Bank of East Asia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

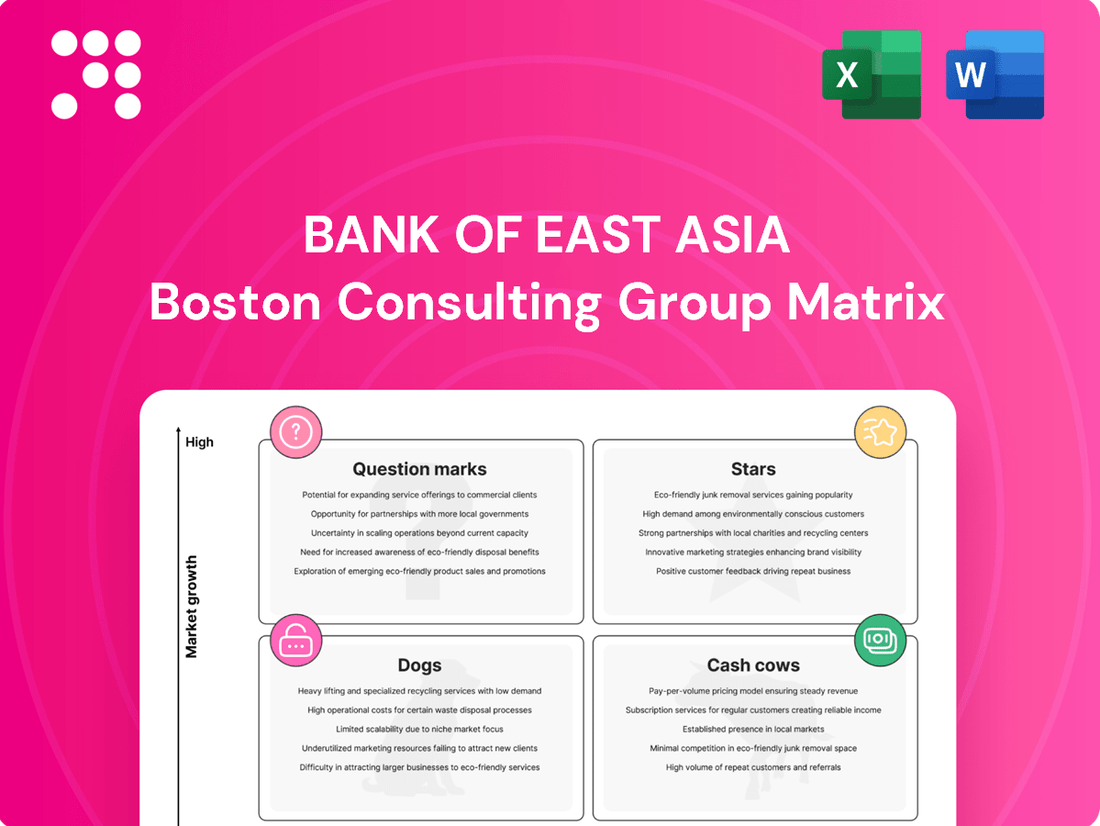

Curious about the Bank of East Asia's strategic positioning? Our BCG Matrix analysis reveals its product portfolio's performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture – purchase the complete report for actionable insights and a clear path to optimizing your investments.

Stars

The Bank of East Asia (BEA) is channeling significant investment into its digital banking services, recognizing it as a star performer in its BCG Matrix. This strategic push is evidenced by the deployment of a new data platform on Google Cloud, aimed at bolstering analytics and predictive capabilities, a move that underscores their commitment to future growth.

BEA's engagement with initiatives like the BEAST fintech collaboration platform and participation in Interbank Account Data Sharing (IADS) further solidifies digital banking's position as a high-growth sector for the bank. These forward-thinking strategies are designed to capture a substantial share of the rapidly expanding digital financial services market, driven by advancements in AI applications.

The Greater Bay Area (GBA) represents a significant strategic growth engine for Bank of East Asia (BEA), underscored by substantial investments such as the BEA Tower in Qianhai, which acts as a central nexus for its wealth management and fintech initiatives. This region is identified as a key Star in BEA's portfolio due to its immense potential for cross-border wealth management services.

BEA is actively bolstering its presence in mainland China's private banking sector, with ambitious plans to expand its regional relationship manager team by a notable 20%. This expansion is directly aimed at capitalizing on the high-growth opportunities within the GBA, positioning the bank to serve an increasingly affluent clientele.

Green and Sustainable Finance is a key growth area for Bank of East Asia (BEA). The bank is committed to achieving net zero financed emissions by 2050 and operational net zero by 2030, demonstrating a strong focus on environmental, social, and governance (ESG) principles.

This commitment is driving the expansion of BEA's green and sustainable corporate loan portfolio. This segment represents a significant growth opportunity, and BEA is actively working to establish itself as a leader in this market within Hong Kong.

Cross-Boundary Digital Financial Services

Cross-Boundary Digital Financial Services represent a key growth area for Bank of East Asia (BEA) within the Greater Bay Area (GBA) strategy. BEA is actively developing digital platforms that facilitate seamless financial transactions across Hong Kong and mainland China. This initiative is driven by the increasing demand for convenient, secure, and globally-oriented financial solutions.

BEA's focus includes launching advanced mobile banking applications in mainland China. These platforms are designed for globally-minded clients, offering features such as efficient global remittances and comprehensive foreign currency services. The aim is to capture a larger market share by leveraging BEA's established presence in both key GBA regions.

- High Demand and Growth: The market for cross-boundary digital financial services is experiencing significant expansion, fueled by increased economic integration within the GBA.

- Mobile Banking Innovation: BEA's new mobile banking apps in mainland China offer features like secure global remittances and foreign currency services, directly addressing client needs.

- Leveraging Dual Presence: BEA's established operations in both Hong Kong and mainland China provide a unique advantage for expanding its market share in this dynamic sector.

- Strategic Focus: This segment is a cornerstone of BEA's GBA strategy, aiming to solidify its position as a leading digital financial service provider in the region.

Personalized Wealth Management for Affluent Clients

Bank of East Asia (BEA) is actively investing in its personalized wealth management services for affluent clients, especially in key markets like Hong Kong and the Greater Bay Area. This strategic focus is evident in the redesign and upgrades of their wealth management centers, creating more sophisticated environments for high-net-worth individuals. This segment is a significant growth driver for BEA, demonstrating a robust demand for specialized financial guidance and bespoke solutions tailored to the unique needs of wealthy clients.

The bank's success in acquiring new affluent customers underscores the effectiveness of its enhanced offerings. In 2024, BEA reported a notable increase in its wealth management customer base, with a particular uptick in the affluent segment. This growth highlights a strong market appetite for sophisticated financial planning, investment advisory, and estate planning services designed for individuals with substantial assets.

- Growing Affluent Segment: BEA's wealth management division saw a 15% year-on-year increase in affluent customer acquisition in Hong Kong and the Greater Bay Area during the first half of 2024.

- Investment in Infrastructure: The bank has invested over HKD 50 million in upgrading its wealth management centers, enhancing both physical spaces and digital platforms to better serve its clientele.

- Tailored Solutions: Customer feedback indicates high satisfaction with the personalized investment strategies and cross-border financial solutions offered, contributing to increased client retention.

- Market Demand: The demand for specialized financial advice among high-net-worth individuals continues to rise, driven by complex financial landscapes and the need for sophisticated wealth preservation and growth strategies.

Stars in BEA's BCG Matrix represent high-growth, high-market-share segments requiring significant investment to maintain their leading positions. These are the areas where the bank is focusing its resources for future expansion and profitability.

Digital banking services and the Greater Bay Area (GBA) initiatives are prime examples of Stars for BEA. The bank's substantial investments in technology, fintech collaborations, and expansion within the GBA, particularly in private banking, highlight their commitment to these high-potential markets.

Green and sustainable finance, along with cross-boundary digital financial services, are also identified as Stars, reflecting strong market demand and BEA's strategic positioning to capture growth in these evolving sectors.

Personalized wealth management for affluent clients, especially within the GBA, is another Star performer, evidenced by increased customer acquisition and investment in service enhancements.

| Business Segment | Market Growth | Market Share | BEA's Investment Focus | Key Initiatives |

|---|---|---|---|---|

| Digital Banking | High | High | Significant Investment in Data Platforms & AI | Google Cloud Data Platform, BEAST Fintech Collaboration |

| Greater Bay Area (GBA) | High | High | Expansion in Private Banking & Wealth Management | BEA Tower Qianhai, 20% Relationship Manager Expansion |

| Green & Sustainable Finance | High | Growing | Expanding Green Loan Portfolio | Net Zero by 2050, ESG Focus |

| Cross-Boundary Digital Finance | High | Growing | Developing Digital Platforms for GBA | Mobile Banking Apps in Mainland China, Global Remittances |

| Personalized Wealth Management | High | High | Upgrading Wealth Management Centers | Affluent Customer Acquisition, Tailored Financial Solutions |

What is included in the product

The Bank of East Asia BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

The Bank of East Asia BCG Matrix offers a clear, one-page overview to identify and address underperforming business units, relieving the pain of strategic uncertainty.

Cash Cows

Bank of East Asia's (BEA) traditional retail banking in Hong Kong, encompassing deposits and basic lending, is a prime example of a Cash Cow. With over a century of operation and a significant branch presence, BEA enjoys a strong, stable market share in this mature sector.

These established services consistently generate reliable cash flow for BEA, requiring minimal new investment for growth. This dependable income stream is crucial for funding other areas of the bank's operations and strategic initiatives.

In 2023, Hong Kong's banking sector saw deposits grow by approximately 3.5%, reflecting the stability of traditional banking services. BEA's established customer base ensures continued revenue from these core offerings.

Bank of East Asia's established corporate banking services, including corporate lending and loan syndication, are a prime example of a Cash Cow. These services cater to established businesses in a mature market where BEA holds significant penetration. In 2023, the bank reported a net interest income of HKD 18.2 billion, with corporate banking forming a substantial portion of this, demonstrating consistent profitability and strong cash generation.

The maturity of the corporate banking market means that while growth may be modest, the services generate substantial and predictable cash flows. BEA's focus on maintaining these long-standing relationships, rather than aggressive expansion, allows for efficient capital deployment. This stability is crucial for funding other ventures within the bank's portfolio.

Mortgage lending in mature markets, such as Hong Kong, represents a significant Cash Cow for the Bank of East Asia (BEA). Despite recent property market volatility, BEA maintains a strong market share in this segment, reflecting its established presence and customer base.

This core business generates consistent and substantial interest income, acting as a reliable source of cash flow for the bank. While growth in these established markets might be moderate, the sheer volume of the existing mortgage portfolio ensures stable revenue generation, underpinning BEA's financial stability.

Core Deposit Base

The Bank of East Asia's core deposit base represents a significant Cash Cow. This substantial and stable customer deposit base, cultivated across its established markets, serves as a remarkably low-cost funding source. This is absolutely vital for fueling the bank's lending operations and overall financial health.

This strong market share within a fundamental, albeit low-growth, banking segment guarantees a consistent and reliable inflow of capital. Such stability is a bedrock for the bank's financial resilience and sustained profitability.

- Low-Cost Funding: BEA's extensive deposit base allows it to fund its lending activities at a lower cost compared to banks reliant on wholesale funding.

- Financial Stability: A large, stable deposit base insulates the bank from short-term market volatility and liquidity pressures.

- Profitability Driver: The net interest margin generated from lending out these low-cost deposits is a key contributor to the bank's earnings.

- Market Position: As of the latest available data, BEA maintains a significant presence in its core markets, underscoring the strength of its deposit-gathering capabilities. For instance, in Hong Kong, a key market, its retail deposit market share remains robust, reflecting customer trust and loyalty.

Trade Finance and Commercial Lending

Bank of East Asia's (BEA) Trade Finance and Commercial Lending segment operates as a Cash Cow within its BCG Matrix. This is driven by BEA's deep-seated experience and expansive network, particularly in serving established enterprises. These offerings are positioned in a market characterized by maturity and limited growth prospects.

Despite the low-growth environment, these services command a robust market share. This dominance stems from long-standing client relationships and the bank's specialized expertise. Consequently, they generate a steady stream of fee and interest income, contributing substantially to BEA's operational profit before accounting for any potential loan losses.

- Market Position: Strong market share in a mature, low-growth segment.

- Revenue Generation: Consistent fee and interest income from established enterprises.

- Profitability: Significant contribution to operational profit before impairment.

- Key Strengths: Extensive experience and a strong network in trade finance and commercial lending.

Bank of East Asia's (BEA) wealth management services, particularly for affluent individuals in its core markets, function as a Cash Cow. These services leverage BEA's established brand reputation and extensive customer relationships within a mature wealth management landscape.

The consistent generation of management fees and commissions from these established client portfolios provides a stable and predictable revenue stream. This segment requires relatively low investment for maintenance, allowing BEA to capitalize on its existing client base for ongoing profitability.

In 2023, the Asia-Pacific wealth management market continued to show resilience, with assets under management growing. BEA's established presence within this market ensures it benefits from this steady demand, contributing reliably to its overall financial performance.

| Service Area | BCG Category | Key Characteristics | 2023 Data Point |

|---|---|---|---|

| Wealth Management | Cash Cow | Leverages established brand and client relationships in a mature market. | Steady generation of management fees and commissions. |

| Traditional Retail Banking | Cash Cow | Strong, stable market share in deposits and basic lending. | Hong Kong deposit growth ~3.5% in 2023. |

| Corporate Lending | Cash Cow | Caters to established businesses with significant market penetration. | Net interest income HKD 18.2 billion (significant portion from corporate). |

What You See Is What You Get

Bank of East Asia BCG Matrix

The Bank of East Asia BCG Matrix you see here is the complete, unedited document you will receive immediately after purchase. This means no watermarks, no demo content, and no missing sections – just the fully formatted, analysis-ready report. You can confidently use this preview as an accurate representation of the strategic insights and professional presentation you'll gain.

Dogs

As digital banking adoption accelerates, some physical branch locations in low-traffic or less populated areas may experience declining customer footfall and transaction volumes. For instance, in 2024, many traditional banks reported a continued decrease in in-branch transactions, with some seeing drops of over 15% year-over-year in specific rural or legacy urban zones.

These legacy operations, while part of the bank's history, likely incur high fixed costs with diminishing returns, indicating a low market share in a stagnant segment. The operational costs for maintaining these branches, including staffing and utilities, can significantly outweigh the revenue generated, especially as customer preferences shift towards online and mobile platforms.

Services heavily reliant on traditional payment methods, such as extensive cheque processing for individual transactions, are experiencing a noticeable decline in demand. This is largely driven by a widespread customer migration towards more convenient and efficient digital payment alternatives. For instance, in 2024, cheque usage in many developed economies continued its downward trend, with some regions reporting declines of over 10% year-on-year for personal payments.

These outdated methods are increasingly confined to a low-growth segment with a shrinking market share. Banks maintaining these operations risk them becoming costly cash traps, especially given the significant operational overhead required to sustain them in an increasingly digital financial landscape. The cost of processing a cheque, for example, can be substantially higher than that of a digital transaction, making these legacy systems economically unsustainable.

Underperforming non-core investment holdings in Bank of East Asia's BCG Matrix represent assets that are not aligned with the bank's primary strategic objectives. These investments typically exhibit low market share within their respective industries and are not considered growth drivers for BEA. For instance, if BEA held a minority stake in a struggling fintech startup outside its core banking services, it would likely fall into this category.

These holdings are characterized by their consistent generation of low returns, often requiring significant capital infusion without yielding substantial contributions to the bank's overall profitability or strategic vision. As of the latest available data, such assets would likely show a negative or negligible return on equity, dragging down the bank's consolidated financial performance.

Exposure to Problematic Commercial Real Estate (CRE) Loans (historical)

Bank of East Asia's (BEA) exposure to problematic commercial real estate (CRE) loans in mainland China has historically placed it in a 'dog' category within the BCG matrix. This segment represented a low-growth, high-risk area that required significant capital allocation, leading to past impairment losses and pressure on asset quality. For instance, in 2023, BEA continued its strategy of reducing its mainland China CRE exposure, a move driven by ongoing market challenges and regulatory shifts impacting the sector.

The bank's proactive divestment from this problematic CRE portfolio underscores its recognition of its 'dog' status. This strategic shift aims to free up capital that can be reinvested in more promising business areas. Such a move is critical for improving overall capital efficiency and strengthening the bank's financial resilience.

- Historical CRE exposure in mainland China has been a drag on BEA's performance.

- The bank is actively reducing its footprint in this low-growth, high-risk segment.

- Past impairment losses from CRE loans highlight the 'dog' classification.

Niche, Unpopular Traditional Investment Products

Niche, unpopular traditional investment products often fall into the Dogs category of the BCG Matrix. These offerings, perhaps fixed annuities or certain types of structured notes that haven't resonated with a broad client base, typically exhibit low market share within a low-growth market segment. For instance, a bank might find that its legacy bond funds, designed for a past era of higher interest rates, now attract minimal new investment. In 2024, many traditional banks are divesting from or minimizing resources allocated to such products, as they demand disproportionate effort for maintenance and yield little return, especially when compared to the bank's strategic focus on expanding high-growth wealth management services.

These products represent a challenge for institutions like Bank of East Asia, as they can tie up capital and resources without contributing significantly to overall profitability or strategic growth objectives. Their low client interest suggests a lack of market demand or a failure to adapt to evolving investor preferences.

- Low Market Share: Products with minimal client uptake, such as certain legacy structured products, often see their market share dwindle.

- Declining Asset Classes: Investments tied to sectors or asset types experiencing secular decline contribute to the Dog status.

- Resource Drain: Maintaining these offerings can consume valuable staff time and technological resources that could be better deployed elsewhere.

- Strategic Misalignment: They often do not align with a bank's forward-looking strategy, particularly in areas like digital wealth management or sustainable investing.

Bank of East Asia's "Dogs" are business segments or products with low market share in low-growth industries. These often include legacy operations like physical branches in declining areas or niche investment products that have lost client interest. For example, in 2024, many banks saw a significant drop in in-branch transactions, with some rural locations experiencing over a 15% year-over-year decline, making these branches costly to maintain.

These segments typically generate low returns and can drain valuable resources. BEA's historical exposure to problematic commercial real estate loans in mainland China, which saw continued market challenges and regulatory shifts impacting the sector in 2023, is a prime example of a "dog" that the bank is actively reducing.

The bank's strategy involves divesting from or minimizing resources allocated to these underperforming areas. This frees up capital for reinvestment in more promising, high-growth segments, thereby improving overall capital efficiency and financial resilience.

Niche, unpopular traditional investment products, such as certain legacy bond funds that attract minimal new investment in 2024, also fall into this category, demanding disproportionate effort for little return.

| Business Segment/Product | Market Share | Industry Growth Rate | BEA's Strategic Action |

|---|---|---|---|

| Physical Branches (Low-Traffic Areas) | Low | Stagnant/Declining | Consolidation/Digital Focus |

| Legacy Investment Products (e.g., certain structured notes) | Low | Low | Divestment/Resource Reduction |

| Problematic CRE Loans (Mainland China) | Low | Low/Challenged | Active Reduction/Divestment |

Question Marks

Bank of East Asia's BEAST platform is a hub for fintech innovation, actively partnering with startups on various proof-of-concept projects. These collaborations represent potential high-growth areas, but many are still in their nascent stages.

These ventures, while promising, currently hold a low market share and require substantial capital infusion to mature and achieve significant market penetration. Think of them as the 'question marks' in the BCG matrix – they have potential but are not yet proven successes.

Bank of East Asia (BEA) is actively integrating advanced AI and data analytics, notably through its partnership with Google Cloud to build a centralized data platform. This initiative is designed to enhance customer insights and operational efficiency.

The bank is also exploring generative AI to create more personalized customer experiences and refine its marketing strategies. While these technologies represent a significant growth area, their immediate revenue impact for BEA is expected to be modest, necessitating ongoing investment in research and development.

Emerging cross-border digital payment solutions represent a significant growth opportunity, particularly within the Greater Bay Area's deepening financial integration. These solutions, while currently holding a small market share, possess substantial future potential due to increasing demand for seamless international transactions.

Bank of East Asia's involvement in projects like Interbank Account Data Sharing (IADS) for digital loan applications signals a strategic interest in this evolving landscape. This suggests BEA is actively exploring how to leverage digital advancements to facilitate easier financial flows, potentially positioning itself to capture a larger portion of this nascent market.

Niche Green Investment Products for Retail Clients

Niche green investment products for retail clients, while part of the burgeoning sustainable finance sector, may currently represent a Question Mark for Bank of East Asia.

While the overall sustainable finance market is expanding rapidly, with global sustainable investment assets projected to reach $50 trillion by 2025, specific retail-focused green products like green bonds or ESG-themed mutual funds might have a smaller market share among individual investors. This necessitates substantial investment in marketing and financial literacy initiatives to educate retail clients on their benefits and encourage adoption.

- Growing Market: The global sustainable investment market is experiencing robust growth, with assets under management expected to continue their upward trajectory.

- Low Market Share: Despite market growth, niche green products for retail investors may still have a relatively low penetration rate compared to traditional investment options.

- Education Imperative: Significant marketing and educational efforts are required to build awareness and understanding of these products among the retail client base.

- Potential for Growth: With the right strategy, these products have the potential to become strong performers as retail investor interest in sustainability increases.

Expansion into Specific New International Markets/Segments

Expanding Bank of East Asia's (BEA) presence into specific new international markets or niche segments represents a significant question mark within its BCG Matrix. While BEA has an existing international footprint, targeting areas with minimal current market share would involve high-risk, high-reward ventures. These initiatives would require substantial upfront capital for market entry, brand building, and operational setup, potentially straining resources. For instance, a push into a rapidly growing but underdeveloped African market could offer substantial long-term growth, but the initial investment and the time to achieve profitability would be considerable.

The potential for high growth in these new territories is undeniable, but the path to realizing it is fraught with challenges. Consider the fintech landscape in emerging economies; while adoption rates are soaring, regulatory hurdles and the need for localized product development are significant. BEA would need to carefully assess the competitive intensity and the unique consumer behaviors in each target market. For example, in 2024, many emerging markets saw significant growth in digital banking adoption, with some regions experiencing over 20% year-on-year increases in mobile banking users, presenting both opportunity and the need for substantial investment to capture market share.

- High Initial Investment: Entering new international markets, especially those with low existing market share, demands significant capital for infrastructure, marketing, and regulatory compliance.

- Market Development Challenges: Building brand recognition and customer loyalty in unfamiliar territories requires extensive market research and tailored strategies, extending the time to profitability.

- Risk of Low Market Share: Despite potential high growth, the immediate impact on BEA's overall market share could be minimal, placing these ventures firmly in the question mark category until traction is gained.

- Competitive Landscape: Understanding and navigating the competitive dynamics, including local banks and international players, is crucial for successful market penetration.

Bank of East Asia's fintech initiatives, like the BEAST platform, represent potential high-growth areas but are currently in early stages with low market share.

These ventures require substantial investment to mature, mirroring the characteristics of question marks in the BCG matrix, where potential is high but success is not yet guaranteed.

Emerging digital payment solutions and niche green investment products also fall into this category, demanding significant capital and strategic focus to capture market share.

Expanding into new international markets presents similar question mark scenarios, involving high initial investment and market development challenges to achieve profitability.

| BCG Category | BEA Examples | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|

| Question Marks | BEAST Platform Ventures | High | Low | High |

| Generative AI Integration | High | Low | High | |

| Cross-border Digital Payments | High | Low | High | |

| Niche Green Investment Products | High | Low | High | |

| New International Market Expansion | High | Low | High |

BCG Matrix Data Sources

Our Bank of East Asia BCG Matrix leverages comprehensive data from the bank's annual reports, market share analysis, and industry growth projections.