ATCO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATCO Bundle

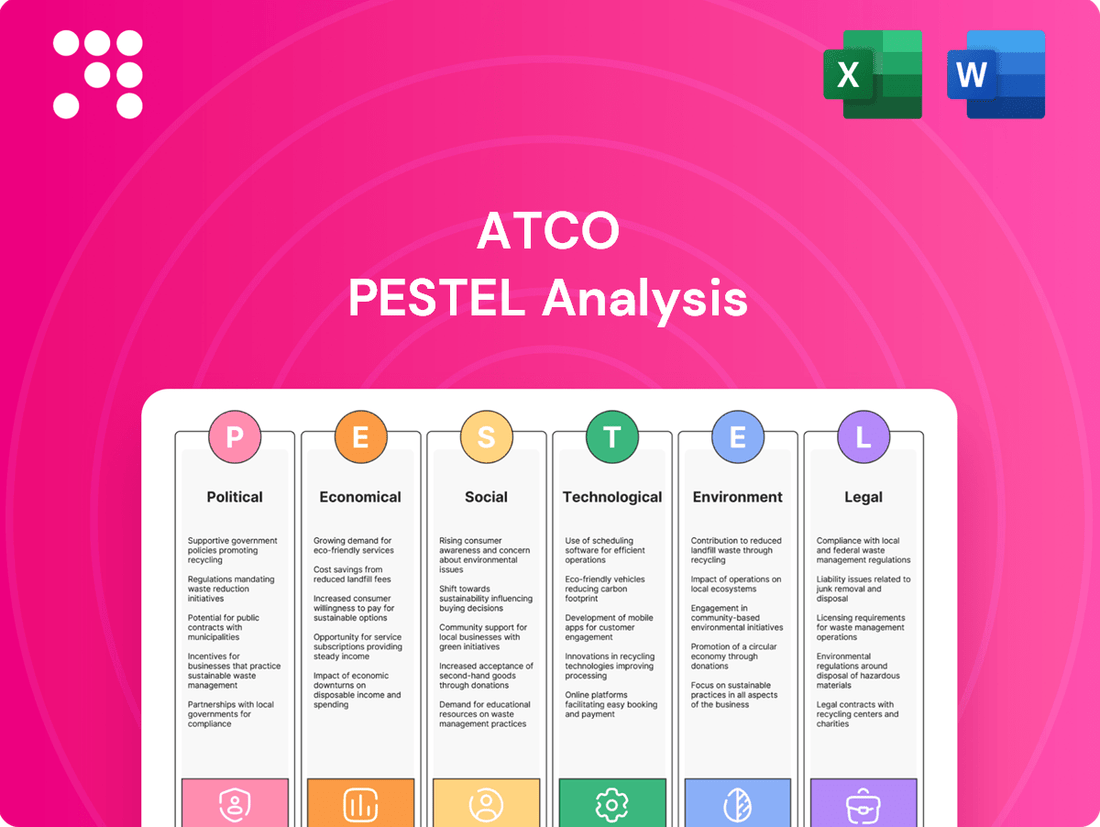

Unlock the strategic advantages ATCO holds by understanding the political, economic, social, technological, environmental, and legal forces at play. Our comprehensive PESTLE analysis provides the critical intelligence you need to anticipate market shifts and capitalize on opportunities. Download the full version now to gain actionable insights for your business strategy.

Political factors

Government policies, especially concerning utilities and energy, heavily shape ATCO's business. Regulatory bodies set the rules for electricity and natural gas transmission and distribution, impacting everything from pricing to how ATCO invests in its infrastructure and the quality of service it provides. For instance, in 2024, Canadian provinces continued to implement policies aimed at grid modernization and renewable energy integration, directly affecting ATCO Electric's capital expenditure plans.

ATCO's primary markets, Canada and Australia, generally exhibit strong political stability, providing a predictable environment for its infrastructure operations. For instance, Canada maintained a stable political landscape throughout 2024, with the federal government continuing its focus on energy transition initiatives. Australia also saw consistent governance, with ongoing policy development in renewable energy and infrastructure, crucial for ATCO's long-term investments.

ATCO's global operations are significantly shaped by international trade agreements and investment policies. For instance, the World Trade Organization (WTO) reported that global trade in goods grew by an estimated 0.5% in 2023, a modest increase that highlights the complex regulatory landscape ATCO navigates when expanding into new territories or sourcing materials. Changes in these policies, such as tariffs or quotas, can directly impact ATCO's cost of goods and its ability to compete in diverse markets.

Furthermore, ATCO's strategy for international investment is influenced by bilateral investment treaties and foreign direct investment (FDI) regulations. In 2024, many countries are reviewing their FDI screening mechanisms to address national security concerns, which could affect ATCO's ability to acquire or invest in foreign entities. The repatriation of profits is also a key consideration, with varying tax regimes and currency controls in different nations posing potential financial hurdles for ATCO's global financial management.

The prevailing trade tensions and rising protectionist sentiments globally present a notable challenge for ATCO's expansion plans. For example, ongoing trade disputes between major economic blocs can disrupt supply chains and create uncertainty, potentially increasing operational costs and delaying market entry. ATCO must remain agile, adapting its strategies to mitigate risks associated with these evolving international trade dynamics, especially as it seeks to leverage opportunities in emerging markets throughout 2024 and 2025.

Energy Policy and Decarbonization Goals

Governments globally are accelerating decarbonization efforts, with many setting net-zero targets for 2050 or earlier. This push directly influences ATCO's strategic direction in utilities and energy infrastructure. For instance, Canada, where ATCO is headquartered, has a federal target of reducing greenhouse gas emissions by 40-45% below 2005 levels by 2030.

These policies are a significant driver for ATCO's transition towards cleaner energy. The company's substantial investments in natural gas, for example, face increasing scrutiny and potential disincentives as renewable energy sources gain favor and policy support. ATCO's 2023 annual report highlights ongoing investments in renewable energy projects, aligning with these evolving governmental mandates.

The financial landscape for energy companies is being reshaped by these policy shifts.

- Policy Incentives: Governments are offering tax credits and subsidies for renewable energy development, such as the Investment Tax Credit for clean electricity in Canada, which can significantly improve project economics.

- Fossil Fuel Disincentives: Carbon pricing mechanisms and regulations on emissions from fossil fuel operations present financial risks and may necessitate accelerated depreciation or write-downs of certain assets.

- Infrastructure Adaptation: ATCO must invest in modernizing its grid to accommodate intermittent renewable sources and potentially phase out or repurpose existing fossil fuel infrastructure.

- Regulatory Uncertainty: Changes in government or policy priorities can create uncertainty, impacting long-term investment decisions and the valuation of energy assets.

Indigenous Relations and Resource Development

ATCO's operations in Canada and Australia frequently intersect with Indigenous communities, necessitating meticulous management of land claims, consultation mandates, and benefit-sharing accords. Government policies and judicial decisions concerning Indigenous rights and the extraction of natural resources significantly shape these interactions. For instance, in 2023, the Canadian government continued to advance reconciliation efforts, with ongoing dialogues and legislative reviews impacting resource project approvals. Similarly, Australian governments are increasingly prioritizing Indigenous co-design and partnership in resource development, as seen in evolving native title legislation and agreements.

Successful engagement with Indigenous groups is paramount for securing project authorizations and maintaining a social license to operate. This involves building trust and demonstrating a commitment to shared prosperity. For example, ATCO's commitment to Indigenous partnerships can be seen in its efforts to create employment and business opportunities for local communities. In 2024, the company reported a notable increase in Indigenous employment across its Australian operations, contributing to local economic development. These relationships are not merely regulatory hurdles but are foundational to sustainable and ethical resource development.

Key considerations for ATCO include:

- Navigating evolving Indigenous land rights legislation in both Canada and Australia.

- Ensuring robust and respectful consultation processes with Indigenous governance bodies.

- Developing and implementing equitable benefit-sharing agreements that foster long-term economic and social advantages for Indigenous partners.

- Adapting to government policies that promote Indigenous participation and ownership in resource projects, which are becoming increasingly stringent.

Government policies are a major force shaping ATCO's operations, particularly in the energy sector. Regulations on utilities dictate pricing, infrastructure investment, and service quality, with Canadian provinces in 2024 focusing on grid modernization and renewable energy integration. Political stability in ATCO's core markets, Canada and Australia, provides a predictable operating environment, though global trade tensions and protectionist sentiments can disrupt supply chains and increase costs for international ventures.

What is included in the product

This ATCO PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive overview of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping to quickly identify and address external factors impacting pest control strategies.

Economic factors

ATCO's diverse portfolio, spanning utilities and energy infrastructure, is closely tied to global economic expansion. When economies are robust, demand for energy and related services naturally increases, benefiting ATCO's revenue streams.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.0% in 2023, indicating a generally supportive environment for infrastructure-dependent businesses like ATCO.

However, a slowdown in economic activity, such as the 2.6% GDP growth anticipated for 2025 by the World Bank, could temper demand for electricity and natural gas, potentially affecting ATCO's earnings and the pace of new infrastructure investments.

Inflationary pressures in 2024 and into 2025 are a significant concern for ATCO. Rising costs for labor, essential materials like steel and concrete, and energy directly impact operational expenses. For instance, if inflation outpaces the approved regulatory rate increases for ATCO's utility segments, it could squeeze profit margins.

Interest rate fluctuations present another challenge. As central banks continue to manage inflation, borrowing costs for ATCO's substantial capital expenditures on infrastructure upgrades and new projects will be affected. Higher interest rates increase the cost of debt financing, potentially making some investments less financially viable compared to periods of lower rates.

ATCO's ability to navigate these economic factors hinges on robust financial management. This includes strategies for cost containment, efficient capital allocation, and timely negotiation of regulated rate adjustments to keep pace with the rising cost of doing business.

ATCO's operations, particularly its retail energy segment and some utility functions, are significantly impacted by the fluctuating prices of natural gas and electricity. These price swings directly affect ATCO's revenue, especially in deregulated markets, and can also shape how much energy customers use.

For instance, the average price of natural gas in North America saw considerable volatility through late 2023 and into 2024, influenced by factors like weather patterns and global supply dynamics. Similarly, electricity prices can be affected by the cost of generation fuels and demand surges, as seen during peak summer or winter months.

To manage this inherent risk, ATCO employs hedging strategies, which involve financial contracts to lock in prices, and relies on regulatory frameworks in its utility operations. These mechanisms are crucial for stabilizing earnings and ensuring reliable service delivery despite the volatile commodity markets.

Foreign Exchange Rate Volatility

ATCO's operations across Canada and Australia mean it's directly exposed to foreign exchange rate volatility. Fluctuations between the Canadian dollar (CAD) and the Australian dollar (AUD) can significantly affect how ATCO's international earnings are reported in its financial statements. For instance, if the AUD weakens against the CAD, the value of earnings generated in Australia, when converted to CAD, will decrease, potentially impacting ATCO's overall reported profitability.

Managing this currency risk is crucial for ATCO to ensure consistent financial performance. The company likely employs hedging strategies to mitigate the impact of adverse currency movements. For example, in early 2024, the CAD experienced some fluctuations against major currencies, highlighting the ongoing need for such risk management. ATCO's ability to navigate these currency shifts directly influences the stability of its international revenue streams.

- Impact on Earnings: A stronger Canadian dollar relative to the Australian dollar would reduce the reported value of ATCO's Australian earnings.

- Hedging Strategies: ATCO likely utilizes financial instruments like forward contracts or options to lock in exchange rates for future transactions.

- Economic Sensitivity: Changes in interest rates or economic stability in either Canada or Australia can exacerbate foreign exchange rate volatility.

- 2024/2025 Outlook: Analysts are closely watching the CAD/AUD exchange rate, with projections suggesting potential for continued, albeit moderate, fluctuations throughout 2024 and into 2025, necessitating ongoing vigilance from ATCO.

Infrastructure Investment Cycles

ATCO's business relies heavily on long-term infrastructure projects, particularly in utilities and energy. These investments are deeply influenced by broader economic trends, population expansion, and government-led stimulus initiatives. Successfully navigating these investment cycles is paramount for ATCO to optimize its capital deployment and ensure its assets are used efficiently over the long haul.

Government spending on infrastructure is a key driver. For instance, in 2024, Canada, where ATCO operates significantly, saw continued discussions and some implementation of infrastructure renewal programs. The Canadian government's 2023 budget, for example, allocated billions towards green infrastructure and public transit projects, which directly impacts the utility and energy sectors. These cycles can span many years, requiring careful planning and execution.

- Infrastructure Spending Trends: Global infrastructure investment is projected to reach $15 trillion by 2040, with a significant portion allocated to energy and utilities.

- Economic Growth Correlation: Infrastructure investment often accelerates during periods of strong economic growth and can be a tool to stimulate economies during downturns.

- Government Stimulus Impact: Policies like the Inflation Reduction Act in the US (passed in 2022, with ongoing implementation and impact in 2024-2025) provide substantial incentives for clean energy and grid modernization, directly benefiting companies like ATCO.

- Interest Rate Sensitivity: Infrastructure projects are capital-intensive and highly sensitive to interest rates, affecting the cost of financing for new developments and upgrades.

ATCO's performance is intrinsically linked to the health of the global and regional economies. Robust economic expansion fuels demand for energy and infrastructure services, directly boosting ATCO's revenue. Conversely, economic downturns can dampen demand and slow investment in new projects.

The IMF forecasts global growth at 3.2% for 2024, moderating to 2.8% in 2025, indicating a generally stable but not exceptionally strong economic environment. For ATCO, this means continued demand but potentially slower growth compared to periods of higher economic acceleration.

Persistent inflation in 2024 and 2025 poses a significant challenge, increasing operational costs for materials and labor. ATCO must manage these rising expenses against regulated utility rate increases to maintain profitability. Similarly, fluctuating interest rates impact the cost of financing ATCO's extensive capital projects, potentially affecting the viability of new investments.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on ATCO |

| Global GDP Growth | 3.2% (IMF) | 2.8% (IMF) | Moderate demand, potential for slower revenue growth |

| Inflation Rate (North America) | ~2.5%-3.5% (Est.) | ~2.0%-3.0% (Est.) | Increased operational costs, pressure on profit margins if rates lag |

| Interest Rates (Key Central Banks) | Holding steady or slight decreases | Potential for further slight decreases | Affects cost of capital for infrastructure projects |

Preview Before You Purchase

ATCO PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ATCO PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Public perception of utility companies like ATCO significantly impacts regulatory decisions and customer engagement. In 2024, surveys indicated that while trust in essential service providers remains relatively stable, concerns about energy affordability and the pace of transition to cleaner sources are growing. For ATCO, fostering a reputation for reliability, safety, and transparent environmental stewardship is paramount to securing public backing for infrastructure investments and maintaining customer loyalty.

Demographic shifts significantly impact ATCO's service demand. For instance, Canada's population is projected to reach 40.1 million by 2025, with continued growth in urban centers. This increasing population, particularly in cities, directly translates to higher demand for electricity and natural gas, requiring ATCO to invest in robust infrastructure to meet these needs.

Aging demographics also present a nuanced challenge and opportunity. As the population ages, there may be shifts in energy consumption patterns, potentially leading to increased demand for reliable heating and cooling services, especially in residential sectors. ATCO must consider how to adapt its service offerings and infrastructure to cater to the evolving needs of an older demographic.

Urbanization trends are a critical factor for ATCO's operational planning. As more people move to urban areas, the concentration of demand for essential services intensifies. ATCO's strategic investments in expanding its electricity and gas networks in growing metropolitan regions, such as Calgary and Edmonton, are crucial for maintaining service reliability and supporting economic development.

ATCO's operations, spanning energy, infrastructure, and logistics, demand a highly skilled workforce, including engineers, technicians, and specialized operational staff. The availability and cost of this talent are directly influenced by evolving workforce demographics. For instance, in Canada, where ATCO operates significantly, the proportion of workers aged 55 and over is projected to continue rising, potentially leading to increased retirements and a tighter labor market for experienced professionals. This trend underscores the critical need for ATCO to focus on robust talent acquisition, development, and retention strategies to ensure operational continuity and future growth.

Consumer Preferences for Sustainable Solutions

Consumers are increasingly prioritizing sustainability, driving demand for eco-friendly energy options. This societal shift puts pressure on companies like ATCO to adopt greener practices and invest in renewable energy sources. For instance, in 2024, a significant portion of new energy capacity added globally was in renewables, reflecting this trend.

ATCO's commitment to sustainable operations and its investments in renewable energy projects directly address these evolving consumer preferences. This alignment can significantly boost customer loyalty and strengthen ATCO's market position. By 2025, ATCO aims to further expand its renewable energy portfolio, responding to market signals.

- Growing Demand: Societal expectations for environmentally responsible energy solutions are on the rise.

- ATCO's Alignment: The company's investments in renewables and sustainable practices resonate with these consumer values.

- Market Competitiveness: Adapting to sustainability demands is crucial for ATCO's future relevance and competitive edge.

- Consumer Choice Influence: In 2024, consumer surveys indicated a willingness to pay a premium for energy from renewable sources.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are on the rise, prompting companies like ATCO to extend their efforts beyond mere regulatory adherence. This includes a greater focus on community involvement, ensuring ethical sourcing of materials, and demonstrating robust environmental stewardship. For instance, in 2024, consumer demand for sustainable products and transparent supply chains continued to grow, influencing purchasing decisions significantly.

Strong CSR practices offer tangible benefits for ATCO. They can significantly bolster brand reputation, making the company more attractive to a wider customer base and potential investors who increasingly prioritize Environmental, Social, and Governance (ESG) factors. ATCO's commitment to these areas in 2024 was reflected in its sustainability reports, highlighting initiatives aimed at reducing its carbon footprint and supporting local communities.

- Increased consumer demand for ethical and sustainable products in 2024.

- Growing investor focus on ESG performance, impacting capital allocation decisions.

- ATCO's ongoing investment in community development programs and environmental initiatives.

Societal values are shifting towards greater environmental consciousness, influencing how consumers and stakeholders view utility companies. ATCO's proactive engagement with renewable energy projects, such as its investments in solar and wind power, directly addresses these evolving expectations. By 2025, ATCO aims to increase its renewable energy generation capacity, aligning with the growing demand for cleaner energy sources and enhancing its public image.

Technological factors

Rapid advancements in renewable energy technologies, like solar and wind power, are reshaping the energy landscape. For ATCO, this means a growing opportunity to integrate these cleaner sources into its operations. For instance, the global renewable energy capacity is projected to reach over 7,000 GW by 2028, a significant jump from recent years, indicating a strong market trend.

These technological leaps, particularly in battery storage, are crucial for managing the intermittency of renewables. ATCO's investment strategy will likely be influenced by the decreasing costs of these technologies; solar panel costs have fallen by over 80% in the last decade, making them increasingly competitive with traditional energy sources.

The ability to enable distributed generation, where energy is produced closer to where it's consumed, also impacts ATCO's utility business. This shift can lead to improved energy efficiency across its service areas, potentially altering demand patterns and requiring flexible infrastructure investments.

The ongoing development of smart grid technologies, encompassing advanced metering infrastructure (AMI), grid automation, and sophisticated data analytics, is fundamentally reshaping the utility sector. These advancements are crucial for modernizing energy distribution and management.

ATCO can strategically harness these smart grid innovations to significantly boost grid reliability and streamline energy distribution processes. By integrating these technologies, the company can achieve greater operational efficiency and deliver enhanced customer service through real-time data insights and effective demand management capabilities.

ATCO is leveraging automation and AI to significantly boost efficiency and safety across its operations. For instance, in its energy sector, AI-powered predictive maintenance is being deployed to monitor infrastructure, aiming to prevent outages and reduce repair costs. This technology is projected to cut unscheduled maintenance by up to 20% in critical infrastructure by 2025.

The company is also exploring AI for optimizing logistics and supply chain management, particularly within its ATCO Structures & Logistics division. By using AI to forecast demand and manage inventory, ATCO anticipates a 10-15% improvement in delivery times and a reduction in transportation expenses. This focus on operational automation is a key technological driver for ATCO's strategic growth.

Cybersecurity Threats and Data Management

As a critical infrastructure operator, ATCO's extensive digital systems face escalating cybersecurity threats. In 2024, the global average cost of a data breach reached an estimated $4.73 million, highlighting the significant financial and operational risks. Protecting both operational technology (OT) and information technology (IT) environments is crucial for maintaining uninterrupted service delivery and safeguarding sensitive data.

The increasing sophistication of cyberattacks, including ransomware and state-sponsored threats, demands continuous investment in advanced security protocols. For instance, the energy sector experienced a notable rise in cyber incidents reported in late 2023 and early 2024, underscoring the vulnerability of utilities. ATCO's commitment to robust cybersecurity measures and effective data management is therefore essential for ensuring operational resilience and maintaining public trust.

- Cybersecurity Investment: ATCO must allocate substantial resources to fortify its digital defenses against evolving threats.

- Data Integrity: Implementing stringent data management practices is vital to prevent corruption or unauthorized access to critical operational data.

- Threat Landscape: Staying abreast of emerging cyber threats, such as AI-powered attacks, is paramount for proactive defense strategies.

- Regulatory Compliance: Adhering to evolving cybersecurity regulations and standards is a non-negotiable aspect of protecting critical infrastructure.

Innovation in Energy Storage and Hydrogen Technologies

Breakthroughs in energy storage, particularly large-scale batteries and green hydrogen, are reshaping the energy landscape. These advancements are crucial for the successful transition to cleaner energy sources. For instance, by mid-2024, global battery storage capacity is projected to reach over 100 GW, a significant jump from previous years, highlighting the rapid growth in this sector.

ATCO's strategic position within energy infrastructure allows it to actively explore and integrate these innovative technologies. This integration is key to improving grid stability, facilitating the seamless incorporation of renewable energy sources like solar and wind, and unlocking new avenues for growth within the burgeoning hydrogen economy. The demand for green hydrogen is expected to surge, with projections indicating a market value of over $100 billion by 2030.

- Energy Storage Growth: Global battery storage capacity is rapidly expanding, exceeding 100 GW by mid-2024, demonstrating a strong market trend.

- Green Hydrogen Potential: The green hydrogen market is poised for substantial growth, with an estimated market value surpassing $100 billion by 2030.

- ATCO's Role: ATCO can leverage these technological advancements to enhance grid reliability and create new business models in the clean energy sector.

- Renewable Integration: Improved storage solutions are vital for integrating intermittent renewable energy sources, ensuring a more consistent power supply.

Technological advancements are fundamentally altering the energy sector, with renewable energy integration and smart grid development at the forefront. ATCO's strategic focus on automation and AI is enhancing operational efficiency and safety, with AI-powered predictive maintenance aiming to reduce unscheduled maintenance by up to 20% by 2025.

The company is also leveraging AI for logistics optimization, anticipating a 10-15% improvement in delivery times. Cybersecurity remains a critical concern, with the global average cost of a data breach reaching an estimated $4.73 million in 2024, necessitating robust defense strategies for ATCO's digital infrastructure.

Breakthroughs in energy storage, such as large-scale batteries and green hydrogen, are crucial for the clean energy transition. Global battery storage capacity is projected to exceed 100 GW by mid-2024, while the green hydrogen market is expected to reach over $100 billion by 2030.

| Technology Area | Key Advancement | ATCO Relevance/Impact | Projected Growth/Data Point |

|---|---|---|---|

| Renewable Energy | Solar and Wind Power Integration | Opportunity to integrate cleaner sources, improve grid stability | Global renewable capacity to exceed 7,000 GW by 2028 |

| Energy Storage | Battery Technology & Green Hydrogen | Enhance grid stability, facilitate renewable integration, new business models | Battery storage capacity > 100 GW by mid-2024; Green hydrogen market > $100 billion by 2030 |

| Smart Grids | AMI, Grid Automation, Data Analytics | Boost reliability, streamline distribution, enhance customer service | Enabling distributed generation, altering demand patterns |

| Automation & AI | Predictive Maintenance, Logistics Optimization | Improve efficiency, safety, reduce costs, optimize supply chain | Predictive maintenance to cut unscheduled maintenance by up to 20% by 2025 |

| Cybersecurity | Advanced Security Protocols, Data Management | Protect critical infrastructure, ensure service delivery, maintain trust | Global average data breach cost $4.73 million in 2024 |

Legal factors

ATCO's operations are deeply intertwined with a complex web of regulations across its utility and energy sectors. In 2024, these include stringent safety standards, environmental protection mandates, and service quality benchmarks, all of which are crucial for maintaining operating licenses and avoiding significant penalties. For instance, compliance with emissions standards and renewable energy targets directly impacts operational costs and strategic investment decisions.

Navigating these regulatory landscapes in Canada and Australia, where ATCO has substantial investments, demands constant vigilance. Failure to adhere to pricing frameworks set by regulatory bodies, such as the Alberta Utilities Commission, could lead to substantial financial repercussions, impacting revenue streams and investor confidence. The company's ability to adapt to evolving environmental legislation, like those concerning carbon capture or methane emissions, is paramount for long-term sustainability.

ATCO's operations are increasingly shaped by stricter environmental laws, particularly concerning carbon emissions, water quality, and land use. For instance, Canada's federal carbon pricing system, which saw the national backstop carbon tax reach $65 per tonne of CO2 equivalent in April 2023 and is projected to rise to $170 per tonne by 2030, directly affects ATCO's energy generation and distribution activities.

Adapting to these evolving regulations, including potential changes in carbon pricing mechanisms or emissions reduction targets, is crucial for ATCO's environmental stewardship and public image. This necessity spurs significant investment in cleaner energy technologies and more sustainable operational methodologies, aiming to mitigate compliance risks and capitalize on emerging green opportunities.

ATCO's operations in the energy and infrastructure sectors necessitate strict adherence to occupational health and safety (OHS) legislation across its various jurisdictions. This includes complying with regulations like Alberta's Occupational Health and Safety Act, which mandates employers to provide a safe workplace and prevent workplace injuries and illnesses. Failure to comply can result in significant fines and operational disruptions.

The company must continually invest in robust safety management systems, employee training, and advanced safety equipment to meet these legal requirements and safeguard its employees. For instance, in 2023, ATCO reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.47, demonstrating a commitment to minimizing workplace incidents and aligning with stringent OHS standards.

Contract Law and Commercial Agreements

ATCO's operations are heavily reliant on a vast array of commercial agreements, from intricate long-term energy supply contracts to large-scale construction projects and ongoing service agreements. Navigating the complexities of contract law is paramount. For instance, in 2024, ATCO Gas Australia finalized a significant agreement for the supply of natural gas, underscoring the critical nature of these contractual frameworks.

Adherence to contract law and diligent oversight of these multifaceted agreements are essential for ATCO to effectively manage financial exposure and operational disruptions. These contracts are the bedrock for ensuring successful project execution and fostering robust, enduring relationships with both its suppliers and its diverse client base.

- Contractual Risk Mitigation: ATCO's ability to secure favorable terms and ensure compliance in its energy, construction, and service contracts directly impacts its financial stability and operational continuity.

- Project Delivery Assurance: Well-defined contractual obligations are key to guaranteeing the timely and successful completion of ATCO's infrastructure and energy projects.

- Partner and Client Relations: Upholding contractual commitments is fundamental to maintaining ATCO's reputation and fostering trust with its business partners and customers.

Privacy and Data Protection Laws

ATCO's increasing reliance on digital services means it manages substantial customer and operational data. Staying compliant with privacy laws, akin to GDPR or regional mandates, is critical for safeguarding sensitive information and preventing legal penalties from data breaches. For instance, in 2024, companies globally faced an average fine of $4.3 million for GDPR violations, highlighting the financial risks of non-compliance.

Failure to adhere to these regulations can lead to severe financial penalties and damage ATCO's reputation. Proactive data protection measures are therefore paramount.

- Data Volume: ATCO handles millions of customer records, requiring robust security protocols.

- Regulatory Landscape: Evolving laws like Canada's proposed Consumer Privacy Protection Act (CPPA) necessitate continuous adaptation.

- Reputational Risk: Data breaches can erode customer trust, impacting brand loyalty and market share.

- Financial Impact: Non-compliance fines can be substantial, as seen in global data protection enforcement actions.

ATCO operates under a rigorous legal framework governing its utility and energy services, with compliance in areas like environmental protection and safety being paramount. In 2024, adherence to emissions standards and renewable energy mandates directly influences operational costs and strategic investment, with Canada's federal carbon pricing system, set to reach $170 per tonne by 2030, significantly impacting operations.

The company must also navigate stringent occupational health and safety (OHS) legislation, such as Alberta's OHS Act, to ensure a safe working environment, as evidenced by ATCO's 2023 Total Recordable Injury Frequency Rate (TRIFR) of 0.47, reflecting a commitment to minimizing workplace incidents.

Furthermore, ATCO's extensive commercial agreements, including energy supply and construction contracts, are governed by contract law, with adherence being crucial for managing financial exposure and ensuring project success, as demonstrated by ATCO Gas Australia's significant natural gas supply agreements finalized in 2024.

Data privacy laws, with global fines for violations averaging $4.3 million in 2024, are critical for ATCO as it manages substantial customer data, necessitating robust security and adaptation to evolving regulations like Canada's proposed Consumer Privacy Protection Act (CPPA).

Environmental factors

Climate change is intensifying extreme weather, posing significant risks to ATCO's infrastructure. In 2024, Canada experienced a record-breaking wildfire season, with over 18 million hectares burned, impacting air quality and potentially disrupting energy supply chains. These events, alongside increased flooding and heatwaves, necessitate robust adaptation strategies.

ATCO's commitment to resilient infrastructure is paramount. This includes investing in upgrades to withstand more severe weather and enhancing emergency response capabilities. For instance, following the 2023 Alberta floods, ATCO focused on reinforcing critical substations and improving vegetation management to reduce wildfire risks near power lines, ensuring continued service delivery and public safety.

Global and national commitments to decarbonization, including net-zero emissions targets by 2050, are significantly shaping ATCO's strategic direction. This is driving a substantial pivot from carbon-heavy operations to cleaner energy alternatives.

ATCO's response involves increased investment in renewable energy sources and exploration of carbon capture technologies. These efforts are crucial for aligning its business model with evolving environmental regulations and market expectations by mid-century.

ATCO's industrial solutions and utility operations depend heavily on water and land resources. For instance, their electricity generation facilities often require significant water for cooling. As of 2024, global freshwater scarcity is a growing concern, with the World Resources Institute reporting that over 2 billion people live in countries experiencing high water stress.

This increasing scarcity, exacerbated by climate change and population growth, directly impacts ATCO's operational costs and the feasibility of new projects. Higher water prices or restrictions could increase expenses for their power generation and other water-intensive industrial processes. Furthermore, competition for land use, driven by urbanization and agriculture, can affect the availability and cost of sites for new infrastructure.

Consequently, ATCO's long-term success hinges on robust sustainable resource management and efficiency. Investments in water conservation technologies and exploring alternative cooling methods for power plants are becoming crucial. For example, by 2025, many energy companies are expected to increase their focus on closed-loop water systems to minimize consumption.

Biodiversity and Ecosystem Protection

ATCO's infrastructure development and energy projects can significantly impact biodiversity and natural ecosystems. For instance, in 2024, the company's renewable energy initiatives, such as wind farms, require careful site selection to avoid critical habitats for species like the endangered Greater Sage-Grouse in Alberta, where ATCO operates extensively. Adherence to rigorous environmental assessments and mitigation strategies is paramount to minimize ecological footprints and protect sensitive areas.

Compliance with biodiversity conservation laws, such as Canada's Species at Risk Act, is a key consideration. ATCO must implement measures to protect sensitive habitats and ensure responsible land stewardship across its operational footprint. In 2025, ongoing monitoring of projects will be crucial to assess the effectiveness of these mitigation efforts and adapt strategies as needed.

- Impact Assessment: Thorough environmental impact assessments are conducted for all new projects, identifying potential risks to biodiversity.

- Mitigation Strategies: ATCO employs measures like habitat restoration, wildlife crossings, and phased construction to reduce ecological disruption.

- Regulatory Compliance: Strict adherence to federal and provincial environmental regulations, including those protecting endangered species, is maintained.

- Ecosystem Protection: Efforts are made to conserve and protect sensitive ecosystems and biodiversity hotspots within and around ATCO's operational areas.

Waste Management and Circular Economy Principles

Effective waste management, encompassing reduction, reuse, and recycling, is a significant environmental factor for ATCO. The company's commitment to these practices directly impacts its operational footprint and resource utilization. For instance, in 2024, many industrial sectors are facing increased scrutiny on landfill diversion rates, with some regions targeting over 75% diversion by 2025.

Embracing circular economy principles offers ATCO a pathway to minimize operational waste and enhance resource efficiency. This approach not only aligns with global sustainability objectives but also addresses growing regulatory expectations for industrial entities. By integrating circularity, ATCO can potentially lower its environmental liabilities and improve its overall resource productivity, a trend that saw significant investment in circular economy startups in 2024, exceeding $20 billion globally.

- Waste Reduction Targets: ATCO's waste reduction initiatives are crucial for environmental compliance and cost savings.

- Recycling Rates: Improving recycling rates across operations can significantly decrease landfill dependency and material costs.

- Circular Economy Investment: The global investment in circular economy solutions reached approximately $25 billion in 2024, highlighting the economic viability of these principles.

- Regulatory Compliance: Adherence to evolving waste management regulations, such as extended producer responsibility schemes, is paramount.

Environmental factors significantly influence ATCO's operations, from extreme weather risks to resource management. The company's adaptation to climate change, including investments in resilient infrastructure and renewable energy, is crucial for navigating these challenges and meeting net-zero targets by 2050.

Water scarcity and land use competition are growing concerns, impacting operational costs and project feasibility. ATCO's focus on water conservation and efficient land stewardship is essential for long-term success and regulatory compliance.

Biodiversity protection and effective waste management are also key environmental considerations. ATCO's adherence to conservation laws and adoption of circular economy principles are vital for minimizing its ecological footprint and enhancing resource productivity.

| Environmental Factor | Impact on ATCO | 2024/2025 Data/Trend |

| Climate Change & Extreme Weather | Risk to infrastructure, service disruption | Record wildfire season in Canada (18M+ hectares burned in 2024); increased focus on flood/heatwave adaptation. |

| Decarbonization & Net-Zero Targets | Shift to renewables, investment in new technologies | Global push for net-zero by 2050; ATCO increasing investment in renewables and carbon capture. |

| Water Scarcity | Increased operational costs, project feasibility | Over 2 billion people in high water stress countries (WRI); ATCO exploring alternative cooling and closed-loop systems. |

| Biodiversity & Ecosystem Protection | Need for careful site selection, regulatory compliance | Protection of endangered species (e.g., Greater Sage-Grouse); adherence to Species at Risk Act. |

| Waste Management & Circular Economy | Operational footprint, resource efficiency | Global investment in circular economy startups ~$25B in 2024; focus on landfill diversion rates (75%+ targets by 2025). |

PESTLE Analysis Data Sources

Our ATCO PESTLE Analysis is built on a robust foundation of data from official government publications, reputable market research firms, and international economic organizations. We meticulously gather information on political stability, economic indicators, societal trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.