Bank of East Asia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

The Bank of East Asia faces moderate bargaining power from its customers, as switching costs are relatively low, and a diverse range of banking options exist. However, the intensity of rivalry within the banking sector is significant, with numerous established players vying for market share and customer loyalty. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Bank of East Asia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The banking sector's growing dependence on specialized technology vendors for essential services like core banking, cybersecurity, and data analytics significantly impacts supplier power. In 2024, the market for core banking solutions, for instance, saw continued consolidation, with a few major players holding substantial market share, giving them leverage.

When a limited number of vendors dominate critical software or infrastructure, their bargaining power escalates. This can translate into increased costs or less favorable contract terms for Bank of East Asia, as these providers are indispensable for modern banking operations.

Bank of East Asia can counter this by investing in developing its own proprietary technology solutions or by actively diversifying its technology suppliers. This strategy reduces reliance on any single vendor, thereby diminishing their ability to dictate terms and prices.

Depositors, institutional investors, and interbank lenders are the primary suppliers of capital for Bank of East Asia (BEA). In 2024, the bank's ability to attract and retain these capital sources is paramount. A highly liquid market with numerous funding options generally grants BEA greater bargaining power.

However, should specific funding sources become scarce or concentrated, those suppliers gain leverage. This scarcity could force BEA to offer higher interest rates or accept more stringent terms, directly increasing its cost of funds and potentially impacting profitability.

The availability of skilled financial professionals, IT specialists, and wealth management experts is crucial for Bank of East Asia (BEA). A tight labor market for these roles, particularly in areas like cybersecurity and digital banking, can significantly increase the bargaining power of potential employees and recruitment agencies. For instance, in 2024, the demand for cybersecurity professionals in the financial sector remained exceptionally high, with average salaries for experienced individuals seeing substantial increases.

Regulatory Bodies and Compliance Frameworks

Regulatory bodies, while not traditional suppliers, wield significant power over Bank of East Asia (BEA) by dictating operational rules and imposing compliance costs. Their authority to levy fines, restrict business activities, or mandate specific investments in compliance infrastructure directly impacts BEA's profitability and strategic flexibility.

BEA must continually invest in adapting to evolving regulatory landscapes, which can translate into substantial operational expenses. For instance, in 2024, financial institutions globally faced increased scrutiny and new compliance requirements related to data privacy and anti-money laundering, leading to heightened IT and legal expenditures.

- Regulatory Imposition: Regulators can enforce costly compliance measures, affecting operational efficiency.

- Financial Penalties: Non-compliance can result in significant fines, impacting financial performance.

- Strategic Constraints: Regulatory frameworks can limit the scope of business activities and product offerings.

- Compliance Costs: Ongoing investment in technology and personnel is required to meet regulatory standards.

Payment Network Providers and Financial Market Infrastructures

Bank of East Asia (BEA), like other financial institutions, is significantly reliant on payment network providers and financial market infrastructures. These entities, such as SWIFT for international messaging and Visa or Mastercard for card processing, are critical for enabling transactions. Their widespread adoption and the network effects they generate often lead to concentrated market structures, giving them considerable leverage.

The bargaining power of these suppliers stems from their essential role and the high switching costs associated with changing networks or infrastructures. For instance, Visa and Mastercard process billions of transactions globally, and their fee structures directly impact the profitability of banks like BEA. In 2024, interchange fees, a primary revenue source for card networks, remained a significant cost component for financial institutions, reflecting the suppliers' pricing power.

- Essential Reliance: BEA depends on global payment networks (e.g., SWIFT, Visa, Mastercard) and financial market infrastructures for its core operations.

- Oligopolistic/Monopolistic Nature: Many of these providers operate in concentrated markets, allowing them to dictate terms and fees.

- Cost Pressure: BEA's limited ability to negotiate with these powerful suppliers can lead to increased operating costs.

- Transaction Fees: In 2024, interchange fees charged by card networks like Visa and Mastercard continued to represent a substantial cost for banks, underscoring supplier leverage.

Suppliers of critical technology and specialized financial services can exert significant bargaining power over Bank of East Asia (BEA). In 2024, the consolidation within core banking software markets meant a few dominant vendors held considerable sway, potentially leading to higher costs or less favorable terms for BEA due to their indispensability.

Similarly, providers of payment networks and financial market infrastructures, like SWIFT and major card processors, demonstrate strong leverage. Their essential role in facilitating transactions and the high costs associated with switching systems mean BEA has limited room to negotiate fees, as evidenced by ongoing interchange fees charged by networks like Visa and Mastercard in 2024.

The availability of skilled labor, particularly in high-demand areas like cybersecurity and digital banking, also empowers potential employees and recruitment agencies. The intense competition for these professionals in 2024 drove up salary expectations, increasing BEA's human capital costs.

| Supplier Type | 2024 Market Dynamics | Impact on BEA | Mitigation Strategies for BEA |

|---|---|---|---|

| Technology Vendors (Core Banking) | Market consolidation, few dominant players | Increased costs, less favorable contract terms | Proprietary tech development, vendor diversification |

| Payment Networks (Visa, Mastercard) | High transaction volume, strong network effects | Pressure on operating costs via interchange fees | Negotiation, exploring alternative payment rails |

| Skilled Financial Professionals | Tight labor market, high demand (e.g., cybersecurity) | Increased salary and recruitment expenses | Talent development programs, competitive compensation |

What is included in the product

This analysis of the Bank of East Asia examines the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitutes on its profitability and strategic positioning.

Effortlessly identify and mitigate competitive threats with a dynamic Porter's Five Forces model, allowing for proactive strategic adjustments to safeguard profitability.

Customers Bargaining Power

For everyday banking needs like savings and checking accounts, individual customers in Hong Kong face minimal hurdles when switching banks. This low barrier to entry, combined with intense competition and promotional offers from rival institutions, significantly enhances the bargaining power of these retail clients. They can readily move to institutions providing more attractive interest rates, reduced service charges, or more advanced digital platforms.

Customers today have unprecedented access to information, making it easier than ever to compare banking products, interest rates, and fees. This transparency significantly boosts their bargaining power.

Online comparison platforms and financial advisors empower individuals and businesses to make informed choices, directly influencing BEA's need to offer competitive pricing and superior service. For instance, in 2024, a significant portion of retail banking customers actively used comparison websites before selecting a new account or loan product.

Many of Bank of East Asia's core banking products, like standard loans and deposit accounts, are viewed by customers as interchangeable commodities. This means customers are highly sensitive to price differences. For instance, a survey in late 2023 indicated that over 60% of retail banking customers consider interest rates the primary factor when choosing a savings account provider.

Unless BEA can effectively differentiate its services beyond just price, perhaps through superior digital platforms or specialized advisory, customers will naturally seek out the lowest cost options. This competitive pricing pressure can significantly squeeze profit margins for the bank. In 2024, average net interest margins for many regional banks have hovered around 2.5% to 3%, making differentiation crucial.

Consolidation and Sophistication of Corporate Clients

Large corporate clients and institutional investors wield considerable influence over Bank of East Asia (BEA). Their substantial transaction volumes and sophisticated financial requirements empower them to negotiate more favorable terms for services like lending and treasury management. For instance, in 2024, major corporations often manage their banking relationships through dedicated teams, increasing their leverage.

These sophisticated clients possess the financial acumen and market knowledge to compare offerings from multiple banks, including BEA's competitors. This ability to shop around intensifies their bargaining power, as they can readily switch providers if terms are not met. This is particularly evident in areas requiring complex advisory services where specialized expertise is sought.

- Sophisticated Needs: Large clients demand tailored financial solutions, increasing their negotiation leverage.

- Multiple Banking Relationships: Access to various banking partners allows clients to compare and demand better terms from BEA.

- Volume of Business: The sheer scale of transactions from these clients incentivizes banks to offer competitive pricing and conditions.

- In-house Expertise: Corporate finance teams can directly negotiate, reducing reliance on external advisory and strengthening their bargaining position.

Emergence of Fintech Alternatives for Specific Services

The rise of fintech alternatives significantly amplifies customer bargaining power. Specialized platforms now offer services like peer-to-peer lending, digital payments, and robo-advisory, directly competing with traditional banks. This unbundling allows customers to cherry-pick the best services, diminishing their dependence on a single institution like Bank of East Asia (BEA). For instance, the global digital payments market was valued at over $2 trillion in 2023 and is projected to grow substantially, indicating a strong shift towards specialized fintech solutions.

This increased choice empowers customers to demand better value and more competitive pricing from incumbent banks. They can easily switch providers for specific needs, forcing banks to innovate and improve their offerings to retain business. This competitive pressure from fintechs means customers are no longer locked into a single banking relationship for all their financial needs.

- Fintech Adoption: In 2023, global fintech adoption reached 75%, up from 64% in 2019, demonstrating a clear trend of consumers embracing alternative financial services.

- Digital Payments Growth: The digital payments market is expected to grow at a CAGR of over 12% from 2024 to 2030, highlighting the increasing preference for specialized payment solutions.

- Robo-Advisory Expansion: Assets under management for robo-advisors in the Asia-Pacific region are projected to reach hundreds of billions by 2027, indicating customer willingness to use technology for investment management.

- Customer Switching Behavior: Surveys in 2024 indicate that a significant percentage of banking customers are willing to switch providers for better digital experiences or lower fees, directly influenced by fintech offerings.

The bargaining power of customers for Bank of East Asia (BEA) is significantly high due to low switching costs for retail banking and the commoditized nature of many core products. Customers can easily compare rates and fees, forcing BEA to remain competitive. Large corporate clients also wield substantial power, leveraging their transaction volumes and sophisticated needs to negotiate favorable terms, further intensifying this pressure.

| Factor | Impact on BEA | Supporting Data (2023-2024) |

|---|---|---|

| Retail Customer Switching Costs | High Bargaining Power | Low barriers to entry for new banks in Hong Kong; 60%+ of retail customers prioritize interest rates. |

| Product Commoditization | High Bargaining Power | Core banking products like savings accounts are seen as interchangeable, increasing price sensitivity. |

| Information Transparency | High Bargaining Power | Widespread use of comparison platforms empowers customers to find best deals. |

| Fintech Competition | High Bargaining Power | Global fintech adoption at 75% (2023); Digital payments market growth exceeding 12% CAGR. |

| Corporate Client Leverage | High Bargaining Power | Large clients negotiate based on transaction volume and specialized needs; dedicated relationship teams. |

Preview the Actual Deliverable

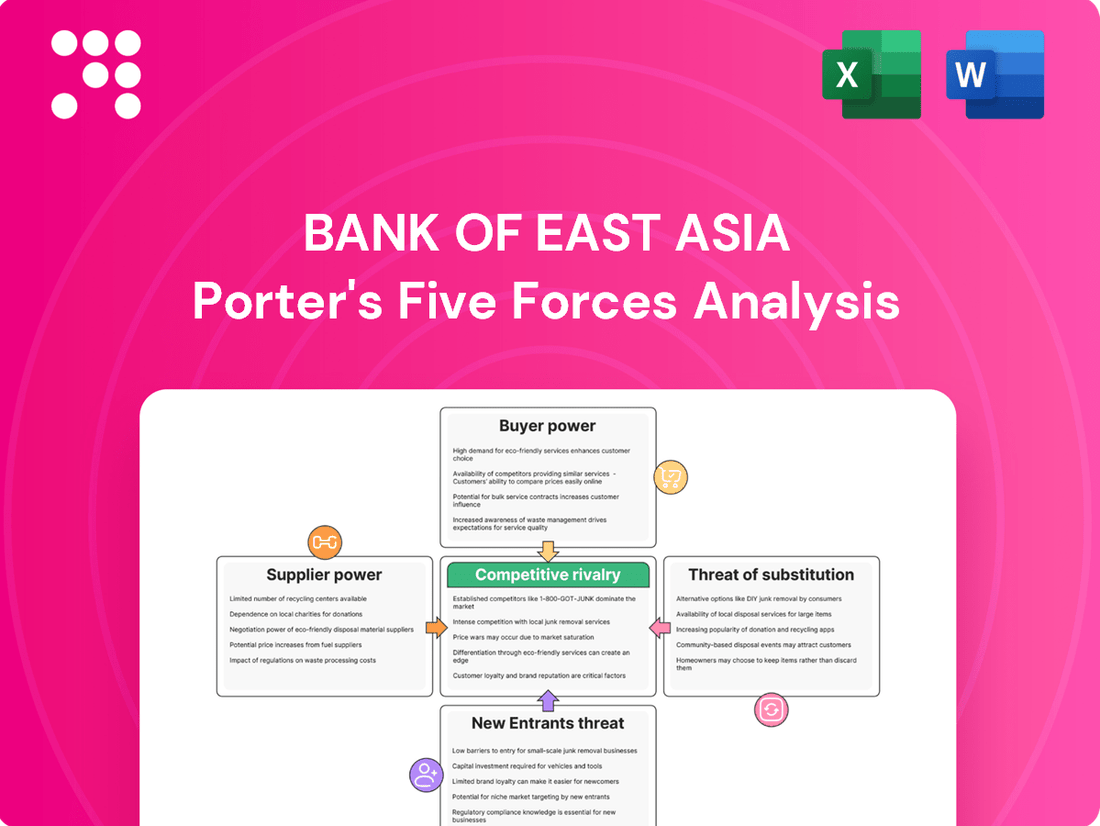

Bank of East Asia Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the Bank of East Asia, detailing the competitive landscape and strategic implications for the institution. The document you see here is the exact, fully formatted report you will receive immediately upon purchase, offering actionable insights without any placeholders or alterations. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this detailed analysis, ready for your immediate use.

Rivalry Among Competitors

The Hong Kong banking sector, Bank of East Asia's (BEA) primary arena, is intensely competitive. BEA contends with formidable local institutions such as HSBC and Bank of China (Hong Kong), which command substantial market share and brand loyalty. This rivalry extends to global banking giants with a strong Hong Kong presence, further intensifying the competitive landscape.

This robust competition compels banks to aggressively pursue customers across all segments, from retail banking and small businesses to high-net-worth individuals in wealth management. Consequently, pricing strategies are often aggressive, and there's a continuous drive for innovative product development to differentiate offerings and capture market share.

The Hong Kong banking sector is a mature market, meaning the days of easy, rapid expansion in traditional services like lending and deposits are largely behind us. This maturity naturally leads to more intense competition as banks vie for a smaller pool of new customers and try to win over existing ones from rivals. In 2023, Hong Kong's GDP growth was around 3.2%, a modest figure that reflects this maturing economic landscape and limits the organic growth potential for established banking products.

This intensified rivalry pushes banks, including Bank of East Asia (BEA), to explore new avenues for growth. Strategies often involve significant investments in digital transformation to improve customer experience and efficiency, expanding into less saturated cross-border markets, or identifying and serving specialized niche markets that offer higher margins. These strategic shifts, while necessary, also introduce new competitive dynamics and pressures as players adapt to evolving market demands.

The competitive rivalry in the banking sector is intensifying due to a significant digital transformation and innovation race. Major banks, including Bank of East Asia (BEA), are pouring substantial resources into virtual banking, artificial intelligence (AI), and enhanced digital platforms to improve customer experience and streamline operations.

This relentless pursuit of technological advancement creates a fierce competition where banks must constantly innovate their services and upgrade their systems. Failure to keep pace risks losing customers to nimbler, digital-first competitors or those banks that successfully leverage new technologies to offer superior convenience and personalized services.

For instance, in 2024, many banks reported increased spending on IT infrastructure and digital development, with some allocating over 15% of their operating expenses to these areas. This investment is crucial for staying relevant in a market where customer expectations are increasingly shaped by seamless digital interactions.

Aggressive Pricing and Product Bundling Strategies

The banking sector, including institutions like the Bank of East Asia, faces intense rivalry, often manifesting in aggressive pricing. This means banks frequently compete by offering lower interest rates on loans and higher rates on savings accounts, alongside reduced service fees. These tactics, while attracting customers, can significantly squeeze profit margins across the industry.

Product bundling is another key competitive tactic. Banks aim to offer a comprehensive suite of financial products, from mortgages and credit cards to investment services, to secure a larger share of a customer's financial needs. This strategy intensifies the competition for building deep, lasting client relationships.

- Aggressive Pricing: Banks compete on price, offering lower loan rates and higher deposit rates.

- Fee Reduction: Competition leads to reduced fees on various banking services, impacting revenue.

- Product Bundling: Institutions bundle products to increase customer loyalty and wallet share.

- Margin Erosion: These competitive pressures can lead to a general erosion of profit margins for all market participants.

Regulatory Environment Promoting Competition

Hong Kong regulators have actively fostered competition within the banking sector. A prime example is the issuance of virtual bank licenses, which has significantly reduced entry barriers for new, digitally-focused financial institutions. This regulatory stance encourages established players like Bank of East Asia (BEA) to enhance their offerings and compete more intensely.

This environment prevents any single entity from dominating the market, creating a more vibrant and dynamic banking landscape. For instance, by the end of 2023, Hong Kong had issued eight virtual banking licenses, bringing new digital-first competitors into play.

- Virtual Bank Licensing: Hong Kong's proactive approach to virtual banking licenses has opened the door for new entrants.

- Lowered Entry Barriers: Digitally-native banks face fewer traditional hurdles, intensifying competition.

- Innovation Driver: Regulatory encouragement pushes incumbent banks like BEA to innovate and improve services.

- Dynamic Market: This fosters a more competitive and less concentrated banking sector.

The competitive rivalry in Hong Kong's banking sector, where Bank of East Asia (BEA) operates, is exceptionally fierce. This intensity stems from a mature market, aggressive pricing strategies, and a significant digital transformation race. Banks are compelled to innovate constantly, leading to potential margin erosion as they vie for market share and customer loyalty.

In 2024, the digital innovation race continues to be a major driver of competition. Banks are investing heavily in areas like AI and virtual platforms, with some allocating over 15% of operating expenses to IT and digital development. This focus on technology is crucial for meeting evolving customer expectations and staying ahead of agile, digital-first competitors.

Regulatory actions, such as the issuance of virtual bank licenses, have further lowered entry barriers, introducing new digital-native players. By the end of 2023, Hong Kong had issued eight such licenses, fostering a more dynamic and less concentrated banking landscape that challenges incumbents like BEA to enhance their offerings and operational efficiency.

SSubstitutes Threaten

Fintech platforms present a significant threat of substitution for Bank of East Asia's (BEA) payment and lending services. Mobile payment giants like Alipay and WeChat Pay, particularly dominant in mainland China where BEA operates, offer seamless alternatives for transactions. In 2023, mobile payments accounted for over 80% of all online transactions in China, demonstrating the widespread adoption of these substitutes.

Similarly, peer-to-peer (P2P) lending platforms provide a direct substitute for traditional bank loans. These platforms often appeal to customers by offering more competitive rates or a faster, more accessible application process. The global P2P lending market was valued at approximately $100 billion in 2023 and is projected to grow substantially, indicating a growing customer preference for these alternative financing channels.

Large corporations are increasingly bypassing traditional banking channels by directly accessing capital markets. In 2024, global bond issuance by corporations reached significant levels, offering a direct alternative to bank loans for financing needs. This trend directly impacts Bank of East Asia's (BEA) corporate lending services, especially for substantial financing requirements where direct market access is more efficient.

Robo-advisors and online investment platforms present a significant threat of substitutes for Bank of East Asia's wealth management services. These digital alternatives offer automated, cost-effective investment management, attracting a growing segment of investors, particularly those who are tech-savvy or have smaller account balances. For instance, by mid-2024, the global robo-advisor market was projected to exceed $2.5 trillion in assets under management, highlighting their increasing appeal and competitive pressure on traditional banking models.

Cryptocurrencies and Decentralized Finance (DeFi)

The rise of cryptocurrencies and Decentralized Finance (DeFi) poses a developing threat to traditional banking services. These digital alternatives are increasingly offering functions like cross-border payments, loans, and even interest-bearing accounts, directly competing with established banks like Bank of East Asia (BEA). While still in its early stages, the potential for these technologies to attract customers away from conventional banking channels is a significant consideration.

The global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, indicating substantial growth and user engagement. This expansion suggests a growing comfort level with digital assets and decentralized platforms. Furthermore, the DeFi sector has seen significant inflows, with total value locked (TVL) in DeFi protocols exceeding $100 billion at various points in 2023 and early 2024, demonstrating a tangible shift in financial activity.

- Growing Adoption: Over 420 million people globally owned cryptocurrency in 2023, a figure projected to increase.

- DeFi Functionality: DeFi platforms now facilitate billions of dollars in lending and borrowing daily, offering alternatives to traditional credit facilities.

- Remittance Alternatives: Stablecoins and other cryptocurrencies are being explored and used for cheaper and faster international money transfers, impacting traditional remittance services.

- Potential Market Share: As regulatory frameworks evolve, DeFi could capture a more significant portion of retail and even institutional financial transactions.

Insurance Products as Savings and Investment Substitutes

Insurance companies present a significant threat of substitutes for Bank of East Asia (BEA) by offering products that compete directly with traditional banking services for savings and investment. Endowment plans and investment-linked policies, for instance, can attract customers seeking long-term financial growth, often with added benefits like tax advantages or tailored risk management.

These insurance offerings can divert substantial capital away from banks. For example, in 2024, the life insurance sector in Hong Kong, BEA's primary market, saw continued robust growth in new business premiums, reaching HK$113.6 billion in the first nine months of 2024, indicating a strong customer preference for these alternative savings vehicles.

The appeal of insurance products as substitutes is often amplified by:

- Tax Efficiency: Many insurance savings plans offer preferential tax treatment on investment returns, making them more attractive than standard bank deposits or investments that are taxed at higher rates.

- Diversified Investment Options: Investment-linked policies allow customers to invest in a range of funds, providing diversification that might not be as readily available or as easily managed through a typical bank account.

- Long-Term Commitment Incentives: Products like endowments are designed for long-term savings, encouraging customers to commit funds for extended periods, thereby reducing the liquidity available for traditional banking products.

The threat of substitutes for Bank of East Asia (BEA) is substantial, driven by evolving financial technologies and consumer preferences. Fintech platforms, cryptocurrencies, and alternative investment vehicles offer increasingly compelling alternatives to traditional banking services, impacting payment, lending, and wealth management sectors.

| Substitute Category | Key Offering | 2023/2024 Data Point | Impact on BEA |

|---|---|---|---|

| Fintech Payment Platforms | Mobile Payments (Alipay, WeChat Pay) | Over 80% of online transactions in China (2023) | Erodes BEA's payment service market share |

| Peer-to-Peer Lending | Alternative Loans | Global market valued at ~$100 billion (2023) | Competes with BEA's lending business |

| Capital Markets | Direct Corporate Financing | Significant global corporate bond issuance (2024) | Reduces demand for BEA's corporate lending |

| Robo-Advisors | Automated Investment Management | Projected global AUM > $2.5 trillion (mid-2024) | Threatens BEA's wealth management services |

| Cryptocurrencies & DeFi | Digital Payments, Loans, Interest Accounts | Global crypto market cap ~$2.5 trillion (early 2024) | Emerging competition across multiple banking functions |

| Insurance Products | Endowment & Investment-Linked Policies | HK$113.6 billion new business premiums in Hong Kong (Jan-Sep 2024) | Diverts savings and investment away from BEA |

Entrants Threaten

The banking sector presents a formidable challenge for newcomers due to its substantial capital demands. For instance, in 2024, regulatory bodies often mandate minimum capital ratios, such as Common Equity Tier 1 (CET1) ratios, which can be as high as 4.5% of risk-weighted assets, plus additional buffers. This necessitates billions of dollars in upfront investment, a significant barrier for many aspiring institutions.

Furthermore, the intricate web of regulations, including those for anti-money laundering (AML) and know-your-customer (KYC) compliance, creates extensive licensing and operational hurdles. Navigating these complex requirements demands considerable expertise and resources, effectively shielding established banks like Bank of East Asia from immediate, widespread new competition.

Established brand loyalty and customer trust represent a significant barrier for new entrants into the banking sector. For instance, Bank of East Asia (BEA), with its long history, has cultivated deep trust among its customer base. This trust, built over decades, makes customers reluctant to move their essential financial services to newer, less-proven institutions.

Incumbent banks like Bank of East Asia (BEA) leverage significant economies of scale. This advantage spans their extensive operational networks, advanced technology infrastructure, and robust risk management frameworks. For instance, in 2024, BEA's operational efficiency, driven by its scale, allows for lower per-transaction costs compared to a new entrant.

New entrants face substantial hurdles in matching these cost efficiencies. Achieving comparable economies of scale requires immense initial capital investment and considerable time to build out similar infrastructure and customer bases. This disparity can disadvantage new players in terms of pricing competitiveness and achieving early profitability against established institutions like BEA.

Emergence of Virtual Banks and Fintech Companies

The threat of new entrants for Bank of East Asia (BEA) is significantly amplified by the emergence of virtual banks and agile fintech companies. While traditional banking faces substantial capital and regulatory hurdles, these digital-first entities bypass many of these legacy constraints. For instance, Hong Kong has actively promoted virtual banking, with several licenses issued, creating a more competitive landscape. These new players often operate with considerably lower overheads, allowing them to offer competitive pricing and innovative digital services, directly challenging BEA’s market share and digital customer acquisition efforts.

These new entrants leverage technology to their advantage, offering streamlined user experiences and specialized financial products. This can include everything from faster loan approvals to more intuitive payment systems. For example, in 2023, the digital banking sector continued to see growth, with many fintechs reporting substantial increases in customer numbers and transaction volumes, indicating a shift in consumer preference towards digital channels. This poses a direct challenge to BEA's established digital strategies and its ability to attract and retain customers in an increasingly digital-first banking environment.

- Lower Operational Costs: Virtual banks and fintechs typically have fewer physical branches, reducing significant overhead expenses compared to traditional banks like BEA.

- Technological Agility: These new players are built on modern technology stacks, enabling faster product development and adaptation to market changes.

- Regulatory Sandbox Opportunities: Some jurisdictions, including Hong Kong, have created regulatory sandboxes that allow new digital banks to test innovative services with less initial regulatory burden.

- Targeted Customer Acquisition: Fintechs often focus on specific customer segments with tailored digital offerings, effectively chipping away at traditional banks' broader customer base.

Access to Distribution Channels and Customer Data

Established banks like Bank of East Asia leverage their extensive physical branch networks and ATM infrastructure, which are crucial distribution channels. For instance, as of the end of 2023, Bank of East Asia operated a significant number of branches and ATMs across its key markets, providing a strong foundation for customer interaction and service delivery. This established presence, coupled with decades of accumulated customer data, allows for sophisticated customer segmentation and personalized product offerings, creating a substantial barrier for newcomers.

New entrants typically lack this ingrained distribution capability and the rich historical customer data that enables targeted marketing and product development. Building a comparable network of physical touchpoints or even a robust digital distribution channel requires substantial capital investment and time. Furthermore, acquiring meaningful customer data to compete on personalization is a slow and costly endeavor, often requiring significant marketing spend to attract initial customers and gather their transactional history.

- Established Distribution Reach: Banks like Bank of East Asia benefit from extensive branch and ATM networks, offering immediate customer access.

- Customer Data Advantage: Decades of data allow for personalized services and targeted marketing, a difficult hurdle for new entrants.

- High Entry Costs: New players face significant investment requirements to replicate distribution channels and acquire customer data.

- Limited Initial Impact: The challenges in distribution and data acquisition temper the immediate threat posed by new entrants.

The threat of new entrants into the banking sector remains moderate for Bank of East Asia, primarily due to high capital requirements and stringent regulatory compliance. For instance, in 2024, new banks must meet substantial minimum capital reserves, often in the hundreds of millions of dollars, to ensure stability. This financial barrier, coupled with the complex licensing processes, significantly deters many potential competitors from entering the traditional banking space.

While virtual banks and fintechs present a more dynamic challenge, their impact is somewhat mitigated by established trust and brand loyalty. Bank of East Asia has cultivated decades of customer confidence, a factor that new, unproven digital entities struggle to replicate quickly. For example, customer retention rates for established banks often exceed 90%, indicating a strong preference for familiar institutions.

The established infrastructure and economies of scale enjoyed by incumbent banks like Bank of East Asia also pose a significant hurdle for newcomers. BEA's extensive branch network and advanced technological systems, built over many years, allow for operational efficiencies that are difficult and costly for new entrants to match. This disparity in operational capacity and cost structure limits the immediate competitive pressure from emerging players.

| Factor | Impact on New Entrants | Mitigation for BEA |

|---|---|---|

| Capital Requirements | Very High (e.g., >$100M in 2024) | Existing capital base |

| Regulatory Hurdles | Complex licensing & compliance | Established compliance infrastructure |

| Brand Loyalty & Trust | Low for new entrants | Decades of customer relationship building |

| Economies of Scale | Difficult to achieve | Existing operational efficiency & network |

| Fintech/Virtual Banks | Agile, lower overhead | Need for digital transformation |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of East Asia is built upon a foundation of credible data, including the bank's annual reports, investor presentations, and official company disclosures. We also incorporate insights from reputable financial news outlets and industry-specific market research reports to capture a comprehensive view of the competitive landscape.