Arconic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arconic Bundle

Arconic faces intense competition, with significant bargaining power from its key customers and a constant threat from substitute materials. Understanding these dynamics is crucial for navigating its market landscape.

The complete report reveals the real forces shaping Arconic’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Arconic's reliance on a concentrated global supply of key raw materials like bauxite and alumina presents a significant bargaining power challenge. Major mining and refining companies hold substantial influence, particularly when supply becomes tight. For instance, alumina shortages in 2024 highlighted this leverage, impacting production costs and availability for downstream manufacturers like Arconic.

The significant energy demands of aluminum production, especially primary smelting, place Arconic at the mercy of energy suppliers. Energy costs can account for a substantial 30-40% of total production expenses, making this a critical cost factor.

Suppliers of electricity, natural gas, or other essential energy sources can exert considerable bargaining power. This is particularly true when alternative energy options are limited or when competing high-demand sectors, like the burgeoning data center industry, increase overall energy consumption and pricing pressures.

Arconic's reliance on specialized aluminum alloys and unique processing chemicals for its high-performance applications, such as aerospace and automotive, significantly influences supplier bargaining power. These niche materials often have limited alternative sources, allowing suppliers to dictate terms and pricing. For instance, in 2023, the aerospace sector, a key market for Arconic, saw continued demand for advanced materials, potentially strengthening the hand of specialized alloy producers.

Limited Forward Integration by Suppliers

Limited forward integration by suppliers means that while some raw material providers may possess downstream capabilities, they typically do not directly challenge Arconic by producing finished aluminum products for specialized sectors. This dynamic curbs the threat of suppliers becoming direct competitors.

However, this lack of direct competition doesn't eliminate supplier influence; they can still leverage their position to impact raw material pricing. For instance, in 2024, the global aluminum market experienced price volatility influenced by energy costs and supply chain disruptions, giving primary aluminum producers leverage over their customers like Arconic.

- Limited Competition: Major raw material suppliers generally avoid direct competition with Arconic in the finished aluminum product market.

- Pricing Influence: Despite limited integration, suppliers retain power to influence raw material costs.

- Market Dynamics: 2024 saw fluctuating aluminum prices due to energy and supply chain factors, enhancing supplier leverage.

Sustainability Requirements and Compliance

Arconic's dedication to sustainability influences its supplier relationships, with a notable percentage of high-risk suppliers now adhering to its supply chain management program criteria. This commitment to responsible sourcing, while bolstering its long-term reputation, can narrow the selection of qualified suppliers.

This focus on ethical and environmental standards can translate into increased compliance costs, potentially impacting Arconic's operational expenses. For instance, in 2024, companies across various manufacturing sectors reported an average of a 5% increase in procurement costs directly attributable to enhanced sustainability vetting and compliance measures.

- Supplier Compliance: A significant portion of Arconic's high-risk suppliers are meeting its supply chain management program criteria.

- Reputational Benefits: Responsible sourcing enhances Arconic's long-term brand image and stakeholder trust.

- Supplier Pool Limitation: The stringent sustainability requirements may reduce the number of eligible suppliers.

- Increased Costs: Compliance with these standards can lead to higher procurement and operational expenses for Arconic.

Arconic faces significant supplier bargaining power due to its reliance on concentrated global sources for critical raw materials like bauxite and alumina. Shortages in 2024, for example, demonstrated how suppliers can leverage tight supply to influence pricing and availability. Furthermore, the high energy intensity of aluminum production means Arconic is susceptible to the power of energy suppliers, with energy costs sometimes representing 30-40% of production expenses.

| Factor | Impact on Arconic | 2024 Context |

|---|---|---|

| Raw Material Concentration | High supplier leverage on pricing and availability | Alumina shortages increased supplier influence. |

| Energy Costs | Significant portion of production expenses (30-40%) | Increased demand from sectors like data centers pressured energy prices. |

| Specialized Materials | Limited alternatives for high-performance alloys | Strong demand in aerospace markets bolstered specialized alloy producers' power. |

| Sustainability Requirements | Narrows supplier pool, potentially increases costs | Reported average 5% increase in procurement costs for enhanced vetting in 2024. |

What is included in the product

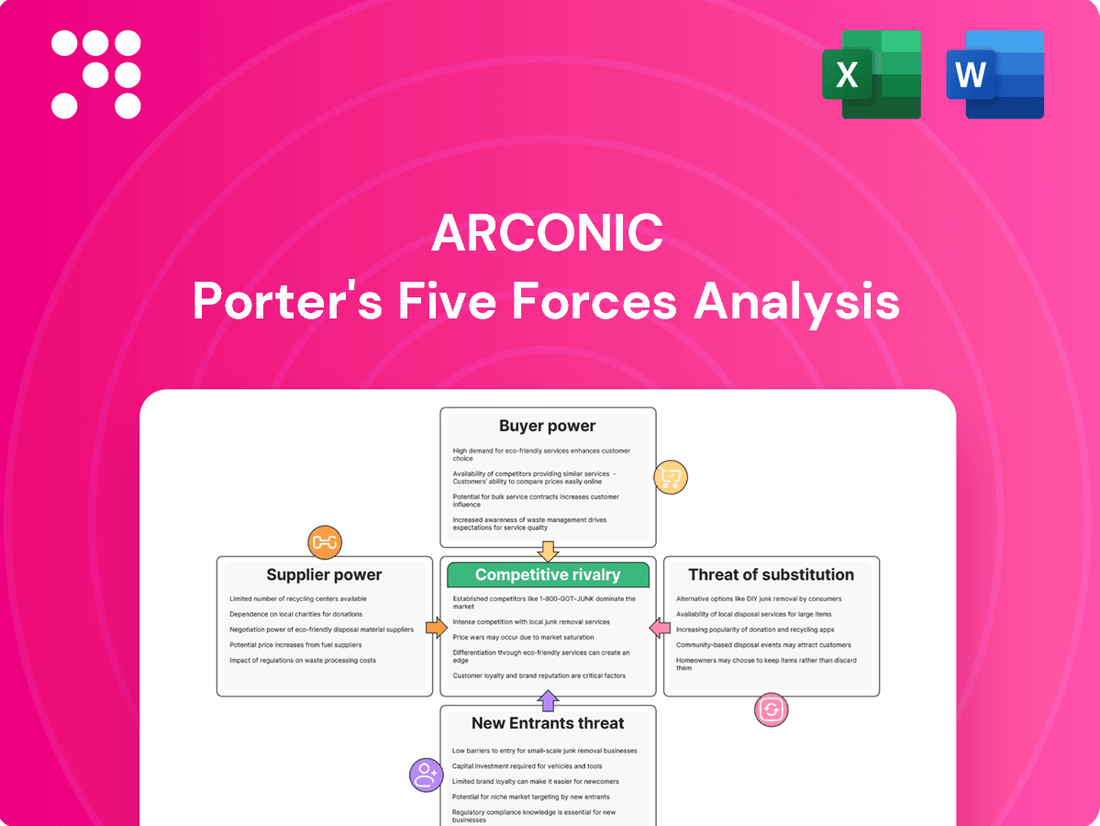

Analyzes Arconic's competitive environment by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the aerospace and automotive materials industry.

Instantly identify and address competitive pressures with a visual breakdown of Arconic's market landscape.

Customers Bargaining Power

Arconic's customer base spans aerospace, automotive, commercial transportation, industrial, and building and construction, which generally spreads out risk. This broad market reach offers a degree of resilience against downturns in any single sector.

However, within specific segments, Arconic faces concentration with a few key customers. For instance, in the aerospace sector, reliance on major aircraft manufacturers means that losing even one significant client could materially impact revenue and profitability for that particular business unit.

This customer-specific concentration can amplify the bargaining power of these large buyers. In 2024, Arconic's financial reports will likely detail the revenue contribution from its top customers, providing insight into the extent of this dependency and the potential leverage these customers hold.

For critical sectors like aerospace and high-performance automotive, the rigorous qualification process for new aluminum suppliers is a significant barrier. This lengthy and expensive vetting procedure, often taking years and millions of dollars, effectively locks customers into existing supplier relationships. For instance, a new supplier must meet stringent FAA or EASA certifications for aircraft components, a process that can delay market entry for years.

Arconic's focus on specialized aluminum solutions, like lightweight materials for aerospace and automotive industries, lessens customer power. These high-performance products offer benefits such as improved fuel economy and enhanced safety, making customers less sensitive to price alone. For instance, the automotive industry's push for lighter vehicles to meet emissions standards, with many manufacturers setting ambitious targets for 2025 and beyond, highlights the demand for Arconic's differentiated offerings.

Customer Price Sensitivity in Commodity Segments

In commodity aluminum segments, customer price sensitivity is a significant factor. For instance, in 2024, fluctuations in the London Metal Exchange (LME) aluminum prices directly impact customer willingness to pay. When prices rise, customers aggressively seek lower prices from Arconic or explore alternative suppliers, especially for standard aluminum sheet and plate used in less specialized applications.

Several external forces amplify this sensitivity. Tariffs, such as those imposed on aluminum imports, can increase costs for customers, further pressuring them to negotiate lower prices. The broader economic outlook also plays a crucial role; during economic downturns, customers in industries like automotive or construction become even more cost-conscious, directly affecting Arconic's pricing power.

- Customer Price Sensitivity: High for commoditized aluminum products.

- Influencing Factors: LME aluminum price volatility, import tariffs, and economic conditions.

- Customer Actions: Pushing for lower prices and seeking alternative suppliers.

- Impact on Arconic: Reduced pricing power in standard product lines.

Influence of Major Automotive and Aerospace OEMs

Major Original Equipment Manufacturers (OEMs) in the automotive and aerospace industries, such as Boeing and General Motors, wield significant bargaining power over Arconic. Their substantial order volumes and critical role in Arconic's revenue stream give them considerable leverage in price negotiations and product specifications. For instance, a single large aerospace contract can represent a substantial portion of Arconic's sales, making it difficult for Arconic to resist OEM demands.

These OEMs' purchasing decisions are increasingly influenced by evolving market demands, including the push for lightweighting to improve fuel efficiency and the growing emphasis on sustainable materials and manufacturing processes. Arconic's ability to meet these stringent requirements directly affects its demand from these key customers. In 2024, the automotive industry's focus on electric vehicles (EVs) intensified the demand for advanced aluminum alloys, a core product for Arconic, but also increased pressure on pricing as multiple suppliers vied for these contracts.

- Significant Volume Purchases: Large automotive and aerospace OEMs regularly purchase vast quantities of materials, giving them substantial negotiating clout.

- Strategic Importance: Arconic's specialized products are often critical components for these OEMs, making their business strategically vital.

- Demand Sensitivity: OEM purchasing decisions, driven by trends like lightweighting and sustainability, directly influence Arconic's sales volume and product development focus.

Arconic's bargaining power with customers is a mixed bag, heavily influenced by product specialization and customer concentration. While its advanced aluminum solutions for aerospace and automotive industries create customer stickiness due to rigorous qualification processes and performance benefits, the company faces significant price pressure in more commoditized segments. For instance, the automotive sector's drive for lightweighting to meet 2025 emissions targets means customers value Arconic's specialized alloys, but this doesn't negate price sensitivity, especially when LME aluminum prices fluctuate, as seen in 2024.

Key customers, particularly major aerospace and automotive OEMs like Boeing and General Motors, possess substantial bargaining power due to their sheer order volumes and the strategic importance of Arconic's materials. These large buyers can exert significant leverage in price negotiations and product specification demands. The automotive industry's intense focus on electric vehicles in 2024, for example, increased demand for advanced aluminum alloys but also intensified competition and pricing pressure among suppliers.

The bargaining power of customers is amplified by factors like the volatility of LME aluminum prices and the impact of tariffs, which directly affect their cost structures and willingness to pay. In 2024, economic conditions further heightened customer cost consciousness, particularly in sectors like construction and automotive, leading to more aggressive price negotiations and a greater propensity to seek alternative suppliers for standard aluminum products.

| Customer Segment | Product Specialization | Customer Bargaining Power Driver | Impact on Arconic |

|---|---|---|---|

| Aerospace OEMs | High-performance alloys, rigorous qualification | Significant order volumes, critical component needs | Moderate to High leverage, especially on specifications |

| Automotive OEMs | Lightweighting alloys, EV applications | Large purchase volumes, demand for cost efficiency | Moderate to High leverage, price sensitivity evident in 2024 |

| Industrial/Construction | Commoditized aluminum products | Price sensitivity, LME price volatility, economic conditions | High leverage, reduced pricing power |

Preview Before You Purchase

Arconic Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Arconic's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the aerospace and automotive materials industry. This comprehensive assessment provides actionable insights into Arconic's strategic positioning and potential challenges.

Rivalry Among Competitors

The advanced aluminum solutions market is intensely competitive, with major global players like Alcoa, Novelis, Norsk Hydro, Constellium, and Kaiser Aluminum actively competing. These established companies often target the same lucrative end markets, such as automotive, aerospace, and construction, intensifying the rivalry for market share and customer contracts.

The aluminum rolling and extrusion sector is inherently capital-intensive, demanding significant upfront investment in advanced manufacturing facilities and specialized machinery. For instance, establishing a new aluminum rolling mill can easily cost hundreds of millions of dollars. This substantial fixed cost burden creates intense pressure on companies to maintain high operational throughput.

Consequently, during economic downturns or periods of reduced demand, firms in this industry often resort to aggressive pricing tactics. The goal is to keep production lines running and cover those high fixed costs, even if it means accepting lower profit margins per unit. This can lead to price wars, particularly when capacity utilization dips below optimal levels, impacting overall industry profitability.

Arconic leverages product differentiation as a key competitive strategy, focusing on engineering innovative products and developing advanced alloys. This approach, exemplified by their work in aerospace and automotive sectors, allows them to command premium pricing and reduce direct price wars. For instance, Arconic's specialized aluminum alloys are critical for lightweighting vehicles, a trend that has seen significant growth, with the automotive lightweight materials market projected to reach $38.5 billion by 2027.

Impact of Global Trade Policies and Tariffs

Geopolitical tensions and evolving trade policies, exemplified by the US tariffs on steel and aluminum, significantly alter the competitive dynamics within industries like aerospace and automotive, where Arconic operates. These measures can cause considerable price volatility for key raw materials, impacting Arconic's cost structure and the pricing strategies of its competitors.

The imposition of tariffs and other trade barriers reshapes global trade flows, potentially creating advantages for domestic producers while disadvantaging those reliant on imports. For instance, in 2024, continued discussions around trade agreements and potential tariffs on manufactured goods could lead to shifts in supply chains and market access, affecting Arconic's international sales and procurement.

- Tariff Impact: US tariffs on steel and aluminum, initially implemented in 2018, continued to influence global metal prices and trade patterns through 2024, affecting Arconic's raw material costs.

- Supply Chain Reshaping: Companies are increasingly evaluating and diversifying their supply chains to mitigate risks associated with trade policy changes, potentially leading to altered competitive positioning.

- Market Access Disparities: Trade policies can create uneven playing fields, granting preferential market access to some competitors while imposing higher costs or restrictions on others.

- Price Volatility: Fluctuations in global commodity prices, often exacerbated by trade disputes, directly impact the cost of production for Arconic and its rivals.

Growth Opportunities Amidst Market Maturity

While certain segments of the aluminum market have reached maturity, Arconic and its competitors face robust growth prospects in specialized areas. Demand for aluminum rolled products and extrusions, crucial for packaging, automotive lightweighting, and construction, is projected to expand significantly. For instance, the global aluminum market was valued at approximately USD 245 billion in 2023 and is expected to grow, with specific segments showing even higher growth rates.

This projected growth in key end-use industries can serve to moderate intense competitive rivalry. As opportunities for expansion become more apparent, companies can focus on capturing new market share rather than solely engaging in price wars for existing, mature business. This dynamic allows multiple players to pursue growth strategies concurrently, potentially easing the pressure on existing market positions.

- Projected Growth in Key Segments: Aluminum rolled products and extrusions are anticipated to see strong demand.

- Driving Industries: Packaging, automotive, and construction sectors are key demand drivers.

- Market Moderation: Expansion opportunities can temper the intensity of competitive rivalry.

- 2024 Market Outlook: The aluminum industry is expected to continue its growth trajectory in 2024, supported by these expanding end-use markets.

The competitive rivalry in the advanced aluminum solutions market is fierce, characterized by a few dominant global players like Alcoa, Novelis, and Arconic itself, all vying for market share in lucrative sectors such as automotive and aerospace.

This intensity is amplified by the capital-intensive nature of the industry, with new facilities costing hundreds of millions, forcing companies to maintain high production levels and often leading to aggressive pricing strategies, especially when demand softens.

Arconic counters this by focusing on product differentiation through innovative alloys, enabling premium pricing and mitigating direct price wars, a strategy supported by the growing demand for lightweight materials in the automotive sector, projected to reach $38.5 billion by 2027.

Geopolitical factors, including tariffs, further complicate the competitive landscape, creating price volatility for raw materials and uneven market access for competitors, with trade policy discussions in 2024 continuing to shape supply chains and international sales.

| Competitor | Primary Markets | Key Strategy |

|---|---|---|

| Alcoa | Aerospace, Automotive, Packaging | Vertical integration, cost leadership |

| Novelis | Automotive, Aerospace, Beverage Cans | Product innovation, sustainability focus |

| Constellium | Aerospace, Automotive, Packaging | Specialty alloys, customized solutions |

| Arconic | Aerospace, Automotive, Construction | Advanced engineering, differentiated products |

SSubstitutes Threaten

Advanced high-strength steels and carbon fiber composites are increasingly viable substitutes for aluminum in the transportation sector, particularly in automotive and aerospace. These materials offer comparable or superior lightweighting capabilities, directly challenging aluminum's market share in structural components.

For instance, the automotive industry's drive for fuel efficiency and electric vehicle range means that manufacturers are actively exploring and implementing these alternatives. By 2024, the global market for advanced high-strength steels was projected to reach over $100 billion, while the carbon fiber composite market was expected to exceed $20 billion, demonstrating substantial growth and a direct competitive pressure on aluminum suppliers.

While substitutes like advanced composites or high-strength steels can sometimes offer lower initial costs, they often present significant performance trade-offs. For instance, these alternatives may not match aluminum's superior strength-to-weight ratio, crucial for reducing vehicle weight and improving fuel efficiency. In 2024, the automotive industry's continued push for lighter materials to meet stricter emissions standards highlights this critical advantage. Arconic's expertise in tailoring aluminum alloys for specific demanding applications directly counters the threat posed by these substitutes by emphasizing performance over mere cost savings.

Aluminum's inherent recyclability, boasting a nearly infinite cycle, positions it as a powerful differentiator against substitutes. This characteristic is crucial in today's economy, where circular economy principles are gaining significant traction. For instance, the Aluminum Association reported that in 2023, approximately 75% of all aluminum ever produced was still in use, a testament to its recyclability.

As businesses and consumers alike increasingly scrutinize the environmental footprint of products, aluminum's sustainable profile becomes a compelling factor. This focus on environmental, social, and governance (ESG) criteria helps to blunt the threat posed by materials with less favorable recycling rates or higher environmental impact. The growing demand for recycled content, with the U.S. aluminum industry utilizing over 90% recycled aluminum in its production processes in 2024, further strengthens this position.

Material Qualification Barriers in Regulated Industries

In highly regulated sectors like aerospace, the rigorous material qualification process acts as a significant barrier to substitutes entering the market. This lengthy and costly approval cycle, often taking years and involving extensive testing, makes it challenging for alternative materials to displace established ones like aluminum. For instance, the Federal Aviation Administration (FAA) requires exhaustive data on material properties, performance under various conditions, and manufacturing consistency before approving a new material for aircraft use, a process that can cost millions of dollars.

These substantial qualification barriers effectively shield incumbent aluminum solutions from direct competition by making the adoption of substitutes a high-risk, high-reward endeavor. The sheer time and financial investment required to navigate these regulatory hurdles means that even technically superior alternative materials may struggle to gain traction. This creates a degree of insulation for established players, as the threat of substitution is significantly dampened by the inherent difficulties in achieving regulatory approval.

The implications for companies like Arconic are clear: the stringent regulatory environment in aerospace and defense significantly reduces the immediate threat of substitutes. This allows them to maintain a stronger market position for their aluminum products, as potential competitors face formidable obstacles to market entry. For example, the development and certification of new composite materials for aircraft structures, while progressing, still face the long road of regulatory validation against decades of proven aluminum performance data.

- Regulatory Hurdles: The extensive qualification processes in aerospace and defense, mandated by bodies like the FAA and EASA, are major deterrents to new material substitutes.

- Time and Cost: Achieving material approval can take several years and incur millions in testing and validation expenses, making it a substantial barrier.

- Established Trust: Decades of proven performance and reliability for aluminum in critical applications create a high bar for any new material to overcome.

- Reduced Substitution Threat: These combined factors significantly lower the immediate threat of substitutes for established aluminum suppliers in these key markets.

Innovation in Aluminum Alloys to Maintain Competitiveness

Arconic's ongoing commitment to innovation in aluminum alloys directly addresses the threat of substitutes. By investing in research and development, the company engineers new materials with superior strength and ductility. For instance, Arconic's advanced high-strength aluminum alloys are finding increased use in the automotive sector, replacing steel in critical components to reduce vehicle weight and improve fuel efficiency.

This continuous improvement in aluminum's properties allows it to compete effectively against other materials. As of 2024, the global automotive aluminum market is projected to reach over $110 billion, demonstrating aluminum's growing importance in substituting heavier materials.

- Enhanced Strength-to-Weight Ratio: Arconic's new alloy developments focus on achieving higher strength without adding significant weight, making aluminum a more attractive option for lightweighting initiatives.

- Improved Formability and Weldability: Innovations are also targeting easier manufacturing processes, reducing costs and making aluminum more accessible for complex designs.

- Expanding Application Range: These advancements enable aluminum to penetrate new markets and applications previously dominated by plastics, composites, or steel.

The threat of substitutes for aluminum remains a significant consideration, particularly from advanced high-strength steels and carbon fiber composites in the transportation sector. These alternatives are increasingly competing on lightweighting capabilities, directly challenging aluminum's market share in automotive and aerospace structural components. The automotive industry's push for fuel efficiency and electric vehicle range by 2024 fuels the adoption of these substitutes, with the advanced high-strength steel market projected to exceed $100 billion and carbon fiber composites over $20 billion.

While substitutes may sometimes offer lower initial costs, they often involve performance trade-offs, such as not matching aluminum's superior strength-to-weight ratio. Arconic's focus on tailoring aluminum alloys for specific demanding applications, emphasizing performance over cost, helps mitigate this threat. Aluminum's inherent recyclability, with approximately 75% of all aluminum ever produced still in use as of 2023 according to the Aluminum Association, and the industry's use of over 90% recycled aluminum in 2024, further strengthens its sustainable profile against less recyclable substitutes.

The stringent material qualification processes in sectors like aerospace, requiring years and millions in testing for regulatory approval by bodies like the FAA, significantly deter substitutes. This lengthy and costly validation process creates a substantial barrier, making it difficult for alternative materials to displace established aluminum solutions and thus dampening the immediate threat of substitution for companies like Arconic.

Entrants Threaten

The advanced aluminum sheet, plate, and extrusion industry demands substantial capital outlays for sophisticated machinery, extensive facilities, and ongoing research and development. For instance, setting up a modern aluminum rolling mill can easily cost hundreds of millions of dollars.

Established companies like Arconic already leverage significant economies of scale, meaning their per-unit production costs are lower due to high-volume output. In 2023, Arconic reported revenues of $9.2 billion, reflecting its substantial operational capacity.

This cost advantage makes it exceedingly difficult for new entrants to achieve price competitiveness, effectively creating a high barrier to entry. Newcomers would struggle to match the efficiency and cost structures that decades of investment and optimization have afforded incumbents.

Arconic benefits from deeply entrenched relationships with key customers in demanding industries like aerospace and automotive. These long-standing partnerships, cultivated over years of consistent quality and dependable supply, create a significant barrier to entry.

Newcomers must invest heavily and demonstrate exceptional performance to even begin replicating Arconic's established customer trust and extensive, reliable supply chain infrastructure. This makes it challenging for potential competitors to gain a foothold.

Arconic's proprietary technology and manufacturing expertise, particularly in high-performance aluminum alloys for aerospace, create a significant barrier to new entrants. Developing these specialized materials and processes demands substantial R&D investment and deep, often patented, know-how. For instance, the complexity and precision required for aerospace-grade aluminum alloys mean that replicating Arconic's capabilities would be extremely costly and time-consuming for any new player.

Regulatory Compliance and Environmental Standards

The aluminum industry faces significant hurdles for new entrants due to rigorous environmental regulations and evolving sustainability standards. These requirements, particularly around emissions control and responsible waste management, necessitate substantial upfront investment and ongoing operational costs. For instance, in 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) continues to impact carbon-intensive industries like aluminum production, requiring new players to account for and potentially pay for their carbon emissions, thereby increasing the cost of entry.

Navigating these complex compliance landscapes adds considerable cost and operational complexity for any new company looking to establish a presence. New entrants must invest heavily in technologies and processes that meet or exceed these environmental benchmarks from the outset.

- Stringent Environmental Regulations: The aluminum sector is heavily regulated regarding greenhouse gas emissions, energy consumption, and waste disposal.

- Sustainability Standards: Growing pressure from consumers and governments for sustainable sourcing and production methods adds another layer of compliance.

- Capital Investment for Compliance: New entrants must budget for advanced pollution control equipment and eco-friendly manufacturing processes, significantly increasing initial capital outlays.

- Operational Complexity: Adhering to diverse and often changing environmental regulations across different jurisdictions makes operational planning and execution more challenging and costly.

Access to Raw Materials and Distribution Channels

New companies entering the aluminum industry face significant hurdles in securing essential raw materials like bauxite and alumina. Established players often have long-term supply contracts and preferential access, making it tough for newcomers to obtain consistent, high-quality inputs. For instance, in 2024, the global supply of bauxite remained tight due to geopolitical factors and production issues in key exporting nations, driving up prices for all market participants.

Building robust and efficient distribution networks is another substantial barrier. New entrants must invest heavily in logistics, warehousing, and transportation to reach diverse global markets effectively. This is particularly challenging in the aluminum sector, where specialized handling and shipping are often required. By 2023, shipping costs for bulk commodities like aluminum had seen a notable increase, adding another layer of expense for any new company trying to establish its market presence.

- Raw Material Access: New entrants struggle to secure reliable, cost-effective supplies of bauxite and alumina, often facing higher prices or limited availability compared to established competitors.

- Distribution Challenges: Establishing efficient global distribution channels requires substantial capital investment and logistical expertise, which new companies may lack.

- Supply Chain Dynamics: Global supply chain disruptions, as seen in 2024 with bauxite availability, disproportionately impact new entrants who lack established relationships and diversified sourcing strategies.

The threat of new entrants in the advanced aluminum sector is considerably low, largely due to the immense capital required for state-of-the-art manufacturing facilities and advanced research and development. Arconic's 2023 revenue of $9.2 billion highlights the scale of operations necessary to compete, a level that is prohibitively expensive for most newcomers.

Established players like Arconic benefit from significant economies of scale, driving down per-unit costs and making it difficult for new entrants to achieve price competitiveness. Furthermore, Arconic's deep-rooted customer relationships, particularly in demanding sectors like aerospace, create a substantial barrier, as trust and proven performance are paramount.

Proprietary technologies and specialized expertise in high-performance alloys, coupled with stringent environmental regulations that necessitate heavy investment in compliance, further deter new companies. For instance, the EU's 2024 Carbon Border Adjustment Mechanism adds a direct cost to carbon-intensive production.

Securing raw materials and establishing efficient global distribution networks also present significant challenges for new entrants, especially given the tight bauxite supply in 2024 and increasing shipping costs seen through 2023. These combined factors create a formidable entry landscape.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Arconic leverages a comprehensive suite of data sources, including Arconic's annual reports and investor presentations, alongside industry-specific market research from firms like IHS Markit and Aluminum Association publications. This blend of internal company data and external industry intelligence provides a robust foundation for assessing competitive dynamics.