Baidu Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Baidu Bundle

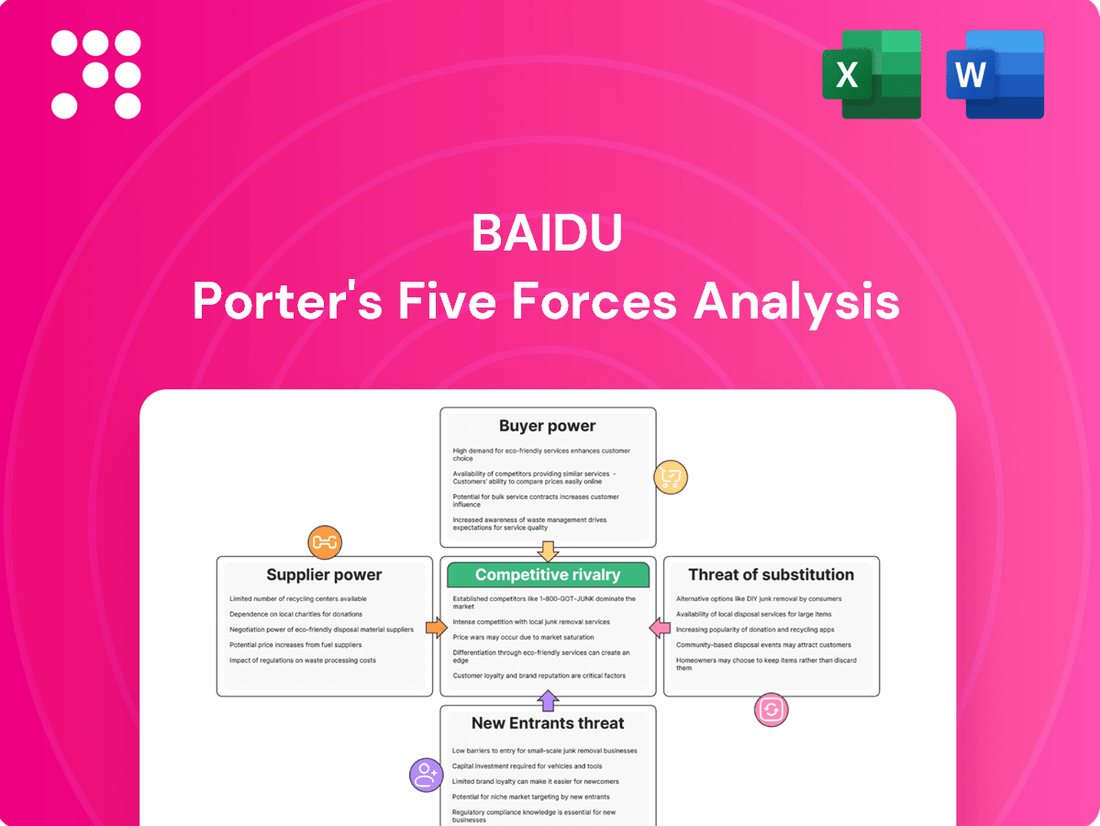

Baidu navigates a complex digital landscape, facing intense rivalry from domestic and international tech giants, while the threat of new entrants remains a constant challenge. Understanding the bargaining power of both buyers and suppliers is crucial for sustainable growth. The availability of substitutes, though evolving, also shapes Baidu's strategic options.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Baidu’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Baidu, a tech giant, sources everything from server hardware to software. For common items like standard servers, the bargaining power of individual suppliers is quite limited. This is because the market for these generic components is crowded, with many companies offering similar products, making it easy for Baidu to switch providers if prices aren't competitive.

The increasing reliance on advanced AI chips for Baidu's operations, spanning intelligent driving and cloud services, significantly boosts the bargaining power of specialized manufacturers. These critical components, often with few viable alternatives, are essential for Baidu's AI innovation and performance.

In 2024, the global AI chip market is projected to reach substantial figures, with companies like NVIDIA, a key player, reporting record revenues driven by AI demand. This intense demand for specialized AI hardware grants these suppliers considerable leverage when negotiating with major tech firms like Baidu.

Suppliers offering specialized software, unique datasets, or proprietary algorithms for Baidu's niche services, like high-definition mapping for autonomous driving or industry-specific data for AI, can exert moderate bargaining power. Their specialized nature and deep integration into Baidu's operations make it challenging and expensive for Baidu to switch to alternative providers. For instance, Baidu's Apollo platform relies on sophisticated mapping data, and providers of such niche information can command higher prices due to this dependency.

Talent as a Critical Supplier

Highly skilled AI researchers, engineers, and developers are critical suppliers for Baidu, akin to traditional suppliers of raw materials or components. The demand for these specialized professionals is exceptionally high, especially given the rapid advancements in artificial intelligence.

The intense global competition for top-tier AI talent, particularly in a rapidly evolving tech landscape, grants these individuals significant bargaining power. This power translates into demands for higher compensation, better benefits, and more flexible working conditions, directly impacting Baidu's talent acquisition and retention costs.

- Talent as a Supplier: Baidu's reliance on AI expertise makes skilled professionals a key supplier group.

- Competitive Landscape: Global demand for AI talent drives up compensation and benefits, increasing supplier power.

- Impact on Baidu: Increased bargaining power of AI talent can raise operational costs and influence strategic hiring decisions.

Government Regulations and Policy as a 'Supplier' of Operating Environment

The Chinese government, through its regulatory and policy pronouncements, acts as a significant, albeit unconventional, supplier to Baidu, dictating the very environment in which it operates. This influence extends to market access, operational rules, and the overall competitive landscape.

For instance, shifts in internet censorship policies, data privacy regulations, and specific industry oversight can dramatically alter Baidu's business model and future growth trajectory. In 2024, China continued to refine its digital economy regulations, with a particular focus on areas like artificial intelligence and data governance, directly impacting companies like Baidu.

- Regulatory Framework: The Cyberspace Administration of China (CAC) is a key regulator, shaping rules around content, data, and platform operations.

- Policy Impact: Government directives on AI development and deployment, for example, directly influence Baidu's investments and product strategies in this crucial sector.

- Data Security Laws: Stricter data security and cross-border data transfer laws, like the Personal Information Protection Law (PIPL), necessitate compliance adjustments for Baidu's data-intensive services.

Baidu’s bargaining power with suppliers varies significantly. For commoditized hardware like standard servers, its power is high due to a competitive supplier market and easy switching. However, for specialized AI chips and unique datasets crucial for its advanced services, like autonomous driving, the power shifts towards suppliers.

The market for AI chips, a critical input for Baidu's growth in areas like intelligent driving, saw significant supplier leverage in 2024. Companies like NVIDIA, a dominant player, continued to command premium pricing due to the intense global demand for their advanced processors. This demand, driven by the AI revolution, means Baidu faces suppliers with considerable pricing power for these essential components.

Suppliers of highly specialized talent, particularly AI researchers and engineers, also wield significant bargaining power. The global scarcity of top-tier AI expertise, coupled with Baidu's heavy reliance on these professionals for innovation, allows these individuals to negotiate favorable terms, impacting Baidu's labor costs and talent acquisition strategies.

| Supplier Type | Baidu's Bargaining Power | Key Factors | 2024 Impact/Data |

|---|---|---|---|

| Standard Server Hardware | High | Many suppliers, easy switching | Competitive pricing, low switching costs |

| Specialized AI Chips | Low | Few suppliers, high switching costs, critical component | High demand for AI chips, e.g., NVIDIA's revenue growth in 2024 |

| Unique Datasets/Algorithms | Moderate | Specialized nature, deep integration | Essential for niche services like HD mapping for Apollo |

| Skilled AI Talent | Low | High demand, scarcity of expertise | Increased compensation and retention challenges for Baidu |

What is included in the product

This analysis dissects the competitive landscape for Baidu, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Baidu's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customers Bargaining Power

Baidu's online marketing clients, especially large corporations, wield considerable bargaining power. These clients have a wide array of digital advertising alternatives, including major players like ByteDance and Alibaba, allowing them to negotiate favorable terms. In 2024, the intense competition in China's digital ad market means clients can effectively demand competitive pricing and superior ad performance, pushing Baidu to offer more customized solutions to retain their business.

Baidu's AI Cloud serves a wide array of industries, including manufacturing and finance. While Baidu provides comprehensive AI solutions and competitive pricing, clients can opt for other Chinese cloud providers, granting them moderate bargaining power, particularly for substantial agreements.

Individual users of Baidu's search engine and mobile apps generally face low switching costs, as they can easily transition to alternative search engines or content platforms. For instance, in 2023, while Baidu held a significant share of China's search market, users could readily access competitors like Sogou or even international options where available.

However, Baidu's dominant market share in China, estimated to be around 65-70% in recent years, and its deeply integrated ecosystem of services, including Baidu Maps, Baidu Tieba, and Baidu Baike, create considerable stickiness for users within its platform. This integration means users often find multiple needs met by a single provider, making a complete switch less appealing despite the low cost of changing search engines alone.

Emerging Bargaining Power of Autonomous Driving Customers

As Baidu's Apollo Go robotaxi service grows and commercializes, the bargaining power of its users, including individual riders and potential partners like ride-hailing platforms, is set to rise. Their willingness to adopt and provide feedback directly influences the widespread acceptance and profitability of autonomous driving technologies.

Customer bargaining power will manifest as they seek competitive pricing and superior service quality. With more autonomous driving options potentially entering the market, users can compare offerings, pushing Baidu to optimize its pricing strategies and enhance the overall rider experience to retain market share.

- Increased Rider Choice: As autonomous vehicle services mature, a wider array of providers may emerge, giving riders more options and thus, greater leverage.

- Demand for Data and Customization: Customers may increasingly demand personalized services or access to usage data, influencing how Baidu designs its Apollo Go platform.

- Partnership Negotiations: Ride-hailing platforms integrating Apollo Go will negotiate terms based on rider demand, service reliability, and revenue sharing, strengthening their bargaining position.

- Feedback Loop Influence: Negative customer feedback or low adoption rates can force Baidu to quickly address service issues or pricing, demonstrating customer sway.

Influence of Content Creators and Developers

Content creators and application developers who leverage Baidu's ecosystem hold significant bargaining power. Their decision to develop for or promote content on alternative platforms directly impacts Baidu's user engagement and advertising revenue.

For instance, a substantial portion of Baidu's search and content services are enhanced by third-party applications and creator-generated content. If these creators find more favorable terms or a larger audience on competing platforms, they can shift their focus, thereby diminishing Baidu's competitive edge.

- Developer Dependence: Baidu's reliance on a vibrant developer community for its app store and various services means it must offer attractive terms to retain these creators.

- Platform Choice: Creators can choose to distribute their content and applications across multiple platforms, including Tencent's WeChat, ByteDance's Douyin, and international alternatives, limiting Baidu's pricing power.

- Revenue Share Influence: Developers can negotiate for more favorable revenue-sharing agreements, influencing Baidu's monetization strategies for its platform services.

Baidu's large online advertising clients possess significant bargaining power due to the competitive landscape in China's digital advertising market. In 2024, these clients can leverage alternatives from rivals like ByteDance and Alibaba to negotiate better pricing and demand higher performance, compelling Baidu to offer more tailored solutions to maintain these relationships.

While Baidu's AI Cloud serves diverse industries, clients can switch to other Chinese cloud providers, especially for large-scale projects. This availability grants them moderate bargaining power, allowing them to seek competitive terms and potentially influence service offerings.

Individual users of Baidu's core services, like search, generally have low switching costs. However, Baidu's extensive ecosystem, including Baidu Maps and Baidu Baike, fosters user stickiness, making a complete migration less likely despite the ease of changing search engines alone.

| Baidu Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Large Online Advertising Clients | High | Availability of alternatives (ByteDance, Alibaba), intense market competition, demand for performance and customization. |

| AI Cloud Clients | Moderate | Availability of alternative cloud providers, scale of agreements, pricing and service demands. |

| Individual Users (Search, Apps) | Low (individually), Moderate (collectively due to ecosystem) | Low switching costs for search engines, but high ecosystem integration and user stickiness. |

| Apollo Go Robotaxi Users/Partners | Rising | Increasing rider choice, demand for data and customization, partnership negotiations, feedback loop influence. |

| Content Creators/App Developers | Significant | Reliance of Baidu on their content, platform choice, revenue share negotiations, competition from other platforms. |

Same Document Delivered

Baidu Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Baidu's competitive landscape through an in-depth analysis of the five forces: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors. This detailed breakdown will equip you with actionable insights into Baidu's strategic positioning and future challenges.

Rivalry Among Competitors

Baidu's core search engine faces fierce competition within China from established players like Microsoft's Bing and 360 Search (Haosou). These rivals command substantial portions of the Chinese search market, directly challenging Baidu's dominance.

The landscape is further complicated by the swift evolution of AI-driven search and conversational agents. Companies such as DeepSeek and Tencent are rapidly innovating in this space, introducing sophisticated AI products that are beginning to siphon users away from Baidu's traditional search services.

Baidu's AI Cloud faces intense competition in China's burgeoning cloud market, primarily from giants Alibaba Cloud and Tencent Cloud. These established players have significant market share and extensive infrastructure, making it a challenging landscape for Baidu to navigate.

While Baidu differentiates itself by highlighting its comprehensive AI capabilities, including its Ernie Bot large language model, it needs to consistently deliver innovative solutions and competitive pricing to capture a larger slice of this rapidly expanding market. The ongoing battle for dominance means continuous investment in technology and customer acquisition is crucial for Baidu.

Baidu's Apollo Go navigates a fiercely competitive landscape in autonomous driving. Domestic rivals like Didi, WeRide, and Pony.ai are aggressively pursuing robotaxi commercialization, backed by substantial funding and strategic alliances. For instance, WeRide announced a significant funding round in 2023, underscoring the capital intensity of this sector.

Global players, notably Tesla with its Autopilot and Full Self-Driving (FSD) capabilities, also present a formidable challenge. The pursuit of regulatory approvals for autonomous vehicle deployment is a critical battleground, with companies investing heavily in R&D and safety testing to gain a competitive edge and market share.

Diversification of Competitors Beyond Traditional Tech

Baidu's competitive environment is evolving, moving beyond just established tech giants. Platforms like WeChat and Douyin are increasingly incorporating search and AI features, directly competing for user attention and time that might otherwise be spent on Baidu's core services. Xiaohongshu, a popular lifestyle and content platform, also presents a challenge by offering discovery and information-seeking functionalities that can substitute for traditional search engines.

This diversification means Baidu faces rivalry from entities that leverage massive user bases and deep engagement through social and content-driven ecosystems. For instance, Douyin, owned by ByteDance, has seen explosive growth, with its daily active users (DAUs) in China reportedly reaching over 700 million by late 2023. WeChat, with over 1.3 billion monthly active users (MAUs) as of early 2024, acts as a super-app where many daily tasks, including information discovery, are performed within its walled garden.

- Expanding Competition: Baidu now contends with social media platforms like WeChat and Douyin, which are integrating search and AI.

- Content Platform Rivalry: Lifestyle and content platforms such as Xiaohongshu are also drawing user engagement away from traditional search.

- User Engagement Shift: These platforms capture user attention through diverse content and integrated functionalities, impacting Baidu's market share.

- Douyin's Scale: Douyin reported over 700 million daily active users in China by late 2023, indicating significant reach.

Strategic Overextension and Capital Competition

Baidu's ambitious expansion into capital-intensive areas like AI and electric vehicles creates intense rivalry. Analysts point to potential strategic overextension as Baidu juggles these ventures alongside established players like Google, Alibaba, and Tencent, who often boast superior financial firepower and broader platform ecosystems.

This competition for capital and market share is particularly fierce in the AI domain. For instance, Baidu's Ernie Bot faces direct competition from Google's Gemini and OpenAI's models, requiring significant ongoing investment in research and development. In 2023, Baidu reported research and development expenses of RMB 27.2 billion (approximately $3.8 billion), a substantial portion of which is directed towards AI initiatives.

- Baidu's AI Investments: Significant R&D spending, over RMB 27.2 billion in 2023, fuels its AI ambitions.

- Competitive Landscape: Faces powerful rivals like Google, Alibaba, and Tencent with greater financial resources.

- Strategic Risk: Pursuing multiple capital-intensive ventures, including EVs and foundational AI, could lead to overextension.

Baidu faces intense competition from established search engines like Microsoft Bing and 360 Search, along with emerging AI-driven platforms such as DeepSeek and Tencent's AI offerings. The rise of super-apps like WeChat, boasting over 1.3 billion monthly active users as of early 2024, and Douyin, with over 700 million daily active users in China by late 2023, further intensifies rivalry by integrating search and AI features, capturing user attention through engaging content ecosystems.

| Competitor | Key Offerings | User Base (Approx.) |

|---|---|---|

| Microsoft Bing | Search Engine | Significant global presence, growing in China |

| 360 Search (Haosou) | Search Engine | Major player in the Chinese market |

| DeepSeek | AI-driven Search, LLMs | Emerging innovator in AI search |

| Tencent (AI) | AI Products, Cloud Services | Leverages WeChat ecosystem |

| Super-app, integrated services | 1.3 billion+ MAU (early 2024) | |

| Douyin (ByteDance) | Short-form video, integrated features | 700 million+ DAU (late 2023) |

SSubstitutes Threaten

The proliferation of social media and content platforms presents a substantial threat of substitution for Baidu's core search engine business. Platforms like WeChat, Douyin (TikTok's Chinese version), and Xiaohongshu are increasingly integrating robust search functionalities and personalized content discovery, directly competing for user attention and information-seeking behavior. For instance, in 2023, Douyin reported over 750 million daily active users, many of whom utilize its internal search to find content, products, and services, bypassing traditional search engines.

Standalone AI chatbots and conversational AI tools are increasingly becoming direct substitutes for traditional search engines. Competitors like DeepSeek and Tencent are developing sophisticated AI that can provide synthesized answers, encouraging users to bypass search for certain information needs.

Vertical search engines and specialized apps pose a significant threat of substitution for Baidu. For instance, users seeking specific product information might turn to e-commerce platforms like Taobao or JD.com, bypassing Baidu's general search. In 2024, the mobile app market continued its robust growth, with specialized apps offering deep functionality that general search engines struggle to replicate.

Offline Information Sources and Traditional Media

While the digital landscape dominates, traditional media like newspapers and television, alongside offline sources such as word-of-mouth and physical directories, can still act as substitutes for Baidu's online offerings. This is particularly relevant for demographics with lower internet access or for specific types of information where traditional channels remain trusted. For instance, in regions with limited internet penetration, these offline methods are crucial for information dissemination.

The threat of substitutes from offline sources is more pronounced in less developed markets. As of early 2024, while internet penetration in China continues to rise, there are still segments of the population, especially in rural areas, who rely more heavily on traditional media. For example, television viewership and radio listenership remain significant in these regions, providing an alternative channel for news and advertising that could bypass Baidu's search and content platforms.

- Traditional Media Reach: Television and radio continue to hold sway in certain demographics and geographic areas, offering an alternative to online information consumption.

- Offline Information Reliance: Word-of-mouth and physical directories still serve as viable information sources for specific needs, particularly where digital access is limited.

- Demographic Specificity: Older populations or those in rural areas may exhibit a stronger preference for or reliance on offline information channels, presenting a substitute threat.

- Internet Penetration Impact: The ongoing growth of internet access in China gradually erodes the threat from offline substitutes, but pockets of reliance remain.

Hardware-Integrated AI Assistants and Smart Devices

The increasing integration of AI assistants into a wide array of smart devices, from smart speakers and wearables to connected cars and home appliances, presents a significant threat of substitution for traditional search engines like Baidu. These hardware-integrated assistants can often provide direct answers or execute tasks, bypassing the need for users to actively type or speak search queries into a search interface.

For instance, by 2024, the global market for smart home devices, which heavily feature AI assistants, is projected to reach hundreds of billions of dollars, indicating a substantial shift in how consumers interact with information and services. Companies like Amazon with Alexa and Google with Google Assistant are embedding their AI capabilities deeply into these devices, offering a more seamless and conversational way to access information and control environments.

- Hardware Integration: AI assistants are becoming standard features in new smart devices, reducing reliance on separate search platforms.

- Direct Answers: These assistants often deliver concise, direct answers, negating the need for users to sift through search results.

- Task Automation: Beyond information retrieval, AI assistants can perform actions like setting reminders, controlling smart home devices, and playing music, further diverting usage from traditional search.

- Market Growth: The rapid expansion of the Internet of Things (IoT) market, with billions of connected devices expected by 2025, amplifies the reach and potential of these AI-powered substitutes.

The threat of substitutes for Baidu is significant, with social media platforms and specialized apps increasingly offering integrated search and content discovery. For example, Douyin's massive user base in 2023, exceeding 750 million daily active users, highlights how users are turning to these platforms for information, often bypassing traditional search engines.

AI-powered chatbots and assistants embedded in smart devices also present a growing substitute threat. By 2024, the global smart home device market's projected reach into the hundreds of billions of dollars underscores the shift towards conversational AI for information access and task completion, directly competing with Baidu's core search services.

| Substitute Category | Key Competitors/Examples | Impact on Baidu | 2023/2024 Data Point |

|---|---|---|---|

| Social Media & Content Platforms | WeChat, Douyin, Xiaohongshu | Diverts user attention and information-seeking behavior | Douyin had over 750 million daily active users in 2023 |

| AI Chatbots & Assistants | DeepSeek, Tencent AI, Google Assistant, Amazon Alexa | Provides direct answers, bypassing traditional search | Global smart home market projected to reach hundreds of billions USD by 2024 |

| Vertical Search & E-commerce Apps | Taobao, JD.com | Captures users seeking specific product or service information | Continued robust growth in the mobile app market in 2024 |

Entrants Threaten

Building a search engine on the scale of Baidu requires immense capital. We're talking about significant investments in data centers, sophisticated algorithms, and cutting-edge AI research. For instance, companies like Google have historically spent billions annually on infrastructure and R&D to maintain their edge, a figure that's likely to have increased substantially by 2024.

The technological complexity involved is another major hurdle. Developing and continuously improving search algorithms, understanding user intent, and managing vast amounts of data demand highly specialized expertise. This isn't something a new player can easily replicate; it requires years of dedicated development and a deep understanding of machine learning and natural language processing.

Furthermore, network effects play a crucial role. The more users a search engine has, the more data it collects, which in turn improves its search results, attracting even more users. This creates a virtuous cycle that is incredibly difficult for newcomers to break into. By 2024, Baidu's established user base and the resulting data advantages solidify this protective moat.

The Chinese internet and technology sector is heavily regulated, with the Cyberspace Administration of China (CAC) being a key oversight body. This stringent regulatory environment poses significant barriers for any new companies looking to enter the market. For instance, in 2023, China continued to enforce its cybersecurity laws and data privacy regulations, requiring extensive compliance efforts.

Securing the necessary licenses to operate online services in China is a complex and time-consuming process. New entrants must navigate a landscape of strict censorship policies and data security mandates. Failure to comply can result in severe penalties, making the initial investment and operational setup considerably riskier and more expensive than in less regulated markets.

Any new player entering the Chinese tech landscape confronts the formidable challenge posed by established titans such as Baidu, Alibaba, and Tencent. These companies command massive user bases, intricate ecosystems, and substantial financial muscle, making it incredibly difficult for newcomers to gain traction.

Talent Acquisition Challenges

The intense competition for skilled AI and tech professionals in China presents a substantial barrier for new companies entering the market. Established players, including Baidu, leverage their financial strength and established reputations to secure top talent, creating an uneven playing field.

Baidu, for instance, has consistently invested in R&D and employee development, making it an attractive employer. In 2023, Baidu reported significant investments in its AI research divisions, aiming to attract and retain leading engineers and data scientists.

- Talent Scarcity: China’s AI sector faces a significant shortage of highly specialized talent, with demand far outstripping supply, particularly for experienced researchers and developers.

- High Compensation Demands: Top AI engineers can command salaries upwards of ¥1 million annually, a considerable cost for new entrants.

- Established Employer Brands: Companies like Baidu, Tencent, and Alibaba have strong employer brands, making it difficult for smaller firms to compete for the best candidates.

- Retention Challenges: Even when hired, startups struggle to retain talent due to better compensation, benefits, and career progression opportunities offered by larger, more established tech giants.

Rapid Technological Advancements and AI Investment

The threat of new entrants for Baidu is significantly influenced by rapid technological advancements, especially in Artificial Intelligence. Companies looking to compete would require massive, ongoing investments in research and development to match Baidu's progress in areas such as large language models, autonomous driving, and its AI Cloud services. For instance, Baidu invested approximately RMB 20 billion (around $2.8 billion USD) in AI in 2023 alone, highlighting the capital intensity required to remain competitive.

New players entering Baidu's market must overcome substantial barriers to entry, particularly in AI innovation. This includes the need for vast datasets, specialized talent, and significant computing power, which are all costly to acquire and maintain. The sheer scale of investment needed to develop and deploy cutting-edge AI solutions means only well-funded entities can realistically challenge established players like Baidu.

- High R&D Expenditure: Competitors need to match Baidu's substantial R&D spending, which was a significant portion of its revenue in 2023.

- Talent Acquisition Costs: Attracting and retaining top AI talent is expensive, creating a barrier for new entrants.

- Infrastructure Requirements: Building out the necessary computing infrastructure for advanced AI development demands considerable capital.

The threat of new entrants in Baidu's core search market is considerably low due to immense capital requirements for infrastructure and AI development. For example, Baidu's significant investments in AI research, estimated to be around RMB 20 billion (approximately $2.8 billion USD) in 2023, underscore the financial scale needed to compete. Furthermore, stringent Chinese regulations and the complex licensing process create substantial hurdles for any new player attempting to enter the market.

Established network effects, where more users lead to better data and improved search results, create a powerful moat for Baidu. Breaking this cycle requires attracting a critical mass of users from the outset, which is exceptionally difficult. The intense competition for scarce, highly skilled AI talent, with top engineers commanding salaries upwards of ¥1 million annually in 2024, further elevates the barrier to entry.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Massive investment in data centers, algorithms, and AI R&D. | Extremely high; only well-funded entities can compete. |

| Technological Complexity | Developing sophisticated search algorithms and AI capabilities. | Significant; requires years of expertise and development. |

| Network Effects | User base growth improves data and search quality, attracting more users. | Very high; difficult for new entrants to gain traction. |

| Regulatory Environment | Strict Chinese regulations and licensing processes. | High; complex compliance and censorship policies. |

| Talent Acquisition | Competition for specialized AI professionals. | High; costly to attract and retain top talent. |

Porter's Five Forces Analysis Data Sources

Our Baidu Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including Baidu's own financial reports, filings with Chinese regulatory bodies, and comprehensive industry research from firms specializing in the Chinese internet sector.