Arconic SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arconic Bundle

Arconic's strengths lie in its specialized aerospace and automotive materials, but its reliance on these sectors presents a significant threat. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Arconic's market position, competitive advantages, and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Arconic stands as a global leader in advanced aluminum solutions, a position reinforced by its extensive reach across critical sectors like aerospace, automotive, and construction. This broad market footprint, encompassing diverse industries, diversifies Arconic's revenue streams, lessening reliance on any single economic segment and fostering financial resilience.

In 2024, Arconic's commitment to innovation and quality solidified its standing, with significant contributions to lightweighting initiatives in the automotive sector, aiming to improve fuel efficiency. The company's advanced materials are integral to the performance and safety standards demanded by the aerospace industry, a testament to its technological prowess.

Arconic's strength lies in its specialized portfolio of high-performance aluminum products. They focus on lightweight, sustainable solutions like sheet, plate, and extrusions, catering to demanding sectors such as architecture and aerospace.

A key differentiator is their commitment to innovation, backed by significant R&D investment. In 2023, Arconic poured over $33 million into research, developing advanced alloys crucial for lightweighting in electric vehicles and cutting-edge aerospace designs.

Arconic's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. Their 2023 Sustainability Report showcased a 6% decrease in overall greenhouse gas emissions compared to the previous year, demonstrating tangible progress. This commitment is further solidified by their ambitious goal to achieve a 30% reduction in GHG emissions intensity by 2030.

This strong emphasis on sustainability directly addresses the growing market preference for environmentally responsible materials. By prioritizing low-carbon solutions, Arconic not only meets evolving customer demands but also bolsters its brand image and market appeal in an increasingly conscious global economy.

Advanced Manufacturing Capabilities

Arconic's advanced manufacturing capabilities are a significant strength, allowing for the creation of high-quality and efficient products. Their state-of-the-art processes and technical expertise are key differentiators in the market.

These capabilities are crucial for meeting evolving customer demands and staying ahead of the competition. For instance, Arconic's focus on engineering recyclable materials and enhancing flow-path efficiencies directly addresses the growing need for sustainable and high-performance solutions.

- State-of-the-art manufacturing processes: Arconic leverages cutting-edge technology to produce complex engineered products.

- Technical know-how: Deep expertise in materials science and manufacturing allows for innovative product development.

- Focus on sustainability: Capabilities include engineering recyclable materials, aligning with environmental goals.

- Efficiency improvements: Arconic works on improving flow-path efficiencies, enhancing product performance and reducing waste.

Established Customer Relationships and Market Position

Arconic benefits from deeply entrenched customer relationships, particularly in demanding sectors like aerospace. For instance, its aluminum sheet and plate products are critical components for major aircraft manufacturers, fostering loyalty built on decades of reliable supply and technical expertise.

The company commands leading market positions in several key areas. In 2023, Arconic maintained its strong foothold in the aerospace aluminum sheet and plate market, a segment characterized by high barriers to entry and stringent quality requirements. Similarly, its position in the North American automotive aluminum sheet market remains robust, driven by the ongoing trend towards lightweighting vehicles to improve fuel efficiency.

These strengths are underpinned by a history of innovation and a dedicated workforce. Arconic's commitment to research and development has consistently delivered advanced material solutions, while its employees' expertise ensures product quality and customer support. This combination solidifies its competitive advantage.

- Established Aerospace Relationships: Arconic's long-standing partnerships with leading aircraft manufacturers provide a stable revenue base and deep market penetration.

- North American Automotive Leadership: The company holds a significant share in the North American automotive aluminum sheet market, benefiting from the lightweighting trend.

- Technical Innovation Legacy: A history of developing advanced aluminum alloys and manufacturing processes supports its premium market positioning.

- Engaged Workforce: Experienced and dedicated employees contribute to product quality and customer satisfaction, reinforcing market strength.

Arconic's primary strengths lie in its specialized portfolio of high-performance aluminum products, particularly sheet, plate, and extrusions, crucial for demanding sectors like aerospace and automotive. The company's significant investment in R&D, exceeding $33 million in 2023, fuels innovation in advanced alloys for electric vehicles and aerospace. Arconic's leadership in sustainability, evidenced by a 6% reduction in GHG emissions in 2023 and a target of 30% reduction by 2030, aligns with market demand for environmentally responsible materials.

Furthermore, Arconic possesses advanced manufacturing capabilities and deep technical expertise, enabling the production of high-quality, efficient, and recyclable materials. These capabilities are essential for meeting evolving customer needs and maintaining a competitive edge in the market.

The company benefits from deeply entrenched customer relationships, especially with major aircraft manufacturers, ensuring a stable revenue stream. Arconic also holds leading market positions in the aerospace aluminum sheet and plate market and the North American automotive aluminum sheet market, driven by the growing trend of vehicle lightweighting.

| Strength Category | Specific Strength | Supporting Data/Fact |

| Product Portfolio | High-performance aluminum solutions | Focus on sheet, plate, and extrusions for aerospace and automotive. |

| Innovation | R&D Investment | Over $33 million invested in 2023 for advanced alloys. |

| Sustainability | ESG Commitment | 6% GHG emissions reduction in 2023; target 30% by 2030. |

| Market Position | Aerospace Leadership | Dominant position in aerospace aluminum sheet and plate market. |

| Customer Relationships | Long-standing Partnerships | Critical supplier to major aircraft manufacturers. |

What is included in the product

Delivers a strategic overview of Arconic’s internal and external business factors, highlighting its strengths in specialized materials and market leadership, while also addressing weaknesses in operational efficiency and opportunities in emerging markets, alongside threats from competition and economic volatility.

Arconic's SWOT analysis offers a clear roadmap for navigating market challenges and capitalizing on opportunities.

It helps identify and address internal weaknesses and external threats, thereby reducing strategic uncertainty.

Weaknesses

Arconic's profitability is directly tied to the volatile prices of key raw materials like aluminum and alumina. For instance, while alumina prices are anticipated to soften in 2025, the broader aluminum market is expected to maintain support but with continued price swings. This inherent volatility in input costs can significantly squeeze Arconic's production costs and, consequently, its profit margins.

Arconic navigates a fiercely competitive aerospace and automotive materials market, facing established rivals like Kaiser Aluminum and Precision Castparts. The influx of emerging competitors, particularly from China and other developing nations, intensifies this pressure. This dynamic environment necessitates constant innovation and cost management to preserve market share and profitability.

Arconic's operations, focused on producing advanced aluminum solutions like sheet, plate, and extrusions, demand significant capital. This means substantial upfront investments in state-of-the-art facilities and specialized machinery are a constant necessity.

While these investments are crucial for growth and maintaining a competitive edge, they can put pressure on Arconic's cash flow. For instance, in 2023, Arconic reported capital expenditures of $430 million, highlighting the ongoing need for significant financial outlays.

This capital intensity requires meticulous capital allocation strategies to balance growth initiatives with maintaining financial flexibility and managing debt levels effectively.

Exposure to Industry-Specific Downturns

Arconic's reliance on key sectors like aerospace, automotive, and construction presents a significant vulnerability. Economic slowdowns or industry-specific challenges in these areas can directly impact Arconic's revenue streams.

For example, a downturn in global automotive production, which saw a slight contraction in 2023 compared to prior years due to supply chain issues and economic uncertainty, could reduce demand for Arconic's engineered aluminum solutions. Similarly, fluctuations in aerospace manufacturing, a sector Arconic heavily serves, can create volatility.

- Vulnerability to Aerospace Sector Fluctuations: Arconic's significant presence in aerospace means that shifts in aircraft production or order backlogs directly affect its performance.

- Impact of Automotive Industry Cycles: Economic downturns or changes in consumer demand within the automotive sector can lead to reduced sales of Arconic's aluminum components.

- Sensitivity to Construction Market Trends: While diversified, Arconic's exposure to the construction industry means it can be affected by housing market slowdowns or commercial building project delays.

Potential Legal and Regulatory Risks

Arconic faces potential legal and regulatory headwinds. For instance, the company was involved in a WARN Act investigation in 2025 related to its workforce reductions, and it also encountered a securities fraud class action lawsuit. These legal entanglements can lead to significant expenses, divert crucial management focus away from core operations, and potentially tarnish Arconic's public image.

These legal challenges can translate into substantial financial burdens. While specific settlement figures for ongoing or past cases are not always public, such litigation can easily run into millions of dollars in legal fees and potential penalties. Furthermore, the distraction for senior leadership can impact strategic decision-making and operational efficiency during the pendency of these matters.

- WARN Act Investigation: Arconic faced scrutiny in 2025 regarding its compliance with the Worker Adjustment and Retraining Notification Act during layoffs.

- Securities Fraud Lawsuit: The company has been a defendant in a class action lawsuit alleging securities fraud, indicating potential investor concerns.

- Reputational Damage: Legal battles and regulatory investigations can negatively impact Arconic's brand perception and stakeholder trust.

- Financial Costs: Litigation expenses, potential fines, and settlement payouts represent a significant financial risk that could affect profitability.

Arconic's profitability is susceptible to the volatile pricing of crucial raw materials like aluminum and alumina, which can squeeze production costs and profit margins. The company also operates in a highly competitive market, facing pressure from established rivals and emerging players, necessitating continuous innovation and cost management.

The capital-intensive nature of Arconic's operations requires substantial ongoing investments in facilities and machinery, potentially straining cash flow and demanding meticulous capital allocation. Furthermore, its reliance on key sectors like aerospace and automotive makes it vulnerable to economic downturns or industry-specific challenges that can directly impact revenue.

Legal and regulatory issues, such as WARN Act investigations and securities fraud lawsuits, pose a significant risk, leading to substantial expenses, diverting management focus, and potentially damaging the company's reputation.

Preview Before You Purchase

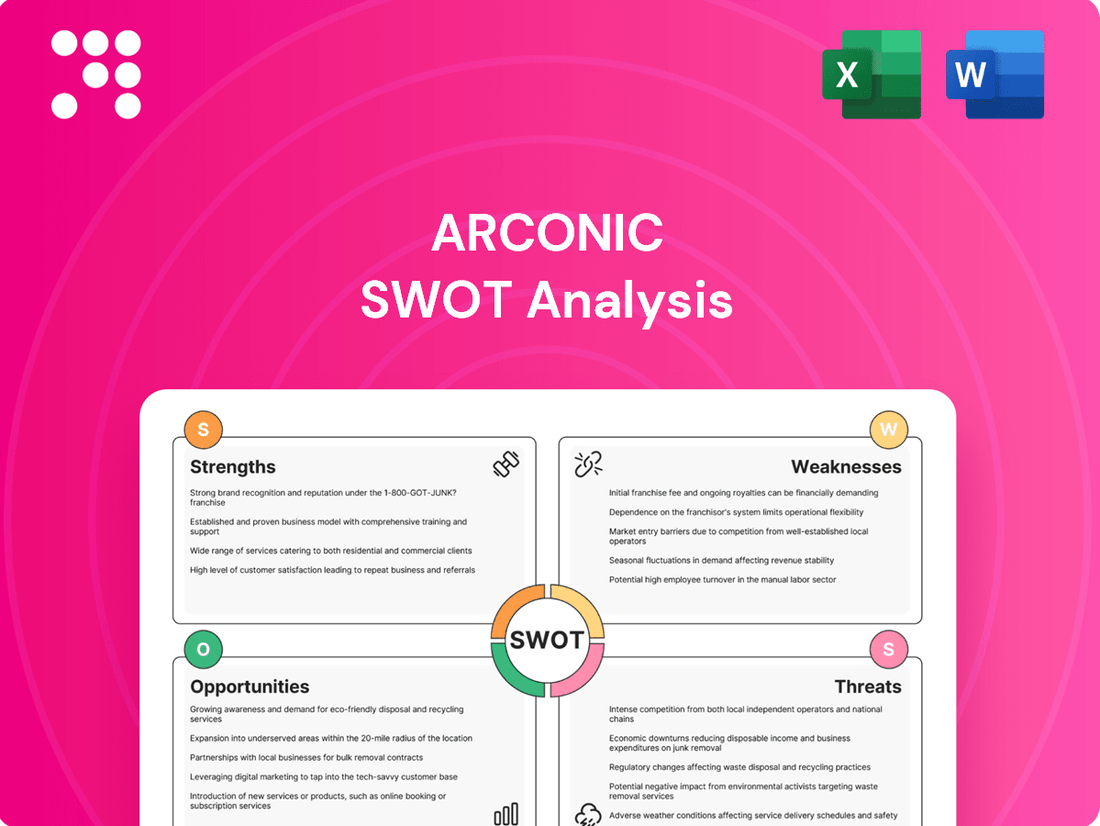

Arconic SWOT Analysis

This is the actual Arconic SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, as well as external Opportunities and Threats.

The preview below is taken directly from the full Arconic SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for Arconic.

This is a real excerpt from the complete Arconic SWOT analysis. Once purchased, you’ll receive the full, editable version, offering actionable insights into Arconic's market position.

Opportunities

The automotive industry's relentless pursuit of enhanced fuel efficiency and the burgeoning electric vehicle (EV) market are driving a significant demand for lightweight materials. Arconic's advanced aluminum solutions are perfectly positioned to capitalize on this trend, offering substantial weight reduction benefits crucial for extending EV range and improving overall vehicle performance. The global aluminum alloys market, a key indicator for Arconic's prospects, was valued at approximately $70 billion in 2023 and is expected to see robust growth through 2030.

Furthermore, the aerospace sector continues to be a strong driver for lightweighting, with airlines and manufacturers seeking ways to reduce fuel consumption and operational costs. This sustained demand from aerospace, coupled with the automotive sector's transformation, creates a substantial growth runway for Arconic. Industry forecasts suggest the aerospace aluminum market alone could reach over $30 billion by 2027, underscoring the vast opportunity.

The growing global push for sustainability and a circular economy is significantly boosting the demand for recycled and low-carbon aluminum. This trend presents a clear opportunity for Arconic, as its strategic focus on reducing greenhouse gas emissions and enhancing recyclability directly aligns with these market demands. By emphasizing these eco-friendly attributes, Arconic can effectively differentiate itself and tap into expanding markets for environmentally conscious products.

The building and construction sector remains a major user of aluminum, especially for extruded and cast components in infrastructure and housing. Urbanization trends and a push for sustainable building practices are increasing demand for Arconic's architectural and construction aluminum products, widening its market reach.

Technological Advancements and AI Integration

Arconic is well-positioned to leverage technological advancements, particularly in AI, to boost its operational efficiency and reduce material waste. Innovations like advanced aluminum alloys and additive manufacturing, or 3D printing, are opening doors for new product possibilities. The company's commitment to research and development is key to capitalizing on these trends.

For instance, Arconic’s investment in R&D for advanced materials, including those used in aerospace and automotive sectors, is crucial. In 2024, the company continued to focus on developing lighter, stronger aluminum solutions that can be produced more sustainably. This focus aligns with the growing demand for high-performance materials that also minimize environmental impact, a trend expected to accelerate through 2025.

- AI-driven process optimization: Implementing AI in manufacturing can lead to predictive maintenance, improved quality control, and streamlined production lines, potentially reducing operational costs by 5-10% in key areas by 2025.

- Additive Manufacturing (3D Printing): This technology allows for the creation of complex aluminum parts with reduced material usage and faster prototyping cycles, opening new markets for customized components.

- Advanced Alloy Development: Continued innovation in aluminum alloys offers enhanced properties like increased strength-to-weight ratios, crucial for sectors like aerospace and electric vehicles.

- R&D Investment: Arconic's sustained investment in research and development ensures it remains at the forefront of material science and manufacturing technology.

Strategic Partnerships and Market Diversification

Arconic can significantly boost its market reach by forging strategic partnerships with manufacturers across diverse sectors. This approach allows for the co-creation of tailored solutions, directly addressing specific industry needs. For instance, collaborations in aerospace and automotive sectors, where Arconic already has a strong presence, can be deepened to introduce innovative material applications.

Expanding its geographical footprint is another key opportunity. By establishing a stronger presence in emerging markets, Arconic can tap into new customer bases and diversify its revenue streams. The company's ongoing efforts to optimize its global operations and portfolio, as seen in its strategic divestitures and acquisitions, are designed to enhance this very global reach.

- Strategic Alliances: Forming partnerships with key players in industries like renewable energy and advanced electronics can unlock new application areas for Arconic's high-performance materials.

- Geographic Expansion: Targeting growth in regions like Southeast Asia and Latin America, where industrial development is accelerating, presents a significant opportunity to diversify market exposure.

- Customized Solutions: Leveraging partnerships to develop bespoke material solutions can create a competitive advantage and foster deeper customer loyalty.

Arconic is well-positioned to benefit from the increasing demand for lightweight materials in the automotive and aerospace sectors, driven by fuel efficiency and EV adoption. The company's focus on sustainability and recycled aluminum also aligns with growing market preferences. Technological advancements in areas like additive manufacturing and AI offer further avenues for growth and operational efficiency.

Strategic partnerships and geographic expansion are key opportunities for Arconic to broaden its market reach and customer base. By developing customized solutions and targeting emerging markets, the company can unlock new revenue streams and solidify its competitive position. Continued investment in R&D for advanced alloys will be crucial for staying ahead in material science.

| Opportunity Area | Key Drivers | Arconic's Advantage |

|---|---|---|

| Automotive Lightweighting & EVs | Fuel efficiency mandates, EV range extension | Advanced aluminum alloys for weight reduction |

| Aerospace Demand | Fuel cost reduction, operational efficiency | High-strength, lightweight aluminum solutions |

| Sustainability & Circular Economy | Environmental regulations, consumer preference | Recycled content, low-carbon production |

| Technological Advancements | AI, Additive Manufacturing | R&D investment, process optimization capabilities |

| Market Expansion | Emerging markets, strategic partnerships | Global operations, tailored product development |

Threats

Global economic instability, marked by persistent inflation and ongoing supply chain disruptions, poses a significant threat to Arconic. Geopolitical tensions further exacerbate this uncertainty, potentially dampening demand across Arconic's key sectors like aerospace and automotive. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, highlighting a challenging macroeconomic environment.

Economic slowdowns directly translate to reduced industrial activity, which can negatively impact Arconic's sales volumes and overall profitability. A contraction in manufacturing output, for example, would lessen the need for Arconic's specialized engineered products. The World Bank's January 2024 forecast indicated a 2.4% global growth for 2024, a slight decrease from 2023, underscoring the continued pressure on industrial demand.

Changes in international trade policies and the imposition of tariffs significantly impact aluminum pricing and availability, key factors for Arconic. For instance, the U.S. imposed Section 232 tariffs on steel and aluminum imports in 2018, which, while subject to some adjustments and exemptions, created price volatility and supply chain uncertainties for global manufacturers.

These evolving regulatory measures can disrupt Arconic's established supply chains, potentially increasing raw material costs and operational expenses. For a company with a global footprint, navigating these trade barriers and fluctuating tariffs presents a substantial challenge to maintaining cost competitiveness and consistent production schedules.

The ongoing advancement of alternative lightweight materials and composites presents a significant long-term threat to the aluminum market. Innovations in materials like advanced plastics, carbon fiber composites, and even novel metal alloys could offer comparable or even superior performance characteristics. For instance, the automotive sector, a key market for Arconic, is increasingly exploring carbon fiber reinforced polymers (CFRPs) for weight reduction, with the global CFRP market projected to reach over $25 billion by 2027, indicating a growing competitive landscape for aluminum.

Supply Chain Vulnerabilities and Disruptions

Arconic, like many global manufacturers, faces significant risks from supply chain disruptions. The availability of key raw materials, such as aluminum, can be volatile, impacting production schedules and costs. For instance, rising energy prices in 2024 and early 2025 have put upward pressure on aluminum production, a core input for Arconic.

Shipping and logistics can also present challenges. Geopolitical tensions or unforeseen events, such as port congestion or trade disputes, can delay the movement of goods, affecting Arconic's ability to deliver products to customers on time. These delays can lead to lost sales and damage customer relationships.

The interconnected nature of global supply chains means that a disruption in one region can have ripple effects across Arconic's operations. This vulnerability was highlighted by the impact of the COVID-19 pandemic, which caused widespread manufacturing and shipping slowdowns. Arconic must continually monitor and adapt to these evolving risks.

- Raw Material Volatility: Fluctuations in aluminum prices, driven by energy costs and global demand, directly impact Arconic's cost of goods sold.

- Logistics Bottlenecks: Delays in shipping and transportation, exacerbated by global events, can hinder timely product delivery and increase operational expenses.

- Geopolitical Instability: Trade policies, sanctions, and regional conflicts can disrupt the flow of materials and finished goods, posing a constant threat to supply chain continuity.

Environmental Regulations and Compliance Costs

Arconic faces growing pressure from increasingly stringent environmental regulations concerning emissions, energy usage, and waste disposal. Meeting these evolving standards could necessitate substantial capital investments and significant changes to current operational practices. For instance, the U.S. Environmental Protection Agency (EPA) continues to update regulations on greenhouse gas emissions and air pollutants, impacting manufacturing sectors like Arconic's.

While Arconic has demonstrated a commitment to sustainability initiatives, unforeseen or accelerated regulatory shifts could lead to increased compliance costs or even restrict certain production activities. The company's 2023 sustainability report highlighted ongoing efforts to reduce its carbon footprint, but the financial implications of future regulatory mandates remain a key concern.

Specific threats include:

- Increased capital expenditure: Investments may be required for new pollution control technologies or facility upgrades to meet stricter air and water quality standards.

- Operational adjustments: Changes to manufacturing processes or material sourcing might be necessary to comply with new waste management or chemical usage regulations.

- Potential production limitations: Failure to meet compliance deadlines or unexpected regulatory changes could lead to temporary or permanent restrictions on certain product lines or manufacturing sites.

The increasing adoption of alternative lightweight materials, such as advanced composites and plastics, presents a significant long-term threat to Arconic's core aluminum business. These materials offer comparable or superior performance in key sectors like aerospace and automotive, potentially eroding aluminum's market share. For example, the global carbon fiber reinforced polymers (CFRP) market is projected to exceed $25 billion by 2027, indicating a growing competitive landscape for traditional materials.

Global economic instability, characterized by persistent inflation and supply chain disruptions, poses a substantial threat to Arconic's operations and profitability. The International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, highlighting a challenging macroeconomic environment that can dampen demand across Arconic's key industries.

Evolving international trade policies and tariffs can significantly impact aluminum pricing and availability, directly affecting Arconic's cost of goods sold and supply chain continuity. These trade barriers can disrupt established supply chains, increasing raw material costs and operational expenses for a globally integrated company like Arconic.

Arconic faces increasing pressure from more stringent environmental regulations concerning emissions, energy usage, and waste disposal. Meeting these evolving standards may require substantial capital investments and operational adjustments, potentially impacting profitability and production capabilities. The U.S. Environmental Protection Agency (EPA) continues to update regulations on greenhouse gas emissions, affecting manufacturing sectors.

SWOT Analysis Data Sources

This Arconic SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary. These sources ensure the insights are accurate, relevant, and provide a clear strategic overview.