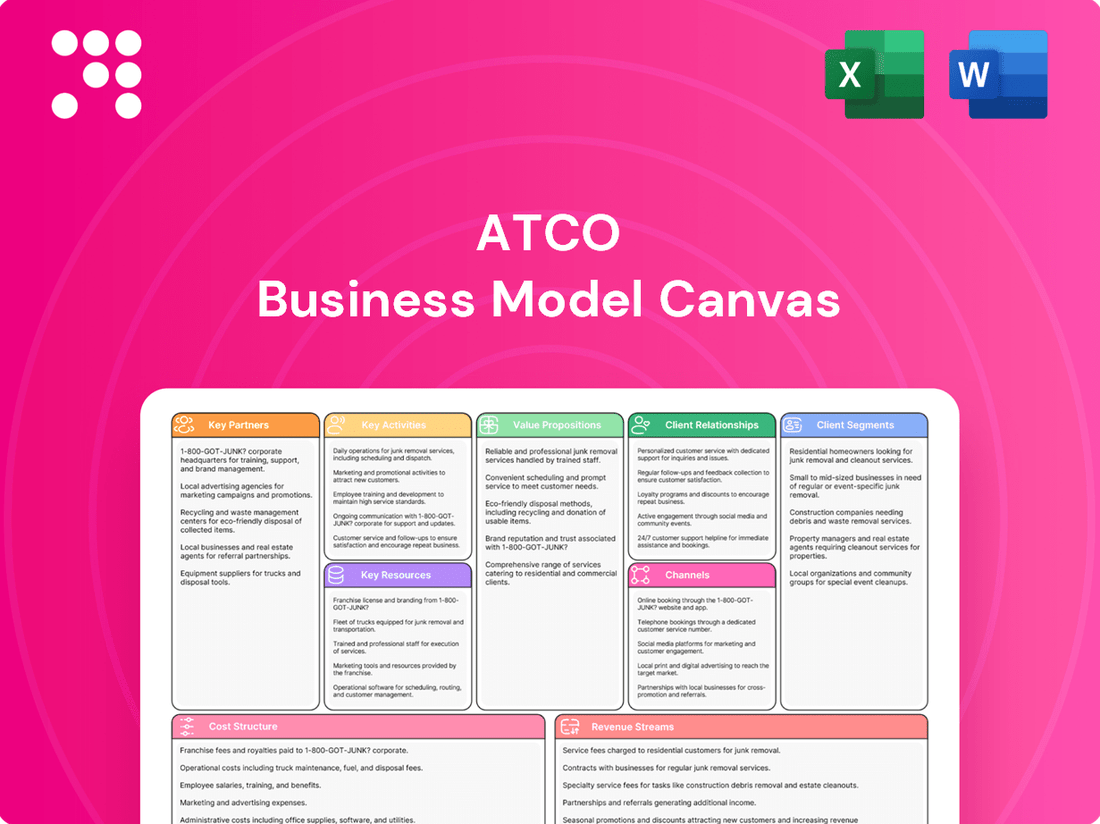

ATCO Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATCO Bundle

Curious about ATCO's strategic engine? Our Business Model Canvas breaks down how they connect with customers, deliver value, and generate revenue. Discover the core components that drive their success.

Unlock the full strategic blueprint behind ATCO's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

ATCO actively collaborates with government agencies and regulators across Canada, Australia, and other international jurisdictions. These partnerships are essential for obtaining critical approvals, licenses, and ensuring ongoing compliance for its diverse utility and infrastructure operations.

Securing regulatory endorsements from bodies like Alberta Utilities Commission or the Australian Energy Regulator is vital for ATCO's large-scale energy projects. For instance, projects such as the Yellowhead Pipeline and the CETO Electricity Project rely on these governmental relationships to meet stringent environmental and safety standards, facilitating their successful development and operation.

ATCO’s collaborations with Indigenous communities are fundamental to its operations, aiming to create shared value and sustainable growth. These partnerships are designed to ensure equitable economic opportunities and long-term prosperity for Indigenous peoples.

A key aspect of ATCO’s strategy involves generating substantial net economic benefits for its Indigenous partners. This commitment is evidenced by the significant contracts awarded to Indigenous and Indigenous-affiliated contractors, reflecting a tangible investment in these communities.

ATCO actively partners with technology providers and innovative firms to drive its energy transition. These collaborations are crucial for developing lower-emitting fuels, expanding renewable energy sources, enhancing energy infrastructure, and implementing advanced storage solutions. For instance, ATCO is involved in hydrogen projects, smart grid development, and carbon capture technologies.

In 2024, ATCO continued to invest in these key partnerships, recognizing their importance in achieving net-zero goals. These alliances enable the company to access cutting-edge technologies and expertise, accelerating the deployment of cleaner energy solutions across its operations and service territories.

Joint Venture Partners

ATCO leverages joint ventures to enhance its operational capacity and broaden its market presence, especially for complex infrastructure and specialized services. These collaborations allow ATCO to access new technologies and expertise, crucial for large-scale undertakings.

Notable partnerships include the Inuvialuit Frontec Services joint venture, focusing on defense systems, and the significant LUMA Energy partnership in Puerto Rico, aimed at modernizing the island's electricity infrastructure. These ventures are strategic moves to share risk and capital while expanding ATCO's service portfolio.

- Inuvialuit Frontec Services: A joint venture focused on providing defense and security services, demonstrating ATCO's ability to operate in specialized sectors.

- LUMA Energy: A partnership in Puerto Rico to manage and improve the island's electricity transmission and distribution system, a major infrastructure undertaking.

- Strategic Expansion: These joint ventures are key to ATCO's strategy of entering new markets and undertaking projects that require significant capital and specialized knowledge, thereby diversifying its revenue streams and operational footprint.

Suppliers and Contractors

ATCO's key partnerships with suppliers and contractors are critical for its multifaceted business. These relationships are vital for acquiring necessary materials for its utility infrastructure projects and for securing specialized services in modular building and logistics. For instance, in 2024, ATCO continued to leverage its extensive supplier network to ensure timely delivery of components for its ongoing energy and infrastructure development projects across North America.

These collaborations are fundamental to the successful execution of ATCO's diverse project portfolio, which includes the provision and setup of remote accommodation and industrial facilities worldwide. The company's ability to manage complex supply chains and engage skilled contractors directly impacts project efficiency and cost-effectiveness. In 2023, ATCO reported significant capital expenditures on materials and services, underscoring the importance of these supplier and contractor relationships to its operational capacity and growth.

- Supplier Network: ATCO relies on a broad base of suppliers for raw materials, specialized equipment, and components essential for utility construction and modular building.

- Contractor Engagement: Skilled contractors are engaged for installation, maintenance, logistics, and specialized services, ensuring project execution adheres to quality and safety standards.

- Global Reach: Partnerships facilitate ATCO's ability to deploy modular solutions and provide services for industrial facilities in remote and challenging locations internationally.

- Operational Efficiency: Strong supplier and contractor relationships contribute to streamlined project timelines and cost management, crucial for ATCO's competitive positioning.

ATCO's strategic alliances with technology providers are crucial for its energy transition initiatives, focusing on innovation in lower-emitting fuels and advanced energy solutions. These collaborations are vital for developing and implementing technologies like hydrogen, smart grids, and carbon capture, with ATCO continuing significant investments in these areas throughout 2024 to accelerate net-zero goals.

Joint ventures are a cornerstone of ATCO's growth strategy, enabling it to expand its operational capabilities and market reach, particularly in complex infrastructure projects. Partnerships like LUMA Energy in Puerto Rico exemplify this, aiming to modernize the island's electricity infrastructure and share significant capital requirements.

ATCO's extensive network of suppliers and contractors is fundamental to executing its diverse project portfolio, from utility infrastructure to remote accommodation. In 2023, the company reported substantial capital expenditures on materials and services, highlighting the critical role these relationships play in operational efficiency and project delivery.

| Partnership Type | Key Collaborators | Strategic Importance | Examples/2024 Focus |

| Government & Regulators | Alberta Utilities Commission, Australian Energy Regulator | Approvals, licenses, compliance | Facilitating large-scale energy projects, ensuring safety standards. |

| Indigenous Communities | Various Indigenous groups | Shared value, economic opportunities | Awarding significant contracts to Indigenous affiliates, fostering long-term prosperity. |

| Technology Providers | Innovative firms | Energy transition, R&D | Hydrogen projects, smart grid development, carbon capture investments in 2024. |

| Joint Ventures | Inuvialuit Frontec Services, LUMA Energy | Risk sharing, market expansion | Defense systems, Puerto Rico's electricity infrastructure modernization. |

| Suppliers & Contractors | Global network | Materials, specialized services | Ensuring timely delivery for utility projects, managing complex supply chains. |

What is included in the product

A structured framework detailing ATCO's operations, outlining key customer segments, value propositions, channels, and revenue streams to support strategic decision-making.

The ATCO Business Model Canvas simplifies complex strategies, making them easy to understand and adapt.

It provides a clear, visual framework to identify and address business model weaknesses efficiently.

Activities

Utility Operations and Management is ATCO's bedrock, focusing on the reliable delivery of electricity and natural gas. This involves meticulously operating and maintaining vast transmission and distribution networks, serving millions. Key activities include crucial grid modernization efforts and consistent preventative maintenance to ensure seamless service.

In 2024, ATCO continued its commitment to infrastructure investment. For instance, ATCO Electric’s capital expenditure program for 2024 was projected to be around $750 million, with a significant portion dedicated to grid enhancements and reliability improvements, directly supporting these utility operations.

ATCO's key activities include the development and construction of vital energy infrastructure, such as pipelines and electricity transmission lines. This focus ensures they can meet increasing energy demands and facilitate the integration of renewable energy sources into the grid.

Notable projects highlight this commitment. For instance, the Yellowhead Pipeline project represents a significant undertaking in expanding natural gas transportation capacity. Similarly, the Central East Transfer-Out (CETO) Electricity Project is crucial for enhancing electricity transmission capabilities in Alberta, demonstrating ATCO's role in modernizing energy networks.

ATCO's modular structures and logistics solutions involve the end-to-end process of designing, building, and transporting modular units. These are deployed across diverse industries such as workforce housing, defense, and large-scale industrial projects worldwide.

In 2024, ATCO secured significant contracts, including providing accommodation camps and modular offices. These projects are located in key markets like Canada, the United States, and Australia, underscoring their global reach and demand for their specialized services.

Sustainable Energy Solutions and Innovation

ATCO actively pursues sustainable energy by investing in renewable generation and advanced storage technologies. This focus is crucial for meeting decarbonization targets and ensuring future energy reliability.

The company is also a pioneer in cleaner fuels, notably hydrogen, and provides essential industrial water solutions. These activities underscore a commitment to environmental stewardship and innovation.

In 2024, ATCO continued to expand its renewable portfolio, with projects contributing to a cleaner energy mix. For example, their investments in solar and wind power are key to reducing greenhouse gas emissions.

- Renewable Energy Generation: Expanding solar and wind farm capacity.

- Energy Storage: Deploying battery storage solutions for grid stability.

- Cleaner Fuels: Advancing hydrogen production and distribution infrastructure.

- Industrial Water Solutions: Providing efficient water management for industrial clients.

Commercial Real Estate and Transportation Management

ATCO's involvement in commercial real estate extends beyond its core energy and structures operations, adding a layer of diversification to its business model. This segment includes managing a portfolio of properties, which generates rental income and capital appreciation. For instance, ATCO’s real estate holdings are strategically located to support its other business lines and generate stable cash flows.

The company’s transportation management activities are equally crucial, encompassing logistics and infrastructure investments. This includes a significant stake in port operations, a vital component for global trade and supply chain efficiency. These ventures not only support ATCO's broader industrial activities but also tap into the growing demand for reliable transportation networks.

- Property Portfolio: ATCO manages commercial real estate assets that contribute to its revenue streams through leasing and property development.

- Port Investments: Investments in port operations are key to ATCO's transportation segment, facilitating the movement of goods and enhancing logistical capabilities.

- Diversification Strategy: These activities serve to diversify ATCO's overall business portfolio, reducing reliance on any single sector and improving financial resilience.

- Financial Contribution: Both commercial real estate and transportation management play a role in ATCO's overall financial performance, contributing to profitability and stability.

ATCO's key activities are multifaceted, encompassing essential utility operations, the development of critical energy infrastructure, and the provision of modular structures and logistics. These core functions are supported by strategic investments in renewable energy, cleaner fuels, industrial water solutions, commercial real estate, and transportation management.

In 2024, ATCO's capital expenditures were substantial, with a significant portion allocated to modernizing its utility networks and expanding its energy infrastructure. The company also advanced its renewable energy projects, aiming to increase its clean energy generation capacity.

ATCO's modular structures segment saw continued demand globally, with projects securing contracts for workforce housing and industrial facilities. Simultaneously, its diversification efforts in real estate and transportation management, including port operations, contributed to stable revenue streams and enhanced logistical capabilities.

| Business Segment | Key Activities | 2024 Highlights/Focus |

|---|---|---|

| Utility Operations | Electricity and natural gas transmission and distribution, grid modernization, maintenance | Continued infrastructure investment, reliability improvements |

| Energy Infrastructure Development | Pipeline construction, electricity transmission line development | Yellowhead Pipeline, Central East Transfer-Out (CETO) Electricity Project |

| Structures & Logistics | Design, build, transport of modular units for housing, industrial projects | Secured contracts for modular offices and accommodation camps globally |

| Renewable Energy & Cleaner Fuels | Solar and wind farm expansion, battery storage, hydrogen initiatives | Expansion of renewable portfolio, investments in cleaner energy |

| Commercial Real Estate & Transportation | Property portfolio management, port operations investment | Strategic property management, enhancing logistical capabilities |

What You See Is What You Get

Business Model Canvas

The ATCO Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can trust that what you see is precisely what you will get, ready for your business planning needs.

Resources

ATCO’s extensive utility infrastructure, a cornerstone of its business, includes a vast network of electricity and natural gas transmission and distribution lines, and pipelines spanning Canada and Australia. This robust network underpins its essential service delivery and represents a significant portion of its asset base. For instance, as of year-end 2023, ATCO Electric’s regulated asset base was valued at approximately $13.5 billion, highlighting the scale of its physical assets.

ATCO's modular manufacturing and construction facilities are a cornerstone of its business model, allowing for the design, production, and assembly of modular structures. This capability supports rapid deployment of housing, offices, and industrial solutions globally, leveraging significant manufacturing capacity and a diverse fleet of modular units.

In 2024, ATCO continued to enhance its operational efficiency and expand its modular offerings. The company's facilities are equipped to handle a wide range of projects, from temporary workforce accommodations to permanent residential and commercial buildings, underscoring its commitment to providing versatile and scalable solutions.

ATCO's operations are powered by a substantial and highly skilled workforce, encompassing engineers, technicians, project managers, and essential operational staff. Their collective expertise spans critical sectors like utilities, energy infrastructure development, and advanced modular construction techniques.

This human capital is not just a resource; it's the engine driving ATCO's success. It ensures efficient project execution, fosters continuous innovation within the company, and is fundamental to upholding ATCO's rigorous safety standards across all its diverse operations.

As of 2024, ATCO employed approximately 6,400 individuals globally, a testament to the scale of its human resource needs. The company consistently invests in training and development to maintain and enhance the specialized skills of its team, ensuring they remain at the forefront of industry advancements.

Financial Capital and Investment Capacity

ATCO's strong financial standing provides substantial capital for its operations, strategic investments, and major infrastructure endeavors. This financial strength is crucial for funding its regulated utility ventures and exploring opportunities for growth through acquisitions or partnerships.

In 2024, ATCO's commitment to robust financial management underpins its capacity to undertake significant projects and adapt to market dynamics. The company's investment capacity is a cornerstone of its strategy, enabling it to pursue both organic and inorganic growth paths effectively.

- Capital for Operations and Growth: ATCO maintains a healthy financial position, allowing for consistent funding of its day-to-day operations and strategic expansion initiatives.

- Infrastructure Project Funding: The company has the financial resources to support large-scale infrastructure development, particularly within its regulated utility segments.

- Inorganic Growth Pursuits: ATCO leverages its financial capacity to actively seek and fund opportunities for growth through mergers, acquisitions, and strategic alliances.

- Financial Stability: A robust balance sheet and access to capital markets ensure ATCO can navigate economic fluctuations and invest for the long term.

Licenses, Permits, and Regulatory Approvals

ATCO’s operations, particularly in the energy and utilities sectors, are fundamentally shaped by a complex web of licenses, permits, and regulatory approvals. These are not mere formalities but critical resources that enable the company to conduct its business. For instance, in 2024, ATCO continued to manage approvals for its significant infrastructure projects, such as the Alberta Capital Region Transmission Line, ensuring compliance with provincial and federal regulations.

Maintaining robust relationships with regulatory bodies like the Alberta Utilities Commission (AUC) and various federal agencies is paramount. These relationships facilitate the approval process for new projects and modifications to existing infrastructure, directly impacting ATCO's ability to expand and invest. For example, the AUC's approval process for rate applications, which ATCO navigates annually, is a key determinant of its revenue and operational flexibility.

The company's portfolio of licenses and permits covers a wide range of activities, from natural gas distribution to electricity transmission and even aviation services. These are essential for ensuring safety, reliability, and environmental stewardship across all its business segments. In 2024, ATCO’s commitment to regulatory compliance was evident in its ongoing adherence to safety standards, which are regularly audited by governing bodies.

- Licenses and Permits: Essential for operating regulated utilities and infrastructure, covering areas like natural gas distribution and electricity transmission.

- Regulatory Approvals: Crucial for project development, including new infrastructure builds and expansions, requiring ongoing engagement with bodies like the AUC.

- Relationship Management: Strong ties with regulatory agencies are vital for smooth operations, compliance, and securing approvals for future growth.

- Compliance and Safety: Adherence to stringent safety and environmental regulations, as mandated by various governmental bodies, underpins ATCO's license to operate.

ATCO's intellectual property includes proprietary technologies in modular construction and specialized expertise in utility operations. This intellectual capital allows for efficient project delivery and innovative solutions in energy and infrastructure.

The company's brand reputation, built over decades, is a significant intangible asset. This strong brand recognition facilitates customer acquisition and partnerships, particularly in its utility and modular business segments.

ATCO's deep understanding of regulatory environments and its established relationships with governing bodies represent crucial intellectual resources. This knowledge base is vital for navigating complex approval processes and ensuring continued operational viability.

Value Propositions

ATCO's core value proposition centers on delivering safe, reliable, and affordable essential services like electricity, natural gas, and water to millions. This commitment underpins the trust of its customer base, ensuring access to critical resources day in and day out.

The company's infrastructure is the backbone of this reliability. For instance, in 2024, ATCO continued its significant investments in maintaining and upgrading its natural gas distribution system, a critical component for energy security across its service territories.

This dedication to uninterrupted service delivery is not just a promise but a tangible outcome. ATCO's operational performance consistently demonstrates high levels of service availability, a key differentiator in the utility sector where dependability is paramount for both residential and commercial customers.

ATCO's Structures & Logistics segment excels at providing flexible and rapid modular solutions. This means customers can get adaptable, quickly deployable buildings for everything from housing workforces to setting up emergency response centers or commercial spaces.

This adaptability translates into efficient and customizable space solutions tailored to specific client needs. For instance, in 2023, ATCO Structures & Logistics reported significant revenue growth, highlighting the demand for these fast-track construction methods.

The modular approach allows for quicker project completion compared to traditional construction, a key advantage in time-sensitive situations. This rapid deployment capability is crucial for industries requiring immediate infrastructure, such as resource extraction or disaster relief.

ATCO is deeply invested in the energy transition, offering customers cleaner energy choices and actively pursuing investments in renewable energy sources, hydrogen technology, and advanced energy storage solutions. This proactive approach directly responds to the increasing market demand for sustainable practices and empowers clients to significantly lower their environmental impact.

Long-Term Partnership and Community Development

ATCO cultivates long-term partnerships with Indigenous communities and local governments, prioritizing mutual prosperity. This focus on social value creation translates into tangible economic benefits and community investments.

Their approach involves deep collaboration on development projects, ensuring shared success. For example, in 2024, ATCO continued its commitment to Indigenous economic participation, with Indigenous businesses contributing significantly to their supply chain across various projects.

- Enduring Relationships: ATCO prioritizes building lasting connections with key stakeholders.

- Mutual Prosperity: The goal is shared economic and social benefits.

- Community Investment: Direct contributions to local development and well-being are central.

- Collaborative Development: Working together on projects fosters trust and shared outcomes.

Operational Excellence and Resilience

ATCO's commitment to operational excellence and resilience is evident in its robust management of a diverse energy and infrastructure portfolio. This focus ensures consistent performance even when facing significant market shifts or unexpected events.

The company demonstrated this resilience during the 2023 wildfire season, where its utility operations maintained service reliability for customers despite challenging conditions. This proactive approach to system reliability is a cornerstone of their value proposition.

Key aspects of their operational excellence include:

- Enhanced System Reliability: ATCO consistently invests in infrastructure upgrades and preventative maintenance to minimize service disruptions.

- Effective Crisis Management: The company has established protocols for rapid response and recovery during emergencies, ensuring business continuity.

- Portfolio Diversification: Managing a broad range of energy and infrastructure assets allows ATCO to mitigate risks associated with any single market segment.

- Efficiency Gains: Continuous improvement initiatives drive cost efficiencies and optimize resource allocation across operations.

ATCO offers dependable essential services, ensuring access to electricity, gas, and water, backed by significant infrastructure investments like those in its natural gas distribution system in 2024. Its Structures & Logistics segment provides rapid, adaptable modular buildings, as evidenced by strong revenue growth in 2023, catering to diverse needs from workforce housing to emergency centers.

The company champions the energy transition with investments in renewables and hydrogen, empowering customers to reduce their environmental footprint. Furthermore, ATCO fosters strong partnerships with Indigenous communities and local governments, driving shared prosperity through collaborative projects and substantial supply chain contributions from Indigenous businesses in 2024.

| Value Proposition | Key Aspects | Supporting Data/Facts |

| Reliable Essential Services | Safe, dependable delivery of electricity, gas, water | Continued investment in natural gas distribution infrastructure (2024) |

| Flexible Modular Solutions | Rapid, adaptable building deployment | Strong revenue growth in Structures & Logistics (2023) |

| Energy Transition Leadership | Renewables, hydrogen, storage solutions | Focus on enabling customer environmental impact reduction |

| Community Partnership & Prosperity | Collaboration with Indigenous communities, local governments | Significant Indigenous business participation in supply chain (2024) |

Customer Relationships

ATCO's regulated utility customer relationships are built on dependable service and clear, regulated pricing. This involves meticulous account management, prompt responses to inquiries, and strict adherence to utility standards, ensuring customer trust and operational integrity.

ATCO cultivates deep, direct relationships with its industrial, commercial, and government clientele, recognizing the intricate demands of energy infrastructure, structures, and logistics. This approach is crucial for securing and retaining large-scale contracts, fostering loyalty through dedicated service and understanding of unique operational requirements.

These relationships are built on more than just transactions; they involve collaborative project development and continuous, hands-on support. For instance, ATCO's involvement in major infrastructure projects often spans years, requiring ongoing technical assistance, maintenance, and adaptation to evolving client needs and regulatory landscapes.

Strategic partnerships are a cornerstone of ATCO's customer relationship strategy. By working closely with clients on long-term planning and solution design, ATCO ensures its offerings are precisely aligned with business objectives, leading to mutually beneficial outcomes and sustained engagement. This is particularly evident in the energy sector, where reliability and efficiency are paramount.

ATCO prioritizes building strong relationships with communities, especially Indigenous groups, through a foundation of respect and collaboration. This approach focuses on creating shared value, ensuring that partnerships are mutually beneficial and sustainable. For instance, in 2024, ATCO continued its commitment to Indigenous engagement through various initiatives aimed at fostering economic participation and community development, reflecting a long-term investment in these relationships.

Retail Energy Customer Support (ATCOenergy and Rümi)

ATCOenergy and Rümi offer direct customer support for electricity and natural gas services, aiming to enhance homeowner comfort and peace of mind. This support extends to providing valuable home maintenance advice.

- Direct Support: ATCOenergy provides essential customer service for electricity and natural gas accounts.

- Home Maintenance Advice: Rümi offers guidance and tips for homeowners to maintain their properties.

- Customer Focus: The relationships are built around delivering comfort, peace of mind, and freedom to homeowners.

Investor Relations and Shareholder Engagement

ATCO prioritizes open communication with its investors and shareholders. This includes providing regular financial updates and sustainability reports, as well as hosting earnings calls and presentations. For instance, in Q1 2024, ATCO reported strong operational performance, with revenues reaching $1.4 billion, demonstrating their commitment to transparency.

This consistent engagement fosters investor confidence and underpins ATCO's strategy for long-term value creation. By keeping stakeholders informed, the company builds trust and encourages continued investment. Their proactive approach ensures that shareholders understand ATCO's strategic direction and financial health.

- Transparent Financial Updates: Regular reporting on financial performance, including quarterly earnings.

- Sustainability Reporting: Detailed information on environmental, social, and governance (ESG) initiatives.

- Investor Events: Hosting earnings calls, investor days, and presentations to facilitate dialogue.

- Shareholder Engagement: Actively seeking feedback and addressing shareholder concerns.

ATCO's customer relationships span a diverse range, from regulated utility users to large industrial clients and community stakeholders. The company emphasizes dependable service, clear communication, and collaborative partnerships to foster loyalty and trust across these varied segments.

In 2024, ATCO continued its focus on direct customer support through ATCOenergy and Rümi, offering assistance and home maintenance advice to enhance homeowner experience. Simultaneously, strategic engagement with investors, marked by transparent financial updates like the Q1 2024 report showing $1.4 billion in revenue, reinforces confidence and supports long-term value creation.

The company's commitment to Indigenous communities is a key relationship pillar, focusing on mutual benefit and sustainable development, with ongoing initiatives in 2024 demonstrating this dedication.

| Customer Segment | Relationship Focus | Key Activities/Data (2024) |

|---|---|---|

| Regulated Utility Customers | Dependable Service, Regulated Pricing | Account Management, Inquiry Response |

| Industrial, Commercial, Government | Large-Scale Contracts, Dedicated Service | Project Development, Technical Support |

| Homeowners (ATCOenergy, Rümi) | Comfort, Peace of Mind, Maintenance Advice | Direct Support, Homeowner Guidance |

| Investors/Shareholders | Transparency, Value Creation | Financial Updates ($1.4B Q1 Revenue), ESG Reports |

| Communities (incl. Indigenous) | Respect, Collaboration, Shared Value | Economic Participation Initiatives |

Channels

ATCO's extensive transmission and distribution networks are the lifeblood of its operations, directly connecting its energy services to over 1.1 million electricity customers and 1.2 million natural gas customers across Alberta as of 2024. These vast physical infrastructures, comprising thousands of kilometers of power lines and gas pipelines, are the primary channels through which electricity and natural gas reach homes, businesses, and industrial facilities, ensuring reliable energy delivery.

ATCO leverages direct sales and project bidding to secure substantial contracts, particularly for large-scale endeavors in structures, logistics, and energy infrastructure. This channel is crucial for engaging with major clients in the government, defense, and commercial sectors.

In 2024, ATCO's focus on these high-value projects is expected to continue driving significant revenue. For instance, their involvement in major infrastructure developments, often secured through competitive bidding, underpins a substantial portion of their project-based earnings. These large contracts are vital for demonstrating their capability and securing future work.

ATCO leverages its corporate website and dedicated investor relations platforms to provide stakeholders with easy access to crucial information, including financial reports and company updates. In 2024, ATCO's investor relations site continued to be a primary channel for detailed financial disclosures, ensuring transparency for investors.

These digital channels also serve as a hub for customer service, allowing for efficient communication and support, thereby enhancing the overall stakeholder experience. The company's commitment to digital accessibility was evident in its 2024 efforts to streamline online customer interactions.

Customer Service Centers and Call

ATCO leverages dedicated customer service centers and robust call channels to directly engage with its utility and retail energy customers. These channels are crucial for managing inquiries, processing service requests, and coordinating emergency responses, ensuring a high level of customer support.

In 2023, ATCO reported that its customer service operations handled millions of interactions, with call centers playing a significant role in resolving customer issues efficiently. The company continuously invests in these channels to improve response times and customer satisfaction.

- Customer Interaction Volume: ATCO's customer service centers manage a substantial volume of daily inquiries, service requests, and emergency communications.

- Service Response: These centers are vital for dispatching field crews and providing timely updates to customers regarding service interruptions or restoration efforts.

- Customer Engagement: Dedicated call channels facilitate direct communication, allowing ATCO to gather feedback and address customer needs effectively.

Strategic Partnerships and Joint Ventures

ATCO leverages strategic partnerships and joint ventures to expand its operational footprint and service offerings. These alliances are crucial for entering new geographic markets and developing specialized capabilities.

For example, in 2024, ATCO continued to strengthen its joint venture with a leading renewable energy developer to accelerate the deployment of clean energy projects across Western Canada. This collaboration allows ATCO to access new technologies and expertise, enhancing its ability to manage large-scale infrastructure development.

- Market Expansion: Partnerships enable ATCO to enter new regions by sharing risks and resources, as seen in its ongoing international infrastructure projects.

- Service Specialization: Collaborations provide access to niche expertise, allowing ATCO to offer advanced services like sophisticated grid modernization solutions.

- Project Feasibility: Joint ventures facilitate the undertaking of capital-intensive and complex projects, such as the development of hydrogen infrastructure, which would be challenging for ATCO to manage alone.

ATCO's physical infrastructure, including transmission and distribution networks, serves as its primary channel to deliver energy to over 1.1 million electricity and 1.2 million natural gas customers in Alberta as of 2024. This extensive network ensures reliable energy supply to homes and businesses.

Direct sales and project bidding are key channels for securing large contracts in sectors like government and defense, particularly for infrastructure projects. In 2024, ATCO's participation in major developments through competitive bidding is a significant revenue driver.

Digital platforms, including the corporate website and investor relations portals, provide essential information and enhance customer service. ATCO's investor relations site in 2024 remained a crucial channel for financial transparency and stakeholder communication.

Dedicated customer service centers and call channels are vital for direct customer engagement, managing inquiries, and coordinating responses. In 2023, ATCO's call centers handled millions of customer interactions, highlighting their importance.

Strategic partnerships and joint ventures, like the one with a renewable energy developer in 2024, expand ATCO's reach and capabilities, enabling entry into new markets and the development of specialized services such as clean energy projects.

| Channel Type | Description | Key Customer Segment | 2024 Relevance | Example Data Point |

|---|---|---|---|---|

| Physical Infrastructure | Transmission and distribution networks | Residential, Commercial, Industrial | Core energy delivery | 1.1 million+ electricity customers (2024) |

| Direct Sales & Project Bidding | Securing large contracts via bidding | Government, Defense, Commercial | Major revenue source for infrastructure | Significant portion of project-based earnings |

| Digital Platforms | Corporate website, investor relations | Investors, General Public, Customers | Information dissemination, customer support | Primary channel for financial disclosures (2024) |

| Customer Service Centers & Call Channels | Direct customer interaction and support | Utility and Retail Energy Customers | Inquiry management, service requests | Millions of interactions handled (2023) |

| Strategic Partnerships & Joint Ventures | Collaborations for market expansion | Renewable energy developers, Infrastructure firms | Access to new markets and technologies | Accelerating clean energy projects (2024) |

Customer Segments

ATCO serves a broad base of residential and commercial customers who depend on its reliable electricity, natural gas, and water services. These customers are primarily located within ATCO's regulated service territories, ensuring a stable and predictable demand for its offerings.

In 2024, ATCO's utilities division, which caters to these customer segments, continued to be a cornerstone of its operations. The company's regulated utilities in Alberta, Canada, for instance, serve millions of people, providing essential energy infrastructure.

ATCO's industrial and resource sector clients, including those in mining and energy, rely on the company for specialized modular structures and housing. These businesses frequently need rapid deployment of facilities to remote or challenging locations, a need ATCO addresses with its tailored solutions.

For instance, the global mining industry, a key ATCO market, saw significant investment in 2024. Capital expenditure in mining was projected to reach hundreds of billions of dollars, driving demand for the kind of integrated infrastructure and workforce support ATCO provides.

These resource-focused clients often operate in demanding environments where efficiency and reliability are paramount. ATCO's ability to deliver customized, pre-fabricated solutions quickly helps these companies minimize downtime and maximize operational output, a critical factor in their profitability.

Government and defense organizations represent a crucial customer segment for ATCO, engaging the company for essential operational support, modular facilities, and vital infrastructure development. These entities rely on ATCO's expertise for projects ranging from defense systems to urban infrastructure enhancements.

In 2024, ATCO continued to secure significant contracts within this sector, underscoring its role as a trusted partner for national security and public works. For instance, ATCO's modular solutions are frequently deployed for temporary or permanent facilities supporting military operations and government agencies, demonstrating a consistent demand for their specialized capabilities.

Developers and Construction Companies

ATCO serves real estate developers and construction companies by offering modular building solutions and essential site services. These offerings are crucial for projects ranging from urban infrastructure development to fulfilling large-scale accommodation requirements, streamlining complex construction processes.

In 2024, the modular construction market continued its robust growth, with projections indicating a significant expansion driven by demand for faster project delivery and cost efficiencies. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is expected to reach over $150 billion by 2028, showcasing the increasing adoption by developers and construction firms.

- Modular Solutions: ATCO provides prefabricated building components and complete modules, reducing on-site construction time and labor costs for developers.

- Site Services: This includes essential services like temporary power, water, and accommodation, critical for maintaining project momentum and worker welfare on construction sites.

- Project Scope: ATCO's capabilities support diverse projects, from high-rise residential buildings and commercial spaces to critical infrastructure like worker camps for major industrial or resource projects.

- Market Demand: The increasing pressure on construction timelines and budgets makes ATCO's efficient and predictable modular solutions highly attractive to this segment.

Investors and Shareholders

Investors and shareholders are vital to ATCO, though they don't directly use its services. Their primary interest lies in financial performance, seeking consistent returns and stable dividends. ATCO's commitment to transparent reporting on its strategic initiatives and operational successes directly addresses this segment's need for information to gauge their investment's health and future prospects.

For ATCO, this segment is critical for capital acquisition and maintaining market confidence. In 2024, ATCO reported strong financial results, demonstrating its ability to generate value for its shareholders. For instance, ATCO Gas's regulated utility operations provided a stable base, while its energy business units pursued growth opportunities, contributing to overall shareholder returns.

- Financial Returns: Shareholders expect ATCO to deliver profitable growth, which translates into capital appreciation and dividend payouts.

- Dividend Stability: ATCO aims to provide reliable and growing dividends, a key factor for income-focused investors.

- Transparency and Reporting: Clear communication on financial health, operational performance, and strategic advancements is paramount for investor trust.

ATCO's customer segments are diverse, ranging from residential and commercial utility users to industrial clients in sectors like mining and energy. It also serves government and defense organizations, as well as real estate developers and construction companies. Finally, investors and shareholders form a crucial segment, focused on financial performance and returns.

In 2024, ATCO’s regulated utilities in Alberta continued to serve millions, a testament to the stable demand from its residential and commercial base. Simultaneously, its industrial and resource sector clients, driven by substantial global mining capital expenditure exceeding hundreds of billions of dollars, relied on ATCO for rapid deployment of specialized modular facilities and workforce support.

The company's engagement with government and defense sectors in 2024 saw continued contract wins, highlighting ATCO's role in national security and public works through modular solutions. Furthermore, the burgeoning modular construction market, valued at approximately $100 billion in 2023 and projected for significant growth, benefited from ATCO's offerings to real estate developers and construction firms seeking efficiency.

| Customer Segment | Key Needs Addressed | 2024 Relevance/Data Point |

|---|---|---|

| Residential & Commercial Utilities | Reliable electricity, natural gas, water services | Millions of customers served in regulated territories (Alberta) |

| Industrial & Resource Sector | Specialized modular structures, rapid deployment for remote locations | Global mining CAPEX in the hundreds of billions driving demand |

| Government & Defense | Operational support, modular facilities, infrastructure development | Continued contract wins for national security and public works |

| Real Estate Developers & Construction | Modular building solutions, site services, streamlined construction | Modular construction market growth (valued ~$100B in 2023) |

| Investors & Shareholders | Financial performance, consistent returns, stable dividends | Strong financial results reported in 2024 |

Cost Structure

ATCO's cost structure heavily features capital expenditures for developing and maintaining its vast utility and energy infrastructure. These investments are crucial for building new pipelines, upgrading electricity grids, and expanding renewable energy projects to meet growing demand and sustainability goals.

In 2024, ATCO continued its significant capital investment program. For instance, the company allocated substantial funds towards the Alberta Utilities Commission approved capital forecast, which includes projects aimed at modernizing and expanding its electricity distribution network, ensuring reliability and capacity for future growth.

Ongoing costs for operating and maintaining ATCO's utility networks and modular facilities are significant. These include expenses for personnel, such as skilled technicians and engineers, as well as the upkeep of specialized equipment.

Preventative maintenance activities are crucial to ensure the reliability and safety of ATCO's infrastructure. In 2024, ATCO Gas Australia reported operational and maintenance expenses of approximately AUD 350 million, reflecting the continuous investment required to manage these essential services.

ATCO faces substantial expenses due to stringent regulations in its energy and utilities sectors. In 2024, these costs encompass ongoing investments in environmental protection measures, adherence to safety protocols, and the acquisition and maintenance of numerous operational permits and licenses.

These compliance expenditures are critical for ATCO's continued operation and include significant capital outlays for sustainability projects and programs aimed at reducing greenhouse gas emissions, ensuring responsible resource management.

Personnel and Labor Costs

As a significant global employer, ATCO's personnel and labor costs represent a substantial part of its expenses. This includes everything from employee salaries and comprehensive benefits packages to ongoing training and development programs essential for managing its diverse workforce across all operational segments.

In 2024, ATCO's commitment to its workforce is reflected in its significant investment in human capital. For instance, in the first quarter of 2024, ATCO reported total employee compensation and benefits expenses amounting to approximately $1.2 billion, highlighting the scale of this cost category.

- Salaries and Wages: The base compensation for ATCO's global workforce forms the largest portion of personnel costs.

- Employee Benefits: This includes health insurance, retirement plans, and other welfare programs provided to employees.

- Training and Development: Investments in upskilling and reskilling employees are crucial for maintaining operational efficiency and innovation.

- Workforce Management: Costs associated with HR, recruitment, and labor relations are also factored into this category.

Raw Material and Supply Chain Costs

ATCO's cost structure is significantly influenced by the procurement of raw materials essential for its modular construction projects. This includes lumber, steel, and other building components, the prices of which can fluctuate based on global demand and supply dynamics.

Furthermore, as a major energy distributor, ATCO incurs substantial costs related to acquiring energy commodities like natural gas and electricity. These costs are directly tied to market prices and are a critical component of its operational expenses.

The company's diverse operations also necessitate the purchase of various other supplies, from specialized equipment for its utilities segment to administrative resources. Managing these varied supply chains efficiently is key to controlling overall expenditures.

- Modular Construction Materials: Costs for lumber, steel, and other building supplies represent a significant portion of capital expenditure for ATCO's modular division.

- Energy Commodity Purchases: For its utilities segment, the price of natural gas and electricity directly impacts the cost of goods sold. In 2024, natural gas prices saw volatility, affecting input costs.

- Operational Supplies: ATCO's diverse operations require a broad range of supplies, from specialized tools to maintenance equipment, contributing to its overhead.

- Supply Chain Management: Investments in efficient logistics and supplier relationships are crucial for mitigating the impact of raw material price fluctuations.

ATCO's cost structure is dominated by significant capital expenditures for infrastructure development and maintenance, alongside substantial operating costs for its utility and modular businesses. Personnel expenses, including salaries and benefits, represent a major outlay, with total employee compensation and benefits approximating $1.2 billion in Q1 2024. The cost of procuring raw materials and energy commodities, subject to market volatility, also significantly impacts its financial performance.

| Cost Category | 2024 Data/Notes | Impact |

|---|---|---|

| Capital Expenditures | Significant investments in utility and energy infrastructure modernization and expansion. | Long-term asset growth, essential for service delivery. |

| Operating & Maintenance | Approx. AUD 350 million (ATCO Gas Australia O&M 2024). | Ensures reliability and safety of existing infrastructure. |

| Personnel Costs | Approx. $1.2 billion (Q1 2024 compensation & benefits). | Major expense supporting global workforce and operations. |

| Commodity Purchases | Subject to market price fluctuations for natural gas and electricity. | Directly impacts cost of goods sold and operational margins. |

| Regulatory Compliance | Investments in environmental protection, safety protocols, and permits. | Crucial for maintaining operational licenses and social responsibility. |

Revenue Streams

ATCO's primary revenue stream originates from regulated rates and tariffs for electricity and natural gas transmission and distribution. These essential services are provided to a broad customer base, encompassing residential, commercial, and industrial sectors. The rates themselves are subject to approval by relevant regulatory authorities, ensuring a structured and predictable income flow.

For instance, ATCO Electric Alberta, a key subsidiary, generated approximately $2.1 billion in revenue in 2023, largely driven by its regulated electricity distribution and transmission operations. These tariffs are meticulously set to cover operational costs, infrastructure investments, and a regulated rate of return, providing a stable financial foundation for the company.

ATCO's modular structures segment generates revenue through both the sale and rental of its diverse building solutions. This encompasses everything from workforce housing and specialized structures to accommodation camps and modular offices, serving a wide array of industries and global locations.

In 2024, ATCO's Structures & Logistics division reported significant revenue contributions from these modular building sales and rentals, reflecting strong demand across sectors like mining, oil and gas, and infrastructure development.

ATCO's revenue from energy infrastructure project contracts stems from agreements to develop, build, and manage substantial projects like pipelines and transmission lines. These contracts are typically long-term, ensuring a steady income stream over many years.

For instance, in 2024, ATCO Gas Australia secured a significant contract to upgrade its natural gas distribution network, valued in the hundreds of millions of dollars, highlighting the substantial nature of these revenue streams.

Retail Energy Sales and Services

ATCO's retail energy sales and services, primarily through ATCOenergy and Rümi, represent a significant revenue stream. This segment focuses on directly selling electricity and natural gas to both residential and commercial clients.

Beyond just energy supply, ATCO leverages these platforms to offer a suite of home maintenance services and expert advice. This diversification aims to capture more value from customer relationships, moving beyond a simple commodity provider to a home solutions partner.

For instance, in 2023, ATCO's Canadian Utilities segment, which includes these retail operations, reported adjusted earnings of $1.3 billion. While specific figures for ATCOenergy and Rümi are not always broken out separately, their contribution is vital to this overall performance, reflecting the growing demand for integrated home services.

- Retail Energy Sales: Direct provision of electricity and natural gas to end-users.

- Home Maintenance Services: Revenue from services like HVAC repair, plumbing, and electrical work.

- Advisory Services: Income generated from providing expert advice on energy efficiency and home care.

- Customer Base: Serving both residential households and commercial businesses.

Income from Investments and Joint Ventures

ATCO's diversified investment portfolio, including its significant stake in Neltume Ports, is a crucial revenue generator. These investments, along with various joint ventures, contribute income streams derived from their operational performance and profit distributions. For instance, Neltume Ports, a key asset, generated substantial revenue through its port operations.

The company's strategic partnerships and equity stakes in other entities allow it to capture a share of their financial success. These ventures span different sectors, providing ATCO with a broader base for income generation beyond its core utility operations. This diversification helps to stabilize overall earnings.

- Neltume Ports: ATCO's investment in this port operator is a significant contributor to its income from investments.

- Joint Ventures: Collaborative projects across various industries provide additional revenue streams through profit sharing and operational earnings.

- Diversified Portfolio: A broad range of investments across different sectors mitigates risk and enhances income stability.

ATCO's revenue streams are robust and diversified, spanning regulated utility services, modular building solutions, energy infrastructure projects, retail energy sales, and strategic investments. This multi-faceted approach ensures financial stability and growth across different economic conditions.

The regulated utility segment, ATCO Electric and ATCO Gas, provides predictable income through approved tariffs. Modular structures and logistics offer revenue from sales and rentals, particularly strong in 2024 for infrastructure and resource sectors. Long-term energy infrastructure contracts, like the 2024 ATCO Gas Australia network upgrade, secure substantial, ongoing revenue.

Retail energy sales via ATCOenergy and Rümi, coupled with home services, capture direct customer spending. Investments, notably in Neltume Ports, contribute significant income through operational success and profit sharing, demonstrating ATCO's strategic financial management.

| Revenue Stream | Primary Activity | Key 2023/2024 Data Point |

|---|---|---|

| Regulated Utilities | Electricity & Gas Transmission/Distribution | ATCO Electric Alberta revenue ~$2.1 billion (2023) |

| Modular Structures | Sales & Rentals of Buildings | Strong 2024 contributions from Structures & Logistics |

| Energy Infrastructure | Project Development & Management | Significant contract value for ATCO Gas Australia network upgrade (2024) |

| Retail Energy & Services | Direct Energy Sales & Home Services | Vital contribution to Canadian Utilities adjusted earnings of $1.3 billion (2023) |

| Investments | Equity Stakes & Joint Ventures (e.g., Neltume Ports) | Neltume Ports generated substantial revenue through port operations |

Business Model Canvas Data Sources

The ATCO Business Model Canvas is built upon a foundation of ATCO's internal financial reports, operational data, and strategic planning documents. This comprehensive data ensures each component of the canvas accurately reflects ATCO's current business reality and future aspirations.