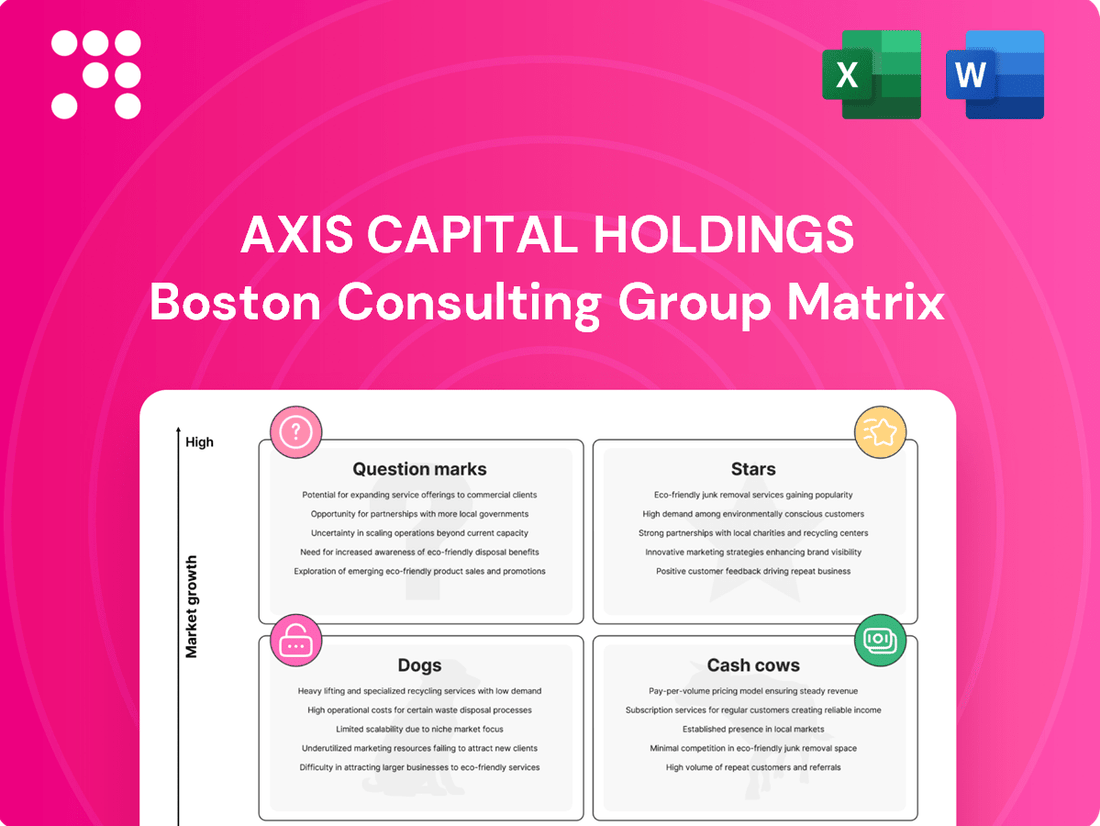

Axis Capital Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

Curious about Axis Capital Holdings' strategic product portfolio? This preview offers a glimpse into their BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full picture and gain actionable insights by purchasing the complete BCG Matrix report, designed to illuminate your investment and product development strategies.

Stars

The Specialty Insurance segment is a strong performer for Axis Capital, contributing significantly to overall results. In the first quarter of 2025, this segment saw gross premiums written climb by 5.2% to $1.7 billion, alongside a healthy rise in underwriting income.

This segment's focus on high-margin specialty lines is a key driver of its success. The impressive combined ratio of 86.7% recorded in Q1 2025 underscores the segment's operational efficiency and profitability, solidifying its position as a leader in its niche markets.

Axis Capital Holdings' Professional Lines, a key component of their BCG Matrix, demonstrated robust growth in the first quarter of 2025. This expansion was fueled by both securing new business and favorable renewal timing within their insurance and reinsurance operations.

The strong performance in areas like directors' and officers' liability, errors and omissions, and other professional indemnity coverages highlights Axis Capital's solid market standing and the significant demand for their specialized products. This success underscores their strategic commitment to these niche, yet critical, insurance segments, allowing them to capture a substantial share of an evolving risk market.

Axis Capital Holdings has a strong footing in the casualty and specialty insurance market, with these lines making up about 80% of its overall business. This significant concentration highlights the importance of this segment to their strategy.

Looking ahead to 2025, industry analysts are forecasting a positive trend for the casualty insurance sector. Axis Capital is strategically positioning itself to benefit from this anticipated growth by actively refining its primary casualty portfolio.

The company's proactive approach, including adjustments to its underwriting and a steady rise in casualty rates, is designed to drive stronger performance and maintain its market leadership in this crucial area. This focus is expected to yield sustained growth in the coming years.

Excess & Surplus (E&S) Lines in North America

Excess & Surplus (E&S) lines in North America represent a significant growth area for Axis Capital, as highlighted by their performance in Q1 2025. This segment benefited from an expansion of product offerings specifically tailored for the North American market.

Axis Capital's strategic focus on E&S lines is paying off, positioning them as a key player in a high-growth sector. Their ability to secure substantial premium volumes demonstrates a robust competitive standing.

- Q1 2025 E&S Growth Driver: E&S lines were a primary contributor to Axis Capital's insurance segment expansion in the first quarter of 2025.

- North American Market Focus: Growth was fueled by an increased range of products available within the North American E&S market.

- Market Share Expansion: Axis Capital is actively enhancing its position in this dynamic, high-growth market through strategic initiatives.

- Premium Generation: The company's success in generating significant premiums within the E&S channel underscores its competitive strengths.

Credit and Surety Reinsurance

Axis Capital Holdings' Credit and Surety Reinsurance segment is a key player in a burgeoning market. In Q1 2025, this area saw significant premium growth, largely driven by new business acquisition. This expansion underscores the company's strategic focus on capitalizing on the high-growth potential within credit and surety reinsurance.

- Premium Growth: Q1 2025 saw notable premium expansion in credit and surety lines.

- New Business Focus: The growth was primarily fueled by securing new business opportunities.

- Market Opportunity: This segment represents a significant high-growth area within the reinsurance industry.

- Strategic Expansion: Axis Capital is actively increasing its presence and capabilities in this niche market.

Stars represent business units with high market share in high-growth markets. Axis Capital's Excess & Surplus (E&S) lines in North America, showing strong premium generation and product expansion in Q1 2025, fit this profile.

Similarly, their Credit and Surety Reinsurance segment, experiencing significant premium growth driven by new business in Q1 2025, also indicates star potential due to the market's high-growth nature.

| BCG Matrix Category | Axis Capital Holdings Segment | Market Growth | Market Share | Q1 2025 Performance Highlight |

|---|---|---|---|---|

| Stars | Excess & Surplus (E&S) Lines (North America) | High | Strong/Growing | Significant premium volume, expanded product offerings |

| Stars | Credit and Surety Reinsurance | High | Growing | Notable premium expansion, driven by new business acquisition |

What is included in the product

This BCG Matrix overview for Axis Capital Holdings identifies strategic priorities for each business unit, guiding investment and divestment decisions.

Axis Capital Holdings' BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

Axis Capital's reinsurance segment is a clear cash cow, consistently delivering robust profits. In 2024, the company achieved a combined ratio of 91.8%, indicating strong underwriting performance. This trend continued into Q1 2025 with a combined ratio of 92.3%.

This mature segment, while seeing growth in certain areas, serves as a reliable generator of substantial cash flow. The established market position means less need for aggressive promotional spending, allowing for efficient cash generation.

Axis Capital Holdings' Fixed Maturity Investment Portfolio functions as a Cash Cow within its BCG Matrix. This portfolio demonstrates robust performance, contributing significantly to the company's financial strength.

In 2024, Axis Capital achieved a record net investment income of $759 million. This strong showing is further evidenced by a 24% increase in net investment income to $208 million in Q1 2025, largely driven by the favorable yields generated from its fixed maturities.

The consistent and expanding income derived from this well-managed portfolio solidifies its position as a reliable and substantial cash generator for Axis Capital Holdings, supporting other strategic initiatives and growth areas.

Axis Capital's well-established property insurance segment, while facing slower growth than casualty lines, remains a cornerstone of its offerings. This mature business area is a reliable generator of underwriting profit, contributing significantly to the company's financial stability.

In 2023, Axis Capital reported that its property and casualty (P&C) segment, which includes property insurance, generated $3.8 billion in net premiums written. This segment consistently delivers steady cash flow, vital for funding the company's investments in growth areas.

Consistent Dividend Payouts

Axis Capital Holdings demonstrates a strong Cash Cow characteristic through its consistent dividend payouts. The company has maintained a steady quarterly dividend of $0.44 per common share for more than twenty years. This enduring commitment to shareholder returns, currently yielding 1.92% at prevailing market prices, underscores its robust and dependable cash flow generation.

The sustained ability to disburse these dividends over such an extended timeframe is a clear indicator of a mature and financially sound operation. Such consistency often implies that the business segment generating these funds requires minimal reinvestment to maintain its market position and profitability.

- Consistent Dividend: Axis Capital has paid $0.44 per common share quarterly for over 20 years.

- Yield: The current dividend yield stands at 1.92%.

- Cash Flow Signal: This long-standing payout demonstrates strong and reliable cash flow generation.

- Maturity: The sustained payouts indicate a mature, cash-rich operation.

Strategic Capital Partners Fees

Strategic Capital Partners fees, a component of Axis Capital Holdings' BCG Matrix, reflect a significant growth area. For the full year 2024, Axis Capital saw a substantial 39% surge in fee income from these partnerships.

These fees, often tied to administrative or acquisition services, highlight a stable revenue stream. This growth demonstrates Axis Capital's ability to effectively monetize its existing expertise and infrastructure.

- Fee Income Growth: 39% increase reported for FY 2024.

- Revenue Stream Stability: Fees are derived from established expertise and infrastructure.

- Leveraging Assets: Indicates efficient use of existing resources for additional income.

Axis Capital's reinsurance segment is a clear cash cow, consistently delivering robust profits. In 2024, the company achieved a combined ratio of 91.8%, indicating strong underwriting performance. This mature segment, while seeing growth in certain areas, serves as a reliable generator of substantial cash flow, requiring less aggressive promotional spending due to its established market position.

Axis Capital Holdings' Fixed Maturity Investment Portfolio functions as a Cash Cow within its BCG Matrix. In 2024, Axis Capital achieved a record net investment income of $759 million, with a 24% increase to $208 million in Q1 2025, driven by favorable yields. This consistent and expanding income solidifies its position as a reliable and substantial cash generator.

Axis Capital's well-established property insurance segment, while facing slower growth, remains a cornerstone, reliably generating underwriting profit. In 2023, its property and casualty segment, including property insurance, generated $3.8 billion in net premiums written, providing steady cash flow vital for funding growth initiatives.

The company's consistent dividend payouts, $0.44 per common share quarterly for over 20 years with a current yield of 1.92%, underscore its robust cash flow generation. This sustained payout signifies a mature, financially sound operation that requires minimal reinvestment to maintain its market position and profitability.

| Business Segment | BCG Category | 2024 Performance Metric | 2025 (Q1) Performance Metric | Key Characteristic |

|---|---|---|---|---|

| Reinsurance | Cash Cow | Combined Ratio: 91.8% | Combined Ratio: 92.3% | Strong underwriting, reliable cash flow |

| Fixed Maturity Investment Portfolio | Cash Cow | Net Investment Income: $759 million | Net Investment Income: $208 million (24% increase) | Consistent and expanding income generation |

| Property Insurance | Cash Cow | Net Premiums Written (P&C segment): $3.8 billion (2023) | N/A | Steady cash flow, underwriting profit |

| Dividend Payout | Cash Cow Indicator | $0.44/share quarterly (over 20 years) | Yield: 1.92% | Demonstrates strong, reliable cash flow |

What You’re Viewing Is Included

Axis Capital Holdings BCG Matrix

The Axis Capital Holdings BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic analysis ready for immediate application in your business planning.

Dogs

Certain Older Reinsurance Portfolios, representing Axis Capital's legacy business, are likely positioned as Cash Cows or potentially Dogs in a BCG Matrix analysis. The significant loss portfolio transfer (LPT) completed in April 2025 with Enstar, which involved $2.3 billion of net reserves primarily from 2021 and prior underwriting years, strongly indicates a strategic divestment of older, less profitable segments.

This transaction effectively sheds legacy business that likely exhibited low growth prospects and tied up valuable capital, aligning with the characteristics of a Dog. By reducing exposure to these potentially volatile portfolios, Axis Capital frees up resources to focus on more dynamic and profitable areas of its operations.

Axis Capital Holdings' Cyber Program Business, within its insurance segment, experienced a notable decrease in gross premiums written during the first quarter of 2025. This decline was primarily attributed to a reduction in premium volume associated with its program business.

This trend suggests a potential contraction in this specific niche of cyber insurance, possibly due to strategic shifts or intensified competition. For instance, if the program business saw a 5% drop in premium volume, it would directly impact the overall cyber line's performance.

Axis Capital's motor reinsurance segment saw a notable contraction in line sizes and a rise in non-renewals during the first quarter of 2025. This trend indicates that the motor reinsurance market is likely experiencing subdued growth and increased competitive pressures, impacting Axis Capital's ability to maintain its previous market penetration.

Specific Accident & Health Reinsurance Lines

Axis Capital Holdings' Accident & Health (A&H) reinsurance lines, much like their motor reinsurance counterparts, experienced a reduction in line sizes during the first quarter of 2025. This contraction suggests a potential shift in Axis's market position or a strategic withdrawal from specific A&H niches. This could stem from intensified competition, pricing pressures, or a deliberate move to avoid less attractive risk profiles within the A&H sector.

The decrease in A&H reinsurance line sizes points to a segment that might be underperforming or facing significant headwinds. For instance, if specific A&H products, such as travel insurance or certain group health coverages, are experiencing rising claims or declining premium growth, Axis might be re-evaluating its exposure. In 2024, the global A&H reinsurance market faced challenges including evolving healthcare costs and regulatory changes, which could have influenced Axis's decision-making.

- Reduced Market Share: A shrinking line size can signal a loss of competitive edge or a deliberate reduction in appetite for specific A&H risks.

- Unfavorable Market Conditions: Economic factors, increased claims frequency, or adverse loss development in certain A&H portfolios could prompt a scaling back.

- Profitability Concerns: If the profitability of particular A&H reinsurance treaties has declined, Axis may opt to reduce its participation to protect overall returns.

- Strategic Repositioning: This move could also be part of a broader strategy to focus on more profitable or strategically advantageous lines of business within the A&H segment.

Underperforming Segments Identified for Remediation

Axis Capital Holdings has been actively addressing underperforming areas within its portfolio. Specifically, remediation efforts were concentrated on cyber and primary casualty insurance lines. While primary casualty has since shown improvement, evolving into a Star segment, the initial focus on remediation indicates that certain historical or sub-segments within these lines were previously identified as dogs.

These remediated segments, even with recent positive shifts, might still represent areas with historically low returns or require ongoing attention to fully overcome past underperformance. For instance, in 2024, while the overall primary casualty market showed resilience, specific niche cyber risks continued to present challenges, potentially impacting profitability in those particular sub-segments.

- Cyber Insurance: Continued volatility in cyber threats and evolving regulatory landscapes in 2024 presented ongoing challenges, potentially keeping certain specialized cyber portfolios in the dog category despite broader market growth.

- Primary Casualty: Although now a Star, prior remediation efforts in primary casualty suggest that certain historical book years or specific geographic exposures within this line may have experienced prolonged periods of low profitability, characteristic of a dog.

- Remediation Impact: The success of remediation is key; if previously underperforming segments within these lines haven't fully achieved market-leading growth and profitability by mid-2025, they could still be classified as dogs from a strategic perspective.

Axis Capital's older reinsurance portfolios, particularly those from 2021 and prior, are likely positioned as Dogs. The significant $2.3 billion loss portfolio transfer to Enstar in April 2025 effectively divested these low-growth, capital-intensive segments. This strategic move aligns with shedding underperforming assets that exhibit characteristics of Dogs in the BCG Matrix.

The Cyber Program Business also shows signs of being a Dog, evidenced by a decline in gross premiums written in Q1 2025, suggesting contraction and potential strategic shifts away from less profitable niches. Similarly, the motor reinsurance and Accident & Health (A&H) reinsurance lines experienced reduced line sizes and increased non-renewals in Q1 2025, pointing to subdued growth and competitive pressures characteristic of Dogs.

Remediation efforts in cyber and primary casualty insurance, while showing improvement in casualty, initially targeted segments that were likely Dogs. Even with recent positive shifts, these areas may still require attention to fully overcome past underperformance, particularly in specific niche cyber risks that continued to present challenges in 2024.

The A&H reinsurance segment's contraction in line sizes, potentially due to evolving healthcare costs and regulatory changes in 2024, further suggests a Dog classification for certain sub-segments. This indicates a potential scaling back due to profitability concerns or a strategic repositioning away from less attractive risk profiles.

Question Marks

Monarch Point Re, launched in 2023 with Stone Point, represents a strategic investment in the casualty ILS market for Axis Capital Holdings. This platform, while new, experienced a notable 13% rise in ceded prospective reinsurance premiums during 2024, signaling strong market adoption and growth potential.

However, this expansion came with a significant increase in losses ceded, a common characteristic of high-growth, capital-intensive ventures. The platform is actively scaling, and its current financial performance reflects the investment phase required to establish long-term profitability in this dynamic sector.

Axis Capital Holdings is channeling significant resources into technology, data analytics, and artificial intelligence. This strategic focus is designed to modernize its operational framework, anticipating future gains in efficiency and market competitiveness. These investments represent a commitment to innovation, though their immediate impact on market share is still developing.

The company's expenditure in these areas is substantial, reflecting a long-term vision for enhanced capabilities. While these initiatives are poised to drive future growth and operational excellence, their current contribution to direct revenue or market share is likely in its early stages. For instance, in 2024, many financial institutions reported increased spending on AI-driven customer service platforms, with some seeing early improvements in customer retention rates.

Axis Capital Holdings' expanded E&S offerings are positioned as question marks within the BCG matrix. While the broader E&S segment demonstrates robust performance, these new product lines are in a growth phase. They are entering a dynamic market but are still in the early stages of capturing market share and client trust.

Significant investment in marketing and product development is crucial for these new E&S products. This strategic focus aims to accelerate adoption and solidify their market position. Without sustained support, there's a risk these promising ventures could stagnate and potentially become underperforming 'dogs' in the portfolio.

Emerging Risks Solutions

Axis Capital Holdings addresses emerging risks, such as those in the energy transition, by developing innovative solutions. These areas, while offering high growth potential, are characterized by significant uncertainty and require substantial investment in research and development, alongside extensive market education. For instance, in 2024, the global renewable energy sector saw investments exceeding $500 billion, highlighting both the opportunity and the evolving nature of these risks.

Developing solutions for these nascent risks positions Axis Capital in a strategic, albeit speculative, market segment. Success here means establishing market share in areas where the landscape is still being defined. The company's approach recognizes that these emerging risks are not just challenges but also avenues for future leadership and profitability.

- Focus on High-Growth, Uncertain Markets: Axis Capital targets areas like energy transition, which experienced over $500 billion in global investment in 2024, indicating substantial growth potential coupled with inherent volatility.

- Investment in R&D and Market Education: Developing solutions for emerging risks necessitates significant upfront investment in research and development, alongside efforts to educate the market about new risk exposures and mitigation strategies.

- Establishing Market Share in Nascent Sectors: These are largely unproven markets where Axis Capital aims to be an early mover, building its position and influence in areas where competitive landscapes are still forming.

- Navigating Speculative Terrain: The company acknowledges the speculative nature of these ventures, understanding that market share is not yet solidified and requires strategic agility to capture and maintain.

Strategic Partnerships for Growth

Axis Capital Holdings actively pursues strategic partnerships as a key growth driver. Collaborations like the one with Blue Hat focus on enhancing accessibility, while the alliance with Mea Platform aims to broaden their network of partners. These initiatives are designed to unlock new revenue streams and extend market penetration.

These partnerships are currently in their early stages, meaning their long-term impact on Axis Capital's market share and overall growth trajectory is yet to be fully determined. Consequently, they are categorized as question marks within the BCG Matrix framework, necessitating careful observation, strategic investment, and focused management to guide them toward becoming stars.

- Strategic Partnerships: Axis Capital is leveraging collaborations like the Blue Hat initiative for accessibility and the Mea Platform for partner expansion.

- Growth Objectives: These alliances are specifically designed to explore new growth avenues and increase market reach.

- BCG Matrix Classification: Due to their nascent stage and uncertain future performance, these partnerships are classified as question marks.

- Future Outlook: Continued investment and strategic nurturing are required to assess and potentially maximize their contribution to Axis Capital's market position.

Axis Capital Holdings' new ventures, such as its expanded E&S offerings and strategic partnerships, are currently classified as question marks. These initiatives are in their early stages, requiring significant investment and strategic nurturing to determine their future success and market impact.

The company is actively investing in technology and exploring emerging risks like the energy transition, areas with high growth potential but also considerable uncertainty. These ventures, like the Monarch Point Re platform which saw a 13% rise in ceded premiums in 2024, represent a commitment to future growth but their long-term positioning is still being defined.

Successfully navigating these question marks involves focused R&D, market education, and strategic partnerships to build market share. Without sustained support and strategic execution, these promising areas risk becoming underperformers.

Axis Capital's strategic partnerships, like those with Blue Hat and Mea Platform, are designed to unlock new revenue and extend market penetration. These alliances, while nascent, are crucial for future growth, but their ultimate contribution remains to be seen.

| Initiative | BCG Classification | Key Characteristics | 2024 Data/Context | Strategic Focus |

| Monarch Point Re | Question Mark | High growth potential, capital intensive | 13% rise in ceded prospective reinsurance premiums | Scaling, investment phase |

| Technology & AI Investment | Question Mark | Modernizing operations, future efficiency | Substantial expenditure, anticipating gains | Innovation, enhanced capabilities |

| Expanded E&S Offerings | Question Mark | Entering dynamic market, early adoption | Requires marketing & product development | Accelerate adoption, solidify position |

| Emerging Risks (e.g., Energy Transition) | Question Mark | High growth potential, significant uncertainty | Over $500 billion global investment in renewables | R&D, market education, future leadership |

| Strategic Partnerships (Blue Hat, Mea Platform) | Question Mark | Enhancing accessibility, broadening network | Designed to unlock new revenue streams | Market penetration, growth driver |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.