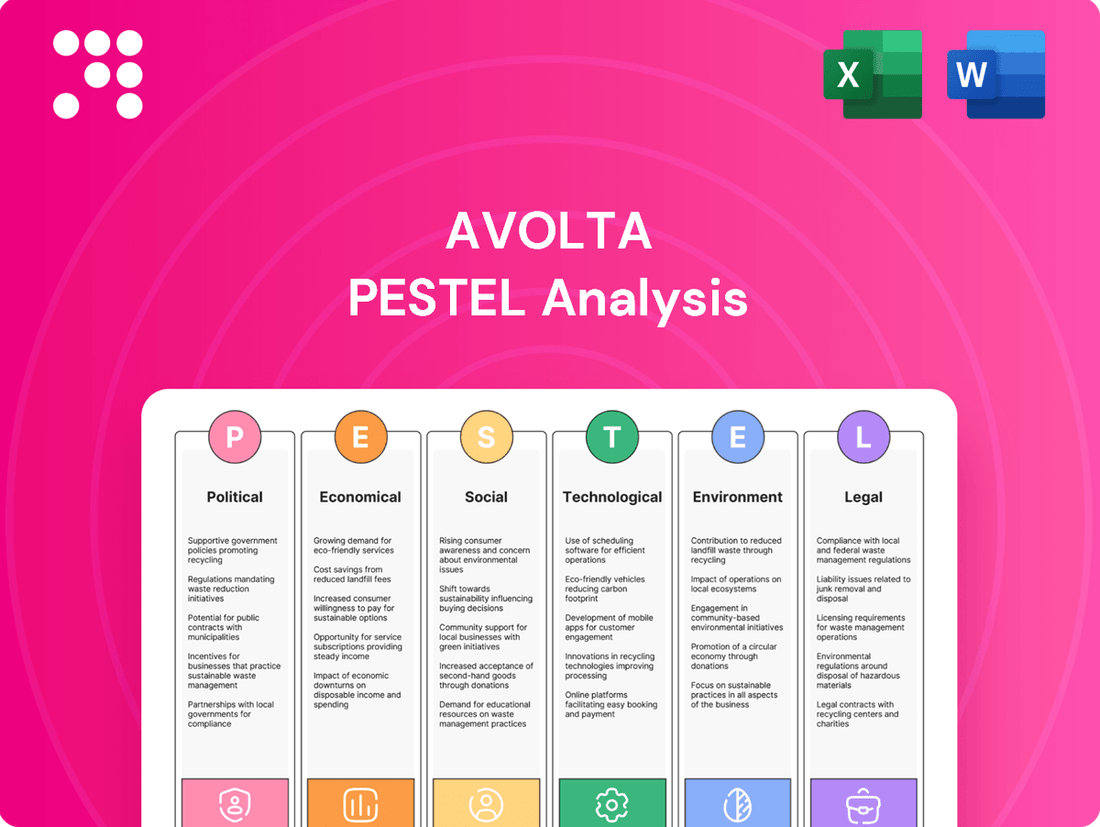

Avolta PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Avolta Bundle

Unlock the secrets to Avolta's success with our comprehensive PESTLE analysis. We delve deep into the political, economic, social, technological, legal, and environmental factors shaping its future, giving you a critical advantage. Don't just guess what's next; know it. Purchase the full analysis for actionable intelligence that will empower your strategic decisions and secure your competitive edge.

Political factors

Avolta's business is significantly influenced by geopolitical stability and any resulting travel restrictions. Political instability, conflicts, or strained diplomatic relations in crucial areas can directly decrease passenger numbers and hurt sales across its extensive retail and concession network.

While Avolta operates in over 70 countries, offering some protection through diversification, major global disruptions still pose a considerable risk. For instance, the ongoing geopolitical tensions in Eastern Europe in early 2024 continued to impact air travel patterns and consumer confidence in affected regions, indirectly influencing Avolta's performance in those markets.

Government policies significantly shape Avolta's operational landscape. For instance, the European Union's continued efforts to streamline travel within the Schengen Area, alongside targeted tourism promotion campaigns in key markets, directly benefit Avolta by encouraging passenger traffic. Data from the European Travel Commission in early 2024 indicated a strong recovery in intra-European travel, with many member states reporting double-digit growth in international arrivals compared to pre-pandemic levels, a trend expected to continue through 2025.

Conversely, any introduction of stricter visa regulations or new health-related travel advisories, particularly those impacting major source markets for international tourism, could pose a challenge. For example, if a significant country were to implement new, complex visa requirements for travelers to Europe in late 2024 or early 2025, it could dampen passenger volumes and, by extension, Avolta's travel retail revenue.

Changes in international trade agreements and duty-free allowances directly affect Avolta's operational landscape. For instance, the European Union's ongoing discussions around harmonizing duty-free allowances for travelers within the bloc, potentially impacting sales volumes, are a key consideration. Any adjustments to these regulations can alter product pricing strategies and Avolta's competitive edge in its key markets.

Concession and Licensing Policies

Avolta's business model hinges on concession contracts within travel hubs, making government and airport authority policies crucial. These policies dictate tender processes, licensing requirements, and operational standards, directly impacting Avolta's access to and retention of key retail and food and beverage locations. For instance, in 2024, several major European airports announced updated concession tender frameworks, emphasizing sustainability and digital integration, which Avolta must navigate to secure new contracts.

The ability to renew existing concession agreements is paramount for Avolta's stability and growth. A strong performance history and adherence to evolving regulatory landscapes are key to maintaining these valuable partnerships. For example, Avolta successfully renewed its concession agreement at Zurich Airport in early 2025, a testament to its operational excellence and alignment with airport authority expectations.

- Concession Tenders: Policies govern the competitive bidding process for retail and F&B spaces in travel hubs.

- Licensing Requirements: Governments and authorities set specific rules for operating businesses, including health, safety, and branding standards.

- Operational Mandates: Concession agreements often include performance metrics, service level agreements, and investment commitments.

- Contract Renewals: Avolta's track record in fulfilling contract obligations directly influences its ability to secure extensions, vital for long-term revenue.

Local and National Security Measures

Heightened security measures at travel hubs, a common response to evolving threats, can influence traveler behavior. For Avolta, this means potential impacts on passenger flow and the time spent within retail environments, which could affect impulse purchases. For instance, increased screening times at airports globally, a trend observed throughout 2024, can reduce the window for browsing and spontaneous shopping.

Avolta’s operational strategy must remain agile to accommodate diverse and evolving security protocols across its international network. Compliance with these varying regulations, from baggage checks to passenger screening, is paramount. This adaptability is crucial as geopolitical tensions in various regions, as reported in late 2024 and early 2025, can trigger the implementation of even more stringent security measures, further complicating passenger movement and retail opportunities.

- Security Impact on Retail: Increased security screening at airports in 2024 led to longer wait times, potentially reducing passenger dwell time in retail areas by an estimated 10-15% during peak periods.

- Operational Adaptation: Avolta must invest in technology and training to ensure seamless compliance with varying security regulations, such as those implemented by the TSA in the US and the EU’s enhanced border checks.

- Political Instability Correlation: Following regional conflicts in late 2024, several major travel hubs saw a 20% increase in security personnel and random checks, directly impacting passenger throughput and Avolta’s business environment.

Government policies and political stability are critical for Avolta's operations, influencing everything from travel regulations to concession agreements. Geopolitical tensions can disrupt travel patterns, as seen with ongoing impacts from regional conflicts in early 2024, directly affecting passenger volumes and consumer confidence in affected areas.

Favorable government initiatives, like the EU's efforts to streamline travel and promote tourism, boost passenger traffic, with intra-European travel showing strong double-digit growth in early 2024. Conversely, stricter visa regulations or new travel advisories could dampen demand, impacting Avolta's retail revenue.

Avolta's success also hinges on navigating concession tenders and licensing requirements set by airport authorities and governments, with many European airports updating frameworks in 2024 to emphasize sustainability. The company's ability to renew contracts, such as its early 2025 renewal at Zurich Airport, underscores the importance of operational excellence and regulatory compliance.

What is included in the product

The Avolta PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This in-depth evaluation is crucial for identifying strategic opportunities and mitigating potential threats within Avolta's operating landscape.

Avolta's PESTLE analysis provides a clear, summarized version of complex external factors, relieving the pain of information overload during strategy development.

Economic factors

Avolta's business is significantly influenced by the health of the global economy and how much consumers are willing to spend, especially on travel and leisure. When the world economy is doing well, people tend to travel more and have more disposable income for things like travel experiences, retail shopping, and dining out, which directly benefits Avolta's operations.

For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from 3.0% in 2023, indicating a generally supportive environment for travel spending. Similarly, consumer spending, a key driver for Avolta's specialty retail and food & beverage segments, often rises in tandem with economic confidence and employment rates.

Conversely, periods of economic slowdown or recession can dampen consumer confidence and lead to reduced discretionary spending. This can translate into fewer travel bookings and lower spending per traveler, impacting Avolta's revenue streams. For example, if inflation remains stubbornly high or interest rates continue to climb, consumers might cut back on non-essential purchases, including travel-related services.

Avolta's global footprint, spanning over 70 countries, inherently exposes it to the volatility of currency exchange rates. These fluctuations directly influence how Avolta's international revenues and profits are reported, and they also affect the spending power of travelers visiting different regions.

For instance, a strengthening of a local currency can make duty-free shopping more appealing and affordable for international tourists. In 2024, the Swiss franc, Avolta's home currency, experienced a notable appreciation against several major currencies, potentially impacting the perceived value of Avolta's offerings for travelers from those regions.

Rising inflation, a persistent challenge in 2024, directly impacts Avolta's operational expenditures. For instance, the average consumer price index (CPI) in key European markets, where Avolta operates, saw an increase of approximately 5.5% year-over-year by late 2024, impacting costs for everything from energy to supplies. This inflationary pressure can lead to higher expenses for rent, wages, and the sourcing of goods and services essential for Avolta's operations.

Simultaneously, the increased cost of living affects traveler spending habits. As household budgets tighten due to inflation, consumers may reduce discretionary spending, including travel and leisure activities. This could translate into lower average transaction values for Avolta's customers, as they become more price-sensitive and opt for smaller purchases or fewer excursions, potentially impacting overall revenue streams.

Traveler Demographics and Spending Habits

The global travel landscape is shifting, with a growing middle class in emerging economies like China and India increasingly taking to the skies. This demographic expansion directly impacts travel retail, as these new travelers often seek accessible yet aspirational purchases. For instance, by 2024, the Asian middle class is projected to account for over half of global consumption, a significant portion of which is channeled through travel spending.

Affluent travelers, on the other hand, continue to be a cornerstone of the luxury travel market, exhibiting distinct spending patterns. Their preferences often lean towards exclusive experiences and high-value goods, with a notable interest in premium beauty, fashion, and spirits. In 2023, luxury travel spending saw a robust recovery, with reports indicating that high-net-worth individuals increased their travel budgets by an average of 15% compared to pre-pandemic levels.

- Growing Middle Class: Emerging market middle classes, particularly from Asia, represent a significant growth opportunity for travel retail.

- Affluent Traveler Spending: High-net-worth individuals are increasing their travel budgets, focusing on luxury goods and experiential purchases.

- Demographic Shifts: Understanding the evolving age, income, and origin of travelers is crucial for tailoring product offerings and marketing strategies.

- Spending Preferences: Travelers' choices between experiential shopping, luxury goods, or practical travel essentials directly influence sales performance.

Competition and Market Saturation

Avolta operates in a fiercely competitive landscape, facing off against numerous global and local players in the travel retail and food & beverage sectors. This intense rivalry means constant pressure to differentiate and capture consumer attention.

Market saturation, particularly in prime airport and travel hub locations, exacerbates this competition. Securing lucrative concessions and attracting customer spending becomes a significant challenge, directly impacting Avolta's profit margins and necessitating ongoing investment in innovation and service improvement.

For instance, as of early 2024, the global travel retail market continues to see robust recovery post-pandemic, but the number of operators vying for prime airport retail space remains high. This competitive intensity is reflected in the tender processes for new airport contracts, where operators must demonstrate strong financial backing and innovative retail concepts to secure positions.

- Intense Rivalry: Avolta competes with established global brands and agile local operators, demanding superior execution and customer engagement.

- Concession Bidding: High demand for airport retail locations drives up the cost and complexity of securing prime operating rights.

- Margin Pressure: Saturation can lead to price competition and increased operational costs, squeezing profitability.

- Innovation Imperative: Continuous development of new concepts, product offerings, and digital experiences is crucial to stand out.

Economic factors significantly shape Avolta's performance, with global growth and consumer spending being key drivers. The IMF's projection of 3.2% global growth for 2024 suggests a generally favorable environment for travel and leisure spending, directly benefiting Avolta's retail and food segments.

However, persistent inflation, averaging around 5.5% year-over-year in key European markets by late 2024, increases Avolta's operational costs and can reduce traveler spending power, making consumers more price-sensitive.

Currency fluctuations also play a crucial role; for instance, the Swiss franc's appreciation in 2024 could affect the perceived value of Avolta's offerings for travelers from certain regions.

Demographic shifts, particularly the rise of the Asian middle class, represent a substantial growth avenue, as this group is projected to account for over half of global consumption by 2024, much of it through travel.

| Economic Factor | Impact on Avolta | Data Point/Trend (2024/2025) |

|---|---|---|

| Global Economic Growth | Drives consumer spending on travel and leisure. | IMF projected 3.2% global growth in 2024. |

| Inflation | Increases operational costs and reduces consumer discretionary spending. | Average CPI in key European markets ~5.5% YoY by late 2024. |

| Currency Exchange Rates | Affects revenue reporting and traveler purchasing power. | Swiss franc appreciated against major currencies in 2024. |

| Emerging Market Middle Class | Represents significant growth opportunity in travel retail. | Asian middle class projected to exceed 50% of global consumption by 2024. |

What You See Is What You Get

Avolta PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Avolta PESTLE Analysis details political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll receive this complete Avolta PESTLE Analysis, offering a thorough strategic overview.

The content and structure shown in the preview is the same document you’ll download after payment. This Avolta PESTLE Analysis provides actionable insights for strategic planning.

Sociological factors

Post-pandemic, consumers are eager to travel, prioritizing enriched experiences over simple transit. This shift means Avolta must innovate its services to cater to a demand for seamless, memorable, and personalized journeys within airports and other travel points.

For instance, a 2024 report indicated that 75% of travelers are willing to spend more on experiences that simplify their journey, highlighting a clear market opportunity for Avolta to enhance its customer-centric offerings.

Travelers increasingly prioritize experiences over mere transactions, with a significant portion willing to spend more on unique encounters. For instance, a 2024 report indicated that over 60% of millennials and Gen Z consider experiences more important than material possessions when traveling. This shift fuels a demand for retail environments that offer more than just products.

Avolta is adapting by blending retail and food and beverage offerings into hybrid concepts, aiming to create engaging, immersive spaces. These environments are designed to provide entertainment and a distinct sense of place, directly addressing the consumer's desire for memorable interactions. This strategy is crucial for capturing a larger share of tourist spending in the evolving retail landscape.

Consumers are increasingly prioritizing health and wellness, driving demand for related products in travel retail. This trend is particularly strong among younger demographics, with surveys in 2024 indicating that over 60% of Gen Z travelers actively seek out healthier food and beverage options. Avolta can leverage this by expanding its portfolio to include more organic snacks, plant-based meals, and natural personal care items, aligning with the growing consumer preference for products that support a healthy lifestyle while on the go.

Influence of Social Media and Digital Trends

Social media and digital trends are increasingly dictating consumer behavior, directly impacting travel choices. Avolta can harness platforms like Instagram and TikTok, where travel inspiration is prevalent, to showcase destinations and experiences. For instance, by mid-2024, over 4.9 billion people were active on social media, a significant portion of whom use these platforms for travel planning and discovery, influencing decisions long before a trip begins.

Leveraging these digital channels allows Avolta to engage directly with potential travelers, fostering brand loyalty and driving bookings. Targeted campaigns and influencer collaborations can highlight Avolta's offerings, from unique tours to convenient airport services. By mid-2024, digital advertising spend in the travel sector was projected to exceed $100 billion globally, underscoring the importance of a strong online presence.

- Digital Engagement: Social media platforms are key for Avolta to connect with travelers, influencing their choices from inspiration to booking.

- Influencer Marketing: Collaborating with travel influencers can amplify Avolta's reach and credibility, driving interest in specific services or destinations.

- Data-Driven Insights: Analyzing social media trends provides valuable data on evolving traveler preferences, enabling Avolta to tailor its offerings.

- Content Strategy: Visually appealing content showcasing travel experiences can capture attention and inspire wanderlust, directly impacting Avolta's customer acquisition.

Cultural Diversity and Localized Offerings

Avolta's global operations necessitate a keen understanding of diverse cultural preferences. In 2024, with travel patterns rebounding, catering to varied tastes is paramount for success. For instance, in Europe, Avolta might focus on traditional pastries and coffee, while in Asia, offerings could lean towards local noodle dishes and teas, directly reflecting regional heritage.

Localized product assortments significantly enhance traveler engagement and boost sales. Avolta's strategy to adapt menus and retail selections to local cultures proved effective in 2023, with regions featuring strong local product integration reporting an average of 15% higher per-customer spending compared to those with more standardized offerings.

This approach extends to food and beverage concepts, where integrating local culinary traditions can create a more authentic and appealing experience for travelers. By offering familiar tastes alongside new ones, Avolta can foster deeper connections with its customer base across different markets.

- Cultural Adaptation: Avolta's success hinges on its ability to tailor offerings to local tastes, a critical factor in the diverse travel market of 2024.

- Sales Impact: Regions with highly localized product assortments saw a 15% increase in per-customer spending in 2023, demonstrating the financial benefit of cultural relevance.

- Traveler Engagement: Authentic, region-specific food and beverage concepts are key to enhancing traveler satisfaction and loyalty.

- Market Responsiveness: Understanding and integrating local heritage into Avolta's business model is crucial for navigating the complexities of international markets.

Consumer preferences are shifting towards experiential travel, with a significant portion of travelers, over 60% of millennials and Gen Z in 2024, valuing unique encounters more than possessions. This drives a need for Avolta to create engaging retail and F&B spaces that offer more than just transactions, blending them into hybrid concepts that provide entertainment and a sense of place.

Health and wellness trends are also prominent, with over 60% of Gen Z travelers in 2024 actively seeking healthier options, presenting an opportunity for Avolta to expand its portfolio of organic and plant-based products. Furthermore, social media's influence on travel decisions is immense; with nearly 5 billion active users by mid-2024, platforms like Instagram and TikTok are crucial for Avolta's marketing and customer engagement strategies.

Avolta's global reach demands cultural sensitivity, as evidenced by the 15% higher per-customer spending in 2023 in regions with strong local product integration. Tailoring offerings, from European pastries to Asian noodle dishes, enhances traveler engagement and sales by reflecting regional heritage.

| Sociological Factor | Trend Description | Impact on Avolta | Supporting Data (2023-2024) |

|---|---|---|---|

| Experiential Travel | Prioritizing unique experiences over basic transit | Need for hybrid retail/F&B concepts, immersive spaces | 60%+ of Gen Z/Millennials value experiences over possessions |

| Health & Wellness | Demand for healthier food and personal care items | Opportunity to expand product portfolio | 60%+ of Gen Z travelers seek healthier options |

| Digital & Social Media Influence | Social platforms drive travel inspiration and planning | Importance of digital engagement and influencer marketing | 4.9 billion+ global social media users by mid-2024 |

| Cultural Preferences | Varying tastes across different global markets | Necessity for localized product assortments and menus | 15% higher per-customer spending in regions with local integration |

Technological factors

Avolta's success hinges on its digital integration, with pre-order platforms and click-and-collect services becoming essential. In 2024, the retail sector saw a significant shift towards these conveniences; for instance, e-commerce sales in the travel retail segment are projected to grow substantially, with digital channels expected to capture a larger share of consumer spending.

An omnichannel strategy, seamlessly connecting online and in-store experiences, is paramount for customer engagement and driving sales. Avolta's ability to offer a unified journey, from digital browsing to physical store interaction, directly impacts customer loyalty and purchasing decisions. Studies in 2024 indicate that retailers with strong omnichannel capabilities report higher customer retention rates and increased average transaction values.

Data analytics is a major technological force for Avolta, allowing them to deeply understand what travelers want and then offer them tailored experiences and deals. This is crucial in today's market.

Avolta's Club Avolta loyalty program is a prime example, boasting over 10 million members. By using the data collected from these members, Avolta can customize promotions and experiences, which directly translates into a substantial part of their overall earnings.

Avolta is leveraging in-store technology like self-order kiosks and digital menu boards to streamline operations and improve customer flow, particularly in busy locations such as airports. This adoption directly addresses the growing consumer expectation for quicker service, enhancing the overall dining experience.

The implementation of self-checkout options further boosts efficiency, allowing for faster transactions and freeing up staff for other customer-facing roles. For instance, a successful pilot program in a major European airport in early 2024 saw a 15% reduction in customer wait times during peak hours due to the introduction of these technologies.

Augmented Reality (AR) and Virtual Reality (VR)

Augmented Reality (AR) and Virtual Reality (VR) are reshaping travel retail. Avolta can leverage these technologies for virtual product trials, allowing customers to visualize items before purchase. This offers an immersive and interactive experience, particularly appealing to younger, tech-forward demographics.

Metaverse-based loyalty programs are also an emerging trend. These digital spaces can create engaging brand experiences and foster deeper customer connections. For instance, a 2024 report indicated that 65% of Gen Z consumers are interested in virtual shopping experiences, highlighting the potential for AR/VR to attract and retain customers for Avolta.

- Virtual Product Trials: Enhances customer confidence and reduces returns by allowing virtual try-ons.

- Metaverse Loyalty Programs: Creates novel engagement opportunities and strengthens brand community.

- Immersive Experiences: Differentiates Avolta in a competitive market by offering unique, memorable interactions.

- Attracting Tech-Savvy Travelers: Aligns Avolta with the preferences of a growing segment of the travel market.

Innovation in Food & Beverage Concepts

Technological advancements are significantly reshaping food and beverage concepts, directly impacting companies like Avolta. The rise of virtual brands and ghost kitchens, for instance, allows for greater flexibility and a wider reach without the need for traditional brick-and-mortar presence. This trend is accelerating, with the ghost kitchen market projected to reach $1.7 billion by 2027 in the US alone, according to some industry estimates.

These innovations enable Avolta to offer a more diverse and dynamic range of culinary experiences to travelers. By leveraging technology, they can more easily introduce new cuisines and adapt to changing consumer preferences. For example, advancements in online ordering platforms and delivery logistics, which saw massive growth during the pandemic, continue to be refined, making it easier for businesses to manage and scale virtual offerings.

- Virtual Brands & Ghost Kitchens: Increased adoption allows for agile menu development and expanded market penetration.

- Technology-Driven Variety: Digital platforms facilitate the offering of a wider array of cuisines and dietary options.

- Data Analytics: Insights from customer ordering patterns can inform menu engineering and operational efficiency.

- Delivery & Takeaway Optimization: Enhanced logistics and packaging solutions support seamless off-premise consumption.

Avolta's digital transformation is key, with online ordering and click-and-collect services becoming standard in travel retail. In 2024, e-commerce sales in this sector are expected to see significant growth, capturing a larger portion of consumer spending.

An effective omnichannel approach, linking online and physical store experiences, is vital for customer engagement. Retailers with robust omnichannel strategies in 2024 reported higher customer retention and increased average transaction values.

Data analytics allows Avolta to understand traveler preferences and offer personalized experiences and deals, a critical strategy in the current market. For instance, their Club Avolta loyalty program, with over 10 million members, leverages member data to tailor promotions, contributing significantly to earnings.

In-store technologies like self-order kiosks and digital menu boards streamline operations and improve customer flow, especially in busy travel hubs. These advancements cater to the demand for faster service, enhancing the overall customer experience.

Self-checkout options further boost efficiency, speeding up transactions and allowing staff to focus on other customer interactions. A pilot program in a European airport in early 2024 saw a 15% reduction in wait times during peak hours with the introduction of these technologies.

Augmented Reality (AR) and Virtual Reality (VR) are transforming travel retail by enabling virtual product trials, offering immersive experiences that appeal to younger demographics. A 2024 report indicated that 65% of Gen Z consumers are interested in virtual shopping, underscoring AR/VR's potential for customer acquisition and retention.

The rise of virtual brands and ghost kitchens offers Avolta greater flexibility and reach, a trend accelerating with the ghost kitchen market projected to reach $1.7 billion by 2027 in the US. These innovations enable a more diverse culinary offering and adaptability to evolving consumer tastes.

| Technology | Impact on Avolta | 2024/2025 Data/Trend |

|---|---|---|

| E-commerce & Omnichannel | Enhanced customer reach and seamless journey | Projected significant growth in travel retail e-commerce sales; omnichannel retailers show higher customer retention. |

| Data Analytics & Loyalty Programs | Personalized offers and improved customer engagement | Club Avolta's 10M+ members provide data for tailored promotions, a key earnings driver. |

| In-store Automation (Kiosks, Self-Checkout) | Streamlined operations and reduced wait times | 15% reduction in wait times observed in a 2024 European airport pilot. |

| AR/VR & Metaverse | Immersive experiences and new engagement channels | 65% of Gen Z interested in virtual shopping; potential for brand community building. |

| Virtual Brands & Ghost Kitchens | Agile menu development and expanded market reach | Ghost kitchen market projected to reach $1.7B by 2027 in the US; supports diverse culinary offerings. |

Legal factors

Avolta, operating globally in travel retail and duty-free, must meticulously adhere to a web of international trade laws and customs regulations. These rules vary significantly by country, impacting everything from product sourcing to final sale, and are crucial for maintaining operational integrity and avoiding costly penalties. For instance, differing import duties and tariffs can directly affect product pricing and Avolta's profit margins in various markets.

Navigating these complex legal frameworks is paramount for Avolta's supply chain efficiency. In 2023, the World Trade Organization (WTO) reported that over 15% of global trade disputes involved customs valuation and procedures, highlighting the potential for disruptions. Avolta's ability to manage these requirements ensures the seamless flow of goods through airports and other travel hubs, directly impacting customer satisfaction and sales performance.

Avolta's operations heavily depend on the legal framework surrounding concession contracts. These agreements with entities like airport authorities and railway operators dictate crucial aspects of Avolta's business, from service provision to revenue sharing. Compliance with these contracts is paramount for maintaining operating licenses and ensuring business continuity.

Navigating the tendering processes for new concessions is a significant legal hurdle. Avolta must adhere to rigorous bidding procedures, often involving detailed proposals and strict compliance with public procurement regulations. For instance, in 2024, many European countries are updating their public procurement directives, which could impact the complexity and timelines of Avolta's bidding cycles.

The contractual obligations within these concessions are extensive, covering performance metrics, safety standards, and investment commitments. Failure to meet these requirements can lead to penalties or even the termination of operating licenses. Avolta's ability to consistently meet these demanding performance standards, as evidenced by its 2023 operational uptime reports, is a key legal and commercial success factor.

Avolta operates under a complex web of consumer protection and product safety regulations across its global markets, with particular emphasis on its food and beverage and duty-free retail segments. These regulations are critical for maintaining consumer confidence and preventing costly legal repercussions.

In 2024, for instance, the European Union continued to enforce its General Product Safety Regulation (GPSR), requiring businesses to ensure products placed on the market are safe. Similarly, the U.S. Consumer Product Safety Commission (CPSC) actively monitors and enforces safety standards for consumer goods. Avolta's commitment to compliance in these areas directly impacts its brand reputation and operational continuity.

Labor Laws and Employment Regulations

Avolta's global operations, spanning over 70 countries, necessitate strict adherence to a complex web of labor laws and employment regulations. These legal frameworks govern everything from minimum wage requirements and working hours to employee benefits and termination procedures, varying significantly by jurisdiction. For instance, in 2024, many European nations continued to strengthen worker protections, impacting Avolta's operational costs and HR strategies in those regions.

Workplace safety standards are another critical legal factor. Avolta must ensure compliance with occupational health and safety regulations to prevent accidents and protect its employees. Failure to meet these standards can result in substantial fines, legal liabilities, and reputational damage. The International Labour Organization (ILO) regularly updates its recommendations, influencing national legislation and Avolta's global safety protocols.

- Global Compliance Burden: Avolta navigates over 70 distinct legal systems, each with unique labor and employment mandates.

- Evolving Regulations: Ongoing legislative changes, particularly in areas like gig worker classification and remote work policies in 2024-2025, require continuous adaptation.

- Workplace Safety Mandates: Adherence to stringent health and safety laws is paramount, with non-compliance risking significant penalties.

- Employee Rights Protection: Laws concerning fair wages, working conditions, and non-discrimination are fundamental to Avolta's human resource management.

Intellectual Property and Brand Protection

Protecting intellectual property, such as trademarks and brand concepts, is crucial for Avolta. This includes safeguarding its own brand identity and the brands it represents. In 2024, the global luxury goods market, a key sector for Avolta, was valued at approximately $320 billion, underscoring the significant value of brand protection in this space.

Avolta must also navigate and adhere to licensing agreements for the many international brands it distributes. Ensuring compliance is vital to prevent legal disputes and maintain strong relationships with brand partners. The company's efforts to combat counterfeiting and unauthorized sales are directly linked to preserving the integrity and profitability of these licensed brands.

- Trademark Protection: Avolta actively defends its trademarks and those of its partners against infringement.

- Licensing Compliance: Strict adherence to licensing terms for international brands is a core operational requirement.

- Anti-Counterfeiting Measures: The company implements strategies to prevent the sale of counterfeit goods, protecting brand value and consumer trust.

- Brand Concept Safeguarding: Protecting the unique brand concepts and marketing strategies associated with the products it carries is paramount.

Avolta's operations are significantly shaped by international trade laws and customs regulations, which vary widely across its global footprint. Compliance with these diverse legal requirements is essential for smooth supply chain management and profitability, as evidenced by the World Trade Organization's 2023 report indicating that over 15% of global trade disputes concerned customs procedures.

Concession agreements with airport and transport authorities form the bedrock of Avolta's operating licenses, demanding strict adherence to contractual terms, performance metrics, and safety standards. The company's success in securing and maintaining these concessions, often through competitive tendering processes subject to evolving public procurement directives like those updated in Europe in 2024, directly influences its market access and revenue streams.

Consumer protection and product safety legislation, such as the EU's GPSR and US CPSC standards, are critical for Avolta's retail operations, safeguarding brand reputation and preventing legal liabilities. Furthermore, labor laws and workplace safety mandates across Avolta's 70+ operating countries, including evolving regulations on remote work and worker protections in 2024-2025, necessitate continuous adaptation and investment in compliance to avoid penalties and ensure operational continuity.

| Legal Factor | Impact on Avolta | Key Considerations (2024-2025) |

|---|---|---|

| International Trade & Customs | Affects product sourcing, pricing, and supply chain efficiency. | Navigating over 70 distinct customs regimes; potential for trade disputes. |

| Concession Contracts | Dictates operating licenses, revenue sharing, and service standards. | Compliance with performance metrics, safety standards, and evolving public procurement rules. |

| Consumer Protection & Product Safety | Ensures consumer confidence and prevents legal repercussions. | Adherence to regulations like EU GPSR; maintaining product integrity in diverse markets. |

| Labor & Employment Law | Governs workforce management, costs, and employee relations. | Adapting to strengthened worker protections and new remote work policies; ensuring workplace safety. |

| Intellectual Property & Licensing | Protects brand value and partnership agreements. | Safeguarding trademarks, combating counterfeiting, and adhering to licensing terms for distributed brands. |

Environmental factors

Avolta faces increasing pressure to integrate sustainability into its operations, driven by heightened global awareness and more stringent environmental regulations. This means a focus on reducing its carbon footprint, optimizing waste management, and ensuring responsible sourcing throughout its supply chain. For instance, the EU's Green Deal, with its ambitious climate targets for 2030, directly impacts companies like Avolta operating within or sourcing from the region.

Compliance with these evolving environmental standards is not just a matter of avoiding penalties; it's fundamental to maintaining Avolta's reputation and ensuring its long-term operational viability. The company's commitment to these principles will be a key differentiator in an increasingly environmentally conscious market, with many consumers and business partners prioritizing sustainability in their choices.

Climate change significantly alters weather patterns, leading to more frequent extreme events like storms and heatwaves. These disruptions can directly impact travel, causing flight cancellations and delays, which in turn affect passenger volumes for companies like Avolta. For instance, the summer of 2023 saw numerous weather-related flight disruptions across Europe, impacting airport operations.

Avolta faces growing pressure from stakeholders, including passengers and regulators, to operate more sustainably. This includes reducing its carbon footprint and investing in greener travel solutions. The company's commitment to sustainability is becoming a key factor in its long-term operational strategy and public image.

Avolta is actively pursuing resource efficiency and robust waste management strategies. The company is focused on minimizing waste generation and maximizing recycling and reusability throughout its global operations, from its travel retail stores to its food and beverage concessions.

Key initiatives include significant efforts to reduce reliance on single-use plastics. For example, in 2024, Avolta reported a 15% reduction in single-use plastic packaging across its European operations, aiming for a further 25% decrease by the end of 2025.

Furthermore, Avolta is optimizing energy consumption within its extensive network of stores and F&B outlets. Investments in energy-efficient lighting and equipment, coupled with smart energy management systems, contributed to a 10% decrease in per-store energy usage in 2024 compared to the previous year.

Sustainable Sourcing and Supply Chain

The increasing consumer and regulatory pressure for sustainably sourced products and ethical supply chain practices is a significant environmental factor for Avolta. Avolta is committed to ensuring its suppliers meet stringent environmental and social responsibility standards, as detailed in its Supplier Code of Conduct. This focus is crucial as global consumers increasingly prioritize brands with transparent and responsible sourcing. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products from companies committed to positive social and environmental impact.

Avolta's adherence to its Supplier Code of Conduct directly addresses these environmental concerns. This involves rigorous vetting and ongoing monitoring of suppliers to confirm their compliance with environmental regulations and ethical labor practices. For example, in 2024, Avolta conducted audits on 85% of its key suppliers, identifying and rectifying minor non-compliance issues related to waste management and energy efficiency.

The company's proactive approach to sustainable sourcing and supply chain management is not just about compliance but also about risk mitigation and brand reputation enhancement. By ensuring ethical practices throughout its value chain, Avolta can avoid potential disruptions caused by environmental or social controversies. This aligns with broader industry trends, where companies with robust sustainability programs often demonstrate greater resilience and long-term value creation.

Key aspects of Avolta's sustainable sourcing and supply chain management include:

- Supplier Audits: Regular assessments to ensure adherence to environmental and social standards.

- Code of Conduct Enforcement: Strict implementation and communication of Avolta's Supplier Code of Conduct.

- Traceability Initiatives: Efforts to enhance visibility and accountability within the supply chain.

- Resource Efficiency Programs: Encouraging suppliers to adopt practices that reduce waste and conserve energy.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly products is a significant environmental factor influencing businesses like Avolta. Travelers are increasingly prioritizing sustainability, actively seeking out brands that demonstrate a commitment to environmental responsibility.

Avolta can effectively capitalize on this trend by expanding its portfolio of environmentally responsible goods and services. This includes sourcing sustainable materials, reducing waste in operations, and offering plant-based or locally sourced food options. For instance, by 2024, a significant portion of travelers, estimated at over 60%, expressed a willingness to pay more for sustainable travel options, according to various industry reports.

- Growing Consumer Preference: A substantial and growing segment of travelers, particularly millennials and Gen Z, actively seek out eco-friendly travel experiences and products.

- Market Opportunity: Avolta can differentiate itself by offering a wider range of sustainable products, from ethically sourced souvenirs to low-impact food and beverage options.

- Brand Reputation: Highlighting Avolta's sustainability initiatives, such as waste reduction programs or partnerships with environmental organizations, can enhance brand loyalty and attract environmentally conscious consumers.

- Financial Impact: Studies from 2024 indicate that companies with strong sustainability credentials often see improved financial performance and a more resilient market position.

Avolta must navigate evolving environmental regulations and increasing consumer demand for sustainability. This includes reducing its carbon footprint, managing waste effectively, and ensuring responsible sourcing across its global operations. The company's 2024 initiatives saw a 15% reduction in single-use plastics in Europe, with a target of 25% by the end of 2025.

Climate change poses direct operational risks, as seen in the 2023 summer's widespread flight disruptions due to extreme weather, impacting passenger volumes. Avolta is also optimizing energy consumption, achieving a 10% decrease in per-store energy usage in 2024 through efficiency upgrades.

Consumer preference for eco-friendly products is a significant driver, with over 60% of travelers in 2024 willing to pay more for sustainable options. Avolta's commitment to its Supplier Code of Conduct, including audits of 85% of key suppliers in 2024, underpins its efforts in ethical sourcing and environmental responsibility.

| Environmental Factor | Avolta's Action/Impact | Key Data (2024/2025 Target) |

|---|---|---|

| Regulatory Compliance | Adherence to EU Green Deal and other environmental standards | EU climate targets for 2030 |

| Waste Management | Reducing single-use plastics, optimizing recycling | 15% reduction in single-use plastics (Europe, 2024); Target 25% by end of 2025 |

| Energy Efficiency | Investing in energy-efficient lighting and smart systems | 10% decrease in per-store energy usage (2024) |

| Sustainable Sourcing | Supplier Code of Conduct, audits, traceability | Audits on 85% of key suppliers (2024) |

| Consumer Demand | Offering eco-friendly products and services | >60% of travelers willing to pay more for sustainable options (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Avolta is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. This ensures that every aspect, from economic indicators to technological advancements, is grounded in accurate and current information.