Baidu PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baidu Bundle

Navigate the complex landscape of Baidu's operations with our expert PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are directly impacting its market position. Gain the strategic foresight you need to make informed decisions and secure your competitive advantage. Download the full analysis now and unlock actionable intelligence.

Political factors

Baidu faces significant government regulatory scrutiny in China, impacting its operations. For instance, in 2023, the Cyberspace Administration of China (CAC) continued to enforce strict rules on online content and data handling, leading Baidu to invest heavily in content moderation systems and compliance measures. These regulations directly affect how Baidu displays advertising, especially in sensitive areas like healthcare, requiring constant adaptation of its platform and business practices to align with evolving government directives.

The Chinese government is heavily invested in AI, seeing it as a key driver for both economic growth and national security. This strong backing translates into tangible support for companies like Baidu.

Baidu has been a frontrunner in the generative AI space, receiving early approvals for its services. This preferential treatment highlights the government's commitment to fostering domestic AI innovation, with significant state funding flowing into AI research and infrastructure development across the nation.

Baidu faces ongoing antitrust scrutiny in China, a significant political factor that could impede its growth strategies, particularly through mergers and acquisitions. Chinese regulators have demonstrated a cautious approach to large-scale acquisitions, which may restrict Baidu's capacity to diversify its business segments and integrate novel technologies.

Geopolitical Tensions and Export Controls

The persistent US-China trade tensions and the imposition of export controls, especially concerning advanced semiconductors, present significant hurdles for Chinese technology firms such as Baidu. These measures are designed to curtail access to cutting-edge technologies.

This geopolitical climate compels companies like Baidu to accelerate their development of indigenous chip solutions and foster greater self-sufficiency in artificial intelligence. For instance, Baidu has been actively investing in its Kunlun AI chips, aiming to reduce reliance on foreign suppliers. In 2023, Baidu reported that its Kunlun chips were being used in a growing number of its own services and were also being offered to external partners, indicating progress in its domestic sourcing strategy.

- US Export Controls: Restrictions on the sale of advanced chip manufacturing equipment and high-end AI chips to China, impacting companies reliant on foreign technology.

- Baidu's Response: Increased investment in and development of its own AI chips, such as the Kunlun series, to mitigate the impact of these controls.

- Self-Reliance Drive: The geopolitical landscape is pushing Chinese tech companies towards greater technological independence, particularly in critical areas like AI and semiconductor manufacturing.

Autonomous Driving Regulatory Approvals

Baidu's advancements in autonomous driving, particularly through its Apollo Go robotaxi service, are heavily dependent on securing necessary governmental approvals for testing and commercial operation. Progress in establishing regulatory frameworks and granting permits directly impacts the scalability of these services.

Recent developments show a positive trend, with Baidu receiving permits to operate fully driverless robotaxis in designated zones in cities like Wuhan and Hong Kong. For instance, by the end of 2023, Baidu's Apollo Go had accumulated over 3.6 million passenger rides across 14 cities in China, highlighting the growing operational footprint enabled by evolving regulations.

- Regulatory Hurdles: Baidu's autonomous driving solutions, like Apollo Go, require specific governmental approvals to operate and expand their service areas.

- Commercialization Enablers: Regulatory progress, including the expansion of testing zones and the issuance of operational permits in cities such as Hong Kong and Wuhan, is vital for the commercial viability and widespread deployment of these services.

- Operational Growth: As of early 2024, Baidu's Apollo Go robotaxi service was operational in over 14 cities, with continued efforts to secure permits for further expansion in key urban centers.

Government policy significantly shapes Baidu's operating environment, from content regulation to AI development support. China's focus on technological self-sufficiency, driven by geopolitical factors like US export controls, directly influences Baidu's strategic investments in areas like indigenous chip development, exemplified by its Kunlun AI chips. Furthermore, the government's evolving stance on autonomous driving is critical for Baidu's Apollo Go robotaxi service, with regulatory approvals directly enabling operational expansion and commercialization.

| Political Factor | Impact on Baidu | 2023/2024 Data/Trend |

| Content Regulation & Data Handling | Compliance costs, operational adjustments | Continued strict enforcement by CAC; Baidu invests in moderation. |

| AI Development Support | Favorable environment for AI innovation | Early approvals for generative AI services; state funding for AI research. |

| Antitrust Scrutiny | Potential restrictions on M&A and growth | Chinese regulators cautious on large acquisitions. |

| US-China Trade Tensions & Export Controls | Need for technological self-reliance | Baidu accelerates Kunlun AI chip development; increased domestic sourcing. |

| Autonomous Driving Regulations | Enables or hinders service expansion | Permits granted for driverless robotaxis in Wuhan, Hong Kong; Apollo Go in 14+ cities by early 2024. |

What is included in the product

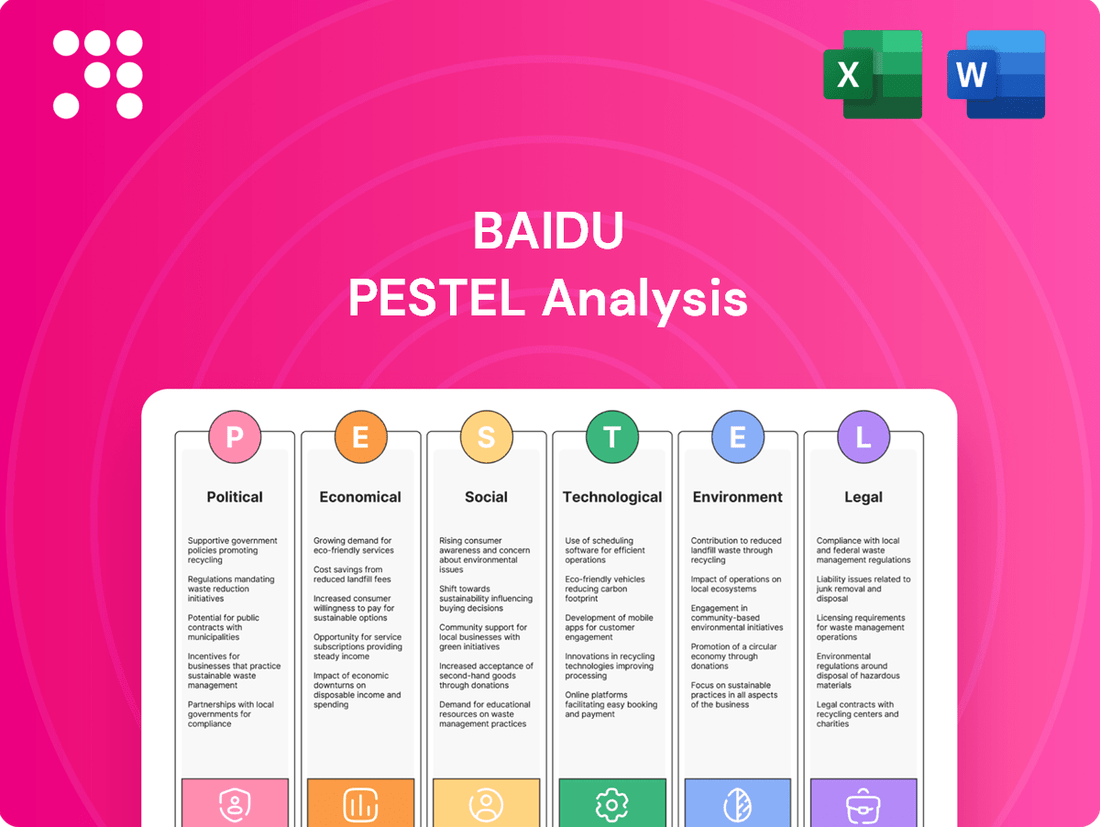

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Baidu, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable breakdown of Baidu's external environment, transforming complex geopolitical and economic shifts into manageable insights for strategic decision-making.

Economic factors

Baidu's core online marketing business has been feeling the pinch from China's economic slowdown. This sluggishness directly translates to reduced advertising spending by businesses, impacting Baidu's top line. For instance, in the first quarter of 2024, Baidu reported a 7% year-over-year decline in its advertising revenue, highlighting the persistent challenges.

The broader economic headwinds in China, including slower consumer spending and a cautious business investment climate, continue to weigh on Baidu's traditional revenue streams. This environment makes it harder for the company to grow its advertising base, a critical component of its financial health. The impact is evident in Baidu's financial reports, where the online marketing segment has shown vulnerability to these macroeconomic shifts.

Baidu faces intense rivalry in its core search engine market from global players like Microsoft's Bing and domestic competitors such as Qihoo's Haosou. This pressure extends to its advertising services, where social media platforms like WeChat and Douyin increasingly capture user attention and advertising budgets, impacting Baidu's revenue streams.

To combat this, Baidu is investing heavily in AI and cloud computing, aiming to differentiate its offerings and create new revenue avenues. For instance, Baidu's Ernie Bot, launched in 2023, represents a significant push into generative AI to enhance its search and other services, directly challenging competitors in this rapidly evolving space.

Baidu's commitment to artificial intelligence and research and development is a cornerstone of its long-term strategy. Over the last ten years, the company has poured close to RMB 170 billion into these critical areas, a significant investment aimed at securing future growth.

While these substantial AI investments are expected to yield significant returns, particularly targeting major breakthroughs by 2025, they currently exert pressure on Baidu's profit margins. This strategic allocation of capital underscores the company's focus on innovation and its ambition to lead in the rapidly evolving AI landscape.

Growth of AI Cloud Services

Baidu's AI Cloud services are experiencing significant growth, with revenue from this division accelerating. This expansion is largely driven by the increasing adoption of Baidu's advanced large language models and a deeper penetration into its client base. The company anticipates this strong growth trajectory to continue well into 2025.

Key factors contributing to this upward trend include:

- Accelerating Revenue Growth: Baidu's AI Cloud division has demonstrated robust momentum, indicating strong market demand.

- Large Language Model Adoption: The increasing use of Baidu's sophisticated AI models is a primary catalyst for this expansion.

- Enhanced Client Penetration: Baidu is successfully deepening its relationships and service offerings with existing clients.

- Positive 2025 Outlook: Prospects for continued growth in the AI Cloud sector remain strong for the upcoming year.

Commercialization of Autonomous Driving

Baidu's Apollo Go robotaxi service is on a clear path to financial viability, aiming to reach break-even by the end of 2024 and achieve profitability in 2025. This ambitious target is underpinned by the strategic deployment of more cost-effective autonomous vehicles and an aggressive expansion strategy. The company is not only broadening its domestic reach but also actively exploring international markets, which is crucial for scaling its operations and improving unit economics.

The commercialization of autonomous driving, exemplified by Apollo Go's progress, is a significant economic factor. By late 2024, Baidu anticipates its robotaxi business will achieve break-even, with profitability projected for 2025. This financial milestone is contingent on several key operational improvements and market expansions.

- Cost Reduction: Baidu is focusing on deploying more affordable autonomous driving hardware and software solutions to lower the per-vehicle operational cost.

- Market Expansion: The company plans to expand Apollo Go's service areas within China and is actively assessing opportunities in international markets to capture a larger customer base.

- Revenue Growth: Increased ride volumes and potential new service offerings within the autonomous mobility ecosystem are expected to drive revenue growth.

- Regulatory Support: Favorable government policies and evolving regulations supporting autonomous vehicle deployment are critical economic enablers for Baidu's strategy.

China's economic slowdown directly impacts Baidu's core advertising business, with reduced corporate spending affecting revenue. For instance, Baidu's advertising revenue saw a 7% year-over-year decrease in Q1 2024. This economic climate makes it challenging for Baidu to expand its advertising base, a critical revenue driver.

Same Document Delivered

Baidu PESTLE Analysis

The preview you see here is the exact Baidu PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing Baidu's Political, Economic, Social, Technological, Legal, and Environmental factors, delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same comprehensive Baidu PESTLE Analysis document you’ll download after payment, providing actionable insights.

Sociological factors

Chinese internet users are increasingly favoring mobile devices for their digital activities, with mobile search and social media platforms becoming primary sources for information and entertainment. By the end of 2024, it's estimated that over 90% of China's internet users will access the web via mobile, highlighting a significant shift from desktop usage.

This evolving user behavior necessitates that Baidu continuously adapts its platforms and services. For instance, Baidu's investment in its short-video and live-streaming capabilities reflects a strategic move to capture user attention in these increasingly popular content formats, aiming to maintain engagement amidst fierce competition.

Baidu has navigated significant public trust challenges, particularly concerning data privacy and the spread of misinformation. Incidents in prior years, such as the 2016 medical advertising scandal, highlighted deep-seated issues that eroded user confidence. These events underscore the critical need for robust data protection measures and greater transparency in how user information is handled to retain its substantial user base.

Societal trends show a significant upswing in the desire for services that understand and adapt to individual needs, largely driven by advancements in artificial intelligence. This shift is evident across numerous sectors, from personalized recommendations in e-commerce to tailored educational content.

Baidu is strategically positioning itself to capitalize on this demand by embedding AI capabilities throughout its core offerings, including its search engine, content platforms, and a wide array of applications. For instance, Baidu's AI-powered recommendation engine for its video platform, Haokan, saw a 20% increase in user engagement in early 2024, demonstrating the effectiveness of personalized content delivery.

Impact of AI on Employment and Society

The rapid advancement of Artificial Intelligence (AI) is profoundly reshaping employment patterns, necessitating a societal adaptation to evolving skill demands. Baidu, at the forefront of AI development, plays a dual role as both a driver of these changes and an entity influenced by them, particularly concerning the workforce's digital literacy and adaptability. For instance, by 2025, it's projected that AI will automate tasks currently performed by millions of workers globally, requiring significant reskilling initiatives.

Societies are grappling with the implications of AI on job displacement and creation, highlighting the urgent need for educational reforms to cultivate digital skills. Baidu's investments in AI research and development directly impact this transition, potentially creating new roles in AI management and ethics while simultaneously automating others. A 2024 report indicated that over 40% of businesses are increasing their investment in AI, signaling a broader societal shift towards AI integration.

- AI-driven automation is expected to impact millions of jobs by 2025, necessitating widespread reskilling and upskilling programs.

- Demand for digital skills is surging, with companies like Baidu actively seeking talent in areas such as machine learning engineering and AI ethics.

- Societal adaptation to AI requires proactive measures in education and workforce development to mitigate potential job displacement and harness new opportunities.

Digital Inclusion and Accessibility

Baidu is actively promoting digital inclusion through innovative AI applications. Their development of sign language 'digital humans' and AI coding assistants tailored for visually impaired developers highlights a dedication to making technology accessible to a broader audience. These efforts not only meet critical societal needs but also significantly broaden the user base for digital services.

These initiatives are crucial as digital divides persist globally. For instance, in 2024, the International Telecommunication Union reported that while internet penetration reached 66% worldwide, significant disparities remain, particularly in developing regions. Baidu's focus on accessibility directly tackles these gaps, ensuring more individuals can participate in the digital economy and benefit from technological advancements.

Baidu's commitment to accessibility is further evidenced by its ongoing investment in research and development for assistive technologies. By creating tools that cater to specific needs, Baidu aims to democratize access to information and digital tools, fostering a more equitable technological landscape.

- AI-Powered Sign Language: Baidu's 'digital humans' translate spoken language into sign language in real-time, aiding communication for the deaf and hard-of-hearing community.

- Assistive Coding Tools: The company is developing AI-driven coding assistants that provide auditory feedback and simplified interfaces, empowering visually impaired individuals in software development.

- Expanding Digital Reach: These projects underscore Baidu's strategy to leverage AI for social good, making its platforms and services usable by a wider range of people.

Societal shifts towards mobile-first internet usage are deeply impacting how Baidu operates, with over 90% of Chinese internet users expected to be mobile-accessing by the end of 2024. This trend has driven Baidu to prioritize mobile-centric services and content formats, like short videos and live streaming, to maintain user engagement in a highly competitive digital landscape.

Public trust remains a critical sociological factor for Baidu, especially concerning data privacy and misinformation, issues highlighted by past incidents. Rebuilding and maintaining user confidence requires robust data protection and increased transparency, essential for retaining its vast user base.

A growing societal demand for personalized services, fueled by AI advancements, presents a significant opportunity for Baidu. The company is integrating AI across its search, content, and application offerings, with AI-powered recommendations on its video platform, Haokan, showing a 20% engagement increase in early 2024.

Technological factors

Baidu stands as a prominent leader in China's large language model (LLM) landscape, with its ERNIE series demonstrating consistent advancements in AI capabilities. The company's commitment to innovation is underscored by the planned 2025 launch of ERNIE 5, which will incorporate multimodal features to bolster its competitive edge in the dynamic AI market.

Baidu's commitment to autonomous driving is evident through its Apollo platform, a comprehensive ecosystem supporting the development and deployment of self-driving technologies. This has enabled the launch of Apollo Go, their robotaxi service, which has already achieved Level 4 autonomous driving capabilities in several Chinese cities.

The company is actively rolling out its sixth-generation self-driving vehicles, signaling a mature and scalable technological advancement. Baidu's strategic goal is the widespread commercialization of these autonomous systems, aiming to integrate them into daily transportation and logistics.

Baidu's AI Cloud, powered by its robust infrastructure, is a significant growth driver. The platform offers comprehensive, full-stack AI solutions, including the Qianfan platform, which is designed to accelerate enterprise AI adoption. This robust cloud computing infrastructure is key to Baidu's strategy, enabling businesses to leverage its advanced AI capabilities.

Development of AI Development Toolkits

Baidu actively cultivates the AI ecosystem by offering comprehensive development toolkits like AgentBuilder, AppBuilder, and ModelBuilder. These platforms are engineered to simplify and expedite the creation of AI-powered applications, making sophisticated AI more accessible to a broader range of developers.

These toolkits are instrumental in driving innovation by enabling the seamless integration of AI capabilities across a vast array of products and services. This fosters a more dynamic and responsive market for AI solutions.

- AgentBuilder: Simplifies the creation of intelligent agents.

- AppBuilder: Accelerates the development of AI-driven applications.

- ModelBuilder: Facilitates the training and deployment of AI models.

By lowering the barrier to entry for AI development, Baidu's toolkits are expected to contribute significantly to the growth of AI adoption within China and globally. For instance, the company reported a substantial increase in the usage of its AI platforms in 2024, indicating strong developer interest.

Strategic Focus on AI Chip Self-Reliance

Baidu is actively pursuing self-reliance in AI chip development, a critical strategy given the current geopolitical climate and export restrictions. This focus on homegrown solutions, including testing alternative semiconductors, is designed to secure Baidu's technological independence and maintain the momentum of its AI research and development.

This strategic pivot is underscored by significant investments. For instance, in 2023, China's semiconductor industry saw substantial government funding aimed at boosting domestic capabilities, with reports indicating billions of dollars allocated to support AI chip innovation. Baidu's efforts align with this national objective, aiming to reduce reliance on foreign suppliers for its advanced AI infrastructure.

- AI Chip Development: Baidu is investing heavily in its Kunlun chip series, aiming for greater performance and efficiency in AI tasks.

- Semiconductor Testing: The company is exploring and testing various alternative semiconductor architectures to diversify its supply chain.

- Geopolitical Resilience: This strategy directly addresses the risks posed by international trade disputes and export controls impacting access to advanced chip technology.

- Innovation Pipeline: Ensuring access to cutting-edge chips is vital for Baidu to continue its leadership in areas like autonomous driving and large language models.

Baidu is aggressively advancing its AI capabilities with the upcoming ERNIE 5 in 2025, featuring multimodal functionalities to enhance its competitive standing. The company's Apollo platform continues to drive autonomous driving innovation, with its robotaxi service, Apollo Go, already operating at Level 4 autonomy in multiple Chinese cities.

Baidu's technological prowess is further demonstrated by its AI Cloud, offering full-stack AI solutions via the Qianfan platform, and its comprehensive development toolkits like AgentBuilder and AppBuilder, which aim to democratize AI application development. The company's strategic focus on self-reliance in AI chip development, exemplified by its Kunlun chip series, is crucial for maintaining its technological independence amidst global supply chain challenges.

| Technological Factor | Description | Key Initiatives/Data |

| Large Language Models (LLMs) | Development of advanced AI models for natural language processing and generation. | ERNIE series; ERNIE 5 planned for 2025 with multimodal features. |

| Autonomous Driving | Building an ecosystem for self-driving vehicle technology. | Apollo platform; Apollo Go robotaxi service (Level 4 autonomy); deployment of sixth-generation self-driving vehicles. |

| AI Cloud & Development Tools | Providing cloud infrastructure and tools for AI development and deployment. | AI Cloud; Qianfan platform for enterprise AI adoption; AgentBuilder, AppBuilder, ModelBuilder toolkits. Significant increase in platform usage reported in 2024. |

| AI Chip Development | Focus on in-house semiconductor solutions for AI hardware. | Investment in Kunlun chip series; exploration of alternative semiconductor architectures; alignment with China's national objective for semiconductor self-sufficiency, supported by significant government funding in 2023. |

Legal factors

Baidu operates under China's stringent data privacy and cybersecurity laws, notably the Personal Information Protection Law (PIPL) and Network Data Security Management Regulations. These regulations require data localization, thorough security assessments, and explicit user consent for data processing. Failure to comply can lead to significant financial penalties, impacting Baidu's operational costs and market reputation.

China's strict regulations on online content mean Baidu must invest heavily in sophisticated filtering and moderation technologies to comply. This includes AI-powered systems to detect and remove prohibited material, which adds significant operational costs and complexity.

These government mandates directly influence what advertisers can promote on Baidu's platform, especially in sensitive industries like healthcare and finance. For instance, in 2023, China's Cyberspace Administration (CAC) continued to emphasize stricter oversight of online advertising, impacting sectors that previously saw less scrutiny.

Failure to adhere to these content and advertising standards can lead to substantial fines, temporary service suspensions, or even permanent closure of certain services, as seen in past crackdowns on various internet companies operating in China.

Baidu, as a major player in China's digital ecosystem, faces increasing scrutiny under the country's antitrust regulations. These laws, particularly those focusing on platform operators, impose significant obligations to ensure fair competition and safeguard user rights. For instance, in 2021, China's State Administration for Market Regulation (SAMR) fined Alibaba a record 18.23 billion yuan for monopolistic practices, setting a precedent for how large tech firms are regulated.

This heightened regulatory environment directly impacts Baidu's strategic decisions, including its expansion initiatives and potential mergers and acquisitions. The company must navigate these rules carefully to avoid penalties and maintain its growth trajectory within the competitive Chinese tech sector. The ongoing enforcement of these regulations means Baidu's competitive strategies are constantly under review, influencing its ability to innovate and acquire new businesses.

Regulations on AI Algorithms and Automated Decision-Making

New regulations emerging in 2024 and 2025 are placing a significant emphasis on transparency and fairness within AI-driven automated decision-making, particularly when personal data is involved. This means companies like Baidu must ensure their AI systems are not only accurate but also equitable in their outcomes.

Baidu is now obligated to demonstrate impartiality and actively prevent any form of unreasonable differential treatment of individuals stemming from its AI applications. This regulatory shift requires a proactive approach to algorithm auditing and bias mitigation.

- Transparency Requirements: Regulations mandate clear explanations of how AI algorithms reach decisions, especially those impacting individuals.

- Fairness Mandates: AI systems must be designed to avoid discriminatory outcomes based on protected characteristics.

- Data Privacy Integration: Compliance necessitates robust data governance frameworks that align AI usage with privacy laws.

- Accountability Frameworks: Companies are being held accountable for the impacts of their AI, requiring clear lines of responsibility.

Intellectual Property Rights and Patent Protection

Baidu's significant investment in AI research and development is reflected in its substantial portfolio of AI patent filings and grants, particularly within China. For instance, as of early 2024, Baidu had filed over 20,000 AI-related patent applications globally, with a significant portion concentrated in its home market. This robust IP protection is fundamental to Baidu's strategy, safeguarding its competitive advantage and enabling the monetization of its cutting-edge technological advancements.

The company's commitment to intellectual property is evident in its proactive approach to patenting innovations across various AI domains, including natural language processing, computer vision, and autonomous driving. This legal framework allows Baidu to maintain exclusivity over its proprietary technologies, preventing competitors from easily replicating its advancements and ensuring a return on its substantial R&D expenditures. Protecting these assets is paramount for its long-term growth and market leadership.

Key aspects of Baidu's intellectual property strategy include:

- Dominant AI Patent Portfolio: Baidu holds a leading position in AI patent filings in China, underscoring its innovation in areas like smart assistants and search technologies.

- Competitive Moat: Patent protection is essential for Baidu to maintain its competitive edge against both domestic and international tech giants, particularly in the fast-evolving AI landscape.

- Monetization Opportunities: Safeguarding its intellectual property allows Baidu to explore licensing agreements and other revenue streams derived from its technological breakthroughs, further solidifying its financial position.

Baidu must navigate China's evolving legal landscape, including strict data privacy laws like PIPL and cybersecurity regulations. These laws mandate data localization and user consent, with non-compliance leading to significant penalties. For instance, in 2023, China's cyberspace administration continued to tighten oversight on online advertising, impacting sectors like healthcare.

Environmental factors

Baidu is actively embedding Environmental, Social, and Governance (ESG) principles into its operations, evident in its regular ESG reports and integrated management approach. The company has structured its ESG oversight with a dedicated three-tier management system, ensuring accountability and strategic implementation.

Baidu is actively pursuing carbon neutrality, a critical environmental objective for tech giants operating extensive data centers. This commitment involves significant investments in renewable energy sources to power their infrastructure. For instance, in 2023, Baidu announced plans to increase its reliance on solar and wind power for its data centers, aiming to reduce its carbon footprint by 30% by 2025 compared to 2020 levels.

Improving energy efficiency across its operations is a key focus for Baidu. This includes optimizing cooling systems in data centers and developing more energy-efficient AI algorithms. The company is also exploring "green" opportunities, such as leveraging its AI technologies to help other industries reduce their environmental impact, for example, through smart grid management solutions.

Baidu is actively working to build a sustainable supply chain as part of its broader Environmental, Social, and Governance (ESG) strategy. This initiative focuses on integrating environmental considerations across its entire operational spectrum and with all its business partners. By 2024, Baidu reported that over 80% of its key suppliers had undergone environmental audits, aiming to ensure compliance with increasingly stringent global standards.

Engaging directly with suppliers is crucial for Baidu's sustainable supply chain efforts. The company is implementing programs to encourage and support suppliers in adopting more responsible environmental practices, such as reducing carbon emissions and waste management. In 2025, Baidu plans to expand these programs, targeting a 15% reduction in the overall carbon footprint of its direct supply chain by 2027.

Green AI Initiatives and Resource Optimization

Baidu is actively pursuing Green AI initiatives, focusing on making its AI models and underlying infrastructure more resource-efficient. This strategic direction involves significant efforts to cut down the substantial energy consumption typically associated with training and running large-scale artificial intelligence systems. For instance, in 2023, the company announced advancements in optimizing its ERNIE 4.0 model, aiming for a notable reduction in computational resources needed for complex natural language processing tasks.

These optimizations are crucial for aligning with global environmental sustainability goals and also present a pathway to operational cost savings. By refining algorithms and hardware utilization, Baidu aims to lessen its carbon footprint. The company's commitment is underscored by its participation in industry-wide discussions around sustainable computing, highlighting the growing importance of eco-friendly AI development.

- Energy Efficiency in AI: Baidu is developing techniques to reduce the power demand of its AI operations, a critical factor given the energy-intensive nature of deep learning.

- Model Optimization: Efforts are underway to create more compact and efficient AI models that require less processing power and memory, thereby lowering energy usage.

- Infrastructure Improvements: Baidu is also looking at its data center infrastructure, exploring ways to improve cooling systems and utilize more energy-efficient hardware to support its AI workloads.

Contribution to Environmental Solutions through AI

Baidu is actively deploying its AI capabilities to address environmental challenges. Through its open-source deep learning platform, PaddlePaddle, the company is facilitating the development of solutions aimed at conservation. For instance, this technology is being used to aid in the identification of illegal wildlife products, thereby supporting efforts to protect endangered species.

This strategic application of AI underscores Baidu's commitment to leveraging advanced technology for positive environmental outcomes. The company's work with PaddlePaddle in conservation highlights a growing trend of tech giants contributing to sustainability initiatives.

- AI for Wildlife Protection: Baidu's PaddlePaddle platform is instrumental in developing AI models that can detect illegal wildlife trade items.

- Species Conservation: The technology assists in identifying and tracking endangered species, bolstering conservation efforts.

- Open-Source Contribution: By making PaddlePaddle available, Baidu encourages broader adoption of AI for environmental solutions.

Baidu is prioritizing carbon neutrality, aiming for a 30% reduction in carbon footprint by 2025 against a 2020 baseline, by increasing renewable energy use in its data centers. The company is also enhancing energy efficiency in its AI operations and infrastructure, including optimizing cooling systems and developing more efficient AI algorithms. Baidu is actively integrating environmental considerations into its supply chain, with over 80% of key suppliers undergoing environmental audits by 2024 and a goal to reduce its direct supply chain carbon footprint by 15% by 2027.

| Environmental Focus Area | Key Initiatives & Targets | Progress/Data Point |

|---|---|---|

| Carbon Neutrality | Increase renewable energy for data centers | Aiming for 30% carbon footprint reduction by 2025 (vs. 2020) |

| Energy Efficiency | Optimize AI model and infrastructure power consumption | Advancements in ERNIE 4.0 model optimization announced in 2023 |

| Sustainable Supply Chain | Environmental audits for key suppliers | Over 80% of key suppliers audited by 2024 |

| Sustainable Supply Chain | Reduce direct supply chain carbon footprint | Targeting a 15% reduction by 2027 |

PESTLE Analysis Data Sources

Our Baidu PESTLE Analysis is built on a robust foundation of data from official Chinese government agencies, leading economic research institutions, and reputable industry-specific reports. We incorporate insights from technology trend forecasts, regulatory updates, and market research to ensure comprehensive coverage.