Aurubis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurubis Bundle

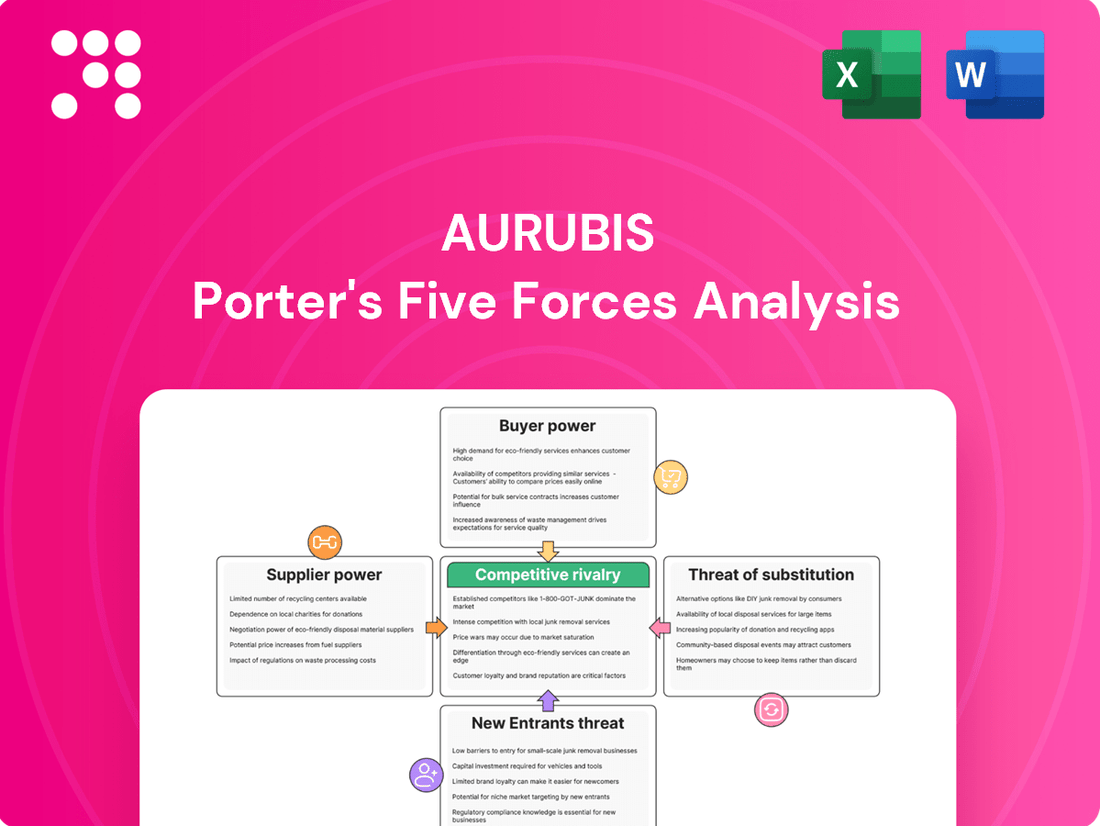

Aurubis, a leading copper producer, navigates a complex landscape shaped by intense rivalry and significant buyer power. Understanding these forces is crucial for any stakeholder. The full Porter's Five Forces Analysis delves into the intricate details of Aurubis's competitive environment, revealing the true pressures and opportunities that define its market position.

Ready to move beyond the basics? Get a full strategic breakdown of Aurubis’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The bargaining power of suppliers to Aurubis is significantly shaped by the concentration within its key raw material markets, particularly copper concentrates and various scrap metals. A situation where only a few large suppliers dominate these essential inputs grants them considerable leverage. This leverage can translate into their ability to dictate higher prices or less favorable payment terms, especially when Aurubis requires high-quality or specialized grades of these materials.

The uniqueness and criticality of Aurubis's input materials significantly influence supplier bargaining power. Aurubis relies heavily on complex metal concentrates and specific types of scrap for its operations. For instance, the availability of certain high-grade copper concentrates or specialized electronic scrap, which requires intricate processing, can be limited. This scarcity, coupled with the specialized nature of these materials, grants suppliers of such inputs greater leverage. Aurubis's strategic focus on processing complex recycling materials, as demonstrated by its significant recycling volumes, further emphasizes the importance of these unique inputs and the power held by their suppliers.

The bargaining power of suppliers for Aurubis is influenced by switching costs. These costs can include the expense and complexity of changing logistics, renegotiating existing contracts, and potentially adapting processing methods to accommodate new raw material sources. If these switching costs are substantial, it naturally strengthens the hand of Aurubis's suppliers.

Aurubis actively seeks to establish long-term contracts with its suppliers. This strategy is crucial for ensuring a stable and predictable supply of essential raw materials, thereby mitigating the risk of supply disruptions and providing a degree of cost certainty. For instance, in 2023, Aurubis secured a significant multi-year contract for copper concentrates, underscoring its commitment to long-term supplier relationships.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Aurubis's core business of refining and processing metals significantly bolsters their bargaining power. This means if a supplier could credibly start doing what Aurubis does, they have more leverage in their dealings with Aurubis.

While this threat is generally less pronounced for a broad base of scrap metal suppliers, it could become a more significant consideration if large mining companies, who supply concentrates, were to consider such a move. Aurubis, however, does not currently have ownership stakes in mining operations, which mitigates this specific risk.

For instance, in 2024, the global copper concentrate market saw significant activity, with major mining players like Codelco reporting substantial production volumes. Should any of these large producers decide to invest in their own refining capabilities, it could directly impact Aurubis's supply chain dynamics and pricing power.

The bargaining power of suppliers is thus influenced by their potential to capture more value downstream:

- Forward Integration Threat: Suppliers moving into refining or processing increases their leverage over Aurubis.

- Scrap vs. Concentrate Suppliers: The threat is lower for diverse scrap suppliers compared to large concentrate providers.

- Aurubis's Mine Ownership: Aurubis's lack of direct stakes in mines limits the likelihood of mining suppliers integrating forward.

- Market Dynamics: Shifts in concentrate markets, like those seen in 2024, can influence supplier integration strategies.

Availability of Substitutes for Inputs

The availability of substitutes for the raw materials Aurubis uses significantly influences supplier bargaining power. If Aurubis can easily switch between different types of copper scrap or alternative metal inputs, suppliers offering specific grades or sources of these materials will have less leverage. For instance, Aurubis's substantial recycling operations, which processed approximately 1.1 million tonnes of recycling materials in fiscal year 2023, demonstrate a degree of flexibility in sourcing inputs. This flexibility inherently limits the power of any single supplier.

Aurubis's ability to process a diverse range of input materials, including various grades of copper scrap, electric arc furnace dust, and other metal-bearing residues, directly mitigates supplier power. This broad processing capability means that if one supplier of a particular scrap grade becomes too demanding, Aurubis can often shift its sourcing to alternative suppliers or different material compositions. This adaptability is a key factor in maintaining competitive input costs.

- Input Flexibility: Aurubis's capacity to process a wide array of recycling materials, such as copper scrap and industrial residues, reduces reliance on any single supplier.

- Market Dynamics: The presence of multiple scrap suppliers and the potential for substituting different material grades limit the pricing power of individual suppliers.

- Cost Management: By diversifying its input sources and grades, Aurubis can more effectively manage its raw material costs, a critical factor in its profitability.

- Operational Resilience: The ability to substitute inputs enhances Aurubis's operational resilience, ensuring a consistent supply chain even when specific material streams face temporary disruptions or price volatility.

The bargaining power of Aurubis's suppliers is moderate, influenced by the concentration in copper concentrate markets and the specialized nature of some recycling materials. While large mining companies supplying concentrates can exert significant influence, Aurubis's broad processing capabilities for diverse scrap materials and its long-term contracts help to balance this power. The threat of forward integration by suppliers exists but is mitigated by Aurubis's lack of mine ownership.

| Factor | Impact on Aurubis's Supplier Bargaining Power | Supporting Data/Context |

|---|---|---|

| Supplier Concentration (Copper Concentrates) | High | Few dominant mining players in the global concentrate market. For example, Codelco's substantial production in 2024 highlights this concentration. |

| Uniqueness/Criticality of Inputs (Specialized Scrap) | Moderate to High | Aurubis's reliance on specific grades of electronic scrap or complex residues for its advanced recycling processes. |

| Switching Costs | Moderate | Costs associated with changing logistics, renegotiating contracts, or adapting processing for new material sources. |

| Availability of Substitutes (Scrap Materials) | Low to Moderate | Aurubis processed approximately 1.1 million tonnes of recycling materials in FY2023, demonstrating flexibility and reducing reliance on single sources. |

| Threat of Forward Integration | Low to Moderate | Limited by Aurubis's lack of mine ownership. A hypothetical move by concentrate suppliers into refining could increase this threat. |

What is included in the product

This analysis delves into the competitive forces impacting Aurubis, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the copper and precious metals markets.

Quickly assess competitive intensity across all five forces with a visual, easy-to-understand dashboard.

Customers Bargaining Power

Customer concentration significantly impacts Aurubis's bargaining power. If a small number of major clients represent a large chunk of Aurubis's revenue, these customers gain considerable leverage to demand lower prices or more favorable payment terms. This is a key consideration for Aurubis as it navigates its diverse customer base.

Aurubis supplies essential materials to a wide array of industries, including the fast-paced electronics sector, the ever-evolving automotive industry, and the foundational construction market. This diversification helps mitigate the risk of over-reliance on any single customer segment, but the concentration within those segments still matters.

The costs and complexities customers face when moving from Aurubis to a competitor significantly shape their bargaining power. When these switching costs are low, customers naturally gain more leverage. For instance, Aurubis's focus on high-quality metals and its engagement in long-term supply agreements, such as those with Prysmian, indicate a strategic intent to foster customer loyalty and consequently, elevate these switching costs.

Customers' price sensitivity is a major driver of their bargaining power. When the cost of copper and other metals forms a substantial portion of a customer's end product, they are naturally inclined to seek lower prices. For instance, in 2023, Aurubis reported that the average realized premium for its standard copper cathodes was €119 per tonne, a figure that directly influences the cost structure for many of its industrial clients.

Threat of Backward Integration by Customers

Customers' potential to integrate backward, meaning they could start producing their own non-ferrous metals or manage their own scrap recycling, significantly boosts their bargaining power. This capability puts pressure on Aurubis by offering customers an alternative to purchasing from the company.

While direct backward integration into complex refining processes is rare for most customers, large-scale manufacturers who are consistent buyers of Aurubis's products might consider such a move if faced with persistently elevated supplier prices. For instance, a major automotive manufacturer, a significant consumer of copper, might explore setting up its own smaller-scale recycling facilities to secure a more stable and potentially cheaper supply of recycled copper feedstock, thereby reducing its reliance on external suppliers like Aurubis.

- Customer Threat of Backward Integration: Customers can gain leverage by producing their own non-ferrous metals or recycling scrap.

- Impact on Aurubis: This reduces customer dependence, potentially leading to lower sales volumes or price concessions for Aurubis.

- Example: Large manufacturers, like those in the automotive sector, might invest in scrap recycling to control costs and supply, especially if Aurubis's pricing is perceived as high.

- 2024 Context: The increasing focus on circular economy principles and sustainability in 2024 encourages more companies to consider in-house recycling solutions, amplifying this threat.

Product Differentiation

The extent to which Aurubis can differentiate its copper products significantly influences customer bargaining power. When Aurubis offers unique features, such as exceptionally high purity levels or specialized alloys tailored for specific industrial applications like advanced electronics or aerospace, customers find it harder to switch to competitors without sacrificing performance or incurring higher costs. This differentiation reduces their ability to negotiate for lower prices because the value proposition is distinct.

Aurubis actively promotes its commitment to high-quality metals and sustainable production practices. For instance, in 2023, the company reported a significant portion of its energy consumption being covered by renewable sources, a factor increasingly valued by downstream manufacturers seeking to improve their own sustainability credentials. This focus on quality and sustainability can create a stronger brand loyalty and make customers less sensitive to price alone, thereby mitigating their bargaining power.

- Product Uniqueness: Aurubis's ability to produce specialized copper alloys and high-purity copper for demanding sectors like automotive and renewable energy limits customer options.

- Quality Assurance: Consistent high quality and stringent testing procedures for its products, such as those used in electrical wiring and plumbing, reduce the perceived substitutability by competitors.

- Sustainability Focus: Aurubis's investment in sustainable mining and recycling processes, which accounted for a substantial percentage of its raw material input in 2023, appeals to environmentally conscious customers.

- Brand Reputation: A strong reputation for reliability and product performance built over decades makes customers more hesitant to switch to less established suppliers, even if they offer slightly lower prices.

Customer concentration, the degree of product differentiation, and the costs associated with switching suppliers all significantly influence the bargaining power of Aurubis's customers. When a few large customers account for a substantial portion of sales, they can demand better terms. Similarly, if Aurubis's products are highly specialized and difficult for customers to source elsewhere, their power is diminished. High switching costs, such as those incurred by integrating Aurubis's materials into complex manufacturing processes, also reduce customer leverage.

In 2023, Aurubis reported that its standard copper cathode premiums averaged €119 per tonne, indicating a baseline price that customers are sensitive to. The company's strategic focus on high-quality, sustainable products, exemplified by its significant use of renewable energy sources in 2023, aims to increase customer loyalty and thus reduce their price sensitivity and bargaining power. This is crucial as customers in sectors like automotive and electronics often have tight cost controls.

The threat of backward integration, where customers might produce their own materials or manage their own recycling, is a growing concern. By 2024, the emphasis on circular economy principles is encouraging more companies to explore in-house recycling solutions. For instance, a large automotive manufacturer might invest in scrap processing to secure a more stable and potentially cost-effective supply of copper, thereby lessening its dependence on external suppliers like Aurubis.

| Factor | Impact on Aurubis | Example | 2024 Trend |

|---|---|---|---|

| Customer Concentration | High concentration increases customer leverage. | A few major electronics manufacturers buying large volumes. | Ongoing consolidation in customer industries may increase concentration. |

| Switching Costs | High switching costs reduce customer bargaining power. | Integrating Aurubis's specialized alloys into automotive production. | Technological advancements can sometimes lower switching costs. |

| Product Differentiation | Unique products decrease customer power. | Aurubis's high-purity copper for sensitive electronic components. | Demand for specialized, high-performance materials is growing. |

| Price Sensitivity | High sensitivity increases customer bargaining power. | Copper costs being a significant portion of a customer's final product cost. | Inflationary pressures in 2023-2024 have heightened price sensitivity. |

| Backward Integration Threat | Potential for customers to produce their own materials. | Automotive firms investing in copper scrap recycling facilities. | Increased focus on sustainability and supply chain control. |

Full Version Awaits

Aurubis Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Aurubis' competitive landscape, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes. This comprehensive Porter's Five Forces analysis provides actionable insights into Aurubis' strategic positioning and potential challenges.

Rivalry Among Competitors

The non-ferrous metals market, especially for copper and its recycling, is characterized by intense competition. A mix of large global corporations, significant regional players, and niche specialists creates a highly rivalrous environment.

Aurubis, a major global copper producer and one of the world's largest copper recyclers, navigates this landscape alongside formidable competitors such as Glencore, Boliden, and Wieland Group. For instance, in 2023, Glencore reported revenues of approximately $216 billion, highlighting the scale of the players Aurubis competes against.

The non-ferrous metals market's growth trajectory significantly shapes competitive rivalry. As demand for key metals like copper surges, fueled by the electric vehicle revolution and renewable energy infrastructure, companies are vying for position.

However, periods of decelerating growth or market oversupply can dramatically escalate competition. In such scenarios, firms intensify their efforts to capture market share, often leading to price pressures and more aggressive strategic moves among industry players.

For instance, while the global copper market was anticipated to see a deficit in 2024, leading to potentially tighter supply and stronger pricing, shifts in demand or production could quickly alter this dynamic, intensifying rivalry.

In the copper cathode market, where products are largely standardized, competition often centers on price. However, Aurubis carves out a competitive edge by emphasizing its robust recycling operations and commitment to sustainable production. This focus on quality and ethical sourcing helps build strong customer relationships, fostering loyalty even in a price-sensitive environment.

Exit Barriers

High exit barriers in the non-ferrous metals sector, exemplified by the substantial capital required for smelters and recycling facilities, can indeed fuel competitive rivalry. Companies find themselves tethered to the market, even when facing unfavorable economic conditions, due to these significant sunk costs.

Aurubis, a major player, is a prime example of this dynamic. The company has considerable fixed assets, including its extensive network of smelters and processing plants. For instance, Aurubis's Hamburg smelter represents a massive investment in specialized infrastructure.

Furthermore, Aurubis's commitment to ongoing large-scale investment projects, such as its expansion and modernization efforts in various European locations, further entrenches its position and raises the stakes for any potential competitor considering an exit. These investments solidify their operational base, making withdrawal exceptionally costly.

- High Capital Investment: The non-ferrous metals industry demands significant upfront capital for specialized equipment like smelters and advanced recycling plants, creating substantial financial commitments.

- Sunk Costs: Once invested, these assets are difficult to repurpose or sell, leading companies to persevere through market downturns rather than incur substantial losses on asset disposal.

- Aurubis's Fixed Assets: Aurubis operates with a large base of fixed assets, including its integrated production sites, which represent significant sunk costs and discourage market exit.

- Ongoing Investment: Aurubis's continuous investment in new technologies and capacity expansions, such as its recent projects in Serbia and Bulgaria, further increases its commitment to the industry and reinforces exit barriers.

Cost Structure and Capacity Utilization

Competitors' cost structures and how much of their production capacity they are using significantly influence how they compete. For instance, companies with lower production costs or idle capacity might engage in aggressive pricing to boost sales volume, intensifying the rivalry within the industry. Aurubis, in contrast, places a strong emphasis on operational efficiency and optimizing its global smelter network to maintain a competitive cost base.

This focus on efficiency is crucial. For example, in the copper smelting industry, high fixed costs mean that operating at higher capacity utilization rates is key to spreading those costs and achieving profitability. Companies that are struggling with low capacity utilization might be more inclined to offer discounts or engage in price wars to fill their plants.

- Cost Structure Impact: Competitors with lower fixed and variable costs can absorb price pressures more effectively, potentially leading to more aggressive pricing strategies.

- Capacity Utilization Drive: Underutilized capacity acts as a powerful incentive for competitors to seek higher sales volumes, often through price reductions, thereby increasing competitive intensity.

- Aurubis's Strategy: Aurubis aims to leverage its efficient production processes and optimized smelter network to manage its cost structure and maintain strong capacity utilization, mitigating some of the pressures from less efficient rivals.

The competitive rivalry in the non-ferrous metals sector, particularly for copper, is intense due to the presence of major global players like Glencore and Boliden, alongside specialized firms. Aurubis, a key participant, faces constant pressure to maintain market share and profitability. This rivalry is amplified by the largely standardized nature of copper cathode products, where price often dictates purchasing decisions.

Aurubis differentiates itself by focusing on its extensive recycling capabilities and a commitment to sustainable production, building customer loyalty beyond just price. The substantial capital required for smelters and recycling facilities creates high exit barriers, meaning companies tend to stay in the market even during downturns, thus sustaining rivalry.

Companies with lower production costs or underutilized capacity are more likely to engage in aggressive pricing to boost sales. Aurubis counters this by prioritizing operational efficiency and optimizing its smelter network to maintain a competitive cost base and high capacity utilization.

| Competitor | Approximate 2023 Revenue (USD Billion) | Key Focus Area |

| Glencore | 216 | Mining, Metals, Oil |

| Boliden | 6.6 | Mining and Smelting |

| Wieland Group | N/A (Private Company) | Copper and copper alloy processing |

SSubstitutes Threaten

The threat of substitutes for copper and other non-ferrous metals is significant, primarily from materials like aluminum. Aluminum offers a lower cost alternative and is increasingly used in applications like high-voltage transmission cables and certain automotive components, despite its lower conductivity compared to copper. For instance, in 2024, aluminum prices have remained considerably lower than copper, making it an attractive option for cost-sensitive industries.

The performance and cost of substitutes significantly impact Aurubis. While aluminum is a cheaper alternative for some copper applications, its lower conductivity and increased energy losses in electrical transmission, for example, often necessitate design modifications and can offset initial cost savings. In 2023, copper prices averaged around $8,500 per metric ton, while aluminum hovered near $2,200 per metric ton, highlighting the significant price differential.

Emerging substitutes like graphite and carbon nanotubes offer superior performance in niche areas, such as advanced electronics and energy storage, but currently come at a much higher cost and are not widely adopted for bulk applications where copper traditionally dominates. This creates a threat in specific, high-value segments of the market.

Customer willingness to adopt substitutes for Aurubis's copper products hinges on several factors. Perceived risk associated with new materials, the need for investment in new equipment, and the cost of retraining personnel all play a significant role. For instance, a shift from copper wiring to aluminum in electrical infrastructure might require specialized tools and updated safety protocols, potentially slowing adoption.

Substitution often necessitates substantial design changes and modifications to existing product lines. This complexity makes rapid, widespread adoption less probable, particularly in established applications where copper's long-standing performance and reliability are well-understood. In 2024, the automotive sector, a major consumer of copper, continued to explore alternative materials in certain components, but the extensive re-engineering required for widespread replacement in critical systems like wiring harnesses remained a significant barrier.

Technological Advancements in Substitutes

Ongoing research and development in alternative materials are poised to escalate the threat of substitutes for non-ferrous metals. Innovations in lightweight alloys, for instance, could offer compelling alternatives in automotive and aerospace sectors, reducing reliance on traditional materials like copper and aluminum.

The emergence of high-performance materials and novel conductive substances, such as carbon nanotubes, presents a significant challenge. These advanced materials offer unique properties that may outperform conventional metals in specific applications, thereby increasing substitution pressure.

- Advancements in Lightweight Alloys: Continued development in aluminum alloys and magnesium alloys is enhancing their strength-to-weight ratios, making them increasingly competitive in industries like automotive manufacturing.

- High-Performance Materials: Innovations in composites and advanced polymers offer superior corrosion resistance and insulation properties, potentially displacing metals in demanding environments.

- Conductive Material Innovation: Research into materials like graphene and carbon nanotubes shows promise for electrical conductivity applications, potentially offering alternatives to copper in electronics and energy transmission.

- Material Substitution Trends: In 2023, the global market for advanced composites was valued at approximately $100 billion, indicating a growing adoption of non-metallic alternatives across various industries.

Regulatory and Environmental Pressures

Environmental considerations and increasing regulatory pressures, particularly concerning carbon emissions and resource depletion, could drive demand for substitute materials. For instance, advancements in aluminum alloys or advanced plastics might offer lighter alternatives in certain applications, potentially impacting copper demand. However, copper's established role in the circular economy through recycling presents a significant counterpoint. Aurubis, a major copper producer, highlights that copper recycling is integral to its operations, contributing to a lower carbon footprint compared to primary production, which can mitigate some of the substitution threat.

The push for sustainability is a significant factor. By 2024, many industries are facing stricter environmental regulations, pushing them to evaluate the lifecycle impact of their materials. Copper recycling, as practiced by companies like Aurubis, is often cited as a key enabler of the circular economy. For example, Aurubis reported in its 2023 sustainability report that its recycling activities significantly reduce CO2 emissions, making copper a more attractive option from an environmental perspective despite the availability of alternatives.

- Environmental Regulations: Increasing global focus on carbon footprint reduction and resource efficiency is a key driver.

- Circular Economy Benefits: Copper recycling offers significant environmental advantages, mitigating substitution pressures.

- Material Innovation: Advancements in materials like aluminum and advanced plastics could present competitive alternatives.

- Aurubis's Role: The company's strong position in copper recycling demonstrates a commitment to sustainability, enhancing copper's appeal.

The threat of substitutes for copper, primarily from aluminum, remains a key concern for Aurubis. While aluminum's lower cost, evident in its 2024 price points compared to copper, makes it attractive, its lower conductivity can offset savings. Emerging materials like carbon nanotubes offer superior performance in niche, high-value segments but are currently too expensive for widespread adoption.

Customer adoption of substitutes is hindered by the significant costs and complexities of re-engineering and retraining, particularly in established sectors like automotive wiring in 2024. Despite these challenges, ongoing material innovation, especially in lightweight alloys and advanced composites, continues to present competitive alternatives, with the advanced composites market valued at approximately $100 billion in 2023.

Environmental considerations are a double-edged sword; while driving demand for lighter materials, copper's strong recycling infrastructure, championed by Aurubis, offers a significant sustainability advantage. Aurubis's 2023 sustainability report highlighted how recycling drastically cuts CO2 emissions, enhancing copper's appeal against alternatives.

| Material | Key Substitute Advantage | Key Copper Advantage | 2024 Price Indication (USD/tonne) | 2023 Application Trend |

|---|---|---|---|---|

| Aluminum | Lower Cost | Higher Conductivity, Established Infrastructure | ~2,000-2,500 | Increasing in some automotive/electrical applications |

| Advanced Composites/Plastics | Lightweight, Corrosion Resistance | Electrical Conductivity, Durability | Varies Widely | Growing in aerospace, automotive |

| Carbon Nanotubes/Graphene | Exceptional Strength, Conductivity | Cost-Effectiveness, Scalability | Very High | Niche electronics, R&D |

Entrants Threaten

The non-ferrous metals industry, particularly for smelting and advanced recycling, demands immense capital. This high barrier makes it very difficult for new companies to enter the market and compete effectively.

For instance, Aurubis's significant $800 million investment in its US recycling facility highlights the substantial financial commitment required. Such large-scale investments are often beyond the reach of many potential new players.

Established players in the copper industry, such as Aurubis, benefit from substantial economies of scale. This means they can produce copper at a lower cost per unit due to high-volume operations. For instance, Aurubis's extensive smelting and refining facilities allow for efficient resource utilization and bulk purchasing of raw materials, driving down their overall production expenses.

New entrants would face a significant hurdle in matching these cost efficiencies. Without the existing infrastructure and established supply chains, newcomers would likely incur higher per-unit production costs. This makes it challenging for them to compete on price with established, large-scale producers like Aurubis, thus acting as a deterrent.

Newcomers face significant hurdles in securing consistent and varied supplies of copper concentrates and scrap, alongside building robust distribution channels. Aurubis, by contrast, benefits from a global supplier base for its raw materials and a well-established sales and service network, giving it a distinct advantage.

Regulatory Hurdles and Environmental Standards

The non-ferrous metals sector faces significant regulatory challenges, particularly concerning environmental standards. New companies entering this market must contend with complex permitting processes and substantial compliance costs, which act as a considerable barrier.

Aurubis demonstrates a strong commitment to sustainability, adhering to rigorous environmental protocols. For instance, in 2023, Aurubis reported a reduction in its greenhouse gas emissions intensity by 44% compared to 2015 levels, showcasing its proactive approach to environmental stewardship.

- Stringent Environmental Regulations: The industry requires new entrants to navigate complex permitting and compliance, increasing initial investment.

- High Compliance Costs: Meeting environmental standards for non-ferrous metals production can be prohibitively expensive for smaller, new operations.

- Aurubis's Sustainability Focus: Aurubis's established commitment to high environmental standards differentiates it and raises the bar for potential competitors.

- Operational Complexity: The need for advanced pollution control and waste management systems adds to the technical and financial burden for new market participants.

Technological Know-how and Expertise

The specialized processes inherent in smelting, refining, and recycling complex metal-bearing materials demand significant technological know-how and a highly skilled workforce. This creates a substantial barrier to entry for potential new competitors, as acquiring such expertise is both time-consuming and capital-intensive. Aurubis itself emphasizes its technological leadership and deep recycling expertise, underscoring this competitive advantage.

New entrants would face immense challenges in replicating the sophisticated metallurgical processes and environmental control systems that Aurubis has developed over decades. The capital investment required for state-of-the-art equipment and the ongoing need for specialized R&D to stay competitive further deter newcomers. For instance, the complexity of processing various copper-bearing scrap materials, each with unique compositions, necessitates advanced analytical capabilities and processing techniques.

- High Capital Investment: Building advanced smelting and refining facilities requires billions in upfront capital, a significant hurdle for new entrants.

- Proprietary Technology: Aurubis leverages proprietary technologies in its recycling processes, offering a competitive edge that is difficult to replicate.

- Skilled Workforce: Access to experienced metallurgists, engineers, and technicians is crucial and not easily obtainable for new market participants.

- Regulatory Compliance: Navigating stringent environmental regulations in metal processing requires specialized knowledge and infrastructure, adding to entry barriers.

The threat of new entrants in the non-ferrous metals industry, particularly for Aurubis, is significantly mitigated by several factors. High capital requirements, economies of scale, established supply chains, stringent environmental regulations, and specialized technological expertise all serve as formidable barriers.

For instance, Aurubis's substantial investments, like the $800 million for its US recycling facility, underscore the immense financial commitment needed. Furthermore, the company's 2023 report of a 44% reduction in greenhouse gas emissions intensity (vs. 2015) highlights the advanced environmental compliance and operational sophistication that new players must match.

These combined elements create a high barrier to entry, making it difficult and costly for new competitors to establish themselves and compete effectively with established players like Aurubis.

| Barrier Type | Description | Impact on New Entrants | Aurubis's Position |

|---|---|---|---|

| Capital Requirements | Massive upfront investment for facilities and technology. | Prohibitive for most new firms. | Significant existing infrastructure and ongoing investment capacity. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | New entrants face higher production costs. | Leverages large-scale operations for cost efficiency. |

| Supply Chain & Distribution | Securing raw materials and establishing sales networks. | Challenging for newcomers to replicate. | Global supplier base and established distribution channels. |

| Environmental Regulations | Complex permits, compliance, and pollution control. | Increases initial costs and operational complexity. | Proactive sustainability focus and proven compliance (e.g., 44% GHG intensity reduction by 2023). |

| Technological Expertise | Specialized smelting, refining, and recycling knowledge. | Requires significant investment in R&D and skilled personnel. | Proprietary technologies and deep recycling expertise. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aurubis is built upon a foundation of comprehensive data, including Aurubis's annual reports, industry-specific market research from firms like CRU and Wood Mackenzie, and global commodity price databases.