Aurubis SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurubis Bundle

Aurubis, a leading global provider of non-ferrous metals, boasts significant strengths in its integrated business model and strong market position. However, understanding its vulnerabilities, like exposure to commodity price fluctuations, and capitalizing on opportunities, such as the growing demand for copper in e-mobility, is crucial for strategic success.

Want the full story behind Aurubis’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aurubis stands as a titan in the global non-ferrous metals sector, a position solidified by its extensive market reach and widely recognized brand. This leadership isn't just about size; it grants Aurubis the power to shape industry benchmarks and leverage significant economies of scale, making its operations highly efficient.

The company’s vast network of suppliers and customers, cultivated over years of reliable service, provides a crucial competitive advantage. In 2024, Aurubis reported revenues of approximately €17.5 billion, underscoring its substantial market footprint and operational capacity within this demanding industry.

Aurubis's position as the world's largest copper recycler is a powerful asset, directly addressing the increasing global emphasis on sustainability and the circular economy. This leadership in recycling not only caters to market demand for environmentally conscious products but also provides a stable and often more economical source of raw materials, lessening dependence on volatile primary mining operations.

Aurubis's strength lies in its extensive diversification of raw material processing, handling a broad spectrum of complex metal concentrates, scrap metals, and various metal-bearing recycling materials. This wide input base significantly reduces reliance on any single material source, offering resilience against supply chain disruptions and market volatility. For instance, in fiscal year 2023, Aurubis processed approximately 1.3 million tonnes of copper concentrates and around 1.2 million tonnes of copper-containing recycling materials, demonstrating its capacity to manage diverse feedstocks.

High-Quality Product Portfolio

Aurubis distinguishes itself with a portfolio of high-quality metals, notably copper cathodes, continuous cast rod, and various shapes. These premium products are essential for demanding industries, including electronics, construction, and automotive manufacturing. For instance, in fiscal year 2023, Aurubis reported a significant contribution from its refined products segment, underscoring the market's reliance on its consistent output.

This unwavering commitment to quality fosters robust customer loyalty and allows Aurubis to command favorable pricing. The company's emphasis on purity and performance in its copper products, for example, directly translates into stronger demand and a competitive edge. This focus is critical in sectors where material integrity is paramount for final product reliability.

- Premium Product Focus: Aurubis specializes in high-purity copper cathodes, continuous cast rod, and shapes.

- Key Market Demand: Products cater to critical sectors like electronics, construction, and automotive.

- Customer Loyalty & Pricing: Consistent quality drives strong customer relationships and favorable market pricing.

- Fiscal Year 2023 Performance: Refined products segment showed significant contribution, highlighting market reliance.

Strong Focus on Circular Economy

Aurubis's business model is deeply rooted in extensive recycling operations, showcasing a significant commitment to the circular economy. This strategic emphasis on recycling is not just about environmental stewardship; it builds a robust supply chain that is less vulnerable to fluctuations in the availability of primary raw materials. For instance, in fiscal year 2023/24, Aurubis processed a record 960,000 tonnes of recycled copper-bearing materials, a testament to its recycling prowess.

This dedication to circularity positions Aurubis favorably in the evolving industrial landscape. By championing sustainable practices, the company attracts investors and partners who prioritize environmental, social, and governance (ESG) principles. This focus is becoming increasingly critical, as evidenced by the growing demand for responsibly sourced metals. Aurubis's ability to recover valuable metals from complex waste streams, such as printed circuit boards and industrial residues, further solidifies its leadership in this area.

Key aspects of Aurubis's circular economy strengths include:

- Leading Recycling Capacity: Processing substantial volumes of complex recycled materials annually.

- Resource Security: Reduced reliance on primary mining through efficient secondary material utilization.

- ESG Appeal: Strong attractiveness to investors focused on sustainability and responsible sourcing.

- Innovation in Recycling: Continuous development of advanced technologies to process diverse waste streams.

Aurubis's primary strength lies in its dominant market position as the world's largest copper recycler and a leading global smelter and refiner. This scale allows for significant cost efficiencies and market influence. The company's strategic focus on high-quality, refined metal products like copper cathodes and continuous cast rod, essential for industries such as electronics and automotive, ensures consistent demand and premium pricing. In fiscal year 2023, Aurubis processed approximately 1.2 million tonnes of copper-containing recycling materials, highlighting its recycling prowess and contribution to a circular economy, which is increasingly valued by investors and customers alike.

| Metric | Value (FY 2023/2024) | Significance |

|---|---|---|

| Copper Concentrates Processed | ~1.3 million tonnes | Demonstrates significant raw material processing capacity. |

| Copper-Recycling Materials Processed | ~1.2 million tonnes | Underlines leadership in circular economy and resource security. |

| Reported Revenues | ~€17.5 billion (2024) | Indicates substantial market footprint and operational scale. |

What is included in the product

Maps out Aurubis’s market strengths, operational gaps, and risks by detailing its leading position in copper and its recycling capabilities, while also acknowledging potential vulnerabilities in raw material sourcing and market volatility.

Simplifies complex market dynamics, offering a clear path to address Aurubis's competitive challenges.

Weaknesses

Aurubis's profitability is heavily tied to the unpredictable swings in copper and other non-ferrous metal prices. Even with hedging, a sharp decline in these commodity markets can significantly shrink profit margins, as seen in periods of economic downturn. This inherent volatility complicates financial forecasting and introduces a level of instability into Aurubis's earnings. For instance, in the first half of fiscal year 2023/24, the average LME copper price hovered around $8,500 per tonne, a level susceptible to rapid shifts.

Aurubis's smelting and refining operations are inherently energy-hungry, leaving the company vulnerable to fluctuations in global energy prices. In 2023, energy costs represented a significant portion of Aurubis's operating expenses. This reliance on energy means that increases in electricity and natural gas prices directly impact profitability, particularly when the energy market is volatile.

These high energy demands also pose a hurdle for Aurubis in achieving its ambitious decarbonization goals. The company's commitment to reducing its carbon footprint is challenged by the energy-intensive nature of its core processes, requiring substantial investment in energy efficiency and alternative energy sources to meet sustainability targets.

Aurubis operates within a sector heavily impacted by environmental regulations, facing increasing pressure regarding emissions, waste, and resource management. For instance, in 2023, the company reported significant investments in sustainability initiatives, with a focus on reducing its environmental footprint, though specific figures for compliance-driven capital expenditures are often embedded within broader sustainability budgets.

Adhering to these complex rules demands considerable financial outlay for facility upgrades and sustained operational expenses. Failure to comply can result in substantial penalties and significant damage to Aurubis's public image, as seen in past environmental incidents within the broader metals industry which have led to multi-million euro fines.

The constantly shifting regulatory environment, especially concerning carbon emissions, presents an ongoing hurdle. Aurubis, like many industrial players, must continuously adapt its processes and invest in cleaner technologies to meet evolving standards, such as those being introduced or tightened in the EU's Green Deal framework.

Dependence on Scrap Metal Availability and Quality

Aurubis's reliance on scrap metal for its recycling operations, while a core strength, also introduces a significant weakness. The availability and quality of this scrap can fluctuate, directly impacting operational efficiency and the overall metal recovery rates. For instance, in fiscal year 2023/24, Aurubis navigated challenges related to the availability of certain high-quality scrap streams, which necessitated adjustments in their processing strategies to maintain optimal output.

This variability in input material means that securing a consistent supply of high-grade scrap is paramount. Aurubis must maintain robust sourcing networks and invest in advanced processing technologies to mitigate the risks associated with lower-quality inputs. The company's ability to adapt to these market dynamics is crucial for maintaining its competitive edge in the copper recycling sector.

The potential for lower-grade scrap materials to enter the supply chain can lead to reduced yields and increased processing costs. This necessitates continuous improvement in sorting and refining techniques. Aurubis's commitment to innovation in recycling processes is therefore a key factor in overcoming this inherent weakness and ensuring high recovery rates for valuable metals.

Key considerations for managing this weakness include:

- Supply Chain Volatility: Managing fluctuations in the availability of specific scrap metal grades.

- Quality Control: Implementing stringent measures to ensure incoming scrap meets processing standards.

- Technological Investment: Continuously upgrading processing capabilities to handle diverse scrap compositions.

- Sourcing Diversification: Expanding and strengthening relationships with scrap suppliers globally.

Capital-Intensive Operations

Aurubis's core operations in metal production and recycling are inherently capital-intensive. The company needs substantial investments in sophisticated plants, advanced machinery, and cutting-edge technology to remain efficient and competitive in the global market. For instance, significant capital expenditure is allocated annually for plant maintenance and upgrades, crucial for ensuring operational continuity and meeting environmental standards. In 2023, Aurubis reported capital expenditures of €436 million, highlighting the ongoing need for investment in its asset base.

This high level of capital expenditure can constrain Aurubis's financial flexibility, potentially limiting its ability to pursue other strategic growth opportunities or respond swiftly to market shifts. The continuous need to maintain and modernize its extensive facilities, which include smelters and recycling plants across Europe and North America, represents a persistent financial commitment. Access to capital markets is therefore vital for funding these ongoing requirements and future expansion projects.

- Significant Investment Needs: Metal production and recycling demand substantial capital for plants, machinery, and technology.

- Financial Flexibility Constraints: High capital expenditure can limit funds available for other investments or growth strategies.

- Constant Need for Upgrades: Maintaining competitive and compliant facilities requires ongoing financial commitment.

- Reliance on Capital Markets: Consistent access to funding is essential for operational continuity and expansion.

Aurubis's profitability is highly sensitive to the volatile prices of copper and other non-ferrous metals. Fluctuations in these commodity markets, even with hedging strategies, can significantly impact profit margins, as demonstrated by periods of economic downturn. This inherent market volatility makes financial forecasting challenging and introduces earnings instability. For example, in the first half of fiscal year 2023/24, the average LME copper price was around $8,500 per tonne, a level prone to rapid changes.

The company's energy-intensive smelting and refining operations make it susceptible to global energy price swings. In 2023, energy costs constituted a substantial portion of Aurubis's operating expenses, directly affecting profitability when energy markets are unstable. Furthermore, these high energy demands present a significant challenge to Aurubis's decarbonization targets, requiring substantial investment in energy efficiency and alternative sources to meet sustainability goals.

Aurubis faces increasing pressure from stringent environmental regulations concerning emissions, waste, and resource management. Compliance necessitates significant capital for facility upgrades and ongoing operational costs, with potential for substantial penalties and reputational damage for non-compliance. The evolving regulatory landscape, particularly regarding carbon emissions under frameworks like the EU's Green Deal, requires continuous adaptation and investment in cleaner technologies.

The reliance on scrap metal for recycling, while a strength, also introduces volatility in the availability and quality of input materials. This directly impacts operational efficiency and metal recovery rates. In fiscal year 2023/24, Aurubis encountered challenges with the supply of certain high-quality scrap, prompting adjustments in processing strategies to maintain optimal output. Lower-grade scrap can lead to reduced yields and increased processing costs, emphasizing the need for continuous investment in sorting and refining technologies.

Aurubis's operations are capital-intensive, requiring substantial investment in sophisticated plants, machinery, and technology to remain competitive. In 2023, capital expenditures amounted to €436 million, underscoring the ongoing need for asset base investment. This high level of capital expenditure can limit financial flexibility, potentially hindering the pursuit of growth opportunities or swift responses to market shifts. Consistent access to capital markets is therefore crucial for funding these ongoing requirements and future expansion.

Preview the Actual Deliverable

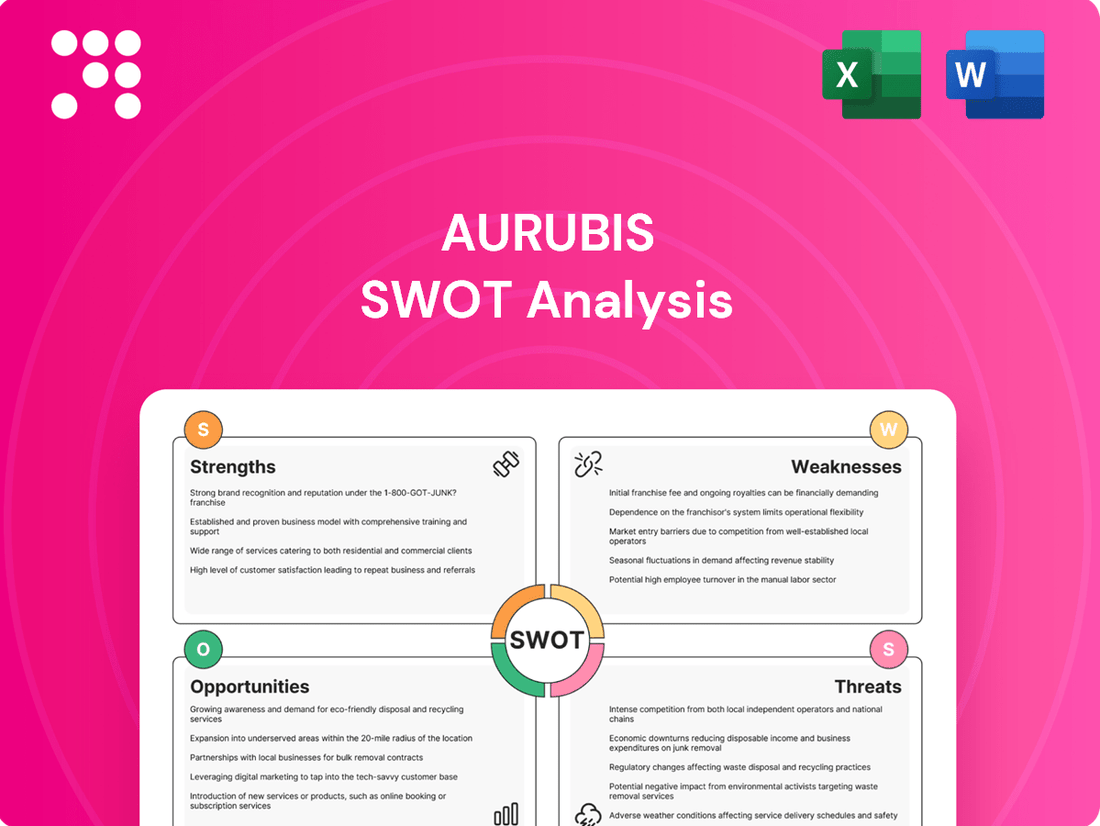

Aurubis SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Aurubis SWOT analysis, providing a clear understanding of its strengths, weaknesses, opportunities, and threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of Aurubis' strategic position.

Opportunities

The global transition to greener energy is a major tailwind for copper. Think about all the electric vehicles (EVs), wind turbines, and solar panels needed – they all require significant amounts of copper. For instance, an EV can use up to four times more copper than a traditional gasoline car. This surge in demand is projected to continue, with the International Energy Agency (IEA) forecasting a near doubling of copper demand for clean energy technologies by 2030 compared to 2020 levels.

Aurubis, being one of the world's leading copper producers and recyclers, is perfectly positioned to benefit from this trend. Their integrated approach, from mining to recycling, allows them to supply this essential metal efficiently. The company’s extensive recycling operations are particularly advantageous, as they can tap into secondary sources to meet the rising demand, offering a more sustainable supply chain.

This growing market for copper in green technologies presents a substantial long-term growth opportunity for Aurubis. The company's strategic investments in expanding its production and recycling capacities are aligned with this increasing demand. Analysts project continued robust demand for copper in the coming years, driven by government policies and consumer adoption of sustainable technologies, offering a strong growth trajectory for Aurubis's core business.

Growing global emphasis on sustainability and stringent environmental regulations present a significant opportunity for Aurubis to bolster its recycling segment. Many nations are enacting policies that mandate higher recycling rates and the use of recycled materials, directly benefiting Aurubis's established recycling infrastructure and expertise.

The increasing push for a circular economy is expanding the availability of valuable scrap materials, such as copper and other metals, which are crucial feedstocks for Aurubis. For instance, by 2025, the European Union aims to increase its recycling rate for certain metal streams, potentially providing Aurubis with a larger and more consistent supply of raw materials.

Continuous innovation in hydrometallurgy and pyrometallurgy offers Aurubis significant opportunities to boost efficiency and cut costs. For instance, advancements in hydrometallurgical processes can lead to higher recovery rates for critical metals like copper and zinc, potentially increasing Aurubis's output from existing waste streams or lower-grade ores. This focus on technological improvement directly translates to a stronger competitive edge.

Investing in cutting-edge research and development is key to unlocking higher yields and minimizing environmental impact. Emerging technologies in bioleaching and electrometallurgy, for example, could allow Aurubis to process complex materials previously considered uneconomical. By embracing these innovations, Aurubis can enhance its profitability and secure a more sustainable operational future.

Diversification into Other Critical Metals

Aurubis can leverage its advanced processing capabilities to extract a wider array of valuable metals beyond copper from complex recycling streams. This includes metals like nickel, tin, lead, gold, silver, and platinum group metals, which are increasingly in demand for various industrial applications. For instance, the growing electric vehicle market is a significant driver for nickel and platinum group metals.

Expanding into these additional critical metals offers a substantial opportunity to diversify Aurubis's revenue sources and strengthen its product portfolio. By utilizing its existing infrastructure and deep metallurgical expertise, the company can tap into new markets and capture additional value from recycled materials. This strategic move aligns with the global trend towards a circular economy and the increasing importance of resource efficiency.

- Nickel: Demand for nickel in EV batteries is projected to grow significantly, with the global nickel market expected to reach approximately $44.7 billion by 2027.

- Precious Metals: Aurubis already recovers significant amounts of gold and silver, contributing to its profitability. In fiscal year 2023/24, Aurubis reported a substantial recovery of precious metals, underscoring this existing strength.

- Platinum Group Metals (PGMs): PGMs are crucial for catalytic converters and other industrial processes, with a growing emphasis on their recovery from end-of-life products.

Strategic Partnerships and Acquisitions

Aurubis can bolster its market position and operational efficiency by forging strategic alliances with technology innovators and waste management firms. These partnerships can streamline recycling processes and secure vital raw material streams, crucial for meeting the increasing demand for copper and its by-products. For instance, a collaboration with a leading battery recycling technology firm could significantly enhance Aurubis’s capacity to process end-of-life electric vehicle batteries, a rapidly growing market segment.

Acquisitions present another avenue for growth, allowing Aurubis to gain immediate access to new markets, advanced processing technologies, or critical raw material reserves. By acquiring smaller, specialized recycling companies or even competitors, Aurubis can achieve greater economies of scale and consolidate its influence in key geographical regions. This strategy was evident in Aurubis’s 2022 acquisition of a 75% stake in the recycling company Metallo, which expanded its portfolio of complex recycling materials and strengthened its European footprint.

- Access to New Markets: Partnerships can open doors to previously untapped customer bases or geographic regions, particularly in emerging markets for recycled metals.

- Enhanced Operational Capabilities: Collaborating with technology providers can lead to the adoption of more efficient and sustainable processing methods, improving yield and reducing environmental impact.

- Raw Material Security: Alliances with waste management companies or other primary producers can ensure a more stable and predictable supply of raw materials, mitigating price volatility and supply chain disruptions.

- Market Consolidation: Strategic acquisitions can lead to greater market share, increased pricing power, and synergistic cost savings through economies of scale.

The global shift towards electrification and renewable energy sources significantly boosts demand for copper, a critical component in EVs, wind turbines, and solar panels. Aurubis is well-positioned to capitalize on this trend due to its integrated production and recycling capabilities, meeting the rising demand for this essential metal.

Aurubis's strong recycling segment is a key opportunity, supported by increasing global sustainability focus and stricter environmental regulations that encourage the use of recycled materials. The company's advanced processing technologies, including innovations in hydrometallurgy and pyrometallurgy, offer pathways to enhance efficiency, reduce costs, and increase metal recovery rates.

Expanding its portfolio to include other valuable metals like nickel, precious metals, and platinum group metals (PGMs) from recycling streams presents a diversification opportunity for Aurubis. Strategic partnerships and acquisitions further bolster its market position, providing access to new technologies, raw material sources, and enhanced operational capabilities.

Threats

The non-ferrous metals sector is fiercely competitive, with established giants and emerging players constantly battling for market dominance. Aurubis faces this reality daily, as companies with lower production costs or preferential access to essential raw materials can undercut pricing and erode profit margins.

For instance, in 2023, global copper production saw significant growth, with major players like Codelco and Glencore reporting robust output, intensifying the supply-demand dynamics. This heightened competition means Aurubis must consistently invest in technological advancements and streamline its operations to remain a cost-effective producer.

Aurubis faces the threat of increasingly stringent environmental regulations, particularly concerning carbon emissions. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which started its transitional phase in October 2023, could impose costs on imported materials with high embedded carbon. This means Aurubis, as a major copper producer, must manage its own carbon footprint closely to remain competitive, as stricter emission limits and potential carbon pricing mechanisms in key markets could elevate operational expenses.

Compliance with these evolving climate policies necessitates significant capital expenditure. Aurubis has already committed to substantial investments in decarbonization, aiming to reduce its Scope 1 and Scope 2 greenhouse gas emissions by 21% by 2030 compared to the 2019 baseline. Further tightening of regulations may require even greater investment in advanced smelting technologies and renewable energy sources, potentially impacting profitability if costs cannot be passed on to customers.

Failure to adapt proactively to these environmental mandates poses a considerable risk. Companies that lag in emissions reduction may face competitive disadvantages, potentially losing market share to more sustainable competitors. Moreover, non-compliance with stricter environmental standards could result in hefty fines and penalties, further eroding financial performance and damaging Aurubis's reputation in an increasingly environmentally conscious market.

Aurubis's extensive global operations and reliance on diverse raw material sources make it susceptible to geopolitical tensions and trade policy shifts. For instance, ongoing conflicts and the potential for new trade barriers in key sourcing regions could disrupt the flow of essential inputs like copper concentrate, impacting production volumes.

Events such as the lingering effects of the COVID-19 pandemic on logistics or unforeseen natural disasters in mining regions can create significant bottlenecks in both raw material acquisition and the delivery of finished copper products. This vulnerability was highlighted in early 2024 when shipping disruptions in the Red Sea led to increased transit times and costs for various industries, a risk Aurubis must actively manage.

Volatile Energy Market and Increasing Costs

Aurubis faces a substantial threat from the ongoing volatility in global energy markets. Geopolitical tensions, supply chain disruptions, and evolving energy policies can lead to unpredictable price swings, directly impacting operational costs. For instance, the European energy crisis in 2022 saw significant price hikes, which, while potentially easing, remain a persistent concern for energy-intensive industries like copper smelting.

Sustained high energy prices pose a direct risk to Aurubis's profit margins. The production of metals is inherently energy-intensive, meaning that increases in electricity and natural gas costs can disproportionately affect profitability. As of early 2024, while some energy prices have stabilized compared to their 2022 peaks, they remain elevated compared to historical averages, necessitating continuous cost management.

To mitigate these risks, Aurubis must continue to focus on robust energy management strategies. This includes optimizing energy consumption within its facilities and exploring long-term supply agreements. Furthermore, strategic investments in renewable energy sources, such as solar and wind power, are crucial for reducing reliance on volatile fossil fuel markets and securing more predictable energy costs in the future.

- Geopolitical Instability: Events like the ongoing conflict in Eastern Europe continue to create uncertainty in global energy supply and pricing.

- Rising Energy Costs: In 2023, industrial electricity prices in key European markets where Aurubis operates remained significantly higher than pre-crisis levels, impacting operational expenditures.

- Transition to Renewables: While a long-term solution, the initial investment and integration of renewable energy sources require substantial capital outlay, posing a short-term financial challenge.

- Supply Chain Vulnerabilities: Disruptions in the global energy supply chain, whether due to infrastructure issues or political factors, can lead to unexpected price spikes and availability concerns.

Technological Obsolescence and Innovation Lag

Aurubis faces the significant threat of technological obsolescence. Rapid advancements in metallurgical processes and recycling technologies mean that if the company doesn't keep pace, its current methods could become less efficient or even unprofitable. For instance, the global copper cathode market saw prices fluctuate, with LME prices averaging around $8,500 per tonne in early 2024, highlighting the need for cost-effective production to remain competitive.

A lag in adopting newer, more efficient, or environmentally conscious technologies could put Aurubis at a disadvantage. This might translate into higher production costs or lower recovery rates when compared to competitors who have successfully integrated cutting-edge solutions. For example, the increasing demand for high-purity copper, essential for electric vehicle batteries and renewable energy infrastructure, necessitates advanced refining techniques that might not be standard in older plants.

To counter this, continuous investment in research and development and the upgrading of existing processes are absolutely vital. This proactive approach is key to maintaining Aurubis's competitive edge in a rapidly evolving industry. The company's commitment to innovation, as seen in its ongoing projects for expanding recycling capabilities, is crucial for navigating these technological shifts.

- Technological Obsolescence: Failure to innovate in metallurgical and recycling processes could make current operations less efficient.

- Innovation Lag Impact: Slower adoption of new technologies may lead to higher costs and reduced recovery rates versus competitors.

- R&D Investment: Continuous investment in research and development is essential to mitigate the threat of becoming outdated.

- Competitive Landscape: Competitors adopting advanced technologies, like those for high-purity copper production, pose a direct challenge.

Aurubis faces intense competition from established players and emerging companies, particularly those with lower production costs or better raw material access, which can pressure profit margins. For instance, in 2023, global copper production saw substantial growth from major producers, intensifying supply-demand dynamics and requiring Aurubis to focus on efficiency.

Increasingly strict environmental regulations, such as the EU's Carbon Border Adjustment Mechanism (CBAM) which began its transitional phase in October 2023, pose a significant threat by potentially increasing costs for imported materials with high embedded carbon. Aurubis's commitment to reducing its greenhouse gas emissions by 21% by 2030 (vs. 2019 baseline) highlights the capital expenditure required to comply with evolving climate policies.

Geopolitical instability and shifts in trade policies can disrupt raw material supply chains and increase logistics costs, as seen with shipping disruptions in the Red Sea in early 2024 affecting transit times and expenses. Similarly, volatility in global energy markets, with industrial electricity prices in key European markets remaining elevated in 2023 compared to pre-crisis levels, directly impacts Aurubis's energy-intensive operations.

The threat of technological obsolescence is also present, as rapid advancements in metallurgical and recycling processes require continuous investment in R&D and plant upgrades to maintain efficiency and competitiveness, especially with growing demand for high-purity copper.

SWOT Analysis Data Sources

This Aurubis SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and insights from industry experts. These diverse sources ensure a well-rounded and accurate assessment of Aurubis's current standing and future potential.