Amkor Technology SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amkor Technology Bundle

Amkor Technology's strengths lie in its established manufacturing capabilities and broad customer base, but it faces significant threats from intense competition and evolving technological demands. Understanding these dynamics is crucial for anyone looking to invest or strategize within the semiconductor packaging industry.

Want the full story behind Amkor's competitive advantages, potential vulnerabilities, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, investment pitches, and market research.

Strengths

Amkor Technology stands out in the outsourced semiconductor assembly and test (OSAT) sector, largely due to its pioneering work in advanced packaging. This leadership is crucial as the demand for sophisticated chip designs continues to surge.

The company is making significant strides in technologies like fan-out wafer-level packaging (FOWLP) and 2.5D/3D integration. These are essential for powering next-generation devices in high-performance computing, artificial intelligence (AI), and 5G networks, areas that saw substantial growth through 2024 and are projected to expand further in 2025.

By investing in these cutting-edge capabilities, Amkor is well-positioned to cater to the evolving needs of the semiconductor industry, which requires increasingly complex and dense packaging solutions to maximize performance and efficiency.

Amkor Technology's strength lies in its extensive global manufacturing presence, with operations spanning Asia, Europe, and the USA. This broad geographical reach, including a new facility in Vietnam that commenced operations in 2024 and a planned expansion in Arizona, offers customers significant supply chain resilience and operational flexibility. This diversified footprint is crucial for serving a worldwide clientele effectively.

Amkor Technology's strategic partnerships with industry titans are a significant strength. The company boasts enduring relationships with major semiconductor manufacturers, foundries, and original equipment manufacturers (OEMs) globally. This extensive network highlights Amkor's integral position within the complex semiconductor supply chain.

A prime example of this strength is Amkor's deep collaboration with TSMC, which includes a vital agreement for advanced packaging and testing services at TSMC's upcoming Arizona facility. Furthermore, Amkor's role in packaging Apple Silicon demonstrates the trust and reliance major innovators place in its capabilities. These alliances are crucial for Amkor's continued growth and market influence.

Strong Financial Position and Investment in Growth

Amkor Technology maintains a very healthy financial standing, which is a significant advantage. As of March 31, 2025, the company reported $1.6 billion in cash and short-term investments, alongside $2.2 billion in total liquidity. This strong financial foundation allows Amkor to pursue ambitious growth strategies and invest heavily in its future.

The company's commitment to expansion is evident in its planned capital expenditures. Amkor has allocated approximately $850 million for 2025, with a clear focus on enhancing its capabilities in advanced packaging and test equipment. A key part of this investment includes the development of a new U.S. facility, underscoring its dedication to technological leadership and market expansion.

- Robust Liquidity: $2.2 billion in total liquidity as of March 31, 2025, provides significant financial flexibility.

- Strong Cash Reserves: $1.6 billion in cash and short-term investments supports operational needs and strategic investments.

- Aggressive Capital Investment: Approximately $850 million planned for 2025, primarily for advanced packaging and test equipment.

- Strategic Facility Expansion: Investment in a new U.S. facility highlights a commitment to growth and technological advancement.

Broad and Diversified End-Market Exposure

Amkor Technology's broad and diversified end-market exposure is a significant strength. The company caters to a wide range of sectors, including communications, consumer electronics, automotive, industrial applications, and computing. This diversification acts as a buffer against sector-specific downturns.

In 2024, Amkor demonstrated this resilience. The company reported record revenue in its computing segment, largely propelled by the demand for AI devices and ARM-based PCs. This strong performance in computing helped to mitigate weaker demand observed in other market segments, highlighting the benefit of its varied customer base.

- Diverse End Markets: Communications, consumer, automotive, industrial, computing.

- 2024 Computing Segment Strength: Record revenue driven by AI devices and ARM-based PCs.

- Resilience: Broad exposure insulates against single-segment fluctuations.

Amkor Technology's leadership in advanced packaging technologies, such as fan-out wafer-level packaging (FOWLP) and 2.5D/3D integration, is a key strength. These capabilities are vital for meeting the increasing demand for sophisticated chips in high-growth sectors like AI and 5G.

The company's global manufacturing footprint, with facilities across Asia, Europe, and the USA, including a new Vietnam site operational since 2024 and planned Arizona expansion, ensures supply chain resilience and operational flexibility for its international clients.

Amkor's strong financial position, evidenced by $1.6 billion in cash and $2.2 billion in total liquidity as of March 31, 2025, combined with a planned $850 million capital investment for 2025, fuels its strategic growth and technological advancement.

Its diversified end-market exposure, serving communications, consumer, automotive, industrial, and computing sectors, provides significant resilience, as demonstrated by record revenue in its computing segment in 2024 driven by AI demand.

| Strength | Description | Supporting Data |

|---|---|---|

| Advanced Packaging Leadership | Pioneering FOWLP and 2.5D/3D integration for next-gen devices. | Essential for AI, 5G, and high-performance computing. |

| Global Manufacturing Footprint | Operations in Asia, Europe, USA, with new Vietnam facility (2024) and Arizona expansion. | Enhances supply chain resilience and customer service. |

| Financial Strength & Investment | $1.6B cash, $2.2B total liquidity (Mar 31, 2025); $850M CAPEX planned for 2025. | Supports growth strategies and technological development. |

| Diversified End Markets | Exposure to Communications, Consumer, Automotive, Industrial, Computing. | 2024 computing segment saw record revenue due to AI demand. |

What is included in the product

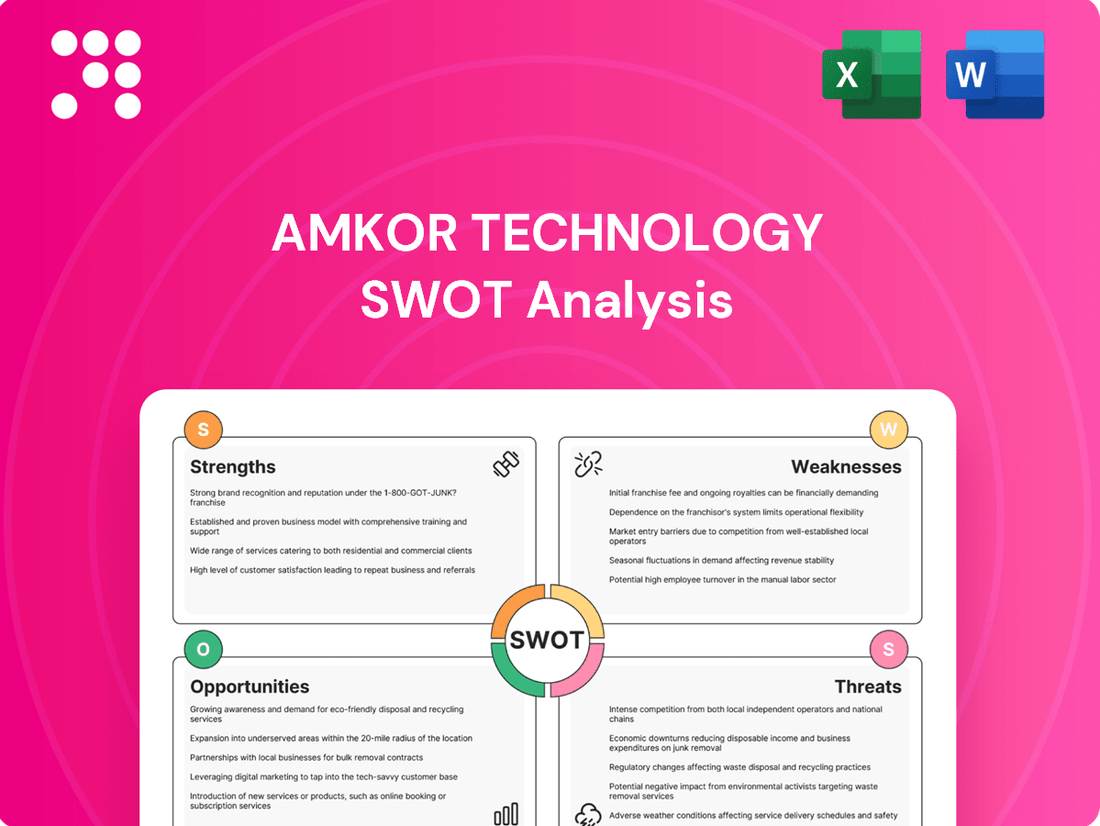

Delivers a strategic overview of Amkor Technology’s internal and external business factors, detailing its strengths in advanced packaging, weaknesses in market diversification, opportunities in emerging technologies, and threats from intense competition and supply chain disruptions.

Highlights Amkor's competitive strengths and mitigates potential weaknesses with actionable insights.

Weaknesses

Amkor Technology operates within the highly cyclical semiconductor industry, meaning its financial results are closely tied to broader market trends and economic conditions. This inherent volatility can lead to significant fluctuations in revenue and profitability.

For instance, Amkor reported revenue declines in both the fourth quarter of 2024 and the first quarter of 2025. These downturns were attributed to general industry headwinds and specific, temporary shortages in certain product segments, highlighting the direct impact of industry cycles on the company's performance.

Amkor's manufacturing model relies heavily on substantial investments in facilities and advanced equipment, leading to significant fixed costs. This operational structure means that achieving healthy gross margins is intrinsically linked to keeping production lines running at high capacity utilization levels.

For instance, in the first quarter of 2024, Amkor reported a gross margin of 15.1%. Maintaining or improving this margin is directly tied to their ability to efficiently utilize their extensive manufacturing base.

Consequently, any downturn in market demand or a broader industry slowdown can result in underutilized capacity, which directly pressures profitability by spreading those high fixed costs over fewer produced units.

Amkor Technology faces a significant weakness in customer concentration. In 2023, a mere handful of its largest customers were responsible for over 60% of its total revenue. This heavy reliance on a few key clients creates a substantial risk.

Should any of these major customers experience a business slowdown, shift their strategies, or decide to bring their semiconductor packaging and testing services in-house, Amkor's financial performance could be severely impacted. This dependency makes the company vulnerable to the decisions and fortunes of a small group of entities.

Intense Competitive Landscape

Amkor Technology operates within an intensely competitive semiconductor packaging and testing market. Rivals are constantly pouring resources into developing cutting-edge packaging solutions, putting pressure on Amkor to innovate rapidly. This dynamic environment means Amkor must continually invest to maintain its technological edge and market position.

Further complicating matters, Amkor faces competition from integrated device manufacturers (IDMs) and foundries that are increasingly offering their own in-house packaging and testing services. This vertical integration by competitors can potentially shrink Amkor's addressable market and erode its pricing power as customers may opt for bundled solutions.

- Intense Rivalry: Amkor competes with numerous OSAT providers who are also heavily investing in advanced packaging technologies.

- IDM/Foundry Competition: Integrated Device Manufacturers and foundries offering their own packaging services present a significant competitive threat.

- Market Share Pressure: The competitive landscape can limit Amkor's ability to capture market share and negotiate favorable pricing.

Vulnerability to Geopolitical and Supply Chain Disruptions

Amkor Technology's extensive global manufacturing footprint, while a strength, also exposes it to significant vulnerabilities. Geopolitical tensions and trade policies can directly impact its operations. For example, evolving U.S. export controls on advanced semiconductor manufacturing equipment could restrict Amkor's access to critical technology or its ability to serve specific markets, potentially impacting revenue streams. These disruptions can lead to increased operational costs due to rerouting, expedited shipping, or the need to establish new supplier relationships, ultimately affecting profitability and the capacity to fulfill customer orders reliably.

The company's reliance on intricate global supply chains makes it susceptible to disruptions beyond its direct control. Events like natural disasters, political instability in key manufacturing regions, or even labor disputes can cause significant delays and cost overruns. For instance, a major port closure or a shortage of critical raw materials due to unforeseen events can halt production lines. Amkor's ability to navigate these complexities is crucial, as even minor disruptions can ripple through its operations, leading to missed delivery targets and customer dissatisfaction.

Specifically, the semiconductor industry, where Amkor is a key player, is heavily influenced by international relations and trade agreements. Changes in tariffs or the imposition of new trade barriers can dramatically alter the cost structure for components and finished goods. Amkor's performance in 2024 and projections for 2025 will likely reflect the ongoing efforts to mitigate these risks through diversification of sourcing and manufacturing locations, though the inherent complexity of global logistics remains a persistent challenge.

Amkor's significant customer concentration, with over 60% of 2023 revenue coming from a few top clients, presents a substantial risk. A slowdown or strategic shift by any of these key customers could severely impact Amkor's financial results, highlighting a vulnerability to the decisions of a small customer base.

The company operates in a highly competitive environment, facing pressure from rivals investing heavily in advanced packaging. Furthermore, the increasing trend of integrated device manufacturers and foundries offering in-house packaging services could shrink Amkor's market and weaken its pricing power.

Amkor's global operations are susceptible to geopolitical tensions and trade policies. For example, evolving U.S. export controls on advanced semiconductor manufacturing equipment could restrict access to critical technology or markets, potentially affecting revenue and operational costs.

The company's reliance on complex global supply chains makes it vulnerable to disruptions like natural disasters, political instability, or labor disputes, which can lead to production delays and increased costs.

Preview Before You Purchase

Amkor Technology SWOT Analysis

This is a real excerpt from the complete Amkor Technology SWOT analysis. Once purchased, you’ll receive the full, editable version of this in-depth report.

Opportunities

The market for advanced semiconductor packaging is experiencing a significant upswing, propelled by the widespread adoption of technologies like 5G, AI, IoT, and sophisticated automotive systems. This escalating demand directly translates into a greater need for high-performance packaging solutions, an area where Amkor Technology holds a strong competitive advantage due to its specialized expertise and technological innovation.

The Outsourced Semiconductor Assembly and Test (OSAT) market, which Amkor operates within, is projected for robust growth, with estimates indicating it could reach USD 91.29 billion by 2034. This expansion presents a substantial opportunity for Amkor to capitalize on the increasing reliance on advanced packaging to enable the next generation of electronic devices.

The U.S. government's CHIPS and Science Act is a significant tailwind, offering substantial incentives to boost domestic semiconductor manufacturing, particularly in advanced packaging. This legislation aims to onshore critical supply chains and foster innovation within the United States.

Amkor's strategic $2 billion investment in a new Arizona facility, bolstered by up to $400 million in direct funding, directly capitalizes on this opportunity. This move is poised to enhance U.S. supply chain resilience and secure a larger share of the growing demand for cutting-edge chips manufactured domestically.

This new facility is specifically designed to cater to high-growth sectors such as high-performance computing and artificial intelligence, positioning Amkor to benefit from the increasing reliance on advanced semiconductor technologies in these vital markets.

The persistent trend of fabless semiconductor companies outsourcing their assembly and test operations is a significant growth driver for specialized firms like Amkor. This allows fabless entities to concentrate on their core competencies in chip design and innovation, while relying on OSAT providers for efficient, large-scale manufacturing. The global OSAT market is projected to reach approximately $80 billion by 2025, up from an estimated $65 billion in 2023, highlighting the increasing reliance on these outsourced services.

Emergence of New Technologies and Architectures

The semiconductor industry's rapid evolution, particularly with technologies like chiplets and advanced 2.5D/3D packaging, is driving significant demand for sophisticated packaging solutions. Amkor Technology's proactive investments in these areas, including their development of bridge-based technologies and enhanced testing for chiplet assemblies, are positioning them to capitalize on high-growth, high-margin sectors such as artificial intelligence (AI). For instance, the AI chip market alone was projected to reach $200 billion by 2027, with advanced packaging being a critical enabler for performance gains in these applications.

Amkor's strategic focus on these emerging technologies is crucial for maintaining a competitive edge. Their commitment to innovation in areas like co-packaged optics, which integrates optical components directly onto semiconductor packages, addresses the increasing need for higher bandwidth and lower power consumption in data centers and high-performance computing. This allows Amkor to offer more integrated and higher-value solutions, moving beyond traditional packaging services.

- Chiplet Integration: Amkor's expertise in advanced packaging techniques supports the growing trend of chiplet architectures, enabling the creation of more powerful and customized processors.

- 2.5D/3D Packaging: Investments in these technologies allow for denser component integration, leading to improved performance and reduced form factors for advanced electronics.

- Co-Packaged Optics: Amkor's work in this area addresses the increasing demand for high-speed data transfer, vital for AI and 5G applications.

- AI Market Growth: The company is well-positioned to benefit from the substantial growth in the AI market, where advanced packaging is a key differentiator for performance and efficiency.

Growth in High-Performance Computing and Automotive Segments

The increasing demand for advanced semiconductor packaging in high-performance computing (HPC) and automotive electronics presents a significant growth avenue. The burgeoning AI and data center sectors are fueling the need for sophisticated packaging solutions that Amkor Technology is well-positioned to supply. This is a key opportunity for Amkor to capitalize on its established expertise.

The automotive electronics market is projected for robust expansion, with an anticipated 20% compound annual growth rate (CAGR) from 2025 through 2034. This surge is driven by the increasing complexity and integration of electronic systems in vehicles, including advanced driver-assistance systems (ADAS) and electric vehicle (EV) powertrains. Amkor can leverage this trend by providing specialized, high-reliability packaging for these critical automotive components.

- HPC Demand: AI and data center growth necessitate advanced packaging for higher performance and reliability.

- Automotive Growth: The automotive electronics sector is expected to see a 20% CAGR from 2025-2034.

- Market Share Expansion: Amkor can increase its footprint in these high-value segments by offering advanced packaging solutions.

Amkor is strategically positioned to benefit from the burgeoning demand for advanced semiconductor packaging, driven by AI, 5G, and IoT. The OSAT market is forecast to reach $91.29 billion by 2034, offering Amkor substantial growth potential.

The U.S. CHIPS and Science Act provides significant incentives for domestic semiconductor manufacturing, including advanced packaging. Amkor’s $2 billion Arizona facility, supported by up to $400 million in funding, directly capitalizes on this to enhance U.S. supply chain resilience and capture domestic demand.

Amkor's focus on chiplets, 2.5D/3D packaging, and co-packaged optics addresses critical needs for higher performance and bandwidth, particularly in AI and data centers. The AI chip market alone was projected to hit $200 billion by 2027, with advanced packaging as a key enabler.

The automotive electronics sector, projected for a 20% CAGR from 2025-2034, presents another significant opportunity for Amkor to supply specialized, high-reliability packaging solutions for ADAS and EV components.

| Opportunity Area | Projected Market Size/Growth | Amkor's Strategic Alignment |

| Advanced Semiconductor Packaging (Overall) | OSAT Market: $91.29B by 2034 | Strong expertise in high-performance solutions |

| AI and High-Performance Computing (HPC) | AI Chip Market: $200B by 2027 | Focus on chiplets, 2.5D/3D, and co-packaged optics |

| Automotive Electronics | 20% CAGR (2025-2034) | Supplying specialized, high-reliability packaging |

| Domestic Manufacturing Incentives (e.g., CHIPS Act) | Significant government support | New Arizona facility investment |

Threats

The semiconductor industry, despite its long-term growth trajectory, is inherently cyclical and vulnerable to economic shifts. For Amkor, this means periods of slowing demand, like those observed in certain segments through 2024 and into early 2025, can directly translate to reduced revenues and pressure on earnings. The company must navigate these unpredictable cycles, which represent a consistent threat to its financial performance.

The semiconductor industry's relentless pace of innovation presents a significant threat, as Amkor's current packaging and test technologies risk rapid obsolescence. This necessitates substantial and ongoing investment in research and development to stay ahead of emerging trends and maintain competitive relevance.

Amkor's commitment to R&D in 2023 reached $348.7 million, a critical expenditure to counter this threat and develop next-generation solutions. Failing to effectively manage these high R&D costs or keep pace with technological advancements could severely impact Amkor's market share and financial performance.

Traditional foundries and IDMs are bolstering their advanced packaging services, presenting a significant challenge to pure-play OSAT providers like Amkor. Companies such as TSMC, a leading foundry, are investing heavily in advanced packaging technologies like CoWoS and InFO, aiming to offer end-to-end solutions that could attract customers seeking consolidated supply chains.

This integration means customers might opt for a single provider for both chip manufacturing and advanced packaging, potentially siphoning market share away from Amkor. For instance, the increasing demand for high-bandwidth memory (HBM) packages, a key growth area, sees foundries directly competing by offering integrated HBM solutions alongside their leading-edge logic manufacturing.

Geopolitical Tensions and Trade Policy Changes

Ongoing geopolitical tensions and shifting trade policies, including export controls and tariffs, pose a significant threat to Amkor Technology's global operations. These disruptions can directly impact its intricate supply chain, potentially increasing costs and limiting market access. For instance, the US-China trade war has already led to increased scrutiny and potential disruptions for semiconductor companies operating in both regions.

These policy changes can elevate operational expenses and restrict Amkor's capacity to serve specific customer bases. Furthermore, they might necessitate a strategic realignment of its manufacturing footprint, moving towards more regionalized supply chains, which could complicate its established global manufacturing strategy. In 2023, many tech companies faced increased compliance burdens due to evolving regulations in key markets.

The semiconductor industry, in particular, is sensitive to these geopolitical shifts. Amkor, as a major player in outsourced semiconductor assembly and test (OSAT), is exposed to risks such as:

- Increased tariffs on imported components and finished goods.

- Export restrictions impacting access to critical manufacturing equipment or materials.

- Potential for supply chain bifurcation, forcing costly operational restructuring.

- Uncertainty in long-term market access due to fluctuating trade agreements.

Challenges in Attracting and Retaining Skilled Labor

The semiconductor industry, a sector Amkor Technology operates within, is grappling with a significant shortage of skilled labor. This scarcity extends to specialized roles crucial for advanced manufacturing processes. For instance, as of early 2024, reports indicate a global deficit of engineers and technicians in advanced packaging and testing, areas where Amkor holds substantial expertise.

Amkor's reliance on highly qualified personnel for its advanced technological development and global operations means that difficulties in attracting, retaining, and replacing this talent pose a direct threat. Challenges in securing enough experienced engineers and technicians could hinder Amkor's capacity to innovate, scale production, and meet the increasing demand for its sophisticated OSAT services.

- Global semiconductor talent gap: Projections suggest millions of unfilled roles in the coming years, impacting companies like Amkor.

- High demand for specialized skills: Expertise in areas like advanced packaging, materials science, and automation is particularly scarce.

- Retention challenges: Competitive compensation and attractive work environments are key to keeping skilled employees, and Amkor faces pressure from rivals.

- Impact on innovation: A lack of skilled personnel can slow down the development and implementation of next-generation semiconductor technologies.

Amkor faces significant threats from increasing competition, as traditional foundries like TSMC are expanding their advanced packaging services, potentially capturing market share. Geopolitical tensions and evolving trade policies also pose risks by disrupting supply chains and increasing operational costs, as seen with increased compliance burdens in 2023.

The semiconductor industry's cyclical nature means Amkor must contend with fluctuating demand, impacting revenues, and the constant threat of technological obsolescence requiring substantial R&D investment. Furthermore, a global shortage of skilled labor, particularly in advanced packaging roles, could hinder Amkor's innovation and production capacity.

| Threat Category | Specific Risk | Impact on Amkor | 2024/2025 Context |

| Competition | Foundry integration of advanced packaging | Loss of market share to end-to-end solution providers | TSMC's continued investment in CoWoS and InFO |

| Geopolitics/Trade | Tariffs, export controls, supply chain bifurcation | Increased costs, market access restrictions, operational restructuring | Heightened regulatory scrutiny in key markets impacting tech firms in 2023 |

| Technology | Rapid obsolescence of packaging solutions | Need for continuous, high R&D spending; risk of falling behind | Amkor's 2023 R&D spend of $348.7 million highlights this pressure |

| Talent | Skilled labor shortage in advanced manufacturing | Hindered innovation, production scaling, and service delivery | Global deficit of engineers and technicians in advanced packaging (early 2024) |

SWOT Analysis Data Sources

This Amkor Technology SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and insightful industry expert commentary. These sources ensure a robust and accurate assessment of the company's internal and external landscape.