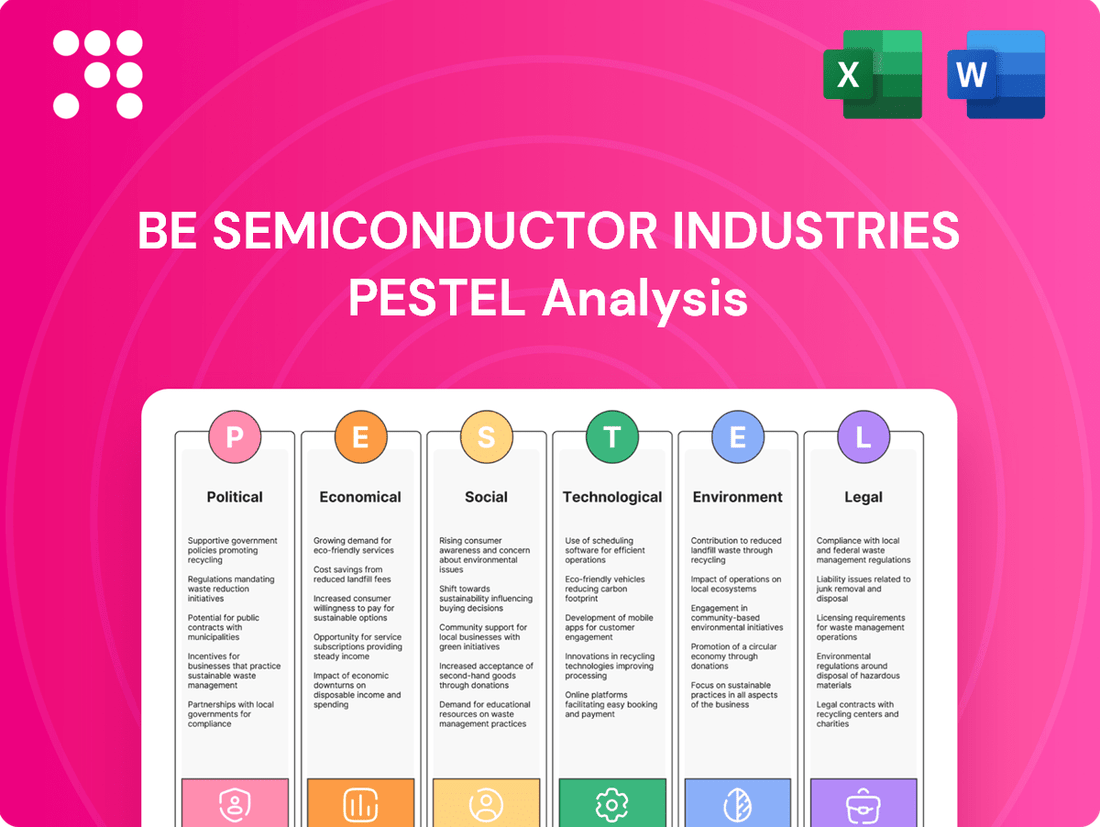

Navigate the complex external forces shaping BE Semiconductor Industries with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are impacting their operations and future growth. Gain a critical edge by downloading the full report to unlock actionable intelligence for your strategic planning.

Political factors

Ongoing geopolitical tensions, especially between the US and China, cast a long shadow over the semiconductor sector. These aren't just abstract political discussions; they translate into very real business challenges.

The US, for instance, has implemented export restrictions on critical advanced computing and manufacturing items. This directly impacts companies like BE Semiconductor Industries (Besi) by potentially disrupting established supply chains and restricting access to key markets. For example, in late 2023, the US government expanded controls on semiconductor manufacturing equipment destined for China, affecting the availability of advanced tools.

These restrictions often zero in on specific technologies, such as advanced inspection and metrology equipment, which are crucial for semiconductor production quality. The stated aim is to prevent these advanced technologies from being used for military applications, creating a complex regulatory environment for global semiconductor players.

Governments globally are actively promoting domestic semiconductor production through significant legislative efforts. The US CHIPS and Science Act, for instance, allocated over $52 billion in funding to boost semiconductor manufacturing and research within the United States. Similarly, the European Chips Act aims to mobilize €43 billion in public and private investment to strengthen Europe's chip industry.

These initiatives, including substantial grants and tax incentives, are designed to encourage the construction of new semiconductor fabrication plants (fabs) and drive innovation in research and development. For a company like BE Semiconductor Industries, which operates on a global scale, these government programs present a significant opportunity to leverage financial support for expansion and technological advancement.

By aligning with national strategies to build resilient semiconductor supply chains, BE Semiconductor Industries is well-positioned to benefit from these subsidies. Countries are eager to attract and retain advanced manufacturing capabilities, making companies with existing global footprints attractive partners for these ambitious industrial policies.

The semiconductor industry is now a critical national security issue, with countries focusing on technological sovereignty. This means governments are pushing for more domestic or nearby manufacturing, which directly impacts where companies like BE Semiconductor Industries (Besi) might set up new facilities or manage their supply chains. For instance, the U.S. CHIPS and Science Act allocated $52.7 billion to boost domestic semiconductor production and research, illustrating this trend.

Governments are also keen on controlling advanced technologies, especially those related to artificial intelligence (AI), due to national security implications. This focus can lead to export controls or incentives for companies developing these critical technologies within national borders, potentially shaping Besi's market access and R&D strategies.

Intellectual Property Protection

The strength of intellectual property (IP) protection significantly impacts companies like BE Semiconductor Industries, especially in regions where it operates. Robust IP laws are vital for safeguarding its innovative designs and manufacturing techniques, fostering continued investment in research and development. For instance, in 2023, the global semiconductor industry saw significant investment in R&D, with leading companies allocating billions to innovation, underscoring the importance of protecting these advancements.

Weaknesses in IP enforcement or changes in regulations across different markets can create substantial risks for Besi. Infringement of its patented technologies could erode its competitive edge and financial performance. Reports from the U.S. Chamber of Commerce Global Innovation Policy Center consistently highlight the varying levels of IP protection worldwide, with some regions offering stronger safeguards than others.

- Global IP Enforcement Varies: Countries differ in their commitment and effectiveness in enforcing IP rights, directly affecting technology firms.

- Innovation Incentive: Strong IP protection encourages companies to invest heavily in developing new technologies, like those Besi utilizes.

- Competitive Advantage: Protecting proprietary processes is key to maintaining Besi's market position against competitors.

Regulatory Environment and Compliance

BE Semiconductor Industries (Besi) navigates a complex global regulatory environment, demanding strict adherence to trade, labor, and environmental laws across its operating regions. For instance, in 2023, the semiconductor industry faced increased scrutiny regarding supply chain transparency and national security concerns, particularly impacting export controls for advanced technologies. Besi's commitment to compliance is crucial for maintaining its access to key markets and ensuring uninterrupted operations.

Shifts in governmental policies, such as the US CHIPS and Science Act of 2022, which aims to bolster domestic semiconductor manufacturing, or similar initiatives in Europe and Asia, can significantly influence Besi's strategic planning and investment decisions. These regulations can create both opportunities for government incentives and challenges related to market access or operational adjustments. Staying ahead of evolving compliance requirements, including those for environmental, social, and governance (ESG) factors, is paramount for Besi's long-term sustainability and market competitiveness.

- Global Compliance Burden: Besi must comply with a multitude of national and international regulations, impacting everything from product sales to factory operations.

- Trade and Export Controls: Evolving trade policies and export restrictions, particularly concerning advanced semiconductor equipment, directly affect Besi's ability to serve certain markets.

- Environmental Mandates: Increasingly stringent environmental regulations worldwide necessitate ongoing investment in sustainable practices and compliance technologies for Besi's manufacturing processes.

- Labor Laws: Adherence to diverse labor laws in countries where Besi has a presence is essential for maintaining a stable workforce and avoiding legal complications.

Geopolitical tensions, particularly between the US and China, directly impact BE Semiconductor Industries (Besi) through trade restrictions and supply chain disruptions. For instance, US export controls on advanced semiconductor manufacturing equipment, expanded in late 2023, limit access to critical tools for certain markets.

Governments worldwide are actively promoting domestic chip production, with initiatives like the US CHIPS and Science Act allocating over $52 billion. These policies create opportunities for Besi to benefit from subsidies and incentives for expansion and technological advancement, aligning with national strategies for supply chain resilience.

The semiconductor industry's classification as a national security issue drives a push for technological sovereignty, influencing where companies like Besi establish operations and manage supply chains. Governments also focus on controlling advanced technologies like AI, potentially shaping Besi's market access and R&D strategies through export controls or domestic development incentives.

What is included in the product

This PESTLE analysis of BE Semiconductor Industries examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive understanding of the external forces shaping the semiconductor equipment market, enabling informed decision-making and risk mitigation.

A concise summary of BE Semiconductor Industries' PESTLE analysis, highlighting key external factors affecting the semiconductor industry, provides a quick reference to mitigate potential risks and inform strategic decisions.

Economic factors

The global semiconductor market is booming, with forecasts indicating double-digit growth for both 2024 and 2025. This surge is primarily fueled by the insatiable demand for artificial intelligence and advanced computing solutions. This robust market expansion directly translates into increased demand for semiconductor assembly equipment, a key area for BE Semiconductor Industries.

The industry is projected to hit a staggering $1 trillion valuation by the year 2030. This monumental growth trajectory underscores the critical role semiconductors play in modern technology and presents a significant opportunity for companies like Besi that supply essential manufacturing tools.

Semiconductor companies are making massive investments in new factories and advanced technologies. For example, Intel announced plans to spend $100 billion in the US by 2030, and TSMC is investing heavily in new fabs in Arizona. This surge in capital expenditures, driven by the insatiable demand for AI chips and advanced packaging, directly benefits equipment makers like BE Semiconductor Industries.

This investment cycle is particularly strong for wafer fab equipment. Industry analysts predict the wafer fab equipment market to grow substantially, with some forecasts suggesting a compound annual growth rate of over 10% in the coming years, reaching hundreds of billions of dollars. This expansion means more orders for the specialized machinery that Besi provides.

BE Semiconductor Industries (Besi) sees its revenue directly tied to the health of crucial sectors like mobile devices, vehicles, and computing. For instance, while the automotive sector experienced a slowdown in early 2024, Besi’s exposure to the burgeoning demand for advanced packaging in AI-driven computing, particularly through hybrid bonding technologies, provided a significant counterbalance. This technological shift is a key growth engine.

Currency Fluctuations and Forex Effects

Currency fluctuations, especially between the Euro and the US Dollar, directly affect BE Semiconductor Industries' (Besi) financial results. For instance, in the first quarter of 2024, Besi reported that unfavorable foreign exchange movements had a negative impact on its gross profit. This highlights how even strong operational performance can be overshadowed by adverse currency swings, reducing overall profitability.

Managing this currency risk is a critical component of Besi's financial strategy. The company operates globally, meaning it deals with multiple currencies, making it susceptible to the volatility of foreign exchange markets. Effective treasury management and hedging strategies are therefore essential to mitigate potential losses and ensure more predictable financial outcomes.

Here are some key impacts of currency fluctuations:

- Reduced Gross Margins: When the Euro strengthens against the US Dollar, revenue earned in dollars translates into fewer Euros, impacting gross margins.

- Lower Net Income: Adverse forex movements can directly decrease the net income reported in the company's consolidated financial statements.

- Increased Financial Planning Complexity: Global operations necessitate robust financial planning to account for and manage currency exposures effectively.

Supply Chain Resilience and Costs

The semiconductor industry continues to grapple with significant supply chain disruptions, a situation exacerbated by ongoing geopolitical tensions and global events. For BE Semiconductor Industries (Besi), this translates into persistent pressures on component availability and manufacturing costs. For instance, the global shortage of critical raw materials and manufacturing equipment, which peaked in 2022-2023, continued to impact lead times and pricing into 2024, with some advanced materials still experiencing tight supply. This necessitates a strategic focus on building more resilient and adaptable supply chains.

Companies like Besi are actively pursuing strategies to mitigate these risks. Diversification of sourcing locations and increased investment in digital supply chain management are key initiatives. These efforts aim to enhance visibility and agility, allowing for quicker responses to unforeseen disruptions. Such investments, while crucial for long-term stability, can also influence short-term operational costs.

The strategic priority for Besi and its peers is the development of more flexible and adaptable supply chains. This involves not only geographical diversification but also fostering closer collaboration with key suppliers and exploring alternative material sources. The goal is to reduce reliance on single points of failure and ensure a more consistent flow of components, thereby safeguarding production schedules and customer commitments in an increasingly volatile global landscape.

- Geopolitical Instability: Continued trade disputes and regional conflicts, particularly impacting East Asia, remain a significant risk factor for semiconductor supply chains, affecting access to essential materials and manufacturing capabilities.

- Digitization Investment: Companies are investing heavily in digital tools for supply chain visibility and optimization, with global spending on supply chain management software projected to reach over $20 billion by 2025, aiming to improve responsiveness.

- Cost Volatility: Fluctuations in raw material prices, energy costs, and logistics expenses directly impact the cost of components, with some specialized materials seeing price increases of 10-15% year-over-year in early 2024 due to constrained supply.

- Resilience as a Priority: Building more robust and agile supply chains is a top strategic imperative, with many firms actively seeking to reduce their dependence on single suppliers or regions to ensure continuity of operations.

The global semiconductor market is experiencing unprecedented growth, with projections indicating a substantial expansion through 2024 and 2025, largely driven by AI and advanced computing demands. This boom directly benefits BE Semiconductor Industries (Besi) by increasing the need for its assembly equipment. The industry's overall valuation is expected to reach $1 trillion by 2030, highlighting the critical role of semiconductor manufacturing technology.

Significant capital investments are being made by major players like Intel and TSMC, with billions allocated to new fabrication facilities. This surge in capital expenditure, particularly for wafer fab equipment, which is forecast to grow at over 10% annually, creates a strong demand for Besi's specialized machinery. Besi's revenue is closely linked to the performance of key sectors such as automotive and computing, with advanced packaging technologies like hybrid bonding offering substantial growth opportunities.

Currency fluctuations, especially between the Euro and the US Dollar, present a notable economic factor impacting Besi's profitability. In Q1 2024, unfavorable foreign exchange movements negatively affected the company's gross profit, underscoring the importance of effective treasury management and hedging strategies for global operations. Managing these currency risks is crucial for ensuring more predictable financial outcomes.

Supply chain disruptions remain a persistent challenge for the semiconductor industry, influenced by geopolitical tensions and global events. Besi faces ongoing pressures regarding component availability and manufacturing costs, with shortages of critical materials continuing into 2024. The company is actively investing in supply chain digitization and diversification to enhance resilience and agility, aiming to mitigate risks associated with single-source dependencies and geopolitical instability.

Same Document Delivered

BE Semiconductor Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of BE Semiconductor Industries.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting BE Semiconductor Industries.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external forces shaping BE Semiconductor Industries.

Sociological factors

The semiconductor industry is grappling with a severe talent shortage, with estimates suggesting a need for a million new skilled workers globally by 2030. This deficit spans critical roles such as engineers, technicians, and computer scientists, impacting companies like BE Semiconductor Industries.

BE Semiconductor Industries, along with its peers, faces the ongoing challenge of attracting and retaining top talent. The demand for specialized skills, particularly in emerging fields like generative AI, intensifies this competition, making it crucial for the company to develop robust human capital strategies.

A significant portion of the semiconductor workforce, particularly in established manufacturing hubs, is approaching retirement age. This demographic shift presents a critical challenge for companies like BE Semiconductor Industries, potentially leading to a 'talent cliff' and a loss of invaluable institutional knowledge.

To mitigate this, robust succession planning and effective knowledge transfer programs are essential. For instance, in 2024, the average age of experienced engineers in some advanced manufacturing sectors has risen, highlighting the urgency for proactive strategies to capture and disseminate their expertise before they retire.

The semiconductor sector, including companies like BE Semiconductor Industries, is increasingly focused on building a more diverse workforce. This includes actively seeking to expand opportunities for veterans, women, and underrepresented minority groups. For instance, a 2024 report indicated a growing emphasis on STEM education outreach to these demographics, aiming to fill future talent gaps.

Besi's proactive stance on diversity and inclusion, coupled with offering flexible work arrangements, significantly boosts its attractiveness to a wider range of potential employees. This approach is crucial for talent acquisition in a competitive field, as demonstrated by industry surveys from late 2024 showing a preference for inclusive work environments among job seekers.

Industry Appeal and STEM Education

The semiconductor industry faces a significant hurdle in attracting top talent due to lower brand recognition and perceived appeal when compared to sectors like software development or artificial intelligence. This makes it harder for companies like BE Semiconductor Industries to compete for the brightest minds. For instance, a 2024 survey indicated that only 15% of high school students aspiring to tech careers specifically considered semiconductor manufacturing, a stark contrast to the 45% interested in software engineering.

To address this, a concerted effort to bolster STEM education and showcase the dynamic, innovation-driven career paths within semiconductors is essential. Highlighting the critical role semiconductors play in everything from advanced medical devices to next-generation computing can significantly boost industry appeal. Initiatives like the Semiconductor Industry Association's (SIA) 2025 "Future of Chips" campaign aim to bridge this gap by partnering with universities and offering internships, with a goal of increasing student enrollment in relevant programs by 20% by 2026.

- Talent Attraction Gap: The semiconductor sector lags behind other tech fields in attracting top talent due to lower brand appeal.

- STEM Education Importance: Promoting STEM education is vital for cultivating a future workforce for the industry.

- Industry Perception Challenge: Many students overlook the exciting career opportunities within semiconductor manufacturing.

- Future Workforce Pipeline: Investing in educational outreach and highlighting innovation are key to securing future talent.

Employee Well-being and Training

Besi recognizes that a healthy and skilled workforce is fundamental to its success, especially in a rapidly evolving technological landscape. The company's dedication to employee well-being and continuous training is a key sociological factor influencing its operational effectiveness and long-term growth.

Investing in employee development directly addresses the need for specialized skills in the semiconductor equipment sector. For instance, Besi reported an increase in overall training hours per employee, a clear indicator of their commitment to upskilling the workforce. This focus on continuous learning is crucial for adapting to new manufacturing techniques and technological advancements, ensuring Besi remains competitive.

The emphasis on employee well-being not only boosts morale but also contributes to higher productivity and lower employee turnover. This sociological aspect is vital for retaining experienced personnel who possess critical knowledge and expertise. A stable and motivated workforce is better equipped to handle the complexities of semiconductor manufacturing and innovation.

Key aspects of Besi's approach to employee well-being and training include:

- Investment in Upskilling: Besi's increased training hours per employee demonstrate a strategic commitment to keeping its workforce current with industry advancements.

- Talent Retention: Prioritizing employee well-being and development fosters a positive work environment, which is essential for retaining valuable talent.

- Productivity Enhancement: A well-trained and healthy workforce is more efficient and innovative, directly impacting operational output and quality.

- Adaptability to Technological Change: Continuous training ensures employees can effectively operate and maintain cutting-edge semiconductor equipment, crucial for industry relevance.

The semiconductor industry, including BE Semiconductor Industries, faces a significant talent deficit, with projections indicating a need for one million new skilled workers globally by 2030. This shortage affects critical roles, intensifying competition for specialized expertise, particularly in areas like generative AI.

A substantial portion of the current semiconductor workforce is aging, raising concerns about knowledge transfer and potential talent gaps as experienced employees retire. Companies like BE Semiconductor Industries must implement robust succession planning and knowledge-sharing initiatives to counter this demographic shift.

BE Semiconductor Industries is actively working to build a more diverse workforce, targeting increased representation from veterans, women, and minority groups. This focus on inclusion, alongside flexible work options, is vital for attracting a broader talent pool in a competitive market, as evidenced by increasing job seeker preferences for inclusive environments in late 2024.

The industry struggles with brand perception compared to sectors like software development, making it harder to attract top minds. For instance, a 2024 survey showed only 15% of high school students interested in tech careers considered semiconductor manufacturing, compared to 45% for software engineering.

Technological factors

Advanced packaging technologies, including hybrid bonding and 2.5D/3D integration, are pivotal for the semiconductor industry's progress, especially in high-performance computing and AI. These innovations allow for more powerful and efficient chips by stacking components or connecting them more closely.

Besi is a key player in this space, supplying essential equipment for these advanced packaging solutions. The company has seen significant growth in its hybrid bonding revenue, indicating strong demand and increasing customer adoption of this cutting-edge technology. This trend is expected to continue as the need for sophisticated semiconductor devices escalates.

The escalating demand for Artificial Intelligence (AI) and High-Performance Computing (HPC) is a significant driver for advanced semiconductor devices, which in turn necessitates more intricate packaging solutions. Besi's specialized equipment is instrumental in the manufacturing of these powerful chips, placing the company in a strong position to capitalize on this burgeoning market.

The surge in AI-driven applications is fueling substantial investments in chip innovation and the expansion of manufacturing capacity. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to reach over $200 billion by 2030, highlighting the immense growth potential.

The relentless drive towards miniaturization in semiconductor devices, coupled with the growing adoption of chiplet architectures, demands assembly equipment capable of extreme precision and efficiency. Besi's strategic investment in technologies like its TCB Next system, designed for smaller bond pad pitches, directly addresses these critical industry needs, positioning them to capitalize on this technological shift.

Automation and Smart Manufacturing

The semiconductor industry's embrace of automation and smart manufacturing is a significant technological shift. This includes the increasing use of robotics and AI in production lines, which boosts efficiency and quality while lowering costs. For BE Semiconductor Industries (Besi), this trend means their advanced assembly equipment is becoming even more crucial as customers demand more sophisticated and automated solutions.

The push for smarter factories is directly influencing the demand for Besi's cutting-edge machinery. For instance, the global market for industrial robots, a key component of smart manufacturing, was projected to reach over $60 billion by 2024, with a significant portion serving the electronics and semiconductor sectors. Besi's equipment is designed to integrate seamlessly into these highly automated environments.

- Increased Demand for Advanced Equipment: As manufacturers invest in automation, the need for Besi's high-precision, automated assembly and packaging solutions grows.

- Efficiency Gains for Customers: Besi's technology enables clients to achieve higher throughput and better yields, directly impacting their cost-effectiveness.

- Integration with AI and IoT: Besi's equipment is increasingly designed to work with AI-driven quality control and the Internet of Things (IoT) for real-time monitoring and optimization.

- Focus on Precision and Reliability: The drive for smarter manufacturing emphasizes the need for highly reliable and precise equipment, a core strength of Besi's product offerings.

Research and Development (R&D) Investment

Besi's commitment to research and development is crucial for maintaining its leadership in semiconductor assembly. In 2023, the company reported R&D expenses of €133.6 million, representing a significant portion of its revenue and underscoring its dedication to innovation. This investment fuels the development of advanced solutions that address the evolving needs of the semiconductor industry, ensuring Besi stays ahead of technological curves.

This continuous investment enables Besi to pioneer technologies for next-generation semiconductor architectures, such as advanced packaging for AI and high-performance computing. By focusing on R&D, Besi strengthens its competitive position, offering cutting-edge equipment that meets the demands of a rapidly advancing technological sector.

- R&D Investment Growth: Besi's R&D expenditure has seen consistent growth, with a notable increase in recent years to support the development of advanced assembly solutions.

- Focus on Future Technologies: Investments are strategically directed towards enabling technologies for emerging semiconductor trends like AI, 5G, and advanced automotive electronics.

- Competitive Advantage: Sustained R&D spending is key to Besi's ability to offer differentiated products and maintain a technological lead over competitors.

- Innovation Pipeline: The company's R&D efforts ensure a robust pipeline of new equipment and processes, critical for capturing market share in high-growth segments.

The semiconductor industry's technological landscape is rapidly evolving, driven by advancements in areas like advanced packaging, AI, and automation. Besi is at the forefront, supplying critical equipment for these innovations, such as hybrid bonding solutions that enable more powerful chips. The company's significant R&D investment, €133.6 million in 2023, underscores its commitment to staying ahead in this dynamic sector.

The increasing demand for AI and high-performance computing (HPC) is a major catalyst, pushing the need for sophisticated semiconductor devices and, consequently, advanced packaging. Besi's specialized equipment plays a vital role in manufacturing these chips, positioning the company to benefit from this growth. The global AI chip market, valued around $20 billion in 2023, is expected to exceed $200 billion by 2030, illustrating the immense opportunity.

Furthermore, the trend towards miniaturization and chiplet architectures requires highly precise assembly equipment, a need Besi addresses with investments in technologies like its TCB Next system. The broader adoption of smart manufacturing and automation within the industry also elevates the importance of Besi's advanced, automated solutions, as seen in the projected over $60 billion market for industrial robots by 2024.

| Key Technological Drivers | Besi's Role/Equipment | Market Data/Trends |

| Advanced Packaging (Hybrid Bonding, 2.5D/3D) | Supplies essential equipment for these processes | Strong growth in hybrid bonding revenue for Besi |

| AI and High-Performance Computing (HPC) | Enables manufacturing of chips for AI/HPC | Global AI chip market projected to reach >$200B by 2030 (from ~$20B in 2023) |

| Miniaturization & Chiplets | Develops high-precision assembly equipment (e.g., TCB Next) | Demand for precision equipment to handle smaller bond pad pitches |

| Automation & Smart Manufacturing | Provides advanced, automated assembly solutions | Industrial robot market projected >$60B by 2024; Besi's equipment integrates into automated lines |

| Research & Development Investment | Consistent R&D spending to drive innovation | Besi's R&D expenses were €133.6 million in 2023 |

Legal factors

Export control regulations, particularly those from the US and other key nations, are a significant hurdle for BE Semiconductor Industries (Besi). These rules restrict the sale of advanced semiconductor technology and manufacturing equipment, directly impacting Besi's global reach, especially concerning markets like China. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) continually updates its Entity List and export control measures, affecting companies that supply advanced semiconductor manufacturing tools. This creates substantial compliance burdens and can lead to outright market limitations.

Trade tariffs and evolving trade policies significantly impact BE Semiconductor Industries (Besi). For instance, increased tariffs on semiconductors and related equipment directly influence the cost of raw materials and components, potentially squeezing profit margins. These tariffs can also alter the price competitiveness of Besi's advanced equipment in key global markets.

Heightened geopolitical tensions are fueling concerns about the renegotiation of existing trade deals. This uncertainty can lead to unpredictable shifts in market access and operational costs for Besi. For example, the US-China trade dispute has already led to restrictions on certain technology exports, impacting global supply chains for semiconductor manufacturing equipment.

As a global entity, BE Semiconductor Industries (Besi) must navigate a complex web of legal requirements, including strict adherence to International Financial Reporting Standards (IFRS). This commitment ensures financial transparency and accuracy across its diverse operational regions, a critical factor for investor confidence. For instance, Besi's 2023 annual report, prepared in accordance with IFRS, details its financial performance and compliance measures, demonstrating its dedication to global accounting principles.

Intellectual Property Laws and Enforcement

Intellectual property laws are foundational to BE Semiconductor Industries' (Besi) competitive edge, safeguarding its innovations in advanced assembly equipment. Patents and trade secrets protect the intricate designs and processes that underpin their high-precision machinery, a critical element of their business model. Without robust legal protection and diligent enforcement, the risk of competitors replicating Besi's proprietary technologies would significantly undermine their market position and profitability.

The effectiveness of these legal frameworks directly impacts Besi's ability to maintain its technological leadership. For instance, in 2023, the global semiconductor equipment market saw continued investment in R&D, with companies like Besi heavily reliant on IP to differentiate their offerings. Strong enforcement prevents the dilution of their intellectual capital, ensuring that their investments in innovation translate into sustainable revenue streams.

- Patent Protection: Besi's patents cover key aspects of its die-attach, wire-bonding, and packaging solutions, providing exclusive rights to its technologies.

- Trade Secret Safeguarding: Confidential manufacturing processes and proprietary software algorithms are protected as trade secrets, requiring internal controls and legal agreements.

- Enforcement Challenges: Navigating international intellectual property law and actively pursuing infringers is a continuous operational requirement for Besi.

- R&D Investment Link: The value derived from IP protection directly influences Besi's ongoing commitment to research and development, estimated to be a significant portion of its annual revenue.

Labor Laws and Employment Regulations

BE Semiconductor Industries (Besi) navigates a complex web of labor laws across its global operations in Europe, Asia, and North America. These regulations dictate everything from minimum wages and working hours to employee benefits and termination procedures. For instance, in 2024, many European nations continued to see robust worker protections, with some countries like Germany implementing further enhancements to collective bargaining rights. This necessitates careful management of payroll and HR policies to ensure full compliance in each region.

Adapting to evolving employment regulations is crucial for Besi's talent acquisition and retention. For example, in the United States, the Department of Labor's proposed changes to overtime rules in 2024 could impact salary structures for a significant portion of the workforce. Similarly, in Asia, countries like Singapore have been actively reviewing and updating their employment acts to address new work models and employee expectations. These shifts directly influence Besi's operational costs and its ability to attract and keep skilled personnel.

Besi must remain vigilant regarding changes in labor laws that can affect its bottom line and human resource strategies. Key areas of focus include:

- Wage and Hour Laws: Ensuring compliance with minimum wage requirements and overtime regulations, which vary significantly by country and can be subject to frequent updates.

- Employee Rights and Protections: Adhering to laws concerning workplace safety, anti-discrimination, and the right to organize, all of which are critical for maintaining a positive employee relations environment.

- Talent Management Regulations: Navigating rules related to hiring practices, background checks, and data privacy for employee information, particularly as remote work models expand globally.

- Contractual Obligations: Understanding and upholding employment contract requirements, severance pay, and dismissal procedures, which differ substantially across jurisdictions.

BE Semiconductor Industries (Besi) faces significant legal challenges related to export control regulations, particularly those originating from the United States. These regulations, such as those managed by the Bureau of Industry and Security (BIS), restrict the sale of advanced semiconductor manufacturing equipment to certain countries, notably China. This directly impacts Besi's market access and necessitates robust compliance frameworks to avoid penalties. For instance, the ongoing updates to export control lists and licensing requirements create a dynamic and complex operating environment for Besi's global sales and distribution channels.

Environmental factors

Besi is facing growing demands from regulators, consumers, and investors to prioritize sustainable operations and showcase robust Environmental, Social, and Governance (ESG) performance. This trend is reshaping industry expectations and driving strategic shifts across the semiconductor sector.

Responding to this pressure, Besi has amplified its ESG initiatives and reporting. The company has established specific targets aimed at reducing its environmental footprint, including lowering emissions, decreasing fuel consumption, and conserving water usage. Furthermore, Besi is actively working to increase its reliance on renewable energy sources, a key component of its sustainability strategy.

Semiconductor manufacturing is notoriously energy-hungry, making energy consumption a significant environmental factor. BE Semiconductor Industries (Besi) acknowledges this, as evidenced by their commitment to boosting renewable energy use across their operations.

This focus on cleaner energy is directly tied to global environmental concerns and increasing regulatory pressure. Besi has set ambitious goals, aiming for net-zero greenhouse gas emissions from their own operations (Scope 1 and 2) by 2030, demonstrating a proactive approach to sustainability.

Water scarcity is a growing environmental challenge, particularly for water-intensive industries like semiconductor manufacturing. As global water resources face increasing strain, companies are under pressure to adopt more sustainable practices. For instance, the European Union is actively developing regulations, such as those within the Green Deal framework, to impose stricter water usage limits and encourage the adoption of advanced water recycling technologies.

Besi's commitment to reducing its water usage intensity directly addresses these mounting environmental pressures. By focusing on efficiency and recycling, the company is aligning its operations with regulatory trends and broader sustainability goals. This proactive approach is crucial for long-term operational resilience and maintaining a positive environmental footprint in a resource-constrained world.

Waste Management and Circular Economy

The semiconductor sector faces significant environmental challenges, particularly concerning waste management. The production process inherently generates various waste streams, including hazardous materials that require careful handling and disposal. Companies like BE Semiconductor Industries (Besi) are under increasing pressure to mitigate these environmental impacts.

There's a growing industry-wide emphasis on adopting circular economy principles. This involves not only reducing waste at the source but also actively pursuing e-waste recycling and material recovery. The goal is to move away from a linear take-make-dispose model towards a more sustainable, closed-loop system.

Besi has reported progress in managing its environmental footprint. For instance, the company's 2023 sustainability report indicated a reduction in absolute hazardous waste generation. This demonstrates a tangible commitment to improving waste management practices and minimizing its environmental impact.

- Hazardous Waste Reduction: Besi's 2023 report showed a decrease in absolute hazardous waste, reflecting efforts to improve waste handling and reduction strategies.

- Circular Economy Initiatives: The semiconductor industry, including Besi, is increasingly exploring e-waste recycling and material recovery to align with circular economy principles.

- Environmental Compliance: Strict regulations govern the disposal of hazardous waste in the semiconductor industry, requiring significant investment in compliance and sustainable practices.

Eco-friendly Packaging and Materials

The push for eco-friendly packaging is significantly impacting the electronics sector, BE Semiconductor Industries' primary customer base. This includes a growing preference for biodegradable, recyclable, and mono-material packaging, a trend amplified by consumer expectations and stricter environmental mandates. For instance, by 2025, the global sustainable packaging market is projected to reach over $400 billion, with electronics being a key driver.

This shift directly influences how semiconductor manufacturers handle and assemble their products. Besi's equipment must adapt to accommodate these new packaging materials and methods, potentially requiring modifications for compatibility with lighter, more environmentally conscious packaging solutions. The demand for sustainable materials in consumer electronics, such as smartphones and laptops, cascades down to the component level, influencing the assembly processes Besi's machinery supports.

- Growing Demand for Recycled Content: Many electronics brands are setting targets for increased recycled content in their product packaging, influencing material choices.

- Biodegradable Alternatives: Research and development into biodegradable plastics and paper-based alternatives are accelerating, potentially changing substrate requirements.

- Mono-Material Focus: Simplification of packaging to single types of materials aids recyclability, which could affect how components are presented and handled during assembly.

Environmental regulations are tightening, pushing companies like Besi to adopt greener practices. This includes managing hazardous waste, with Besi reporting a reduction in absolute hazardous waste generation in 2023. The industry is also embracing circular economy principles, focusing on e-waste recycling and material recovery.

Water scarcity is another key concern, prompting Besi to focus on reducing water usage intensity and increasing water recycling. Furthermore, the growing demand for eco-friendly packaging in the electronics sector, projected to exceed $400 billion globally by 2025, requires Besi's equipment to adapt to new, sustainable materials.

Besi has set a target for net-zero greenhouse gas emissions from its own operations (Scope 1 and 2) by 2030, underscoring its commitment to sustainability and aligning with global environmental goals.

PESTLE Analysis Data Sources

Our BE Semiconductor Industries PESTLE analysis is built upon a robust foundation of data sourced from leading semiconductor industry associations, global economic reports from institutions like the IMF and World Bank, and official government policy documents. We also incorporate market research from reputable firms and technological trend forecasts to ensure comprehensive coverage.