Beam Therapeutics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beam Therapeutics Bundle

Navigate the complex external landscape impacting Beam Therapeutics with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and emerging social trends are shaping the future of gene editing. Equip yourself with actionable intelligence to forecast risks and identify growth opportunities.

Gain a competitive edge by delving into the technological advancements and environmental regulations affecting Beam Therapeutics. Our expert-crafted PESTLE analysis provides critical insights for investors and strategists. Download the full version now for a complete understanding.

Political factors

Government grants, tax incentives, and public-private partnerships are crucial for biotechnology firms like Beam Therapeutics. For instance, the U.S. National Institutes of Health (NIH) awarded over $40 billion in research grants in fiscal year 2023, a significant portion of which supports early-stage biomedical innovation. These funding streams directly impact the pace of drug discovery and clinical development, making them vital for companies advancing novel genetic medicines.

The regulatory environment, especially concerning gene editing therapies, presents a significant factor for Beam Therapeutics. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are key bodies, and their guidelines directly shape development pathways. Recent FDA guidance released in 2024 offers more clarity on gene therapy products that utilize human genome editing, impacting safety and development standards.

Navigating these regulatory processes is critical for Beam's success. Delays in approvals, or any increase in the complexity of these pathways, can substantially affect the company's development timelines and its overall financial health. For instance, the time it takes to gain approval for a new therapy can directly influence revenue generation and investor confidence.

Global political stability and trade agreements significantly influence Beam Therapeutics' operational landscape. Favorable trade policies can streamline the import of specialized raw materials and advanced manufacturing equipment essential for gene editing therapies, while geopolitical tensions, particularly concerning regions like China, could disrupt these supply chains. For instance, ongoing trade disputes or sanctions can lead to increased costs or delays in obtaining critical components, forcing companies like Beam to diversify their sourcing strategies.

Geopolitical relations also impact the feasibility and cost of conducting international clinical trials, a crucial step for advancing gene editing therapies through regulatory approval. Political instability in potential trial locations can pose risks to data integrity and patient recruitment. Furthermore, market access for Beam's innovative treatments is often dictated by bilateral trade agreements and the regulatory alignment between countries, with the US and EU remaining key markets.

The biopharmaceutical sector is particularly sensitive to geopolitical shifts. For example, in 2023, concerns over intellectual property protection and data security in certain international markets prompted some US biotech firms to re-evaluate their global expansion plans. This environment necessitates that Beam Therapeutics maintains a flexible approach to its international operations and supply chain management, anticipating potential disruptions stemming from evolving trade policies and geopolitical dynamics.

Healthcare Policy and Reimbursement

Government healthcare policies significantly influence the commercial viability of Beam Therapeutics' gene editing therapies. Decisions on drug pricing, reimbursement rates, and patient access to novel treatments directly shape market penetration and profitability. For instance, the Inflation Reduction Act of 2022 in the U.S. introduced measures for Medicare drug price negotiation, potentially impacting future pricing strategies for advanced therapies.

Favorable reimbursement policies, such as those that recognize the long-term value of curative genetic medicines, can unlock broader patient access and accelerate market adoption. Conversely, restrictive policies or payer hesitancy in covering high-cost, innovative treatments could impede Beam's revenue growth and the widespread availability of its potentially life-changing therapies. In 2024, continued scrutiny on the cost-effectiveness of gene therapies by payers globally remains a key consideration.

- Drug Pricing Regulations: Evolving government regulations on drug pricing, particularly in major markets like the U.S. and Europe, can directly affect the revenue potential of Beam's gene editing products.

- Reimbursement Models: The specific reimbursement models adopted by public and private payers (e.g., value-based agreements, installment payments) will determine how accessible Beam's therapies become to patients.

- Market Access for Advanced Therapies: Policies that facilitate or hinder the market access of novel genetic medicines, including approval pathways and evidence requirements, are critical for Beam's commercial success.

- Healthcare Spending Caps: Broader government efforts to control healthcare spending could lead to tighter controls on reimbursement for high-cost therapies, posing a challenge for companies like Beam.

Ethical and Societal Debates on Gene Editing

Public and political conversations about the ethics of gene editing, especially germline editing, are shaping policy and how readily people accept new treatments. For instance, in 2024, ongoing debates in the European Parliament continued to explore the implications of CRISPR technology for human health and societal values, potentially impacting regulatory frameworks for companies like Beam Therapeutics.

While gene therapy targeting somatic cells is widely supported for treating diseases, worries about non-therapeutic applications or unforeseen long-term consequences are leading to demands for tighter regulations or even temporary halts on certain research. This sentiment was echoed in a late 2024 survey by the Pew Research Center, where a significant portion of respondents expressed concerns about the potential for gene editing to be used for enhancement rather than treatment.

- Ethical Scrutiny: Public discourse in 2024-2025 continues to focus on the ethical boundaries of gene editing, particularly concerning germline modifications.

- Regulatory Influence: Policy decisions in key markets are being influenced by these societal debates, potentially affecting the approval pathways for new gene therapies.

- Public Perception: While somatic gene therapy enjoys broad support for disease treatment, concerns about potential misuse or long-term effects could lead to increased regulatory oversight.

Government funding and policy directly fuel advancements in genetic medicine. For example, the U.S. government allocated over $40 billion to the National Institutes of Health (NIH) in fiscal year 2023, supporting critical early-stage research. Favorable regulatory frameworks, such as the FDA's 2024 guidance on gene editing, are essential for navigating the complex approval processes for therapies like Beam Therapeutics'. Political stability and international trade agreements also play a role, influencing supply chains for specialized materials and the cost of global clinical trials.

What is included in the product

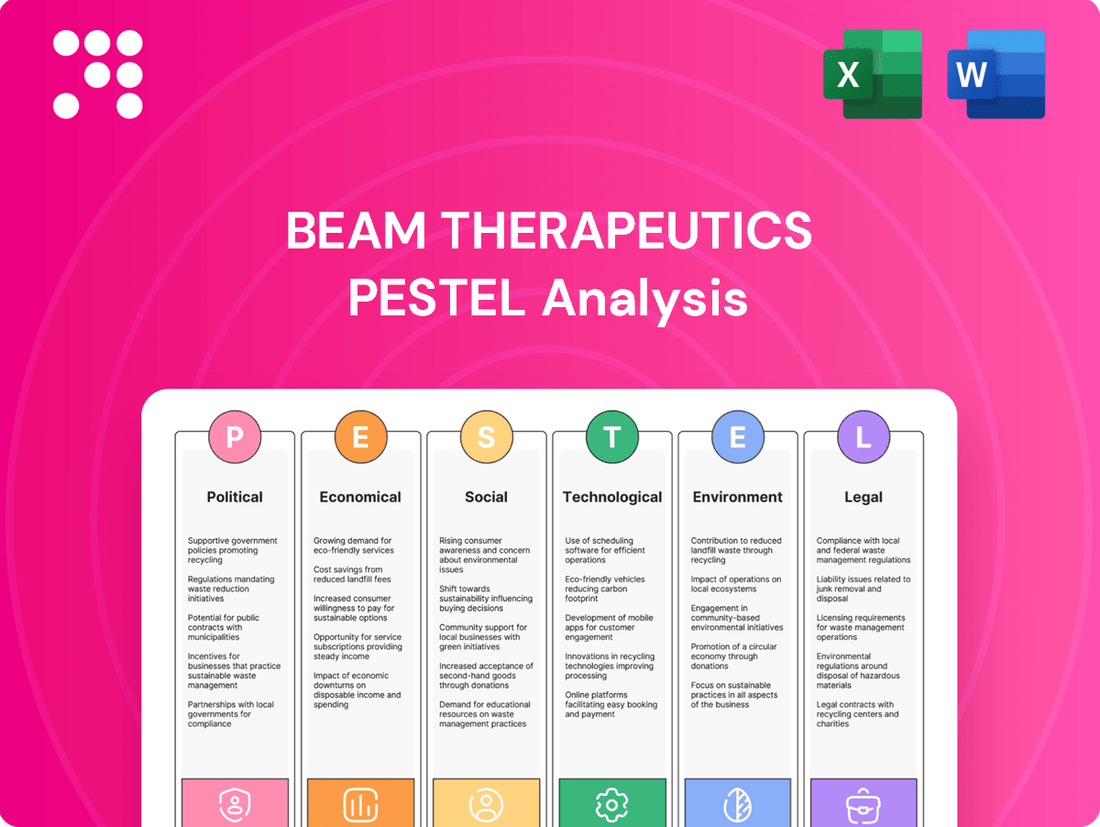

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Beam Therapeutics, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help navigate market dynamics and capitalize on emerging opportunities within the gene editing landscape.

Provides a concise PESTLE analysis of Beam Therapeutics, highlighting how understanding political, economic, social, technological, environmental, and legal factors can alleviate the pain points of navigating the complex gene editing landscape.

Visually segmented by PESTEL categories, this analysis offers a quick interpretation of external forces impacting Beam Therapeutics, serving as a pain point reliever for strategic planning by clarifying market dynamics.

Economic factors

The investment and funding environment is paramount for a biotech firm like Beam Therapeutics, especially during its research and development stages. Investor sentiment and capital availability directly impact a company's ability to advance its pipeline.

While the broader biotech funding landscape in 2024 showed a degree of caution, often favoring later-stage projects, Beam Therapeutics demonstrated resilience. The company successfully raised $500 million in early 2025, a significant injection of capital that extends its operational runway through 2028.

This substantial financing round underscores continued investor belief in the potential of Beam's innovative gene editing technologies, signaling a positive outlook for companies with strong scientific validation and promising therapeutic candidates.

Developing precision genetic medicines like those Beam Therapeutics is working on requires substantial financial investment. These costs cover everything from early-stage research and lab work to rigorous clinical trials and setting up manufacturing capabilities. It's a long and expensive road to bring these innovative therapies to patients.

Beam Therapeutics, for instance, reported research and development expenses of $98.8 million in the first quarter of 2025. This figure highlights the company's commitment to advancing its pipeline of gene-editing technologies. Effectively managing these significant R&D expenditures is crucial for maintaining the company's financial health and its ability to continue developing these advanced treatments.

The economic viability of Beam Therapeutics' innovative gene editing therapies hinges directly on the prevalence and market size of the serious diseases they target. For instance, their BEAM-101 program is designed to treat sickle cell disease, a condition affecting hundreds of thousands globally, with an estimated 100,000 people in the United States alone living with the disease. This substantial patient population translates to significant market potential.

Conversely, BEAM-302 addresses Alpha-1 Antitrypsin Deficiency (AATD), a rarer genetic disorder. While the overall patient numbers for AATD are smaller, estimated at around 1 in 2,500 people in Northern European ancestry populations, the unmet medical need and potential for premium pricing in rare diseases can still create a substantial economic opportunity. The market size for these therapies directly impacts projected revenues and profitability.

Competition and Pricing Pressure

The gene editing landscape, particularly in biotechnology, is intensely competitive. Numerous firms are actively developing therapies that are either similar to or offer alternatives to Beam Therapeutics' approaches. This crowded market environment often translates into significant pricing pressures for new treatments, making strong clinical differentiation a critical factor for securing market share.

Beam Therapeutics' base editing technology is designed to provide distinct advantages over existing gene-editing modalities, such as CRISPR-Cas9. A key differentiator is its potential to minimize off-target effects, a common concern with earlier gene-editing systems. This focus on precision aims to enhance both safety and efficacy, crucial for gaining regulatory approval and market acceptance.

The competitive dynamics are evident in the significant investment flowing into the sector. For instance, in 2024, venture capital funding for gene therapy companies remained robust, with several early-stage companies securing substantial rounds to advance their platforms. This influx of capital fuels innovation but also intensifies the race to bring first-in-class therapies to market.

- Intense Competition: Multiple companies are developing gene editing therapies, creating a crowded market.

- Pricing Pressure: High competition can lead to pressure on the pricing of new gene editing treatments.

- Clinical Differentiation: Beam's base editing aims to offer advantages like reduced off-target effects compared to CRISPR-Cas9.

- Market Share: Strong clinical data and unique technology are essential for capturing market share in this sector.

Global Economic Conditions and Inflation

Global economic conditions, particularly inflation and interest rates, significantly influence the biotechnology sector. For instance, the US inflation rate hovered around 3.4% in early 2024, a decrease from its 2022 peaks but still a factor impacting operational costs and research budgets. Higher interest rates, such as the Federal Reserve's benchmark rate holding steady in the 5.25%-5.50% range through mid-2024, can make it more challenging for venture capital firms to secure funding, potentially slowing investment in early-stage companies like Beam Therapeutics.

These macroeconomic trends directly affect investor sentiment and the availability of capital. When interest rates are high, the cost of borrowing increases, and investors may seek safer, less volatile returns, diverting funds from riskier biotech ventures. This can lead to a more constrained funding environment for companies reliant on external capital for their extensive R&D pipelines.

- Inflation Impact: Continued elevated inflation can increase the cost of raw materials, laboratory supplies, and personnel for biotech firms, potentially squeezing profit margins or requiring budget reallocations.

- Interest Rate Sensitivity: The Federal Reserve's monetary policy, with rates remaining elevated through the first half of 2024, directly impacts the cost of capital for companies and the investment appetite of venture capital and private equity firms.

- Economic Growth Outlook: Projections for global economic growth in 2024, generally anticipated to be moderate, influence overall market confidence and the willingness of consumers and healthcare systems to adopt new, potentially expensive, therapies.

- Venture Capital Landscape: The ability of venture capital groups to raise new funds is closely tied to prevailing interest rates and market liquidity, directly affecting the funding available for innovative biotech companies.

The economic landscape for Beam Therapeutics in 2024-2025 is shaped by significant capital needs and market dynamics. The company's ability to secure substantial funding, such as the $500 million raised in early 2025, is critical for its extensive research and development efforts, which saw first-quarter 2025 R&D expenses reach $98.8 million. This financial backing is essential to navigate the high costs associated with developing precision genetic medicines, from initial research to late-stage clinical trials and manufacturing.

Market potential for Beam's therapies is directly tied to the prevalence of target diseases, like sickle cell disease, which affects approximately 100,000 individuals in the U.S., and rarer conditions such as Alpha-1 Antitrypsin Deficiency. The competitive environment, with numerous firms developing similar gene editing technologies, necessitates strong clinical differentiation, such as Beam's focus on reduced off-target effects, to secure market share and manage pricing pressures.

Macroeconomic factors, including inflation around 3.4% in early 2024 and interest rates held by the Federal Reserve between 5.25%-5.50% through mid-2024, influence the availability and cost of capital. These conditions can impact investor sentiment, potentially making funding more challenging for biotech ventures reliant on external investment.

| Factor | 2024/2025 Data Point | Impact on Beam Therapeutics |

| R&D Expenses | $98.8 million (Q1 2025) | High costs necessitate robust funding to sustain pipeline advancement. |

| Funding Raised | $500 million (Early 2025) | Extends operational runway, demonstrating investor confidence. |

| Interest Rates | 5.25%-5.50% (Federal Reserve, mid-2024) | Can increase cost of capital and affect venture capital investment appetite. |

| Inflation Rate | ~3.4% (Early 2024) | Impacts operational costs for materials, supplies, and personnel. |

Preview the Actual Deliverable

Beam Therapeutics PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a comprehensive PESTLE analysis of Beam Therapeutics. This document meticulously examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company’s operations and future growth. You will receive this exact, detailed analysis immediately after purchase, ready for your strategic planning.

Sociological factors

Public acceptance of gene editing, like Beam Therapeutics' base editing, is a major hurdle. Surveys in late 2023 indicated that while a majority of Americans were optimistic about gene editing's potential to treat diseases, a significant portion still harbored concerns about its safety and long-term effects.

Building trust is paramount. For instance, a 2024 report by the National Academies of Sciences, Engineering, and Medicine highlighted the need for transparent communication regarding clinical trial outcomes and potential side effects to foster public confidence in gene editing therapies.

Misinformation remains a challenge, potentially impacting patient enrollment in trials and market adoption. Addressing these fears through clear, evidence-based information is critical for the successful integration of technologies like those developed by Beam Therapeutics.

Strong patient advocacy groups are pivotal for Beam Therapeutics, particularly for conditions like sickle cell disease (SCD). For instance, organizations such as the Sickle Cell Disease Association of America actively campaign for research funding and patient access. Their efforts directly translate into increased demand for innovative treatments and can significantly boost clinical trial recruitment, a critical factor for gene therapy development. In 2024, continued advocacy is expected to push for broader insurance coverage for advanced therapies, benefiting companies like Beam.

Heightened public awareness of genetic diseases and the transformative potential of gene editing technologies like CRISPR, which Beam utilizes, creates a more favorable landscape for their therapies. As of early 2025, media coverage and patient testimonials have significantly demystified gene therapy, fostering greater public acceptance. This increased understanding not only encourages patient interest but also influences policymakers to prioritize regulatory pathways and reimbursement structures for these cutting-edge treatments.

The equitable distribution of advanced genetic medicines like those Beam Therapeutics develops is a major societal concern. Disparities in socioeconomic status, geographic location, and the availability of robust healthcare infrastructure can significantly impact who can access these potentially life-changing treatments. For instance, in 2024, reports indicated that while gene therapies are becoming more available, their high cost often limits access to wealthier populations or those in well-developed regions, a trend expected to continue into 2025 without targeted interventions.

Impact on Quality of Life and Morbidity

Beam Therapeutics' innovation in gene editing holds the promise of transforming patient outcomes, offering potential cures for debilitating genetic diseases. This advancement directly addresses the quality of life for individuals suffering from chronic conditions, aiming to reduce the burden of morbidity and mortality. By developing effective therapies, Beam can significantly lessen the strain on healthcare infrastructure and provide immense relief to affected families.

The sociological impact is substantial, as successful treatments can restore health and productivity. Consider that in 2024, an estimated 1.4 million people in the US are living with cystic fibrosis, a condition Beam is targeting. Alleviating such burdens can lead to a healthier, more engaged populace.

- Disease Eradication Potential: Beam's gene editing technology aims to provide one-time cures, fundamentally altering the trajectory of genetic diseases.

- Improved Quality of Life: Successful therapies can free patients from lifelong management of chronic conditions, enhancing their daily lives and capabilities.

- Reduced Healthcare Burden: By offering cures, Beam's work can decrease the long-term demand for expensive, ongoing medical treatments and hospitalizations.

- Societal Economic Benefits: A healthier population contributes more to the economy through increased workforce participation and reduced disability.

Workforce and Talent Availability

The genetic medicine field demands highly specialized talent, encompassing researchers, geneticists, bioinformaticians, and manufacturing specialists. Beam Therapeutics' success hinges on its ability to access and retain this expert workforce. For instance, as of early 2024, the demand for gene therapy specialists significantly outpaced supply, with reports indicating a shortage of experienced professionals in key areas like process development and regulatory affairs.

Attracting and retaining top-tier talent is crucial for Beam's innovation pipeline and operational efficiency. This involves competitive compensation, robust professional development opportunities, and fostering an inclusive work environment. The company's ability to secure talent directly impacts its capacity to advance its pipeline of gene editing therapies through clinical trials and towards commercialization.

- Specialized Skill Demand: The genetic medicine sector requires a deep bench of scientists and engineers with expertise in areas like CRISPR-Cas9 technology, AAV vector manufacturing, and gene regulatory pathways.

- Talent Acquisition Challenges: Competition for these specialized roles is intense, with many biotech firms vying for the same limited pool of qualified candidates, driving up recruitment costs and time.

- Diversity and Inclusion Imperative: Ensuring a diverse and inclusive workforce is not only a sociological goal but also a strategic advantage, bringing varied perspectives to problem-solving and innovation in a complex scientific field.

- Workforce Development: Investing in training programs and academic partnerships is vital to cultivate the next generation of genetic medicine professionals, addressing long-term talent availability.

Public perception of gene editing technologies, like those Beam Therapeutics is developing, is evolving. While optimism for treating diseases is high, as evidenced by late 2023 surveys, concerns about safety and long-term effects persist, necessitating transparent communication from companies and researchers. This evolving public sentiment directly influences regulatory approvals and market acceptance of novel therapies.

The demand for specialized talent in genetic medicine is a significant sociological factor. As of early 2024, the shortage of experts in areas like CRISPR technology and bio-manufacturing is pronounced, impacting companies like Beam Therapeutics' ability to innovate and scale operations efficiently. Addressing this talent gap through education and recruitment is crucial for the industry's growth.

Societal expectations regarding equitable access to advanced therapies are also critical. The high cost of gene editing treatments, a trend anticipated to continue into 2025, raises concerns about disparities, where access may be limited to wealthier populations or those in well-resourced regions. This necessitates discussions around pricing, insurance coverage, and healthcare infrastructure to ensure broader patient benefit.

Patient advocacy groups play an increasingly vital role in shaping the landscape for companies like Beam. Their efforts in 2024 to increase research funding and push for better insurance coverage for advanced therapies directly impact patient access and clinical trial recruitment, especially for conditions like sickle cell disease.

Technological factors

Beam Therapeutics' core advantage is its innovative base editing technology, enabling precise single-base DNA alterations without double-strand breaks. This precision is key to developing novel therapies. The company's pipeline, including programs targeting conditions like sickle cell disease and beta-thalassemia, relies heavily on the continued evolution of this platform.

The success of gene editing therapies, like those developed by Beam Therapeutics, hinges on how effectively and safely they can reach their intended cells or tissues. This is where delivery mechanisms play a crucial role.

Beam Therapeutics employs lipid nanoparticles (LNPs) for delivering its gene editing components directly into the body. Continued advancements in these delivery systems are essential for broadening the application and improving the safety profile of their innovative treatments.

For instance, the development of non-genotoxic conditioning approaches, such as ESCAPE, is a key technological factor. This innovation aims to prepare the body for gene therapy without causing unintended genetic damage, a significant hurdle in the field. The market for gene therapy delivery systems is projected to grow substantially, with some estimates suggesting it could reach tens of billions of dollars by the late 2020s, underscoring the importance of technological progress here.

Manufacturing gene editing therapies like those developed by Beam Therapeutics presents a substantial technological hurdle, particularly in achieving consistent, high-fidelity production at scale. This is crucial for ensuring patient safety and therapeutic efficacy.

Beam Therapeutics is actively investing in the robustness of its manufacturing processes. For instance, in their Q1 2024 update, they highlighted progress in their internal manufacturing capabilities, aiming to de-risk the supply chain for their lead programs like BEAM-201.

The ability to scale production while maintaining strict quality control is paramount for Beam's commercialization strategy and its potential to reach a wider patient population. Successfully navigating these manufacturing challenges will be a key determinant of their long-term success.

Bioinformatics and Data Science

The rapid advancement in bioinformatics and data science is fundamentally reshaping the landscape for genetic medicine developers like Beam Therapeutics. The sheer volume of genomic data being generated, from sequencing to clinical trials, necessitates sophisticated analytical tools. In 2024, the global bioinformatics market was valued at approximately $13.4 billion and is projected to grow significantly, underscoring the critical role of these technologies.

These capabilities are essential for Beam to effectively analyze complex genomic information, pinpointing precise therapeutic targets and predicting potential off-target effects, which is vital for safety and efficacy. Furthermore, data science plays a key role in optimizing the design of their base editing and prime editing therapies, ensuring greater precision and therapeutic benefit.

The integration of artificial intelligence (AI) into genomic analysis is a particularly impactful trend. For instance, AI algorithms are increasingly used to identify novel therapeutic targets and predict patient responses to gene editing therapies. By 2025, AI in drug discovery is expected to contribute to faster and more efficient development cycles, a benefit Beam can leverage.

- Data Volume: Genetic medicine research generates petabytes of genomic data, requiring advanced bioinformatics for interpretation.

- Target Identification: Data science algorithms help identify precise genetic targets for Beam's base and prime editing platforms.

- Predictive Analytics: Bioinformatics tools are used to predict potential off-target edits and optimize therapy safety profiles.

- AI Integration: The use of AI in genomic analysis is accelerating the discovery and development of new genetic medicines.

Competitive Landscape in Gene Editing

The gene editing landscape is a hotbed of activity, with companies like CRISPR Therapeutics and Intellia Therapeutics making significant strides. CRISPR Therapeutics, for instance, reported a net loss of $226 million for the first quarter of 2024, highlighting the substantial investment required for R&D in this competitive space. Beam Therapeutics needs to constantly push the boundaries of its base editing technology to stand out.

The rapid evolution of gene editing, including the advancements in CRISPR-Cas9 and the emergence of prime editing, creates a dynamic environment. These parallel innovations offer potential avenues for strategic partnerships but also intensify the competitive pressure. Beam's focus on base editing is a key differentiator, but continued investment in research and development is crucial to solidify its market position.

Maintaining a competitive edge requires Beam Therapeutics to not only refine its base editing platform but also explore novel applications and therapeutic targets. The company’s ongoing clinical trials, such as those for sickle cell disease and beta-thalassemia, are critical in demonstrating the efficacy and safety of its approach, thereby distinguishing it from competitors.

Key players and their advancements include:

- CRISPR Therapeutics: Leading development in CRISPR-based therapies, with significant clinical trial progress.

- Intellia Therapeutics: Advancing in vivo CRISPR-based therapies, targeting various genetic diseases.

- Editas Medicine: Focusing on in vivo and ex vivo gene editing approaches for inherited diseases.

The rapid advancement of bioinformatics and data science is crucial for Beam Therapeutics, enabling the analysis of vast genomic datasets. In 2024, the global bioinformatics market was valued at approximately $13.4 billion, highlighting the importance of these tools for target identification and safety prediction.

AI integration is further accelerating drug discovery, with AI in drug discovery expected to contribute to faster development cycles by 2025. Beam leverages these technologies to refine its base editing therapies for enhanced precision and therapeutic benefit.

Technological factors also encompass the development of non-genotoxic conditioning, such as ESCAPE, to prepare patients for gene therapy without genetic damage. Furthermore, advancements in manufacturing processes, like Beam's Q1 2024 focus on internal capabilities for BEAM-201, are vital for scaling production and ensuring consistent quality.

| Factor | Description | Impact on Beam Therapeutics |

| Bioinformatics & Data Science | Analysis of genomic data, target identification, safety prediction. | Essential for optimizing base editing platform and therapeutic design. |

| AI in Drug Discovery | Accelerating discovery and development cycles. | Enhances identification of novel targets and prediction of patient response. |

| Non-Genotoxic Conditioning | Safe preparation of patients for gene therapy. | Addresses a key hurdle in gene therapy application, improving safety profiles. |

| Manufacturing Advancements | Scaling production, ensuring quality and consistency. | Crucial for commercialization and wider patient access, as seen in Q1 2024 updates. |

Legal factors

Beam Therapeutics' success hinges on its robust intellectual property (IP) protection, particularly for its groundbreaking base editing technology and pipeline of therapeutic candidates. Patents are the bedrock of its competitive advantage in the rapidly evolving gene editing landscape.

The gene editing sector has witnessed significant IP disputes, such as those involving CRISPR-Cas9 technology, which can profoundly affect a company's market standing and financial health. Beam must navigate this complex legal terrain to safeguard its innovations.

Beam Therapeutics must navigate a complex web of regulations, particularly from bodies like the U.S. Food and Drug Administration (FDA), to advance its gene editing therapies. Compliance with guidelines for human gene editing products, including rigorous safety testing and robust manufacturing processes, is paramount for gaining approval for clinical trials and eventual market access.

Clinical trial regulations are paramount for companies like Beam Therapeutics, ensuring patient safety and ethical research. These rules dictate everything from how trials are structured and how patients give informed consent to the rigorous monitoring of safety throughout the process. Navigating this complex legal landscape is crucial for gaining regulatory approval and maintaining public trust.

Beam Therapeutics must adhere to stringent guidelines set by bodies like the FDA in the US and the EMA in Europe. For instance, the FDA's Code of Federal Regulations (21 CFR Part 50) outlines detailed requirements for informed consent, ensuring patients fully understand the risks and benefits of participating in gene editing trials.

The potential for long-term implications and off-target effects inherent in gene editing technologies, such as CRISPR, necessitates particularly careful regulatory oversight. Beam's commitment to these standards is reflected in its ongoing research, where patient well-being remains the top priority, aligning with global best practices in biomedical research.

Product Liability and Litigation Risks

As a pioneer in base editing, Beam Therapeutics faces significant product liability and litigation risks. Any adverse events or unexpected long-term consequences arising from its novel genetic medicines could lead to costly lawsuits and reputational damage. For instance, in 2023, the U.S. Food and Drug Administration (FDA) placed a clinical hold on Beam's investigational new drug application for its lead candidate, BEAM-201, due to concerns about the therapy's safety profile, highlighting the scrutiny these advanced therapies undergo.

Mitigating these legal challenges requires an unwavering commitment to the highest safety and efficacy standards throughout the development and clinical trial process. Beam's investment in robust preclinical testing and transparent communication with regulatory bodies is paramount. The company's 2024 guidance, which includes significant spending on research and development, reflects this focus on ensuring the safety and effectiveness of its gene editing platforms before wider commercialization.

- Regulatory Scrutiny: Increased FDA oversight on gene therapies means potential delays or holds on clinical trials, as seen with BEAM-201.

- Long-Term Monitoring: The complex nature of gene editing necessitates extensive, long-term patient monitoring to detect any unforeseen effects, adding to development costs and potential liability.

- Litigation Costs: Successful litigation can result in substantial financial penalties and damages, impacting Beam's profitability and future investment capacity.

- Public Perception: Negative outcomes in clinical trials or litigation can severely damage public trust in Beam's technology, affecting market adoption and investor confidence.

Data Privacy and Security Laws

Beam Therapeutics operates in a highly regulated environment concerning data privacy and security. Handling sensitive genetic and health data from patients necessitates strict adherence to global regulations like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Protecting this information from unauthorized access and misuse is a significant legal consideration for Beam. As genetic research involves the creation and management of large-scale genomic databases, the risk of data breaches is amplified. For instance, in 2023, a data breach affecting a major health provider exposed the genetic information of thousands of individuals, highlighting the critical need for robust security measures.

- GDPR fines can be up to 4% of global annual revenue or €20 million.

- HIPAA violations can lead to penalties ranging from $100 to $50,000 per violation, with annual caps.

- The increasing volume of genomic data necessitates advanced cybersecurity protocols.

- Reputational damage from data breaches can severely impact patient trust and investor confidence.

Beam Therapeutics' intellectual property strategy is crucial, with a focus on patenting its base editing technology and therapeutic candidates. The company navigates a complex patent landscape, referencing ongoing disputes in the gene editing sector, such as those surrounding CRISPR-Cas9, which can significantly impact market position and financial performance.

Regulatory compliance is paramount, with the FDA and EMA setting stringent guidelines for gene editing therapies. Beam must adhere to these for clinical trial approval and market access, including rigorous safety testing and manufacturing standards. For example, the FDA's 21 CFR Part 50 details informed consent requirements for clinical trials.

Product liability and litigation risks are substantial for Beam due to the novel nature of its gene editing treatments. Adverse events could trigger costly lawsuits and reputational damage, as exemplified by the FDA's clinical hold on BEAM-201 in 2023 due to safety concerns, underscoring the intense scrutiny these therapies face. Mitigating these risks involves robust preclinical testing and transparent regulatory engagement, with Beam's significant R&D investment in 2024 reflecting this commitment to safety and efficacy.

Data privacy and security are critical legal considerations, requiring strict adherence to GDPR and HIPAA. Non-compliance can lead to severe penalties, with GDPR fines potentially reaching 4% of global annual turnover or €20 million. Protecting sensitive genetic data from breaches is vital, especially given the increasing volume of genomic data managed by companies like Beam, and the potential for significant reputational harm and loss of trust from data security failures.

| Legal Factor | Implication for Beam Therapeutics | Relevant Regulations/Data (2023-2024) |

|---|---|---|

| Intellectual Property | Protection of base editing technology and pipeline is key to competitive advantage. | Ongoing patent disputes in gene editing sector. |

| Regulatory Approval | Navigating FDA/EMA guidelines for gene editing therapies is essential for clinical trials and market access. | FDA's 21 CFR Part 50 for informed consent. |

| Product Liability | Potential for litigation due to adverse events from novel gene editing treatments. | FDA clinical hold on BEAM-201 in 2023. |

| Data Privacy & Security | Compliance with GDPR/HIPAA for sensitive genetic data is mandatory to avoid penalties. | GDPR fines up to 4% global turnover; HIPAA fines up to $50,000 per violation. |

Environmental factors

Beam Therapeutics, like other biotech firms, must ensure the ethical sourcing of biological materials and reagents crucial for its gene editing research and potential therapies. This involves strict adherence to regulations governing the use of human and animal-derived materials, ensuring patient privacy and animal welfare are paramount.

For instance, the responsible procurement of cell lines or primary tissues, often sourced from biobanks or clinical trials, requires robust consent protocols and transparent supply chains. Failure to maintain these ethical standards can lead to reputational damage and regulatory scrutiny, impacting investor confidence and operational continuity.

Beam Therapeutics, like other companies in the genetic medicine space, must navigate the complexities of waste management. Their laboratories and potential future manufacturing facilities generate biological waste, necessitating specialized handling and disposal methods to prevent any environmental contamination. This is a critical aspect of their operations, ensuring they meet stringent environmental standards.

Adherence to strict biocontainment protocols is paramount for Beam Therapeutics. These measures are not just about safety within their facilities but are also crucial for compliance with evolving environmental regulations. For instance, the U.S. Environmental Protection Agency (EPA) continuously updates guidelines for hazardous waste, and companies like Beam must stay ahead of these changes to avoid penalties and maintain public trust.

Beam Therapeutics' operations, particularly its research facilities and potential future manufacturing, inherently involve significant energy consumption. This energy use, often derived from fossil fuels, contributes to the company's carbon footprint through greenhouse gas emissions. For instance, the biotech sector as a whole is a notable energy consumer, with research labs requiring constant power for equipment and specialized environments.

The cold chain logistics necessary for handling biological products, such as the gene editing components Beam works with, also demand substantial energy to maintain specific temperature ranges. This continuous need for refrigeration, from development to potential distribution, adds to the overall environmental impact. Companies like Beam are increasingly scrutinized for their energy efficiency and emissions.

As of 2024, there's a growing mandate across industries, including biotechnology, to adopt more sustainable practices. This includes exploring renewable energy sources for facilities and optimizing logistics to minimize fuel consumption. Beam Therapeutics, like its peers, faces pressure from investors, regulators, and the public to demonstrate a commitment to reducing its environmental footprint and transitioning towards greener operations.

Impact of Climate Change on Operations

While Beam Therapeutics' core business is gene editing, climate change can indirectly affect its operations. Extreme weather events, like those becoming more frequent globally, could disrupt the supply chains for critical raw materials or reagents needed for their advanced therapies. For instance, a severe hurricane could impact a key supplier's manufacturing facility, leading to temporary shortages. Companies in the biotech sector are increasingly factoring in supply chain resilience into their operational strategies to mitigate such risks.

The logistics of transporting highly sensitive biological materials, crucial for clinical trials and manufacturing, also present a vulnerability. Disruptions caused by climate-related events, such as flooding or extreme heat impacting transportation routes, could compromise the integrity of these materials. In 2024, the World Economic Forum highlighted supply chain resilience as a top global risk, a concern that extends to the specialized logistics required by companies like Beam Therapeutics.

- Supply Chain Vulnerability: Extreme weather events can disrupt the sourcing of specialized reagents and materials essential for gene editing research and development.

- Logistical Challenges: Maintaining the integrity of temperature-sensitive biological samples during transport becomes more difficult with climate-related disruptions to transportation networks.

- Operational Resilience: Companies are increasingly investing in strategies to ensure their facilities and operations can withstand environmental shocks, including potential impacts on energy supply or water availability.

Public Perception of Biotechnology's Environmental Impact

Public perception of biotechnology, including companies like Beam Therapeutics, can significantly influence its environmental impact, even if indirectly. Concerns about gene editing technologies and their potential long-term ecological effects are present. For instance, a 2024 survey indicated that while a majority of the public supports gene editing for medical advancements, a notable percentage expressed apprehension regarding its environmental applications.

Demonstrating a robust commitment to sustainable practices and proactively mitigating any potential environmental risks associated with their research and development is crucial for Beam Therapeutics. This proactive approach can foster a more positive public image and enhance the broader acceptance of gene editing technologies within the scientific and general communities. Companies that transparently address environmental considerations often build greater trust.

- Public awareness of biotechnology's environmental footprint is growing.

- A 2024 poll revealed public support for gene editing in medicine but also noted environmental concerns.

- Transparent communication regarding environmental safeguards is key to public trust.

- Proactive environmental stewardship can bolster industry acceptance.

Environmental regulations continue to shape the operational landscape for biotech firms like Beam Therapeutics. Adherence to evolving waste management protocols and biocontainment standards is critical, as exemplified by the EPA's ongoing updates to hazardous waste guidelines. Companies must invest in robust systems to ensure compliance and avoid potential penalties.

Beam Therapeutics faces increasing pressure to reduce its carbon footprint, driven by investor and public demand for sustainable practices. This includes optimizing energy consumption in research facilities and cold chain logistics, with a growing emphasis on exploring renewable energy sources. The biotech sector's overall energy intensity highlights the importance of these initiatives.

Climate change poses indirect risks to Beam Therapeutics, primarily through supply chain vulnerabilities. Extreme weather events can disrupt the availability of specialized reagents and impact the integrity of temperature-sensitive biological materials during transport. Building operational resilience against such environmental shocks is a key strategic consideration for 2024 and beyond.

Public perception of gene editing technologies, and by extension Beam Therapeutics, is influenced by environmental considerations. While public support for medical applications of gene editing is strong, as indicated by 2024 polls, concerns about potential ecological effects persist. Transparent communication about environmental safeguards is vital for building public trust and fostering broader acceptance.

| Environmental Factor | Impact on Beam Therapeutics | Key Considerations (2024-2025) |

|---|---|---|

| Regulatory Compliance | Adherence to waste management and biocontainment standards. | Ongoing updates to EPA guidelines for hazardous waste; potential for fines for non-compliance. |

| Carbon Footprint | Energy consumption in labs and cold chain logistics. | Investor and public demand for renewable energy adoption; focus on energy efficiency. |

| Climate Change Risks | Supply chain disruptions from extreme weather; logistical challenges for sensitive materials. | Increased focus on supply chain resilience; WEF highlights supply chain disruption as a top global risk. |

| Public Perception | Concerns about ecological effects of gene editing. | Need for transparent communication on environmental safeguards; building trust through proactive stewardship. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Beam Therapeutics is built on a foundation of comprehensive data from leading scientific journals, patent databases, and regulatory filings from agencies like the FDA. We also incorporate insights from market research reports and financial news sources to capture the broader economic and social landscape.