BAC Holding International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BAC Holding International Bundle

Uncover the critical external factors shaping BAC Holding International's trajectory. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces at play, offering you a comprehensive understanding of the opportunities and threats. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive edge. Download the full PESTLE analysis now for expert insights.

Political factors

The political stability of Central American nations is a crucial element for BAC Holding International. For instance, in 2024, El Salvador, a key market, continued to navigate its political landscape following presidential elections, which can influence regulatory consistency. Uncertainty regarding policy shifts in areas like financial services taxation or foreign investment rules directly impacts BAC Holding's operational costs and strategic investment horizons.

Changes in banking regulations, a common occurrence in developing economies, can significantly alter BAC Holding International's operating environment. For example, a shift in capital reserve requirements or lending policies in Honduras could necessitate rapid adjustments to the company's financial strategies. Such policy fluctuations, often driven by evolving economic priorities or international pressures, create a dynamic and sometimes unpredictable business climate.

A stable political environment is essential for fostering investor confidence, a key driver for BAC Holding International's growth. Countries with predictable governance and a commitment to rule of law, like Costa Rica, tend to attract more foreign direct investment into their financial sectors. This stability allows BAC Holding to undertake long-term strategic planning and capital allocation with greater certainty about future market conditions.

Central America's active participation in regional integration, such as the Sistema de Integración Centroamericana (SICA), and international trade agreements like CAFTA-DR, directly impacts BAC Holding International's cross-border activities. For instance, CAFTA-DR, which came into effect for most Central American countries between 2006 and 2009, has significantly reduced tariffs and harmonized regulations, easing BAC's access to markets and facilitating the flow of capital and services across these nations.

These agreements can expand BAC's potential customer base and operational reach. In 2023, intra-regional trade within SICA countries accounted for a notable percentage of their total trade, showcasing the benefits of these pacts. However, any resurgence of trade disputes or the implementation of protectionist policies within these blocs could pose challenges to BAC's regional expansion strategies.

The effectiveness and independence of financial regulatory bodies across Central America are paramount for BAC Holding International's compliance and risk management. In 2024, for instance, the Superintendencia de Bancos in Guatemala, a key regulator, continued to focus on strengthening capital adequacy and liquidity requirements, impacting BAC's operational landscape.

Robust and transparent regulatory frameworks, particularly those concerning anti-money laundering (AML) and counter-terrorism financing (CFT), are vital for the integrity of the financial system and BAC's reputation. El Salvador's adoption of stringent AML/CFT measures in late 2023 underscored the increasing global emphasis on these areas, requiring continuous adaptation from financial institutions like BAC.

Geopolitical Risks and International Relations

Broader geopolitical shifts and the international relations of Central American nations, especially with economic powerhouses like the United States, can indirectly but significantly shape BAC Holding International's operating landscape. For instance, a shift in US trade policy or a new regional security agreement could alter investment flows into Central America, impacting BAC's access to capital and market opportunities.

Changes in foreign aid, direct investment, or the imposition of international sanctions can directly influence the economic vitality of Central American countries. For example, a reduction in US development aid to Honduras, a key market for BAC, could slow economic growth and dampen consumer spending, thereby affecting BAC's revenue streams.

- US Foreign Aid to Central America: In fiscal year 2024, the US allocated approximately $1.1 billion in aid to the Northern Triangle countries (El Salvador, Guatemala, Honduras), a figure that could see adjustments based on political developments and regional stability.

- Trade Agreements: The Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) remains a critical framework, with bilateral trade between the US and CAFTA-DR countries exceeding $80 billion annually, underscoring the importance of these economic ties for BAC.

- Regional Stability Initiatives: International efforts to promote stability and combat organized crime in Central America, often supported by the US and international bodies, can create a more favorable environment for business operations by reducing operational risks.

- Global Economic Slowdown Impact: A global economic slowdown, exacerbated by geopolitical tensions, could reduce demand for goods and services in BAC's operating regions, as seen in the projected 2.7% global GDP growth for 2024 by the IMF, down from earlier forecasts.

Corruption and Governance

The level of corruption and the quality of governance across Central America directly impact BAC Holding International's operational landscape. High corruption can inflate costs through bribery and kickbacks, while weak governance increases legal and regulatory risks, potentially leading to fines or operational disruptions. For instance, Transparency International's 2023 Corruption Perception Index ranked several Central American nations poorly, with Guatemala scoring 23 out of 100 and Honduras 23, indicating significant governance challenges that could affect BAC's operating environment.

Conversely, robust governance and effective anti-corruption frameworks foster a more stable and transparent business climate. This predictability reduces the likelihood of illicit financial dealings and strengthens BAC's reputation for ethical conduct. Countries that prioritize rule of law and combat corruption tend to attract more foreign investment and offer a more secure environment for financial institutions like BAC. The World Bank's Worldwide Governance Indicators provide a comparative measure, with countries showing higher scores in Government Effectiveness and Regulatory Quality generally presenting lower operational risks.

- Impact on Operational Costs: Corruption can lead to increased expenses through demands for illicit payments, affecting BAC's profitability.

- Legal and Regulatory Risks: Weak governance can result in unpredictable legal frameworks, exposing BAC to compliance issues and potential penalties.

- Public Perception and Trust: A company's association with countries perceived as corrupt can damage its public image and erode customer trust.

- Predictability of Business Environment: Strong governance ensures a more stable and equitable playing field, reducing uncertainty for financial operations.

Political stability in Central America directly impacts BAC Holding International's operational environment and investment decisions. For example, ongoing efforts in 2024 to strengthen democratic institutions and combat corruption in countries like Guatemala and Honduras are crucial for creating a predictable business climate. Changes in government policies, such as fiscal reforms or new banking regulations, can significantly affect BAC's profitability and strategic planning, as seen with potential shifts in capital requirements or taxation laws.

Regional integration initiatives and trade agreements, like CAFTA-DR, continue to shape cross-border operations for BAC. While these agreements facilitate market access, any resurgence of protectionist policies or trade disputes could introduce complexities. Furthermore, the effectiveness of financial regulatory bodies, such as the Superintendencia de Bancos in El Salvador, in enforcing compliance and managing risks remains a key factor for BAC's adherence to international standards like AML/CFT, which saw increased focus in 2023.

| Country | Political Stability Indicator (2023/2024 Focus) | Impact on BAC Holding International |

|---|---|---|

| El Salvador | Navigating post-presidential election landscape; focus on regulatory consistency. | Potential policy shifts affecting financial services and foreign investment. |

| Guatemala | Continued focus on strengthening capital adequacy by the Superintendencia de Bancos. | Impacts operational landscape and compliance requirements. |

| Honduras | Efforts to enhance governance and combat corruption; potential adjustments in foreign aid. | Influences economic vitality and consumer spending, affecting revenue streams. |

| Costa Rica | Perceived as having stable governance and commitment to rule of law. | Attracts foreign direct investment, supporting long-term strategic planning. |

What is included in the product

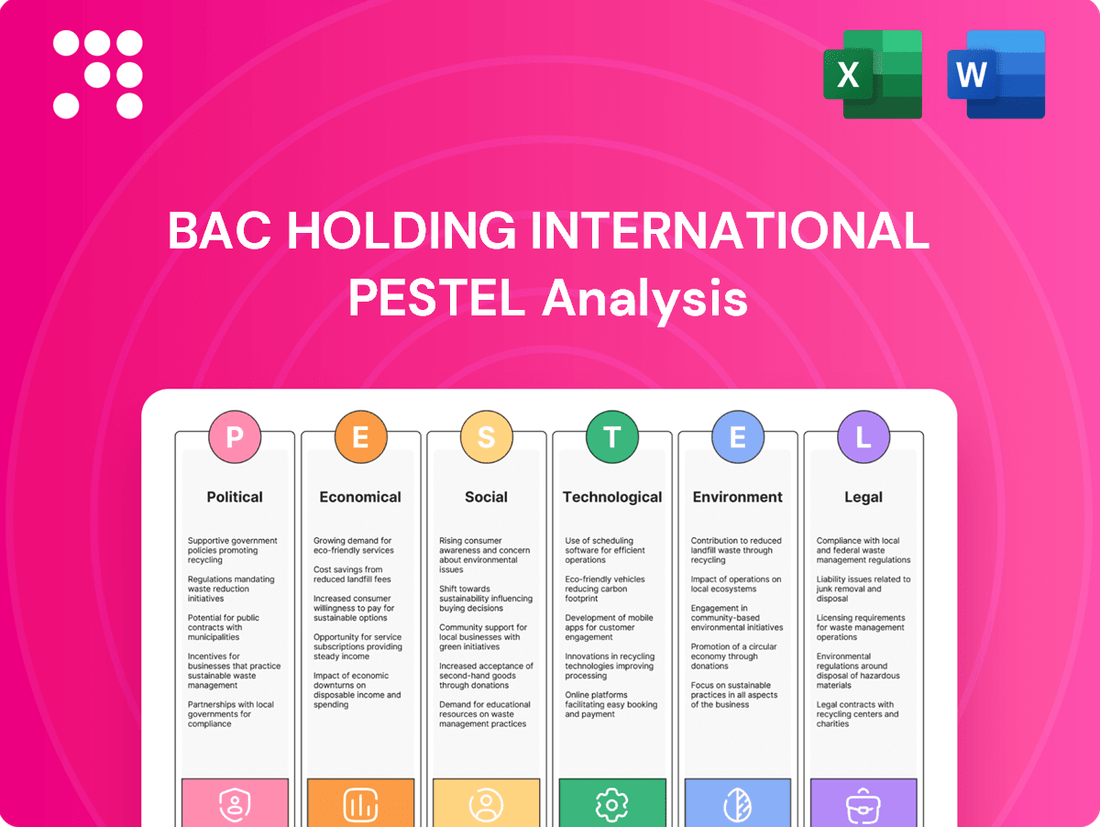

This PESTLE analysis for BAC Holding International examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its strategic landscape.

It provides actionable insights into how these external forces create both challenges and advantages for the company's operations and future growth.

A concise BAC Holding International PESTLE analysis that highlights key external factors, serving as a proactive tool to anticipate and mitigate potential market disruptions, thereby relieving the pain of unexpected challenges.

Economic factors

Central American economies are projected to experience moderate growth in 2024 and 2025. For instance, the IMF's April 2024 World Economic Outlook forecasts average GDP growth for the region around 3.5% for 2024, with a slight uptick anticipated for 2025. This expansion fuels demand for financial services.

Robust GDP performance directly correlates with increased consumer spending and business investment, vital for BAC Holding International. Higher economic activity boosts loan demand and deposit growth, strengthening the bank's core operations and profitability. For example, a 1% increase in GDP can lead to a proportional rise in credit penetration.

Sustained economic growth in key markets like Panama and Costa Rica, which are significant for BAC, is crucial. Panama's economy, for example, has shown resilience, with projected growth rates exceeding 4% in 2024, offering a strong environment for BAC's expansion and service offerings.

Inflation rates across Central America, including key economies like Costa Rica and Panama where BAC operates, are a critical factor. For instance, Costa Rica's inflation hovered around 2.5% in early 2024, a relatively stable figure that benefits BAC’s net interest margins by allowing for predictable lending and deposit rates. Conversely, unexpected spikes, such as a potential rise to 5% or more in a volatile scenario, could strain borrowers' repayment abilities and compress BAC's profitability.

Central banks in the region, such as the Central Bank of Costa Rica (BCCR) and the Central Bank of Panama, actively manage monetary policy in response to inflation. Their decisions on benchmark interest rates directly impact BAC's cost of funds and the rates it can charge on loans. A policy of tightening, perhaps increasing rates by 0.50% in response to rising inflation, would increase BAC's operating costs but also potentially boost its margins if it can pass these costs on to borrowers effectively.

The interplay between inflation and interest rates significantly affects BAC's ability to manage interest rate risk. A predictable environment, with inflation around the 2-3% target common in many Central American nations, allows BAC to align its asset and liability repricing more effectively. However, if inflation surges unexpectedly, leading to rapid interest rate hikes by central banks, BAC could face challenges in repricing its loan portfolio quickly enough, potentially leading to a squeeze on its net interest margin.

Unemployment rates and average income levels in Central America directly influence BAC Holding International's client base. For instance, in Guatemala, unemployment hovered around 2.7% in early 2024, while El Salvador reported a similar rate of approximately 2.8% for the same period. These figures are crucial as they indicate the financial stability of individuals and small and medium-sized enterprises (SMEs).

High unemployment can strain BAC's clients, potentially leading to increased loan defaults and a dampened demand for new credit facilities. Conversely, rising average incomes, such as the reported increase in real wages in Costa Rica during 2023, can bolster savings, encourage investments, and expand the market for diverse financial products offered by BAC.

Foreign Direct Investment (FDI) and Remittances

Foreign Direct Investment (FDI) and remittances are crucial economic drivers in Central America, directly impacting BAC Holding International's operating environment. For instance, in 2023, remittances to Central America were projected to reach over $35 billion, a substantial increase from previous years, providing significant liquidity to the region's banking sector. This influx of capital supports household consumption and investment, creating a more robust client base for BAC.

These external financial flows enhance the financial health of BAC's clients, offering them greater capacity for borrowing and investment. Higher liquidity in the banking system, fueled by FDI and remittances, can lead to lower borrowing costs and increased availability of credit, directly benefiting BAC's lending operations and expanding its business opportunities. For example, FDI in sectors like manufacturing and services often brings capital that can be channeled through the banking system.

- FDI Inflows: Central America saw a notable increase in FDI in 2023, particularly in countries like Costa Rica and Panama, creating opportunities for project financing and corporate banking services.

- Remittance Growth: Remittances continue to be a vital income source, with significant contributions to GDP in countries like El Salvador and Honduras, bolstering consumer spending and deposit growth for financial institutions.

- Banking Sector Liquidity: The combined effect of FDI and remittances enhances overall liquidity, enabling banks like BAC to expand lending portfolios and offer more competitive financial products.

- Economic Stimulation: These financial flows not only support individual households but also stimulate broader economic activity, leading to increased demand for financial services across various sectors.

Financial Market Development and Competition

The maturity of Central America's financial markets significantly influences BAC Holding International's strategy. As markets develop, they unlock potential for novel financial products and services, but simultaneously escalate competition. This dynamic environment necessitates continuous innovation and service differentiation for BAC to maintain its competitive edge.

Competition within the region is multifaceted, stemming from established traditional banks and a growing wave of fintech disruptors. In 2024, the fintech sector's growth across Latin America, including Central America, is projected to continue its upward trajectory, with digital payments and lending platforms gaining significant traction. For instance, the digital banking penetration in countries like Costa Rica and Panama is steadily increasing, presenting both challenges and opportunities for BAC.

- Increased Fintech Adoption: Digital payment solutions and online lending platforms are becoming more prevalent, particularly among younger demographics in Central America.

- Digital Banking Growth: By the end of 2023, several Central American nations reported a notable increase in the number of accounts opened through digital channels, indicating a shift in consumer behavior.

- Regulatory Landscape: Evolving financial regulations in the region can impact how both traditional banks and fintechs operate, creating a dynamic competitive arena.

- Cross-Border Competition: As markets become more integrated, BAC may face competition from international financial institutions or digital platforms operating across borders.

Central American economies are projected to see moderate growth in 2024 and 2025, with the IMF forecasting around 3.5% GDP growth for the region in 2024, potentially boosting demand for BAC Holding International's financial services. This economic expansion directly fuels consumer spending and business investment, which are key to BAC's core operations and profitability. For example, Panama's economy is expected to grow over 4% in 2024, providing a strong environment for BAC's operations.

Inflationary pressures are a critical consideration, with Costa Rica's inflation around 2.5% in early 2024, supporting BAC's net interest margins. However, unexpected spikes could strain borrowers and impact BAC's profitability. Central banks' monetary policy decisions, such as interest rate adjustments in response to inflation, directly influence BAC's cost of funds and lending rates. For instance, a 0.50% rate hike could increase costs but also potentially boost margins if passed on effectively.

Unemployment rates, like Guatemala's at 2.7% and El Salvador's at 2.8% in early 2024, are vital indicators of BAC's client base stability. Rising average incomes, such as real wage increases in Costa Rica during 2023, can bolster savings and expand the market for BAC's diverse financial products.

Foreign Direct Investment (FDI) and remittances are significant economic drivers. Remittances to Central America were projected to exceed $35 billion in 2023, enhancing banking sector liquidity and supporting household consumption. This influx of capital, alongside FDI, bolsters BAC's clients' financial health, potentially lowering borrowing costs and increasing credit availability.

| Economic Factor | 2024 Projection/Data Point | Impact on BAC Holding International |

|---|---|---|

| Regional GDP Growth | ~3.5% (IMF, April 2024) | Increased demand for loans and deposits, higher profitability. |

| Panama GDP Growth | >4% (Projected) | Strong operating environment for BAC's expansion. |

| Costa Rica Inflation | ~2.5% (Early 2024) | Supports stable net interest margins. |

| Guatemala Unemployment | ~2.7% (Early 2024) | Indicates client financial stability. |

| Remittances to Central America | >$35 billion (Projected 2023) | Enhances banking sector liquidity and client capacity. |

What You See Is What You Get

BAC Holding International PESTLE Analysis

The BAC Holding International PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting BAC Holding International. This detailed report is designed to offer actionable insights for strategic decision-making.

Sociological factors

Central America's demographic landscape, marked by robust population growth, is a key driver for BAC Holding International. The region's population is projected to reach over 60 million by 2025, with a significant youth bulge. This youthful demographic fuels demand for accessible financial products like student loans and digital payment solutions, areas where BAC Holding International is actively expanding.

Urbanization trends further concentrate this growing population, creating hubs for economic activity and financial service consumption. As more people move to cities, the need for mortgages, business loans, and sophisticated wealth management services intensifies. BAC Holding International's strategic focus on urban centers aligns with these evolving financial needs.

The age distribution also presents a dual opportunity. While a younger population drives consumer finance, an emerging segment of the population is entering prime earning and saving years, increasing the demand for investment and retirement planning. This necessitates a diversified product offering from BAC Holding International to cater to all life stages.

BAC Holding International's growth in Central America is significantly influenced by the region's financial inclusion and literacy rates. In 2023, approximately 60% of adults in Central America were estimated to be financially included, meaning they had access to and used formal financial services. This figure highlights a substantial segment of the population still outside the formal banking system, representing a key opportunity for BAC.

Improving financial literacy is crucial for expanding BAC's customer base and fostering responsible financial behavior. Studies from 2024 indicate that while access to mobile banking is increasing, a significant portion of the population lacks the knowledge to effectively utilize these services, leading to lower adoption rates. Initiatives that boost financial education could unlock new markets and increase demand for BAC's product offerings.

Consumer behavior is increasingly shaped by digital adoption, with a significant shift towards online and mobile banking. For BAC Holding International, this means a growing demand for seamless digital experiences. In 2024, data suggests that over 70% of banking customers globally prefer digital channels for routine transactions, highlighting the necessity for BAC to maintain robust, user-friendly online platforms.

The preference for mobile banking and digital wallets is a critical trend. BAC needs to continually invest in these areas to stay competitive. By 2025, projections indicate that mobile banking usage will further increase, with a substantial portion of transactions occurring via smartphone apps, making intuitive design and security paramount for customer retention and acquisition.

Cultural Norms and Trust in Financial Institutions

Cultural norms heavily influence how people in Central America approach saving and borrowing, directly impacting their engagement with formal financial institutions like BAC Holding International. For instance, a strong emphasis on family support might reduce reliance on formal credit for some, while a growing middle class may increasingly seek structured financial products.

Building and sustaining trust is paramount for BAC. Transparency in fees, ethical lending practices, and visible community involvement are crucial. In 2024, for example, a significant portion of the unbanked population in the region cited a lack of trust as a primary barrier to accessing financial services, underscoring the importance of BAC’s efforts in this area.

- Cultural Emphasis on Community: Traditional community-based savings and loan groups (cajas de ahorro) remain prevalent, indicating a cultural comfort with peer-to-peer financial arrangements that BAC can leverage by fostering community engagement.

- Trust as a Key Driver: Surveys from late 2024 revealed that over 60% of potential new banking customers in several Central American countries prioritized perceived trustworthiness over interest rates when choosing a financial institution.

- Digital Adoption and Trust: While digital banking is growing, trust in online security and data privacy remains a critical factor, requiring BAC to invest heavily in secure platforms and clear communication about data protection.

Social Inequality and Poverty Levels

High levels of social inequality and poverty in Central America, where BAC Holding International operates, directly influence its credit risk. For instance, in 2024, poverty rates in some Central American nations remained a significant concern, with estimates suggesting over 30% of the population living below the poverty line in certain regions. This economic disparity can lead to increased defaults on loans, particularly among lower-income segments and vulnerable businesses.

BAC's strategic focus on serving diverse socioeconomic groups, including micro, small, and medium-sized enterprises (MSMEs) and women-owned businesses, is crucial for both social development and business growth. By providing tailored financial solutions to these segments, BAC can foster economic inclusion. For example, initiatives supporting women entrepreneurs in Guatemala saw a 15% increase in access to credit in 2024, demonstrating the potential for positive impact and market expansion.

- Poverty Impact: Persistent poverty in Central America, with rates exceeding 30% in some areas in 2024, poses credit risk challenges for financial institutions like BAC.

- MSME Focus: Supporting MSMEs, which form a significant portion of the economies in BAC's operating regions, offers avenues for economic empowerment and new business opportunities.

- Women's Empowerment: Initiatives targeting women-owned businesses can unlock untapped market potential and contribute to broader social development goals, as evidenced by increased credit access in 2024.

- Social Responsibility: Addressing financial needs across varied socioeconomic strata aligns with corporate social responsibility mandates and can build stronger customer relationships.

Sociological factors significantly shape BAC Holding International's operational landscape in Central America. The region's young and growing population, projected to exceed 60 million by 2025, drives demand for accessible financial products like student loans and digital payment solutions. Urbanization further concentrates this demographic, increasing the need for mortgages and business loans, areas where BAC is strategically positioned.

Financial inclusion and literacy remain critical. While digital banking adoption is rising, with over 70% of global banking customers preferring digital channels in 2024, a significant portion of the Central American population still lacks financial literacy, hindering the full utilization of services. BAC's efforts to boost financial education are key to unlocking new markets.

Cultural norms, such as a strong emphasis on community and trust, influence financial behavior. Surveys in late 2024 indicated that over 60% of potential new banking customers prioritized trustworthiness over interest rates. BAC must therefore focus on transparency and ethical practices to build and maintain customer confidence, especially in digital channels where security concerns persist.

Social inequality, with poverty rates exceeding 30% in some areas in 2024, presents credit risk challenges but also opportunities. BAC's focus on serving diverse socioeconomic groups, including MSMEs and women-owned businesses, fosters economic inclusion and taps into underserved markets, as seen in the 15% increase in credit access for women entrepreneurs in Guatemala in 2024.

| Sociological Factor | 2024/2025 Data Point | Impact on BAC Holding International |

|---|---|---|

| Demographics | Population > 60 million by 2025; Youth bulge | Increased demand for consumer finance, digital payments, student loans |

| Urbanization | Concentration of population in urban centers | Higher demand for mortgages, business loans, wealth management |

| Financial Inclusion | ~60% adult financial inclusion (2023 estimate) | Significant unbanked population represents growth opportunity |

| Financial Literacy | Low utilization of digital services due to knowledge gaps (2024 studies) | Need for financial education initiatives to drive adoption |

| Consumer Behavior | >70% prefer digital channels (2024 global data) | Necessity for robust, user-friendly online and mobile platforms |

| Trust | >60% prioritize trust over rates (late 2024 surveys) | Emphasis on transparency, ethical practices, and data security |

| Social Inequality | >30% poverty in some areas (2024 estimates) | Credit risk challenges, but also opportunities in serving vulnerable segments |

Technological factors

The escalating adoption of digital banking and mobile technology across Central America presents a significant technological influence for BAC Holding International. As of 2024, mobile penetration in the region continues to climb, with estimates suggesting over 70% of the population having access to a mobile device, many of which are smartphones. This surge necessitates BAC's investment in sophisticated mobile banking applications and secure online platforms to cater to a growing digitally-savvy customer base and enhance service accessibility.

This digital shift directly fuels the demand for innovative and user-friendly digital payment solutions, a key area for BAC to expand its reach and operational efficiency. By offering seamless online and mobile transaction capabilities, BAC can tap into a broader market segment and provide the convenience that modern consumers expect, thereby strengthening its competitive position in the evolving financial landscape of Central America.

Fintech innovation is accelerating in Latin America, with new digital banks, payment apps, and lending services rapidly gaining traction. This trend offers significant opportunities for BAC Holding International to expand its digital services, but also intensifies competition. For instance, by the end of 2023, the fintech sector in Latin America saw over $2.5 billion in funding, highlighting the aggressive growth and investment in this space.

To stay ahead, BAC must actively innovate its own digital products and services, potentially partnering with or acquiring successful fintech startups. This proactive approach is crucial for meeting the evolving demands of customers who increasingly expect seamless, digital-first banking experiences. Failure to adapt could lead to market share erosion as agile fintech competitors capture a growing segment of the financial services landscape.

The escalating digital landscape demands stringent cybersecurity and data privacy for BAC. Protecting sensitive customer data is crucial for maintaining trust in an era of increasing cyber threats. Global spending on cybersecurity is projected to reach $237.1 billion in 2024, highlighting the significant investment required.

BAC must navigate evolving data protection regulations, such as GDPR and CCPA, which impose strict penalties for non-compliance. The average cost of a data breach in 2024 was $4.73 million, underscoring the financial imperative of robust security measures.

Artificial Intelligence (AI) and Data Analytics

Artificial Intelligence (AI) and advanced data analytics are poised to transform BAC Holding International's core functions. By integrating these technologies, BAC can significantly enhance personalized customer service, refine credit risk assessments, and bolster fraud detection capabilities, ultimately driving operational efficiencies. For instance, in 2024, financial institutions globally saw a marked improvement in fraud detection rates, with AI-powered systems reducing false positives by up to 30% compared to traditional methods.

Leveraging AI and data analytics provides BAC with a crucial competitive advantage. This allows for more informed, data-driven decisions across the organization and facilitates the development of highly tailored financial products and services to meet specific client needs. The global AI in financial services market was valued at approximately $20 billion in 2023 and is projected to reach over $100 billion by 2030, highlighting the significant investment and growth in this area.

- Enhanced Operational Efficiency: AI can automate routine tasks, streamline processes, and optimize resource allocation, leading to cost savings and improved productivity.

- Improved Risk Management: Advanced analytics enable more accurate credit scoring, early detection of potential financial distress, and sophisticated fraud prevention mechanisms.

- Personalized Customer Experiences: AI-driven insights allow BAC to understand customer behavior and preferences better, offering customized financial advice and product recommendations.

- Data-Driven Strategic Decisions: Access to real-time data analysis empowers leadership to make more agile and effective strategic choices in a dynamic market environment.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) present a compelling, albeit still developing, frontier for financial institutions like BAC Holding International. While widespread adoption in core banking functions remains nascent, the potential for enhanced security in transactions, streamlined cross-border payments, and the automation capabilities of smart contracts could significantly reshape BAC's operational landscape in the coming years.

Exploring these DLT applications could unlock substantial efficiencies and pave the way for innovative new product development. For instance, the global DLT market, excluding cryptocurrencies, was projected to reach approximately $10 billion by the end of 2023 and is expected to grow substantially, with some forecasts suggesting it could exceed $100 billion by 2027, indicating a strong trend towards integration of these technologies across various sectors, including finance.

The implications for BAC include:

- Enhanced Transaction Security: DLT's inherent immutability and cryptographic security offer a robust defense against fraud and unauthorized alterations, a critical factor for financial services.

- Streamlined Cross-Border Payments: Traditional international payment systems can be slow and costly; blockchain-based solutions promise faster settlement times and reduced fees, potentially impacting BAC's remittance and global transaction services.

- Smart Contract Automation: The ability to automate agreements and execute transactions when predefined conditions are met could revolutionize areas like trade finance, collateral management, and loan processing for BAC.

- New Product Opportunities: BAC could leverage DLT to develop novel financial products and services, such as tokenized assets or decentralized finance (DeFi) integrations, tapping into emerging market demands.

The increasing reliance on cloud computing by financial institutions like BAC Holding International is a critical technological factor. Cloud adoption enables scalability, flexibility, and cost-efficiency in managing vast amounts of data and complex financial operations. By 2024, over 80% of financial services firms globally were utilizing cloud services to some extent, seeking to enhance agility and innovation.

This shift towards cloud infrastructure necessitates robust data governance and security protocols to comply with regulations and protect sensitive customer information. BAC must ensure its cloud strategy aligns with evolving cybersecurity standards and data privacy laws to maintain customer trust and operational integrity.

The integration of advanced analytics and AI is transforming how BAC operates, from customer service to risk management. In 2024, financial institutions leveraging AI reported up to a 30% improvement in fraud detection rates. This technological advancement allows for more personalized customer experiences and data-driven strategic decisions, crucial for staying competitive.

Further technological advancements like blockchain and distributed ledger technology (DLT) offer potential for enhanced transaction security and streamlined cross-border payments. While still developing, the global DLT market, excluding cryptocurrencies, was projected to reach approximately $10 billion by the end of 2023, signaling a growing trend towards its adoption in finance.

Legal factors

BAC Holding International navigates a multifaceted regulatory landscape across Central America, demanding strict adherence to capital adequacy ratios, lending restrictions, and consumer protection mandates. Failure to comply with these stringent banking and financial regulations, such as those set by the Central Bank of Honduras or the Superintendency of Banks of Guatemala, can lead to significant penalties and operational disruptions.

BAC Holding International operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations, a critical legal consideration. These laws, enforced globally, mandate rigorous internal controls and customer due diligence to prevent illicit financial flows. Failure to comply can result in substantial fines and severe reputational damage, impacting market trust and operational continuity.

Consumer protection and data privacy laws are increasingly stringent across Central America, directly affecting how BAC Holding International manages customer information, conducts marketing, and handles grievances. For instance, El Salvador's Data Protection Law, enacted in 2023, mandates clear consent for data collection and processing, impacting BAC's customer engagement strategies. Failure to comply risks significant fines and reputational damage, making adherence crucial for maintaining customer trust and avoiding legal entanglements.

Labor Laws and Employment Regulations

Labor laws and employment regulations significantly shape BAC Holding International's operations across its various markets, impacting everything from recruitment and salary structures to employee dismissal procedures. Staying compliant with these diverse legal frameworks is paramount for fostering a just workplace and mitigating the risk of costly labor disputes. For instance, in 2024, the average cost of a wrongful termination lawsuit in the United States can range from $40,000 to $150,000, highlighting the financial implications of non-compliance.

Navigating these regulations requires a proactive approach to human resource management. Key areas of focus include adherence to minimum wage laws, working hour restrictions, and employee benefits mandates, which can vary substantially by region. Companies like BAC must also stay abreast of evolving legislation, such as the proposed changes to overtime eligibility in the US expected by late 2024, which could affect a significant portion of its workforce.

- Hiring Practices: Ensuring fair hiring processes and compliance with anti-discrimination laws.

- Compensation & Benefits: Adhering to minimum wage, overtime, and statutory benefit requirements.

- Termination Procedures: Following legal guidelines for employee dismissal to prevent disputes.

- Worker Safety: Complying with occupational health and safety regulations to ensure a secure working environment.

International Sanctions and Compliance

BAC Holding International, operating globally, must navigate a complex web of international sanctions. Compliance with regimes set by entities like the United Nations, the European Union, and the United States Treasury Department is non-negotiable. Failure to adhere can result in severe penalties, reputational damage, and restricted access to international financial markets.

The evolving landscape of global sanctions, particularly concerning economic restrictions on various nations and entities, directly impacts BAC's operational capacity and strategic partnerships. For instance, the extensive sanctions imposed on Russia following its 2022 invasion of Ukraine have significantly altered global financial flows and necessitated rigorous due diligence for any transactions involving sanctioned individuals or organizations. Similarly, ongoing sanctions related to Iran and North Korea require constant monitoring and adaptation of compliance protocols.

- Sanctions Compliance Costs: Financial institutions globally are investing billions annually in sanctions screening technology and compliance personnel, a trend expected to continue through 2025 as regulatory scrutiny intensifies.

- Impact on Cross-Border Transactions: Sanctions can freeze assets and block payments, directly hindering BAC's ability to conduct international business and potentially leading to significant revenue losses if critical markets become inaccessible.

- Regulatory Fines: In 2023, financial institutions faced billions in fines for sanctions violations, underscoring the critical need for robust compliance frameworks to avoid such costly repercussions.

- Reputational Risk: Association with sanctioned entities, even inadvertently, can severely damage BAC's reputation, impacting investor confidence and customer trust.

BAC Holding International must navigate evolving data privacy laws, such as El Salvador's 2023 Data Protection Law, impacting customer information management and consent requirements. Compliance with stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations is also paramount, with global enforcement leading to substantial fines for non-compliance. Furthermore, labor laws across Central America dictate hiring, compensation, and termination practices, with potential litigation costs for wrongful termination in the US averaging $40,000-$150,000 in 2024.

Environmental factors

Central America, where BAC Holding International operates, faces significant climate change impacts. The region is prone to extreme weather events like hurricanes, floods, and droughts, which directly threaten BAC's physical assets and the financial well-being of its diverse client base. For instance, the 2023 Atlantic hurricane season saw several powerful storms impacting Central America, causing billions in damages and disrupting economic activity, directly affecting loan repayment capabilities.

BAC must proactively assess and manage these climate-related risks within its extensive lending portfolios. This involves understanding how physical climate impacts could impair borrowers' ability to repay loans and ensuring the operational resilience of BAC's own infrastructure against these events. For example, a prolonged drought in an agricultural-heavy region could severely impact BAC's agribusiness loans, necessitating proactive risk mitigation strategies.

Environmental, Social, and Governance (ESG) standards are increasingly shaping global finance. BAC's investment decisions and risk management are directly impacted by this trend, as stakeholders demand greater accountability for sustainability. For instance, the sustainable finance market is projected to reach $50 trillion by 2025, highlighting the significant capital flow towards ESG-compliant entities.

Adherence to ESG principles, such as the UN Principles for Responsible Banking, can significantly boost BAC's reputation. This commitment attracts a growing pool of responsible investors, with global ESG assets expected to exceed $53 trillion by 2025, according to Bloomberg Intelligence. Furthermore, embracing these standards can unlock new opportunities in green and social financing, aligning BAC with the burgeoning sustainable economy.

Resource scarcity, especially concerning water, presents a significant challenge for BAC Holding International. Sectors it supports, like agriculture and manufacturing, rely heavily on water availability, impacting their economic stability and thus BAC's lending portfolio. For instance, in 2024, many agricultural regions experienced severe drought conditions, leading to reduced crop yields and increased operational costs for businesses in these sectors.

The increasing global demand for water, coupled with climate change impacts, is intensifying this scarcity. By 2025, projections indicate that over two-thirds of the world's population could face water shortages. This reality necessitates that BAC Holding International integrates robust sustainable resource management into its operational strategies and lending criteria, ensuring long-term viability for both the company and its clients.

Pollution and Environmental Regulations

Environmental regulations concerning pollution control and waste management directly influence BAC Holding International's operational expenses and the inherent environmental risks tied to its financed ventures. Stricter enforcement of these rules, particularly in 2024 and projected into 2025, could necessitate increased capital expenditure for compliance, impacting project viability and profitability.

BAC's role in guiding clients toward cleaner production methods and sustainable practices is crucial. For instance, the global push for reduced carbon emissions, with many nations setting ambitious targets for 2030 and beyond, means that financing projects with lower environmental footprints becomes increasingly important. This proactive approach not only ensures regulatory adherence but also strengthens BAC's commitment to long-term sustainability goals.

- Increased compliance costs: Companies face higher expenses for pollution control equipment and waste disposal, potentially affecting project financing terms.

- Shift towards green financing: Demand for financial products supporting environmentally friendly projects is growing, with sustainable finance market expected to reach $50 trillion by 2025 globally.

- Reputational risk: Failure to comply with environmental standards can damage a company's image and its ability to attract investment.

- Opportunities in clean tech: Regulations can spur innovation and investment in renewable energy and pollution abatement technologies, creating new financing avenues.

Biodiversity Loss and Ecosystem Services

The escalating concern over biodiversity loss and its impact on ecosystem services in Central America presents a significant environmental challenge for financial institutions like BAC Holding International. Businesses operating in this region, and by extension their financiers, are increasingly scrutinized for their contributions to habitat degradation and species decline.

BAC may encounter mounting pressure from regulators, investors, and the public to rigorously evaluate and reduce the biodiversity footprint associated with its loan portfolios and investment strategies. This is especially pertinent for activities undertaken in ecologically sensitive zones, where the consequences of business operations on natural capital are amplified. For instance, the Inter-American Development Bank (IDB) has highlighted that the Central American Dry Corridor, a vital agricultural region, is particularly vulnerable to climate change and biodiversity loss, impacting livelihoods and economic stability.

- Central America's rich biodiversity is under threat: Over 60% of the region's original forest cover has been lost, impacting critical ecosystem services like water regulation and pollination.

- Financial institutions face growing scrutiny: Investors are increasingly demanding transparency on environmental, social, and governance (ESG) factors, including biodiversity risk in lending.

- Ecosystem services are vital for economic stability: The loss of these services, such as clean water and fertile soil, directly impacts sectors like agriculture and tourism, which are crucial to Central American economies.

- Mitigation efforts are becoming essential: BAC will likely need to integrate biodiversity risk assessments into its due diligence processes to align with international sustainability standards and maintain market access.

Central America's vulnerability to climate change, evidenced by frequent extreme weather events, poses direct risks to BAC Holding International's assets and clients' financial stability. The region's reliance on climate-sensitive sectors like agriculture means that droughts or floods directly impact loan repayment capabilities, as seen with significant damages from 2023 hurricanes.

Increasingly stringent environmental regulations, particularly concerning pollution and waste, are raising compliance costs for businesses BAC finances, potentially affecting project viability. The global shift towards sustainable finance, with market growth projected to reach $50 trillion by 2025, incentivizes BAC to support cleaner production methods and green investments to attract capital and maintain a strong reputation.

Resource scarcity, especially water, is a growing concern, impacting sectors like agriculture and manufacturing that are key to BAC's lending portfolios. With over two-thirds of the world potentially facing water shortages by 2025, integrating sustainable resource management into lending criteria is crucial for long-term portfolio health.

Biodiversity loss in Central America, with over 60% of original forest cover lost, creates reputational and operational risks for BAC. Investors are increasingly scrutinizing ESG factors, including biodiversity impact, necessitating robust risk assessments in lending to maintain market access and align with sustainability standards.

| Environmental Factor | Impact on BAC Holding International | Data/Projection (2024/2025) |

|---|---|---|

| Climate Change & Extreme Weather | Threat to physical assets, loan repayment capacity, operational disruption | 2023 hurricane season caused billions in damages; projections indicate increasing frequency and intensity of events. |

| Environmental Regulations | Increased compliance costs, potential impact on project financing, opportunities in clean tech | Stricter enforcement expected; global sustainable finance market projected to reach $50 trillion by 2025. |

| Resource Scarcity (Water) | Impact on agricultural and manufacturing sectors, loan portfolio risk | Over 2/3 of global population may face water shortages by 2025; drought conditions in 2024 affected crop yields. |

| Biodiversity Loss | Reputational risk, investor scrutiny, need for ESG integration | Over 60% of Central America's original forest cover lost; growing demand for transparency on biodiversity risk in lending. |

PESTLE Analysis Data Sources

Our PESTLE analysis for BAC Holding International is informed by a comprehensive review of global economic indicators, regulatory updates from key operating regions, and industry-specific market research. We also incorporate insights from technological trend reports and socio-demographic data to provide a well-rounded perspective.