BE Semiconductor Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BE Semiconductor Industries Bundle

BE Semiconductor Industries operates in a dynamic semiconductor equipment market where the threat of new entrants is moderate, but intense rivalry among existing players shapes the competitive landscape. Buyer power is significant due to the concentration of major semiconductor manufacturers, while supplier power is relatively low for standard components but can increase for specialized, proprietary parts. The threat of substitutes is minimal given the unique nature of semiconductor manufacturing processes.

The complete report reveals the real forces shaping BE Semiconductor Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BE Semiconductor Industries (Besi) depends on highly specialized components and advanced materials for its sophisticated semiconductor assembly equipment. The unique nature of these inputs grants suppliers considerable leverage, particularly when alternative sources are scarce or proprietary technologies are involved.

This supplier power is further magnified by the stringent precision and quality standards inherent in semiconductor manufacturing. For instance, in 2023, Besi reported that its cost of goods sold was €1.18 billion, highlighting the significant expenditure on these specialized inputs and the potential impact of supplier pricing.

Supplier concentration significantly impacts BE Semiconductor Industries' (Besi) bargaining power of suppliers. If a few key suppliers dominate the market for critical components or sub-systems essential for Besi's advanced machinery, these suppliers gain considerable leverage. This can translate into Besi facing elevated prices or less favorable contractual terms, especially if it has limited alternative sourcing options for these specialized parts.

Switching suppliers for critical semiconductor equipment, like that provided by Besi, involves substantial hurdles. Companies must undertake rigorous re-qualification processes for new equipment, often necessitating redesigns of their manufacturing lines and extensive testing to ensure compatibility and performance. This complexity and the associated costs can be quite high.

These elevated switching costs significantly bolster the bargaining power of existing suppliers. For Besi, a change in its supplier base would likely translate into considerable expenses and potential disruptions to its production schedules, making it more challenging to negotiate favorable terms or switch providers readily.

Forward Integration Threat

The threat of forward integration by suppliers, while generally low for highly specialized semiconductor assembly equipment, can still influence BE Semiconductor Industries' (BESI) bargaining power. If a key component supplier were to develop its own assembly equipment, it could directly compete with BESI, potentially altering market dynamics and BESI's negotiation leverage.

While direct forward integration into complex assembly equipment by component suppliers is uncommon due to the high R&D and manufacturing expertise required, it remains a theoretical strategic option. This possibility, however remote, can serve as a subtle bargaining chip for suppliers during price or supply agreement negotiations.

For BESI, understanding this potential threat means valuing supplier relationships and ensuring competitive pricing for critical components. The semiconductor equipment industry, valued in the tens of billions globally, sees intense competition, making supply chain stability paramount.

- Forward Integration Threat: Suppliers might enter the semiconductor assembly equipment market, posing a competitive risk to BESI.

- Strategic Lever: Even a remote possibility of supplier forward integration provides a negotiation advantage to suppliers.

- Industry Context: The global semiconductor equipment market is highly competitive, underscoring the importance of managing supplier relationships.

Technological Dependence

BE Semiconductor Industries (Besi) often relies on suppliers for highly specialized components and technologies crucial for its advanced semiconductor equipment. When Besi's innovative product roadmap is heavily tied to a supplier's proprietary technology or ongoing research and development, that supplier's bargaining power increases significantly. This dependence can lead to suppliers dictating pricing, delivery schedules, or even influencing the pace of technological adoption for Besi.

The bargaining power of suppliers due to technological dependence is a critical factor for Besi. Consider the intricate nature of the equipment Besi manufactures; these systems require highly specialized, often patented, components. If a single supplier holds a unique technological edge or a critical patent for a key component, Besi's ability to negotiate favorable terms is diminished.

- Supplier Technology Lock-in: Besi may find itself locked into using specific supplier technologies, limiting its flexibility and increasing switching costs.

- R&D Collaboration Dependence: If Besi's product development heavily relies on a supplier's R&D efforts, the supplier gains leverage in pricing and access to innovations.

- Intellectual Property Control: Suppliers with strong intellectual property portfolios for essential technologies can command higher prices and exert control over Besi's product designs.

The bargaining power of suppliers for BE Semiconductor Industries (Besi) is substantial due to the highly specialized nature of components and the significant switching costs involved. Suppliers of critical, proprietary technologies or those with concentrated market share can command higher prices and dictate terms, directly impacting Besi's cost structure and operational flexibility.

In 2023, Besi's cost of goods sold reached €1.18 billion, underscoring the financial weight of its supply chain. The scarcity of alternative sources for advanced materials and precision components further amplifies supplier leverage, making robust supplier relationship management crucial for Besi's profitability and competitive edge.

The threat of forward integration by suppliers, while generally low, remains a theoretical consideration that can subtly influence negotiations. Besi's reliance on specific supplier R&D and intellectual property also grants suppliers considerable bargaining power, potentially limiting Besi's access to innovations and influencing its product development timelines.

| Factor | Impact on Besi | Example/Data Point |

| Supplier Specialization | High leverage due to unique, proprietary components | Critical components often require specialized manufacturing processes. |

| Switching Costs | Significant barriers to changing suppliers, increasing supplier power | Re-qualification, line redesign, and extensive testing are required. |

| Supplier Concentration | Few dominant suppliers for essential parts can dictate terms | Limited alternative sourcing options for specialized parts. |

| Technological Dependence | Supplier R&D and IP control can dictate pricing and access | Besi's product roadmap tied to supplier's patented technologies. |

| Forward Integration Threat | Remote possibility that can be used as a negotiation lever | Suppliers potentially entering the assembly equipment market. |

What is included in the product

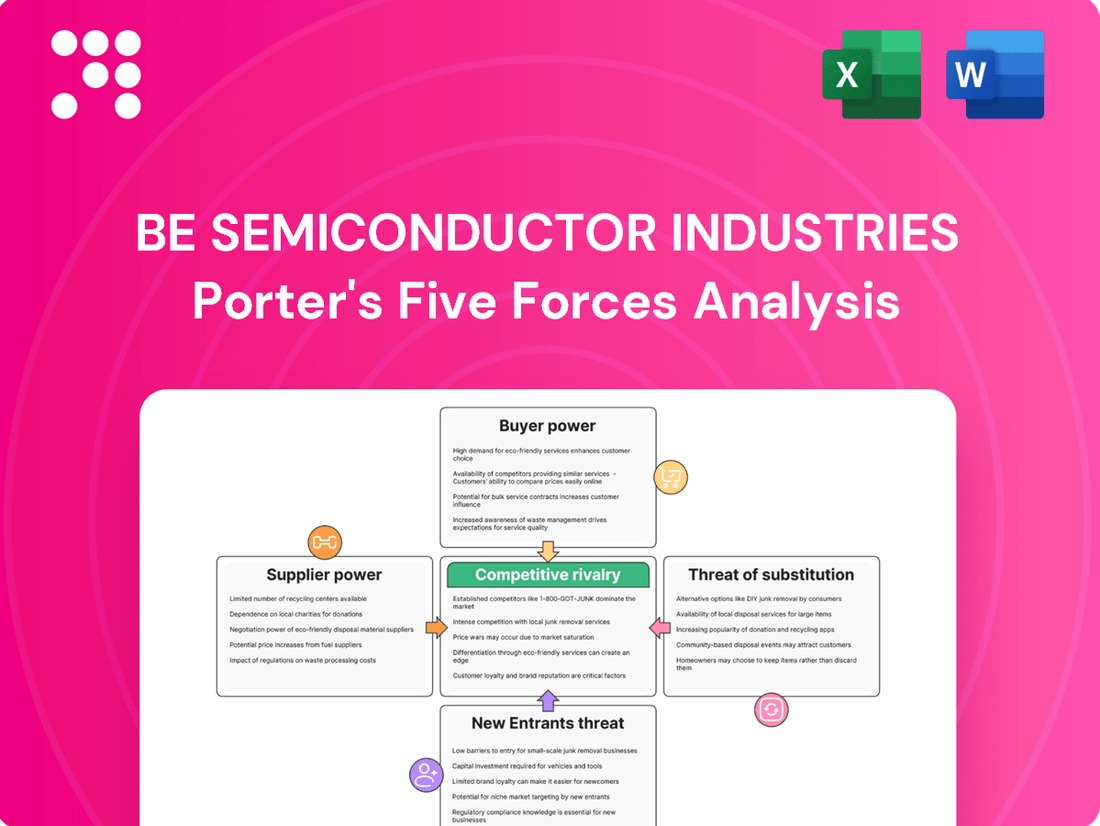

This analysis dissects the competitive forces impacting BE Semiconductor Industries, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Gain immediate clarity on competitive pressures with a visual representation of each force, simplifying complex market dynamics for strategic advantage.

Customers Bargaining Power

Besi's customer base is highly concentrated, primarily serving leading global semiconductor manufacturers, foundries, and assembly subcontractors. This means a few major players often represent a significant chunk of Besi's sales. For instance, in 2023, Besi's top five customers accounted for approximately 40% of its total revenue, highlighting the significant influence these entities can wield.

When a few large customers dominate a supplier's revenue, they gain considerable bargaining power. This allows them to negotiate for lower prices, better payment terms, or demand highly specialized equipment tailored to their unique production needs. Such leverage can put pressure on Besi's profit margins if not managed strategically.

While large customers can exert considerable bargaining power, the specialized nature of BE Semiconductor Industries (Besi) equipment often creates substantial switching costs for them. These costs can include the significant investment required for re-tooling production lines, extensive validation processes, and the potential disruption to manufacturing output, all of which can deter customers from frequently changing suppliers.

Semiconductor manufacturers, facing intense global competition, are highly attuned to cost efficiencies. This pressure translates directly into increased price sensitivity when procuring essential equipment, such as that provided by BE Semiconductor Industries (Besi). For instance, in 2024, the average selling price for advanced semiconductor manufacturing equipment saw continued pressure due to market saturation in certain segments and the ongoing drive for lower unit costs in chip production.

Threat of Backward Integration by Customers

Large semiconductor manufacturers, like those who are key customers for BE Semiconductor Industries, possess the financial muscle and technical expertise to consider developing critical assembly equipment in-house. This threat of backward integration is a significant factor in their bargaining power.

For instance, a major chip producer might invest in R&D to create proprietary solutions for specific, high-volume assembly tasks, thereby reducing their reliance on external suppliers like BE Semiconductor. This capability acts as a constant pressure, influencing pricing and contract terms.

- Customer Capability: Major semiconductor firms often have substantial R&D budgets, with leading companies investing billions annually in technology development. For example, in 2023, many top-tier semiconductor companies reported R&D expenditures exceeding $5 billion each.

- Strategic Incentive: Developing in-house equipment can offer competitive advantages through proprietary process control and faster innovation cycles, directly impacting their market position.

- Alternative Sourcing: The potential to bring production in-house provides a credible alternative, strengthening the customer's hand in negotiations with BE Semiconductor.

Information Asymmetry

Information asymmetry is significantly reduced in the semiconductor equipment sector. Customers, particularly large chip manufacturers, are typically highly informed about prevailing market prices, the latest technological innovations, and the product portfolios of various suppliers. This transparency empowers them to negotiate from a position of strength, leveraging their deep understanding of the market to secure more favorable terms from equipment providers like BE Semiconductor Industries.

This heightened customer awareness directly impacts bargaining power. For instance, major players in the semiconductor manufacturing space often have the scale to demand customized solutions or bulk discounts, knowing the cost structures and competitive landscape intimately. In 2023, leading semiconductor manufacturers continued to invest heavily in advanced manufacturing, driving demand for specialized equipment but also reinforcing their negotiating leverage due to their significant order volumes.

- Informed Buyers: Semiconductor manufacturers possess extensive knowledge of market prices and technological capabilities.

- Reduced Information Gap: Transparency in pricing and product features minimizes the information advantage of suppliers.

- Negotiating Strength: Well-informed customers can effectively negotiate terms, pushing for better pricing and service agreements.

- Impact on Suppliers: This dynamic increases pressure on equipment manufacturers to offer competitive value and differentiated technology.

The bargaining power of customers for BE Semiconductor Industries (Besi) is significant, primarily due to the concentrated nature of its customer base. A few major semiconductor manufacturers represent a substantial portion of Besi's revenue, giving these clients considerable leverage in negotiations. For example, Besi's top five customers accounted for around 40% of its revenue in 2023.

These large customers can leverage their purchasing power to negotiate for lower prices and more favorable terms. Furthermore, their deep understanding of market prices and technological advancements, coupled with the potential for in-house development of certain equipment, strengthens their negotiating position. In 2024, ongoing market pressures on semiconductor equipment pricing underscore this customer influence.

| Factor | Description | Impact on Besi |

| Customer Concentration | Top customers represent a large share of revenue (40% in 2023) | Increased leverage for key clients |

| Price Sensitivity | Drive for cost efficiencies in chip production | Pressure on equipment pricing |

| Potential for Backward Integration | Ability of large clients to develop in-house solutions | Threat to Besi's market share and pricing power |

| Information Asymmetry | Customers are well-informed about market prices and technology | Empowers customers in negotiations |

Preview Before You Purchase

BE Semiconductor Industries Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of BE Semiconductor Industries, detailing the competitive landscape and strategic implications within the semiconductor equipment sector. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

The semiconductor assembly equipment sector, where BE Semiconductor Industries (Besi) operates, faces significant competitive rivalry driven by substantial fixed costs. These costs are primarily tied to extensive research and development, state-of-the-art manufacturing plants, and highly specialized production machinery. For example, companies in this space often invest hundreds of millions of dollars in new fabrication technologies and automation.

This high capital intensity compels firms like Besi to strive for maximum capacity utilization. When market demand softens, this pressure to cover fixed costs can intensify price competition. In 2023, the semiconductor industry experienced a notable cyclical downturn, leading to reduced order volumes for equipment manufacturers, which in turn can exacerbate price pressures as companies seek to maintain revenue streams.

The semiconductor assembly and packaging equipment market is experiencing robust growth, with projections indicating a significant expansion. This surge is largely fueled by the relentless demand for smaller, faster, and more energy-efficient electronic devices, alongside crucial advancements in packaging technologies, especially those supporting artificial intelligence (AI) applications.

While this expanding market can dilute competitive intensity by increasing the overall available business, market performance has been uneven. Weakness in some mainstream segments is being counterbalanced by strong demand specifically linked to AI-related hardware, creating a bifurcated growth landscape.

BE Semiconductor Industries (Besi) actively differentiates itself through its cutting-edge packaging solutions, especially in hybrid bonding and 2.5D/3D applications crucial for AI advancements. This specialization allows Besi to carve out a distinct market position, lessening the intensity of direct competition.

By focusing on these high-growth, specialized segments, Besi can often command premium pricing and foster strong customer loyalty. For instance, the demand for advanced packaging in AI chips, a key area for Besi, is projected to grow significantly, with the global AI chip market expected to reach over $200 billion by 2026, according to some industry estimates. This strong product differentiation acts as a barrier to entry and reduces the threat of direct rivalry.

Number and Diversity of Competitors

The semiconductor assembly equipment market is characterized by a substantial number of competitors, including both large, diversified manufacturers and smaller, specialized firms. This dense competitive landscape directly fuels intense rivalry as companies constantly strive to capture market share and maintain a leading edge in technological innovation.

BE Semiconductor Industries operates within this dynamic environment. For instance, in 2023, the global semiconductor equipment market was valued at approximately $117.5 billion, showcasing the scale of the industry and the significant competition present. Companies like Applied Materials, ASML, and Lam Research are major players, but the market also includes numerous niche providers focusing on specific assembly processes.

- Established Players: A significant number of well-established companies operate in the semiconductor assembly equipment sector, offering a wide range of solutions.

- Specialized Competitors: The market also features numerous niche players that focus on specific assembly technologies or equipment types, increasing the diversity of competition.

- Market Share Battles: The presence of many competitors leads to aggressive competition for market share, driving innovation and price pressures.

- Technological Leadership: Companies are in a continuous race to develop and offer the most advanced assembly equipment, further intensifying the rivalry.

Exit Barriers

BE Semiconductor Industries likely faces moderate exit barriers. While specialized equipment for semiconductor manufacturing can be costly to dispose of or redeploy, the industry's dynamic nature and the potential for asset resale in a global market might mitigate this. Companies might also have long-term supply agreements or significant investments in R&D that make exiting difficult. For instance, in 2023, the capital expenditure for semiconductor manufacturing equipment remained substantial, indicating the significant investment required to enter and potentially exit the market.

High exit barriers can trap companies in a market, intensifying competition even when profits are low. This situation forces firms to continue operating and competing aggressively rather than withdrawing.

- Specialized Assets: The highly specific and advanced machinery used in semiconductor manufacturing represents a significant investment that can be difficult and costly to sell or repurpose.

- Long-Term Contracts: Commitments to suppliers or customers can create obligations that hinder a swift exit from the industry.

- Employee Commitments: Skilled labor in the semiconductor sector often requires specialized training, making it challenging to downsize or relocate operations without incurring significant severance costs or losing valuable expertise.

The competitive rivalry within the semiconductor assembly equipment sector is intense, fueled by a substantial number of players, including both large, established companies and specialized niche providers. This crowded market, valued at approximately $117.5 billion in 2023 for the broader semiconductor equipment market, compels firms like BE Semiconductor Industries to constantly innovate and compete aggressively for market share.

Companies are locked in a continuous race for technological leadership, particularly in advanced packaging crucial for AI applications. This drive for innovation, coupled with high fixed costs associated with R&D and manufacturing, intensifies price competition, especially during market downturns like the one experienced in 2023, where reduced order volumes can pressure companies to maintain revenue.

BE Semiconductor Industries differentiates itself through specialized solutions in hybrid bonding and 2.5D/3D packaging, targeting high-growth AI segments. This strategic focus allows Besi to command premium pricing and build customer loyalty, thereby mitigating some of the direct competitive pressures in broader market segments.

SSubstitutes Threaten

The threat of substitutes for BE Semiconductor Industries (Besi) primarily stems from alternative or evolving semiconductor assembly technologies that could potentially reduce the demand for their current equipment. While Besi is a leader in advanced packaging solutions, the rapid pace of technological innovation means new methods or materials could emerge that bypass the need for their specialized machinery, impacting their market position.

For instance, advancements in wafer-level packaging or novel interconnect technologies might offer more integrated or cost-effective solutions, thereby substituting for some of the assembly steps Besi's equipment currently performs. The industry's constant pursuit of miniaturization and performance enhancements means that disruptive technologies are always a potential concern for established equipment manufacturers.

Large semiconductor manufacturers, often referred to as Integrated Device Manufacturers (IDMs), possess the resources and expertise to develop and produce their own assembly equipment. This backward integration is a significant threat, as it directly substitutes the need for external suppliers like BE Semiconductor Industries (Besi).

For instance, a major IDM might invest in developing proprietary solutions for processes like wafer-level packaging or die-attach, bypassing the market for Besi's advanced equipment. This can lead to a reduced customer base and lower sales volumes for Besi if key clients opt for in-house capabilities.

Fundamental shifts in chip design architectures, such as a move towards highly integrated monolithic designs that render advanced packaging obsolete, pose a significant threat. If monolithic integration becomes universally more cost-effective and efficient across all applications, the demand for specialized assembly equipment, like that offered by BE Semiconductor Industries (Besi), could diminish substantially. This would reduce the need for complex processes currently employed in advanced packaging.

Software-based Solutions

While software solutions for design, simulation, and process optimization are increasingly sophisticated, they are unlikely to be direct substitutes for BE Semiconductor Industries' (BESI) core physical assembly equipment. Instead, these advancements tend to complement BESI's offerings by improving efficiency and outcomes in related stages of semiconductor manufacturing. For instance, advanced simulation software can reduce the need for physical prototyping, indirectly impacting the demand for certain types of assembly, but not replacing the need for the specialized machinery BESI provides.

However, the evolving landscape of semiconductor manufacturing does present potential indirect threats. Innovations in areas like advanced packaging technologies, which integrate multiple components into a single package, could alter the demand for specific types of assembly equipment. If these new packaging methods reduce the number of discrete assembly steps, it might lessen the reliance on some of BESI's traditional product lines. For example, a shift towards monolithic 3D integration, where components are built directly on top of each other, could bypass certain traditional assembly processes that BESI's machines currently facilitate.

It's important to note that the capital-intensive nature of semiconductor manufacturing and the highly specialized requirements for precision and reliability mean that complete substitution by software alone is improbable in the near to medium term. The physical manipulation and precise placement of delicate semiconductor components still necessitate advanced, purpose-built machinery. BESI's focus on innovation in areas like advanced packaging and wafer-level packaging positions them to adapt to these evolving industry needs rather than being entirely supplanted.

The threat from software-based solutions is therefore more nuanced. While they can optimize and streamline processes, they are unlikely to replace the fundamental need for the specialized assembly equipment that BESI manufactures. The industry's trajectory suggests a greater likelihood of integration and synergy between advanced software and advanced hardware, rather than a complete substitution of the latter by the former.

Lower-Cost, Less Advanced Equipment

Customers with less demanding assembly needs might turn to simpler, more affordable equipment from competitors or even opt for older, refurbished machinery. This poses a threat if BE Semiconductor Industries' (Besi) advanced solutions are perceived as unnecessarily complex or costly for certain applications.

For instance, in the 2024 market, while Besi focuses on high-end semiconductor packaging, a segment of the market might find value in legacy equipment that still meets basic production requirements at a fraction of the cost. This could impact Besi's market share in lower-tier segments.

- Lower Cost Alternative: Simpler assembly equipment from alternative providers offers a direct substitute for customers prioritizing price over advanced features.

- Legacy Equipment Viability: Older generation or refurbished equipment can still be a viable option for less complex manufacturing processes, representing a significant substitution threat.

- Capability Overkill: If customers deem Besi's highly advanced capabilities as excessive for their specific production needs, they are more likely to seek out less sophisticated and cheaper alternatives.

The threat of substitutes for BE Semiconductor Industries (Besi) involves alternative technologies and backward integration by customers. Simpler, lower-cost equipment or even refurbished machinery can serve as substitutes for less demanding applications, particularly in 2024 where cost-efficiency remains a key driver for some market segments. For example, while Besi targets advanced packaging, some manufacturers might opt for less sophisticated equipment if their needs are basic.

| Threat Category | Description | Example for Besi (2024 Context) |

|---|---|---|

| Alternative Technologies | Emerging assembly methods or materials that reduce reliance on current equipment. | Wafer-level packaging advancements that consolidate multiple assembly steps. |

| Backward Integration | Large customers developing their own in-house assembly solutions. | An IDM investing in proprietary die-attach technology, bypassing Besi's offerings. |

| Lower Cost Alternatives | Simpler, more affordable equipment from competitors or refurbished units. | A smaller fab choosing older, less advanced machines for less critical production runs. |

Entrants Threaten

The semiconductor assembly equipment industry presents a significant hurdle for new players due to extremely high capital requirements. Developing cutting-edge technology, establishing state-of-the-art manufacturing plants, and acquiring specialized, precision machinery demand investments often running into hundreds of millions, if not billions, of dollars. For instance, a new entrant would need to secure substantial funding for advanced R&D labs and sophisticated production lines capable of handling intricate wafer-level processes.

This financial barrier effectively deters many potential competitors. Companies without access to vast capital reserves find it nearly impossible to enter the market and compete with established players who have already amortized their initial investments. In 2024, the ongoing advancements in chip technology, such as miniaturization and new packaging techniques, continue to drive up the cost of essential equipment, further solidifying this high capital requirement as a formidable threat of new entrants.

Developing cutting-edge semiconductor assembly equipment, particularly for advanced packaging solutions like hybrid bonding, demands substantial, ongoing investment in research and development. This deep technological expertise creates a significant barrier to entry, making it challenging for new players to quickly establish a competitive foothold against established firms such as BE Semiconductor Industries.

BE Semiconductor Industries (Besi) benefits from deeply entrenched customer relationships with major global semiconductor manufacturers. These clients, often industry leaders, typically foster long-term partnerships with their equipment providers, making it challenging for newcomers to break in. For instance, Besi's 2023 revenue of €1.1 billion was built on these established ties.

Gaining the trust and securing contracts with these large, sophisticated players is a time-consuming and demanding endeavor. New entrants must demonstrate not only advanced technology but also a proven track record of reliability and support, which takes years to cultivate, mirroring the industry's capital-intensive nature where supplier switching costs are substantial.

Intellectual Property and Patents

The semiconductor equipment industry, including players like BE Semiconductor Industries (Besi), is significantly protected by intellectual property and patents. Besi itself holds a substantial portfolio of patents covering its advanced assembly and packaging equipment, creating a formidable barrier to entry. For instance, in 2023, Besi continued to invest in R&D, a key driver for patent acquisition, to maintain its technological edge.

New entrants would face considerable challenges in circumventing Besi's existing patent landscape, which protects critical technologies in areas like die bonding and wafer-level packaging. The cost and complexity of developing novel, non-infringing technologies are substantial, deterring many potential competitors. This reliance on proprietary technology means that innovation is often incremental and requires significant upfront investment to even approach the capabilities of established firms.

- Intellectual Property Barrier: Besi's extensive patent portfolio on its advanced semiconductor assembly and packaging equipment acts as a significant deterrent to new market entrants.

- R&D Investment: Continued investment in research and development, such as Besi's ongoing focus on innovation in 2023, is crucial for maintaining and expanding this intellectual property advantage.

- Replication Difficulty: The proprietary nature of Besi's technologies and processes makes them difficult and costly for new companies to replicate legally.

- Legal and Financial Hurdles: New entrants must navigate complex patent laws and invest heavily in their own R&D to avoid infringement, presenting substantial financial and legal obstacles.

Supply Chain Complexity and Integration

The semiconductor industry's intricate supply chain presents a significant barrier for new entrants. Establishing relationships with specialized component manufacturers and ensuring consistent quality and delivery requires substantial time and investment. For instance, securing access to advanced lithography equipment or high-purity chemicals often involves long lead times and stringent qualification processes.

BE Semiconductor Industries, like other established players, has spent years building a resilient network of suppliers. Newcomers would struggle to replicate this, facing difficulties in negotiating favorable terms and ensuring the seamless integration of these critical inputs into their manufacturing operations. This complexity directly impacts production scalability and cost-effectiveness, deterring potential competitors.

- Supply Chain Complexity: The semiconductor assembly equipment sector demands highly specialized components, making it difficult for new entrants to establish reliable sourcing.

- Supplier Relationships: Existing players like BE Semiconductor Industries have cultivated long-standing relationships with key suppliers, creating a significant advantage.

- Integration Challenges: New companies would face considerable hurdles in integrating these specialized suppliers into their production processes efficiently and cost-effectively.

The threat of new entrants in the semiconductor assembly equipment market is significantly mitigated by the immense capital required to establish operations. Building advanced manufacturing facilities and acquiring the precision machinery needed for cutting-edge processes demands investments that can easily reach hundreds of millions of dollars. This financial barrier effectively discourages many potential competitors from entering the space.

Furthermore, the sector is characterized by deep technological expertise and proprietary intellectual property, including extensive patent portfolios held by established firms like BE Semiconductor Industries (Besi). New entrants would face considerable challenges in developing comparable technologies and navigating existing patents, requiring substantial R&D investment and legal navigation. By the end of 2023, Besi's continued investment in innovation underscored the importance of R&D for maintaining this competitive edge.

Established customer relationships with major semiconductor manufacturers also present a formidable barrier. These long-term partnerships, built on trust and proven reliability, are difficult for newcomers to penetrate. Besi's 2023 revenue of €1.1 billion exemplifies the strength of these entrenched relationships, which newcomers would struggle to replicate without years of dedicated effort and demonstrated performance.

| Barrier Type | Description | Impact on New Entrants | Example for Besi (2023/2024) |

|---|---|---|---|

| Capital Requirements | High cost of advanced manufacturing and precision equipment. | Deters entry due to prohibitive upfront investment. | Ongoing investment in state-of-the-art production lines. |

| Intellectual Property | Extensive patent portfolios on proprietary technologies. | Requires significant R&D and legal expertise to overcome. | Besi's continued R&D focus to expand patent coverage. |

| Customer Relationships | Long-standing, trust-based partnerships with major clients. | Difficult for new players to gain access and secure contracts. | Besi's €1.1 billion revenue built on established client ties. |

Porter's Five Forces Analysis Data Sources

Our BE Semiconductor Industries Porter's Five Forces analysis is built upon a robust foundation of data, drawing from the company's annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and competitor analysis to provide a comprehensive view of the semiconductor equipment landscape.