Baidu SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baidu Bundle

Baidu's dominance in China's search engine market presents a significant strength, yet its reliance on this core business and intense competition from global tech giants pose considerable threats. Understanding these dynamics is crucial for anyone looking to navigate the rapidly evolving digital landscape.

Want the full story behind Baidu's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Baidu commands a commanding presence in China's search engine market, consistently holding over 50% of the total share. This dominance is even more pronounced on mobile devices, where its user base is particularly strong.

This substantial market share is a critical strength, forming the bedrock for Baidu's lucrative advertising business and its ability to drive user engagement across the vast Chinese digital landscape. It's a powerful platform for connecting global brands with Chinese consumers actively seeking products and services.

Baidu's significant investment in Artificial Intelligence (AI) is a core strength, with the company consistently reinvesting over 20% of its revenue into research and development. This commitment fuels its application of AI across its diverse platforms and the creation of advanced technologies.

The company's AI prowess is clearly demonstrated through its expanding AI Cloud services and the development of sophisticated AI models such as Ernie 4.5 and Ernie X1, positioning Baidu at the forefront of AI innovation in China, as evidenced by its leading number of AI-related patents.

Baidu's Apollo Go is a significant strength, showcasing advanced autonomous driving capabilities. The unit is targeting profitability by 2025, a testament to its commercialization efforts.

As of Q1 2025, Apollo Go has deployed over 1,000 autonomous vehicles and provided 11 million rides globally, demonstrating substantial operational scale and user adoption, outpacing some international competitors.

The company's strategy of pursuing an 'asset-light' model through partnerships for international expansion, including planned robotaxi launches in Southeast Asia and the Middle East, positions Apollo Go for wider market penetration and growth.

Diversified Product Portfolio and Cloud Computing Growth

Baidu's strength lies in its extensive and diversified product portfolio, extending far beyond its foundational search engine. This includes a robust suite of internet services such as online marketing, content and information platforms, a variety of mobile applications, and tailored enterprise solutions. This broad offering creates multiple avenues for revenue generation.

The company's AI Cloud division is a significant growth driver. In the first quarter of 2025, Baidu reported a substantial revenue surge from this segment, primarily fueled by the increasing adoption of its advanced large language models and a deeper penetration into its client base. This upward trend highlights the growing demand for its AI-powered cloud services.

- Diversified Revenue Streams: Baidu's product range, including search, online marketing, content services, mobile apps, and enterprise solutions, provides resilience against fluctuations in any single market.

- AI Cloud Momentum: The AI Cloud division experienced significant revenue growth in Q1 2025, driven by strong demand for its large language models and expanded client relationships.

- Strategic Expansion: Diversification into areas like AI Cloud helps Baidu mitigate risks associated with its traditional advertising business and capture new market opportunities.

Robust IT Infrastructure and Innovation Culture

Baidu's robust IT infrastructure serves as a significant strength, enabling the company to scale its diverse range of services across China and explore international expansion. This foundation is crucial for supporting its ambitious growth plans.

The company fosters a strong culture of innovation, which is a key driver for its competitive advantage. By consistently developing cutting-edge solutions, Baidu aims to enhance efficiency and reduce operational costs.

Baidu's commitment to innovation is underscored by its substantial research and development investments. For instance, in 2023, Baidu reported R&D expenses of approximately RMB 21.2 billion (around $2.9 billion), demonstrating its dedication to staying ahead in rapidly evolving technological sectors.

- Strong IT Backbone: Supports scalability and service expansion within China and globally.

- Innovation-Driven Growth: Develops new technologies to reduce expenses and gain market share.

- Significant R&D Investment: RMB 21.2 billion in 2023, fostering adaptability and technological leadership.

Baidu's dominance in China's search market, holding over 50% share, provides a robust platform for its advertising business and user engagement. This strong market position is further bolstered by significant investments in AI, with over 20% of revenue reinvested in R&D, leading to advanced models like Ernie 4.5 and a leading patent portfolio in AI. The company's Apollo Go autonomous driving unit is also a key strength, targeting profitability by 2025 with over 1,000 vehicles deployed globally by Q1 2025, demonstrating substantial operational scale and user adoption.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Search Market Share (China) | > 50% | 2024/2025 | Dominant user base for advertising and services. |

| R&D Investment | > 20% of Revenue | 2024/2025 | Drives AI innovation and technological leadership. |

| Apollo Go Vehicles Deployed | > 1,000 | Q1 2025 | Demonstrates operational scale in autonomous driving. |

| Apollo Go Rides Provided | 11 million | Q1 2025 | Indicates significant user adoption and market traction. |

| R&D Expenses | RMB 21.2 billion | 2023 | Highlights commitment to technological advancement. |

What is included in the product

Analyzes Baidu’s competitive position through key internal and external factors, detailing its strengths in AI and search, weaknesses in diversification, opportunities in cloud and autonomous driving, and threats from global competition and regulatory changes.

Identifies Baidu's competitive advantages and weaknesses to inform strategic adjustments, alleviating the pain of navigating a complex and rapidly evolving digital landscape.

Weaknesses

Baidu's significant reliance on the Chinese market presents a notable weakness. While its core search engine and many other services are deeply entrenched in China, this concentration leaves the company vulnerable to domestic economic shifts and evolving regulatory landscapes. For instance, in 2023, China's digital advertising market, a key revenue driver for Baidu, experienced slower growth compared to previous years, directly impacting Baidu's top-line performance.

Furthermore, Baidu's limited international presence hinders its ability to diversify revenue streams and tap into global growth opportunities. Despite ongoing investments in areas like autonomous driving, such as its Apollo platform which has seen pilot programs in countries like Japan and Singapore, the majority of its user base and revenue generation remains within China. This geographical concentration restricts its overall market reach and exposes it to greater risk from any single market's downturn.

Baidu's primary online advertising revenue has faced a notable downturn. In the first quarter of 2024, Baidu reported a 1% year-over-year decrease in online marketing revenue, a trend that has persisted through recent reporting periods.

This weakening is largely due to broader economic headwinds impacting advertiser spending and intensifying competition from rivals like Douyin and Kuaishou, which are capturing a larger share of the digital ad market.

Furthermore, Baidu's ongoing shift towards more sophisticated, AI-powered advertising solutions, while strategic for the long term, has created short-term revenue disruption as the company retools its offerings and client base adapts.

Baidu, despite its AI leadership, navigates a landscape of intense competition. Giants like Alibaba and Tencent are formidable rivals, alongside agile AI startups such as DeepSeek, all vying for dominance in China's burgeoning AI sector. This rivalry, particularly in the crucial area of large language models, necessitates constant innovation and strategic monetization to maintain its edge.

Regulatory Challenges and Content Moderation Issues

Baidu navigates China's stringent regulatory landscape, which imposes significant control over online content and is increasingly targeting AI development. This environment presents ongoing challenges, as demonstrated by past warnings Baidu received for inadequate content moderation, highlighting the risk of penalties and reputational damage.

The evolving regulatory framework, particularly concerning AI and data privacy, can impede Baidu's innovation pipeline and necessitate substantial investments in compliance, thereby increasing operational overhead. For instance, China's Cybersecurity Law and Personal Information Protection Law (PIPL) impose strict data handling requirements.

- Regulatory Scrutiny: Baidu faces constant oversight from Chinese authorities regarding content and data, impacting its service offerings.

- Content Moderation Burden: The company must invest heavily in systems to detect and remove prohibited content, a resource-intensive task.

- AI Governance Impact: New regulations on AI algorithms and data usage can slow down the development and deployment of Baidu's advanced AI products.

Profitability Pressures from AI Investments

Baidu's substantial investments in artificial intelligence and cloud computing, though vital for future expansion, are currently impacting its profitability. For instance, in the first quarter of 2024, Baidu reported a net income of RMB 3.5 billion (approximately $483 million), a decrease from RMB 4.2 billion in the same period of 2023, partly reflecting these ongoing R&D expenditures. The company is navigating the complex task of allocating significant capital to these advanced technologies while simultaneously striving to uphold its current earnings performance.

The critical challenge for Baidu lies in effectively monetizing its AI and cloud ventures at a pace that validates the considerable financial resources being deployed. While Baidu Cloud revenue grew 8% year-over-year in Q1 2024, reaching RMB 6.7 billion (approximately $922 million), the overall growth trajectory of these newer segments needs to accelerate to offset the high upfront costs and contribute more significantly to the bottom line.

- AI and Cloud Investment Strain: Baidu's commitment to AI R&D and cloud infrastructure development is a significant drain on current profits.

- Monetization Lag: The revenue generated from these advanced technologies has not yet fully compensated for the substantial investment, creating a profitability gap.

- Balancing Act: Baidu must find a way to balance aggressive future-oriented spending with the immediate need to demonstrate strong financial returns.

Baidu's overwhelming reliance on the Chinese market is a significant weakness, making it susceptible to domestic economic fluctuations and regulatory shifts. For example, slower growth in China's digital advertising market in 2023 directly impacted Baidu's revenue.

The company's limited international footprint restricts its ability to diversify revenue and capitalize on global growth, with the majority of its user base and earnings concentrated within China.

Baidu's core online advertising revenue has seen a decline, with a 1% year-over-year decrease reported in Q1 2024, attributed to economic headwinds and increased competition from platforms like Douyin.

Intense competition within China's AI sector from giants like Alibaba and Tencent, as well as emerging AI startups, demands continuous innovation and strategic monetization to maintain its market position.

Navigating China's stringent regulatory environment, particularly concerning content moderation and AI development, poses ongoing challenges and necessitates significant investment in compliance.

Substantial investments in AI and cloud computing, while crucial for future growth, are currently pressuring Baidu's profitability, as evidenced by a decrease in net income in Q1 2024 compared to the previous year.

The monetization of Baidu's AI and cloud ventures is not yet fully compensating for the high upfront costs, creating a gap in profitability that needs acceleration in revenue generation from these newer segments.

| Area of Weakness | Impact | Supporting Data (Q1 2024 unless specified) |

|---|---|---|

| Geographic Concentration | Vulnerability to domestic market changes and limited global diversification. | Majority of revenue and user base in China. |

| Online Advertising Revenue | Declining revenue impacting core business performance. | 1% year-over-year decrease in online marketing revenue. |

| Competitive Landscape | Pressure to innovate and monetize in a crowded AI market. | Competition from Alibaba, Tencent, and AI startups. |

| Regulatory Environment | Compliance costs and potential impact on AI development. | Stringent Chinese regulations on content and AI. |

| Investment in Future Technologies | Strain on current profitability due to high R&D and infrastructure spending. | Net income decreased to RMB 3.5 billion from RMB 4.2 billion year-over-year. |

Preview Before You Purchase

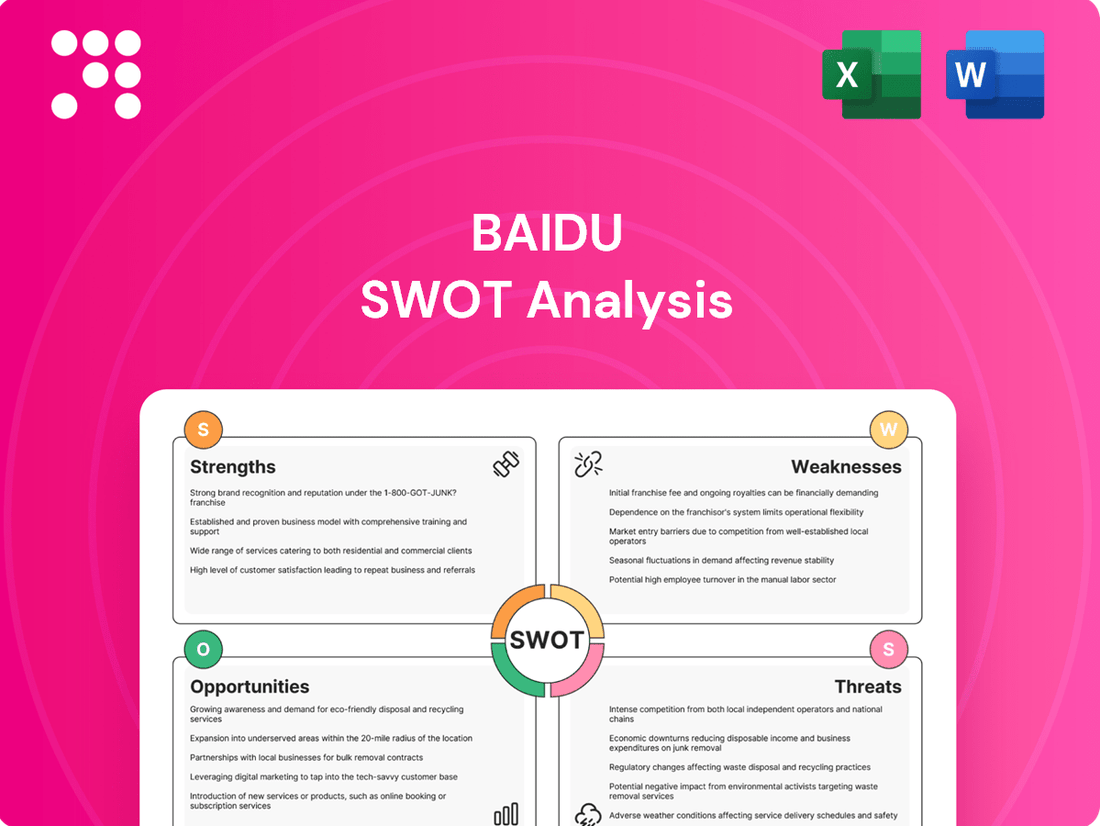

Baidu SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Baidu's Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to delve deeper into Baidu's strategic positioning and competitive landscape.

Opportunities

Baidu's AI Cloud division is poised for significant growth, with projections indicating continued expansion in the coming years. This segment is a key focus for the company, leveraging its advancements in artificial intelligence.

The increasing adoption of Baidu's large language models, like Ernie 4.5 and Ernie X1, alongside its Qianfan platform, offers a substantial opportunity for monetizing AI. Competitive pricing strategies and the provision of advanced tools for enterprises are expected to drive revenue from these AI offerings.

There is a clear potential for Baidu's AI Cloud to capture a larger share of China's burgeoning AI infrastructure market. As demand for AI solutions escalates, Baidu is strategically positioned to benefit from this trend.

Baidu's Apollo Go is poised for significant global growth, building on its validated business model. The company has announced intentions to launch robotaxi services in key Southeast Asian markets, including Malaysia and Singapore, as well as in the Middle East with operations planned for Dubai and Abu Dhabi.

Strategic alliances are crucial to this expansion. Baidu's partnership with Uber for international deployment is a prime example, aiming to extend Apollo's autonomous driving capabilities beyond China's borders. This collaboration is expected to unlock substantial new revenue streams and tap into diverse international markets.

Baidu is heavily investing in AI to upgrade its search engine, aiming to significantly improve how users find information and get tasks done. This AI-driven transformation is expected to boost user engagement across its product suite, including offerings like Baidu Wenku, which could lead to increased traffic and a more attractive advertising environment.

The company's AI push is designed to revitalize its core search business. By offering more intelligent and personalized search results, Baidu anticipates drawing in more users and advertisers, potentially reversing recent market share trends.

Growing Demand for Online Advertising and Digital Marketing Solutions

The burgeoning demand for online advertising and digital marketing, especially from foreign brands looking to enter China, offers a significant avenue for Baidu's growth. Its established position in the search market, coupled with advanced commercial tools, enables precise targeting of users with strong purchasing intent. This capability is crucial for facilitating quicker market entry and boosting conversion rates for these businesses.

Baidu's platform is well-positioned to capitalize on this trend. For instance, in 2023, China's digital advertising market was estimated to be worth over $100 billion, with search advertising forming a substantial portion. Baidu's existing infrastructure and user base provide a strong foundation to capture a significant share of this growing market.

- Targeted Reach: Baidu's search engine allows advertisers to connect with users actively seeking products and services.

- Market Entry Facilitation: The platform can significantly streamline the process for foreign companies entering the competitive Chinese market.

- Performance-Driven Solutions: Baidu's commercial tools are designed to optimize campaigns for measurable results, appealing to businesses focused on ROI.

- Evolving Digital Landscape: As more businesses shift their marketing budgets online, Baidu's role as a primary gateway for information discovery becomes increasingly valuable.

Strategic Partnerships and Collaborations

Baidu's strategic partnerships are a key opportunity for growth, particularly in cutting-edge fields like autonomous driving. By teaming up with other tech giants, car manufacturers, and local entities, Baidu can speed up its expansion into these new markets. These alliances also help distribute the costs and complexities of regulatory compliance, while simultaneously broadening market access and combining unique capabilities to create advanced products.

Consider these specific partnership avenues:

- Autonomous Driving Ecosystem: Collaborations with automakers like Geely and BYD can accelerate the deployment of Baidu's Apollo autonomous driving platform in mass-produced vehicles. For instance, Baidu announced in late 2023 plans to integrate its autonomous driving technology into a wider range of vehicles through partnerships.

- AI and Cloud Services: Strategic alliances with enterprise software providers or hardware manufacturers can embed Baidu's AI capabilities and cloud services into broader business solutions, expanding its reach beyond consumer applications.

- International Expansion: Partnering with local players in emerging markets can help Baidu navigate diverse regulatory landscapes and consumer preferences, facilitating its global ambitions.

Baidu's AI Cloud is a significant growth engine, with its AI-powered solutions and large language models like Ernie 4.5 and Ernie X1 offering substantial revenue potential. The company is well-positioned to capture a larger share of China's rapidly expanding AI infrastructure market, driven by increasing enterprise demand for advanced AI tools and services.

The global expansion of Baidu's Apollo Go robotaxi service, with planned launches in Southeast Asia and the Middle East, presents a major opportunity. Strategic partnerships, such as the one with Uber, are crucial for navigating international markets and unlocking new revenue streams for its autonomous driving technology.

By integrating AI into its core search engine, Baidu aims to enhance user experience and engagement, which in turn can boost its advertising business. This AI-driven revitalization is expected to attract more users and advertisers, particularly as the digital advertising market, valued at over $100 billion in China in 2023, continues to grow.

Threats

Baidu navigates a fierce competitive arena, challenged by domestic titans like Alibaba and Tencent, whose expansive ecosystems often overlap with Baidu's offerings, particularly in cloud and AI services. This rivalry extends to emerging AI startups, constantly innovating and chipping away at market share.

The threat is amplified by global tech giants such as Google and Microsoft's Bing, which maintain a presence in China's search engine market, adding another layer of pressure. In 2023, Baidu's search engine market share in China hovered around 60%, a strong position but one that requires constant vigilance against these powerful international and domestic competitors.

Baidu faces considerable risk from China's increasingly strict regulatory landscape. New rules governing artificial intelligence, coupled with ongoing internet content crackdowns, directly impact Baidu's operations and future development. These measures necessitate greater compliance, potentially slowing down innovation and increasing operational expenses.

The Chinese government's intensified scrutiny, particularly in the tech sector, means Baidu must navigate a complex web of new mandates. For instance, regulations introduced in 2023 and further refined in early 2024 around generative AI and data security require significant adjustments. These shifts could limit how Baidu develops and deploys its AI technologies, impacting its competitive edge and profitability. Analysts noted that compliance costs for major tech firms in China rose by an estimated 10-15% in 2024 due to these evolving requirements.

Baidu faces significant threats from a subdued macroeconomic environment in China. A weaker-than-expected economic recovery directly impacts consumer spending and business investment, which in turn dampens advertising budgets. This slowdown has already been a contributing factor to Baidu's core online marketing revenue experiencing a decline, as businesses cut back on their promotional activities.

Economic pressures in China have demonstrably affected Baidu's financial performance. For instance, in the first quarter of 2024, Baidu reported that its online marketing services revenue saw a year-on-year decrease, a clear indication of how macroeconomic headwinds translate into reduced advertising spend on its platform. This trend highlights the vulnerability of Baidu's primary revenue stream to broader economic downturns.

Challenges in Monetizing AI Investments and Achieving Profitability

Baidu's significant investments in AI and cloud computing, while promising for the future, present a challenge in generating immediate returns. The company must find effective ways to translate these technological advancements into tangible revenue streams in the near to medium term.

The substantial research and development expenditures required for AI innovation place pressure on Baidu's profit margins. If revenue growth from these ventures doesn't accelerate, it could become difficult to satisfy shareholder expectations and maintain profitability.

- Monetization Lag: Baidu's AI and cloud segments, despite substantial investment, are still developing robust monetization strategies. For instance, while cloud revenue grew, the overall profitability of these newer ventures remains a key concern for investors looking for near-term returns.

- R&D Cost Burden: In 2023, Baidu reported significant R&D expenses, a portion of which is allocated to AI development. This high expenditure, without commensurate revenue generation from these specific AI initiatives, directly impacts overall profit margins, creating a threat to short-term financial performance.

- Shareholder Justification: The ongoing need to demonstrate a clear path to profitability for its AI investments to shareholders is a constant pressure. Failure to show a strong return on these large capital outlays could lead to investor skepticism and negatively affect Baidu's market valuation.

Shifting User Preferences and Alternative Information Platforms

Baidu's core search business is feeling the heat from evolving user habits. People are spending more time on social media and exploring new AI-powered search alternatives, which directly challenges Baidu's traditional dominance. This shift could chip away at its market share and advertising income if Baidu doesn't keep pace.

For instance, while Baidu remains a search giant, the increasing popularity of platforms like Douyin (TikTok's Chinese version) for information discovery presents a significant threat. Users are often finding answers and content through short videos and community discussions rather than traditional search queries. This trend highlights a critical need for Baidu to diversify its content delivery and engagement strategies beyond its search engine.

- Evolving User Behavior: A growing number of users, particularly younger demographics, are turning to social media and specialized content platforms for information, bypassing traditional search engines.

- Rise of AI Search: New AI-driven search tools and conversational interfaces offer alternative ways to find information, potentially fragmenting the search market.

- Market Share Erosion: Failure to adapt to these changing preferences could lead to a further decline in Baidu's search market share and, consequently, its advertising revenue.

- Content Diversification: Baidu needs to integrate or compete with these new information platforms, possibly by enhancing its own content ecosystem and user engagement features.

Baidu faces intense competition from both domestic rivals like Alibaba and Tencent, and global tech giants such as Google. These competitors are actively expanding into Baidu's core search and emerging AI markets, putting pressure on its market share, which stood at approximately 60% in China's search engine market in 2023.

The company is also navigating a challenging regulatory environment in China, with new rules impacting AI development and data security. These regulations, which intensified in 2023 and early 2024, could increase compliance costs by an estimated 10-15% for major tech firms, potentially slowing innovation.

A subdued Chinese macroeconomic environment poses a threat, as weaker consumer spending and business investment directly reduce advertising budgets, impacting Baidu's primary revenue stream. This was evident in Q1 2024, where Baidu reported a year-on-year decrease in its online marketing services revenue.

Baidu’s significant investments in AI and cloud computing, while strategic, present a threat due to the lag in generating substantial returns. High R&D expenses, as seen in 2023, can strain profit margins if revenue from these ventures does not accelerate, creating pressure to justify these outlays to shareholders.

| Threat Category | Specific Threat | Impact on Baidu | Supporting Data/Context |

|---|---|---|---|

| Competition | Domestic & Global Rivals | Market share erosion, reduced ad revenue | Baidu's 2023 search market share ~60%; Alibaba, Tencent, Google active in AI/cloud. |

| Regulatory Environment | Stricter AI & Data Security Rules | Increased compliance costs, slowed innovation | Estimated 10-15% rise in compliance costs for Chinese tech firms in 2024. |

| Macroeconomic Factors | Economic Slowdown in China | Reduced advertising spend, lower revenue | Q1 2024 online marketing revenue saw year-on-year decrease. |

| Financial/Investment | Monetization Lag in AI/Cloud | Pressure on profit margins, shareholder concerns | High R&D spend in 2023 without immediate commensurate revenue from AI initiatives. |

SWOT Analysis Data Sources

This Baidu SWOT analysis is built upon a robust foundation of data, including official financial reports, comprehensive market research from leading industry analysts, and insights from reputable technology and business publications. We also incorporate expert opinions and verified news sources to provide a well-rounded and accurate strategic assessment.