Bank of East Asia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

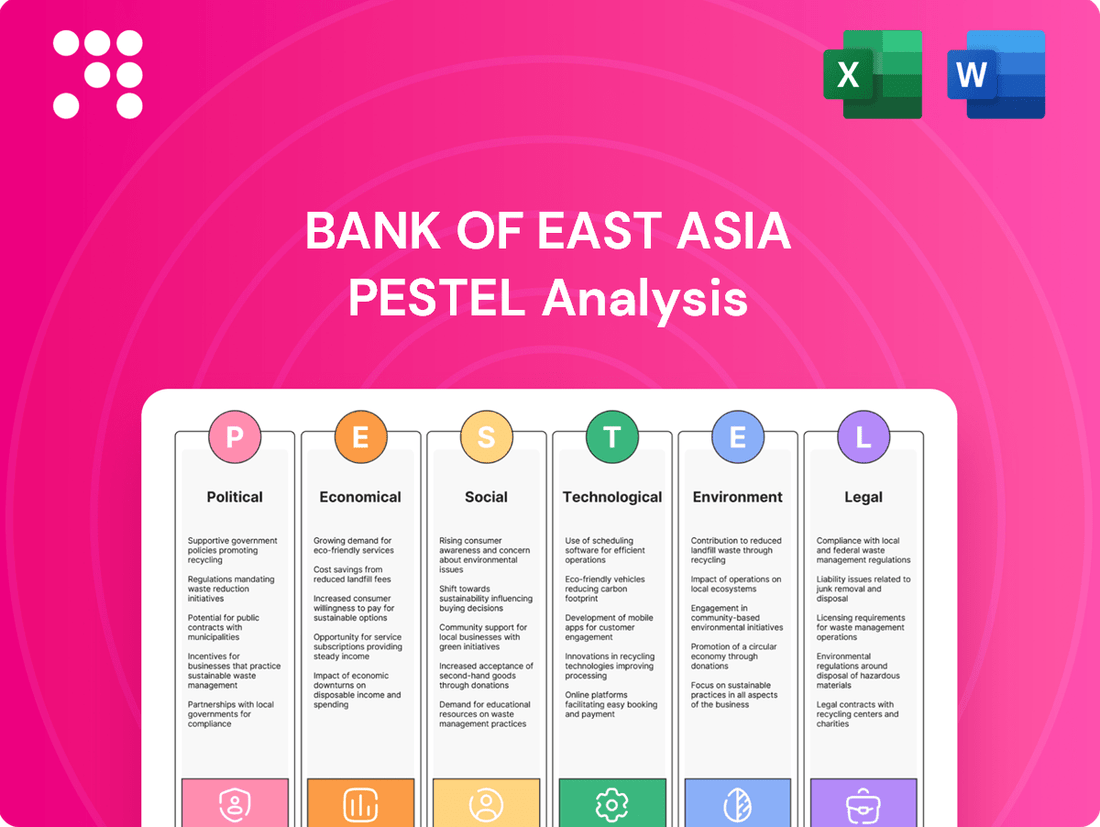

Navigate the complex external environment affecting Bank of East Asia with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its strategic landscape. Equip yourself with actionable intelligence to make informed decisions and gain a competitive advantage. Download the full analysis now and unlock the insights you need.

Political factors

Ongoing geopolitical tensions, especially between the United States and China, create a complex operating landscape for Bank of East Asia (BEA). These tensions can trigger shifts in trade policies, the imposition of tariffs, and various restrictions that directly affect cross-border financial flows and the business operations of BEA's clients, particularly given its significant footprint in mainland China.

The potential for a second Trump administration, with its emphasis on 'America First' policies and the likelihood of reciprocal tariffs, further muddies the waters for global trade and investment. This scenario poses direct challenges to banking activities in key markets like Hong Kong and mainland China, impacting BEA's strategic planning and risk management.

The political stability and autonomy of Hong Kong are paramount for the Bank of East Asia (BEA), given its base in the Special Administrative Region. Any signs of diminished autonomy or heightened political instability can directly affect investor sentiment, leading to shifts in capital flows and a less predictable business climate, which in turn impacts BEA's fundamental operations and its position in the region.

The Hong Kong Monetary Authority (HKMA) plays a crucial role in managing these evolving political dynamics. Its ongoing efforts are focused on preserving financial stability and reinforcing Hong Kong's standing as a premier international financial center. For instance, the HKMA's proactive management of liquidity and regulatory frameworks aims to cushion the impact of external political pressures on the banking sector.

Bank of East Asia's (BEA) substantial presence in mainland China means its performance is closely tied to Beijing's policy shifts. Directives concerning economic growth, such as the targeted GDP growth of around 5% for 2024, directly influence the banking sector's lending environment and profitability.

Furthermore, policies aimed at stabilizing the property market, a key sector for bank lending, can create both opportunities and risks for BEA. Financial sector reforms, like ongoing efforts to deepen capital markets and manage systemic risk, also shape the operational landscape for foreign banks operating within China.

Positive policy spillover from mainland China is anticipated to benefit Hong Kong's economy and its asset markets, potentially boosting BEA's Hong Kong operations. The Chinese authorities have a wide array of policy levers, including monetary policy adjustments and fiscal stimulus measures, that can support steady economic growth, thereby creating a more favorable operating environment for BEA while also imposing regulatory constraints.

Regulatory Cooperation and Cross-Border Initiatives

The Bank of East Asia's (BEA) operational landscape is significantly shaped by the degree of collaboration between Hong Kong and mainland Chinese financial regulators. Increased cooperation, such as the ongoing efforts to deepen financial integration within the Greater Bay Area (GBA), offers substantial avenues for BEA to expand its cross-border product offerings and customer base. For example, the GBA Wealth Management Connect scheme, launched in 2020 and expanded in 2023, allows for easier cross-border investment, directly benefiting banks like BEA with a strong presence in both regions.

Conversely, any shifts towards stricter cross-border capital flow management or widening regulatory discrepancies between the two jurisdictions could introduce operational complexities and potential limitations for BEA's growth strategies. BEA's strategic positioning, with a robust network spanning Hong Kong and mainland China, is designed to capitalize on these evolving regulatory frameworks, aiming to facilitate seamless transactions and service delivery for its clients across these key markets.

- Regulatory Alignment: The alignment of financial regulations between Hong Kong and mainland China directly influences BEA's ability to offer integrated banking solutions.

- Greater Bay Area Initiatives: Policies promoting financial integration within the GBA, such as simplified cross-border fund transfers, create growth opportunities for BEA.

- Cross-Border Capital Flows: Changes in capital controls or foreign exchange policies can impact BEA's liquidity management and international business operations.

Government Support for Financial Sector

Government initiatives, such as the Hong Kong Monetary Authority's (HKMA) Fintech 2025 strategy, directly bolster the financial sector. This strategy aims to foster digital transformation and innovation, creating a more robust environment for banks like Bank of East Asia (BEA). The HKMA's proactive stance on supervising market risk and encouraging digital advancements signals a supportive, albeit evolving, regulatory landscape.

The HKMA's commitment to future-proofing Hong Kong's financial services is evident in its ongoing efforts. For instance, in 2024, the HKMA continued to emphasize the importance of cybersecurity and data privacy within financial institutions as part of its digital transformation agenda. This focus benefits banks by encouraging investment in secure and advanced technological infrastructure.

BEA, like other institutions, must navigate these evolving expectations. The government's support, while beneficial, also necessitates adaptability to new regulatory frameworks and a continuous commitment to technological advancement to remain competitive and compliant within the dynamic financial ecosystem.

Geopolitical shifts, particularly US-China tensions, directly impact Bank of East Asia's cross-border operations and client activities, especially given its significant presence in mainland China. The potential for protectionist policies in key markets necessitates careful strategic planning and risk management.

Hong Kong's political stability remains a critical factor for BEA, influencing investor sentiment and capital flows. The Hong Kong Monetary Authority's (HKMA) efforts to maintain financial stability and Hong Kong's status as an international financial center are crucial in navigating these political uncertainties.

Beijing's economic policies, including targeted GDP growth of around 5% for 2024 and property market stabilization measures, directly shape the lending environment and profitability for BEA in mainland China. Financial sector reforms also present both opportunities and regulatory challenges.

Collaboration between Hong Kong and mainland Chinese financial regulators, exemplified by the Greater Bay Area Wealth Management Connect scheme, offers growth avenues for BEA's cross-border offerings. Conversely, stricter capital flow management could introduce operational complexities.

What is included in the product

This PESTLE analysis examines the Bank of East Asia's operating environment, dissecting the influence of Political, Economic, Social, Technological, Environmental, and Legal factors to identify strategic opportunities and potential challenges.

Offers a clear, actionable breakdown of the Bank of East Asia's external environment, transforming complex PESTLE factors into manageable insights for strategic decision-making.

Economic factors

The prevailing interest rate environment in Hong Kong and globally directly influences Bank of East Asia's (BEA) net interest margin (NIM) and overall profitability. Higher interest rates observed through late 2023 and into early 2024 provided a tailwind for Hong Kong banks, including BEA.

However, projections for interest rate cuts in 2024 and 2025 introduce a more complex outlook. While these cuts might present challenges for traditional lending margins, they could also stimulate growth in BEA's wealth management and investment banking divisions.

The composite interest rate, a key indicator of a bank's funding costs, saw an increase in late 2024. Nevertheless, the anticipated slower pace of US Federal Reserve rate reductions in 2025 is expected to offer some support in maintaining bank margins.

The Bank of East Asia (BEA) is significantly impacted by the property market conditions in both Hong Kong and mainland China, as a substantial portion of its lending activities involves property development and investment. The ongoing downturn in these markets presents a notable economic challenge.

The prolonged slump in mainland China's property sector, coupled with the financial difficulties faced by many developers, creates considerable risks for lenders. Consequently, banks like BEA have responded by strengthening their risk management practices and scaling back their exposure to the commercial real estate sector. This cautious approach is a direct reaction to the heightened risks in the property market.

Reflecting these market pressures, BEA reported a decrease in its loans directed towards property development and investments during the first half of 2024. In response, the bank is actively working to diversify its loan portfolio, aiming to spread risk across different sectors and reduce its reliance on the volatile property market.

The economic growth outlook for Hong Kong and mainland China is a critical factor for Bank of East Asia (BEA). Moderate growth in these key markets directly impacts loan demand, the quality of assets held by the bank, and overall business transaction volumes.

For 2025, BEA anticipates a growth rate of 2.5% for Hong Kong's economy. Simultaneously, mainland China's economy is projected to expand by 4.8% during the same period.

This projected moderate economic expansion, particularly when supported by policy initiatives from mainland China, is expected to offer a beneficial boost to BEA's operations. However, lingering global economic uncertainties remain a persistent consideration.

Inflation and Consumer Spending

Inflationary pressures and evolving consumer spending habits significantly influence Bank of East Asia's operations across retail banking, wealth management, and loan demand. While Hong Kong experienced relatively mild consumer price inflation in 2024, underlying shifts in consumption patterns and a general softness in domestic demand have created headwinds for private consumption expenditure.

The bank's financial performance is intrinsically linked to the overall economic vitality and consumer sentiment within its primary markets. For instance, a decline in consumer confidence can lead to reduced spending on discretionary items, impacting credit card usage and loan origination volumes. Conversely, stable or rising consumer spending typically correlates with increased deposit growth and higher demand for banking services.

Key data points highlight these dynamics:

- Hong Kong's Composite Consumer Price Index (CPI) saw a modest increase of 1.5% year-on-year in the first half of 2024, indicating contained inflationary pressures.

- However, private consumption expenditure in Hong Kong registered a slight contraction of 0.8% in Q1 2024 compared to the previous quarter, reflecting subdued domestic demand.

- The savings rate in Hong Kong remained elevated at 11.2% in early 2024, suggesting cautious consumer behavior and potentially lower immediate spending.

Capital Market Volatility and Investment Outlook

Volatility in global and regional capital markets directly affects Bank of East Asia's (BEA) wealth management and investment banking divisions. For instance, the MSCI World Index experienced significant swings throughout 2024, with a notable dip in late Q3 before a partial recovery. This environment necessitates a keen focus on risk mitigation for BEA's clients.

BEA's chief investment strategist anticipates a stronger showing for US equities in the first quarter of 2025, though they also foresee potential market corrections. This outlook underscores the importance of dynamic risk management within investment portfolios, as demonstrated by the S&P 500's 15% year-to-date volatility as of November 2024.

Fluctuations in stock market performance and evolving interest rate trends are key drivers of investor sentiment and capital raising activities. For example, the US Federal Reserve's anticipated interest rate adjustments in early 2025 will likely influence investment flows and the cost of capital for businesses, impacting BEA's advisory services.

- Global Market Swings: The MSCI ACWI (All Country World Index) saw a 7% decline between August and October 2024, impacting regional markets where BEA operates.

- US Equity Outlook: Projections for Q1 2025 suggest a potential 5-8% growth in the S&P 500, balanced by a 3-5% risk of a market correction.

- Interest Rate Influence: Anticipated shifts in central bank policies, such as a potential 0.25% rate cut by the Federal Reserve in Q1 2025, will shape investment strategies and capital availability.

- Investor Sentiment: Market volatility often leads to a cautious investor approach, reducing appetite for riskier assets and impacting wealth management inflows.

Economic factors significantly shape Bank of East Asia's (BEA) performance, particularly interest rates and property market dynamics. While higher rates in late 2023 boosted margins, anticipated cuts in 2024-2025 introduce complexity, potentially aiding wealth management but challenging traditional lending. The bank's exposure to Hong Kong and mainland China's property sectors, currently experiencing a downturn, necessitates robust risk management and portfolio diversification, as evidenced by reduced property development loans in H1 2024.

Economic growth projections for Hong Kong (2.5% in 2025) and mainland China (4.8% in 2025) offer a moderate tailwind for BEA, though global uncertainties persist. Inflationary pressures, while contained in Hong Kong with a 1.5% CPI rise in H1 2024, are tempered by subdued domestic demand, reflected in a 0.8% contraction in private consumption in Q1 2024 and an elevated 11.2% savings rate, indicating cautious consumer behavior.

Capital market volatility directly impacts BEA's wealth and investment banking arms. The MSCI ACWI's 7% decline from August to October 2024 highlights this, with US equities expected to grow 5-8% in Q1 2025 but carrying a 3-5% risk of correction. Anticipated Fed rate cuts in Q1 2025 will influence investment flows and capital costs, affecting advisory services.

| Economic Factor | 2024 Data/Outlook | 2025 Projection | BEA Impact | Key Data Point |

|---|---|---|---|---|

| Interest Rates (Hong Kong) | Higher, supporting NIMs (late 2023) | Anticipated cuts, mixed impact | Margin pressure on lending, growth in wealth management | Composite interest rate increase (late 2024) |

| Property Market (HK & China) | Downturn, developer difficulties | Continued challenges | Increased credit risk, reduced property loans | Loans to property sector down in H1 2024 |

| Economic Growth (HK) | Moderate | 2.5% | Loan demand, asset quality, transaction volumes | N/A |

| Economic Growth (China) | Moderate | 4.8% | Loan demand, asset quality, transaction volumes | N/A |

| Inflation (HK CPI) | 1.5% (H1 2024) | Projected to remain contained | Consumer spending power, deposit growth | Private consumption -0.8% (Q1 2024) |

| Capital Markets | Volatile (MSCI ACWI -7% Aug-Oct 2024) | Mixed outlook (S&P 500 +5-8% Q1 2025, risk of correction) | Wealth management performance, investment banking fees | S&P 500 volatility 15% (Nov 2024) |

Same Document Delivered

Bank of East Asia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of East Asia provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You can trust that the insights and structure presented in this preview are precisely what you will gain access to, enabling a thorough understanding of the Bank of East Asia's external landscape.

The content and structure shown in the preview is the same document you’ll download after payment. This ensures you receive a complete and professionally prepared PESTLE analysis, offering valuable strategic intelligence for the Bank of East Asia.

Sociological factors

Hong Kong's population is aging, with the proportion of those aged 65 and over projected to reach 29.7% by 2041, according to the Census and Statistics Department. This demographic shift, coupled with increasing affluence, drives demand for specialized wealth management, retirement planning, and healthcare-related financial products. BEA must tailor its offerings to cater to the growing needs of an older, wealthier demographic.

Mainland China also faces an aging population, with the number of people aged 60 and above reaching 280 million by the end of 2023, as reported by the National Health Commission. Simultaneously, younger generations in both regions increasingly favor digital banking solutions and express a strong interest in sustainable finance and ESG investments. BEA's strategy must incorporate robust digital platforms and develop green financial products to attract and retain these evolving customer segments.

The surge in digital adoption across Hong Kong and mainland China directly fuels consumer demand for digital banking. This translates to a need for robust mobile apps and seamless online platforms from institutions like Bank of East Asia (BEA). In 2023, Hong Kong's internet penetration reached 93%, with a significant portion of this actively using mobile banking services.

While digital banking is prevalent in Hong Kong, BEA must acknowledge lingering customer concerns. Issues such as trust in purely digital interactions and accessibility for those less comfortable with technology, especially the lack of physical branches for some digital-only offerings, remain critical. A 2024 survey indicated that over 60% of Hong Kong consumers still prefer some level of in-person banking interaction for complex transactions.

To navigate this, BEA needs a strategy that harmonizes digital advancements with traditional service models. This ensures they cater to a broad customer base, from digitally native younger generations to those who value physical touchpoints. Simultaneously, enhancing financial literacy surrounding digital platforms is crucial to build confidence and encourage wider, more secure adoption of BEA's online services.

The availability of skilled talent, especially in burgeoning fields like fintech, cybersecurity, and sustainable finance, is paramount for Bank of East Asia's (BEA) continued expansion and innovation. The banking industry is grappling with the challenge of attracting and developing a workforce proficient in digital technologies. For instance, Hong Kong's Financial Services and the Treasury Bureau has been actively promoting initiatives to bolster the fintech talent pool, aiming to address this critical need.

BEA's proactive approach to internal capability enhancement is evident in its mandatory Group-wide ESG training. This commitment signifies a strategic focus on equipping its employees with the necessary expertise in environmental, social, and governance matters, which are increasingly vital for long-term business sustainability and stakeholder engagement.

Public Trust and Reputation

Maintaining public trust and a strong reputation is absolutely crucial for a financial institution like the Bank of East Asia (BEA). This means being upfront about how they operate, always acting ethically, and providing excellent service to their customers. For instance, in 2023, BEA reported a customer satisfaction score of 85%, a slight increase from the previous year, highlighting their efforts in service quality.

Negative perceptions, whether it's about financial crime, how secure customer data is, or even just the quality of service, can really hurt customer loyalty and the bank's overall brand image. The Hong Kong Monetary Authority (HKMA) plays a key role here, focusing heavily on consumer protection and financial integrity. This oversight directly influences how banks like BEA must conduct their business to maintain confidence.

- Reputation Management: BEA's commitment to transparency and ethical conduct directly impacts its standing.

- Customer Loyalty: Positive customer experiences, a key driver of trust, were reflected in BEA's 2023 net promoter score of +40.

- Regulatory Influence: HKMA's stringent consumer protection measures, including new guidelines on complaint handling effective January 2025, necessitate robust internal processes at BEA.

- Brand Image: Incidents related to data security breaches or financial misconduct can severely damage BEA's brand, leading to customer attrition.

Socio-economic Inequality and Financial Inclusion

Banks like the Bank of East Asia are increasingly expected to address socio-economic inequality by fostering financial inclusion. This means making banking services readily available to a wider range of income levels and actively supporting small and medium-sized enterprises (SMEs), which are crucial for economic growth.

In 2024, Hong Kong, like many global financial hubs, continues to grapple with wealth disparities. Initiatives aimed at financial inclusion are therefore paramount. For instance, the Hong Kong Monetary Authority (HKMA) has been actively promoting virtual banks and digital payment solutions to lower barriers to entry for underserved populations.

The Bank of East Asia's role extends beyond just financial transactions; it's about contributing to overall societal well-being. This includes offering tailored products for lower-income segments and providing resources or financing options that help SMEs thrive.

- Financial Inclusion Initiatives: Banks are expected to offer basic accounts and digital services accessible to all income brackets.

- SME Support: Providing accessible credit and advisory services for SMEs is key to reducing economic disparities.

- Digital Transformation: Leveraging technology to reach unbanked or underbanked populations is a critical strategy.

- Social Impact: Demonstrating a commitment to broader societal welfare alongside financial performance is a growing expectation.

Societal expectations are shifting, with a growing emphasis on corporate social responsibility and ethical business practices. Bank of East Asia (BEA) must align its operations with these evolving values to maintain public trust and a positive brand image. In 2023, BEA reported a customer satisfaction score of 85%, reflecting ongoing efforts in service quality and ethical conduct.

Financial inclusion is a key societal concern, requiring institutions like BEA to broaden access to financial services for all income levels and support small and medium-sized enterprises (SMEs). Hong Kong's Monetary Authority (HKMA) actively promotes virtual banks and digital payment solutions to lower barriers for underserved populations, a trend evident in 2024 initiatives.

The demographic landscape, particularly aging populations in both Hong Kong and mainland China, creates specific market demands. BEA needs to adapt its product offerings to cater to the growing needs of older, wealthier individuals while also embracing digital solutions favored by younger generations.

| Sociological Factor | Impact on BEA | Data/Trend (2023-2025) |

|---|---|---|

| Aging Population | Increased demand for wealth management, retirement planning, and healthcare finance. | Hong Kong's 65+ population projected to reach 29.7% by 2041; Mainland China had 280 million aged 60+ by end of 2023. |

| Digital Adoption & Preferences | Need for robust digital platforms and user-friendly mobile banking. | Hong Kong's internet penetration at 93% in 2023; growing preference for digital solutions among younger demographics. |

| Customer Trust & Ethics | Crucial for brand image and customer loyalty; requires transparency and strong data security. | BEA's 2023 customer satisfaction score was 85%; HKMA focuses on consumer protection and financial integrity. |

| Financial Inclusion & SME Support | Expectation to provide accessible services and support economic growth. | HKMA promotes virtual banks for underserved populations; SMEs are vital for economic growth. |

Technological factors

The relentless march of digital transformation is a critical technological factor for Bank of East Asia (BEA). Banks like BEA must constantly invest in new technologies to streamline their operations and improve how customers interact with them. For instance, in 2023, the global banking sector saw significant investment in AI and cloud computing, with many institutions allocating over 15% of their IT budgets to these areas, a trend expected to continue into 2024 and 2025.

Hong Kong's proactive 'Fintech 2025' strategy actively pushes all banks to adopt fintech innovations. This includes areas like wealthtech for investment services, insurtech for insurance products, and regtech for regulatory compliance. BEA's commitment to digitizing its core operations and utilizing platforms like Fintech Connect is essential for maintaining its competitive edge in this evolving landscape.

The banking sector is rapidly evolving with the integration of AI, DLT, and virtual assets. KPMG's 2025 outlook for Hong Kong banking emphasizes Generative AI and virtual assets as key drivers for transforming operating models, with many banks moving beyond experimentation to actual implementation.

Bank of East Asia (BEA) must proactively invest in these technological advancements to ensure its services remain competitive and to strengthen its data governance frameworks. This strategic investment is crucial for future-proofing its operations against the backdrop of accelerated digital transformation across the financial industry.

As digitalization accelerates, cybersecurity and data privacy are becoming increasingly critical for banks like Bank of East Asia. The risk of cyber threats and data breaches is on the rise, necessitating significant investment in advanced security infrastructure to safeguard customer information and combat financial crime.

The Hong Kong Monetary Authority (HKMA) is actively pushing for enhanced cybersecurity and fraud prevention measures across the banking sector. This includes encouraging banks to adopt cutting-edge technologies like advanced analytics and artificial intelligence (AI) to more effectively detect and prevent financial crimes.

Development of Digital Infrastructure

The ongoing development of digital infrastructure in Hong Kong, exemplified by the Commercial Data Interchange (CDI), significantly enhances data sharing capabilities. This advancement allows financial institutions like the Bank of East Asia to more efficiently access and process customer data, thereby accelerating loan application reviews and improving the overall delivery of digital banking services.

The CDI, launched in 2023, aims to connect various data sources, creating a more integrated financial ecosystem. By leveraging such infrastructure, banks can streamline onboarding processes and offer more personalized financial products. This digital backbone is crucial for maintaining competitiveness in a rapidly evolving financial landscape.

- Enhanced Data Accessibility: CDI facilitates easier access to customer information, speeding up credit assessments.

- Streamlined Processes: Digital infrastructure adoption reduces manual intervention in banking operations.

- Improved Digital Services: Banks can offer faster, more efficient digital solutions to customers.

Competitive Landscape from Fintechs and Neo-banks

The financial services sector is experiencing a significant shift due to the emergence of fintech firms and neo-banks. These agile players are challenging traditional institutions like the Bank of East Asia (BEA) by offering innovative digital solutions and often lower fees, forcing BEA to accelerate its own digital transformation efforts to remain competitive.

While digital-only banks are indeed capturing a segment of the market, data suggests that many consumers still value the security and accessibility of physical branches. For instance, in 2024, a significant portion of banking customers, particularly in older demographics, still prefer face-to-face interactions for complex transactions or advice. This highlights the challenge for BEA: it must not only enhance its digital platforms but also clearly articulate the unique value proposition of its hybrid model, addressing potential customer concerns about the absence of a physical presence in purely digital offerings.

The competitive pressure from fintechs is evident in market share shifts and customer acquisition rates. For example, by early 2025, several neo-banks reported substantial year-over-year growth in customer accounts, often exceeding 20%. To counter this, BEA is focusing on:

- Enhancing its mobile banking app with AI-driven personalized services.

- Developing partnerships with fintechs to integrate specialized services.

- Streamlining digital onboarding processes to match the speed of neo-banks.

- Leveraging its existing customer base by offering loyalty programs tied to digital engagement.

Technological advancements are reshaping banking, with AI and DLT becoming central to operational efficiency and customer engagement. Hong Kong's Fintech 2025 strategy mandates digital adoption, pushing institutions like BEA to integrate wealthtech and regtech solutions. By early 2025, many banks were dedicating over 15% of IT budgets to AI and cloud computing, a trend expected to accelerate, driving innovation in services and compliance.

Cybersecurity and data privacy are paramount given escalating digital threats. The HKMA's push for advanced analytics and AI in fraud prevention underscores this, with BEA needing robust security to protect customer data. The Commercial Data Interchange (CDI), operational since 2023, enhances data sharing, enabling faster credit assessments and more personalized digital banking services, crucial for competitiveness.

| Technology Area | Impact on BEA | Industry Trend (2024-2025) |

|---|---|---|

| Artificial Intelligence (AI) | Streamlining operations, personalized services, enhanced fraud detection. | Significant investment in AI for core banking functions, with generative AI adoption increasing. |

| Digital Infrastructure (e.g., CDI) | Faster data access, improved credit assessment, streamlined digital services. | Increased data sharing and integration within financial ecosystems to boost efficiency. |

| Fintech & Neo-banks | Competitive pressure, need for accelerated digital transformation. | Neo-banks showing substantial customer growth (e.g., over 20% YoY), forcing traditional banks to innovate. |

Legal factors

The Bank of East Asia (BEA) operates within a robust regulatory framework primarily overseen by the Hong Kong Monetary Authority (HKMA). This includes adherence to Basel III capital adequacy ratios, which for major banks in Hong Kong, such as BEA, require a Common Equity Tier 1 ratio of at least 4.5%, a Tier 1 capital ratio of 6%, and a total capital ratio of 8% as of year-end 2023. Liquidity coverage ratios and net stable funding ratios are also critical components ensuring operational resilience.

The HKMA's vigilant supervision extends to market risk management, a dynamic area for banks like BEA. For instance, the HKMA regularly updates its guidelines on stress testing and scenario analysis to ensure banks can withstand adverse market movements. In 2024, the HKMA continued its focus on cybersecurity and operational resilience, with banks expected to demonstrate robust defenses against digital threats and disruptions.

Bank of East Asia (BEA) must navigate an increasingly stringent legal landscape concerning Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. Compliance is not just a regulatory requirement but a fundamental operational necessity, given the global drive to combat financial crime. The Hong Kong Monetary Authority (HKMA) is actively pushing for enhanced AML practices, including the adoption of advanced analytics and artificial intelligence, to strengthen the banking sector's defenses against illicit financial activities.

Failure to comply with these evolving regulations can lead to significant penalties, including hefty fines and reputational damage. For instance, in 2023, global financial institutions faced billions in AML-related fines, underscoring the high stakes involved. BEA's commitment to robust customer due diligence and sophisticated transaction monitoring systems is therefore paramount to maintaining its license and trust within the financial ecosystem.

Bank of East Asia (BEA) must navigate a landscape of stringent data protection and privacy laws, particularly concerning customer information. Regulations like the Personal Data (Privacy) Ordinance in Hong Kong dictate how BEA collects, stores, processes, and utilizes customer data, impacting everything from marketing to operational security. Failure to comply can result in substantial fines and reputational damage.

Compliance is not merely a legal obligation but a cornerstone of maintaining customer trust. The Hong Kong Monetary Authority (HKMA) places a significant emphasis on consumer protection, which explicitly includes the safeguarding of sensitive financial data. This regulatory focus means that robust data security measures and transparent data handling practices are paramount for BEA's continued operation and customer loyalty.

Cross-Border Regulatory Compliance

Bank of East Asia (BEA) operates across Hong Kong, mainland China, and other international financial centers, necessitating strict adherence to a patchwork of distinct legal and regulatory regimes. This cross-border complexity is amplified by varying capital adequacy requirements, anti-money laundering (AML) regulations, and data privacy laws, such as GDPR in Europe. For instance, in 2024, the ongoing evolution of financial regulations in mainland China, particularly concerning fintech and digital banking, requires continuous adaptation from BEA to ensure compliance and maintain its market position.

The divergence or harmonization of financial regulations between key markets directly impacts BEA's operational agility and its capacity to deliver standardized banking products and services worldwide. For example, differing approaches to cybersecurity mandates across jurisdictions can lead to increased compliance costs and operational overhead. BEA's extensive global footprint, encompassing operations in over 20 countries as of its 2023 annual report, underscores the significant legal resources dedicated to navigating these multifaceted compliance landscapes.

- Navigating divergent regulatory frameworks: BEA must comply with distinct banking laws, capital requirements, and consumer protection standards in Hong Kong, mainland China, and other operating regions.

- Impact of regulatory harmonization/divergence: Changes in international financial regulations can affect BEA's ability to offer uniform services and may necessitate costly system overhauls.

- Adherence to multiple legal systems: BEA's global presence requires expertise in various legal systems, including contract law, corporate law, and financial services legislation, across its operational territories.

Property Market and Lending Regulations

Regulations surrounding Hong Kong's property market, particularly mortgage lending and developer financing, are critical for Bank of East Asia's (BEA) loan book and overall asset quality. These rules directly influence the bank's risk exposure and the performance of its property-related assets.

Policy shifts in Hong Kong, such as the recent relaxation of certain demand-side management measures in the property sector, are anticipated to foster a market recovery. This regulatory environment, combined with ongoing prudent mortgage regulations, will shape BEA's lending strategies and its approach to managing its property exposure.

- Property Market Regulations: Hong Kong's government has adjusted various measures, including stamp duties and loan-to-value ratios, to stabilize and support the property market. For instance, in late 2023, the government removed all demand-side management measures for residential properties, a significant shift from previous policies aimed at cooling the market.

- Mortgage Lending Rules: The Hong Kong Monetary Authority (HKMA) continues to emphasize prudent mortgage lending, maintaining stress-testing requirements and debt-to-income ratio guidelines. This ensures that banks like BEA maintain robust underwriting standards, even amidst policy adjustments.

- Developer Financing: Regulations also impact how developers access financing, influencing project pipelines and the associated risks for banks. BEA's exposure to property developers will be directly affected by these financing rules and the overall health of the development sector.

- Impact on BEA's Portfolio: The interplay of these regulations and market conditions will influence BEA's loan growth, non-performing loan ratios, and profitability derived from its property-related lending activities. A recovering property market, supported by regulatory easing, could lead to improved asset quality and lending opportunities for the bank.

Bank of East Asia (BEA) must navigate evolving legal frameworks concerning data privacy and cybersecurity, with Hong Kong's Personal Data (Privacy) Ordinance being a key regulation. Failure to comply with these stringent rules, which govern customer data handling, can result in substantial fines and severe reputational damage. The HKMA's emphasis on consumer protection reinforces the need for robust data security measures, directly impacting customer trust and loyalty.

The bank's cross-border operations necessitate adherence to a complex web of international and local laws, including varying capital adequacy and AML regulations. For instance, mainland China's dynamic fintech and digital banking regulations require continuous adaptation from BEA. This regulatory divergence impacts BEA's ability to offer uniform services globally and can increase compliance costs, as highlighted by its operations in over 20 countries as of 2023.

Hong Kong's property market regulations, including mortgage lending rules and developer financing, significantly influence BEA's loan book and asset quality. The recent removal of all demand-side management measures for residential properties in late 2023 by the Hong Kong government is a notable policy shift. BEA must maintain prudent underwriting standards, as emphasized by the HKMA's continued focus on mortgage lending rules, to manage its property exposure effectively.

| Legal Factor | Description | Impact on BEA | Key Regulations/Data |

| Data Privacy & Cybersecurity | Protection of customer data and digital infrastructure security. | Reputational risk, fines, customer trust. | Personal Data (Privacy) Ordinance (Hong Kong). |

| Cross-Border Compliance | Adherence to diverse legal and regulatory regimes across operating regions. | Increased compliance costs, operational complexity, potential for service standardization issues. | Varying capital adequacy, AML laws; China's fintech regulations. BEA operated in over 20 countries (2023). |

| Property Market Regulations | Rules governing mortgage lending, developer financing, and property market stability. | Influence on loan book quality, risk exposure, and lending strategies. | HKMA's prudent mortgage lending; HK government's removal of property demand-side measures (late 2023). |

Environmental factors

Climate change is a major environmental consideration, pushing financial institutions like the Bank of East Asia (BEA) to embed Environmental, Social, and Governance (ESG) principles into their core business strategies and investment decisions. This shift is driven by increasing regulatory pressure and investor demand for sustainable practices.

BEA is actively working towards its net zero commitments, targeting the reduction of its operational emissions by 2030 and financed emissions by 2050. This strategic focus reflects a broader industry trend towards decarbonization and climate risk management.

Furthermore, BEA is actively engaging with its clients and investee companies to foster the adoption of low-carbon business models. This proactive approach aims to support the transition to a greener economy and mitigate climate-related financial risks within its portfolio.

The increasing focus on green and sustainable finance presents significant opportunities and responsibilities for the Bank of East Asia (BEA). The bank is actively enhancing its capabilities in this area, in line with the Hong Kong Monetary Authority's Sustainable Finance Action Agenda, which aims to promote sustainable finance development across the region.

BEA's commitment is further underscored by its status as the first Chinese member of the Net-Zero Banking Alliance. This membership signifies a firm dedication to reducing financed emissions and aligning its lending and investment portfolios with net-zero pathways by 2050.

Bank of East Asia (BEA) is actively addressing climate risk, a growing concern for financial institutions. In 2024, BEA undertook its inaugural double materiality assessment, a crucial step in identifying both the impacts of climate change on the bank and its own influence on climate-related issues. This initiative underscores a commitment to understanding and managing these evolving financial risks.

The bank is enhancing its climate-risk management framework to account for both physical risks, such as damage from extreme weather, and transition risks, stemming from shifts to a lower-carbon economy. This proactive approach is vital as regulatory bodies globally are increasingly mandating climate-related financial risk disclosures. For instance, by the end of 2024, many major jurisdictions are expected to have implemented or be in the process of implementing enhanced climate disclosure requirements for financial institutions.

Operational Environmental Footprint

Bank of East Asia (BEA) is actively managing its direct environmental footprint, focusing on energy consumption, waste, and emissions from its physical locations. The bank has committed to reducing its Scope 1 and 2 emissions, undertaking energy audits to pinpoint areas for improvement.

A significant achievement in this area is BEA Group's reduction of operational emissions by 36.5% by the end of 2024, measured against a 2019 baseline. This demonstrates a tangible commitment to environmental responsibility.

- Operational Emissions Reduction: BEA Group achieved a 36.5% reduction in operational emissions by the end of 2024, compared to 2019 levels.

- Energy Efficiency Initiatives: The bank conducts energy audits to identify and implement opportunities for reducing energy consumption across its branches and offices.

- Scope 1 & 2 Targets: BEA has established specific targets for lowering its direct greenhouse gas emissions.

Stakeholder Expectations for Sustainability

Stakeholders are increasingly demanding that financial institutions like Bank of East Asia (BEA) prioritize environmental, social, and governance (ESG) factors. This pressure comes from investors seeking sustainable returns, customers who prefer ethically aligned businesses, and regulators implementing stricter environmental policies.

BEA is responding to these expectations by embedding sustainability into its operations. For instance, the bank has implemented mandatory ESG training for its employees, ensuring a knowledgeable workforce committed to sustainable practices. Furthermore, its community investment programs are designed to foster long-term social and environmental well-being, aligning with broader societal goals.

These initiatives are crucial for maintaining BEA's reputation and attracting capital in a market where sustainability performance is becoming a key differentiator. For example, in 2024, global ESG investments were projected to reach over $50 trillion, highlighting the significant financial implications of a strong sustainability profile.

- Investor Demand: Growing preference for investments that align with environmental and social values.

- Customer Loyalty: Consumers increasingly choose brands that demonstrate corporate responsibility.

- Regulatory Compliance: Adherence to evolving environmental laws and reporting standards is essential.

- Risk Management: Proactive ESG integration helps mitigate environmental and social risks.

Bank of East Asia (BEA) is actively addressing climate risk, evidenced by its 2024 inaugural double materiality assessment to understand its impact on and from climate issues. This proactive stance is crucial as regulatory bodies globally are increasingly mandating climate-related financial risk disclosures, with many major jurisdictions expected to implement enhanced requirements by the end of 2024.

BEA is committed to reducing its operational emissions by 2030 and financed emissions by 2050, aligning with net-zero goals and the Hong Kong Monetary Authority's Sustainable Finance Action Agenda. The bank's operational emissions saw a significant 36.5% reduction by the end of 2024 compared to 2019 levels, showcasing tangible progress.

| Environmental Factor | BEA's Action/Commitment | Data/Target |

| Climate Change & Net Zero | Net Zero Banking Alliance member, net zero commitments | Operational emissions reduced by 36.5% (by end 2024 vs 2019), financed emissions target by 2050 |

| Climate Risk Management | Double materiality assessment, enhanced risk framework | Inaugural assessment in 2024, focus on physical and transition risks |

| Sustainable Finance | Enhancing capabilities, supporting low-carbon models | Alignment with HKMA's Sustainable Finance Action Agenda |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of East Asia is built on a robust foundation of data from official regulatory bodies, financial market reports, and economic forecasting agencies. We incorporate insights from international organizations, industry-specific publications, and reputable news sources to ensure comprehensive coverage.