Beam Therapeutics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beam Therapeutics Bundle

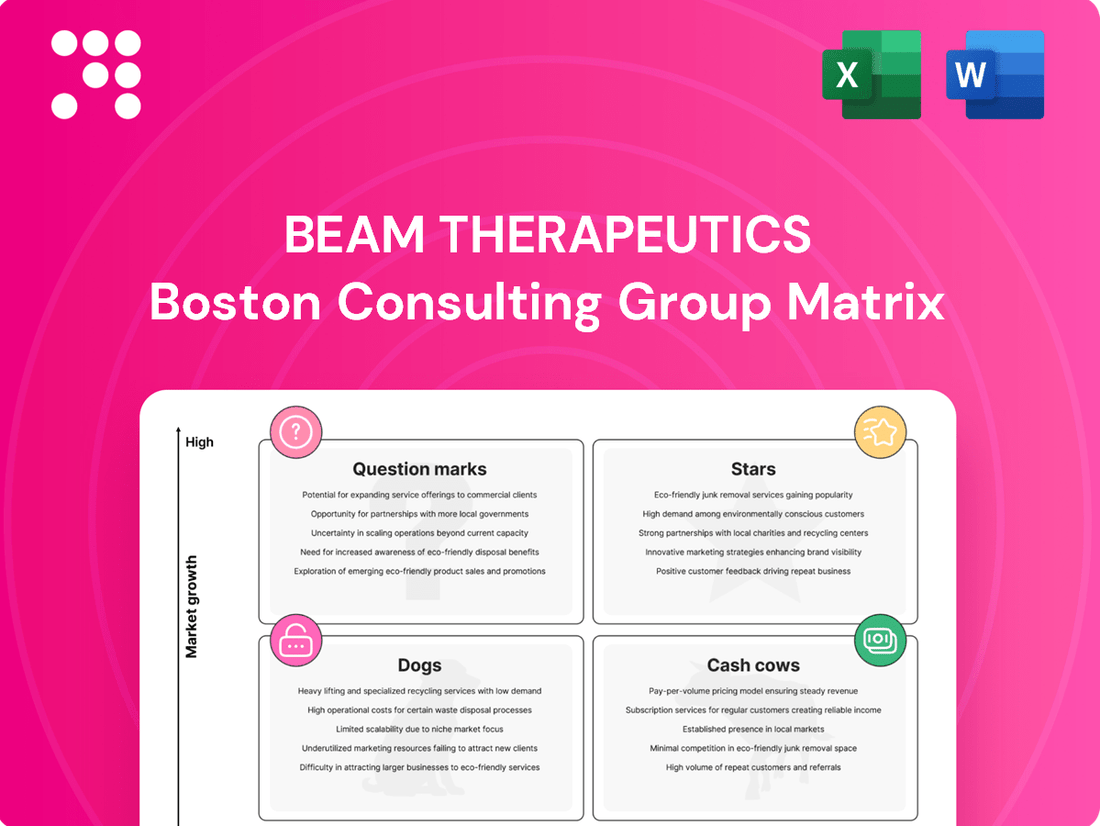

This preview offers a glimpse into Beam Therapeutics' strategic positioning, highlighting key product categories within the BCG Matrix framework. Understand where their innovations fit as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full report for a comprehensive breakdown and actionable strategic insights to guide your investment and product development decisions.

Stars

BEAM-101 represents Beam Therapeutics' flagship ex vivo gene editing therapy targeting severe sickle cell disease (SCD). This program has shown impressive, lasting increases in fetal hemoglobin and significant decreases in sickle hemoglobin during clinical testing.

The BEACON Phase 1/2 trial for BEAM-101 has successfully enrolled its adult participants, with updated clinical data anticipated around mid-2025. This milestone highlights the program's progress in addressing a serious condition with limited effective treatments.

Further underscoring its therapeutic promise, BEAM-101 has secured Orphan Drug Designation from the U.S. Food and Drug Administration. This designation is a crucial step, recognizing the therapy's potential to make a substantial impact on patients suffering from sickle cell disease.

Beam Therapeutics' foundational base editing technology is a significant strength, enabling precise genetic corrections without the double-strand DNA breaks associated with some other gene-editing tools. This technological advantage positions Beam favorably within the expanding gene editing market, which is anticipated to see substantial growth. The platform's precision and potential safety benefits are crucial assets supporting all of Beam's therapeutic initiatives.

BEAM-302 represents Beam Therapeutics' innovative approach to treating Alpha-1 Antitrypsin Deficiency (AATD) through in vivo base editing. This program has already demonstrated promising initial safety and efficacy in early trials, successfully establishing a clinical proof of concept for this novel gene editing technology.

The significance of BEAM-302 is further underscored by its receipt of both U.S. FDA Orphan Drug Designation and Regenerative Medicine Advanced Therapy (RMAT) designation. These designations signal the FDA's recognition of its potential to address serious conditions and its eligibility for expedited review and development pathways.

Investors and stakeholders can anticipate further updates on BEAM-302's progress, with Beam Therapeutics planning to release additional data from its ongoing Phase 1/2 clinical trial in the latter half of 2025. This upcoming data will be crucial in evaluating the continued clinical validation of this promising AATD therapy.

Strategic Focus on Core Franchises

Beam Therapeutics is sharpening its focus on its core franchises in hematology and liver-targeted genetic diseases. This strategic concentration allows the company to dedicate its resources and expertise to areas where its base editing technology can make the most significant impact, addressing substantial unmet medical needs.

By prioritizing these specific therapeutic areas, Beam aims to develop therapies that are not just effective but potentially best-in-class. This targeted approach enhances the efficiency of its platform development and clinical progression, aiming for leadership in these specialized genetic medicine markets.

This strategic clarity is designed to drive long-term growth. For instance, in 2024, Beam continued to advance its lead programs, including its sickle cell disease and beta-thalassemia therapies, demonstrating tangible progress in its core focus areas.

- Hematology Focus: Advancing programs for sickle cell disease and beta-thalassemia, targeting significant patient populations with limited curative options.

- Liver Franchise: Developing therapies for genetic liver diseases, leveraging the liver's accessibility for gene editing.

- Resource Allocation: Concentrating R&D and clinical development efforts on these high-potential franchises to maximize impact.

- Market Potential: Targeting diseases with substantial unmet medical needs and significant commercial opportunities.

Strong Financial Position and Cash Runway

Beam Therapeutics boasts a strong financial foundation, a critical asset for a company in the rapidly evolving biotechnology sector. This financial strength is crucial for funding extensive research and development initiatives. The company's ability to sustain its operations and advance its pipeline without immediate funding pressure is a significant advantage.

As of the close of the first quarter of 2025, Beam Therapeutics reported a substantial cash reserve of $1.2 billion, comprising cash, cash equivalents, and marketable securities. This robust liquidity provides a significant operational runway. The projected cash runway extends into 2028, a testament to prudent financial management and the company's strategic planning. This extended runway is vital for achieving key developmental milestones across its most promising programs.

- $1.2 Billion Cash Reserve: Beam Therapeutics ended Q1 2025 with this substantial amount in cash, cash equivalents, and marketable securities.

- Operating Runway into 2028: This strong financial position is expected to fund operational plans and key milestones for its lead programs well into 2028.

- Sustained R&D Funding: The financial stability ensures continued investment in research and development without immediate dilution concerns.

BEAM-101 and BEAM-302 are Beam Therapeutics' leading programs, strategically positioned as potential "Stars" in the BCG Matrix due to their high growth potential and strong market positioning in addressing significant unmet medical needs. BEAM-101, a sickle cell disease therapy, has advanced into clinical trials with promising data, while BEAM-302 targets Alpha-1 Antitrypsin Deficiency with early positive results. Both have received important regulatory designations, signaling strong clinical validation and market opportunity.

The company's focused approach on hematology and liver-targeted genetic diseases, supported by a robust cash reserve of $1.2 billion as of Q1 2025 extending runway into 2028, further solidifies the "Star" status of these programs. This financial strength allows for continued investment in these high-potential assets, aiming for market leadership.

| Program | Therapeutic Area | BCG Status | Key Progress/Designations |

|---|---|---|---|

| BEAM-101 | Sickle Cell Disease | Star | Phase 1/2 trial ongoing, Orphan Drug Designation |

| BEAM-302 | Alpha-1 Antitrypsin Deficiency | Star | Early trials showing promise, Orphan Drug & RMAT Designations |

What is included in the product

Beam Therapeutics' BCG Matrix offers a strategic framework to analyze its gene editing programs, categorizing them by market growth and share.

It guides decisions on investing in promising "Stars," maintaining stable "Cash Cows," nurturing "Question Marks," and divesting "Dogs."

A clear BCG Matrix visual for Beam Therapeutics' pipeline, simplifying complex portfolio decisions.

Cash Cows

Beam Therapeutics' extensive intellectual property portfolio, while not yet generating direct product revenue, is a critical component of its BCG Matrix positioning as a potential Cash Cow. This robust portfolio of patents and intellectual property safeguards their pioneering base editing technology, establishing a significant competitive advantage in the rapidly evolving gene editing landscape. As of early 2024, Beam held over 100 granted patents and a substantial number of pending applications globally, protecting key aspects of their platform and therapeutic candidates.

Beam Therapeutics leverages strategic collaborations as a key component of its growth strategy, particularly in its base editing programs. These partnerships are designed to accelerate development and provide crucial financial and scientific support.

Beam has forged significant research collaborations with industry giants such as Pfizer and Apellis. These alliances focus on advancing various base editing programs, bringing Beam's innovative technology to a wider audience and potential therapeutic applications.

These collaborations are instrumental in providing non-dilutive funding, which is vital for offsetting substantial research and development expenses. This financial backing enhances Beam's stability and allows for continued investment in its cutting-edge platform.

Beyond funding, these partnerships offer access to extensive resources and crucial external validation for Beam's base editing technology. This validation helps to de-risk the development process and strengthens the company's position in the competitive biotech landscape.

Beam Therapeutics' internal GMP manufacturing capability for cell therapies like BEAM-101 is a significant asset. This allows direct oversight of production, ensuring consistent quality and potentially lowering long-term costs.

Having this in-house infrastructure is vital for optimizing yields and supporting Beam's entire pipeline of innovative treatments. As of early 2024, Beam has been actively scaling its GMP operations to meet anticipated clinical demand.

Broad Applicability of Base Editing

Beam Therapeutics' base editing technology demonstrates remarkable versatility, positioning it as a potential cash cow due to its broad applicability across numerous genetic diseases and therapeutic categories. This inherent flexibility allows the company to leverage its core platform for multiple distinct programs, fostering a pipeline of potential new drug candidates. The foundational nature of this technology makes it a valuable asset that can be exploited for a diverse range of applications, generating sustained revenue streams. For instance, Beam's focus extends to conditions like sickle cell disease, beta-thalassemia, and various other inherited disorders, showcasing the platform's wide reach.

- Broad Disease Coverage: The base editing platform is designed to address a wide spectrum of genetic mutations, making it applicable to hundreds of rare and common diseases.

- Pipeline Expansion: Each new therapeutic target validated with base editing represents a potential new revenue-generating product, amplifying the cash cow potential.

- Platform Reusability: The underlying technology is robust and adaptable, meaning significant R&D investment in the core platform can yield multiple distinct product candidates.

- Reduced Development Costs: By utilizing a common editing engine across programs, Beam can potentially reduce the per-program development costs compared to traditional gene therapy approaches.

Existing Cash Reserves

Beam Therapeutics' existing cash reserves are the company's current cash cow. As of March 31, 2025, Beam held approximately $1.2 billion in cash, cash equivalents, and marketable securities. This substantial financial cushion is crucial for fueling its extensive research and development activities.

This capital directly supports the advancement of its innovative gene editing programs, particularly those in high-potential pipeline stages. The liquidity provided by these reserves ensures Beam can navigate the lengthy and expensive process of clinical trials, a hallmark of a strong cash cow.

- $1.2 billion in cash, cash equivalents, and marketable securities as of March 31, 2025.

- Funds ongoing research and development for its gene editing platform.

- Enables progression of pipeline programs into late-stage clinical trials.

- Provides essential financial stability and operational liquidity.

Beam Therapeutics' substantial cash reserves are its current cash cow, providing the financial engine for its pioneering base editing technology. As of March 31, 2025, the company reported approximately $1.2 billion in cash, cash equivalents, and marketable securities. This significant liquidity directly fuels its extensive research and development efforts, enabling the progression of its innovative gene editing programs through critical clinical trial stages.

| Asset Type | Amount (as of March 31, 2025) | Purpose |

|---|---|---|

| Cash, Cash Equivalents, and Marketable Securities | $1.2 billion | Funding R&D, clinical trials, and operational liquidity |

Full Transparency, Always

Beam Therapeutics BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This ensures you get exactly what you see, a comprehensive strategic tool ready for immediate application without any alterations or hidden elements.

Dogs

Beam Therapeutics' late 2023 restructuring, which included a workforce reduction, signaled a strategic pivot towards portfolio prioritization. While the exact programs discontinued remain undisclosed, this move indicates that earlier-stage or less promising initiatives were likely deprioritized or halted. These terminated projects, having consumed capital without significant progress, can be viewed as past 'dogs' in the company's development pipeline.

Beam Therapeutics' preclinical and early-stage clinical programs that don't show enough safety, effectiveness, or a clear advantage over current treatments risk becoming 'dogs' in their BCG matrix. These initiatives drain R&D resources without a clear market entry or substantial patient benefit.

For instance, if a gene editing program targeting a rare disease shows minimal efficacy in Phase 1 trials, as seen in some early-stage biotech ventures in 2024, it could be classified as a dog. Such a program might consume tens of millions in development costs without a viable path forward, forcing a strategic decision.

Typically, these 'dog' programs are either discontinued entirely or sold off to other companies. This action is crucial for Beam to preserve capital and redirect its focus toward more promising candidates, ensuring efficient allocation of its substantial R&D budget, which was reported to be over $200 million in 2023.

Beam Therapeutics, like many biotech firms, navigates a pipeline where many discovery-stage candidates ultimately falter. These early-stage projects, though crucial for innovation, often encounter insurmountable scientific challenges or fail to demonstrate a clear path to commercialization.

These internal research efforts, if they don't meet stringent progression criteria, are categorized as 'dogs' within the R&D framework. For instance, in 2023, Beam Therapeutics reported significant investments in its discovery and preclinical programs, but the success rate for candidates at this very early stage is inherently low, often below 10% for progressing to clinical trials.

Inefficient or Cost-Prohibitive Development Paths

Even groundbreaking scientific ideas can falter if the path to bringing them to market is simply too difficult or expensive. For Beam Therapeutics, this means a promising gene editing technology could become a 'dog' if manufacturing proves incredibly complex, regulatory approvals are exceptionally tough, or the number of patients who could benefit is too small to warrant the massive investment needed.

Consider the immense costs associated with developing novel therapies. For instance, the average cost to bring a new drug to market has been estimated to be over $2 billion. If Beam encounters unforeseen manufacturing hurdles that significantly inflate this figure, or if the target patient population for a specific base editing program is projected to be only a few thousand individuals globally, the economic viability of that particular development path could be severely compromised.

Beam's strategy actively works to avoid these 'dog' scenarios by focusing on efficiency and making tough choices about which programs to prioritize. This foresight is crucial.

- Development Complexity: Unforeseen manufacturing challenges or intricate delivery mechanisms can render a scientific concept commercially unviable.

- Economic Viability: High regulatory hurdles or a limited target patient population can make the substantial investment required for commercialization unjustifiable.

- Strategic Prioritization: Beam's commitment to efficiency and careful program selection is designed to preemptively identify and mitigate these 'dog' characteristics.

- Market Realities: The sheer expense of drug development, often exceeding $2 billion per drug, underscores the need for clear commercial potential from the outset.

Programs Facing Intense Competition with Inferior Profile

Beam Therapeutics faces the risk of certain programs becoming 'dogs' in the BCG Matrix if they enter highly competitive markets with established players offering superior or more advanced therapies. If Beam's candidate lacks significant differentiation, it could struggle to gain market share and recover development expenses, potentially leading to divestment or discontinuation.

For instance, if a gene editing therapy developed by Beam for a specific rare disease enters a market where a competitor already has an approved, highly effective treatment with a strong safety profile and broad patient adoption, Beam's program could be classified as a dog. This is particularly true if Beam's therapy offers only marginal improvements or faces significant manufacturing or delivery challenges compared to the incumbent. In 2024, the biotechnology sector continued to see intense competition, with companies investing heavily in R&D to gain first-mover advantage in areas like gene editing. Companies that fail to demonstrate clear clinical superiority or a significant unmet need fulfillment risk being outpaced.

- Market Entry Challenges: Programs entering crowded therapeutic areas with dominant competitors risk low market share.

- Differentiation is Key: Lack of a unique selling proposition or clinical advantage can lead to 'dog' status.

- Recouping Costs: Inferior profiles make it difficult to recover substantial R&D investments.

- Strategic Review: 'Dogs' often become candidates for divestment or project termination to reallocate resources.

Programs within Beam Therapeutics' pipeline that fail to demonstrate sufficient efficacy, face insurmountable development hurdles, or enter highly competitive markets with little differentiation are considered 'dogs' in the BCG Matrix. These initiatives consume valuable resources without a clear path to market success or significant patient impact. For example, a gene editing therapy facing a dominant competitor with a superior treatment, as seen in the intense biotech competition of 2024, could easily become a dog. Beam's strategic restructuring in late 2023, including workforce reductions, signaled a move to deprioritize such underperforming or high-risk projects.

| BCG Category | Beam Therapeutics Example (Potential) | Characteristics | Financial Implication |

|---|---|---|---|

| Dogs | Preclinical gene editing program with low efficacy in early trials | Low market share potential, low growth prospects, high resource drain | Negative cash flow, requires divestment or discontinuation |

| Dogs | Early-stage therapy facing a well-established competitor with better outcomes | Limited differentiation, high market entry barriers, low probability of recouping R&D costs | Significant R&D investment at risk, potential for write-offs |

| Dogs | Program with unforeseen manufacturing complexity leading to prohibitive costs | High development costs, uncertain commercial viability, potential regulatory delays | Capital intensive without clear return on investment |

Question Marks

BEAM-301 represents Beam Therapeutics' second venture into in vivo base editing, specifically addressing Glycogen Storage Disease Type 1a (GSD1a). This rare genetic disorder presents a significant unmet medical need, positioning BEAM-301 as a potential game-changer for affected patients.

Currently, BEAM-301 is in its nascent clinical stages, with patient dosing in the Phase 1/2 trial anticipated to begin in early 2025. This early-stage development means its market share is virtually nonexistent, reflecting the substantial investment and robust clinical data needed to validate its efficacy and secure a foothold in the therapeutic landscape.

The Engineered Stem Cell Antibody Paired Evasion (ESCAPE) platform, represented by BEAM-103, is a groundbreaking innovation in hematopoietic stem cell transplantation. Its core aim is to facilitate non-genotoxic conditioning, a significant advancement that could expand treatment accessibility and enhance patient safety profiles.

BEAM-103, a key component of the ESCAPE platform, is poised to enter a Phase 1 clinical trial with healthy volunteers by the close of 2025. This early-stage development signifies substantial future growth potential for Beam Therapeutics.

Beam Therapeutics' early-stage research and preclinical programs are crucial for its long-term growth, exploring base editing applications across a spectrum of genetic diseases. These initiatives, while holding significant future potential, are characterized by high risk and demand continuous investment in discovery and validation.

As of early 2024, Beam has advanced several preclinical candidates, including those targeting conditions like sickle cell disease and beta-thalassemia, alongside programs investigating treatments for other inherited blood disorders and certain cancers. The company's commitment to these foundational stages is evident in its substantial R&D expenditures, which are essential for de-risking future clinical development and ultimately bringing novel therapies to patients.

Apellis Collaboration (FcRn Program)

Beam Therapeutics' collaboration with Apellis Pharmaceuticals on the FcRn program positions this initiative as a potential 'Question Mark' within its BCG Matrix. The focus is on a one-time base editing treatment for the neonatal Fc receptor (FcRn), a key component in managing immunological disorders.

This program represents a high-growth potential area, targeting a novel mechanism within the complement system. However, its current preclinical stage means significant investment is still required to navigate development and regulatory hurdles.

- High Growth Potential: Targeting FcRn offers a novel approach to immunological diseases, a significant and expanding market.

- Uncertainty: As a preclinical program, its future market success and commercial viability are not yet established, requiring substantial R&D investment.

- Strategic Importance: This collaboration aligns with Beam's strategy to leverage base editing for a range of serious diseases, diversifying its pipeline.

Future 'Wave 3' In Vivo Sickle Cell Disease Programs

Beam Therapeutics envisions a future 'Wave 3' for sickle cell disease (SCD) centered on in vivo gene editing. This strategy aims to directly edit the faulty gene within a patient's body, bypassing the complex ex vivo cell modification and transplantation process.

The core of this Wave 3 approach involves delivering gene editing machinery, likely via lipid nanoparticles (LNPs), directly into patients. This represents a significant technological hurdle, moving from modifying cells outside the body to precise in vivo editing.

While promising, this in vivo strategy for SCD is currently a significant question mark for Beam. It requires substantial advancements in LNP delivery technology and a deep understanding of in vivo editing efficiency and safety.

Beam Therapeutics' commitment to this ambitious in vivo approach underscores its long-term vision for SCD treatment, aiming for a potentially more accessible and streamlined therapy if the significant technical challenges can be overcome.

The collaboration with Apellis Pharmaceuticals on the FcRn program, targeting immunological disorders with a one-time base editing treatment, represents a significant 'Question Mark' in Beam Therapeutics' portfolio. While the FcRn target offers high growth potential within the expanding market for immunological diseases, its preclinical status means considerable R&D investment is still needed to overcome development and regulatory hurdles. This strategic initiative aligns with Beam's broader aim to apply base editing across various serious genetic conditions, thereby diversifying its pipeline and exploring novel therapeutic mechanisms.

| Program | Target Indication | Stage | Potential | Risk |

|---|---|---|---|---|

| FcRn Program (with Apellis) | Immunological Disorders | Preclinical | High (novel mechanism, expanding market) | High (early stage, regulatory uncertainty) |

| In Vivo SCD Strategy (Wave 3) | Sickle Cell Disease | Preclinical/Early Research | High (potential for more accessible therapy) | Very High (significant delivery and editing challenges) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from clinical trial results, patent filings, and regulatory approvals to assess the market potential and competitive standing of Beam Therapeutics' pipeline.