Axis Capital Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axis Capital Holdings Bundle

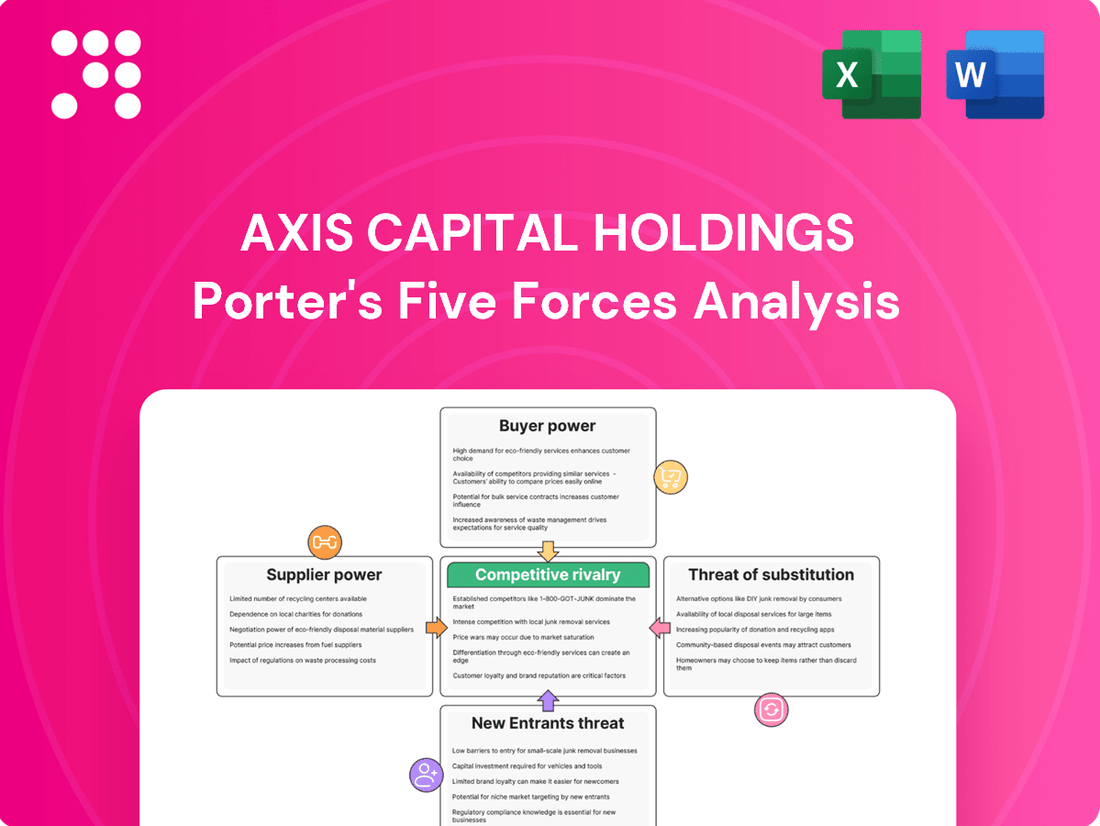

Axis Capital Holdings operates within an industry characterized by moderate rivalry, with established players vying for market share. The threat of new entrants is somewhat constrained by capital requirements and regulatory hurdles, but potential disruptors could emerge. Buyer power is a significant factor, as clients can often switch providers with relative ease, demanding competitive pricing and robust service offerings.

The complete report reveals the real forces shaping Axis Capital Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Axis Capital Holdings, like many insurers, depends on the global reinsurance market to manage its exposure to large or unusual risks. The availability and cost of this reinsurance capacity directly impact Axis's profitability and operational flexibility.

The reinsurance market, especially for specialized coverages such as catastrophe risks, is characterized by a concentration of capital. When a few large reinsurers dominate these segments, they gain considerable leverage in negotiating terms and prices with primary insurers like Axis. This concentration means reinsurers can dictate more favorable conditions for themselves, increasing costs for Axis.

While the overall reinsurance market capacity has seen growth, certain areas, notably casualty reinsurance, continue to experience upward pricing pressure. This trend is driven by ongoing concerns about social inflation and the increasing frequency and severity of litigation, which makes reinsurers more cautious and demanding in their pricing for Axis.

Insurers like Axis Capital Holdings are heavily reliant on specialized data and technology providers to stay competitive. The increasing use of advanced analytics, artificial intelligence, and sophisticated software for underwriting, claims processing, and risk modeling means these tech companies hold significant sway. For instance, the global AI in insurance market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, highlighting the critical role of these providers.

The specialty insurance and reinsurance sectors heavily rely on underwriters possessing specialized knowledge and significant experience. This scarcity of highly skilled underwriting talent means these professionals often command greater influence, impacting recruitment expenses and retention plans for firms like Axis Capital.

The insurance industry is experiencing a notable decline in accumulated expertise as a generation of experienced professionals retires. This trend exacerbates the challenge of accessing and retaining critical underwriting talent, thereby amplifying the bargaining power of those with the requisite skills.

Cost of Capital and Investment Market Conditions

Suppliers of capital, such as debt and equity investors, wield significant bargaining power, particularly influenced by prevailing interest rates and broader financial market sentiment. Axis Capital Holdings, like other reinsurers, navigates this dynamic where investor expectations for returns directly impact the cost of funding.

The investment market in 2024 and into 2025 has shown a trend where strong investment income, often driven by elevated bond yields, has bolstered the capital positions of reinsurers. This improved financial health can, in turn, reduce the bargaining power of capital suppliers as the company becomes a more attractive and stable investment.

- Investor Influence: The cost of capital for Axis Capital is directly tied to investor demands for returns, which fluctuate with market conditions.

- 2024-2025 Capital Strength: Reinsurers generally benefited from favorable investment income in 2024-2025, strengthening their capital bases.

- Yield Impact: High bond yields, a feature of the recent market, have been a key driver of this improved investment income for companies like Axis Capital.

Regulatory and Rating Agency Requirements

Axis Capital Holdings must navigate a complex web of regulatory and rating agency demands. Compliance with frameworks set by bodies like the SEC and maintaining strong financial strength ratings from agencies such as S&P and A.M. Best are paramount to their operations and market standing.

These external entities effectively function as suppliers of essential credibility and operational benchmarks. Their stringent requirements can significantly shape Axis Capital's business strategies and dictate capital deployment decisions, thereby influencing the bargaining power they exert.

- Regulatory Compliance Costs: Axis Capital's adherence to evolving insurance regulations, such as Solvency II in Europe or NAIC requirements in the US, necessitates significant investment in compliance infrastructure and personnel. For instance, in 2024, the global insurance regulatory technology market was projected to grow substantially, reflecting the ongoing investment in this area.

- Rating Agency Influence: Favorable ratings from agencies like S&P (e.g., A+ or higher) and A.M. Best (e.g., A++ or A+) are critical for attracting and retaining clients, particularly in the wholesale insurance and reinsurance markets. A downgrade can lead to increased capital costs and reduced market access.

- Capital Requirements: Rating agencies and regulators often impose specific capital adequacy ratios that insurers must meet. These requirements can limit the flexibility of capital allocation and may necessitate raising capital at less opportune times if shortfalls arise, thereby increasing the bargaining power of capital providers.

- Operational Standards: Beyond capital, rating agencies and regulators set standards for governance, risk management, and reporting. Meeting these benchmarks requires continuous investment in systems and processes, giving these bodies leverage over how Axis Capital operates.

The bargaining power of suppliers for Axis Capital Holdings is notably influenced by the concentration within the global reinsurance market, particularly for specialized risks. This concentration grants reinsurers significant leverage in pricing and terms, directly impacting Axis's costs.

Furthermore, the scarcity of highly skilled underwriting talent, exacerbated by retiring professionals, amplifies the influence of those with specialized knowledge. This trend increases recruitment and retention expenses for firms like Axis Capital.

The cost of capital for Axis Capital is also tied to investor demands, which are influenced by market conditions. However, strong investment income in 2024-2025, driven by high bond yields, generally bolstered reinsurers' capital positions, potentially reducing the bargaining power of capital suppliers.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Axis Capital | 2024-2025 Data/Trends |

|---|---|---|---|

| Reinsurers | Market concentration, specialized risk capacity | Higher reinsurance costs, reduced flexibility | Continued upward pricing in casualty reinsurance; stable but selective catastrophe capacity |

| Talent Providers (Underwriters) | Scarcity of specialized skills, demographic shifts | Increased recruitment and retention costs | Growing gap in experienced underwriting talent due to retirements |

| Capital Suppliers (Investors) | Investor return expectations, market sentiment | Cost of debt and equity financing | Strong investment income from elevated bond yields improved capital positions; reduced reliance on costly capital |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Axis Capital Holdings within the insurance and reinsurance sectors.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of each of Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Axis Capital Holdings' commercial clients, including large businesses, insurance companies, and governmental entities, are highly sophisticated. These clients often maintain robust risk management departments, giving them the leverage to negotiate favorable terms, coverage, and pricing due to their substantial premium volumes.

As the dominant end-user segment in specialty insurance, these business customers possess significant bargaining power. For instance, in 2024, the specialty insurance market continued to see large corporate buyers demanding tailored solutions and competitive pricing, directly impacting insurers like Axis Capital.

Axis Capital Holdings, like other insurers, faces increased customer bargaining power due to the growing availability of Alternative Risk Transfer (ART) mechanisms. Large clients, particularly those with complex or challenging risk profiles, are increasingly leveraging solutions like captive insurance companies, catastrophe bonds, and other sophisticated financial instruments to manage their exposures. This trend allows them to bypass traditional insurance placements, thereby strengthening their negotiating position.

The demand for ART solutions is particularly pronounced among clients seeking to innovate or secure coverage for risks that are difficult to place in standard markets. For instance, the global insurance-linked securities (ILS) market, a key component of ART, saw significant growth, with total ILS capital reaching an estimated $100 billion by the end of 2023, demonstrating a clear shift in how large entities manage risk and influencing their interaction with traditional reinsurers like Axis Capital.

While specialty insurance typically commands less price sensitivity due to its tailored nature, a general softening in property reinsurance rates and increased capacity in certain lines can indeed heighten customer price sensitivity. This shift means clients are more inclined to shop around for the best deals.

Customers are increasingly empowered by access to market data and the expertise of brokers. This enhanced awareness allows them to readily compare pricing across different providers, putting more pressure on insurers to remain competitive. For instance, industry reports in early 2024 indicated a notable increase in available reinsurance capacity, especially for property catastrophe risks, which naturally drives down prices.

The reinsurance market's pricing cycle may have passed its peak, signaling a potentially softer market. This is largely attributed to abundant capital flowing into the sector, creating a more competitive environment where clients can negotiate more favorable terms and prices.

Ability to Self-Insure or Retain More Risk

Larger, financially robust customers can opt to absorb more risk themselves by using higher deductibles or self-insurance. This directly diminishes their need for insurance carriers like Axis Capital Holdings.

As companies grow and their balance sheets strengthen, they are increasingly comfortable self-insuring for significant portions of their risk exposure. They are actively seeking coverage primarily for catastrophic, multi-billion dollar events.

- Self-insurance adoption is growing among large corporations.

- Companies with substantial financial reserves can offset smaller claims.

- This trend shifts the demand towards high-severity, low-frequency risk coverage.

Broker and Distribution Channel Influence

Brokers wield significant influence by advising clients and directing business to specific insurers, effectively acting as a collective voice for numerous policyholders. This ability to steer client decisions grants them considerable bargaining power.

In 2024, the insurance brokerage sector continued to consolidate, with larger players increasingly dictating terms due to their market reach. For instance, Marsh McLennan reported strong organic growth in its brokerage segments, underscoring their continued client influence.

- Broker Influence: Brokers can shift substantial premium volume, forcing carriers to compete on price and service to secure their business.

- Demand for Transparency: Brokers increasingly demand sophisticated digital tools and transparent pricing to better serve their clients and strengthen relationships.

- Distribution Costs: The reliance on brokers means insurers incur distribution costs, which can be substantial and are a key lever for customer power.

Axis Capital's customers, particularly large, sophisticated businesses, possess considerable bargaining power. Their ability to self-insure, utilize alternative risk transfer (ART) mechanisms, and leverage the expertise of influential brokers allows them to negotiate favorable terms and pricing. This is especially true in 2024, where increased capacity in certain insurance lines, like property reinsurance, has intensified price sensitivity among these clients.

| Factor | Impact on Axis Capital | Supporting Data (2023/2024 Trends) |

|---|---|---|

| Sophistication of Clients | Clients demand tailored solutions and competitive pricing. | Large corporate buyers in specialty insurance continued to drive this trend in 2024. |

| Alternative Risk Transfer (ART) | Clients can bypass traditional insurance, strengthening negotiation power. | Global ILS capital reached an estimated $100 billion by end-2023, indicating growing ART adoption. |

| Market Capacity & Price Sensitivity | Increased capacity in lines like property reinsurance leads to client price shopping. | Reports in early 2024 noted increased reinsurance capacity, particularly for property catastrophe risks. |

| Broker Influence | Brokers direct substantial premium volume, forcing insurer competition. | Marsh McLennan's strong organic growth in 2024 brokerage segments highlights continued client influence. |

Same Document Delivered

Axis Capital Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Axis Capital Holdings, detailing the competitive landscape and strategic implications. The document displayed here is the exact version you'll receive immediately after purchase, offering actionable insights without any placeholders or alterations. You're looking at the actual, professionally formatted analysis, ready for your immediate use upon completing the transaction.

Rivalry Among Competitors

Axis Capital Holdings operates in a specialty insurance and reinsurance market that is quite fragmented, featuring a wide array of participants from massive global entities to highly specialized niche providers. This broad base of competitors naturally fuels intense rivalry as each player vies for a greater share of the market.

Despite this fragmentation, the industry is also experiencing a notable trend of consolidation. Merger and acquisition (M&A) activity has been on the rise, with companies actively seeking to expand their reach and capabilities, particularly through international growth initiatives. For instance, the global reinsurance market saw significant M&A deals in 2023 and early 2024, as firms looked to bolster their portfolios and gain scale in an increasingly competitive environment.

Competitive rivalry in the insurance sector, particularly for companies like Axis Capital Holdings, often hinges on product differentiation and specialization. This means insurers compete by developing unique offerings that cater to very specific, often complex, risk profiles. Axis Capital, for instance, emphasizes its ability to provide tailored underwriting expertise for niche market segments, setting itself apart from more generalized insurers.

This specialization allows companies to command premium pricing and build strong customer loyalty within their chosen areas. For example, in 2024, the specialty insurance market continued to see robust growth, with many insurers reporting increased profitability in lines like cyber insurance and professional liability, areas where deep underwriting knowledge is paramount. Axis Capital's strategic focus on these specialized products directly addresses this competitive dynamic.

Competitive rivalry in the reinsurance market, including for companies like Axis Capital Holdings, is influenced by pricing discipline and capitalization levels. While ample capacity in certain lines can create pricing pressure, reinsurers are largely demonstrating strong underwriting discipline. This, coupled with robust capitalization, helps maintain stable market conditions.

The global reinsurance sector is expected to see stability through 2025. This outlook is underpinned by strong operating profits and healthy capitalization levels across the industry. For instance, the sector's capital base remained strong in 2023, enabling it to absorb losses and support pricing stability.

Technological Advancements and Innovation Race

Insurers are in a fierce race to innovate, pouring resources into technologies like artificial intelligence (AI), advanced analytics, and digital platforms. This investment is crucial for gaining an edge in areas such as underwriting accuracy, claims processing efficiency, and overall customer experience. For instance, by mid-2024, many leading insurers reported significant increases in their IT budgets, with a substantial portion allocated to AI and data analytics initiatives, aiming to refine risk assessment and personalize offerings.

The adoption of AI is fundamentally reshaping the insurance landscape. Carriers are leveraging AI to optimize product pricing, making it more responsive to real-time data and individual risk profiles. Furthermore, AI-powered tools are enhancing customer interactions, from faster claims approvals to more intuitive digital interfaces. This technological arms race means that companies not investing in these advancements risk falling behind in efficiency and customer satisfaction.

- AI in Underwriting: Insurers are using AI to analyze vast datasets, improving the accuracy and speed of risk assessment, which can lead to more competitive pricing.

- Digital Platforms: The push for seamless online customer journeys and self-service options is driving investment in user-friendly digital platforms.

- Advanced Analytics: Predictive analytics are being employed to forecast trends, identify potential fraud, and understand customer behavior more deeply.

- Investment Trends: Reports from late 2023 and early 2024 indicated that technology spending within the insurance sector saw a notable year-over-year increase, with a significant focus on digital transformation and AI capabilities.

Global Reach and Regulatory Arbitrage

Axis Capital Holdings, a significant player in the re/insurance sector, leverages its global footprint to navigate diverse markets. Its operations span key regions including Bermuda, the United States, Europe, Singapore, and Canada, enabling risk diversification and strategic positioning within varying regulatory frameworks. This broad reach, however, can amplify competitive pressures as firms vie for market share across these distinct geographical and legal landscapes.

The ability of major re/insurers like Axis Capital to operate internationally allows them to exploit differences in regulatory requirements and capital standards. This can lead to a form of regulatory arbitrage, where companies can strategically place their operations or capital to minimize costs or maximize flexibility. For instance, in 2023, the global insurance market saw continued adaptation to evolving solvency regulations, with companies evaluating their geographic exposures and operational structures.

- Global Operations: Axis Capital's presence in Bermuda, the US, Europe, Singapore, and Canada facilitates risk diversification and access to varied markets.

- Regulatory Environment: Companies can seek favorable regulatory regimes, potentially creating competitive advantages and intensifying rivalry.

- Market Competition: The international scope means Axis Capital competes with a wide array of global and local insurers across multiple jurisdictions.

Competitive rivalry within the specialty insurance and reinsurance market, where Axis Capital Holdings operates, is intense due to the industry's fragmented nature and ongoing consolidation. Companies differentiate themselves through specialized underwriting and innovation, particularly in areas like AI and digital platforms, to gain an edge.

Axis Capital's global presence means it faces competition across diverse markets, navigating varying regulations and capital standards. This international scope amplifies competitive pressures as firms seek market share and operational advantages.

The sector's capitalization levels and pricing discipline are key factors influencing rivalry. While abundant capacity can create pricing pressure, strong underwriting discipline and robust capital bases, as seen through 2023 and projected into 2025, help maintain market stability.

Technological investment, especially in AI and advanced analytics, is a critical battleground. Insurers are significantly increasing IT budgets, with a focus on AI for underwriting accuracy and customer experience, as evidenced by mid-2024 spending trends.

SSubstitutes Threaten

For larger corporations and government bodies, the option to self-insure or retain more risk through higher deductibles or robust internal risk management programs acts as a significant substitute for traditional insurance products. Companies with substantial revenues and strong balance sheets are increasingly focused on protecting themselves against multi-billion dollar risks, coverage that can be challenging to secure in the conventional insurance market.

The increasing availability and sophistication of Alternative Risk Transfer (ART) mechanisms, like catastrophe bonds and industry loss warranties, pose a significant threat by allowing risks to bypass traditional insurers. These instruments, often referred to as insurance-linked securities (ILS), directly channel risk to capital markets investors. For instance, the ILS market saw substantial growth, with gross inflows reaching an estimated $16 billion in 2023, demonstrating a clear alternative for risk financing.

Companies increasingly establish their own captive insurance entities to underwrite their specific risks. This grants them enhanced control over policy terms, claims processing, and the investment returns generated from premiums, directly substituting the need for traditional external insurance providers. For instance, the captive insurance market saw significant growth, with premiums written by U.S. domiciled captives reaching approximately $60 billion in 2023, indicating a strong trend towards self-insuring.

The advent of protected cell captives further amplifies this threat. These structures allow businesses to effectively rent a captive cell, gaining the benefits of self-insurance without the substantial capital investment and administrative overhead of forming a standalone entity. This flexibility makes captive insurance a more accessible and attractive alternative for a wider range of companies, potentially diverting significant premium volume from the commercial insurance market.

Parametric Insurance Products

Parametric insurance products present a significant threat of substitutes for traditional insurance, particularly in managing catastrophe risks. These products offer payouts triggered by predefined events, such as specific wind speeds during a hurricane or earthquake magnitudes, rather than the traditional assessment of actual losses. This streamlined approach can lead to faster claim settlements.

The demand for parametric solutions is notably high for natural catastrophes and weather-related risks. For instance, the market for parametric insurance in natural catastrophe coverage has seen substantial growth, with deal volumes increasing significantly in recent years. In 2023, the global parametric insurance market was valued at approximately $12.5 billion and is projected to grow substantially, indicating a clear preference for these alternative risk transfer mechanisms among certain clients seeking efficiency and speed in payouts.

- Faster Payouts: Parametric insurance bypasses the often lengthy and complex loss adjustment process of traditional insurance.

- Simplified Claims: Payouts are triggered automatically when predefined event parameters are met, simplifying the claims experience.

- Growing Market Share: The increasing adoption of parametric solutions, especially for weather and catastrophe risks, signifies their growing competitive threat.

- Cost Efficiency: For certain risks, parametric policies can offer more cost-effective coverage compared to traditional indemnity-based policies due to reduced administrative overhead.

Enhanced Risk Management and Prevention

Businesses are increasingly investing heavily in advanced risk management and loss prevention technologies. For example, by mid-2024, many companies reported a 15-20% reduction in insurance premiums due to proactive risk mitigation strategies. This trend directly impacts insurers, as it lowers the demand for certain traditional insurance products, essentially acting as a substitute for coverage.

Insurers themselves are recognizing the critical role of risk management. By the end of 2023, major insurance providers like AXA and Allianz had significantly expanded their risk assessment and mitigation services, aiming to not only underwrite but also actively reduce the likelihood of claims. This shift means that insurers are becoming partners in prevention, further diminishing the need for some external insurance solutions.

- Proactive Risk Mitigation: Companies are adopting technologies to reduce their inherent risks.

- Reduced Insurance Dependence: Enhanced internal controls lessen the reliance on specific insurance policies.

- Insurer Adaptation: Insurers are integrating risk management services into their offerings.

- Substitute Solutions: Advanced risk management acts as a substitute for traditional insurance coverage.

The threat of substitutes for traditional insurance products is substantial, encompassing self-insurance, alternative risk transfer, and captive insurance. Companies with strong financial footing increasingly opt to retain risk, while sophisticated instruments like catastrophe bonds channel risk directly to capital markets. Captive insurance, including protected cell structures, offers greater control and cost-efficiency, directly competing with traditional insurers.

| Substitute Mechanism | Description | 2023/2024 Data Point |

|---|---|---|

| Self-Insurance/Risk Retention | Companies retaining their own risk, often through higher deductibles or internal programs. | Major corporations focus on protecting against multi-billion dollar risks, a segment challenging for traditional markets. |

| Alternative Risk Transfer (ART) | Instruments like catastrophe bonds and industry loss warranties that bypass traditional insurers. | ILS market gross inflows reached an estimated $16 billion in 2023, showing significant capital market participation. |

| Captive Insurance | Companies establishing their own insurance entities to underwrite specific risks. | U.S. domiciled captives wrote approximately $60 billion in premiums in 2023, highlighting a strong self-insurance trend. |

| Parametric Insurance | Products with payouts triggered by predefined event parameters, not actual losses. | Global parametric insurance market valued at ~$12.5 billion in 2023, with strong growth in natural catastrophe coverage. |

Entrants Threaten

Entering the specialty insurance and reinsurance sector, where Axis Capital Holdings operates, demands immense financial resources. New companies need significant capital to cover potential claims, comply with stringent regulatory solvency standards, and build market trust.

This high capital requirement acts as a formidable barrier. For context, global reinsurance capital reached $766 billion by mid-2024, highlighting the sheer scale of investment needed to compete effectively.

The insurance sector is a minefield of regulatory complexities, with licensing requirements that differ significantly across various countries and even states within them. This intricate web of rules creates a substantial barrier, demanding considerable time and resources for any new entrant to navigate successfully. For instance, the Digital Operational Resilience Act (DORA), which became applicable across the EU in January 2025, mandates robust internal governance frameworks for managing IT risk, adding another layer of compliance for financial institutions.

The specialty insurance and reinsurance sectors demand highly specialized expertise, particularly in underwriting, actuarial science, and complex claims handling. This need for deep, niche knowledge acts as a significant barrier to entry, as new players must invest heavily in acquiring and retaining talent with these specific skills. For instance, a report from the Insurance Information Institute in 2024 highlighted a persistent shortage of actuaries, a critical role in pricing and risk assessment.

Furthermore, the industry is grappling with a demographic shift, with an aging workforce and the potential loss of invaluable institutional knowledge. This exodus of experienced professionals, many of whom possess decades of insight into underwriting unique risks, creates a knowledge gap that is difficult and time-consuming for new entrants to bridge. In 2023, industry surveys indicated that over 40% of insurance professionals were aged 50 or older, underscoring the urgency of knowledge transfer and talent development.

Brand Reputation and Client Relationships

Established players like Axis Capital Holdings leverage decades of experience, fostering deep-rooted relationships with brokers and clients that are difficult for newcomers to replicate. This trust, built on a consistent track record of performance and reliability, creates a significant barrier.

New entrants face the daunting task of not only matching service quality but also overcoming ingrained brand loyalty and establishing their own credibility in a market that values proven stability. For instance, in the insurance sector, client retention rates often exceed 80% for established firms, making acquisition a costly endeavor for new players.

- Brand Reputation: Axis Capital's established name provides a significant advantage, reducing customer acquisition costs.

- Client Relationships: Long-term partnerships with brokers and clients are a key asset, fostering loyalty and repeat business.

- Integration Preference: Customers increasingly seek integrated coverage solutions, favoring incumbents with existing transaction platforms.

Technological Investment and Data Access

The substantial capital outlay for cutting-edge technology, including AI and advanced analytics platforms, presents a significant hurdle for potential new entrants in the insurance sector. For instance, insurers are channeling billions into digital transformation, with many reporting that technology investments represent a substantial portion of their operational budget. This high barrier to entry is amplified by the need for access to vast, high-quality datasets essential for accurate underwriting and risk modeling, which are difficult and costly for newcomers to procure.

Newcomers face the challenge of acquiring the necessary data infrastructure and analytical capabilities to compete. Established players are leveraging their existing data pools and investing heavily in AI to refine pricing and claims processing. By 2024, the global AI in insurance market was projected to reach tens of billions of dollars, underscoring the significant investment required to even approach parity.

- High Technology Investment: Significant capital is needed for advanced analytics, AI, and IT infrastructure.

- Data Access Challenges: Acquiring comprehensive, high-quality data for risk assessment is difficult for new firms.

- AI Adoption: Insurers are making substantial investments in AI to improve operational efficiency and competitiveness.

The threat of new entrants in the specialty insurance and reinsurance market, where Axis Capital Holdings operates, remains relatively low. This is primarily due to the substantial capital requirements, estimated in the hundreds of billions globally, and the highly specialized expertise needed in areas like underwriting and actuarial science. For example, the insurance industry faced a shortage of actuaries in 2024, making talent acquisition a significant hurdle for newcomers.

Navigating the intricate and varied regulatory landscapes across different jurisdictions further complicates entry, demanding significant time and resources. The increasing reliance on advanced technology and data analytics, with billions invested in digital transformation by established players, also presents a high barrier. For instance, the global AI in insurance market was projected to reach tens of billions by 2024, requiring substantial upfront investment.

| Barrier Type | Description | Impact on New Entrants | Supporting Data (2024/2025) |

|---|---|---|---|

| Capital Requirements | High initial investment needed for solvency, claims, and market trust. | Formidable barrier. | Global reinsurance capital reached $766 billion by mid-2024. |

| Regulatory Complexity | Navigating diverse licensing and compliance rules. | Time-consuming and resource-intensive. | DORA applicable in EU from January 2025 mandates robust IT risk frameworks. |

| Specialized Expertise | Need for deep knowledge in underwriting, actuarial science, and claims. | Difficult and costly to acquire talent. | Reported shortage of actuaries in 2024. |

| Technology & Data | Investment in AI, analytics, and access to quality data. | High upfront costs and data procurement challenges. | Global AI in insurance market projected in tens of billions by 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Axis Capital Holdings is built upon a foundation of comprehensive data, including annual reports, SEC filings, and industry-specific market research from reputable providers like AM Best and Fitch Ratings. This blend of financial disclosures and expert industry analysis ensures a robust understanding of competitive pressures.