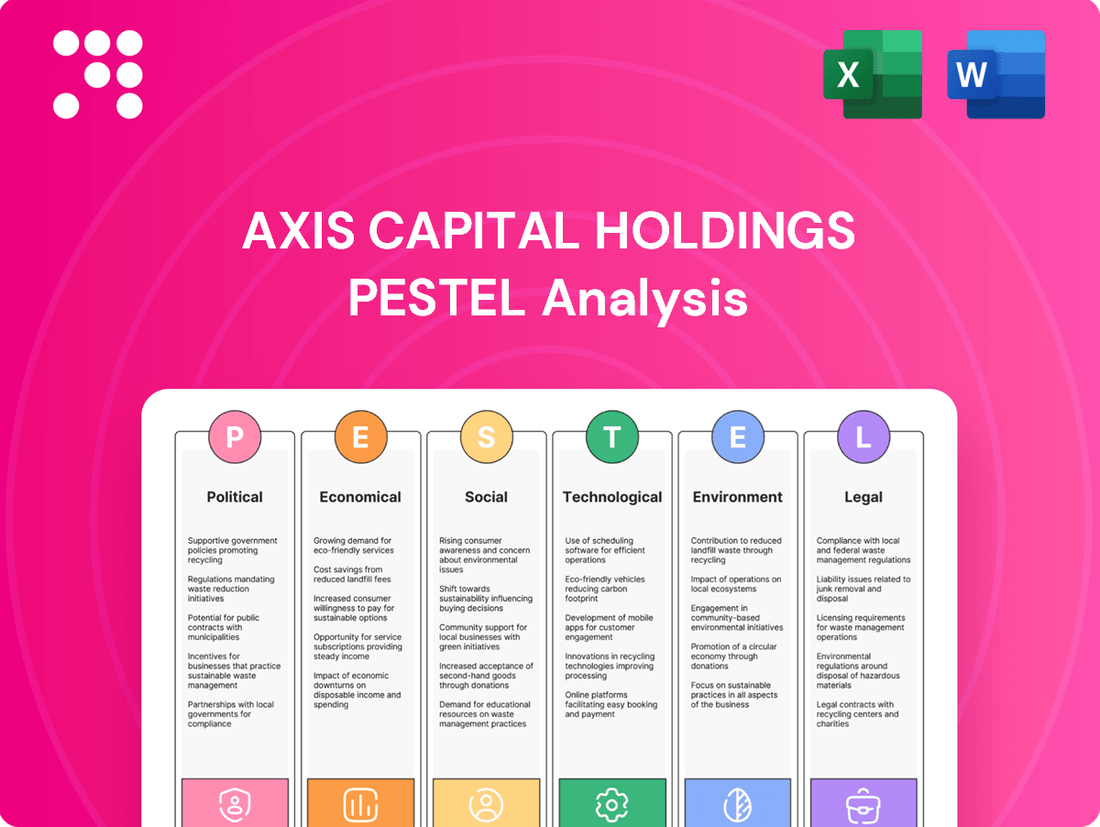

Axis Capital Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

Unlock the strategic advantages of Axis Capital Holdings by understanding the intricate web of political, economic, social, technological, legal, and environmental factors impacting its operations. Our meticulously researched PESTLE analysis provides a clear roadmap of these external forces, empowering you to anticipate challenges and seize opportunities. Gain a competitive edge and make informed decisions—download the full PESTLE analysis for Axis Capital Holdings today!

Political factors

Global geopolitical tensions, including ongoing conflicts and trade disputes, directly shape the political risk insurance market. These situations often boost demand for coverage against political violence, terrorism, and expropriation, while simultaneously affecting the stability of international markets where Axis Capital Holdings operates.

For instance, the ongoing conflict in Eastern Europe has led to a significant increase in demand for political risk insurance, with premiums for coverage in affected regions rising by an estimated 20-30% in 2023 according to industry reports. Axis Capital's ability to precisely assess and price these dynamic risks is therefore paramount for maintaining underwriting profitability in 2024 and beyond.

Governments globally are continually refining insurance sector regulations. For instance, in 2024, the European Union's Solvency II directive saw ongoing reviews, impacting capital requirements for insurers like Axis Capital. These adjustments directly influence operational expenses and profitability by altering how much capital must be held against potential risks.

Tax policy shifts are equally impactful. A notable trend in 2024 and projected into 2025 is the potential for corporate tax rate adjustments in several major economies where Axis Capital operates. Furthermore, changes in specific premium taxes or the introduction of new financial transaction taxes could necessitate strategic re-evaluations of pricing and market entry.

Staying ahead of these evolving legislative landscapes is crucial. For example, if a key operating region were to increase its capital adequacy ratio by 2% in 2025, Axis Capital would need to assess its capital structure and potentially reallocate assets to maintain compliance, directly affecting its financial flexibility and investment capacity.

Shifts in global trade policies significantly influence Axis Capital Holdings. For instance, the World Trade Organization (WTO) reported a slowdown in trade growth in 2023, with forecasts for 2024 remaining subdued, impacting the demand for trade credit insurance. Conversely, the USMCA agreement, fully implemented in 2020, continues to shape North American trade, potentially creating opportunities for specialized insurance products within those markets.

Government Intervention in Disaster Response

Government policies on disaster relief significantly shape the financial burden for insurers and reinsurers like Axis Capital Holdings. For instance, the U.S. National Flood Insurance Program (NFIP) plays a crucial role in managing flood-related claims, impacting the overall market for catastrophe reinsurance. In 2024, discussions around NFIP reform and its potential impact on private insurers continued, highlighting the direct link between government programs and the private insurance sector's exposure.

The extent to which governments absorb catastrophe losses varies globally. Some nations have established national disaster funds or reinsurance pools, which can mitigate the direct impact on private insurers for certain perils. Conversely, in regions with less government support, the private insurance market, including reinsurers, often carries a greater portion of the risk. This disparity necessitates careful regional analysis for accurate risk modeling.

- Government-backed programs can reduce the net claims paid by reinsurers, especially in areas with high catastrophe frequency.

- Policy variations across jurisdictions mean that understanding local disaster management frameworks is critical for Axis Capital Holdings' risk assessment.

- The 2024 hurricane season projections, while still developing, underscore the ongoing need to monitor government preparedness and response strategies in key markets.

Political Risk Insurance Demand

The current geopolitical climate, marked by escalating social unrest, coups, and civil conflicts globally, is significantly boosting the demand for political risk insurance. This trend offers Axis Capital a prime opportunity to expand its specialty insurance offerings.

For Axis Capital, this surge in demand translates into a growth avenue within its specialty lines. However, it also necessitates robust strategies to effectively assess and manage the inherent complexities and unpredictability of these political events.

Navigating this evolving market requires Axis Capital to focus on sophisticated risk assessment methodologies and maintaining diversified portfolios to mitigate exposure. The global political risk insurance market is projected to see substantial growth, with some estimates suggesting a compound annual growth rate of over 5% through 2028, driven by these very factors.

- Increased Demand: Heightened global instability fuels a greater need for political risk insurance.

- Growth Opportunity: This presents a chance for Axis Capital to expand its specialty insurance business.

- Risk Management Challenge: Effectively managing the unpredictable nature of political events is crucial.

- Market Outlook: The political risk insurance market is expected to experience significant growth in the coming years.

Global political instability, including ongoing conflicts and trade disputes, directly impacts the demand for political risk insurance, a key area for Axis Capital Holdings. For example, the conflict in Eastern Europe led to an estimated 20-30% premium increase for coverage in affected regions during 2023, highlighting the need for precise risk assessment by Axis Capital in 2024 and beyond.

Government regulatory changes, such as ongoing reviews of the EU's Solvency II directive in 2024, affect insurers like Axis Capital by altering capital requirements and influencing operational costs and profitability.

Shifting tax policies, including potential corporate tax rate adjustments in major economies and changes to premium or financial transaction taxes in 2024-2025, necessitate strategic re-evaluations of pricing and market entry for Axis Capital.

Government approaches to disaster relief, like the U.S. NFIP, significantly influence the financial burden on insurers and reinsurers. Discussions around NFIP reform in 2024 underscore the direct link between government programs and private insurance sector exposure.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Axis Capital Holdings, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both strategic challenges and opportunities.

Axis Capital Holdings' PESTLE analysis offers a pain point reliever by providing a clean, summarized version of the full analysis for easy referencing during meetings or presentations, streamlining strategic discussions.

Economic factors

The global economy is projected to grow at a moderate pace in 2024 and 2025. The International Monetary Fund (IMF) forecasted global growth at 3.2% for 2024, with a slight uptick to 3.4% expected in 2025. This steady expansion is crucial for Axis Capital, as a healthier economy generally translates to increased demand for its insurance and reinsurance services. More economic activity means more businesses, higher asset values, and thus, more insurable risks, leading to higher premium volumes.

However, potential headwinds exist. Factors like persistent inflation, geopolitical tensions, and the ongoing transition to greener economies could temper growth. For instance, higher interest rates, while potentially boosting investment income for Axis Capital, can also slow down business investment and consumer spending, indirectly impacting insurance demand. The World Bank noted in its January 2024 Global Economic Prospects report that growth is expected to slow from 2.6% in 2023 to 2.4% in 2024, primarily due to tighter financial conditions and the lingering effects of high inflation.

Axis Capital's performance is therefore closely tied to these global economic trends. A robust growth environment supports premium growth and investment income, while a slowdown could lead to reduced demand for insurance products and potentially lower investment returns. The company's ability to navigate these varying economic conditions will be key to its sustained success.

Interest rates are a huge deal for companies like Axis Capital Holdings, which make money by investing the premiums they collect before they have to pay out claims. When interest rates are low, it means less income from those investments, which can squeeze profits from their core insurance business. For instance, the Federal Reserve kept its benchmark interest rate near zero for years following the 2008 financial crisis, significantly impacting insurers' investment income.

Conversely, a rising interest rate environment can be a real boon for their bottom line. As of early 2024, central banks globally have been increasing rates to combat inflation, and this trend is expected to continue through 2025. This means Axis Capital Holdings can likely expect to see a healthy boost in its investment returns, which will positively impact its overall financial performance and ability to absorb underwriting losses.

Inflationary pressures are a significant concern for Axis Capital, especially concerning construction, supply chains, and legal expenses. For instance, the U.S. Producer Price Index for construction inputs saw a notable increase in late 2023 and early 2024, impacting repair and replacement costs. This rise directly affects the severity of property and casualty claims, potentially squeezing underwriting margins if premiums aren't adjusted accordingly.

Higher inflation means the cost to repair damaged buildings or replace insured assets escalates. Similarly, the cost of settling liability claims can grow. Axis Capital needs to meticulously incorporate these inflationary trends into its pricing strategies and the reserves set aside for future claims to maintain profitability and solvency.

Capital Market Volatility

Capital market volatility directly impacts Axis Capital Holdings by influencing the valuation of its investment portfolio. Fluctuations across global equity, bond, and alternative investment markets can lead to significant swings in asset values. For instance, during periods of heightened uncertainty, such as the economic recalibration seen in late 2023 and early 2024, major indices like the S&P 500 experienced considerable intra-day and week-to-week price movements.

Significant market downturns can translate into unrealized losses for Axis Capital, potentially weakening its capital position. This can have a knock-on effect, impacting the company's capacity to underwrite new insurance business or its ability to distribute dividends to shareholders. The VIX index, a common measure of expected stock market volatility, often spikes during such periods, highlighting the elevated risk environment.

- Global Equity Market Fluctuations: The MSCI World Index saw a notable increase of over 20% in 2023, but this followed a challenging 2022, demonstrating the inherent volatility.

- Bond Market Sensitivity: Rising interest rates in 2023, with central banks like the Federal Reserve maintaining higher policy rates, led to declines in bond prices, impacting fixed-income portfolios.

- Alternative Investment Performance: While often seen as diversifiers, private equity and hedge fund returns can also be subject to market cycles and liquidity constraints, particularly in uncertain economic climates.

- Impact on Capital Ratios: A substantial decline in investment assets could pressure Axis Capital's solvency ratios, a key metric for regulatory compliance and financial strength.

Currency Exchange Rate Fluctuations

Axis Capital Holdings, as a global insurer, navigates a complex landscape shaped by currency exchange rate fluctuations. These shifts directly influence the reported value of its international operations, impacting everything from premiums collected in foreign currencies to claims paid out. For instance, a strengthening US dollar against the Euro could reduce the dollar-equivalent value of premiums earned in Europe, and vice-versa.

The financial statements of Axis Capital are inherently sensitive to these movements. A significant appreciation of the currency in which Axis holds a large portion of its assets, relative to the currency of its reporting, can distort its consolidated financial results. This volatility underscores the importance of robust financial management.

To mitigate these risks, Axis Capital likely employs sophisticated currency hedging strategies. These can involve financial instruments like forward contracts or options to lock in exchange rates for future transactions, thereby stabilizing earnings and providing greater predictability for investors. For example, if Axis anticipates significant claims payouts in Japanese Yen in the coming year, it might enter into forward contracts to buy Yen at a predetermined rate.

- Impact on Assets and Liabilities: Fluctuations can alter the reported value of Axis Capital's international holdings and obligations.

- Premiums and Claims Volatility: Exchange rate changes directly affect the translated value of premiums earned and claims paid in different currencies.

- Hedging as a Risk Management Tool: Strategies like forward contracts are crucial for stabilizing earnings and reducing exposure to currency volatility.

- Global Operations Exposure: Operating in multiple markets means Axis Capital is constantly exposed to the interplay of various global currencies.

The global economic outlook for 2024 and 2025 suggests moderate growth, with the IMF projecting 3.2% in 2024 and 3.4% in 2025. This environment generally supports demand for insurance services, as increased economic activity leads to more insurable risks. However, persistent inflation and geopolitical tensions could temper this growth, with the World Bank noting a slowdown to 2.4% in 2024 due to tighter financial conditions.

Interest rates are a key factor for Axis Capital, influencing investment income. As central banks globally raised rates in 2023 and into 2024 to combat inflation, Axis Capital can anticipate improved returns on its investment portfolio. Inflationary pressures, particularly in construction and supply chains, directly impact claim severity, necessitating careful premium adjustments and reserve management.

Capital market volatility, as seen in equity and bond markets during 2023-2024, affects Axis Capital's investment valuations and capital ratios. Currency fluctuations also pose a risk, impacting the reported value of international operations and requiring robust hedging strategies. For instance, the MSCI World Index saw a significant rebound in 2023, but this followed a volatile 2022.

What You See Is What You Get

Axis Capital Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Axis Capital Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external forces shaping Axis Capital Holdings' operations and future growth. This detailed breakdown will equip you with a thorough understanding of the market dynamics.

Sociological factors

Demographic shifts are reshaping the insurance market. For instance, the aging population in developed countries, like Japan where the median age was 48.6 years in 2023, increases demand for health and annuity products but also presents longevity risks. Conversely, rapid urbanization in emerging markets, with over 57% of the world's population living in urban areas as of 2023, creates new insurance needs related to property and infrastructure.

Evolving societal values directly influence risk perceptions and, consequently, insurance product demand. Growing awareness of cyber threats, for example, has fueled a surge in demand for cyber insurance. Globally, the cyber insurance market is projected to reach $37.4 billion by 2027, up from $11.7 billion in 2022, highlighting a critical new exposure area. Similarly, climate change concerns are driving demand for parametric insurance and coverage for climate-related liabilities.

Axis Capital Holdings must strategically adapt its product portfolio and risk management frameworks to address these dynamic demographic and societal trends. This involves developing innovative solutions for longevity, cyber, and climate risks, ensuring the company remains competitive and relevant in a constantly changing global landscape.

Growing public and corporate awareness of climate change is significantly altering consumer behavior and corporate risk management. This heightened sensitivity to environmental impacts, including extreme weather events, directly fuels demand for specialized insurance products. For instance, in 2024, the insurance industry saw a notable uptick in claims related to natural catastrophes, underscoring this trend.

Axis Capital Holdings, like its peers, must adapt to this evolving landscape by innovating its insurance offerings to address climate-related perils. Companies are increasingly scrutinizing their own environmental footprints, creating new risk exposures that insurers need to underwrite. This means developing more sophisticated coverage for supply chain disruptions caused by climate events and for transition risks as businesses decarbonize.

Social inflation, a phenomenon marked by increasing litigation costs and larger jury awards, directly affects claims severity, especially in casualty and professional liability sectors. This trend requires Axis Capital to maintain rigorous underwriting standards, sound reserving strategies, and proactive claims management to safeguard its profitability.

For instance, the U.S. saw a significant rise in large jury verdicts in recent years, with some exceeding hundreds of millions of dollars, underscoring the financial implications of social inflation. Monitoring evolving legal precedents and adapting risk assessment models are therefore critical for insurers like Axis Capital.

Shift in Work Models and Business Structures

The global workforce is increasingly embracing flexible work arrangements, with remote work and the gig economy becoming mainstream. This trend significantly impacts traditional employment structures and the associated business liabilities, presenting both challenges and opportunities for insurers like Axis Capital Holdings.

These evolving work models necessitate new insurance products tailored to the risks of distributed workforces. For instance, cybersecurity for remote operations and updated professional liability coverage for freelance or contract workers are becoming critical. Axis Capital must innovate to meet these emerging demands.

- Remote Work Growth: By the end of 2024, it's projected that 30% of the global workforce will be working remotely at least part-time, a substantial increase from pre-pandemic levels.

- Gig Economy Expansion: The gig economy is expected to continue its rapid growth, with projections indicating it could account for over 50% of the total workforce by 2027 in some developed economies.

- New Risk Exposures: Businesses face increased risks related to data breaches from remote access points and potential liability claims arising from the management of a dispersed workforce.

- Insurance Innovation Needs: Insurers need to develop specialized policies covering cyber risks for remote employees and adapt professional liability coverage to the nuances of contract-based work.

ESG Expectations from Stakeholders

Stakeholders, including investors, customers, and employees, are increasingly demanding that companies like Axis Capital Holdings demonstrate robust Environmental, Social, and Governance (ESG) practices. This trend directly influences investment decisions, with a growing number of funds prioritizing companies with strong ESG scores. For instance, global sustainable investment assets reached an estimated $37.8 trillion in early 2024, reflecting this significant shift.

Axis Capital's ability to align with these ESG expectations impacts its attractiveness as a partner and employer. Clients are more likely to choose insurers and investment firms that demonstrate a commitment to sustainability, while employees seek organizations with strong ethical and social values. This pressure necessitates integrating ESG considerations into core business functions, from underwriting policies to shaping investment portfolios.

- Investor Scrutiny: A significant portion of global assets under management now have ESG mandates, pressuring companies like Axis Capital to report transparently on their ESG performance.

- Customer Loyalty: Consumers are increasingly making purchasing decisions based on a company's social and environmental impact, affecting client retention and acquisition for Axis Capital.

- Talent Acquisition: A strong ESG reputation is becoming a key factor for attracting and retaining top talent, influencing Axis Capital's human capital strategy.

- Regulatory Landscape: Evolving regulations globally are mandating greater ESG disclosure and accountability, requiring Axis Capital to adapt its reporting and operational frameworks.

Societal values are increasingly shaping risk perception and insurance demand, with growing awareness of cyber threats driving a surge in cyber insurance, projected to reach $37.4 billion by 2027. Climate change concerns are also escalating demand for parametric and climate-liability coverage, evidenced by increased natural catastrophe claims in 2024.

Social inflation, characterized by rising litigation costs and larger jury awards, directly impacts claims severity in casualty lines. For example, significant jury verdicts exceeding hundreds of millions of dollars in the U.S. highlight the financial implications, necessitating rigorous underwriting and claims management for Axis Capital.

The shift towards remote work and the gig economy by the end of 2024, with an estimated 30% of the global workforce working remotely, creates new insurance needs for cyber risks and professional liability for contract workers.

Growing demand for robust Environmental, Social, and Governance (ESG) practices influences investment decisions, with global sustainable investment assets reaching an estimated $37.8 trillion in early 2024, impacting Axis Capital's attractiveness to investors, customers, and talent.

Technological factors

The insurance industry is seeing a significant transformation driven by advanced data analytics, machine learning, and artificial intelligence. These technologies are fundamentally changing how companies like Axis Capital approach underwriting, pricing, and claims management.

Axis Capital can harness these powerful tools to gain a more granular understanding of risk. This allows for more precise pricing, a sharper ability to detect fraudulent activities, and the automation of repetitive administrative tasks, ultimately boosting both accuracy and operational efficiency. For instance, AI-powered fraud detection systems are estimated to save the global insurance industry billions annually, with some reports suggesting savings upwards of $30 billion by 2025.

Investing in these cutting-edge capabilities is no longer optional; it's a necessity for maintaining a competitive edge in the evolving market. Companies that effectively integrate AI and advanced analytics are better positioned to offer personalized customer experiences and streamline their internal processes, leading to improved profitability and market share.

The insurance technology (InsurTech) landscape is rapidly evolving, with startups introducing novel business models, distribution methods, and technological solutions. Axis Capital faces a critical decision: to see these as competitive threats or as opportunities for strategic partnerships.

Collaborating with agile InsurTech firms allows Axis Capital to integrate specialized technologies, potentially improving customer experience and operational efficiency. For instance, partnerships can facilitate the adoption of AI for claims processing or advanced data analytics for risk assessment, areas where InsurTechs often excel.

Strategic alliances are increasingly prevalent as a means for established insurers like Axis Capital to leverage InsurTech innovation. This approach can unlock access to new customer segments and streamline existing operations, as demonstrated by various collaborations announced in the 2024-2025 period, aiming to enhance digital distribution and personalized product offerings.

Cybersecurity risks are a major concern for insurers like Axis Capital. The increasing sophistication of attacks means data breaches and operational disruptions are a constant threat. In 2023, the average cost of a data breach reached $4.45 million globally, highlighting the significant financial exposure.

This escalating threat landscape is fueling a surge in demand for cyber insurance. The global cyber insurance market was valued at approximately $11.5 billion in 2023 and is projected to grow substantially. Axis Capital must therefore bolster its internal defenses while simultaneously developing comprehensive cyber insurance products to meet this growing client need.

Automation of Claims and Operations

Robotics Process Automation (RPA) and similar technologies are significantly reshaping back-office functions within the insurance sector, impacting areas like policy administration, claims processing, and customer service. Axis Capital can leverage these advancements to streamline repetitive tasks, leading to reduced operational expenses and faster processing times. This shift also allows for the redeployment of human resources towards more intricate and value-generating responsibilities, ultimately boosting overall efficiency and customer experience.

The impact of automation on operational costs and efficiency is substantial. For instance, a 2024 industry report indicated that companies implementing RPA saw an average reduction of 25-40% in processing costs for routine tasks. This translates directly to improved profitability and competitiveness for insurers like Axis Capital. Furthermore, faster claims settlement, often a pain point for customers, can be a significant differentiator.

- Reduced Operational Costs: Automation can lower expenses associated with manual data entry and processing.

- Improved Processing Speed: Tasks like claims intake and policy administration can be completed much faster.

- Enhanced Efficiency: Freeing up staff from repetitive duties allows for focus on complex problem-solving and customer engagement.

- Increased Customer Satisfaction: Quicker turnaround times and more accurate processing contribute to a better customer journey.

Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) offer significant promise for enhancing transparency, security, and efficiency throughout the insurance industry's operations. These advancements could streamline everything from how policies are issued to how claims are settled. For instance, in 2024, the global blockchain in insurance market was valued at approximately $1.1 billion and is projected to reach $8.2 billion by 2030, indicating growing industry interest and investment.

These technologies are particularly relevant for simplifying intricate reinsurance processes and facilitating more secure data sharing among various stakeholders. The potential for smart contracts, which can automate claims payments upon verification of predefined conditions, is also a key area of exploration. Axis Capital actively monitors and investigates the evolving capabilities of blockchain and DLT to identify strategic applications within its business model.

Key potential impacts include:

- Enhanced Data Integrity: DLT can create immutable records, reducing fraud and disputes in policy and claims data.

- Streamlined Reinsurance: Smart contracts can automate complex contract execution and settlement in reinsurance, improving speed and reducing administrative costs.

- Improved Customer Experience: Faster, more transparent claims processing enabled by DLT can lead to greater customer satisfaction.

Technological advancements are profoundly reshaping the insurance landscape, with AI and data analytics enabling more precise risk assessment and fraud detection. The global insurance industry is projected to save over $30 billion annually by 2025 through AI-powered fraud detection. Axis Capital's strategic integration of these tools is crucial for enhancing operational efficiency and customer experience, positioning it for sustained competitiveness in a rapidly evolving market.

Legal factors

Axis Capital, like all global insurers, faces a dynamic regulatory environment. For instance, the ongoing implementation and refinement of Solvency II-equivalent frameworks in various regions, including Europe and beyond, mandate stringent capital adequacy and risk management practices. These evolving rules, which dictate how much capital insurers must hold against potential losses, directly impact operational strategies and profitability.

Navigating these complex, and often jurisdiction-specific, insurance regulations is a significant undertaking for Axis Capital. Failure to comply with capital requirements, reporting standards, or risk mitigation protocols can lead to substantial fines, license revocation, and severe damage to the company's reputation. For example, in 2024, several European insurers faced increased scrutiny and fines for non-compliance with data reporting under Solvency II, highlighting the critical nature of adherence.

Axis Capital operates under a complex web of data privacy and cybersecurity laws, like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations dictate how customer information is handled, demanding robust security and transparent practices. Non-compliance can lead to significant penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This directly influences underwriting, as access to and use of sensitive data for risk assessment must adhere strictly to these legal frameworks, impacting pricing and product development.

Axis Capital Holdings operates within a stringent Anti-Money Laundering (AML) and sanctions compliance framework. This means they must actively prevent financial crime and terrorist financing, a critical task for any global insurer. In 2023, regulatory fines for AML failures globally reached billions, underscoring the significant financial risks involved.

To navigate this, Axis Capital implements thorough due diligence on its clients and transactions. This is essential for adhering to complex international regulations, especially given their worldwide operations. Failure to comply can lead to severe legal penalties and reputational damage, making robust compliance programs a cornerstone of their operations.

Litigation Trends and Class Action Lawsuits

The increasing frequency and severity of class action lawsuits, particularly in casualty and professional liability sectors, pose a significant challenge to insurers like Axis Capital. For instance, in 2024, the U.S. saw a notable rise in securities class action filings, with a 15% increase in the first half of the year compared to the same period in 2023, according to Cornerstone Research. This trend directly impacts the profitability of lines of business susceptible to such litigation, necessitating robust legal risk management and dynamic reserving practices to account for evolving liability exposures and potential punitive damage awards.

Axis Capital must remain vigilant in tracking shifts in legal precedents and judicial interpretations that could broaden liability definitions or increase claims costs. For example, evolving interpretations of directors and officers (D&O) liability, especially concerning cybersecurity breaches and environmental, social, and governance (ESG) issues, can create new avenues for litigation. Proactive monitoring of these legal developments is crucial for accurate risk assessment and ensuring adequate capital reserves are maintained.

- Increased Class Action Filings: In 2024, the U.S. experienced a 15% surge in securities class action filings during the first half of the year compared to the prior year, highlighting a growing litigation environment.

- Evolving Liability Exposures: Emerging legal precedents in areas like D&O liability, particularly related to cybersecurity incidents and ESG mandates, are expanding the scope of potential claims.

- Impact on Profitability: The rising trend in litigation directly affects the profitability of casualty and professional lines, demanding sophisticated legal risk assessment and dynamic reserving strategies.

- Judicial Interpretations: Continuous monitoring of judicial interpretations of liability and punitive damages is essential for Axis Capital to adapt its risk management and underwriting practices.

Cross-Border Licensing and Operational Requirements

Axis Capital Holdings, as a global insurance and reinsurance entity, faces a complex web of legal factors when operating across borders. Compliance with varying licensing regimes, foreign ownership limitations, and specific local operational mandates in each territory is paramount for market entry and continued lawful business practices. For instance, in 2024, many jurisdictions continued to review and update their financial services regulations, impacting how international insurers can establish and maintain operations.

Navigating these diverse legal landscapes is not merely about adherence but is a strategic imperative for expanding market reach and ensuring the integrity of international insurance and reinsurance products. Failure to comply can lead to significant penalties, operational disruptions, and reputational damage.

- Licensing Hurdles: Axis Capital must secure and maintain appropriate licenses in each country, which can involve rigorous application processes and ongoing compliance checks.

- Foreign Ownership Rules: Many nations impose restrictions on the percentage of foreign ownership in financial services companies, directly affecting Axis Capital's control and operational structure.

- Local Operational Mandates: These can include data localization requirements, specific solvency standards, and reporting obligations tailored to each jurisdiction's legal framework.

- Regulatory Evolution: The dynamic nature of global financial regulation, with ongoing reviews and updates in 2024 and projections for 2025, necessitates continuous monitoring and adaptation by Axis Capital.

Axis Capital operates under stringent financial regulations, including capital adequacy rules like Solvency II, which dictate reserve levels and risk management. Non-compliance can result in substantial fines, as seen with European insurers facing scrutiny in 2024 for reporting failures. Furthermore, data privacy laws such as GDPR and CCPA impose strict handling of customer information, with potential fines reaching up to 4% of global annual revenue, directly impacting underwriting and product development.

Environmental factors

Axis Capital, a significant player in property and casualty reinsurance, faces direct headwinds from escalating climate change impacts. The increasing frequency and severity of natural disasters like hurricanes, wildfires, and floods translate into higher claims payouts, directly impacting their underwriting results and profitability.

For instance, the 2023 Atlantic hurricane season, while not as active as some record-breaking years, still saw significant insured losses. The National Oceanic and Atmospheric Administration (NOAA) reported that the season had 20 named storms, with 7 becoming hurricanes, 3 of which were major. While specific figures for Axis Capital are proprietary, the overall industry faced substantial claims from these events, underscoring the need for robust risk assessment.

This heightened catastrophe risk necessitates sophisticated climate risk modeling and a dynamic adaptation of underwriting strategies. Axis Capital must continuously refine its models to accurately price risk and manage its exposure, ensuring the solvency and long-term viability of its property and casualty reinsurance segments in an increasingly volatile environment.

Institutional investors, regulators, and other stakeholders are increasingly pushing insurance companies like Axis Capital to embed Environmental, Social, and Governance (ESG) factors into their investment strategies. This trend is significantly shaping asset allocation decisions, with a growing emphasis on sustainability principles.

Axis Capital faces heightened scrutiny to align its investments with these ESG mandates. This could involve divesting from carbon-intensive industries, a move echoed by many global insurers who, as of early 2024, have committed to net-zero investment portfolios, impacting potential returns and requiring careful risk management.

The global move to a greener economy creates transition risks for insurers like Axis Capital. This includes the possibility of their investments in carbon-heavy industries becoming devalued, essentially becoming stranded assets. For instance, the International Energy Agency projected in 2024 that fossil fuel demand might peak by 2030, a significant shift impacting traditional energy investments.

Axis Capital needs to carefully evaluate how this transition affects its insurance policies and investments. They must consider new potential liabilities arising from climate change-related lawsuits or failing to meet evolving environmental regulations. By 2025, many jurisdictions are expected to have stricter carbon pricing mechanisms, increasing compliance costs for carbon-intensive businesses that Axis Capital insures.

Identifying opportunities within new green sectors is also crucial. Axis Capital should analyze how to underwrite renewable energy projects or invest in sustainable technologies. The renewable energy sector, for example, saw global investment reach over $600 billion in 2023, according to BloombergNEF, signaling substantial growth potential.

Physical Risk from Climate Impacts

Beyond immediate, severe weather events, Axis Capital must also account for the chronic physical risks of climate change. These include gradual shifts like rising sea levels, extended periods of drought, and altered temperature patterns. For instance, the Intergovernmental Panel on Climate Change (IPCC) projects global mean sea level to rise by 0.28 to 0.55 meters by 2100 under a low-emissions scenario. Such changes can fundamentally impact the long-term viability of insuring coastal properties, affecting their valuations and potentially leading to increased business interruption claims due to prolonged operational disruptions.

Axis Capital's risk management and underwriting strategies need to integrate these evolving, long-term physical risks. This involves:

- Re-evaluating underwriting models to incorporate chronic climate impacts on asset insurability.

- Developing new products that address emerging risks like gradual inundation or persistent heat stress on infrastructure.

- Enhancing catastrophe modeling to include the cumulative effects of slower-onset climate changes.

- Engaging with policyholders to promote resilience and adaptation measures against these chronic physical risks.

Regulatory Push for Climate Risk Disclosure

Regulators globally are intensifying mandates for financial institutions, including insurers like Axis Capital, to assess, disclose, and actively manage climate-related financial risks. This regulatory momentum is a significant environmental factor. For instance, by 2024, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are expected to be adopted by major economies, influencing reporting standards for companies worldwide.

This regulatory push directly impacts Axis Capital by requiring enhanced reporting on its climate exposures and the development of robust internal capabilities for climate scenario analysis. Integrating climate risk into governance and strategic planning is no longer optional but a necessity for compliance and long-term resilience. Transparency regarding climate risk is rapidly becoming a standard expectation from both regulators and investors.

- Increased Disclosure Requirements: Axis Capital must adapt to evolving disclosure frameworks, such as those aligned with TCFD, to report on physical and transition risks associated with climate change.

- Climate Scenario Analysis: The company needs to invest in sophisticated modeling to understand potential impacts of various climate scenarios on its underwriting, investments, and overall financial health.

- Governance Integration: Climate risk management needs to be embedded within the board's oversight and executive decision-making processes, ensuring accountability.

- Strategic Planning: Long-term business strategies must incorporate climate considerations, influencing product development, investment portfolios, and operational resilience.

Axis Capital's environmental exposure is significantly shaped by the escalating physical risks of climate change, manifesting in both acute events and chronic shifts. The increasing frequency and intensity of natural disasters directly inflate claims, impacting underwriting results, while gradual changes like rising sea levels necessitate long-term adjustments to risk assessment and product development.

The global transition to a greener economy presents both risks and opportunities. Axis Capital must navigate potential devaluation of investments in carbon-intensive industries, while also capitalizing on the substantial growth in renewable energy sectors, which saw over $600 billion in global investment in 2023.

Regulatory bodies are increasingly mandating climate risk disclosure and management, pushing companies like Axis Capital to integrate ESG factors into their strategies. By 2025, stricter carbon pricing mechanisms in many jurisdictions will likely increase compliance costs for insured carbon-intensive businesses.

Axis Capital must enhance its climate risk modeling to account for both acute and chronic physical impacts, ensuring solvency and adapting underwriting to evolving environmental conditions. This includes re-evaluating models, developing new products, and engaging policyholders on resilience measures.

| Environmental Factor | Impact on Axis Capital | Data/Trend (2023-2025) |

|---|---|---|

| Extreme Weather Events | Increased claims payouts, reduced underwriting profitability | 2023 Atlantic hurricane season had 20 named storms; industry faced substantial losses. |

| Climate Transition | Risk of stranded assets in carbon-intensive industries; opportunities in green sectors | Global renewable energy investment exceeded $600 billion in 2023. Potential fossil fuel demand peak by 2030. |

| Regulatory Mandates | Enhanced disclosure requirements (TCFD), climate scenario analysis | TCFD recommendations expected adoption by major economies by 2024. |

| Chronic Physical Risks | Long-term impact on asset insurability (e.g., coastal properties) | Projected sea level rise of 0.28-0.55 meters by 2100 (low-emissions scenario). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Axis Capital Holdings is built upon a robust foundation of data sourced from leading financial institutions like the IMF and World Bank, alongside insights from reputable industry analysis firms and official government publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the global insurance and reinsurance markets.