BE Semiconductor Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BE Semiconductor Industries Bundle

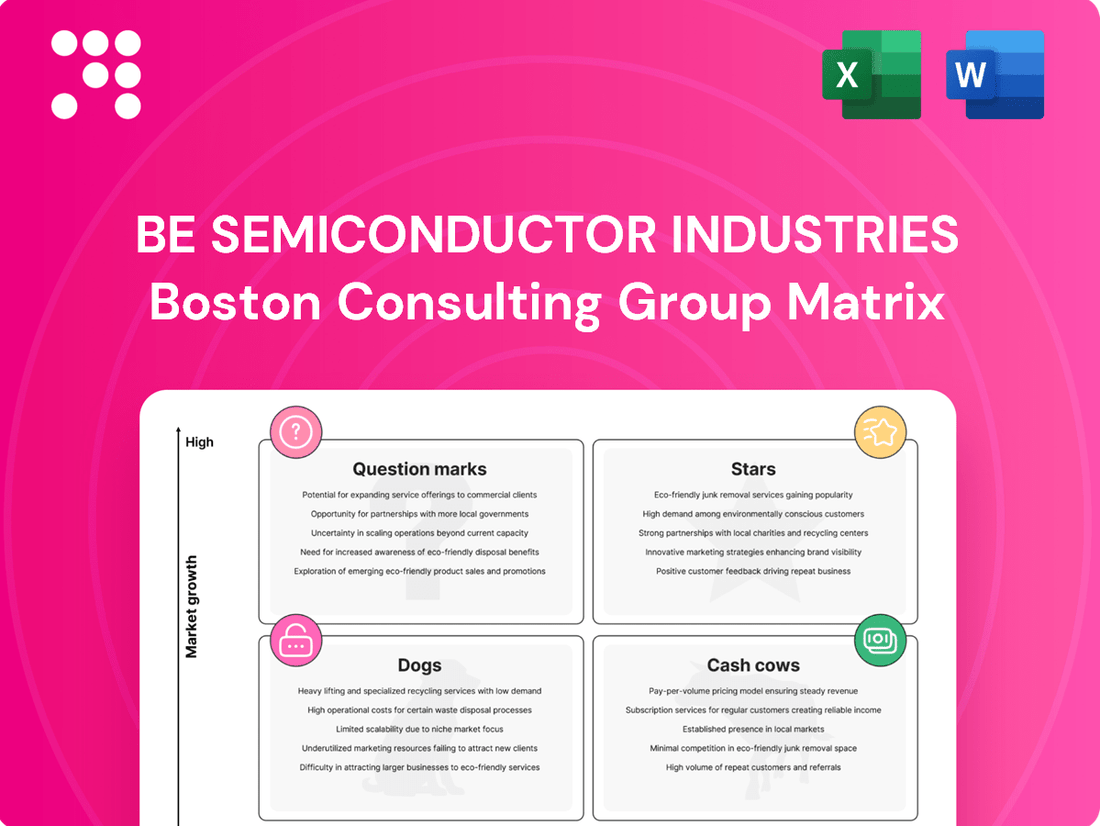

Uncover the strategic positioning of BE Semiconductor Industries' product portfolio with our comprehensive BCG Matrix analysis. See at a glance which segments are driving growth and which might require a closer look.

This preview offers a glimpse into BE Semiconductor Industries' market dynamics, highlighting key areas for potential investment and resource allocation. Ready to transform this insight into actionable strategy?

Purchase the full BCG Matrix report for a detailed breakdown of BE Semiconductor Industries' Stars, Cash Cows, Dogs, and Question Marks, complete with data-backed recommendations to optimize your business decisions.

Don't miss out on the complete picture; get the full BCG Matrix and gain a clear roadmap for BE Semiconductor Industries' future success.

Stars

BE Semiconductor Industries' hybrid bonding systems are a significant growth area, often categorized as a Star in the BCG matrix due to their high market share and rapid expansion. Revenue from this segment saw a remarkable tripling in 2024, and is expected to continue its impressive trajectory with a projected surge of 104% in 2025. This growth is fueled by the critical role these systems play in advanced semiconductor packaging, facilitating direct chip-to-chip connections vital for demanding applications like high-performance computing (HPC) and artificial intelligence (AI).

The broader market for advanced packaging is booming, largely driven by the insatiable demand for AI-enabled devices and the ongoing expansion of data centers. Analysts anticipate a substantial 19.2% market expansion in 2025 alone, underscoring the strong tailwinds for BE Semiconductor's hybrid bonding technology. As a leading supplier of these sophisticated machines, and a key partner to major foundries like TSMC, BE Semiconductor is well-positioned to capitalize on this burgeoning market.

Besi's advanced die attach equipment is a cornerstone of semiconductor assembly, holding a substantial 25% market share in 2024. This technology is indispensable for the precise packaging required by sectors like automotive electronics and advanced computing.

The growing demand for specialized die attach solutions, particularly for AI-driven 2.5D computing, signals strong future growth potential for this segment.

BE Semiconductor Industries' TCB Next Systems are positioned as a Star in the BCG Matrix due to robust demand. The company has secured substantial new orders for these advanced packaging solutions, underscoring their market appeal.

Thermocompression Bonding (TCB) is crucial for next-generation AI applications, placing Besi in a strong growth sector. This technology is vital for handling the intricate designs and demanding performance needs of AI and High Bandwidth Memory (HBM) semiconductors.

Solutions for AI and HPC Applications

Besi's strategic focus on advanced packaging technologies for AI applications places it in a rapidly expanding market. The company anticipates significant innovation in this area between 2026 and 2030, driven by increasing AI demand across various computing sectors. This strategic positioning is crucial for capturing market share in a segment poised for substantial growth.

The broader semiconductor manufacturing equipment market is experiencing a significant boost, projected to reach a record $125.5 billion in 2025, largely due to the insatiable demand from AI applications. Besi's expertise in advanced packaging is directly addressing this demand, offering solutions that are vital for the performance and efficiency of AI-driven systems.

- Market Growth: Besi targets the high-growth advanced packaging segment for AI, anticipating accelerated innovation from 2026-2030.

- AI Demand Driver: Growing AI applications, from cloud to edge, are fueling the need for advanced packaging solutions.

- Industry Forecast: The semiconductor manufacturing equipment market is expected to hit a new record of $125.5 billion in 2025, largely due to AI demand.

Next-Generation Flip Chip Tools

BE Semiconductor Industries (Besi) is making significant moves in the advanced packaging sector with its next-generation flip chip tools. These tools are designed to meet the increasing precision demands of high-performance computing and interconnected devices. Besi's strategic focus on this area is a key driver for its future growth.

The company plans to introduce a new flip chip tool in the first quarter of 2026, boasting an impressive 1-micron accuracy. This technological advancement is poised to solidify Besi's standing in a competitive market. Such precision is crucial for the miniaturization and enhanced functionality required by modern electronics.

This development directly supports Besi's strategy to capture a larger share of the expanding advanced packaging market. The demand for sophisticated packaging solutions, especially for data centers and the Internet of Things (IoT), continues to surge. Flip-chip technology is at the forefront of this trend, enabling more powerful and compact semiconductor devices.

Key aspects of Besi's next-generation flip chip tools include:

- Targeted Q1 2026 Launch: A new flip chip tool with 1-micron accuracy is slated for release.

- Market Position Enhancement: This launch aims to strengthen Besi's competitive edge in advanced packaging.

- Capitalizing on Demand: The initiative aligns with Besi's strategy to meet growing needs for advanced packaging.

- Flip-Chip Technology Focus: The tools cater to the rapidly expanding flip-chip segment, crucial for high-performance applications.

BE Semiconductor Industries' hybrid bonding systems, particularly their TCB Next Systems, are firmly positioned as Stars in the BCG matrix. These technologies are experiencing rapid market growth, driven by the escalating demand for advanced semiconductor packaging solutions essential for AI and high-performance computing. The company's substantial order book for these systems highlights their strong market position and the critical role they play in next-generation semiconductor manufacturing.

| Product/Technology | BCG Category | Key Growth Drivers | 2024 Market Share (Estimate) | 2025 Market Growth Forecast |

|---|---|---|---|---|

| Hybrid Bonding Systems | Star | AI, HPC, Advanced Packaging Demand | High (Leading position) | 104% projected increase |

| Advanced Die Attach Equipment | Star | Automotive Electronics, Advanced Computing | 25% | Strong, driven by AI 2.5D computing |

| TCB Next Systems | Star | AI, High Bandwidth Memory (HBM) | High (Leading position) | Significant growth anticipated |

| Next-Generation Flip Chip Tools | Star | Data Centers, IoT, High-Performance Computing | Growing | Targeted Q1 2026 launch with 1-micron accuracy |

What is included in the product

This BCG Matrix offers a tailored analysis of BE Semiconductor Industries' product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The BE Semiconductor Industries BCG Matrix offers a pain point reliever by providing a clear, one-page overview placing each business unit in a quadrant.

Cash Cows

Besi's mainstream die attach systems are a solid Cash Cow within their product portfolio. These systems saw their shipments contribute to a revenue uptick in the second quarter of 2025, underscoring their consistent demand.

While not experiencing the explosive growth of cutting-edge advanced packaging solutions, these mainstream systems offer a reliable and mature revenue stream. Their widespread adoption across numerous electronic devices ensures they are a significant generator of steady cash flow for the company.

Wire bonding equipment represents a significant Cash Cow for BE Semiconductor Industries. In 2024, this segment commanded a substantial portion of the semiconductor assembly and packaging equipment market, demonstrating its continued relevance even as newer technologies emerge.

Despite the rise of advanced methods like flip-chip, wire bonding remains the cornerstone for traditional integrated circuit packaging. This enduring demand ensures a consistent and reliable revenue stream for Besi, solidifying its Cash Cow status. The mature nature of this market likely translates to lower promotional and placement costs, further enhancing profit margins.

Besi's existing packaging and plating equipment represents a classic Cash Cow within its BCG Matrix. These are the established product lines that form the backbone of the company's offerings, providing a comprehensive suite of solutions from die sorting to the final singulation process.

While the market for this equipment might not be experiencing explosive growth, its consistent demand and Besi's strong market position ensure reliable and substantial cash flow. The company's long-standing presence and expertise in this segment translate into high profit margins and a significant competitive advantage.

In 2023, Besi reported total revenue of €924.7 million, with a significant portion attributed to its established equipment segments. This consistent revenue generation from mature product lines is characteristic of a Cash Cow, allowing Besi to fund investments in its other business units.

After-Sales Service and Support

After-sales service and support for BE Semiconductor Industries' (Besi) equipment, particularly its advanced hybrid bonding machines, are poised to be significant cash cows. The inherent complexity of these cutting-edge machines necessitates ongoing, high-value service and support, translating into robust, recurring revenue streams. This segment benefits from high profit margins due to the specialized expertise and proprietary parts involved, directly bolstering the company's cash flow generation.

Besi's installed base of equipment represents a stable foundation for service revenue. As of the first half of 2024, Besi reported a substantial installed base, with service contracts and spare parts sales contributing a growing portion of their revenue. For instance, in Q1 2024, Besi noted that their service segment demonstrated resilience and strong performance, underscoring its role as a consistent cash generator.

- High-Margin Service Revenue: The increasing complexity of hybrid bonding machines drives demand for specialized, high-margin after-sales services.

- Recurring Revenue Stream: Ongoing support and maintenance for the installed base provide a stable and predictable income for Besi.

- Profitability Boost: Services often carry high profit margins, making them a significant contributor to the company's overall cash flow.

- Strategic Importance: This segment is crucial for customer retention and profitability, especially as Besi continues to innovate in advanced packaging technologies.

Established Global Customer Base

BE Semiconductor Industries' established global customer base is a key component of its Cash Cow status. The company serves a wide array of clients, including major semiconductor manufacturers, foundries, and assembly subcontractors spread across Europe, Asia, and North America. This broad geographic and industry reach ensures a stable and consistent demand for its products.

This diverse and loyal customer network provides a robust foundation for predictable revenue streams. The long-standing relationships BE Semiconductor Industries has cultivated translate into repeat business and reliable cash flows, characteristic of a Cash Cow. For instance, in 2024, the company continued to secure significant orders from major players in the semiconductor ecosystem, reinforcing its market position.

- Global Reach: Serves leading semiconductor manufacturers, foundries, and assembly subcontractors in Europe, Asia, and North America.

- Customer Loyalty: Established relationships foster repeat business and predictable revenue.

- Market Stability: Diverse customer base mitigates risks associated with reliance on a single segment.

- Revenue Predictability: Long-term contracts and consistent demand contribute to stable cash flows.

Besi's mainstream die attach systems are a solid Cash Cow. These systems saw their shipments contribute to a revenue uptick in the second quarter of 2025, underscoring their consistent demand. While not experiencing the explosive growth of cutting-edge advanced packaging solutions, these mainstream systems offer a reliable and mature revenue stream. Their widespread adoption across numerous electronic devices ensures they are a significant generator of steady cash flow for the company.

Wire bonding equipment represents a significant Cash Cow for BE Semiconductor Industries. In 2024, this segment commanded a substantial portion of the semiconductor assembly and packaging equipment market, demonstrating its continued relevance even as newer technologies emerge. Despite the rise of advanced methods like flip-chip, wire bonding remains the cornerstone for traditional integrated circuit packaging, ensuring a consistent and reliable revenue stream for Besi.

Besi's existing packaging and plating equipment represents a classic Cash Cow. These established product lines provide a comprehensive suite of solutions, and while market growth might be modest, Besi's strong position ensures reliable cash flow. In 2023, Besi reported total revenue of €924.7 million, with a significant portion attributed to these mature segments, allowing the company to fund investments in other business units.

After-sales service and support for Besi's equipment, particularly its advanced hybrid bonding machines, are poised to be significant cash cows. The complexity of these machines necessitates ongoing, high-value service, translating into robust, recurring revenue streams with high profit margins. As of the first half of 2024, Besi reported a substantial installed base, with service contracts and spare parts sales contributing a growing portion of their revenue.

BE Semiconductor Industries' established global customer base is a key component of its Cash Cow status, providing a stable foundation for predictable revenue streams. The company serves a wide array of clients across Europe, Asia, and North America, fostering long-standing relationships that translate into repeat business and reliable cash flows. In 2024, Besi continued to secure significant orders from major players, reinforcing its market position.

What You’re Viewing Is Included

BE Semiconductor Industries BCG Matrix

The BE Semiconductor Industries BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a professionally designed and analysis-ready document for immediate strategic application.

Dogs

Besi's Q2 2025 revenue took a hit, largely because of a slowdown in the mobile sector. This indicates that their equipment catering to this market might be facing a low-growth environment, potentially giving Besi a smaller slice of that pie.

If this mobile segment weakness persists, Besi's offerings for this market could be categorized as Dogs in the BCG matrix. This classification implies that these product lines might not be the best candidates for substantial future investment, given their current performance and market outlook.

BE Semiconductor Industries' (Besi) products catering to mainstream computing applications are experiencing a slowdown. Orders for these products remained weak through the first two quarters of 2025, signaling a challenging environment for this segment.

While die attach shipments for mainstream computing saw a modest uptick, the broader order picture points towards a low-growth market. This suggests that the equipment used in these applications may be facing market share erosion or operating within a declining sector.

Revenue in Q4 2024 saw a dip, largely because demand for automotive applications softened. While hybrid bonding shipments offered some support, the automotive sector, a key area for Besi, revealed vulnerabilities in its legacy equipment segment.

This legacy automotive equipment, facing reduced demand and potentially declining market share, might be categorized as a ‘Dog’ within Besi’s product portfolio. Such products typically generate low returns and have limited growth prospects, requiring careful management to avoid becoming a drain on resources.

Products Affected by Broader Macroeconomic Uncertainty

While AI is a powerful growth engine for semiconductors, the broader industry is sensitive to global economic headwinds. For example, in the first half of 2024, while AI chip demand surged, overall semiconductor shipments saw a more modest recovery compared to pre-pandemic levels, reflecting softer demand in other sectors.

The automotive and industrial markets, key consumers of semiconductors, have experienced cyclical downturns. In 2024, automotive production forecasts were revised downwards in several major regions due to persistent supply chain issues and slowing consumer demand for new vehicles, impacting chip orders for this segment.

Products within BE Semiconductor Industries' portfolio that are heavily reliant on these weaker end markets, and lack a distinct competitive edge, would likely be classified as Dogs in the BCG matrix. These could include certain types of back-end equipment catering specifically to automotive or industrial applications where demand is currently subdued and competition is fierce.

- Automotive Chip Demand: Global automotive chip demand in 2024 remained below its 2021 peak, despite some recovery.

- Industrial Semiconductor Market: The industrial semiconductor market experienced a growth rate of approximately 5% in 2024, significantly lower than the double-digit growth seen in AI-driven segments.

- Consumer Electronics Slowdown: Weak consumer spending in 2024 led to a decline in demand for chips used in traditional consumer electronics like laptops and smartphones.

Non-Differentiated Standard Products

Non-differentiated standard products in BE Semiconductor Industries' portfolio might reside in the 'Dogs' quadrant of the BCG matrix. These are typically highly commoditized pieces of assembly equipment where the company doesn't possess a dominant market share or offer truly unique technological advantages. Think of standard bonding or die-attach machines that face stiff competition from numerous players.

These products, by their very nature, often yield low profit margins. The intense competition means pricing power is limited, and profitability relies heavily on volume and cost efficiency rather than premium pricing. Consequently, they generally require minimal further investment to maintain their market position.

For example, if BE Semiconductor Industries offers a basic wire bonder that competes with many other manufacturers, and it doesn't have proprietary features or a significant market lead in that specific segment, it would likely be classified as a Dog. Such products often contribute modestly to revenue and may even be candidates for divestment or phasing out if they drain resources without offering substantial returns.

- Low Market Share: Products in this category typically have a small percentage of the overall market for standard assembly equipment.

- Low Growth Potential: The markets for these commoditized products are often mature with limited opportunities for significant expansion.

- Low Profitability: Intense competition drives down prices, resulting in thin profit margins for these standard offerings.

- Minimal Investment Required: To maintain their position, these products generally need little to no additional capital expenditure.

BE Semiconductor Industries' (Besi) products that are heavily reliant on the automotive sector, particularly legacy equipment, are likely categorized as Dogs. This is due to a softened demand in 2024, with global automotive chip demand remaining below its 2021 peak.

Similarly, standard, non-differentiated assembly equipment facing intense competition and low profit margins would also fall into the Dog category. These products often have low market share and limited growth potential, requiring minimal investment to maintain their position.

The mobile sector slowdown also points to potential Dog status for related equipment, as this segment experienced a revenue hit in Q2 2025, indicating a low-growth environment.

These products generally contribute modestly to revenue and might even be considered for divestment if they become a drain on resources, given their limited returns and prospects.

| Product Category | Market Trend (2024/2025) | BCG Classification | Reasoning |

|---|---|---|---|

| Legacy Automotive Equipment | Softened Demand, Below 2021 Peak Chip Demand | Dog | Reduced demand and potential market share erosion in a cyclical downturn. |

| Standard Assembly Equipment (e.g., basic wire bonder) | Mature Market, Intense Competition | Dog | Low profit margins, limited growth potential, and low market share. |

| Mobile Sector Equipment | Slowdown in Mobile Sector | Potential Dog | Indicates a low-growth environment for this segment's equipment. |

Question Marks

Besi anticipates a long-term increase in unit pricing for its hybrid bonding systems due to the introduction of new generations offering enhanced accuracy. This strategic move aligns with a rapidly expanding market fueled by demand from AI and High Bandwidth Memory (HBM) technologies.

These next-generation systems are positioned within a high-growth sector, yet their market share is still in its nascent stages as adoption progresses. Besi's commitment to significant research and development is crucial for bringing these advanced systems to market and securing a dominant position.

For instance, the global AI chip market was projected to reach over $200 billion by 2024, with HBM being a key component in high-performance computing. Besi's investment in R&D for these sophisticated bonding systems is therefore a critical factor in capturing a substantial portion of this burgeoning market.

Besi anticipates a substantial surge in orders for 2.5D advanced packaging, fueled by evolving applications in cloud and edge computing, as well as the integration of co-packaged optics. These sectors represent high-growth frontiers.

While these emerging use cases offer significant expansion potential, Besi's current market penetration within them may still be in its nascent stages. The development of these sophisticated packaging technologies demands considerable investment in research and development alongside market cultivation.

These cash-intensive endeavors hold the promise of evolving into 'Stars' within the BCG matrix should market adoption rates for these advanced solutions accelerate significantly in the coming years.

BE Semiconductor Industries (Besi) is eyeing expansion into new AI-related applications beyond its current core, recognizing the significant growth potential. The expanded deployment of AI technologies in data centers, edge computing, and consumer devices is projected to surge through 2030, creating substantial demand for advanced semiconductor packaging solutions.

While Besi feels optimistic about its positioning in AI-enhanced devices, specific new product developments targeting these emerging AI applications might currently hold a low market share. These represent high-growth opportunities, but capturing significant market share will necessitate considerable investment in research and development.

Die Attach Systems for Emerging 2.5D Computing

Besi anticipates a significant surge in demand for its die attach systems, particularly those tailored for the burgeoning 2.5D computing sector, driven by AI advancements. This specialized area represents a high-growth segment where Besi is strategically investing to expand its market footprint.

The company's expertise in die attach is a foundational strength, but the unique and rapidly evolving demands of 2.5D computing necessitate continuous research and development. This commitment ensures Besi remains at the forefront, poised to capture a larger share of this dynamic market.

- Market Growth: The 2.5D computing market, especially for AI applications, is projected for substantial growth, creating a fertile ground for advanced die attach solutions.

- R&D Investment: Besi is actively channeling resources into research and development to enhance its die attach systems, ensuring they meet the stringent requirements of next-generation computing architectures.

- Competitive Landscape: The specialized nature of these systems means ongoing innovation is crucial for Besi to maintain and grow its competitive edge in this expanding market.

- Strategic Focus: Die attach systems for 2.5D computing are a key strategic focus for Besi, aligning with the increasing demand for high-performance semiconductor packaging.

Future Products from Increased R&D Spending

BE Semiconductor Industries' (Besi) increased R&D spending, a 7.3% rise in H1 2025 versus H1 2024, signals a strategic push into developing entirely new products or technologies. These nascent innovations, not yet proven in the market, fall into the Stars category of the BCG Matrix. They are high-potential ventures that require substantial investment in market development and sales to achieve widespread adoption.

These future products represent Besi's bet on emerging semiconductor technologies, aiming to capture future market share. Success hinges on their ability to differentiate and meet evolving industry demands, a common characteristic of Star investments. The company's commitment to R&D underscores its ambition to remain at the forefront of semiconductor manufacturing solutions.

- Emerging Wafer-Level Packaging Technologies

- Advanced Die Bonding Solutions for Heterogeneous Integration

- Next-Generation Inspection and Metrology Systems

- AI-Driven Process Optimization Software for Semiconductor Manufacturing

Besi's investments in new, unproven AI-related technologies and advanced packaging solutions are key examples of their 'Question Marks'. These are high-growth potential areas where Besi is still building market share and requires significant investment to establish a strong position.

The company's increased R&D spending, a 7.3% rise in H1 2025 compared to H1 2024, directly supports these ventures. These investments are critical for developing differentiated products that can capture future market demand in areas like AI and advanced computing.

The success of these 'Question Marks' hinges on Besi's ability to effectively develop, market, and gain adoption for these new technologies, transforming them into future 'Stars' or even 'Cash Cows'.

Besi's strategic focus on emerging wafer-level packaging, advanced die bonding for heterogeneous integration, next-gen inspection systems, and AI-driven manufacturing software all represent current 'Question Marks' within their portfolio.

| Besi's BCG Matrix: Question Marks Examples | Market Growth Potential | Current Market Share | Required Investment | Strategic Outlook |

|---|---|---|---|---|

| New AI-Related Technologies | Very High | Low/Nascent | High (R&D, Market Development) | Potential to become Stars |

| Advanced Packaging for 2.5D Computing | High | Developing | Significant (R&D, Sales) | Targeting growth in AI sector |

| Next-Generation Hybrid Bonding Systems | High | Early Adoption | Substantial (R&D, Production Scale-up) | Capturing HBM and AI demand |

BCG Matrix Data Sources

Our BE Semiconductor Industries BCG Matrix leverages comprehensive data from financial reports, market research, and industry trend analyses to provide accurate strategic insights.