ATCO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATCO Bundle

ATCO's strengths lie in its diversified energy portfolio and strong regulatory relationships, but potential threats from evolving energy markets and infrastructure modernization needs demand a closer look. Want to understand how these factors shape ATCO's future and uncover actionable strategies?

Discover the complete picture behind ATCO's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to leverage ATCO's opportunities and mitigate its weaknesses.

Strengths

ATCO's diversified global operations are a significant strength, spanning utilities, energy infrastructure, structures & logistics, and retail energy. This broad reach means the company isn't overly reliant on any single industry or region, which helps to smooth out the bumps that can come from economic downturns in specific sectors. For example, as of the first quarter of 2024, ATCO Electric's regulated utility business provided a stable revenue stream, while its energy infrastructure segment, particularly its Neltje settlement project, showed strong growth potential.

ATCO demonstrated strong financial health in 2024, achieving adjusted earnings of $481 million, marking a significant $49 million increase year-over-year. This robust performance underpins the company's capacity for strategic growth and investment.

The company has outlined an ambitious capital expenditure plan, dedicating at least $6.1 billion to its regulated utilities between 2025 and 2027. This substantial investment is strategically directed towards regulated assets within ATCO Energy Systems and ATCO Australia, ensuring a foundation of stable and predictable earnings for the future.

ATCO's leadership in energy transition initiatives is a significant strength, underscored by its pioneering work in hydrogen. The company's Energy Discovery Centre, which began using 100% hydrogen for heating in May 2024, demonstrates tangible progress in this area.

Furthermore, ATCO has substantially grown its renewable energy capacity, with renewables accounting for 63% of its power generation in 2023. This aligns with its ambitious goal to manage 1,000 megawatts of renewable energy by 2030, showcasing a clear commitment to a cleaner energy future.

The company's dedication to reducing its environmental footprint is also evident in its achievement of a 40% reduction in company-wide GHG emissions intensity by 2024, relative to its 2020 baseline.

Robust Structures & Logistics Business

ATCO Structures stands out as a global frontrunner in modular building solutions, boasting operations spanning four continents and a proven history of successful project execution worldwide. This segment has shown remarkable stability, marking its eleventh consecutive quarter of year-over-year adjusted earnings growth as of Q1 2025.

The company's expanding international reach is further underscored by substantial contract wins in 2024 and 2025. These include major projects secured in key markets such as Canada, Australia, and Chile, demonstrating ATCO Structures' capability to attract and deliver large-scale, complex assignments.

- Global Leadership: ATCO Structures is recognized globally for its modular shelter solutions.

- Consistent Growth: Achieved 11 consecutive quarters of year-over-year adjusted earnings growth (Q1 2025).

- Expanding Footprint: Secured significant contracts in 2024-2025 across Canada, Australia, and Chile.

Strategic Infrastructure Project Development

ATCO excels in developing major utility infrastructure projects that are crucial for economic expansion and energy reliability. The company is actively engaged in significant undertakings like the Yellowhead Mainline Project, a natural gas pipeline valued at approximately $2.8 billion, and the Central East Transfer Out (CETO) project for electricity transmission. These initiatives are designed to generate thousands of jobs and stimulate considerable customer investment within Alberta, reinforcing ATCO's position in bolstering essential energy networks.

- Yellowhead Mainline Project: $2.8 billion natural gas pipeline development.

- CETO Project: Enhancing electricity transmission infrastructure.

- Economic Impact: Expected to create thousands of direct jobs and spur customer investment.

- Strategic Importance: Reinforces critical energy infrastructure for economic growth.

ATCO's diversified business model, encompassing utilities, energy infrastructure, structures, and logistics, provides a robust foundation against sector-specific volatility. This global reach is further strengthened by a solid financial performance, with adjusted earnings reaching $481 million in 2024, a notable increase from the previous year. The company's strategic capital expenditure plan, allocating at least $6.1 billion to regulated utilities between 2025 and 2027, signals a commitment to stable, long-term earnings growth.

ATCO's leadership in the energy transition is a key differentiator, particularly its advancements in hydrogen technology, exemplified by its Energy Discovery Centre operating on 100% hydrogen since May 2024. This forward-looking approach is complemented by a substantial increase in renewable energy capacity, which constituted 63% of its power generation in 2023, aligning with its objective to manage 1,000 megawatts of renewables by 2030. The company's commitment to sustainability is further evidenced by a 40% reduction in company-wide GHG emissions intensity by 2024 compared to a 2020 baseline.

ATCO Structures has solidified its position as a global leader in modular building solutions, demonstrating consistent growth with eleven consecutive quarters of year-over-year adjusted earnings increases as of Q1 2025. This segment's international success is highlighted by significant contract wins in 2024 and 2025 across Canada, Australia, and Chile, showcasing its ability to manage large-scale projects on a global scale. Furthermore, ATCO's development of critical utility infrastructure, such as the $2.8 billion Yellowhead Mainline Project and the CETO project, underscores its role in supporting economic expansion and energy reliability, expected to generate thousands of jobs.

| Segment | 2024 Adjusted Earnings (Millions) | 2025-2027 Capital Expenditure (Billions) | Key Initiative |

|---|---|---|---|

| Utilities | $481 (Company-wide) | $6.1+ (Regulated Utilities) | Hydrogen energy, Renewable energy growth |

| Energy Infrastructure | Strong Growth (Neltje settlement) | $2.8 (Yellowhead Mainline Project) | Natural gas pipeline development, Electricity transmission |

| Structures & Logistics | 11 Consecutive Quarters of YoY Growth (Q1 2025) | N/A | Global modular building solutions, International contract wins |

What is included in the product

Delivers a strategic overview of ATCO’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Provides a structured framework to identify and address ATCO's critical challenges, transforming potential roadblocks into actionable strategies.

Weaknesses

ATCO's regulated utility businesses, such as ATCO Electric and ATCO Gas, are heavily reliant on regulatory approvals for rate adjustments and project authorizations. For instance, in 2023, ATCO Gas filed for a rate increase that was subject to Alberta Utilities Commission (AUC) review, highlighting the impact of these processes on capital deployment timelines and earnings stability.

This dependence on regulatory bodies introduces inherent delays and uncertainties in project execution and the realization of planned capital expenditures. The need for continuous engagement and negotiation with regulators for rate applications and new infrastructure projects can significantly influence ATCO's ability to execute its growth strategies promptly, as demonstrated by past instances where rate decisions led to adjustments in capital spending plans.

While ATCO's regulated utilities offer a predictable income stream, its non-regulated ventures, such as ATCO EnPower which operates in energy solutions including natural gas storage, are susceptible to the unpredictable swings in commodity prices. Even though the first quarter of 2025 benefited from favorable natural gas storage market conditions, this inherent volatility poses a persistent challenge to the profitability and revenue consistency of these less regulated segments.

ATCO's Alberta Utilities segment faces a direct earnings impact from regulatory rate adjustments. For 2025, the allowable Return on Equity (ROE) has been reset to 8.97%, a decrease from 9.28% in 2024. This, coupled with the end of efficiency carryover mechanisms, will likely reduce income generated by these regulated operations.

Significant Capital Expenditure Requirements

ATCO's ambitious growth strategies, especially within its regulated utility segments, demand significant financial backing. The company projects a minimum capital expenditure of $6.1 billion between 2025 and 2027 to support these expansion efforts. This substantial investment requirement highlights a key weakness, as it necessitates continuous access to capital markets and meticulous financial management to avoid potential strain on resources.

The sheer scale of these capital expenditures presents a potential vulnerability.

- High Capital Outlay: ATCO faces substantial financial commitments for growth, with an estimated $6.1 billion in capital expenditures planned for 2025-2027.

- Dependency on Capital Markets: The company's ability to fund these extensive projects relies heavily on consistent access to capital, making it susceptible to market conditions.

- Risk of Cost Overruns: Large-scale projects inherently carry the risk of unforeseen cost escalations, which could impact ATCO's financial flexibility.

Potential for Public Scrutiny on Traditional Energy Assets

ATCO's ongoing involvement in natural gas transmission and distribution, despite its renewable energy investments, presents a notable weakness. This reliance on fossil fuels, even with emission reduction efforts, could attract heightened public and investor scrutiny concerning its environmental impact and commitment to climate targets. For instance, in 2023, ATCO Gas Australia continued to operate and maintain extensive natural gas networks, which, while essential for current energy needs, remain under the spotlight of decarbonization initiatives.

The company faces the challenge of balancing its traditional energy assets with its transition to cleaner energy sources. This duality can lead to perceptions of a slower pace in decarbonization compared to companies solely focused on renewables. Balancing these portfolios is crucial for maintaining investor confidence and public approval in an era increasingly focused on environmental, social, and governance (ESG) factors.

- Continued reliance on natural gas infrastructure may lead to negative public perception.

- Investor scrutiny on environmental, social, and governance (ESG) performance is likely to increase.

- Balancing traditional energy assets with renewable investments presents an ongoing strategic challenge.

ATCO's regulated utility earnings are directly impacted by regulatory rate adjustments, with the allowable Return on Equity for Alberta Utilities set to decrease to 8.97% in 2025 from 9.28% in 2024, further compounded by the end of efficiency carryover mechanisms.

The company's significant capital expenditure plans, projected at $6.1 billion for 2025-2027, create a dependency on capital markets and introduce risks of cost overruns, potentially straining financial flexibility.

ATCO's continued investment in natural gas infrastructure, despite its renewable energy initiatives, may attract increased investor and public scrutiny regarding its environmental commitments and pace of decarbonization.

| Weakness | Description | Impact |

|---|---|---|

| Regulatory Dependence | Reliance on regulatory approvals for rate adjustments and project authorizations. | Delays in project execution and earnings stability. |

| Commodity Price Volatility | Exposure of non-regulated ventures to fluctuating commodity prices. | Inconsistent profitability and revenue in less regulated segments. |

| High Capital Outlay & Market Access | Significant capital expenditures ($6.1 billion for 2025-2027) require continuous access to capital markets. | Potential strain on resources and susceptibility to market conditions. |

| Fossil Fuel Infrastructure | Ongoing operations in natural gas transmission and distribution. | Risk of negative public perception and increased ESG scrutiny. |

Same Document Delivered

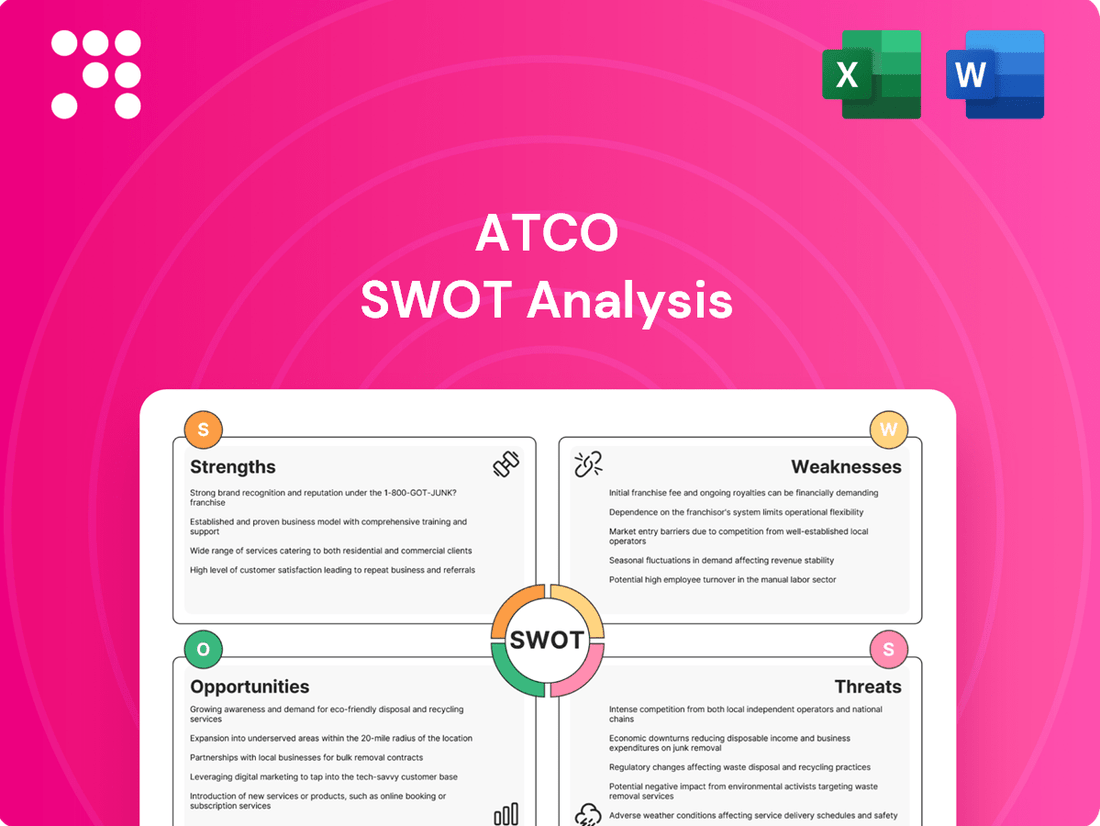

ATCO SWOT Analysis

This is the actual ATCO SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the comprehensive breakdown of ATCO's Strengths, Weaknesses, Opportunities, and Threats right here. This preview ensures you know exactly what you're getting before you buy.

Opportunities

The global shift towards cleaner energy sources presents a substantial opportunity for ATCO to broaden its involvement in renewable energy, encompassing solar, wind, and emerging hydrogen projects. ATCO is strategically investing in these areas, with a target to surpass 1,000 megawatts of renewable energy capacity by 2030 and actively developing hydrogen production capabilities.

This growing global demand for sustainable energy solutions directly supports ATCO's strategic focus and investments in the clean energy sector, positioning the company to capitalize on market trends.

The increasing demand for upgraded and expanded energy infrastructure, driven by industrial expansion, population growth, and the shift towards renewables, presents a significant opportunity. ATCO is well-positioned to meet this need, as demonstrated by its involvement in crucial projects.

Projects like the Yellowhead Mainline and the Central East Transfer Out Project (CETO) highlight ATCO's capacity to leverage this growing demand. These undertakings are vital for bolstering energy security and enabling the transition to a less carbon-intensive economy by linking new energy sources with consumer needs.

ATCO's Structures business is poised to capitalize on the growing worldwide need for adaptable and swift modular construction. Sectors like mining, defense, urban development, and affordable housing are increasingly turning to these solutions, presenting a significant opportunity for ATCO. The company's ability to offer flexible and rapid deployment of modular units aligns perfectly with these evolving market demands.

The strategic acquisition of NRB Ltd. in 2024 is a key factor in this expansion. This move bolstered ATCO's manufacturing capacity and broadened its market access, enabling deeper penetration into a variety of sectors. Such strategic investments are crucial for scaling operations and capturing a larger share of the expanding modular solutions market.

This segment of ATCO's business consistently shows robust growth potential, driven by the inherent advantages of modular construction – speed, cost-effectiveness, and sustainability. As global infrastructure needs continue to rise and the demand for efficient building methods intensifies, ATCO's Structures business is well-positioned to deliver significant value and achieve sustained growth in the coming years.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions offer ATCO significant avenues for growth and market penetration. By teaming up with industry leaders or acquiring complementary businesses, ATCO can rapidly expand its service portfolio and geographic reach.

A prime example is ATCO’s Final Investment Decision on the Atlas Carbon Storage Hub, a collaboration with Shell Canada Limited. This venture positions ATCO at the forefront of the energy transition, leveraging expertise from both entities to develop critical carbon capture infrastructure. Furthermore, the acquisition of modular building maker NRB Ltd. in early 2024 for approximately $1.1 billion (CAD) demonstrates ATCO’s commitment to diversifying its business segments and tapping into the growing modular construction market. These strategic moves are designed to unlock new revenue streams and create synergistic value across ATCO’s diverse operations.

- Expansion into New Markets: Partnerships and acquisitions allow ATCO to enter previously untapped geographic regions or industry sectors.

- Enhanced Capabilities: Collaborations can bring in specialized knowledge and technology, improving ATCO’s service offerings.

- Diversification of Revenue Streams: Acquiring businesses like NRB Ltd. broadens ATCO's income sources, reducing reliance on any single market.

- Competitive Advantage: Strategic alliances and acquisitions can strengthen ATCO’s market position against competitors.

Increased Focus on ESG and Indigenous Partnerships

ATCO's dedication to Environmental, Social, and Governance (ESG) principles, including substantial investments in grid modernization, directly appeals to a growing segment of socially responsible investors. These efforts, coupled with significant economic contributions to Indigenous communities, bolster ATCO's corporate image and can unlock new avenues for growth. In 2024 alone, ATCO delivered $123 million in net economic benefits to its Indigenous partners, a testament to these collaborative relationships.

These strategic partnerships not only strengthen community ties but also pave the way for future project development through shared success and collaborative planning. This focus on sustainability and inclusive growth positions ATCO favorably in the evolving energy landscape.

- ESG Commitment: ATCO's strong ESG performance, evidenced by grid modernization investments, attracts socially responsible investors.

- Indigenous Partnerships: Significant economic benefits, totaling $123 million in net economic benefit to Indigenous partners in 2024, enhance reputation and foster collaboration.

- New Project Opportunities: Collaborative development with Indigenous partners creates new project opportunities and shared prosperity.

- Reputation Enhancement: These initiatives improve ATCO's standing and can attract capital from investors prioritizing sustainability.

The global transition to cleaner energy sources presents a significant opportunity for ATCO to expand its renewable energy portfolio, targeting over 1,000 megawatts of capacity by 2030 and developing hydrogen production. The increasing demand for modernized energy infrastructure, exemplified by projects like the Yellowhead Mainline, also positions ATCO to capitalize on essential infrastructure upgrades.

ATCO's Structures business is well-positioned to meet the growing global demand for modular construction solutions across various sectors, further strengthened by its 2024 acquisition of NRB Ltd. for approximately $1.1 billion (CAD), which enhanced manufacturing capacity and market access.

Strategic partnerships and acquisitions, such as the Atlas Carbon Storage Hub with Shell Canada, allow ATCO to enter new markets, enhance capabilities, diversify revenue, and gain a competitive advantage. Furthermore, ATCO's commitment to ESG principles, including $123 million in net economic benefits to Indigenous partners in 2024, attracts socially responsible investors and fosters new project opportunities.

Threats

ATCO faces ongoing threats from evolving energy policies and environmental regulations. For instance, changes in how utilities like ATCO Electric can earn a return on their investments, as seen in the Alberta Utilities Commission's (AUC) decisions on Return on Equity (ROE), directly affect profitability. A lower ROE, like the 7.0% set for Alberta Electric System Operator (AESO) in 2024, can reduce ATCO's earnings potential and make new infrastructure projects less attractive.

ATCO faces significant competition in its core energy and infrastructure markets. Established global energy companies and emerging players in renewable energy are vying for market share, potentially impacting ATCO's pricing power and profitability. For instance, in 2024, the global renewable energy sector saw substantial investment, with projections indicating continued growth, intensifying the competitive landscape for companies like ATCO involved in utility services and modular construction.

Economic downturns pose a significant threat to ATCO. A global economic slowdown, for instance, could dampen industrial activity and reduce energy demand, directly impacting ATCO's revenue streams. This slowdown also makes it harder to finance and execute new infrastructure projects, a key part of their growth strategy.

Geopolitical instability adds another layer of risk. Conflicts or trade disputes can disrupt crucial supply chains, leading to increased material costs for ATCO's operations. Furthermore, these uncertainties create a volatile investment climate, making it challenging to predict future returns and potentially deterring investment in large-scale energy and infrastructure developments.

Technological Disruption and Pace of Energy Transition

The energy sector is experiencing rapid technological shifts, and ATCO's investments in new energy technologies, such as its work in hydrogen and renewable energy projects, are designed to address this. However, an even faster pace of energy transition or the emergence of entirely new disruptive technologies could pose a threat to the long-term value of ATCO's existing infrastructure. This risk is particularly relevant if traditional assets, like natural gas pipelines, become obsolete more quickly than anticipated due to insufficient adaptation or diversification efforts. For instance, while ATCO is actively expanding its renewable energy portfolio, aiming for a significant portion of its energy generation to be from clean sources by 2030, a sudden leap in battery storage technology or widespread adoption of direct air capture could accelerate the obsolescence of current fossil fuel-dependent infrastructure.

ATCO's strategic foresight is therefore critical. The company needs to continuously assess and adapt its business model to remain competitive. This includes not only investing in emerging technologies but also ensuring its existing infrastructure can be repurposed or integrated into a lower-carbon future. Failure to do so could lead to stranded assets, impacting profitability and future growth prospects. For example, ATCO Gas's 2024 capital expenditure plan includes investments in modernizing its distribution systems, which can be a foundation for hydrogen blending, but the ultimate success depends on the pace of hydrogen adoption and regulatory support.

- Technological Obsolescence Risk: Rapid advancements in renewable energy, energy storage, and other clean technologies could devalue ATCO's traditional energy infrastructure faster than current projections.

- Pace of Energy Transition: An accelerated global shift away from fossil fuels, driven by policy or technological breakthroughs, could challenge ATCO's existing asset base and revenue streams.

- Adaptation and Diversification Needs: ATCO must continue to strategically invest in and diversify its energy portfolio to mitigate the risk of its current infrastructure becoming unviable.

Environmental Risks and Climate Change Impacts

ATCO's vast infrastructure, especially its utility operations, faces growing threats from environmental hazards such as extreme weather. Wildfires, for instance, pose a significant risk, potentially damaging assets and disrupting essential services, which could lead to substantial repair and resilience investments.

These events directly impact operational continuity and financial performance. For example, in 2024, ATCO proactively invested in measures like fire-wrapping electrical poles to mitigate these risks, demonstrating a commitment to asset protection and service reliability in the face of escalating environmental challenges.

The company's exposure to climate change impacts necessitates ongoing capital allocation for adaptation and mitigation strategies. This includes enhancing grid hardening and developing more resilient infrastructure to withstand severe weather phenomena, which could strain financial resources if not managed effectively.

Key environmental threats include:

- Increased frequency and intensity of extreme weather events (e.g., wildfires, floods, storms).

- Potential for significant damage to ATCO's extensive utility and energy infrastructure.

- Disruptions to service delivery, impacting customer satisfaction and revenue streams.

- Substantial capital expenditure requirements for asset repair, reinforcement, and climate adaptation measures.

ATCO's profitability is directly impacted by regulatory decisions concerning its utility operations. For example, the Alberta Utilities Commission's (AUC) 2024 decision to set the Return on Equity (ROE) for Alberta Electric System Operator (AESO) at 7.0% is lower than previous periods, potentially reducing ATCO's earnings potential from its regulated assets.

The company faces intensifying competition from global energy firms and new entrants in renewables, which could pressure pricing and margins. This is underscored by the significant global investment in renewable energy in 2024, a trend expected to continue, creating a more competitive landscape for ATCO's utility and modular businesses.

Economic slowdowns pose a risk by decreasing energy demand and hindering the financing of new infrastructure projects, crucial for ATCO's growth. Geopolitical instability can disrupt supply chains, increasing costs and creating a volatile investment environment for large-scale developments.

Rapid technological shifts in the energy sector, particularly in renewables and storage, present a threat of obsolescence to ATCO's traditional infrastructure. While ATCO is investing in areas like hydrogen and renewables, an accelerated energy transition could outpace its adaptation efforts, potentially leading to stranded assets if current infrastructure, like natural gas pipelines, becomes uneconomical faster than anticipated.

SWOT Analysis Data Sources

This ATCO SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and insights from industry experts to ensure a thorough and accurate strategic assessment.