Avolta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avolta Bundle

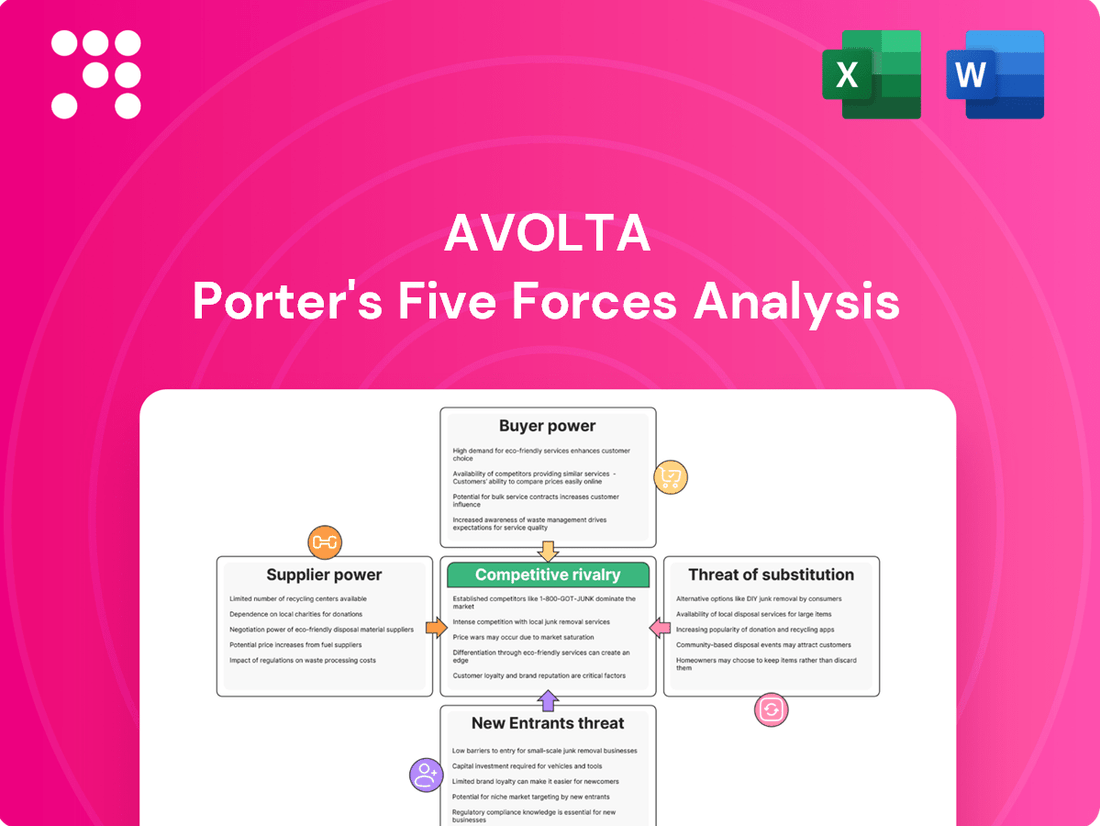

Our Avolta Porter's Five Forces analysis highlights the intense rivalry and significant buyer power within its market. Understanding these core dynamics is crucial for navigating Avolta's competitive landscape. The complete report reveals the real forces shaping Avolta’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Airport authorities and landlords possess substantial bargaining power over Avolta. Their control over limited, high-demand retail and food and beverage spaces within travel hubs makes them critical suppliers. Avolta's dependence on securing and renewing concession agreements underscores this supplier leverage.

Avolta partners with a wide array of global brands, from luxury goods to everyday consumer products, for its duty-free, specialty retail, and food and beverage operations. This broad product offering is a key strategy to manage supplier influence.

While Avolta's significant scale as the world's largest travel retailer offers some negotiation strength, major global brands, particularly in the luxury sector, can still wield considerable power. They can impact pricing, dictate product availability, and set marketing conditions, potentially affecting Avolta's margins and product mix.

For instance, in 2023, the global luxury goods market reached an estimated €362 billion, highlighting the substantial market presence and pricing power of many brands Avolta collaborates with. This underscores the need for Avolta to maintain strong relationships and strategic sourcing to balance this supplier leverage.

Avolta's extensive food and beverage operations, particularly through its HMSHost division, depend on a wide array of suppliers for food, beverages, and ingredients. While many of these are commodity suppliers with limited individual power, specialized or local suppliers offering unique culinary items can exert more influence. For instance, Avolta's strategy of integrating local flavors, as demonstrated at airports like DFW and San Antonio, necessitates building relationships with these niche suppliers, potentially increasing their bargaining leverage.

Technology and Service Providers

Avolta's increasing reliance on technology providers for its digital transformation, including self-order kiosks and the Club Avolta loyalty program, grants these specialized firms a moderate level of bargaining power. This is particularly true for those offering unique or proprietary software and hardware solutions critical to Avolta's strategy of data-driven decisions and enhanced customer experience.

The bargaining power of these technology and service providers is influenced by factors such as the uniqueness of their offerings and the switching costs for Avolta. For instance, if Avolta's core operational software is highly customized or deeply integrated, changing providers could be complex and costly, thereby strengthening the supplier's position.

- Technology Integration: Avolta's investment in digital ordering and loyalty platforms increases dependence on specialized tech suppliers.

- Proprietary Solutions: Providers with unique or patented technology can command stronger negotiating positions.

- Switching Costs: The complexity and expense of migrating integrated systems can enhance supplier leverage.

Labor Force

The bargaining power of suppliers, particularly concerning the labor force, is a significant consideration for Avolta. The availability and cost of skilled labor within the global travel retail and food and beverage industries directly impact Avolta's operational expenses and overall efficiency. With a workforce of approximately 76,000 individuals spread across 73 countries, Avolta benefits from a diversified labor pool, which can mitigate the impact of localized labor market conditions. However, specific regional labor regulations, unionization efforts, and the demand for specialized skills can still grant employees a degree of bargaining power, influencing wage negotiations and employment terms.

In 2024, the travel retail and hospitality sectors continued to face challenges in attracting and retaining talent, particularly in key operational roles. This tight labor market can increase wage pressures. For instance, reports from various regions in early 2024 indicated average wage increases in the hospitality sector ranging from 3% to 6% year-over-year, depending on the country and skill level. Avolta's ability to effectively manage its extensive workforce, implement competitive compensation and benefits strategies, and foster employee engagement is therefore critical for maintaining operational stability and profitability.

- Global Labor Market Dynamics: Avolta's 76,000 employees operate in diverse international markets, each with unique labor supply and demand characteristics.

- Skilled Labor Scarcity: The travel retail and F&B sectors often require specialized skills, and shortages of qualified personnel can elevate labor costs.

- Unionization and Local Regulations: In certain operating countries, strong labor unions or specific employment laws can enhance employee bargaining power, impacting Avolta's labor costs and operational flexibility.

- Wage Inflation: As of mid-2024, many economies experienced persistent wage inflation, particularly in service-oriented industries, directly affecting Avolta's personnel expenses.

Airport authorities and landlords hold significant sway over Avolta due to their control over prime retail locations. This leverage is amplified by the high demand for these spaces within travel hubs, making concession agreements crucial for Avolta's operations. Major global brands, especially in luxury, also possess considerable power, influencing pricing and product availability, which can impact Avolta's profitability.

Avolta's extensive food and beverage operations, managed by its HMSHost division, rely on a diverse supplier base. While many are commodity providers, specialized or local suppliers offering unique products can exert more influence, particularly as Avolta integrates local culinary elements into its offerings.

The bargaining power of technology providers is increasing as Avolta invests in digital transformation. Unique software and hardware solutions critical to Avolta's strategy can give these firms leverage, especially when switching costs are high.

Labor is another key supplier group where Avolta faces bargaining power. Skilled labor shortages in the travel retail and food and beverage sectors, coupled with wage inflation observed in 2024, can increase operational expenses for Avolta.

| Supplier Type | Nature of Bargaining Power | Impact on Avolta | 2024 Context/Data |

|---|---|---|---|

| Airport Authorities/Landlords | Control over limited, high-demand locations | Critical for operational presence, renewal leverage | High demand for airport retail space remains constant. |

| Major Global Brands (e.g., Luxury) | Brand strength, pricing power, product exclusivity | Influence on margins, product mix, and marketing terms | Global luxury goods market valued at €362 billion in 2023, indicating strong brand leverage. |

| Specialized/Local F&B Suppliers | Unique product offerings, local market knowledge | Enhances culinary differentiation, potential for higher costs | Avolta's focus on local flavors increases reliance on these suppliers. |

| Technology Providers (Digital Transformation) | Proprietary solutions, high switching costs | Impacts operational efficiency, customer experience, and integration costs | Digitalization efforts increase dependence on specialized tech firms. |

| Labor Force | Skill availability, unionization, local regulations | Affects operational costs, efficiency, and labor relations | 2024 saw wage increases in hospitality sectors (3-6% YoY in some regions) due to talent shortages. |

What is included in the product

Avolta Porter's Five Forces analysis provides a comprehensive understanding of the competitive intensity and attractiveness of the travel retail market, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and quantify competitive threats, allowing for proactive strategy adjustments and reduced market uncertainty.

Customers Bargaining Power

Travelers within airports and similar transit points often face a limited selection of vendors, significantly diminishing their bargaining power. This captive audience dynamic means that choices are constrained, making them more amenable to prevailing prices.

The sheer convenience of acquiring items like duty-free goods, unique souvenirs, or quick food and beverages during travel frequently overrides concerns about price for a substantial portion of passengers. For instance, in 2024, global airport retail sales are projected to reach over $50 billion, indicating a strong demand driven by convenience.

This situation allows companies like Avolta to sustain specific pricing structures. While competitive pricing remains a consideration, the inherent convenience factor in these travel hubs provides a degree of pricing flexibility.

Avolta's strategic focus on enhancing customer loyalty through programs like Club Avolta, launched globally in late 2024, directly addresses the bargaining power of customers. By offering exclusive pricing and tailored experiences, Avolta aims to foster repeat business and deepen customer relationships. This approach is designed to reduce price sensitivity and increase switching costs, thereby mitigating customer leverage.

While passenger traffic has rebounded robustly, a key observation in the travel industry is that spend per passenger has sometimes lagged. This suggests a degree of price sensitivity among travelers or a reallocation of their spending priorities. For instance, in 2024, many airlines reported load factors exceeding 80%, yet ancillary revenue per passenger growth was more modest in certain segments.

Avolta is strategically addressing this by focusing on enriching the overall traveler experience. By introducing localized Food & Beverage concepts and curated experiential retail offerings, the company aims to directly influence and increase the spend per passenger, thereby mitigating some of the customer bargaining power.

Digital Integration and Information Access

Customers today are highly connected, able to research prices and product details online, even when on the go. Avolta's investment in digital solutions, such as self-order kiosks and digital menus, plus its loyalty program, directly addresses these evolving customer needs. This increased digital access empowers customers by allowing them to make more informed choices, potentially shifting the balance of power.

The digital integration within Avolta's operations, including its loyalty app which had millions of active users by early 2024, enhances customer engagement. This digital presence, however, also amplifies the bargaining power of customers. They can easily compare Avolta's offerings with competitors, especially when traveling, and leverage information to seek better value or personalized deals.

- Digital Savvy Customers: Consumers increasingly use mobile devices for price comparisons and product research, even during travel.

- Avolta's Digital Strategy: The company utilizes self-order kiosks, digital menu boards, and a loyalty app to meet these expectations.

- Information Transparency: Increased access to information online can empower customers, leading to more discerning purchasing decisions.

- Impact on Bargaining Power: This transparency can subtly increase customer leverage by facilitating easier comparison shopping and demand for value.

Product Diversification and Experience

Avolta's broad array of products and services, spanning duty-free, specialty retail, and food and beverage, effectively caters to a diverse traveler base. This extensive offering allows Avolta to present a holistic travel experience, aiming to meet a wide spectrum of customer needs and preferences.

By consolidating various retail and dining options, Avolta seeks to enhance customer satisfaction and loyalty. This strategy can diminish the bargaining power of customers by making it less necessary for them to seek out alternative providers for different travel-related needs.

- Diversified Offerings: Avolta's portfolio includes duty-free, specialty retail, and F&B, providing a one-stop shop for travelers.

- Enhanced Customer Experience: The company focuses on creating a comprehensive travel experience to meet varied demands.

- Reduced Reliance on Alternatives: By satisfying multiple needs, Avolta aims to lessen customer inclination to shop elsewhere.

While travelers in transit often have limited choices, increasing digital connectivity empowers them to compare prices and research products. Avolta's digital investments, like its loyalty app with millions of users by early 2024, enhance engagement but also amplify customer bargaining power by facilitating easier comparison shopping.

| Factor | Impact on Customer Bargaining Power | Avolta's Response |

|---|---|---|

| Digital Connectivity | High - Enables easy price comparison and research. | Loyalty app, self-order kiosks, digital menus. |

| Information Transparency | Moderate - Empowers informed decision-making. | Consistent product information across channels. |

| Diversified Offerings | Low - Reduces need to seek alternatives. | Integrated duty-free, retail, and F&B. |

What You See Is What You Get

Avolta Porter's Five Forces Analysis

The preview you see is the exact, professionally crafted Avolta Porter's Five Forces Analysis you will receive immediately after purchase. This comprehensive document details the competitive landscape, outlining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Avolta's industry. You can trust that what you preview is precisely what you'll download, ready for your strategic planning needs.

Rivalry Among Competitors

Avolta's position as the number one global travel retailer, a title it reclaimed in 2023 based on turnover, significantly intensifies competitive rivalry. This leadership, particularly in the travel food and beverage (F&B) sector, means rivals are constantly striving to match or surpass its scale and offerings.

The company’s extensive reach across airports, railway stations, cruise ports, and motorways further amplifies the competitive pressure. Competitors must invest heavily to build comparable networks and operational efficiencies to challenge Avolta's established presence and customer loyalty.

The travel retail and food and beverage sector is a battlefield of giants, with Avolta facing formidable rivals. Key global competitors like China Duty Free Group, Lagardère Travel Retail, Lotte Duty Free, DFS Group, SSP Group, and Areas are locked in a fierce struggle for dominance. These companies are not standing still; they are continuously innovating and aggressively expanding their presence across airports and other travel hubs worldwide, intensifying the competition for lucrative concession agreements and valuable market share.

Avolta's strategic diversification into food and beverage (F&B) alongside traditional duty-free, coupled with the creation of hybrid retail and dining spaces, directly addresses competitive rivalry by offering a more integrated traveler experience. This strategy aims to capture a larger share of traveler spending by providing convenience and variety, thereby reducing the incentive for customers to seek out separate F&B providers within airports.

This integrated model fosters cross-selling opportunities, where travelers purchasing duty-free items may be more inclined to patronize Avolta's dining outlets, and vice-versa. For instance, by 2024, Avolta reported a significant presence in F&B, aiming to leverage these synergies to enhance customer loyalty and increase average transaction values, directly competing with standalone food operators and other travel retailers.

Concession Agreement Competition

Competition for valuable concession agreements at major travel hubs is intense. Avolta's strategic wins, such as securing long-term contracts at New York JFK, Dallas Fort Worth, and San Antonio airports, highlight its capability in this demanding market. The acquisition of the Free Duty concession in Hong Kong further solidifies its position.

Avolta's strong performance is evidenced by its ability to secure and maintain these lucrative agreements. The company's high contract renewal rates, exceeding 90% in recent years, demonstrate robust relationships with airport authorities and landlords. This success is a testament to their operational excellence and value proposition.

- Secured Key Airport Concessions: Avolta holds significant contracts at major international airports including New York JFK and Dallas Fort Worth.

- Strategic Acquisitions: The acquisition of the Free Duty concession in Hong Kong expanded Avolta's global footprint.

- High Contract Renewal Rate: Avolta consistently achieves renewal rates above 90% for its existing concession agreements.

- Competitive Landscape: The bidding process for prime airport retail and food service locations is highly competitive, involving global players.

Technological and Experiential Innovation

Competitive rivalry in the travel retail sector is intensifying, driven by significant investments in technological and experiential innovation. Companies are pouring resources into digital integration, personalization, and unique retail concepts to differentiate themselves. For instance, in 2023, the global travel retail market saw substantial growth, with technology playing a crucial role in enhancing customer journeys and operational efficiency.

Avolta is strategically positioning itself within this landscape by emphasizing its Club Avolta loyalty program, leveraging AI-powered data analysis for personalized offers, and developing localized Food & Beverage (F&B) experiences. These initiatives are designed to build a strong competitive moat, making it challenging for rivals to easily replicate Avolta's customer-centric approach and unique value proposition.

- Technological Investment: Travel retailers are boosting spending on digital platforms and data analytics to improve customer engagement and operational efficiency.

- Experiential Focus: The emphasis is shifting towards creating memorable in-store and online experiences, including personalized recommendations and unique retail formats.

- Avolta's Strategy: Club Avolta, AI-driven insights, and localized F&B are key components of Avolta's plan to create a defensible competitive advantage.

The travel retail and food and beverage sectors are characterized by intense competition, with Avolta facing numerous global players like China Duty Free Group and SSP Group. These competitors are actively expanding and innovating, particularly in key travel hubs, making it a constant challenge to maintain market leadership. The battle for prime locations and customer spending is fierce, requiring significant investment in networks and operational efficiency to compete effectively.

Avolta's strategy of integrating duty-free with food and beverage offerings creates a more comprehensive traveler experience, aiming to capture a larger share of customer expenditure. This hybrid model fosters cross-selling opportunities, enhancing customer loyalty and increasing average transaction values. By 2024, Avolta's significant presence in F&B was crucial in leveraging these synergies against competitors.

| Competitor | Primary Focus | Geographic Strength |

|---|---|---|

| China Duty Free Group | Duty-Free Retail | Asia-Pacific |

| Lagardère Travel Retail | Travel Retail (News & Gifts, F&B, Duty-Free) | Global |

| SSP Group | Food & Beverage | Global |

| Areas | Food & Beverage, Retail | Europe, North America |

SSubstitutes Threaten

The burgeoning online retail sector presents a significant threat of substitutes for Avolta's travel retail operations, particularly for non-essential, non-perishable items. While the allure of duty-free pricing and instant purchase at the airport remains, consumers increasingly leverage e-commerce platforms for convenience and competitive pricing, even if duty-free benefits aren't fully replicated. For instance, the global e-commerce market was valued at approximately $5.7 trillion in 2023 and is projected to continue its robust growth, offering a readily accessible alternative for many product categories typically sold in travel retail environments.

Travelers can often find similar goods, especially non-specialty items and food and beverage options, at downtown retail stores or local markets. This is a significant threat as these alternatives offer competitive pricing and accessibility outside of travel times. For instance, a 2024 report indicated that general merchandise sales in urban retail districts grew by 4.5%, highlighting the strong competition.

However, the unique convenience of purchasing items directly within travel hubs, coupled with exclusive product assortments not readily available elsewhere, helps mitigate this threat for travel retail. The ability to buy duty-free items also presents a distinct advantage, though its impact varies by product category and destination regulations.

The threat of travelers bringing their own food and beverages is a notable substitute for Avolta's food and beverage segment. This is particularly true for shorter journeys or when budget is a primary concern. For instance, a significant portion of passengers on short-haul flights might opt to pack snacks and drinks to avoid airport or onboard prices.

However, this substitute's impact is somewhat tempered. The appeal of fresh, hot meals and a variety of dining choices available at travel hubs, which Avolta caters to, often outweighs the convenience of self-prepared food. Furthermore, security regulations, such as restrictions on carrying liquids, can limit the extent to which passengers can bring their own beverages, thereby supporting demand for Avolta's offerings.

Alternative Travel Experiences

While Avolta serves various travel segments, a significant substitute threat arises from a fundamental shift in consumer behavior away from traditional travel altogether. Imagine people opting for more immersive, local experiences or even virtual reality travel that eliminates the need for physical journeys. This macro-level shift, though not directly tied to travel retail, could indirectly impact Avolta by reducing the overall demand for travel services.

However, the global travel industry's resilience and projected growth offer a counterpoint. For instance, the World Travel & Tourism Council (WTTC) projected the sector's contribution to global GDP to reach $14.5 trillion by 2024, a substantial increase from pre-pandemic levels. This indicates a strong underlying demand for travel, which generally benefits companies like Avolta.

The threat of substitutes for Avolta, specifically within the travel retail context, can be viewed through several lenses:

- Shifting Consumer Preferences: A move towards experiences that don't involve traditional travel, such as hyper-local tourism or advanced virtual reality entertainment, represents a substitute for the core travel Avolta facilitates.

- Growth of Alternative Leisure: Non-travel related leisure activities could capture consumer spending that might otherwise be allocated to travel, thereby reducing the market size for travel retail.

- Industry Resilience: Despite potential shifts, the overall travel industry is robust. Projections for 2024 show continued expansion, with the WTTC forecasting a significant contribution to global GDP, suggesting that the demand for travel, and by extension travel retail, is likely to persist.

Direct-to-Consumer (DTC) from Brands

The threat of substitutes for Avolta's travel retail business is evolving as global brands explore direct-to-consumer (DTC) sales. This shift could bypass traditional airport and travel hub retail environments. For example, many luxury and beauty brands have significantly expanded their online DTC capabilities in recent years, aiming to capture a larger share of the profit margin and build direct customer relationships. This trend, while still developing in its impact on travel retail, represents a potential substitute for the curated shopping experience Avolta provides.

Avolta's strategy to counter this threat focuses on its established brand partnerships and its unique value proposition. By offering a curated selection and a seamless, travel-specific retail experience, Avolta aims to remain indispensable to both brands and travelers. In 2024, Avolta reported continued growth in its brand partnerships, highlighting the ongoing demand from brands to leverage Avolta's airport presence and customer reach. This allows Avolta to differentiate itself from generic online DTC offerings.

- Brands expanding DTC channels: Many global brands, particularly in luxury and beauty, have invested heavily in their own e-commerce platforms, offering direct sales to consumers.

- Bypassing traditional retail: This DTC push can circumvent the need for intermediaries like travel retailers, potentially impacting Avolta's sales volume.

- Avolta's counter-strategy: Avolta leverages its strong brand relationships and its ability to provide a unique, curated travel retail experience as a key differentiator.

- 2024 performance: Avolta's continued growth in brand partnerships in 2024 underscores the enduring value brands place on its airport retail footprint and customer access.

The threat of substitutes for Avolta is multifaceted, encompassing both direct retail alternatives and broader shifts in consumer behavior. Online retail, downtown stores, and even passengers bringing their own goods present competitive options that can divert spending from travel retail. Furthermore, evolving leisure preferences and the rise of direct-to-consumer (DTC) brand strategies also pose significant challenges.

The convenience of e-commerce, with the global market valued at approximately $5.7 trillion in 2023, offers a readily accessible substitute for many travel retail items. Similarly, urban retail growth, with general merchandise sales up 4.5% in 2024, highlights accessible alternatives outside of travel times. This means Avolta must continuously emphasize its unique value proposition beyond mere product availability.

| Substitute Category | Description | Key Data Point (2023-2024) | Impact on Avolta |

|---|---|---|---|

| Online Retail | Convenient access to a wide range of products globally. | Global e-commerce market valued at ~$5.7 trillion (2023). | Direct competition for non-essential, non-perishable goods. |

| Physical Retail (Non-Airport) | Competitive pricing and accessibility outside travel. | Urban general merchandise sales grew 4.5% (2024). | Offers alternatives for everyday items and food/beverages. |

| Consumer Self-Provisioning | Passengers bringing own food, beverages, or items. | Prevalence on short-haul flights for budget-conscious travelers. | Reduces demand for Avolta's F&B and convenience items. |

| Direct-to-Consumer (DTC) Brands | Brands selling directly to consumers, bypassing intermediaries. | Significant expansion of DTC channels by luxury/beauty brands. | Potential to disintermediate travel retail, impacting sales volume. |

Entrants Threaten

The threat of new entrants in the global travel retail and food and beverage (F&B) sector is significantly tempered by the immense capital required. New players must secure lucrative concessions, which often involve substantial upfront payments and long-term commitments, alongside the cost of building and maintaining sophisticated operational infrastructure. This high barrier to entry, coupled with the intricate management of global supply chains and diverse regulatory environments, makes it exceptionally challenging for newcomers to compete effectively.

Airport authorities and travel hubs often grant long-term concession contracts based on existing relationships, demonstrated operational expertise, and financial strength. This creates a significant barrier for newcomers seeking prime locations.

Avolta's impressive 95% contract renewal rate from 2022 to 2024 highlights its deeply entrenched position within these networks. This high renewal rate signifies the trust and proven performance that airport operators value, making it exceptionally challenging for new entrants to secure comparable agreements and access key travel infrastructure.

The duty-free and travel retail sector is a minefield of regulations. Newcomers must grapple with intricate customs procedures, varying tax laws, and the need for specific licenses in each country they wish to operate. For instance, in 2024, navigating the EU's VAT refund schemes alone presents a substantial compliance burden.

These regulatory complexities act as a significant barrier. Establishing operations requires substantial investment in legal counsel and compliance personnel to ensure adherence to diverse international standards. This adds considerable cost and time to market entry, deterring potential new competitors.

Brand Relationships and Portfolio

The threat of new entrants in the travel retail sector, particularly concerning brand relationships and portfolio, is significantly mitigated by the immense effort required to cultivate a comprehensive selection of desirable global and local brands. Avolta, for instance, has spent years building trust and strong partnerships with a vast array of brands. This deep integration makes it exceedingly difficult for newcomers to replicate the diverse and appealing product offerings that are essential for attracting and retaining travelers in 2024.

New entrants face a substantial hurdle in quickly establishing the kind of brand relationships that Avolta leverages. For example, securing prime locations within airports, a key factor in visibility and sales, often depends on established relationships and a proven track record. Without this, a new player would struggle to present a compelling and competitive product range, a critical element for success in this market.

- Brand Loyalty and Trust: Years of consistent service and quality have cemented customer trust in established travel retail brands, making it hard for new entrants to gain immediate traction.

- Exclusive Partnerships: Many desirable brands have exclusive or long-term agreements with major players like Avolta, limiting product availability for new competitors.

- Portfolio Breadth: Avolta's extensive portfolio, catering to diverse traveler preferences, from luxury goods to everyday essentials, represents a significant barrier to entry for any new company aiming to offer a comparable selection.

- Airport Concessions: Securing prime retail space in high-traffic airports is highly competitive and often favors incumbents with proven performance records and established brand relationships.

Economies of Scale and Experience

Avolta's substantial economies of scale across procurement, logistics, and operations, stemming from its vast global network, present a significant barrier to new entrants. For instance, in 2024, Avolta's purchasing power likely allowed for more favorable terms with suppliers compared to a smaller, new competitor.

The company's deep operational experience in managing a wide array of retail and food and beverage formats within high-traffic locations, such as airports, translates directly into enhanced efficiency. This accumulated know-how, honed over years of operation, is difficult for newcomers to replicate quickly.

- Economies of Scale: Avolta's global presence in 2024 likely enabled cost advantages in sourcing and distribution, making it harder for new players to match pricing.

- Operational Experience: Years of managing complex, high-volume environments provide Avolta with efficiencies that new entrants would struggle to achieve initially.

- Cost and Service Competition: New entrants face a steep challenge in competing with Avolta on both cost-effectiveness and service quality due to this scale and experience gap.

The threat of new entrants into the travel retail and F&B sector is considerably low due to high capital requirements for airport concessions and infrastructure. Avolta's strong contract renewal rates, like its 95% from 2022-2024, underscore its established relationships and operational excellence, making it difficult for newcomers to secure prime locations and replicate its success.

Navigating complex global regulations, including varying tax laws and customs procedures, presents a significant hurdle for new players. For instance, in 2024, compliance with diverse international standards demands substantial investment in legal and personnel resources, deterring many potential entrants.

Avolta's established brand partnerships and broad product portfolio are formidable barriers. Cultivating similar relationships and offering a comparable range of desirable brands, as Avolta did by 2024, requires years of effort and trust-building, which new entrants cannot easily replicate.

Economies of scale in procurement and distribution, coupled with extensive operational experience, provide Avolta with significant cost advantages. In 2024, this scale likely allowed for more favorable supplier terms, making it challenging for new competitors to match Avolta's pricing and service quality.

| Barrier Type | Description | Impact on New Entrants | Avolta's Position |

|---|---|---|---|

| Capital Requirements | High costs for airport concessions and infrastructure. | Significant deterrent for new players. | Established financial strength and proven track record. |

| Regulatory Complexity | Navigating diverse international customs, tax, and licensing laws. | Requires substantial investment in legal and compliance expertise. | Extensive experience in managing global regulatory landscapes. |

| Brand Relationships & Portfolio | Cultivating partnerships with desirable brands and offering a broad selection. | Time-consuming and requires significant trust-building. | Deeply integrated with a wide array of global and local brands. |

| Economies of Scale & Experience | Cost advantages from large-scale operations and operational know-how. | Makes it difficult to compete on price and efficiency. | Global network leading to procurement and operational efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Avolta Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research from firms like Statista and IBISWorld, and regulatory filings to ensure comprehensive insights into competitive dynamics.