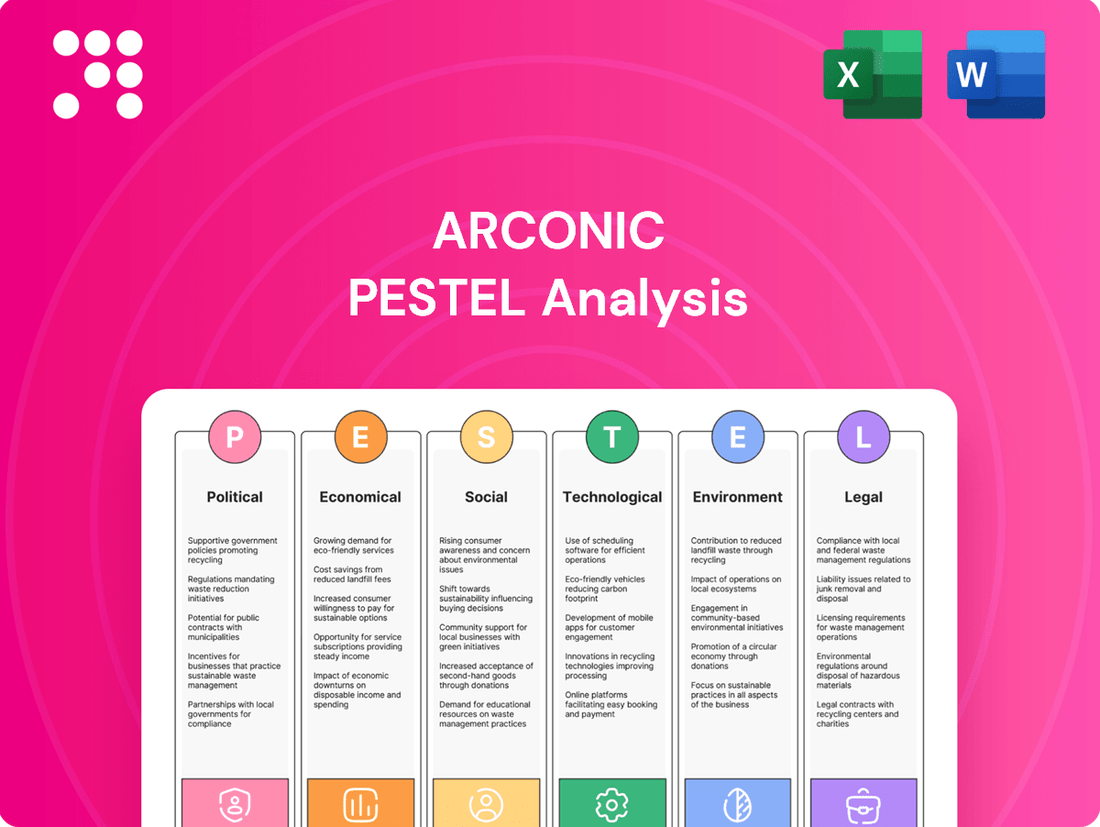

Arconic PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arconic Bundle

Navigate the complex external forces shaping Arconic's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your own strategic planning and investment decisions. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

The imposition of significant trade tariffs, such as the 50% tariffs on steel and aluminum imports into the US effective June 2025, directly impacts global trade flows and raw material costs for companies like Arconic. These protectionist policies aim to bolster domestic industries but can result in elevated input expenses or compel businesses to reassess their supply chains and market strategies.

Governments, especially in the United States, are actively working to bolster the domestic aluminum supply chain, viewing it as vital for both economic strength and national security. This strategic focus includes encouraging investments in recycling capabilities and supporting advancements in aluminum production technologies, alongside favorable tax policies designed to spur growth.

For instance, the Inflation Reduction Act of 2022, enacted in August 2022, offers significant tax credits for clean energy manufacturing, which can indirectly benefit domestic aluminum producers investing in greener technologies and processes. This policy aims to make U.S. manufacturing more competitive globally.

In 2023, the U.S. Department of Energy's Critical Materials Institute continued to fund research into advanced aluminum alloys and recycling methods, highlighting a commitment to reducing reliance on foreign sources for this essential material. Such initiatives underscore a clear political will to onshore and strengthen the U.S. aluminum sector.

Ongoing geopolitical tensions, like the prolonged Ukraine-Russia crisis, continue to disrupt global trade, particularly impacting metal markets. These conflicts can trigger sanctions and trade restrictions, directly influencing the availability and pricing of essential raw materials for industries like aerospace and automotive. For instance, in 2024, the volatility in nickel prices, a key component in many alloys, remained a significant concern for manufacturers due to these geopolitical uncertainties.

Environmental Policy and Regulations

The European Union's Carbon Border Adjustment Mechanism (CBAM), set to fully apply to aluminum imports from 2026, will directly influence Arconic's cost structure for EU-bound products. This mechanism aims to level the playing field for EU industries by taxing carbon emissions embedded in imported goods, potentially increasing the cost of aluminum sourced from regions with less stringent climate policies. For instance, countries with higher carbon prices or less developed emissions trading systems may see their aluminum exports to the EU become more expensive under CBAM.

This evolving regulatory landscape necessitates careful management of Arconic's supply chain and production processes to mitigate potential cost increases and ensure compliance. The policy's intent is to incentivize cleaner industrial practices worldwide, pushing for greater adoption of renewable energy and reduced carbon footprints across the aluminum value chain. Arconic's strategic response will likely involve optimizing sourcing from regions that align with or anticipate stricter environmental standards.

- CBAM Implementation: Full application to aluminum imports by the EU begins in 2026, impacting cost competitiveness.

- Global Impact: Encourages cleaner production worldwide but introduces regulatory complexity for importers like Arconic.

- Strategic Adaptation: Arconic may need to adjust sourcing and production to manage compliance and cost implications.

Political Stability in Operating Regions

Political stability in regions where Arconic operates is a significant factor. For instance, in 2024, geopolitical tensions in Eastern Europe, a key sourcing region for certain industrial metals, have continued to pose risks to supply chain reliability and cost stability for manufacturers like Arconic.

Unstable political climates can directly impede Arconic's ability to maintain consistent production and manage its investments. Disruptions stemming from civil unrest or sudden policy changes can halt manufacturing, damage infrastructure, and create uncertainty for long-term strategic planning, as seen in some developing markets in 2023 where infrastructure projects faced significant delays due to political instability.

- Geopolitical Risk: Arconic's global footprint means exposure to varying levels of political risk in countries where it has manufacturing facilities, such as its operations in North America and Europe.

- Supply Chain Vulnerability: Political instability in raw material sourcing countries, like those in parts of Africa for titanium or bauxite, can lead to price volatility and supply shortages impacting production costs.

- Investment Climate: Favorable political conditions and regulatory frameworks encourage foreign direct investment, which is crucial for Arconic's expansion and modernization plans, with countries offering stable governance typically attracting more capital.

Government policies significantly shape the aluminum industry, influencing trade, domestic production, and environmental standards. The US focus on strengthening its domestic aluminum supply chain, supported by initiatives like the Inflation Reduction Act of 2022, aims to boost local manufacturing and green technologies. For instance, tax credits for clean energy manufacturing can benefit producers investing in sustainable processes.

Geopolitical events, such as the ongoing Ukraine-Russia crisis, introduce volatility into global metal markets, impacting raw material prices and supply chain reliability for companies like Arconic. In 2024, nickel price fluctuations, a key alloy component, highlighted this vulnerability. Furthermore, the EU's Carbon Border Adjustment Mechanism (CBAM), fully applicable to aluminum from 2026, will increase costs for non-EU producers, incentivizing cleaner global production practices.

Political stability is crucial for Arconic's operations. In 2024, geopolitical tensions in Eastern Europe, a key sourcing region, continued to pose risks to supply chain stability. Political instability in developing markets in 2023 led to project delays and infrastructure damage, underscoring the need for stable governance for investment and consistent production.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Arconic, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate these influences, empowering Arconic to identify opportunities and mitigate potential threats.

A clear, actionable summary of Arconic's PESTLE factors, enabling faster strategic decision-making and mitigating the risk of overlooking critical external influences.

Economic factors

The global economy's expansion, especially within developing nations, is a key driver for Arconic. This growth fuels demand for aluminum products used in critical sectors like construction, automotive manufacturing, and packaging. For instance, projections indicate global GDP growth around 2.7% in 2024 and a slight uptick to 2.8% in 2025, according to the IMF, which directly correlates with increased industrial activity and material consumption.

Global aluminum commodity prices are subject to considerable volatility, directly influencing Arconic's top-line performance. For instance, the London Metal Exchange (LME) aluminum price saw significant swings throughout 2023 and early 2024, reflecting shifts in global demand and supply dynamics. This price uncertainty is a key factor for Arconic.

Analysts project a potential surplus in the aluminum market for both 2024 and 2025. Reports from organizations like the International Aluminium Institute (IAI) suggest that production capacity might outpace consumption growth. This surplus environment typically exerts downward pressure on prices, which could compress Arconic's profit margins on its aluminum products.

A sustained surplus could lead to a scenario where Arconic faces challenges in maintaining favorable pricing for its offerings, impacting overall revenue generation. The company's ability to manage costs and optimize its production efficiency will be crucial in navigating these potential margin pressures in the coming years.

Arconic's production costs are heavily tied to the availability and price of essential raw materials like bauxite and energy. Fluctuations in these inputs directly impact the company's profitability.

For instance, global bauxite prices saw a notable increase in early 2024, driven by supply chain disruptions and increased demand from emerging markets, potentially adding pressure to Arconic's cost base.

Furthermore, the ongoing global emphasis on sustainability and decarbonization is driving up energy costs, particularly for energy-intensive processes like aluminum smelting, which Arconic relies on.

Demand from Lightweighting Trends in End-User Markets

The global drive towards lightweighting, particularly in the automotive and aerospace industries, is a major catalyst for aluminum demand. This trend is amplified by the rapid growth of electric vehicles (EVs), where reducing weight is crucial for extending battery range and improving overall efficiency. Arconic's focus on advanced aluminum alloys and engineered solutions directly addresses this burgeoning market need.

By 2025, the automotive sector is expected to see continued strong demand for lightweight materials. For instance, the average weight of a new passenger car in North America has been a focus for reduction, with aluminum content per vehicle steadily increasing. Arconic's ability to supply high-strength, low-weight aluminum sheet and extrusions for body structures, closures, and battery enclosures positions it favorably.

- Automotive Lightweighting: The automotive industry is projected to be a significant consumer of lightweight aluminum, with estimates suggesting aluminum content in vehicles could reach over 200 kg per vehicle by 2025 in some segments.

- Aerospace Advancements: The aerospace sector continues to integrate advanced aluminum alloys for structural components, aiming to reduce fuel consumption.

- Commercial Transportation Efficiency: In commercial transportation, lightweighting aluminum components helps improve fuel economy and payload capacity, a key consideration for fleet operators.

- EV Battery Enclosures: The demand for specialized aluminum solutions for EV battery enclosures is a rapidly growing segment, driven by safety and performance requirements.

Interest Rates and Investment Climate

Lower interest rates anticipated for 2025 are poised to create a more favorable investment climate, potentially stimulating demand within Arconic's served industries. This economic shift could encourage companies to increase capital expenditures, fostering expansion and innovation. For instance, a projected Federal Reserve rate cut in late 2024 or early 2025, bringing the target federal funds rate closer to 4.5%, could significantly reduce borrowing costs for manufacturers.

Continued investment in US manufacturing, a trend expected to persist through 2025, further bolsters the outlook. Government initiatives and private sector commitments are channeling substantial funds into domestic production capabilities. The CHIPS and Science Act, for example, allocated over $52 billion to boost semiconductor manufacturing, with ripple effects expected across related supply chains and materials sectors where Arconic operates.

- Lower Interest Rates: Anticipated rate cuts by the Federal Reserve in 2025 could decrease borrowing costs, making capital investments more attractive for companies like Arconic.

- Manufacturing Investment: Ongoing government and private sector investment in US manufacturing, supported by legislation like the CHIPS Act, signals robust demand for advanced materials.

- Capital Expenditure: Favorable economic conditions are expected to encourage increased capital expenditure, driving demand for Arconic's engineered products and solutions.

Global economic expansion, particularly in emerging markets, directly fuels demand for Arconic's aluminum products across construction, automotive, and packaging sectors. IMF projections estimate global GDP growth around 2.7% in 2024 and 2.8% in 2025, indicating a positive correlation with industrial activity and material consumption.

Aluminum commodity prices remain volatile, impacting Arconic's revenue. The London Metal Exchange (LME) aluminum price saw significant fluctuations in early 2024, influenced by global demand and supply shifts. A projected market surplus for 2024-2025, as indicated by the International Aluminium Institute (IAI), could exert downward pressure on prices, potentially compressing Arconic's profit margins.

Arconic's production costs are sensitive to raw material prices like bauxite and energy. Bauxite prices increased in early 2024 due to supply chain issues, and rising energy costs, driven by decarbonization efforts, add to production expenses for energy-intensive smelting processes.

The global push for lightweighting, especially in automotive and aerospace due to EV growth, is a key driver for aluminum demand. Arconic is well-positioned to supply advanced alloys for vehicle components, with aluminum content in cars expected to rise significantly by 2025.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Arconic |

| Global GDP Growth | ~2.7% (IMF) | ~2.8% (IMF) | Increased demand for aluminum products |

| Aluminum Market Balance | Potential Surplus | Potential Surplus | Downward pressure on prices, margin compression |

| Bauxite Prices | Increased in early 2024 | N/A | Higher production costs |

| Energy Costs | Rising due to decarbonization | Rising | Higher production costs for smelting |

| Automotive Lightweighting | Strong demand | Continued strong demand | Increased demand for advanced aluminum alloys |

What You See Is What You Get

Arconic PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Arconic PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Consumers and industries are increasingly prioritizing products made from sustainable and recyclable materials, a trend that strongly favors aluminum due to its nearly infinite recyclability. This societal shift means companies like Arconic, which are committed to providing eco-friendly solutions, are well-positioned to meet these evolving expectations.

Arconic's dedication to sustainability is not just a response to demand; it's a core part of their strategy. For instance, their Eco-Smart™ aluminum solutions are designed to reduce environmental impact throughout the product lifecycle, appealing to a growing segment of the market that actively seeks out greener options.

The manufacturing industry is grappling with a severe shortage of skilled labor, with forecasts suggesting a deficit of over 2 million jobs by 2033. This talent gap directly impacts operational efficiency and growth potential for companies like Arconic.

Addressing this challenge requires proactive strategies, including investing in apprenticeship programs and reskilling existing employees to bridge the identified skill gaps. Arconic's commitment to workforce development will be crucial for its long-term success.

Societal pressure is mounting for companies like Arconic to actively engage in corporate social responsibility, focusing on ethical labor and community involvement. Arconic's commitment to STEM education, evidenced by their 2023 partnerships with organizations like the National Action Council for Minorities in Engineering (NACME), directly addresses this expectation.

Furthermore, Arconic's diversity and inclusion programs, which saw a reported increase in representation across various demographics in their 2024 workforce statistics, demonstrate a proactive approach to meeting evolving societal demands for equitable workplaces.

Public Perception of Manufacturing Industries

Public sentiment towards heavy industries, including aluminum manufacturing, is increasingly shaped by concerns over environmental footprints and labor standards. Negative perceptions can arise from historical issues related to pollution or worker safety, impacting a company's social license to operate.

Arconic, like other players in the sector, must proactively address these perceptions. Highlighting advancements in sustainable manufacturing processes and ensuring robust worker safety protocols are vital for building trust and a positive brand image. For instance, in 2024, the aluminum industry globally saw increased scrutiny on its energy consumption, with initiatives focused on reducing greenhouse gas emissions per ton of aluminum produced.

- Environmental Scrutiny: Public pressure continues to mount for cleaner production methods, with a focus on reducing energy intensity and waste in aluminum smelting and processing.

- Labor Practice Transparency: Companies are expected to demonstrate fair wages, safe working conditions, and ethical labor sourcing throughout their supply chains.

- Corporate Social Responsibility (CSR): Positive public perception is increasingly linked to demonstrated commitment to community engagement and environmental stewardship, influencing purchasing decisions and investor confidence.

- Talent Acquisition: A reputation for sustainability and ethical practices is becoming a significant factor in attracting and retaining skilled workers, especially among younger generations entering the workforce.

Demographic Shifts and Aging Workforce

The aging demographic in developed nations, including key markets for Arconic, is leading to a noticeable decline in labor participation rates within manufacturing sectors. This trend directly affects the availability of experienced workers, a critical component for industries relying on specialized skills. For instance, in the US, the median age of manufacturing workers has been steadily increasing, with many experienced individuals nearing retirement age.

Companies like Arconic must proactively address this by rethinking recruitment strategies to attract younger talent and by significantly investing in comprehensive training and upskilling programs. This ensures a pipeline of skilled labor for the future and helps bridge the knowledge gap left by retiring employees. The need for continuous learning is paramount as manufacturing processes evolve.

Key impacts include:

- Shrinking Pool of Experienced Labor: As a significant portion of the manufacturing workforce approaches retirement age, the availability of seasoned professionals with deep industry knowledge diminishes.

- Increased Recruitment Challenges: Attracting younger generations to manufacturing careers requires a concerted effort to showcase the sector's technological advancements and career growth opportunities.

- Emphasis on Training and Development: Companies must prioritize investing in robust training programs to equip new and existing employees with the skills needed for modern manufacturing processes.

- Potential for Automation Adoption: The labor shortage may accelerate the adoption of automation and advanced manufacturing technologies to compensate for reduced human capital.

Societal expectations are increasingly pushing companies like Arconic towards greater environmental stewardship and ethical labor practices. Consumers and investors alike are scrutinizing corporate behavior, with a growing preference for brands demonstrating a commitment to sustainability and social responsibility. This trend is evident in the rising demand for recycled materials, with aluminum's recyclability being a significant advantage.

Arconic's proactive engagement in STEM education, such as its 2023 partnerships, and its focus on diversity and inclusion, reflected in its 2024 workforce statistics, directly address these societal pressures. These initiatives not only enhance its brand image but also contribute to attracting and retaining talent in a competitive market. The company's commitment to Eco-Smart™ solutions further aligns with the market's demand for greener products.

The manufacturing sector faces a critical talent shortage, with projections indicating a deficit of over 2 million jobs by 2033 in the US alone. This labor gap, exacerbated by an aging workforce, necessitates significant investment in training and upskilling programs to ensure a skilled workforce for Arconic's operations. The increasing median age of manufacturing workers underscores the urgency of these efforts.

| Societal Factor | Impact on Arconic | Supporting Data/Trend |

| Demand for Sustainability | Increased preference for eco-friendly materials and processes. | Aluminum's infinite recyclability is a key advantage. |

| Corporate Social Responsibility (CSR) | Need for ethical labor, community engagement, and transparency. | Arconic's 2023 STEM education partnerships and 2024 diversity statistics. |

| Skilled Labor Shortage | Challenges in recruitment and retention of experienced workers. | Projected 2 million job deficit in US manufacturing by 2033; increasing median age of manufacturing workers. |

| Public Perception of Industry | Scrutiny on environmental impact and labor standards. | Global aluminum industry focus on reducing greenhouse gas emissions per ton in 2024. |

Technological factors

Innovations in aluminum production are rapidly transforming the industry. New alloys offer enhanced strength-to-weight ratios and improved corrosion resistance, directly impacting product performance in sectors like aerospace and automotive. For instance, advancements in additive manufacturing, or 3D printing, are enabling the creation of complex, lightweight aluminum components that were previously impossible to produce.

Arconic's commitment to research and development in this area is particularly noteworthy. The company is investing heavily in developing more recyclable aluminum materials and exploring low-carbon fabrication technologies. This focus is critical, as the demand for sustainable manufacturing processes continues to grow, influencing both operational costs and market competitiveness.

Arconic is heavily influenced by the surge in automation and digitalization within manufacturing. The adoption of technologies like artificial intelligence (AI) and the Internet of Things (IoT) is transforming aluminum production, leading to more streamlined operations and enhanced quality control. For instance, in 2024, the global industrial automation market was projected to reach over $250 billion, highlighting the significant investment in these areas.

These advancements are crucial for Arconic to boost production efficiency and tackle persistent skill shortages in the workforce. By integrating AI-powered predictive maintenance, companies can reduce downtime by up to 30%, as reported by industry studies in late 2023. Furthermore, digitalization allows for better data analysis, optimizing resource allocation and minimizing waste, a key concern in material-intensive industries.

Advancements in aluminum recycling technologies, including sophisticated sorting and separation methods, are significantly boosting efficiency. These innovations reduce the industry's dependence on primary aluminum, which is energy-intensive to produce. For instance, by 2024, the global aluminum recycling rate was projected to reach approximately 75%, a substantial increase from previous years, directly supporting a more robust circular economy.

Lightweighting Innovations and Multi-Material Design

The ongoing advancements in lightweighting technologies, such as multi-material structuring and integrated design optimization, are fueling a significant demand for sophisticated aluminum solutions. Arconic's deep knowledge in producing high-performance, lightweight aluminum is particularly vital for demanding sectors like aerospace and automotive.

For instance, the automotive industry is increasingly focused on reducing vehicle weight to improve fuel efficiency and meet stringent emissions standards. By 2025, the average fuel economy target for new passenger cars and light trucks in the U.S. is projected to be around 49 miles per gallon, a goal that heavily relies on material innovation. Arconic's advanced aluminum alloys are instrumental in achieving these targets, contributing to lighter and more efficient vehicle designs.

- Demand for lightweight materials: The global automotive lightweight materials market is expected to reach over $270 billion by 2027, with aluminum playing a substantial role.

- Aerospace applications: Aluminum alloys account for a significant portion of an aircraft's structure, with advancements in multi-material design enabling further weight reduction and performance enhancements.

- Arconic's role: The company's investment in R&D for advanced aluminum solutions directly addresses these industry trends, positioning it to capitalize on the growing need for lighter and stronger materials.

Energy Efficiency and Decarbonization Technologies

Technological advancements are significantly reshaping aluminum production, with a strong focus on energy efficiency and decarbonization. Innovations like zero-emission smelting processes and AI-driven energy management systems are crucial for meeting global sustainability targets. For instance, Arconic has been investing in technologies that reduce greenhouse gas emissions, aligning with the broader industry push towards net-zero goals by 2050.

These technological shifts are driven by increasing regulatory pressure and consumer demand for environmentally responsible products. The development of advanced electrolysis technologies and the integration of renewable energy sources into aluminum smelting are key areas of progress. Companies are exploring methods to reduce the energy intensity of aluminum production, which historically has been a very energy-demanding process.

Key technological drivers include:

- Zero-emission smelting: Research into inert anode technologies promises to eliminate direct greenhouse gas emissions from the smelting process.

- AI-driven energy management: Artificial intelligence is being deployed to optimize energy consumption in real-time across production facilities, leading to substantial efficiency gains.

- Renewable energy integration: Increased use of solar, wind, and hydropower to power aluminum smelters directly reduces the carbon footprint.

- Advanced recycling technologies: Innovations in scrap sorting and melting are enhancing the efficiency and economic viability of aluminum recycling, a far less energy-intensive process than primary production.

Technological advancements are pivotal for Arconic, particularly in developing advanced aluminum alloys for lightweighting applications in aerospace and automotive sectors. The push for improved fuel efficiency and reduced emissions, with U.S. vehicle targets around 49 mpg by 2025, directly fuels demand for Arconic's high-performance materials.

Automation and digitalization, including AI and IoT, are transforming production, boosting efficiency and quality control, with the global industrial automation market exceeding $250 billion in 2024. Innovations in recycling, aiming for higher efficiency and reduced reliance on energy-intensive primary production, are also key, with recycling rates projected to reach 75% by 2024.

Arconic's R&D focus on zero-emission smelting and AI-driven energy management aligns with the industry's decarbonization efforts, aiming for net-zero goals by 2050. These technological investments are crucial for maintaining competitiveness and meeting growing demand for sustainable, high-performance aluminum solutions.

| Key Technological Drivers | Impact on Arconic | Relevant Data/Projections |

| Advanced Alloys & Lightweighting | Enhanced product performance, meeting fuel efficiency targets | Automotive lightweight materials market > $270B by 2027; U.S. vehicle MPG target ~49 by 2025 |

| Automation & Digitalization (AI/IoT) | Increased production efficiency, improved quality control, reduced downtime | Global industrial automation market > $250B in 2024; AI predictive maintenance can reduce downtime by up to 30% |

| Recycling Technologies | Reduced reliance on primary production, lower energy consumption, circular economy support | Global aluminum recycling rate projected ~75% by 2024 |

| Decarbonization Technologies (Zero-Emission Smelting, AI Energy Management) | Reduced carbon footprint, alignment with sustainability goals | Industry push towards net-zero goals by 2050 |

Legal factors

Changes in international trade laws and the imposition of tariffs significantly shape Arconic's operational landscape. For instance, the United States' tariffs on imported aluminum, which have seen adjustments throughout 2024 and into early 2025, directly impact Arconic's raw material costs and the competitiveness of its finished products. Navigating these evolving policies is crucial for maintaining compliance and managing the financial implications of import and export activities.

Stringent environmental regulations, particularly concerning greenhouse gas (GHG) emissions, waste disposal, and water consumption, directly shape Arconic's manufacturing processes. These legal mandates necessitate ongoing investment in compliance and operational adjustments.

Arconic's stated commitment to reducing its carbon footprint and water usage reflects a strategic alignment with these evolving legal frameworks. For instance, as of early 2024, many jurisdictions are tightening Scope 1 and Scope 2 emission reporting requirements, pushing companies like Arconic to demonstrate tangible progress toward decarbonization goals.

Arconic's commitment to product safety and quality is paramount, particularly given its significant presence in the aerospace and automotive sectors. These industries demand rigorous adherence to safety protocols and performance benchmarks, directly impacting Arconic's reputation and market access.

Compliance with certifications such as ISO 9001 and AS9100 for aerospace is critical. These standards, which Arconic actively maintains, demonstrate its capability to consistently provide products and services that meet customer and regulatory requirements. For instance, in 2023, Arconic reported that its quality management systems were a key driver for customer satisfaction, with a focus on reducing defects across its product lines.

Labor Laws and Workforce Regulations

Arconic, as a major manufacturing entity, navigates a complex web of labor laws impacting everything from minimum wages to workplace safety standards. These regulations are paramount for ensuring fair treatment of employees and maintaining operational integrity. For instance, in 2023, the U.S. Bureau of Labor Statistics reported an average hourly wage of $23.78 for manufacturing production workers, a figure Arconic must consider in its compensation strategies.

Compliance with these labor mandates is non-negotiable, especially as Arconic addresses critical workforce challenges. The company's ability to retain skilled talent and foster continuous skill development directly hinges on its adherence to and proactive management of these regulations. In 2024, the manufacturing sector continued to face a significant skills gap, with reports indicating that over 80% of manufacturers struggled to find qualified workers.

Key areas of focus for Arconic include:

- Wage and Hour Laws: Ensuring compliance with federal and state minimum wage requirements, overtime pay, and record-keeping.

- Workplace Safety Regulations: Adhering to Occupational Safety and Health Administration (OSHA) standards, which saw a 2.7% increase in average weekly wages for private industry workers in 2023.

- Employee Benefits and Leave Policies: Managing requirements for health insurance, retirement plans, and various forms of paid and unpaid leave.

- Worker Classification: Correctly classifying employees versus independent contractors to avoid penalties.

Antitrust and Competition Laws

Arconic, as a global player in the aerospace and automotive industries, must navigate a complex web of antitrust and competition regulations worldwide. These laws are in place to prevent anti-competitive practices and ensure a level playing field for all market participants. Failure to comply can lead to significant penalties, including hefty fines and restrictions on business operations, impacting Arconic's ability to serve its diverse customer base.

The company's global operations mean it's subject to the scrutiny of various regulatory bodies, such as the U.S. Department of Justice and the European Commission. For instance, in 2023, the U.S. Federal Trade Commission (FTC) continued its focus on mergers and acquisitions, reviewing deals that could potentially stifle competition. Arconic's strategic decisions regarding partnerships, acquisitions, and pricing strategies are therefore carefully evaluated against these legal frameworks.

- Regulatory Scrutiny: Arconic's global presence necessitates adherence to diverse antitrust laws in key markets like North America, Europe, and Asia.

- Compliance Costs: Maintaining robust compliance programs and legal counsel to navigate these regulations represents a significant operational expense.

- Market Access: Non-compliance can result in market access restrictions or divestitures, directly impacting Arconic's revenue streams and strategic growth.

- Merger Review: Arconic's potential future acquisitions will undergo rigorous antitrust review, a process that has intensified globally in recent years.

Legal factors significantly influence Arconic's operations, from trade tariffs impacting raw material costs to stringent environmental regulations requiring compliance investments. Adherence to product safety and quality certifications is paramount, especially in the aerospace and automotive sectors, with companies like Arconic investing in quality management systems to meet customer and regulatory demands. Furthermore, navigating global antitrust and competition laws is crucial to avoid penalties and maintain market access.

Arconic's commitment to labor laws ensures fair employee treatment and operational integrity, with an eye on wage and hour compliance and workplace safety standards. The company's global footprint means it must also comply with diverse antitrust regulations worldwide, impacting strategic decisions like mergers and acquisitions. These legal considerations shape Arconic's operational costs, market access, and overall business strategy.

| Legal Factor | Impact on Arconic | Data/Trend (2023-2025) |

|---|---|---|

| International Trade Laws & Tariffs | Affects raw material costs and product competitiveness. | US tariffs on aluminum saw adjustments through 2024 and into early 2025. |

| Environmental Regulations | Mandates investments in compliance and operational adjustments for emissions and waste. | Tightening Scope 1 & 2 emission reporting requirements in many jurisdictions as of early 2024. |

| Product Safety & Quality Standards | Critical for market access in aerospace and automotive sectors. | Arconic reported quality management systems as a key driver for customer satisfaction in 2023, focusing on defect reduction. |

| Labor Laws | Impacts wages, safety, and workforce management. | The manufacturing sector faced a significant skills gap in 2024, with over 80% of manufacturers struggling to find qualified workers. |

| Antitrust & Competition Laws | Governs pricing, partnerships, and M&A activities globally. | US FTC continued focus on mergers and acquisitions in 2023, reviewing deals that could stifle competition. |

Environmental factors

Global and national climate change policies, including ambitious carbon emissions targets, are increasingly shaping Arconic's operational strategies and investment decisions. Many governments, including those in key Arconic markets, are implementing stricter regulations and incentives aimed at reducing greenhouse gas (GHG) emissions, directly impacting energy consumption and manufacturing processes.

Arconic itself has committed to tangible environmental goals, aiming to reduce its greenhouse gas emissions intensity by 15% by 2030 compared to a 2021 baseline. This target reflects a proactive approach to aligning with evolving climate policy landscapes and investor expectations for sustainability performance.

The growing concern over resource scarcity is amplifying the importance of circular economy principles, which encourage the use of recycled materials and smarter resource management. Arconic's commitment to sustainable manufacturing practices, including its focus on recycled aluminum, directly addresses this environmental factor.

Effective waste management and recycling are crucial for minimizing the environmental impact of aluminum production. Arconic's commitment to engineering recyclable materials, like their advanced aluminum alloys, directly supports these initiatives by promoting a circular economy for aluminum. This focus is increasingly important as global recycling rates for aluminum continue to be a key metric for sustainability performance.

Water Usage and Pollution Control

Arconic operates under stringent environmental regulations concerning water usage and pollution control, which are critical for its manufacturing operations. These laws dictate practices for preventing soil, air, and water contamination, directly impacting operational costs and compliance strategies.

The company actively monitors and reports its water footprint, demonstrating a commitment to sustainability. Arconic's sustainability reports highlight efforts to reduce total water withdrawal across its facilities. For instance, in their 2023 ESG report, Arconic noted a total water withdrawal of 8,674 million gallons, with a stated goal of reducing this figure.

- Water Withdrawal: Arconic reported a total water withdrawal of 8,674 million gallons in 2023.

- Pollution Control: Compliance with regulations preventing soil, air, and water pollution is a key operational factor.

- Reduction Targets: The company aims for ongoing reductions in its overall water usage.

Demand for Eco-Friendly and Lightweight Materials

The growing consumer and regulatory push for eco-friendly and lightweight materials significantly influences Arconic's strategic direction. This is particularly evident in the automotive and aerospace industries, where efficiency and sustainability are paramount. For instance, by 2025, the automotive industry is projected to see a substantial increase in demand for lightweight materials to meet stricter emissions standards.

Arconic's innovation in advanced aluminum alloys and composites directly addresses this market trend. These materials offer a compelling combination of reduced weight and environmental consciousness. The global market for lightweight materials, valued at over $100 billion in 2023, is expected to continue its robust growth through 2030, driven by these environmental considerations.

- Automotive Sector Focus: Increased demand for lightweight aluminum components to improve fuel efficiency and reduce emissions.

- Aerospace Advancements: Development of advanced composites and alloys for aircraft to enhance performance and reduce environmental footprint.

- Sustainability Initiatives: Alignment with global sustainability goals by offering recyclable and lower-impact material solutions.

- Market Growth Projection: Anticipated continued expansion of the lightweight materials market, driven by environmental regulations and consumer preferences.

Arconic's environmental strategy is heavily influenced by global climate policies and the increasing demand for sustainable, lightweight materials. The company's commitment to reducing greenhouse gas emissions by 15% by 2030, compared to a 2021 baseline, underscores its adaptation to stricter regulations and investor expectations for environmental performance.

Resource scarcity is driving a focus on circular economy principles, with Arconic emphasizing recycled aluminum in its production. Stringent regulations on water usage and pollution control also impact operations, as seen in Arconic's 2023 water withdrawal of 8,674 million gallons, with ongoing reduction efforts.

The market demand for eco-friendly materials, particularly in automotive and aerospace, is a key driver for Arconic's innovation in advanced alloys and composites. This trend is supported by the projected growth of the lightweight materials market, which exceeded $100 billion in 2023.

| Environmental Factor | Arconic's Response/Impact | Relevant Data/Trends |

| Climate Change Policies | Adherence to emissions targets, investment in sustainable manufacturing. | 15% GHG intensity reduction target by 2030 (vs. 2021 baseline). |

| Resource Scarcity & Circular Economy | Focus on recycled materials, promoting material recyclability. | Increasing global demand for recycled aluminum. |

| Water Usage & Pollution Control | Compliance with regulations, monitoring water footprint. | 8,674 million gallons total water withdrawal in 2023. |

| Demand for Sustainable Materials | Innovation in lightweight alloys and composites. | Lightweight materials market valued over $100 billion in 2023; automotive sector driving demand for emission reduction. |

PESTLE Analysis Data Sources

Our Arconic PESTLE Analysis draws from a comprehensive blend of official government publications, reputable financial institutions like the IMF and World Bank, and leading industry-specific market research reports. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting Arconic.