Aurubis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurubis Bundle

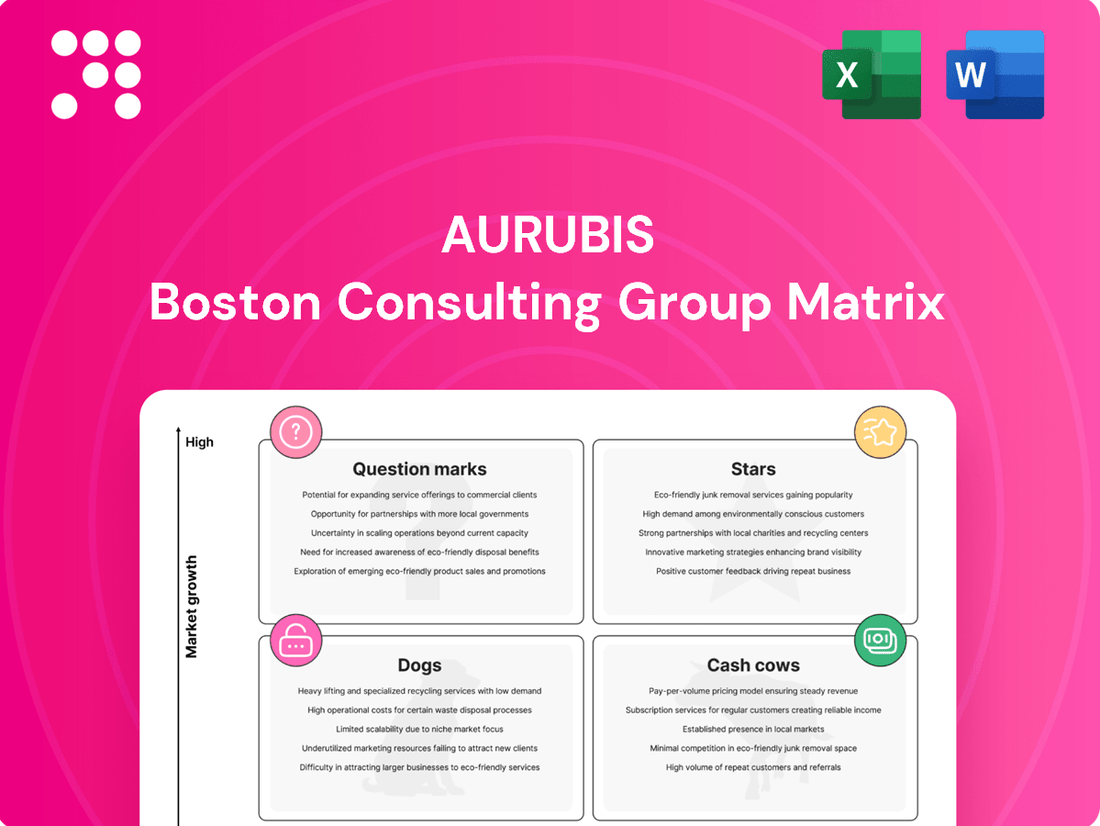

Curious about Aurubis's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the complete picture; purchase the full report for a detailed breakdown and actionable insights to guide your investment decisions.

Stars

Aurubis's high-quality copper products, like cathodes, are critical for the booming energy transition. Think electric vehicles, solar farms, and wind turbines – they all need a lot of copper to function efficiently.

The demand from these sectors is really taking off. For instance, the electric vehicle market alone is expected to see a compound annual growth rate of 14.3%. Across the board, energy transition industries are projected to increase their copper consumption by 10.7% annually. This puts Aurubis in a prime position as a vital supplier in a market that’s expanding rapidly.

Aurubis' advanced copper recycling operations are a cornerstone of its business, positioned within a high-growth market. This segment benefits from a global surge in demand for sustainable materials and increasingly rigorous environmental standards, creating a fertile ground for expansion. The company's commitment to this area is evident in its ongoing investments aimed at boosting recycling capacity and improving the quality of its recycled copper output.

In 2024, Aurubis continued to solidify its position as a premier copper recycler. The company processed a significant volume of complex copper-bearing materials, demonstrating its technical prowess. These advanced operations are crucial for meeting the circular economy goals, with recycled copper playing an ever-larger role in industries like electronics and renewable energy infrastructure.

The Aurubis Richmond facility, a significant $800 million investment, is set to become a major player in copper recycling. It's designed to process 180,000 metric tons of complex scrap each year, yielding 70,000 tons of refined copper. This strategic expansion is targeting burgeoning sectors such as data centers, aiming to bolster domestic supply chains.

Precious Metals Recovery

Aurubis's precious metals recovery is a star performer within its recycling operations. The company extracts valuable precious metals, a segment that significantly bolsters its overall metal earnings, especially given the robust market prices for these commodities.

This area thrives in the expanding recycling sector, concentrating on premium-value outputs. This strategic focus positions it as a high-growth, strong-performing segment, showcasing Aurubis's competitive edge in efficiently recovering vital resources.

- Aurubis's precious metals recovery segment is a key contributor to its financial results, driven by high market prices.

- The segment benefits from the overall growth in the recycling market.

- Aurubis holds a competitive advantage in resource recovery, particularly for high-value precious metals.

- In fiscal year 2023/24, Aurubis reported a significant contribution from its recycling segment to its operating earnings before interest, taxes, depreciation, and amortization (EBITDA).

High-Quality Metals for Electronics and AI Infrastructure

Copper is absolutely essential for the technology we rely on every day, from the smartphones in our pockets to the vast networks that power telecommunications and the massive data centers fueling artificial intelligence. This means the demand for copper is really strong and keeps growing as technology advances and more of the world gets connected.

Aurubis is in a great spot because they produce high-quality metals that are crucial for these growing tech sectors. The market for these materials is expanding rapidly, driven by continuous technological innovation and the ever-increasing need for connectivity.

- Copper's critical role in electronics and AI infrastructure is a major demand driver.

- Aurubis's production of high-quality metals serves this rapidly expanding market.

- Technological evolution and increasing global connectivity fuel this growth.

Aurubis's precious metals recovery operations are a standout performer, fitting perfectly into the Stars category of the BCG Matrix. This segment capitalizes on high demand and strong market prices for precious metals, significantly boosting Aurubis's overall earnings.

The company's expertise in extracting these valuable resources from complex scrap materials gives it a distinct competitive edge. This focus on premium-value outputs within the expanding recycling sector positions precious metals recovery as a high-growth, high-market-share business for Aurubis.

In fiscal year 2023/24, the recycling segment, which includes precious metals, contributed substantially to Aurubis's operating earnings before interest, taxes, depreciation, and amortization (EBITDA), underscoring its star status.

Aurubis's commitment to advanced recycling, particularly in precious metals, is a strategic advantage, aligning with global trends towards resource efficiency and circular economy principles.

What is included in the product

The Aurubis BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear Aurubis BCG Matrix visualizes business unit performance, easing strategic decision-making for resource allocation.

Cash Cows

Aurubis's primary copper cathode production stands as a robust cash cow within its portfolio. The company commands a significant market share, producing over 1 million tons of copper cathodes annually.

These cathodes are essential for established industries like construction and manufacturing, which, while experiencing slower growth (estimated around 1.4% CAGR), provide a stable demand base. Aurubis's sheer production volume and market leadership in these sectors translate into consistent and substantial cash flows, underpinning its financial strength.

Sulfuric acid, a significant by-product of Aurubis's copper smelting operations, consistently contributes robust revenues. The company projected very strong sales for sulfuric acid in fiscal year 2024, driven by elevated market demand and favorable price trends.

This strong performance solidifies sulfuric acid's position as a reliable cash cow for Aurubis. Its consistent revenue generation, coupled with minimal need for substantial growth investments, highlights its status as a stable, low-growth, high-profitability business unit within the company's portfolio.

Aurubis' treatment and refining charges for concentrates are a cornerstone of its business, acting as a reliable cash cow. This segment generates substantial and stable revenue, underscoring Aurubis' dominance in processing primary raw materials.

Despite occasional market volatility, Aurubis benefits from its strong market standing and the security of long-term contracts. These factors are crucial in maintaining a predictable and consistent revenue stream from these essential services.

For the fiscal year 2023, Aurubis reported significant earnings from its recycling segment, which heavily relies on these treatment and refining charges. While specific figures for just concentrate charges aren't isolated, the overall segment performance highlights the robustness of this revenue source.

Continuous Cast Rod and Shapes (Traditional Markets)

Aurubis's continuous cast rod and shapes are key offerings for traditional markets, serving foundational roles in general manufacturing and conventional construction sectors. These mature industries provide a stable demand base for Aurubis's established products.

While not experiencing rapid growth, these segments are characterized by consistent cash generation due to Aurubis's strong market position and optimized production processes. This allows for steady, reliable income with limited need for significant capital reinvestment.

- Market Position: Aurubis holds a significant share in the continuous cast rod and shapes market, particularly within Europe.

- Revenue Contribution: In fiscal year 2023, Aurubis reported revenues of €17.6 billion, with its integrated copper production, which includes these segments, contributing substantially.

- Investment Needs: The mature nature of these markets means capital expenditure is primarily focused on maintenance and efficiency improvements rather than expansion.

- Cash Flow Generation: These products are considered cash cows because they generate consistent profits that can fund other business areas or investments.

Established European Recycling Operations

Aurubis's established European recycling operations, exemplified by its Olen facility, are true cash cows. These mature sites boast significant competitive advantages and high operational efficiency, allowing them to consistently generate substantial cash flow. This strong financial performance is built on processing a diverse range of recycling materials in a well-developed European market, where Aurubis maintains a robust market share.

These operations are cornerstones of Aurubis's financial stability, contributing significantly to the company's overall profitability. Their ability to efficiently convert diverse recycling streams into valuable metals underpins their cash-generating prowess. For instance, in fiscal year 2023, Aurubis reported a substantial increase in its earnings before interest, taxes, depreciation, and amortization (EBITDA) from recycling, highlighting the continued strength of these established assets.

- Long-standing European presence: Aurubis has decades of experience in European recycling.

- High efficiency and competitive advantages: Operations like Olen are optimized for maximum output and cost-effectiveness.

- Substantial cash flow generation: Mature facilities reliably produce significant earnings from processing various recycling materials.

- Strong market position: Aurubis holds a leading market share in the developed European recycling sector.

Aurubis's copper cathode production is a prime example of a cash cow. With an annual output exceeding 1 million tons, the company serves stable, albeit slower-growing, industries like construction and manufacturing. This consistent demand, coupled with Aurubis's market leadership, ensures a steady and significant inflow of cash, bolstering the company's financial foundation.

Sulfuric acid, generated as a by-product of copper smelting, is another reliable cash cow. Aurubis anticipated strong sales for sulfuric acid in fiscal year 2024, driven by high market demand and favorable pricing. This consistent revenue generation, requiring minimal growth investment, highlights its role as a stable, high-profitability unit.

Treatment and refining charges for concentrates also function as a significant cash cow for Aurubis. Despite market fluctuations, long-term contracts and a strong market position provide a predictable revenue stream. The recycling segment, which heavily utilizes these charges, reported substantial earnings in fiscal year 2023, underscoring the robustness of this revenue source.

| Business Unit | BCG Category | Key Characteristics | Fiscal Year 2023 Data/Outlook |

| Copper Cathodes | Cash Cow | High production volume, stable demand in mature industries, market leadership | Over 1 million tons produced annually; ~1.4% CAGR for end markets |

| Sulfuric Acid | Cash Cow | By-product of smelting, consistent revenue, low investment needs | Projected very strong sales for FY2024 due to elevated demand and prices |

| Treatment & Refining Charges (Concentrates) | Cash Cow | Dominant market position, secure revenue from long-term contracts | Recycling segment (reliant on these charges) showed substantial earnings growth in FY2023 |

| Continuous Cast Rod & Shapes | Cash Cow | Mature products for traditional markets, consistent cash generation | Contributed substantially to FY2023 revenues of €17.6 billion (integrated copper production) |

| European Recycling Operations | Cash Cow | High efficiency, competitive advantages, strong market share in developed markets | Substantial EBITDA increase from recycling in FY2023; decades of experience |

What You’re Viewing Is Included

Aurubis BCG Matrix

The Aurubis BCG Matrix preview you see is the definitive report you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This document has been meticulously prepared by industry experts to provide actionable insights into Aurubis's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs. You can confidently expect the exact same professionally formatted and data-rich BCG Matrix report to be delivered, ready for immediate integration into your business planning and decision-making processes. No alterations or missing sections will be present in the final downloaded file, ensuring you get the full value of this critical strategic tool.

Dogs

Non-strategic minor by-products for Aurubis are those metals extracted in small quantities where the cost of processing outweighs their market value. These can become a drain on resources if not managed efficiently. For instance, if a specific trace element requires a specialized, expensive refining process but fetches a very low price on the market, it fits this description.

In 2024, Aurubis's focus remains on optimizing its core copper and nickel value chains. While the company extracts numerous metals, any by-products that do not contribute significantly to overall profitability or require disproportionate investment are carefully evaluated. For example, if a minor metal's extraction costs exceed 15% of its market value, it might be considered non-strategic.

Certain older or less-modernized parts of Aurubis's primary smelting or refining network could be considered Dogs if they operate at significantly lower efficiency or higher cost compared to newer facilities. This often leads to lower profit margins in a mature market, making them a drag on overall performance. For instance, if a legacy plant's energy consumption per ton of refined copper is 15% higher than state-of-the-art facilities, it directly impacts profitability.

The divestment of Aurubis Buffalo, a facility specializing in flat rolled products, signals its classification as a non-core or underperforming segment within the broader Aurubis portfolio. This strategic move often reflects a business unit operating in a low-growth market with a limited market share, thereby immobilizing capital without generating adequate returns.

In 2023, Aurubis reported a significant strategic realignment, including the sale of its Buffalo, USA, flat rolled products business. This unit, while contributing to Aurubis's historical operations, was likely assessed as having a relatively low position in a mature market, fitting the profile of a 'Dog' in the BCG matrix. Such divestitures are common when a company aims to streamline operations and focus resources on higher-potential business areas.

Niche Products with Declining Demand

Niche products within Aurubis that cater to industries experiencing a downturn or intense, undifferentiated competition would fall into the Dogs category. These offerings likely possess a small market footprint within shrinking markets, rendering them candidates for divestment or careful management to minimize losses.

For instance, if Aurubis had a specific copper alloy primarily used in older cathode ray tube (CRT) television manufacturing, this would be a prime example of a Dog product. The demand for CRTs has plummeted due to the widespread adoption of flat-screen technology.

Consider a hypothetical scenario where Aurubis produces a specialized zinc product for a particular type of legacy industrial coating that is being phased out due to environmental regulations. This product would likely exhibit:

- Low Market Share: The product serves a very specific, diminishing application.

- Low Market Growth: The overall market for this niche application is contracting.

- Limited Differentiation: Few unique selling propositions compared to potential substitutes or alternative solutions.

- Potential for Divestment: Aurubis might consider selling off this product line to focus resources on more promising areas.

Underutilized or High-Cost Production Lines

Aurubis might have production lines or facilities that are not being fully utilized or have very high running costs without generating significant revenue. These could be considered Dogs in the BCG matrix. Such assets would tie up valuable capital and resources, and in a slow-growth market, they would contribute very little to the company's profits. For instance, if a specific smelter operates at only 60% capacity and has higher energy costs per ton than newer facilities, it could fall into this category.

- Underutilized Capacity: Facilities operating significantly below their optimal production levels.

- High Operating Costs: Production lines with costs exceeding industry benchmarks or those that don't justify their output value.

- Low Contribution to Profitability: Assets that drain resources without delivering commensurate financial returns.

- Impact on Capital Allocation: These Dog assets can hinder investment in more promising areas of the business.

Aurubis's "Dogs" in the BCG matrix likely represent niche products or older facilities with low market share in stagnant or declining markets, characterized by high operating costs and low profitability. The divestment of the Buffalo flat rolled products business in 2023 exemplifies this, indicating a strategic move away from underperforming assets. For instance, a specialized zinc product for a phased-out industrial coating would fit this profile, facing shrinking demand and limited differentiation.

In 2024, Aurubis continues to focus on its core copper and nickel operations, scrutinizing any by-products or segments that do not contribute significantly to profitability. Older, less efficient smelting or refining plants, which consume more energy per ton of output compared to modern facilities, could also be classified as Dogs. These underutilized assets tie up capital and hinder investment in more promising areas, such as optimizing their high-tech recycling capabilities.

Aurubis's strategic realignments, including the sale of non-core assets, are designed to shed these low-return units. By identifying and managing these 'Dog' segments, the company aims to improve overall capital allocation and enhance financial performance by concentrating resources on its Star and Cash Cow business units.

Question Marks

Aurubis' new €300 million precious metals refinery in Hamburg positions it within a high-growth market segment. This significant investment signals confidence in the future demand for recycled precious metals, a crucial area for sustainability and resource management.

Currently, this state-of-the-art facility is in its nascent stages, meaning its market share in the precious metals recycling sector is still developing. Despite this, the segment itself is experiencing robust growth, suggesting a strong potential for future market penetration and profitability for Aurubis.

Aurubis is investing in hydrogen-ready anode furnaces and expanding industrial heat projects to achieve carbon-neutral production. These are key moves in the growing market for sustainable materials, reflecting a commitment to green copper.

While these initiatives are positioned in a high-growth environmental market, their immediate impact on market share and complete financial returns are still unfolding as the demand for green metals solidifies. Aurubis's 2024 sustainability report highlights significant progress in reducing its carbon footprint through these technologies.

Aurubis is investing in cutting-edge sorting technologies such as X-ray fluorescence (XRF) and electrochemical separation to boost metal recovery from intricate waste streams. These advancements hold significant promise for the recycling sector, potentially increasing the value derived from secondary raw materials.

While the exact market share of these advanced technologies within Aurubis's current operations is still developing, their implementation signifies a strategic move towards higher efficiency and greater value extraction. For instance, XRF sorting can identify and separate different metal alloys with remarkable speed and accuracy, a crucial step in processing complex e-scrap.

Expansion of Cathode Production in Bulgaria

Aurubis is injecting €120 million into its Bulgarian facility to boost cathode production, a move driven by escalating European demand for copper. This significant investment positions Aurubis to seize a greater slice of the expanding European copper market.

However, the full realization of this expanded capacity and the subsequent market share gains are still in progress. Consequently, this initiative fits squarely within the Question Mark quadrant of the BCG Matrix, signifying potential for growth but also inherent uncertainty regarding its ultimate success and market positioning.

- Investment: €120 million allocated for cathode production expansion in Bulgaria.

- Objective: To meet rising European demand for copper and increase market share.

- Current Status: Full ramp-up and market share capture are still in development, indicating potential but also risk.

- BCG Matrix Classification: Question Mark, due to the ongoing development and uncertain future market performance.

Developing Recycling Solutions for New Waste Streams (e.g., Data Centers)

Aurubis is investing in proprietary sorting technologies to extract valuable copper from new, rapidly expanding waste sources like data centers. This strategic move positions the company to capitalize on future growth in niche recycling markets, even though its current presence in these areas is minimal. The global data center market was valued at approximately $200 billion in 2023 and is projected to see significant expansion, creating a substantial future supply of electronic scrap.

This initiative aligns with Aurubis's approach to the BCG matrix by targeting potential future stars. While the immediate market share in data center recycling is low, the long-term growth potential is substantial. Aurubis's commitment to developing these specialized recycling capabilities requires considerable upfront investment to achieve scalability and market leadership in these emerging waste streams.

- Future Growth Market: Data centers represent a burgeoning source of copper-rich electronic waste.

- Proprietary Technology: Aurubis is developing its own sorting systems for efficient recovery.

- Investment Required: Significant capital is needed to scale operations in these nascent recycling niches.

- Market Potential: The global data center market's growth signals a large future scrap supply.

Aurubis's investment in advanced sorting technologies, such as XRF and electrochemical separation, targets the recovery of metals from complex waste streams. While the current market share for these specific technologies within Aurubis is still developing, their implementation signifies a strategic push towards greater efficiency and value extraction.

The company's focus on extracting copper from new, rapidly expanding waste sources like data centers, through proprietary sorting technologies, positions it to capitalize on future growth in niche recycling markets. Despite a minimal current presence in these areas, the global data center market's projected expansion, valued around $200 billion in 2023, indicates a substantial future supply of electronic scrap.

These initiatives, while promising for long-term growth and market leadership in emerging waste streams, require considerable upfront investment to achieve scalability. This strategic approach aligns with targeting potential future stars, acknowledging the substantial long-term growth potential despite low immediate market share in these nascent recycling niches.

Aurubis's €120 million investment to boost cathode production at its Bulgarian facility aims to meet escalating European demand for copper. However, the full realization of this expanded capacity and subsequent market share gains are still in progress, placing this initiative firmly in the Question Mark quadrant due to ongoing development and uncertain future market performance.

| Initiative | Market Segment | Investment (EUR) | Current Market Share | Growth Potential | BCG Classification |

|---|---|---|---|---|---|

| Precious Metals Refinery (Hamburg) | Precious Metals Recycling | 300 million | Developing | High | Question Mark |

| Hydrogen-Ready Anode Furnaces & Industrial Heat Projects | Sustainable Materials / Green Copper | Undisclosed | Developing | High | Question Mark |

| Advanced Sorting Technologies (XRF, Electrochemical) | Complex Waste Stream Recycling | Undisclosed | Developing | High | Question Mark |

| Bulgarian Facility Cathode Production Expansion | European Copper Market | 120 million | Developing | High | Question Mark |

| Proprietary Sorting for Data Center Waste | Niche E-Scrap Recycling | Undisclosed | Minimal | Very High | Question Mark |

BCG Matrix Data Sources

Our Aurubis BCG Matrix leverages comprehensive data from Aurubis' annual reports, market share analysis, and industry growth forecasts to provide a clear strategic overview.