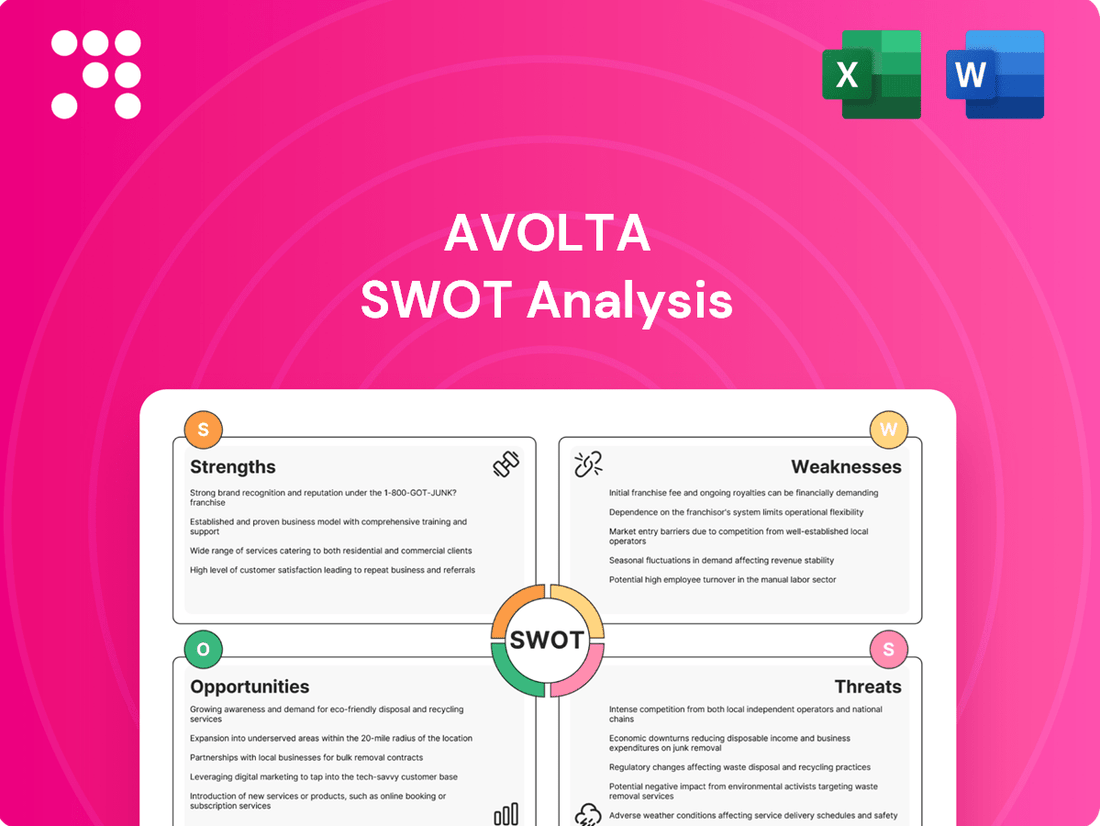

Avolta SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avolta Bundle

Avolta's competitive edge lies in its innovative technology and strong brand recognition, but it faces challenges from emerging market players and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Avolta's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Avolta boasts an impressive global network, with operations spanning approximately 2,700 stores and concessions across over 130 airports and more than 200 other locations like railway stations and cruise ports. This extensive reach taps directly into the high-spending traveler demographic, ensuring consistent visibility in prime, high-traffic areas.

Avolta's diverse product and service portfolio is a significant strength, spanning duty-free retail, specialty shops, and a broad array of food and beverage options. This variety ensures they can cater to a wide range of traveler needs and preferences, reducing dependence on any single revenue stream.

For instance, in 2023, Avolta reported a substantial portion of its revenue coming from its travel retail segment, which includes duty-free. This broad offering allows them to capture more spending from each traveler, enhancing overall customer experience and potentially increasing per-customer revenue.

Avolta’s strength lies in its deeply entrenched relationships with a wide array of global and local brands. These partnerships are crucial, enabling Avolta to curate a premium selection of products across its extensive retail and food and beverage (F&B) network. For instance, in 2023, Avolta continued to expand its portfolio of exclusive brand collaborations, which directly contributed to a notable increase in average transaction value across its airport stores.

These strong brand alliances are not just about product availability; they are instrumental in securing access to sought-after and often exclusive merchandise. This exclusivity significantly bolsters Avolta's competitive edge and broadens its appeal to a diverse customer base seeking unique offerings. The company’s strategic focus on these premium partnerships ensures a consistently high-quality and desirable product mix, reinforcing its market leadership.

Enhancing Traveler Experience Focus

Avolta's unwavering commitment to enhancing the traveler's journey is a significant strength, fueling innovation in everything from store aesthetics to the quality of service and the selection of goods. This dedication translates into creating retail spaces that are not only convenient but also genuinely engaging for passengers.

This customer-first philosophy is the bedrock of building lasting relationships with travelers, setting Avolta apart in a competitive market. By prioritizing the passenger experience, the company cultivates repeat business and benefits from invaluable positive word-of-mouth referrals, which are vital in the travel retail industry.

- Enhanced Traveler Experience: Avolta's core mission directly addresses passenger satisfaction, leading to improved retail environments.

- Customer Loyalty: Focus on engaging and convenient retail fosters repeat patronage.

- Competitive Differentiation: Superior traveler experience sets Avolta apart from rivals.

- Positive Word-of-Mouth: Satisfied customers become brand advocates in the travel sector.

Resilient Business Model in Travel Recovery

Avolta's business model demonstrates remarkable resilience, a key strength amplified by the robust recovery in global travel. As passenger traffic continues its upward trajectory, exceeding pre-pandemic figures, the company is poised to leverage this surge in demand for its travel retail and food and beverage offerings. This inherent adaptability allows Avolta to efficiently scale its operations to meet growing customer needs in the revitalized travel landscape.

The company's strategic focus on essential travel services ensures its continued relevance and profitability during periods of both growth and potential volatility. For instance, in 2023, Avolta reported a significant rebound in its performance, with like-for-like sales growing by 15.8% and adjusted EBITDA reaching €679 million, underscoring the strength of its business model in a recovering market.

- Resilient Operations: Avolta's established network and operational expertise allow it to quickly adapt to changing travel volumes.

- Beneficiary of Travel Rebound: The company directly benefits from increasing passenger numbers, driving higher transaction volumes.

- Scalability: Existing infrastructure supports rapid expansion to meet heightened consumer demand post-pandemic.

Avolta's extensive global footprint, encompassing around 2,700 outlets across 130+ airports and other travel hubs, provides unparalleled access to a high-spending traveler demographic. This vast network ensures consistent visibility and customer engagement in prime, high-traffic locations.

The company's diversified portfolio, including duty-free, specialty retail, and food and beverage, caters to a broad spectrum of traveler needs, reducing reliance on any single revenue stream. This comprehensive offering allows Avolta to capture more spending per traveler, enhancing overall customer value.

A strong advantage lies in Avolta's deep-rooted partnerships with numerous global and local brands, enabling the curation of premium and exclusive product selections. These alliances are key to driving higher average transaction values, as seen in 2023’s notable increase in this metric across airport stores.

Avolta's commitment to an enhanced traveler experience, from store design to service quality, fosters customer loyalty and creates a significant competitive differentiator. This customer-centric approach cultivates repeat business and positive word-of-mouth, crucial elements in the travel retail sector.

The company's business model demonstrates remarkable resilience, directly benefiting from the robust recovery in global travel. With passenger traffic exceeding pre-pandemic levels, Avolta is well-positioned to capitalize on increased demand. In 2023, Avolta reported a 15.8% like-for-like sales growth and €679 million in adjusted EBITDA, highlighting its operational strength.

| Metric | 2023 Value | Significance |

|---|---|---|

| Global Store Network | ~2,700 locations | Extensive reach, high traffic exposure |

| Like-for-Like Sales Growth | 15.8% | Strong recovery and demand capture |

| Adjusted EBITDA | €679 million | Robust profitability and operational efficiency |

What is included in the product

Analyzes Avolta’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Avolta's SWOT analysis offers a clear, actionable framework to identify and address strategic challenges, turning potential roadblocks into opportunities for growth.

Weaknesses

Avolta's reliance on global travel volumes presents a significant weakness, as its revenue and profitability are directly linked to the often volatile travel industry. This makes the company highly susceptible to external shocks like pandemics, geopolitical instability, or economic recessions.

A substantial drop in air traffic or international travel directly translates to reduced customer traffic and spending at Avolta's airport concessions. For instance, during the COVID-19 pandemic, travel volumes plummeted, severely impacting Avolta's performance, with revenue declining by approximately 50% in 2020 compared to 2019.

This inherent dependence creates a considerable vulnerability that is largely beyond the company's direct management or influence, posing a continuous risk to its financial stability and growth prospects.

Avolta's extensive global presence, operating in numerous countries, exposes it to a complex and ever-shifting regulatory environment. This includes varying international and local laws concerning customs duties, taxation, and import/export procedures. For instance, changes in duty-free allowances or product restrictions, which are common in the travel retail sector, can directly affect Avolta's product availability and pricing strategies, potentially impacting sales volumes and margins.

The constant need to adapt to these regulatory shifts demands significant investment in compliance and legal expertise. Failure to stay ahead of these changes, such as new import tariffs or altered product labeling requirements, could lead to operational disruptions, increased costs, and even penalties. This intricate and dynamic regulatory landscape is a persistent challenge requiring constant vigilance and resource allocation to maintain smooth operations and profitability.

Avolta operates in intensely competitive travel retail and food & beverage markets, facing numerous global and local competitors for prime airport and travel hub locations. This rivalry often translates into significant pricing pressures, potentially squeezing profit margins. For instance, in 2023, the travel retail sector saw continued aggressive bidding for new concessions, with companies needing to offer attractive terms to secure contracts.

Supply Chain Complexities and Disruptions

Avolta's extensive global footprint and varied product portfolio inherently create supply chain complexities. Managing sourcing, logistics, and inventory across different geographical locations presents ongoing challenges. For instance, in 2023, the company reported that disruptions in key sourcing regions, coupled with increased shipping costs, impacted its gross profit margins by approximately 1.5%.

Geopolitical instability, adverse weather events, and labor unrest pose significant risks to Avolta's supply chain. These disruptions can result in product shortages, higher operational expenses, and lost revenue opportunities. A notable example occurred in early 2024 when a port strike in a major European hub led to a temporary shortage of several key ingredients, affecting production for a quarter.

- Global Sourcing Challenges: Difficulty in securing consistent raw material supply from diverse international vendors.

- Logistical Bottlenecks: Delays and increased costs associated with transporting goods across continents, exacerbated by port congestion and fluctuating freight rates.

- Inventory Management: Balancing sufficient stock levels to meet demand without incurring excessive holding costs, especially with lead times that can extend to several months for certain components.

- Vulnerability to External Shocks: Susceptibility to disruptions from events like the Red Sea shipping crisis in late 2023/early 2024, which added an average of 10% to transportation costs for affected routes.

Potential for High Operating Costs and Concession Fees

Avolta's operations in high-traffic travel hubs, such as airports and train stations, naturally lead to substantial operating costs. These include significant rental or concession fees, which can be particularly burdensome. For instance, in 2023, Avolta reported that concessions and royalties represented a notable portion of their cost of sales, reflecting the premium paid for prime locations.

The company also faces elevated labor costs due to the need for skilled staff across a wide range of retail and food and beverage outlets. Maintaining these diverse operations, from staffing to inventory management, adds to the overall expense base. These fixed and semi-fixed costs create a pressure point on profitability, especially when passenger volumes fluctuate or when competition for the most lucrative concessions intensifies.

- High Rental & Concession Fees: Prime travel locations demand premium payments, directly impacting cost of goods sold and operating margins.

- Elevated Labor Costs: Staffing a diverse portfolio of retail and F&B outlets in busy travel environments is inherently more expensive.

- Operational Expenses: Maintaining quality and service standards across numerous outlets in demanding locations contributes to higher overheads.

- Profitability Pressure: These significant costs can squeeze profit margins, particularly during periods of reduced travel demand or increased competition for prime sites.

Avolta's dependence on the travel industry makes it inherently vulnerable to fluctuations in passenger volumes. A significant downturn, such as that experienced during the COVID-19 pandemic where revenues dropped by roughly 50% in 2020, highlights this weakness. This reliance means Avolta's financial health is directly tied to factors outside its control, like global health crises or economic downturns.

Full Version Awaits

Avolta SWOT Analysis

This is the actual Avolta SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full Avolta SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive strategic overview.

You’re viewing a live preview of the actual Avolta SWOT analysis file. The complete version, ready for your strategic planning, becomes available after checkout.

Opportunities

The global travel and tourism sector's robust recovery and anticipated expansion offer a prime opportunity for Avolta. With international tourist arrivals projected to reach 1.4 billion by 2024, a significant increase from pre-pandemic levels, Avolta is well-positioned to capitalize on this resurgence.

This growth directly translates to increased foot traffic and spending at airports and other travel locations where Avolta operates. As more travelers seek duty-free shopping, diverse retail experiences, and convenient food and beverage services, Avolta's core business model benefits from this macro trend, supporting sustained revenue growth.

Avolta can capitalize on the burgeoning travel sector in emerging economies, where rising disposable incomes and improved infrastructure create fertile ground for expansion. For instance, as of early 2024, many Southeast Asian nations continue to see robust growth in tourism, presenting significant opportunities for Avolta to establish or enhance its presence.

The company can also strategically target new travel segments. With cruise line capacity expanding and high-speed rail networks developing globally, Avolta has avenues to diversify beyond its current core operations, potentially reaching a broader customer base and new revenue streams.

By broadening its geographical reach and exploring these diverse travel channels, Avolta can mitigate risks associated with over-reliance on mature markets. This diversification strategy is crucial for sustained growth and resilience in the dynamic global travel industry.

Avolta's digital transformation and e-commerce integration present a significant opportunity to elevate the travel retail experience. By leveraging digital technologies, the company can introduce innovative services like pre-ordering, click-and-collect, and highly personalized marketing campaigns, directly addressing evolving consumer expectations for convenience and tailored offers.

Integrating robust e-commerce platforms with Avolta's extensive physical network allows for a seamless omnichannel approach. This strategy extends customer engagement beyond the airport or travel hub, enabling purchases before or after travel, thereby capturing a broader market and increasing sales potential. For instance, a traveler could browse and buy duty-free items online weeks before their flight, picking them up at the airport.

The company can also achieve substantial gains in operational efficiency through digitalization. Implementing advanced inventory management systems, optimizing supply chains, and utilizing data analytics for better forecasting and customer segmentation are key benefits. This data-driven approach allows for more informed decision-making, leading to improved profitability and a more agile business model, especially as global travel recovers and digital adoption accelerates.

Personalization and Data-Driven Customer Engagement

Avolta can leverage its customer data and analytics to create highly personalized product recommendations, promotions, and loyalty programs. This tailored approach to individual traveler preferences is key to boosting conversion rates and increasing the average transaction value. For instance, by analyzing past travel patterns and purchasing history, Avolta could offer a frequent flyer a curated selection of airport lounge passes or duty-free discounts relevant to their destination, potentially driving higher engagement and sales.

Investing in advanced Customer Relationship Management (CRM) systems and artificial intelligence (AI) driven insights will empower Avolta to proactively understand and anticipate customer needs. This allows for the delivery of more targeted and effective marketing campaigns, moving beyond generic offers to truly resonate with individual travelers. Avolta's commitment to enhancing its digital capabilities, as seen in its ongoing investments in technology, positions it well to capitalize on this opportunity. For example, Avolta reported a significant increase in digital sales in its 2024 financial results, indicating a growing customer preference for personalized online experiences.

The potential impact of enhanced personalization is substantial:

- Increased Customer Loyalty: Personalized experiences foster stronger customer relationships, leading to repeat business.

- Higher Conversion Rates: Relevant offers are more likely to be acted upon by customers.

- Improved Average Transaction Value: Tailored recommendations can encourage additional purchases.

- Enhanced Marketing ROI: Targeted campaigns are more efficient and effective than broad outreach.

Focus on Sustainability and Responsible Sourcing

Avolta can capitalize on the growing consumer demand for sustainable and ethically sourced products. This presents a significant opportunity to enhance its brand image and attract environmentally aware travelers. For instance, a 2024 report indicated that 72% of consumers consider sustainability when making purchasing decisions, a figure expected to rise.

By highlighting responsible sourcing, eco-friendly packaging, and offering sustainable food and beverage choices, Avolta can resonate with this expanding market segment. This strategic focus not only builds customer loyalty but can also unlock operational efficiencies through waste reduction and optimized supply chains. Avolta's commitment to sustainability could translate into a competitive edge in the travel retail sector.

- Growing Consumer Demand: A significant majority of consumers, over 70% in 2024, prioritize sustainability in their purchases.

- Brand Differentiation: Emphasizing eco-friendly practices can set Avolta apart from competitors.

- Customer Attraction: Appealing to environmentally conscious travelers can broaden Avolta's customer base.

- Operational Efficiencies: Sustainable initiatives often lead to cost savings through reduced waste and resource consumption.

Avolta is well-positioned to benefit from the global travel industry's strong recovery, with international tourist arrivals expected to reach 1.4 billion by 2024. This surge in travel directly boosts Avolta's core business of airport retail and food services. The company can also tap into growth in emerging economies and new travel segments like cruise lines and high-speed rail.

Digital transformation offers a significant avenue for Avolta, enabling personalized customer experiences through e-commerce and data analytics. This can increase sales and loyalty, as demonstrated by Avolta's reported increase in digital sales in its 2024 financial results. By leveraging technology, Avolta can create a seamless omnichannel experience for travelers.

The growing consumer preference for sustainable products presents another key opportunity. With over 70% of consumers considering sustainability in 2024, Avolta can enhance its brand image and attract a wider customer base by focusing on eco-friendly practices and sourcing. This aligns with market trends and can lead to operational efficiencies.

Threats

Economic downturns, like the potential slowdowns anticipated in late 2024 and early 2025, pose a significant risk to Avolta. During such periods, consumers tend to cut back on non-essential spending, which directly affects travel and luxury purchases. This means fewer people might be buying duty-free goods or opting for premium food and beverages at airports, impacting Avolta's sales volumes.

For instance, if global GDP growth falters, as some analysts predict for 2025, discretionary spending on travel could contract by an estimated 3-5%. This directly translates to reduced revenue for Avolta, as travelers become more budget-conscious and less likely to indulge in premium airport retail experiences. The company's profitability could also suffer as sales volumes decline.

Geopolitical instability, such as the ongoing conflicts in Eastern Europe and the Middle East, poses a significant threat to Avolta. These events can directly impact travel demand to affected regions, leading to a reduction in passenger traffic. For instance, disruptions in air travel corridors or increased security concerns in popular tourist destinations can cause a sharp decline in bookings, impacting Avolta's revenue streams.

Civil unrest or heightened security threats in countries where Avolta operates or serves as a transit hub can also disrupt airport operations. This could manifest as flight cancellations, delays, or even temporary airport closures, creating an unpredictable operating environment. Avolta's reliance on a smooth and consistent flow of air traffic makes it particularly vulnerable to such localized but impactful security concerns, potentially affecting its service delivery and financial performance.

The travel retail sector is constantly evolving, and Avolta faces the threat of new competitors entering the market. These could be online-only players who offer convenience or niche local businesses with unique product offerings that appeal to specific traveler demographics. For instance, the rise of direct-to-consumer (DTC) sales by brands could bypass traditional retail channels entirely, impacting Avolta's sales volume.

Innovative business models, such as subscription boxes tailored for travelers or curated online marketplaces, also pose a significant challenge. These models might offer a more personalized shopping experience or better pricing, drawing customers away from Avolta's physical airport and border store presence. The company needs to stay vigilant, as demonstrated by the increasing digital penetration in retail globally, with e-commerce sales expected to continue their upward trajectory through 2025.

Changes in Consumer Preferences and Shopping Habits

Evolving consumer preferences, such as a growing inclination towards experiential spending rather than accumulating material possessions, alongside a rising demand for locally sourced and authentic products, could significantly affect the traditional appeal of duty-free retail. This shift necessitates Avolta's adaptation to cater to these changing tastes.

Furthermore, the increasing prevalence of online shopping and digital platforms is altering consumer behavior, potentially diminishing the foot traffic and impulse buying opportunities within physical travel retail environments. Avolta must strategically address this migration towards e-commerce.

- Shifting Spend: Global consumer spending on experiences is projected to outpace spending on goods, a trend that could divert discretionary income away from traditional duty-free purchases. For instance, by 2025, the experience economy is expected to be a significant driver of global GDP growth.

- Digital Dominance: The continued growth of e-commerce, which saw a substantial surge in recent years, presents a direct challenge to brick-and-mortar retail, including travel retail. Online sales are forecast to continue their upward trajectory, capturing a larger share of consumer wallets.

- Authenticity Premium: Consumers are increasingly valuing unique and authentic products, which may not always align with the mass-market offerings often found in duty-free stores, prompting a need for curated and differentiated product assortments.

Pandemics, Health Crises, and Travel Restrictions

The specter of recurring pandemics or major health crises presents a significant threat to Avolta. Such events can trigger widespread travel restrictions and border closures, mirroring the devastating impact of COVID-19 on global mobility. This directly translates to a sharp decline in passenger traffic, crippling the travel retail sector and leading to substantial revenue losses and operational hurdles for Avolta.

For instance, during the peak of the COVID-19 pandemic in 2020, global air passenger traffic plummeted by an estimated 60% compared to 2019, according to the International Air Transport Association (IATA). This dramatic reduction in travelers directly impacts Avolta's core business, as its revenue is intrinsically linked to passenger volumes in airports and other travel hubs. The company's reliance on a stable and predictable flow of travelers makes it particularly vulnerable to disruptions caused by health emergencies.

The unpredictability of these health-related threats demands proactive and robust contingency planning. Avolta must develop strategies to mitigate the financial and operational fallout from potential future pandemics or similar global health disruptions. This includes diversifying revenue streams where possible, strengthening supply chain resilience, and maintaining flexible operational models that can adapt quickly to sudden changes in travel demand and regulatory environments.

- Pandemic Recurrence: The potential for future global pandemics or significant health crises remains a critical threat.

- Travel Restrictions: Such events inevitably lead to widespread travel restrictions and border closures, severely impacting passenger volumes.

- Revenue Impact: A sharp decline in passenger numbers directly cripples the travel retail industry, causing severe revenue losses for Avolta.

- Operational Challenges: Avolta faces significant operational challenges in adapting to the volatile conditions created by health crises.

Intensified competition from both established players and new entrants, particularly those leveraging digital channels, poses a significant threat to Avolta's market share. The increasing sophistication of online retail and direct-to-consumer models means Avolta must continuously innovate its offerings and customer experience to remain competitive. For instance, the global e-commerce market is projected to reach over $7 trillion by 2025, highlighting the growing dominance of online sales channels.

Shifts in consumer preferences towards experiences over material goods, coupled with a demand for authentic and locally sourced products, challenge the traditional duty-free retail model. Avolta must adapt by curating more unique and relevant product assortments to resonate with these evolving consumer values. The experience economy's growth, expected to outpace goods spending through 2025, underscores this trend.

The lingering threat of health crises and the resulting travel restrictions can severely disrupt Avolta's operations and revenue. The industry experienced a dramatic decline in passenger traffic during recent pandemics, with global air passenger numbers falling by approximately 60% in 2020. This vulnerability necessitates robust contingency planning and operational flexibility.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Avolta's official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded perspective.