BAC Holding International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAC Holding International Bundle

BAC Holding International's strengths lie in its diverse portfolio and established market presence, but its weaknesses, particularly in operational efficiency, demand attention. Understanding these internal dynamics is crucial for navigating the competitive landscape.

Seize the opportunity to fully grasp BAC Holding International's strategic position. Our comprehensive SWOT analysis delves into the external opportunities and threats that shape its future, providing you with the critical intelligence needed for informed decision-making.

Don't miss out on the complete picture. Purchase the full SWOT analysis to unlock actionable insights, expert commentary, and an editable format perfect for strategic planning and investor pitches.

Strengths

BAC Holding International stands as the undisputed leader in Central America's financial sector, a position solidified by its extensive reach serving over 5 million customers and employing more than 20,000 individuals throughout the region. This extensive network translates into substantial market shares across key metrics like assets, loan portfolios, deposits, and profitability, underscoring its regional dominance.

BAC Holding International boasts a truly extensive range of financial services. This includes everything from everyday retail banking for individuals to specialized corporate banking and treasury services for businesses. They even offer insurance, creating a one-stop shop for many financial needs.

This broad service offering is a significant strength because it allows BAC Holding to serve a wide variety of clients. Whether you're an individual looking for a mortgage, a small business needing a loan, or a large corporation requiring complex treasury solutions, BAC Holding has something to offer. This diversity in their customer base helps to spread risk.

By catering to such a wide spectrum of clients and offering multiple financial products, BAC Holding diversifies its revenue streams. This means the company isn't overly dependent on any single service or customer segment. For instance, in the first half of 2024, their retail banking segment contributed significantly, but their corporate banking and treasury services also showed robust growth, highlighting this diversification.

BAC Holding International's advanced digital transformation is a significant strength. As of March 2025, an impressive 95% of their transactions are conducted digitally, showcasing a deep integration of technology across their operations. This high level of digitalization streamlines processes, boosts operational efficiency, and provides a superior, modern experience for their customers.

Strong Commitment to ESG and 'Net Positive' Strategy

BAC Holding International stands out as the first financial group in Central America to embrace the United Nations Principles for Responsible Banking. This commitment guides its aspiration to become a 'Net Positive' bank, aiming to create more environmental and social value than its operational impact. This forward-thinking sustainability strategy not only positions BAC favorably within global trends but also bolsters its brand image, attracting environmentally and socially aware customers and investors alike.

Stable Funding Base and High Entry Barriers

BAC Holding International benefits from a robust funding structure, drawing stability from its vast merchant network and a significant base of customer deposits. This deep integration into the financial fabric of its operating regions provides a cost-effective and reliable source of capital.

The company's substantial influence on Central America's Gross Domestic Product (GDP) through its payment systems acts as a formidable barrier to entry for new players. This is particularly true in the business-to-business (B2B) and customer-to-merchant (C2M) segments, where BAC's established infrastructure and market share make it exceptionally difficult for competitors to gain traction.

- Stable Funding: Access to low-cost funds from customer deposits and merchant relationships.

- High Entry Barriers: Significant competitive advantage due to market dominance in payment processing.

- Market Share: BAC's role in processing a large portion of Central America's GDP transactions solidifies its position.

BAC Holding International's market leadership in Central America is a significant strength, evidenced by its extensive customer base of over 5 million and a workforce exceeding 20,000. This dominance translates into substantial market shares across key financial metrics, including assets, loans, deposits, and profitability, underscoring its regional preeminence. The company's comprehensive suite of financial services, from retail banking to corporate solutions and insurance, caters to a diverse clientele, thereby diversifying revenue streams and mitigating risk. Furthermore, BAC's advanced digital transformation, with 95% of transactions conducted digitally as of March 2025, enhances operational efficiency and customer experience.

| Metric | BAC Holding International (as of H1 2024) | Significance |

|---|---|---|

| Digital Transactions | 95% | Operational efficiency and customer engagement |

| Customer Base | > 5 million | Market penetration and brand loyalty |

| Market Share (Assets) | Leading in Central America | Regional dominance and competitive advantage |

What is included in the product

Delivers a strategic overview of BAC Holding International’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats to inform future decision-making.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, transforming potential threats into manageable challenges.

Weaknesses

A significant weakness for BAC Holding International is its exposure to challenging regional operating conditions. A substantial 60% of its loan portfolio is concentrated in Central American countries that carry lower sovereign credit ratings, specifically B or below. This high concentration inherently exposes the company to elevated political and economic risks.

These risks include potential instability, which could directly impact the quality of BAC's assets and, consequently, its overall financial performance. Such an environment can lead to increased loan defaults and a more volatile revenue stream for the company.

Operating across six Central American countries presents significant challenges for BAC Holding International, requiring navigation of varied and often intricate regulatory frameworks. This multi-jurisdictional complexity can translate into higher compliance expenses and increased administrative workloads.

The need to standardize operational procedures across such a diverse regional footprint can also pose substantial hurdles, potentially impacting efficiency and consistency. For instance, differing data privacy laws across countries like Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, and Panama necessitate tailored compliance strategies, adding layers of operational overhead.

While Bank of America (BAC) has shown robust profitability, a key weakness lies in the potential for rising credit costs. Analysts anticipate that loan loss provisions will gradually increase, moving back towards pre-pandemic figures. This shift could impact the bank's earnings.

For instance, in the first quarter of 2024, Bank of America's provision for credit losses on loans stood at $1.1 billion, a notable increase from prior periods. This trend suggests a normalization of credit expenses, which could put pressure on net income if economic growth slows, potentially leading to a deterioration in asset quality.

Vulnerability to Regional Economic Downturns

BAC Holding International's extensive presence in Central America, while a strength, also exposes it to significant risks. The bank's financial health is intrinsically linked to the economic stability of these nations. For instance, a slowdown in Costa Rica, a key market for BAC, could directly affect loan growth and profitability.

Any disruption, whether it's a political crisis or an external economic shock impacting the region, can swiftly translate into reduced business volumes and a deterioration of asset quality for BAC. This interconnectedness means that even with diversification across several Central American countries, the bank cannot entirely insulate itself from localized economic vulnerabilities.

- Regional Economic Sensitivity: BAC's performance is directly influenced by the economic health of Central American countries, its primary operating markets.

- Impact of Downturns: Economic slowdowns, political instability, or external shocks in these regions can negatively affect loan demand, interest income, and asset quality.

- Interconnectedness of Markets: Despite operating in multiple countries, the interconnected nature of regional economies means a downturn in one significant market can have ripple effects across BAC's portfolio.

Intensifying Competition from Fintechs

The Central American financial landscape is seeing a surge in fintech companies, actively challenging established banks with cutting-edge digital offerings. This escalating competition could erode BAC's market share, especially in digital banking services, and put pressure on its pricing and profitability.

Fintechs are rapidly capturing market share in key banking segments. For instance, in 2024, digital payment solutions in Central America saw a 25% year-over-year growth, with fintechs leading this expansion. This trend directly impacts traditional banks like BAC, forcing them to innovate faster to retain customers and revenue streams.

- Increased Competition: Fintechs are offering specialized, user-friendly digital services that appeal to a growing customer base.

- Market Share Erosion: BAC could see a decline in its share of digital transactions and customer acquisition if it doesn't match fintech innovation.

- Margin Pressure: To compete, BAC might need to lower fees or invest heavily in technology, potentially squeezing profit margins.

BAC Holding International's significant concentration of its loan portfolio, with 60% in Central American countries rated B or below, exposes it to substantial political and economic risks. This high exposure means that any instability in these regions, such as policy changes or economic downturns, could directly impact loan quality and the bank's overall financial health.

Navigating the diverse and often complex regulatory environments across its six Central American operating countries presents a significant operational challenge. This multi-jurisdictional complexity leads to higher compliance costs and demands considerable administrative resources to ensure adherence to varied legal frameworks, potentially impacting efficiency.

The competitive landscape is intensifying due to the rapid rise of fintech companies in Central America, which are offering innovative digital solutions. This trend poses a direct threat to BAC's market share, particularly in digital banking, and could lead to pressure on its pricing strategies and overall profitability as it strives to keep pace with technological advancements.

Full Version Awaits

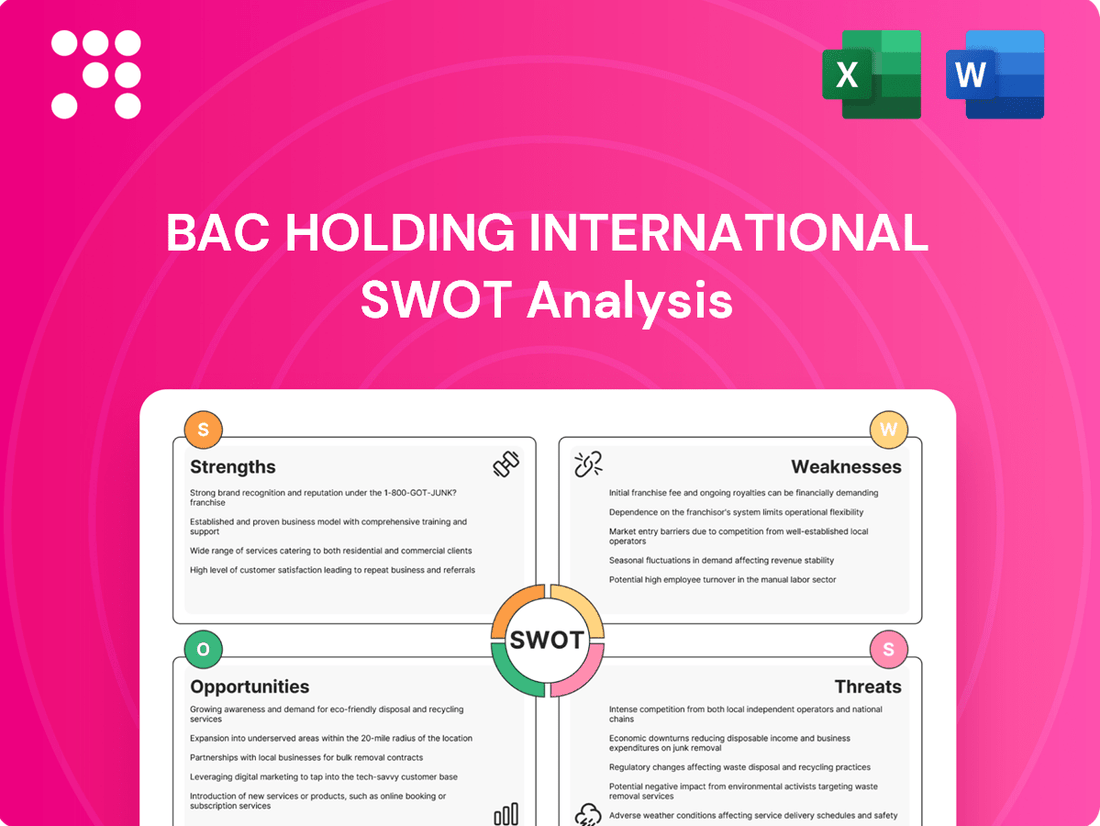

BAC Holding International SWOT Analysis

This is the actual BAC Holding International SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive look at the company's internal strengths and weaknesses, alongside external opportunities and threats. This detailed breakdown is crucial for strategic planning.

Opportunities

The digital banking sector in Latin America, including Central America, is booming. By 2025, the region is projected to have over 500 million digital banking users, a substantial increase from previous years. This surge is fueled by widespread smartphone adoption and government efforts to bring more people into the formal financial system.

This trend offers BAC Holding International a prime chance to amplify its digital services. Expanding these offerings can help BAC connect with a much larger customer segment across the region, solidifying its digital presence and strengthening its overall financial ecosystem.

BAC's 'Net Positive' strategy, a forward-thinking approach to banking, positions it to capitalize on the growing demand for ESG-aligned financial products. This commitment to responsible banking principles, which aligns with the global push for sustainability, offers a clear pathway to developing and marketing a diverse suite of green and ethical financial solutions. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, highlighting a significant opportunity for institutions like BAC to capture market share.

By offering these specialized products, BAC can attract a growing segment of environmentally and socially conscious customers and investors. This not only enhances brand differentiation in a competitive landscape but also opens up new and potentially lucrative revenue streams. The increasing investor preference for ESG factors is evident, with reports indicating that over 70% of institutional investors consider ESG criteria in their investment decisions, a trend BAC is well-positioned to leverage.

BAC Holding International's extensive handling of business and personal payment data provides a goldmine of insights into customer habits and evolving market dynamics. For instance, in 2024, the bank processed trillions in transaction volume, offering a granular view of spending patterns across various demographics.

By leveraging this wealth of information, BAC can craft highly personalized financial products and services. This data-driven approach allows for more competitive lending terms and sophisticated customer segmentation, which in turn fosters deeper customer loyalty and expands market reach.

Favorable Regional Economic Growth Projections

BAC Holding International is well-positioned to capitalize on the strong economic trajectory of the Central America, Panama, and Dominican Republic (CAPDR) region. Projections indicate continued robust growth for CAPDR in both 2024 and 2025, exceeding the performance of the broader Latin American and Caribbean markets.

This favorable macroeconomic environment creates fertile ground for financial institutions like BAC. Opportunities for credit expansion are significant, driven by increased consumer and business spending. Furthermore, the anticipated rise in financial activity translates directly into greater potential for fee-based income and expanded service offerings.

Key growth drivers for the CAPDR region in 2024-2025 include:

- Strong GDP growth forecasts: The IMF, in its April 2024 World Economic Outlook, projects average GDP growth for Central America to be around 3.5% for 2024, with similar or higher figures expected for 2025, outperforming many other emerging markets.

- Increased foreign direct investment (FDI): The region is attracting substantial FDI, particularly in sectors like logistics, tourism, and manufacturing, which fuels economic activity and demand for financial services.

- Growing consumer confidence: Improved employment prospects and stable inflation in key CAPDR economies are boosting consumer confidence, leading to higher spending and greater demand for credit products.

Adoption of Open Banking Frameworks

The expansion of open banking in Latin America is a significant tailwind, encouraging innovation and partnerships between established financial institutions and fintechs. For BAC Holding International, this presents a prime opportunity to leverage new technologies and forge strategic alliances. This could lead to a broader range of integrated financial services, offering customers a more connected and complete experience.

Specifically, BAC can capitalize on this trend by:

- Integrating third-party fintech solutions to enhance its digital offerings and customer experience.

- Developing new APIs to facilitate data sharing and create innovative financial products.

- Expanding its digital ecosystem through collaborations, potentially reaching new customer segments.

The adoption of open banking is projected to drive significant growth in digital financial services across the region. For instance, Brazil's open banking implementation, which began in 2021, has already seen millions of data sharing consents, indicating strong customer acceptance and potential for new service development. By embracing these frameworks, BAC can position itself at the forefront of this digital transformation in Latin America.

BAC Holding International can leverage the burgeoning digital banking sector in Latin America, projected to reach over 500 million users by 2025, by expanding its digital services to capture a larger customer base. The bank's 'Net Positive' strategy is also a key opportunity, allowing it to develop and market ESG-aligned financial products, tapping into a global sustainable investment market valued at an estimated $35.3 trillion in early 2024. Furthermore, the bank's vast transaction data, processing trillions in volume in 2024, can be used to create personalized financial products and enhance customer loyalty.

The strong economic growth forecasts for the CAPDR region, with GDP growth around 3.5% for 2024, coupled with increasing FDI and consumer confidence, create a favorable environment for credit expansion and fee-based income growth. The expansion of open banking in Latin America also presents a significant opportunity for BAC to integrate fintech solutions, develop new APIs, and forge strategic alliances to broaden its digital ecosystem and customer reach.

Threats

The global and regional banking sectors are navigating a complex macroeconomic landscape in 2025, with modest economic growth forecasts and persistent geopolitical tensions creating significant headwinds. These uncertainties directly translate into increased market volatility and can erode investor confidence, posing a direct threat to BAC Holding International's operational stability in Central America.

Regulatory shifts also add another layer of complexity. For instance, ongoing discussions around capital requirements and liquidity ratios could necessitate adjustments to BAC's financial strategies. The International Monetary Fund (IMF) projected global growth at 3.1% for 2025 in its April 2024 report, a figure that, while stable, indicates a lack of robust expansion to absorb shocks.

The Central American banking sector, once relatively concentrated, is now seeing a significant uptick in competition. This isn't just from traditional banks expanding their reach, but also from nimble Fintech companies entering the market with innovative digital solutions. For BAC Holding International, this means a tougher environment where keeping customers and attracting new ones requires constant effort.

This intensified competition directly impacts pricing strategies and profit margins. Banks are finding it harder to command premium rates when alternatives are readily available and often more cost-effective. For instance, in 2024, several regional banks reported a slight compression in net interest margins, a trend attributed in part to increased competition from digital-only players offering attractive deposit rates.

To stay ahead, BAC Holding International must commit to ongoing investment in technology and product development. Failing to innovate means risking market share erosion as customers are drawn to newer, more user-friendly, and potentially cheaper financial services offered by Fintechs. This continuous need for investment can strain resources, especially for established institutions.

Anticipated shifts in global interest rates, with some major economies potentially seeing rate cuts in 2024 and 2025, present a significant threat. This volatility directly impacts BAC's net interest income, as the spread between interest earned on assets and interest paid on liabilities can narrow or widen unpredictably.

For instance, if the Federal Reserve were to lower rates, BAC's income from its vast loan portfolio could decrease, while funding costs might not decline as rapidly, squeezing margins. This necessitates robust strategies to manage interest rate risk effectively.

Evolving Regulatory Landscape and Compliance Costs

The financial sector constantly faces evolving regulations, impacting areas like capital conservation buffers and risk management. For BAC Holding International, navigating these changes across various Central American countries presents a significant challenge.

Compliance with these shifting rules can lead to substantial costs, requiring ongoing adjustments to operations. For instance, in 2024, increased capital requirements in some Latin American markets could necessitate BAC Holding International to hold more liquid assets, potentially affecting lending capacity and profitability.

- Increased Capital Requirements: Regulatory bodies in key markets may mandate higher capital ratios, impacting BAC Holding International's leverage and return on equity.

- Enhanced Risk Management Scrutiny: Banks face greater oversight on credit, market, and operational risk, requiring investment in more sophisticated risk management systems and personnel.

- Data Privacy and Cybersecurity Regulations: Stricter data protection laws, such as those strengthening in 2024 across several Central American nations, demand significant investment in cybersecurity infrastructure and compliance protocols.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Updates: Continuous updates to AML/KYC regulations require ongoing training and technological upgrades to prevent financial crime, adding to operational expenses.

Increased Cybersecurity Risks

BAC's commitment to digital transformation and its high volume of online transactions expose it to a growing threat from cybersecurity breaches. The financial services sector, in particular, has seen a significant rise in sophisticated cyberattacks. For instance, reports indicate that the average cost of a data breach in the financial industry reached $5.90 million in 2024, a notable increase from previous years.

A successful cyberattack could lead to substantial financial losses through direct theft, recovery costs, and potential regulatory fines. Furthermore, the reputational damage from such an incident could be severe, eroding customer trust and impacting long-term business stability. In 2024, financial institutions experienced an average of 27 days to identify and contain a breach, highlighting the ongoing challenge.

- Elevated Threat Landscape: The increasing sophistication of cyber threats targets financial institutions heavily.

- Financial Impact: A breach can incur significant direct losses, recovery expenses, and regulatory penalties, with average data breach costs in finance exceeding $5.9 million in 2024.

- Reputational Damage: Loss of customer trust due to data breaches can severely harm BAC's brand and long-term viability.

- Operational Disruption: Cyberattacks can disrupt critical digital services, impacting transaction processing and customer access.

Intensified competition from both traditional banks and agile Fintech firms in Central America poses a significant threat, potentially compressing BAC Holding International's profit margins and requiring continuous investment in innovation to retain market share. Anticipated shifts in global interest rates also introduce volatility, impacting net interest income and necessitating robust risk management strategies to navigate potential margin squeezes.

Evolving regulatory landscapes across Central America demand ongoing adaptation and investment in compliance, potentially affecting lending capacity and profitability. Furthermore, the escalating sophistication of cyber threats presents a substantial risk, with the financial sector experiencing high average data breach costs exceeding $5.9 million in 2024, threatening financial stability and customer trust.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible information, drawing from BAC Holding International's official financial statements, comprehensive market research reports, and insights from industry experts to provide a robust and actionable assessment.